Tagged: Child Support Income

-

How Do Lenders Qualify Child Support Income for Mortgage?

Posted by Brett on March 16, 2024 at 2:03 pmWhen using child support as income, which of the following is required to verify the income for an FHA loan?

Gustan Cho replied 1 year, 8 months ago 4 Members · 3 Replies -

3 Replies

-

Final divorce decree, legal separation agreement, or court order and proof of receipt of child support payment for the past 3 months. In the FHA Handbook 4000.1 it states that, for child support used as income, the mortgagee must obtain a fully executed copy of the borrower’s final divorce decree, legal separation agreement, court order, or voluntary payment agreement with documented receipt. When using a final divorce decree, legal separation agreement or court order, the mortgagee must obtain evidence of receipt using deposits on bank statements, canceled checks, or documentation from the child support agency for the most recent three months that supports the amount used in qualifying. The mortgagee must document the voluntary payment agreement with 12 months of canceled checks, deposit slips, or tax returns. The mortgagee must provide evidence that the claimed income will continue for at least three years. The mortgagee may use the front and pertinent pages of the divorce decree/settlement agreement and/or court order showing the financial details.

https://gustancho.com/fha-loans-with-child-support-payments/

gustancho.com

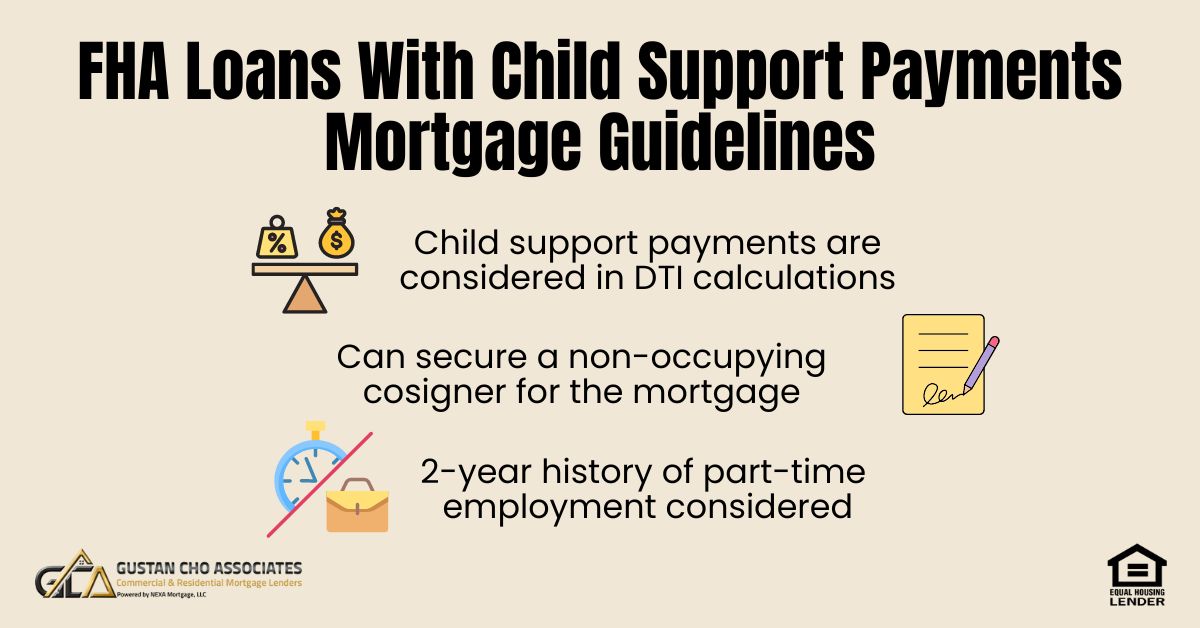

FHA Loans With Child Support Payments Mortgage Guidelines

FHA Loans With Child Support Payments: Child Support Payments can be used as income as long as they continue for 3 years on FHA Loans.

-

Yes, child support income can be used when qualifying for an FHA (Federal Housing Administration) loan, but there are specific requirements and documentation that lenders will need to verify this income source.

Here are the key points regarding using child support income for FHA loan qualification:

- Proof of Receipt: Lenders will require documentation proving that the borrower has been receiving child support payments consistently for at least the most recent 12 months. Acceptable documentation includes:

- Court orders or divorce decrees showing the amount of child support awarded

- Canceled checks or bank statements demonstrating receipt of payments

- Tax returns showing child support income

- Continuity: The child support income must have a reasonable expectation of continuity for at least 3 years after the date of the mortgage application. If the child support payments are due to terminate within this timeframe, the income may not be considered or may be prorated.

- Verification: Lenders may require additional verification, such as contacting the paying party or obtaining a written statement from them confirming the amount, frequency, and expected duration of child support payments.

- Calculation: For qualifying purposes, lenders will typically calculate the average amount of child support received over the most recent 12-month period. This averaged amount will be used in determining the borrower’s debt-to-income ratio and overall creditworthiness.

- Exposure to Risk: If the child support income represents a significant portion of the borrower’s total income, lenders may require additional documentation or compensating factors to mitigate the risk of interruption or termination of these payments.

It’s important to note that while child support income can be used for FHA loan qualification, it is subject to lender scrutiny and must meet the FHA’s guidelines for stable and consistent income sources. Lenders may also have additional overlays or requirements beyond the FHA’s minimum standards.

If you are relying on child support income, be prepared to provide thorough documentation and be transparent about any potential changes or risks associated with this income stream. Consulting with an experienced mortgage lender or broker can also help ensure that you meet all necessary requirements when using child support income for your FHA loan application.

-

This reply was modified 1 year, 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

Child support income and alimony income can be used as qualified income for mortgage loans debt to income but the Child support and alimony income needs to continue for the next three years. Copy of divorce decree is required validating the Child support, alimony or other income.

Log in to reply.