Tagged: Buy Out Chapter 13 Bankruptcy

-

Buy Out Chapter 13 Bankruptcy While in Repayment Plan

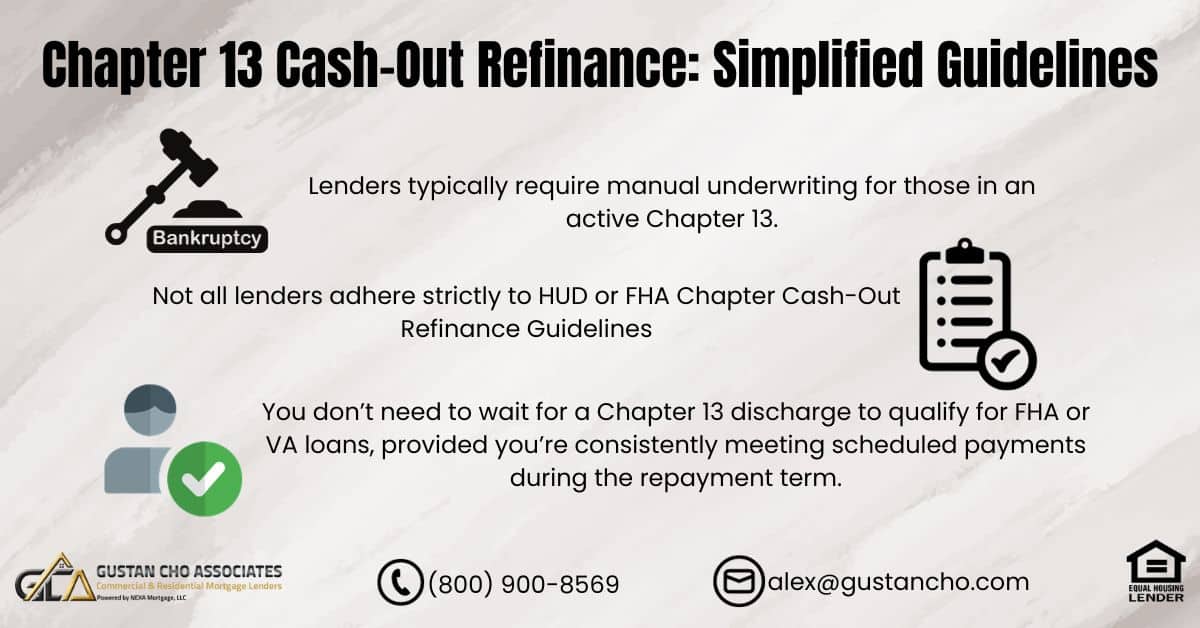

Posted by Gustan Cho on October 15, 2023 at 7:34 pmHomeowners with equity in their homes can buy out Chapter 13 Bankruptcy while in an active Chapter 13 Bankruptcy repayment plan by doing a cash-out refinance and paying off the bankruptcy early. HUD and VA loans allow for borrowers to qualify for FHA and VA loans while in an active Chapter 13 Bankruptcy with trustee approval and a manual underwriting. Here is a link to a new blog posted today.

Chase replied 1 year, 8 months ago 2 Members · 1 Reply -

1 Reply

-

Ways of Purchasing Chapter 13 Bankruptcy with a Cash-Out Refinance

Know the prerequisites:

Home Equity: For you to be eligible for a cash-out refinance, you should have sufficient equity in your home.

Agreement on Chapter 13: Get an endorsement from your bankruptcy trustee to seek a cash-out refinance.

Credit And Income: Make sure that your credit score and income are good enough for the refinance. FHA and VA loans have more flexible requirements, sometimes allowing for lower credit scores and manual underwriting.

Talk With Your Bankruptcy Trustee:

Ask for permission: Request permission from your Chapter 13 trustee to move forward with the refinance. This is important because any changes in repayment plan must be approved by the trustee.

Plan adjustment: Explain how money generated by refinancing will be used to pay off remaining balance owed under Chapter 13 plan.

Check Loan Eligibility:

FHA Loans: These types of loans are easily accessible during chapter thirteen bankruptcies. Under FHA guidelines one can still refinance even when he/she is in active repayment plan as long as there is approval from trustee.

VA Loans: Veterans also have another option which is VA loan. It allows for refinancing during an active chapter thirteen plan provided there is consent from trustee.

Prepare Documents:

Income verification documents: Gather pay stubs, tax returns or any other necessary papers showing that indeed you earn income.

Bankruptcy papers filing evidence : Have all relevant bankruptcy forms including payment proposal together with approval from court-appointed administrator or judge presiding over such cases where applicable).

Proof Of Home Equity: Get recent valuation report done by qualified appraiser indicating current market price/value of residential property plus available equity amount if any at this time..

Find A Lender:

Specialist lenders : Look out for those who deal specifically with borrowers going through chapter thirteen bankruptcies; not every lender may know about them nor want anything to do with such cases.

Loan application: Fill in an application form for cash out refinance and indicate your bankruptcy status truthfully.Most of the information requested will be similar to that which one would provide when applying for a normal loan.

Loan Underwriting:

Manual Underwriting: If you are applying for FHA or VA loans then expect this process where they look at all details about your financial life including how well have been repaying debts so far. They usually want evidence showing regularity and consistency of such payments over time.

Appraisal: Your current home value will be assessed by an independent valuation firm working on behalf of the lender,so as to establish how much it is worth now in comparison with what was paid when you bought it initially.

Approval & Closing:

Conditional Approval: Once your application is conditionally approved, the lender will work with your trustee to ensure that part or all of the proceeds go towards settling any outstanding debts under chapter thirteen bankruptcy plan.

Closing costs: Prepare yourself financially for closing costs as they are not covered by most refinancing deals and can sometimes amount up-to few thousands dollars depending largely upon size loan being sought after plus other factors like location among others..This money may either be paid upfront during signing new mortgage loan agreement or added onto total amount borrowed thereby increasing monthly repayments slightly until fully paid off usually within first year after refinancing has taken place.

Settlement: At closure, cash received through refinancing process replaces original mortgage balance owed thus effectively buying out chapter 13 bankruptcy.Directly related expenses include trustee fees charged by court-appointed administrator who oversees debt repayment plans proposed under Chapter Thirteen rules.

https://gustancho.com/chapter-13-cash-out-refinance-guidelines/

-

This reply was modified 1 year, 8 months ago by

Chase. Reason: Forgot image

Chase. Reason: Forgot image

gustancho.com

Chapter 13 Cash-Out Refinance Guidelines During Repayment

Chapter 13 Cash-Out Refinance Guidelines During Repayment Plan is allowed to pay off the Chapter 13 debt repayment plan early

-

This reply was modified 1 year, 8 months ago by

Log in to reply.