Gustan Cho

Loan OfficerForum Discussions Started

-

All Discussions

-

In this thread we will cover a comprehensive guide to homebuyers in Maryland. How to go about buying your first home in Maryland, down payment assistance programs, FHA, VA, USDA, Conventional loans, jumbo, and non-QM loans. Advice and tips on getting the lowest rates and lowest closing costs. How much of a house should I buy? What are the eligibility requirements for me to buy a house in Maryland. And all the things I need to know when buying a house in Maryland.

Comprehensive Guide to Buying Your First Home in Maryland

Buying your first home in Maryland is an exciting milestone that requires careful planning and preparation. This comprehensive guide will walk you through everything you need to know about purchasing your first home in the Old Line State, from understanding different loan options to securing down payment assistance and finding the best rates. Whether you’re navigating the competitive markets near Baltimore or Washington D.C., or exploring more affordable areas in Western Maryland or the Eastern Shore, this guide will help you make informed decisions throughout your homebuying journey.

Understanding Maryland’s Housing Market

Maryland offers diverse housing options with varying price points across its 23 counties and Baltimore City. The median home price in Maryland is approximately $485,000, though this varies significantly by region. Areas closer to Washington D.C. and Baltimore typically command higher prices, while more rural counties offer more affordable options. Understanding these regional differences will help you set realistic expectations for your homebuying budget and identify areas that align with your financial situation.

Maryland Mortgage Loan OptionsFHA Loans in Maryland

Federal Housing Administration (FHA) loans provide an excellent entry point for many Maryland first-time homebuyers. These government-backed mortgages require just 3.5% down with a minimum credit score of 580, making them more accessible than conventional loans. FHA loans are particularly attractive to buyers with limited savings or those working to improve their credit scores. However, borrowers should be aware that FHA loans require mortgage insurance premiums (MIP) for the life of the loan unless refinanced to a conventional loan later.

VA Loans for Maryland Veterans

For eligible veterans, active-duty service members, and surviving spouses, VA loans represent one of the most advantageous mortgage options in Maryland. These loans typically require no down payment and feature competitive interest rates without monthly mortgage insurance requirements. VA loans can be combined with Maryland’s assistance programs to further reduce out-of-pocket costs, making homeownership more accessible for those who have served our country.

USDA Rural Development Loans

Maryland homebuyers in designated rural areas may qualify for USDA loans, which offer 100% financing with no down payment required. These loans are designed to promote homeownership in less populated areas and feature income restrictions based on location and household size. Many Maryland counties have eligible areas for USDA financing, particularly in more rural parts of the state.

Conventional Mortgages in Maryland

Conventional loans, including Fannie Mae’s Conventional 97 program, require just 3% down with a minimum credit score of 620. These loans are not government-insured but often appeal to borrowers with stronger credit profiles. While conventional loans may have slightly higher interest rates than government-backed options, private mortgage insurance can typically be cancelled once 20% equity is achieved, potentially saving money over the life of the loan.

Jumbo and Non-QM Loans

For borrowers purchasing higher-priced homes or those with unique financial situations, Maryland lenders offer jumbo and Non-Qualified Mortgage (Non-QM) options. These products provide flexibility for self-employed individuals, real estate investors, or those purchasing homes exceeding conventional loan limits. Jumbo loans typically require larger down payments and higher credit scores due to the increased lending risk.

Maryland First-Time Homebuyer ProgramsThe Maryland Mortgage Program (MMP)

The Maryland Mortgage Program serves as the state’s flagship initiative for first-time homebuyers, offering competitive 30-year fixed-rate mortgages with down payment assistance. MMP provides both government-insured loans (FHA, VA, USDA) and conventional options, with eligibility requirements including:

- Minimum credit score of 640 for most loan options

- Income limits based on household size and county

- Completion of a homebuyer education course

The program’s 1st Time Advantage products offer the lowest interest rates available, while Flex products provide additional flexibility for borrowers who may not qualify for standard programs.

Down Payment Assistance Programs

Maryland offers numerous down payment assistance (DPA) programs to help bridge the gap between savings and homeownership costs:

- The MMP Down Payment Assistance program, providing up to $5,000 in zero-interest deferred loans

- The HomeAbility program for buyers with disabilities, offering a secondary loan covering up to 25% of the purchase price

- County-specific programs like Prince George’s County’s Pathway to Purchase offering up to $10,000

- Baltimore’s Live Near Your Work program providing $10,000 grants

Specialized Assistance Programs

Maryland offers targeted assistance for specific populations:

- Maryland SmartBuy helps homebuyers with eligible student debt by providing additional assistance

- The HomeAbility program assists buyers with disabilities through specialized loan products

- County-specific programs offering additional benefits for teachers, first responders, and other professions

Determining How Much House You Can Afford

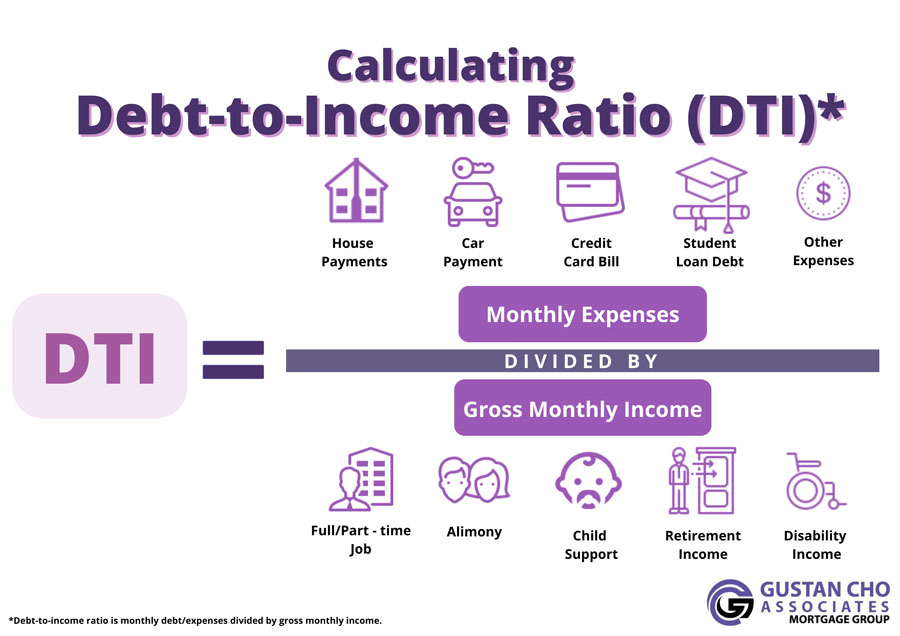

Before beginning your home search, it’s essential to establish a realistic budget. Financial experts recommend that your total housing payment (including principal, interest, taxes, insurance, and any HOA fees) should not exceed 28-31% of your gross monthly income. Additionally, your total debt-to-income ratio (including all monthly debt payments) should ideally stay below 43% for most loan types.

Several online calculators can help you estimate your purchasing power, but working with a mortgage lender for pre-approval will give you the most accurate assessment of what you can afford. Remember that buying at the maximum of your budget doesn’t always leave room for unexpected expenses or future financial goals.

Eligibility Requirements for Buying a House in MarylandCredit Score Requirements

Credit score requirements vary by loan type:

- FHA loans: Minimum 580 (with 3.5% down) or 500 (with 10% down)

- Conventional loans: Minimum 620

- VA loans: No minimum set by VA, but most lenders require at least 620

- USDA loans: Typically 640 or higher

Higher credit scores generally qualify for better interest rates across all loan types. Before applying, check your credit report, dispute any errors, and focus on paying down existing debt to improve your debt-to-income ratio.

Income Requirements

Maryland mortgage programs have specific income limits based on household size and county. These limits ensure assistance programs target those with moderate incomes. For example, the Maryland Mortgage Program sets income limits that vary by county, with higher limits in more expensive areas.

Documentation Requirements

When applying for a mortgage in Maryland, you’ll typically need to provide:

- Proof of income (pay stubs, W-2s, tax returns)

- Bank statements and asset documentation

- Identification documents

- Rental history

- Information about any existing debts

Tips for Getting the Lowest Rates and Closing CostsImprove Your Financial Profile

Before applying for a mortgage, take steps to strengthen your financial position:

- Pay down existing debts to lower your debt-to-income ratio

- Avoid new credit applications or large purchases

- Save for a larger down payment if possible

- Work on improving your credit score

Compare Multiple Lenders

Maryland mortgage rates vary between lenders. Shopping around with different lenders, including those participating in the Maryland Mortgage Program, can help you find the most competitive rate for your situation. When comparing offers, look at both the interest rate and the annual percentage rate (APR), which includes lender fees.

Negotiate Closing Costs

Closing costs in Maryland typically range from 2-5% of the purchase price. You can potentially reduce these costs by:

- Asking the seller to contribute toward closing costs

- Shopping for lower-cost service providers for appraisals and inspections

- Negotiating lender fees

- Looking for no-closing-cost mortgage options (though these typically come with higher interest rates)

The Homebuying Process in MarylandPre-Approval and House Hunting

The first step in your homebuying journey is getting pre-approved for a mortgage. This involves submitting your financial documents to a lender who will determine how much you’re qualified to borrow. With pre-approval in hand, you can begin house hunting with confidence, knowing your budget and demonstrating to sellers that you’re a serious buyer.

Making an Offer and Negotiations

Once you find a home you love, your real estate agent will help you craft a competitive offer. In Maryland’s competitive market, you may need to consider strategies like:

- Offering above asking price in hot markets

- Including an escalation clause

- Minimizing contingencies while still protecting your interests

- Writing a personal letter to the seller

Home Inspection and Appraisal

After your offer is accepted, you’ll typically have a home inspection period to identify any potential issues with the property. The lender will also order an appraisal to ensure the home is worth the purchase price. If issues arise during either process, you may need to negotiate repairs or price adjustments with the seller.

Closing and Final Steps

The final step in your homebuying journey is the closing, where you’ll sign all necessary documents, pay your remaining closing costs and down payment, and receive the keys to your new home. Before closing, you’ll have a final walk-through to ensure the property is in the agreed-upon condition.

Maryland Homebuying FAQsWhat is the minimum down payment required for a Maryland mortgage?

The minimum down payment varies by loan type: 0% for VA and USDA loans (if eligible), 3% for conventional loans, and 3.5% for FHA loans. Down payment assistance programs can further reduce or eliminate this requirement.

What credit score do I need to buy a house in Maryland?

Credit score requirements vary: 580 for FHA loans, 620 for conventional loans, and 640 for most Maryland Mortgage Program options. VA and USDA loans have more flexible credit requirements but still consider credit history in approval decisions.

Can I get a mortgage in Maryland with no money down?

Yes, eligible borrowers can secure 100% financing through VA loans (for qualifying military members), USDA loans (for rural properties), or by combining FHA loans with down payment

-

This discussion was modified 1 month, 1 week ago by

Sapna Sharma.

Sapna Sharma.

gcaforums.com

Bank Statement Loans For Self-Employed Borrowers

Bank Statement Loans does not require income tax returns. Income is calculated by averaging 23 months of bank statements.

-

This poet covers Mortgage Loan Officers seeking to get Real Estate Agent License to become a dually licensed MLO and REAL ESTATE AGENT. We will also cover how Loan Officers at NEXA MORTGAGE can become dually licensed MLO with NEXA MORTGAGE AND REAL ESTATE AGENT WITH AXEN REALTY.

-

NEXA Mortgage Compensation Plan For Branch Sponsored Mortgage Loan Originators, and Independent Loan Officers, Team Leaders, Independent Branch Managers, and Branches and Independent MLO OPERATING AS A DBA OF NEXA MORTGAGE

https://www.loanofficersupport.com/assets/NEXAOnboardingFlightPlan1.26.pdf

-

Anyone in the Rockford Illinois area needing a talented general home improvement expert with a proven track record contact Matt Krienke, owner, master renovation expert, general contractor, and hands on carpenter of Becky Vision Renovation and Construction.

608- 718-2929

Highly recommend and endorsed by Gustan Cho Associates and its Wholly-Owned Subsidiary Companies

https://www.beckysvisionremodelingandcontractingllc.com/

-

This discussion was modified 1 month, 2 weeks ago by

Gustan Cho.

Gustan Cho.

beckysvisionremodelingandcontractingllc.com

Vision Remodeling and Contracting

Vision Remodeling and Contracting

-

This discussion was modified 1 month, 2 weeks ago by

-

I am in charge of a regional mortgage branch office licensed in 48 states am have a licensed mortgage originator colleague who has a potential client who has an investor who owns a hotel/motel in Texas. My MLO colleague has a client who needs to do a rate and term refinance on a commercial loan. I am a licensed NMLS licensed mortgage loan originator and have owned, and managed 3,000 plus residential units consisting of free standing apartment buildings and seven apartment complexes and am familiar with originating mutli-family commercial loans. but not motels and/or hotels. My expertise on commercial loans are free standing apartment buildings and apartment complexes. My associate reached out to me for advise and guidance on him taking on financing this motel-hotel for this investor. Can you please guide and advise us on the steps on proceeding with this borrower? The investor/borrower will be getting multiple quotes from commercial lenders so me and my fellow loan officer would like to get the borrower the best rate and term and become the winning bid on this motel financing commercial loan. Can you guide us through a Step by step process starting on the documentation needed? I worked on my own commercial loans on the apartment buildings and apartment complexes that needed financing and the general docs commercial banks and brokers needed were the following:

Summary Statement of the history of the property owned including but n ot limited to the history of the property and scope of work such as the purchase price, loan-to-value, renovations completed and/or budget and capital required, type of loan requesting includoing recourse or non-recourse, personal financial statenent, schedule of real estate owned, profit and loss statement, nearby comparable sales, and any documentation or data supporting the strength and risk tolerance of the subject property. I am assuming motel-hotel financing probably requires similar data and documents. Again, if you can guide us through the comprehensive step of the commerical lending process from start to finish as well as commercial lenders that are broker friendly it would be greatly appreciated. Thank you in advance.

-

Current Stock Market Information for SPDR Dow Jones Industrial Average ETF (DIA)

- The SPDR Dow Jones Industrial Average ETF remains a favorite among U.S. investors, consistently capturing attention and fueling enthusiasm nationwide.

- The ETF is currently trading at $481.15, which is $0.65 higher than the previous close.

- The trading day began at $480.56, and with over 6.4 million shares changing hands, the market was abuzz with heightened activity.

- Throughout the session, prices swung between $482.75 and $479.31, reflecting a day marked by noticeable volatility.

- The final trade rang in at 3:55 PM PST on Friday, December 19, capping off a day of gains for U.S. stocks, thanks largely to robust performances in the technology sector.

- The Dow Jones Industrial Average closed at 43,246.65, up 86.31 points.

- The S&P 500 rose 0.7% to 6,140.74, while the Nasdaq gained 1.0% to 20,173.89.

- Shifts in the market were shaped by fresh inflation numbers, ongoing tariff negotiations, and a wave of company earnings, with Nike’s results making a particularly strong impression.

LIVE Rates: Treasuries + Mortgage RatesYields on Treasuries (as of the end of the trading day)

- 10 Treasury = 4.16% (closed)

- 2 Year Treasury = 3.48%

- 30 Year Treasury = 4.82% (closed)

Average Rates on Mortgages (as of today)

- Mortgage News Daily (as of today) 30 Year Fixed = 6.25% (as of 12/19/2025)

- Freddie Mac PMMS week prior to 12/18/25): 30-year.

- With mortgage and real estate rates trending downward, the housing market has sprung to life with renewed activity.

- Buyers are now finding themselves in the driver’s seat, often securing discounts or special incentives from eager sellers and builders.

Live Precious Metals Update: Gold is trading at $4,328.24 per ounce, dipping about 0.1% today.

- Spot silver is currently priced at $65.93 per ounce, up about 0.8% today.

- In the world of precious metals, easing inflation is fueling growth and sparking hopes for more favorable interest rates ahead.

- However, a stronger U.S. dollar is preventing gold prices from rising further.

Economy Watch:

Tariffs and state inflation credits are reshaping the marketplace, changing shopping habits and shifting the price tags on everyday goods.

As store shelves fill up and prices climb, consumers are tightening their wallets, financial leaders report.

Another report states that officials remain cautious about tariffs and anticipate the company will reveal $1.5 billion in new tariffs, a hit that could dent both its profits and its stock price. In the housing sector, rising tariff-related costs have prompted the Federal Reserve to tread carefully, slowing the decline in mortgage and other long-term interest rates. the long-term interest rates.

Circumstances of Policy

The White House disclosed an extension of particular Section 301 tariff exclusions (and associated trade actions) as part of a U.S.–China economic/trade package.

For an overview of 2025 tarifFor a summary of 2025 tariff actions and their status, CRS provides an ongoing update.et: This week, what changed

Existing Home Sales: A Small Improvement, Affordability. November saw existing-home sales tick up by 0.5% to an annualized pace of 4.13 million. The median price climbed to $409,200, outpacing last year’s mark. With 1.43 million homes on the market—a 4.2-month supply—the market is stabilizing. Still, steep interest rates and lofty prices remain hurdles for first-time buyers, who accounted for 30% of the sales in November. According to the National Association of Realtors.

The Mortgage Bankers Association (MBA) reported that mortgage applications declined by 3.8% for the week ending Dec. When rates hover between 6.2% and 6.4%, borrowers tend to act quickly, eager to lock in a deal. Usually move fast.

Lower rates make people more likely to refinance, while higher rates reduce demand.

Soaring prices and mounting costs are squeezing borrowers, making homeownership feel further out of reach.

It’s essential to continually review political and media reports to distinguish facts from speculation.

Erika Kirk and Vice President JD Vance, specifically concerning relationships and paternity, remain unsubstantiated despite mention by some credible sources.

No evidence has been presented to support the alleged affair.

Vance has addressed public discussion of his marriage, and both he and his wife have characterized the rumors as Social media claims about paternity and infidelity have not been verified and are not backed by major news outlets. These claims should be viewed as unconfirmed.

What happened with Erika Kirk and Candace Owens’ meeting (Monday, Dec. 15, 2025)?

Some sources suggest that Erika Kirk and Candace Owens met, possibly to discuss Owens’ criticisms. The meeting was reportedly focused on Owens’ public comments.

- Kirk mentioned Owens during AmericaFest, indicating a clear tension between them.

- Major news outlets have covered the scripts from the closed meeting, so any specific claims should be treated with caution.

Candace Owens’ criticism of Erika Kirk

Owens increased the backlash and controversy surrounding Sabina Kirk, exacerbating the public rivalry. Reuters reported that Bongino plans to resign because of disagreements and issues with FBI Director Christopher Wray, not with Kash Patel. Bongino reportedly wants to avoid a major conflict. Other reports on Facebook and from the Associated Press also stated that Bongino would resign due to disagreements with Patel. However, neither Reuters nor the Associated Press stated that FBI staff mocked Bongino or spoke negatively about him; those claims remain unproven rumors.

Kash Patel: There are rumors about Kash Patel, his girlfriend, and the use of a private jet and security detail. Here’s what has been confirmed: an FBI spokesperson said claims about a SWAT team as security are **false** and that only standard protective measures are used for leadership, not a SWAT team. A local Fox station reported that Patel denied any false claims about using jets or security. No reliable sources have confirmed any details about the ‘Utah tantrum’ or ‘missing FBI jacket’ stories. These should be considered unverified social media speculation until trustworthy reports confirm them. Mortgage rates and 10-year Treasury yields are staying about the same (mid-6% for mortgages, about 4.16% for the 10-year). It remains challenging for many people to afford a home. Home sales have increased slightly, but prices remain high, and the number of homes for sale is limited. Inflation has decreased, but it could remain high, depending on company profits and consumer spending trends. Kirk and JD Vance’s infidelity and paternity rumors have not been confirmed by major news sources. Kash Patel discussed Dan Bongino’s departure from the FBI, stating, “Kash Patel praises Dan Bongino, exiting the FBI.” This headline from Facebook’s Breaking News sums up the story.

-

Minnesota Mortgage and Homebuyers Guide

Minnesota Mortgage and Home Buying Guide

MORTGAGE OPTIONS AND HOME BUYING IN MINNESOTA

(GCA Forums • Geographical Section • Minnesota Category)

This guide covers how to buy a home in Minnesota, compares different loan options, and explains down payment assistance programs.

Table of Contents

- Minnesota Homebuying Checklist (fast path)

- Step-by-step homebuying process in Minnesota

- Mortgages in Minnesota (FHA, VA, USDA, Conventional, Jumbo, Non-QM)

- Minnesota Housing and Down Payment Assistance (Start Up / Step Up / First-Gen options)

- Credit flags, DTI, overlays, and score

- Property issues in Minnesota (rural homes, condos, lake homes)

- Tips for Getting Great Rates in Minnesota

- Frequently Asked Questions

Minnesota Homebuying Checklist (Fast Path)

Complete the following steps in sequence:

- Pull your credit and income documents (W-2s/1099s, pay stubs, bank statements, ID).

- Obtain full pre-approval, rather than only pre-qualification.

- Choose the right loan type for your needs, such as Conventional, FHA, VA, USDA, Jumbo, or Non-QM. If you need help, ask about Minnesota Housing Start Up or Step Up programs and check if you need to take a homebuyer education course.

- Look for homes with monthly payments you can afford, instead of just focusing on the highest loan amount you qualify for.

- Once you make an offer, you’ll go through inspection, appraisal, underwriting, final approval, and then closing.

2) How Buying a Home Works in Minnesota

Step 1: Get pre-approved. This is the most important first step.

Real pre-approval involves checking:

- Income (hourly/salary/commission/self-employed)

- Assets (down payment, reserves)

- Credit and debts (DTI)

- Basic eligibility for the loan

Step 2: Decide on your loan strategy before you start looking at This helps you avoid looking at homes that don’t meet these requirements:

- Condo rules

- Rural eligibility (USDA)

- Jumbo loan requirements

Step 3: Non-QM documentation: Think about Minnesota-specific factors when looking at homes

Homebuyers in Minnesota should keep these things in mind:

- Rural issues (well/septic) and extended inspection time

- Snow and its impacts (roof, HVAC, insulation, ice dams)

- Higher escrow sensitivity (property taxes + insurances)

Step 4: Most buyers in Minnesota choose to have an inspection. They usually pay attention to:

- Is the roof aged, and what about the attic ventilation and insulation?

- Foundation and drainage

- Water heater and furnace/boiler

- Scope (as needed) sewer

Step 5: Appraisal + underwriting

At this point, the process can slow down, especially for condos, unique properties, or if paperwork is missing.

3) Different Types of Mortgages in Minnesota Conventional Mortgages

Best for borrowers with:

- Good credit and consistent income

- Different down payment options (even low down payment options)

- Some borrowers want to avoid paying FHA mortgage insurance every day.

Minnesota Housing may combine certain conventional HFA products with Start Up or Step Up programs for eligible borrowers.

FHA Loans (Lower credit & higher DTIs are acceptable)

FHA can be used if:

- Credit scores are low.

- Need more flexible requirements.

- FHA loans let you make a smaller down payment. Keep in mind that FHA and Conventional loans have different mortgage insurance rules, which can affect your long-term costs.

VA Loans (Veterans and Active Service Members)

VA loans also offer flexible funding options, including:

- 0% down payment (for eligible borrowers)

- Affordable interest rates

- More flexible qualification requirements

USDA Loans (Rural Minnesota)

USDA loans can help buyers outside the Metro area who:

- Approved for designated rural areas

- Zero-down financing for eligible buyers through the guaranteed program

- Includes options for low and very-low-income approved borrowers through USDA RD

Check the USDA eligibility map, since these loans are only for certain areas.

Jumbo Loans (High loan amounts)

WIf your loan amount is higher than conventional limits, you’ll need a Jumbo loan. These loans require additional requirements

- Higher credit score

- More reserves (months of payment saved)

- Additional documentation and appraisal scrutiny

Non-QM Loans (When conventional guidelines don’t apply)

If you’re self-employed and your tax returns don’t show your full income, you might use business bank statement options.

- Real estate investor situations (DSCR)

- Asset depletion

- ITIN loans (the availability of the program will depend on the lender)

Non-QM loans still need documentation, but the requirements are different from conventional loans.

4. Down Payment Aid in Minnesota (Follow This Path)Minnesota Housing: Start Up (For First-Time Buyers)

Start-up is most often used when you:

- Are a first-time buyer (or have not owned a home in the last 3 years, depending on program rules)

- Are within the income and purchase price limits (based on household and where you live)

- You may need to complete a homebuyer education course. Minnesota Housing offers programs with second mortgages. Depending on your eligibility and the program, you could get help with your down payment and closing costs.

Minnesota Housing: Step Up (Repeat Buyers / Higher Income)

Step Up may be applicable if:

- You’re a repeat buyer or

- You’re a first-time buyer, but your income or purchase price is above the Start Up limits on Homebuyer Options

Minnesota Housing also offers a First-Generation Homebuyer Loan Program with Start Up for some eligible buyers.

Be Mindful of Property Tax Relief Programs

In Minnesota, you may qualify for property tax refunds or relief based on your income and if the home is your main residence. These programs can make homeownership more affordable over time.

5. Credit Score, DTI, and Overlay Red Flags What matters most for approval

- Payment history (when late payments / collections occur)

- DTI (your monthly debts vs income)

- Stable income documentation

- Cash to close + reserves

Overlay red flags (what can cause “denied” even when guidelines allow it)

- Lender requires higher credit score than the program minimum.

- The agency does not require extra reserves.

- Stricter DTI caps than the baseline program

- Manual underwrite restrictions that aren’t actually required

If a lender turns down your application, ask if it was because of agency rules or the lender’s own requirements.

Condos & HOAs (Twin Cities especially)

Condo approvals can derail timelines due to:

- HOA budget/reserves questions

- Insurance requirements

- Owner-occupancy ratios

- Litigation status

Lake homes / cabins / seasonal-use properties

These can trigger:

- Second-home pricing rules

- Appraisal complexity (comparable)

- Insurance considerations

Rural homes (well/septic)

Plan for:

- Well/septic inspections (where customary/needed)

- Longer underwriting timeline if repairs or conditions arise

- You can improve your credit score by paying down credit card balances and not opening new accounts rate lock strategy by requesting quotes and reviewing available options.

- Evaluate whether to use seller credits or pay points based on the anticipated duration of homeownership.

- Consider the total monthly payment, including principal, interest, mortgage insurance, homeowners association fees, and taxes or insurance.

FAQs (Minnesota Homebuyers Ask These Every Week)

What loan options are the best for first-time buyers in Minnesota?

- Convention: Many first-time buyers choose Conventional loans with low down payment options or FHA loans.

- If you qualify, Minnesota Housing Start Up is also a popular choice.

- Start Up is suitable for most first-time buyers, whereas Step Up may be available for repeat buyers or first-time buyers who meet specific criteria.

Do I need homebuyer education?

- Some Minnesota Housing programs require you to complete a homebuyer education course, especially if you’re a first-time buyer.

Can I buy a house in Minnesota with no down payment?

- USDA loans (for eligible areas) or VA loans may provide options for purchasing with no down payment.

I’m attempting to buy a home that satisfies USDA criteria. How can I check whether it is USDA-eligible?

- The USDA property eligibility tool or map can be used to verify eligibility.

Are property taxes significant in Minnesota?

- Property taxes can be significant, but Minnesota offers relief and refund programs for homeowners who qualify.

What DTI do I need?

- DTI requirements depend on the loan program, your credit, and underwriting results.

- Getting fully pre-approved will give you the most accurate answer;

Can self-employed borrowers qualify in Minnesota?

- Yes, self-employed buyers can qualify with Conventional or FHA loans using standard paperwork, or with Non-QM bank statement options, depending on their situation.

Do condos take longer to close?

- It can take longer to close on a condo because of the extra review and approval needed for HOA and condo documents.

What’s the biggest mistake Minnesota buyers make?

- Focusing solely on purchase price, rather than considering the total monthly payment including taxes, insurance, HOA fees, and mortgage insurance, is a common error.

Related:

Try The Best Online Minnesota Mortgage Calculator, powered by Gustan Cho Associates

If you want to buy a home in Minnesota or have had trouble getting approved elsewhere, we can help.

Gustan Cho Associates handles FHA, VA, USDA, Conventional, Jumbo, and Non-QM loans. The team at Gustan Cho Associates helps clients with tight DTI, low credit, or alternative income. Reply to this thread with your city or county, credit, income, and down payment amount, and we’ll help you find the best option and next steps.

Compliance Note

This is for consumer education only and is not an offer for financial or legal advice. Responses regarding loan pricing and other services are contingent on underwriting, the specifics of a loan program, and the borrower and property.

-

This discussion was modified 1 month, 2 weeks ago by

Sapna Sharma.

Sapna Sharma.

gcamortgage.com

Financing Options for Minnesota Mortgage Loans

Learn about the different types of Minnesota mortgage loans, including FHA, VA, jumbo, and non-QM loans as well as DPA and low rates.

-

GCA FORUMS NEWS Comprehensive Financial Markets & Real Estate Report Sunday, January 18, 2026

Powered by Gustan Cho Associates

BREAKING: DOJ INVESTIGATION OF FED CHAIR JEROME POWELL

On Friday, January 10, 2026, the Department of Justice delivered grand jury subpoenas to the Federal Reserve. Chairman Jerome Powell may face criminal charges connected to his June 2025 testimony before the Senate Banking Committee.

The Criminal Subpoena Details

The investigation centers on Powell’s comments about the Federal Reserve headquarters renovation, a project now estimated at about $2.5 billion and possibly facing more cost overruns.

On Sunday evening, Federa Reserve Board Chairman Jerome Powell released a video saying the investigation is political pressure, not a real legal inquiry.

He said the threat of charges is “a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

Political Implications

This situation shows the ongoing tension between the Trump administration and the Federal Reserve’s independence. President Trump has often criticized Powell for not cutting rates, which led to policy disputes in 2025. Republican senators like Thom Tillis of North Carolina have spoken out against the investigation.

Tillis said he would block Federal Reserve nominees until the issue is settled. Former Fed chairs and top economists released a bipartisan statement, comparing the investigation to what happens in countries with weak institutions.

Jeanine Pirro, the U.S. Attorney for the District of Columbia and a long-time Trump supporter, signed the subpoena. When asked, President Trump said he “knew nothing about it” but kept criticizing Powell’s leadership at the Federal Reserve and his handling of the renovation project.

Federal Reserve Independence at Stake

Powell said the investigation shows continued pressure from the administration. The Federal Reserve kept its main interest rate steady for most of 2025, but made three quarter-point cuts in September, October, and December, bringing rates down to 3.5%–3.75%. One analyst said,

“This is ham-handed, counter-productive, and going to set back the president’s cause.”

He also said the investigation might increase support for Powell within the Fed’s interest-rate committee.

According to the latest data from multiple sources:

- 30-Year Fixed Rate: 5.90% (Zillow average)

- 15-Year Fixed Rate: 5.36%

- 30-Year Refinance Rate: 6.01%

- 15-Year Refinance Rate: 5.45%

- VA 30-Year: 5.48%

- FHA Rates: Similar to conventional, averaging 5.87-5.99%

The 30-year mortgage rate has dropped by 19 basis points in the past month and is now almost one percentage point lower than a year ago. Freddie Mac reports a weekly average of 6.06% as of January 15, the lowest since September 2022.

2026 Mortgage Rate Forecast

Major forecasting institutions predict:

- Mortgage Bankers Association (MBA): Expects rates near 6.4% through 2026

- Fannie Mae: Projects rates above 6% through next year, dipping to 5.9% in Q4 2026

- National Association of Realtors: Anticipates rates between 5.5% and 6.5%

- Freddie Mac: Forecasts modest easing with a higher-for-longer scenario

The 2026 Housing Market Presents Shifting Trends And Complex Challenges:

Elevated home prices despite some regional cooling

- Inventory is still high, but many buyers are struggling with affordability, even as mortgage rates are declining.

- Many homeowners are locked in mortgage rates of 2% to 3% during the pandemic, which still limits the housing supply.

Opportune Rates are now significantly lower than the 7% or higher levels seen in 2023 and 2024.02. Federal Reserve rate cuts are offering some relief. relief.

- Increased refinancing opportunities for homeowners who purchased in recent years

- First-time buyers are re-entering the market as rates fall below 6%.

Mortgage Industry Survival

The mortgage industry is facing a tough 2026. Even though rates have dropped since 2024, loan volumes remain lower than usual, leading many small lenders to merge or close. Gustan Cho Associates NMLS 2315275, a dba of NEXA Lending NMLS 166090 stands out by serving borrowers nationwide through its Westmont, Illinois, Office. Licensed in 48 states (Not licensed in NY and MA), Gustan Cho Associates and its wholly-owned subsidiary companies help clients who have been turned down elsewhere by offering loans with no extra requirements. More than 80% of their clients were previously declined by traditional lenders.

PRECIOUS METALS MARKET SURGE On January 18, 2026, silver climbed to almost $91 per ounce, showing the high volatility in the precious metals market:

- Weekly Performance: Up approximately 12.46% for the week ending January 16

- Year-over-Year: Up over 196% compared to January 2025

- Recent High: Silver briefly surpassed $93 per ounce during the week.

- Friday Pullback: Fell to $89.94 per ounce due to profit-taking

GCA Forums News Market Dynamics The dramatic silver rally has been driven by multiple factors:

- Critical Minerals Designation: Silver was added to the U.S. critical minerals list in 2025 due to its role in advanced technologies and clean energy, particularly solar panels

- Tariff Uncertainty: Early-week surges came from concerns about potential U.S. import tariffs on critical minerals (later clarified by the Trump administration)

- Safe-Haven Demand: Geopolitical tensions and Federal Reserve independence concerns

- Supply and demand are out of balance: Higher industrial demand has caused some investors to wait weeks for physical silver from dealers like JD Bullion, and some have not received tracking numbers after paying.

- These delays suggest possible supply chain issues in the precious metals market.

- Some YouTube personalities and investors, including Robert Kiyosaki, have made very optimistic predictions, with claims from $1,000 to $20,000 per ounce.

- Most mainstream analysts, however, remain cautious.

- Traditional financial advisors suggest allocating 10–15% of a portfolio to precious metals and recommend not allocating more than 20% to any single metal.

- Silver’s rapid rise briefly pushed its market value to $5 trillion last week, making it the world’s second-most-valuable asset and surpassing several tech giants.

STOCK MARKET PERFORMANCE Major Indices (as of Friday, January 16, 2026)

- Dow Jones Industrial Average: 49,359.33 (-83.07 points, -0.17%)

- S&P 500: 6,940.01 (-0.06%)

- Markets finished the week flat, even though they hit new highs earlier in January.

- The Dow Jones Industrial Average passed 49,000 for the first time, jumping by 1,500 points in the first days of 2026.

- Fourth-quarter earnings reports showing mixed results

- Federal Reserve policy uncertainty

- Trump administration economic proposals creating volatility

- Technology stocks are doing well, especially semiconductor companies, which are leading the sector.

- Financial stocks are facing challenges as lawmakers consider capping credit card interest rates.

10-Year Treasury Yields

Treasury yields have been up and down because of uncertainty about Federal Reserve policy and concerns about its independence. The 10-year Treasury note still affects mortgage rates and usually trades about 1.8 percentage points higher.

MINNEAPOLIS ICE CONTROVERSY Mayor Jacob Frey’s Confrontation with Federal Agents

Minneapolis Mayor Jacob Frey drew national attention for his strong response to ICE actions in the city. He told federal agents to leave Minneapolis after an ICE agent fatally shot 37-year-old Renee Nicole Good on January 7, 2026. ICE agent Jonathan Ross shot Good during an encounter at East 34th Street and Portland Avenue. Video shows Good in her car as ICE agents approach. She was shot several times, including in the head and chest, and was pronounced dead less than an hour later.

Department of Justice Investigation Of Minnesota Governor Tim Walz And Minneapolis Mayor Jacob Frey

The Department of Justice is reportedly investigating both Mayor Frey and Minnesota Governor Tim Walz for possible obstruction of federal law enforcement. Mayor Frey defended his statements on ABC’s “This Week,” saying: “If the rumors are true, this is deeply concerning, because this is way more important than just me. There are other countries where you get investigated for saying something that runs counter to what the federal government states.” occurred on January 14, involving a Venezuelan immigrant who was in the country illegally and allegedly attacked a federal agent with a shovel. The individual was subsequently shot in the leg. Mayor Frey called for peace but maintained his stance that ICE should leave Minneapolis.

Ice versus Minnesota Politicians

The Department of Homeland Security says that since President Trump took office, Governor Walz and Mayor Frey have not worked with ICE. As a result, nearly 470 undocumented immigrants have been released into Minnesota communities.

Attorney General Pam Bondi was recently confirmed and is now involved in several investigations, including the Minneapolis case and the Federal Reserve probe. She has often said that “no one is above the law.” There is speculation about Patel’s status, but no confirmed reports say he is leaving. Patel was confirmed as FBI Director and is carrying out the administration’s law enforcement priorities.

Anti-Corruption Initiatives

President Trump has named officials to lead corruption investigations across the country. However, there are no independent sources confirming details about an “Assistant Attorney General” for corruption. President Trump still has strong support from his political base, though some Republican senators have criticized certain policies, especially the Federal Reserve investigation. Major business leaders have had mixed reactions to different administration actions.

SANCTUARY CITIES & ILLINOIS EXODUS Chicago, Illinois, is still losing residents, with both people and businesses pointing to high taxes and living costs as the main reasons. However, 2026 migration data is not yet available.

Cook County and the Chicago area have some of the highest property taxes in the country, prompting people to move to nearby states such as Indiana, Wisconsin, and Tennessee. As city policies become stricter, the Trump administration is pushing places like Chicago and Minneapolis to work with federal immigration enforcement.

This conflict is part of a larger debate about the roles of federal, state, and local governments. There is no current data on the auto industry’s performance, financing rates, or 2026 forecasts for this report.

The auto sector usually follows broader economic trends, and financing costs depend on Federal Reserve policy.

GCA Forums (www.gcaforums.com), also called the Great Community Authority Forums, is a fast-growing online platform for real estate and mortgage discussions. The site connects professionals and consumers to share insights and information. Gustan Cho Associates supports transparency in lending and helps guide borrowers through complex mortgage situations.

NEXA MORTGAGE & GUSTAN CHO ASSOCIATES PERFORMANCE Company Overview

Gustan Cho Associates operates as a division of NEXA Mortgage, LLC (NMLS 1660690), one of the fastest-growing mortgage brokers in the United States. The company:

- Licensed in 48 states (excluding New York and Massachusetts)

- Operates from Oakbrook Terrace, Illinois

- Maintains over 160 wholesale lending partnerships

- Specializes in no-overlay lending on government and conventional loans

- Offers extensive non-QM and alternative financing programs

Competitive Position

NEXA Mortgage has established itself as a major player in the mortgage broker space, differentiating through:

- 24/7 availability (evenings, weekends, holidays)

- Acceptance of challenging credit profiles

- Comprehensive loan product offerings

- Technology-driven processes

- National footprint with local service

Gustan Cho Associates says that over 75% of its clients were turned down by other lenders due to overlays, credit issues, or unique situations. By focusing on these often-overlooked borrowers, the company continues to do well even in tough market conditions.

Summary

As January 2026 continues, the financial sector is dealing with political pressure on the Federal Reserve, mortgage rates that have improved but remain high, volatility in precious metals, and ongoing debates over immigration enforcement in U.S. cities. The mortgage industry is preparing for a complicated year, but lenders like Gustan Cho Associates, which work with many types of borrowers, may find new opportunities even as interest rates remain challenging.

For more information or to talk about your mortgage needs, contact Gustan Cho Associates (https://www.gustancho.com/):

- Phone: (800) 900-8569

- Email: gcho@gustancho.com

- We are available 7 days a week, including evenings, weekends, and holidays.

This report is for informational purposes only and does not constitute financial, legal, or investment advice. Readers should consult with qualified professionals before making financial decisions.

GCA Forums News | Powered by Gustan Cho Associates |

gcaforums.com

Great Content Authority FORUMS and Sub-Forums Activities

Great Content Authority FORUMS activities in an online community to share ideas, ask questions, and connect with like-minded individuals.

-

Purchasing a House in Maine: A Complete Guide to Maine Mortgage Loans

Maine’s real estate market has a lot to offer, from coastal getaways and farmland to classic homes in small towns. If you’re a first-time buyer or moving to Maine, understanding local mortgage options and the homebuying process is important. Let’s look at what makes Maine’s housing market different.

What Makes Maine’s Housing Market Unique

Maine’s housing market is unique. There are oceanfront cottages in Portland and Bar Harbor, and more affordable rural homes in Aroostook County. Prices vary widely by region, with the southern coast more expensive and central or northern Maine more budget-friendly. More remote workers and changing age groups are also affecting the market.

Types of Mortgages In Maine

Maine offers several state-sponsored programs to assist first-time and moderate-income buyers. The Home Loan Program provides subsidized rates and down payment assistance. Buyers must complete homebuyer education, meet household income limits, and follow region-specific requirements.

- The Maine State Housing Authority (MaineHousing) also runs the Advantage Program, which offers up to $7,500 in down payment and closing cost assistance to eligible buyers.

- These initiatives help ease the financial burden of purchasing a home.

- The Pine Tree Zone Mortgage Program targets economically distressed regions, providing tax incentives and improved loan terms to buyers moving into designated zones. Its goal is to encourage growth and revitalize these communities.

Landscape Of Maine

Much of Maine is rural, making USDA Rural Development Loans valuable. Eligible buyers may qualify for a zero-down payment in areas outside cities such as Portland, Bangor, and Lewiston.

Mainstream Mortgage Options in Maine

In addition to state programs, Maine homebuyers can access national mortgage products. The three main types of loans for buyers in Maine are Conventional, FHA, and VA.

- Conventional loans, the most prevalent in Maine, are offered by banks, credit unions, and mortgage lenders.

- Conventional loans typically require a three percent down payment for qualified applicants.

- Conventional loans are often referred to as Con forming Loans because they conform to Fannie Mae and Freddie Mac guidelines.

- Buyers with strong credit and steady income secure the best terms.

FHA Loans In Maine

FHA loans offer greater credit flexibility, requiring a minimum down payment of 3.5 percent. FHA home loans are suitable for first-time buyers and those with lower credit scores and are backed by the Federal Housing Administration. They permit the purchase of older homes that meet FHA property standards.

VA Loans In Maine

VA loans are offered to veterans, active-duty service members, and surviving spouses, requiring no down payment or private mortgage insurance and offering attractive rates.

- Because of Maine’s robust veteran population, these are widely used.

- High-value properties such as those in Cape Elizabeth, Kennebunkport, and Mount Desert Island often require jumbo loans with higher down payments and credit scores.

Thinking about a seasonal home in Maine? Expect higher down payments, usually 10-20 percent. For primary homes, you may need a down payment of little or no amount.

Many Maine homes were built before 1960, making the state home to some of the oldest houses in the country. These homes have character, but older properties can be harder to finance and may need repairs. FHA 203(k) and Fannie Mae HomeStyle loans let you finance both the purchase and renovations.

Rural homes often have wells and septic systems, while city homes use municipal utilities. Lenders will require inspections of these systems, which can slow down the process. Be sure to budget for these inspection costs.

Heating is a big expense in Maine’s cold winters. Lenders look at these costs when deciding how much you can borrow, so homes with efficient heating can help you get better rates.

Property Taxes In Maine

Property tax rates in Maine vary widely by town. While Maine’s taxes are usually lower than those of other New England states, popular properties like waterfront homes can have higher taxes. Be sure to include these costs in your budget. Maine’s home-buying process is similar to that of other states, but there are some local differences. Getting pre-approved for a mortgage shows you’re serious and helps set your budget.

Working with a real estate agent who knows Maine well can be a big help. In most states, title companies handle closings, but in Maine, real estate attorneys handle them and offer additional legal protection.

Make sure to budget for attorney fees. Closings usually take 30 to 45 days, but cash or pre-approved buyers might close faster. Inspections are essential in Maine because foundations, roofs, heating, and water systems can have hidden problems. Even in a busy market, skipping inspections can lead to costly mistakes.

Down Payment Grants And Assistance In Maine

Beyond MaineHousing programs, some local governments provide additional down payment help. Portland, Bangor, and other cities periodically offer grants or forgivable loans for buyers in targeted neighborhoods.

Many Maine employers, especially hospitals and schools, extend homeownership assistance to attract staff. These may include down payment grants, forgivable loans, or help with closing costs.

Tribal housing authorities in Maine offer special programs benefiting Native American members who purchase homes on tribal lands or in eligible areas.

Partnering with Lenders in Maine

Local banks, credit unions, and mortgage companies in Maine understand the state’s unique housing market. They often offer more flexible financing for older homes, seasonal properties, and rural areas. Credit unions like Infinity Federal and Maine State, and community banks such as Bangor Savings, Camden National, and The First, give personal service and good rates. National online lenders also operate in Maine, but they might not be familiar with all the local challenges.

Things To Consider Buying A Home In Maine

Maine’s housing market is changing rapidly due to remote work, out-of-state buyers, and limited inventory. Understanding these trends can help you plan your move, make strong offers, and pick the right loan. In popular areas like Southern Coastal Maine, homes sell fast, so having a pre-approval and being ready to close quickly is important. Programs like GCA Mortgage Group’s Maine mortgage loans can help you compete.

Tips For Success

Begin with a homebuyer education course. Many Maine assistance programs require it, and it will give you the knowledge and confidence to handle the process. Set a clear budget from the start. Maine’s cost of living varies by region, so factor in property taxes, heating, insurance, and upkeep in your plan. Each area has its own feel, job market, and growth.

Research local areas to ensure your new home aligns with your long-term goals. Closing costs are usually 2-5% of the home’s price and cover attorney fees, title insurance, inspections, and lender fees.

Some Maine programs can help with these costs. Be patient—finding the right home at a fair price can take time. Don’t rush into a decision that doesn’t fit your needs. Are you curious about buying a house in Maine? Do you have questions about a certain area or property type? Join the discussion below and share your questions or experiences. We’d love to hear from you.

https://www.gcamortgage.com/maine-mortgage-loans/

gcamortgage.com

Maine Mortgage Loans - Home Financing In Maine

Explore Maine Mortgage Loans, including FHA, VA, USDA, Conventional, Non-QM, and Jumbo options. Find low-cost Maine home loans and grants.

-

GCA Forums News – Saturday, January 17, 2026Comprehensive Market Report & Economic Update

Powered by Gustan Cho Associates

BREAKING: DOJ Serves Subpoenas to Jerome Powell

On January 10, 2026, financial markets reacted strongly to news that the Department of Justice had launched a major investigation and sent legal requests for information to Federal Reserve Chair Jerome Powell and other officials. The investigation looks at what Powell told Congress in June 2025 about renovating the Federal Reserve’s main office.

The Fed’s Headquarters Renovation

The Fed has requested a $2.5 billion budget to renovate its headquarters. This has raised questions about how taxpayer money will be explained, tracked, and used. Powell confirmed he received the legal requests and said the Fed is fully cooperating with investigators. This is the first time a sitting Federal Reserve Chair has received these types of legal orders, raising new concerns about the central bank’s independence and possible political influence.

Market Response

The news has created uncertainty in global markets, and many now question the Fed’s independence. Powell has said he is worried that politics could affect sound economic decisions. As inflation continues and the investigation unfolds, the Fed’s interest rate decisions will be closely watched, and Powell will need to explain his views.

Current Market Overview – January 17, 2026

Market Overview for January 17, 2026

Stock Market Overview

As of this writing, January 17, 2026, early afternoon trading is as follows:

- S&P 500: 6,852.34 (+.29%, 19.91 Points Gained)

- Dow Jones Industrial Average: Stable, with typical volatility

- Financial markets remain strong despite ongoing global uncertainty.

Yields and Bond Markets

- 10-year Treasury Yield: 4.23% as of Friday, January 10

- Over the past week, yields have stayed between 4.15% and 4.23%.

- 2-Year Treasury: about 3.54%

- 30-Year Treasury: about 4.82%

The 10-year Treasury yield is at its highest in four months, driven by concerns about the Federal Reserve and strong economic data. Investors are seeking higher returns on long-term bonds, which suggests growing confidence in the economy.

Silver Market UpdatesSpot Silver Price: $90.88 (January 17, 2026)

- Silver prices are fluctuating between $88.00 and $91.00 per ounce, drawing close attention from investors.

- More investors are choosing silver to protect themselves from the weakening U.S. dollar.

- Consume delivery delays for physical silver are common among precious metals dealers.

- Be cautious of sensational price predictions from online personalities.

- Claims that silver will rise above $1,000 or even $1,000,000 per ounce are pure speculation and not based on solid analysis.

- Use reputable dealers and always check your tracking information. nt Mortgage Rates (January).

- Even though the Federal Reserve lowered rates at the end of 2025, mortgage rates are still high because people are still worried about inflation and the economy.

- Average rates are between 6.7% and 7.1%.7% and 7.1%.

- 15-Year Fixed Mortgage: About 6.0%-6.4%

- Actual rates vary based on credit score, down payment, and lender.

Housing Market Predictions for 2026

Homebuyers should expect a difficult market in 2026, as housing conditions remain challenging.

Main Affordability Crisis: Because home prices and interest rates are still high, it is hard for most people to afford a home.

- Inventory Pressures: While more homes are for sale, many buyers remain hesitant to purchase.

- Price Adjustments: Because many people cannot afford homes, prices may decrease slightly to reflect buyers’ limited budgets.

- First-Time Buyers Sidelined: High prices and high interest rates are still keeping many people from buying their first home.

Industry Consolidation

As of 2023, the mortgage industry has been shrinking as smaller brokers and lenders leave due to fewer new loans. Companies that made it through the tough years from 2022 to 2024 now have more money and are ready to grow again. The performance of Gustan Cho Associates stands out as one of the few companies thriving in this tough market, focusing on non-QM lending, government-backed loans, and unique borrower needs.

Strategic Advantages:

- Ability to offer a variety of loan products beyond traditional mortgages

- Strong partnerships with lenders leading to better pricing

- Experience in handling difficult loan situations that many other companies do not take on

- Fast processing is enabled by advanced technology.

The Mortgage Industry: Current Spotlight – Nexa Mortgage UpdateMajor Rebranding

In October 2025, NEXA Lending (formerly Nexa Mortgage), the largest U.S. mortgage brokerage by employee count, announced it was changing its name and shifting from being only a broker to also acting as a lender that works directly with other banks.

Key Points

- NEXA now provides the money for over half of its loans by working directly with other banks, and this figure is approaching 60%.

- The company is phasing out the “Brokers Are Better” slogan.

- Growth target: 5,000 mortgage loan officers

CEO Mike Kortas Said,

“We are a lender, more than we are a broker now. The difference between us and retail is that we have wholesale rates and we share the purchase advice on every single transaction.”

Industry Performance

NEXA Lending is expanding and hiring more staff. The company recently hired experienced leader Eric Mitchell to lead sales and business growth, and partnered with Tidalwave to provide brokers with new computer tools that use artificial intelligence to help find customers and manage paperwork. 350 loan officers remain the largest by headcount in the industry.

- NEXA keeps its loan officers happy, earning a 4.9 out of 5 rating for pay and benefits.

- Combined salary of NEXA mortgage brokers: $193,774 per year.

- Customer reviews of NEXA mortgage brokers are mixed.

- Some praise their service and efforts, while others mention communication issues.

Trends in the Auto Sector for 2026In 2026, The Auto Industry Continues To Face Several ChallengesAuto Loan Rates:

- New Car Loans: 6.56% (2023 was 7.11%)

- Used Car Loans: 11.4% (2023 was 11.59%)

- 2026 estimates: New car loans at 6.7%, used car loans at 7.1%

The Auto Sector’s Affordability Crisis ContinuesSome Important Figures:

- Nearly 17% of new-car buyers pay over $1,000 per month on their auto loans.

- Over 90% of buyers pay less than $400 per month for their auto loans.

- The average monthly payment for a new car loan is $748.

- The average monthly payment for a used car loan is $532.

- The average price for a new car is just under $50,000.

Trusting the Numbers:

More people are falling behind on their car loans, with late payments reaching the highest level in 15 years in November 2025. This shows that people are having more trouble with their finances. By 2026, TransUnion expects that over 1.54% of car loans will be more than 60 days late, up from 1.51% at the end of 2025.

Sales ForecastEdmunds Projects:

- 2026 new vehicle sales: Approx. 16 million units (almost unchanged from 2025)

- Affordability remains the primary constraint.

- Electric vehicle sales are expected to drop to 6% of total car sales in 2026, down from 7.5% in 2025, as the federal tax credit ends.

Industry OutlookThe auto industry is contending with:

- New tariffs on imported vehicles are making it harder to get a loan, especially for people with low credit scores.

- People with very low credit scores (300-500) make up about 16% of new-car buyers and over 21% of used-car buyers.

- Cars are returned to the market.

- Bottom Line: For most people, 2026 is not a good.

- Bottom Line: For most people, 2026 is not a good year to buy a new car.

- High prices, high loan costs, and possible new taxes on imported cars could make buying even more expensive & Initiatives.

Attorney General Pam Bondi:

Pam Bondi has served as U.S. Attorney General since January 17, 2026, following her appointment and confirmation after the Trump administration’s inauguration on January 20, 2025. There is no evidence supporting claims that she is “on the way out”; such reports are likely misinformation.

President Trump nominated Kash Patel as FBI Director. As of this report, there is no indication he will leave his position. Reports of his departure appear to be unfounded speculation.

Initiatives for the Oversight of Corruption

The Trump administration plans to increase oversight of federal agencies and address corruption at all levels of government. Details on new Assistant Attorney General appointments focused on corruption remain limited.

Sanctuary Cities and Enforcement of ImmigrationChicago and Illinois Migration PatternsIllinois Is Losing Population, And The Reasons Are Clear:

- High state and local taxation

- Rules and regulations that make it hard for businesses to operate

- Declining population in and around Chicago

- Companies based in Chicago are relocating to pro-business states such as Texas, Florida, and Tennessee.

Costs:

- Declining tax receipts as businesses and top earners exit.

- A bigger tax burden on the people who stay.

- A weaker commercial real estate market in downtown Chicago.

- A greater financial burden on school districts.

City Policies:

- Chicago and other major cities are Sanctuary Cities, with policies that limit federal immigration enforcement.

- These policies are controversial; supporters claim they protect communities, while critics argue they shield criminals and strain government services.

Welfare Fraud Investigation in Minnesota

- There is national interest in ongoing welfare fraud investigations in Minnesota.

- State and federal officials are examining complaints involving misuse of emergency relief funding and other welfare programs.

Summary:

- There are several active fraud investigations along with federal partners.

- There are investigations into allegations of fraud totaling hundreds of millions of dollars.

- Certain investigations have named particular community organizations.

- Fraud allegations have not named former Minnesota Governor Tim Walz, who is now a private citizen after running for Vice President in 2024.

- Minnesota’s Attorney General Keith Ellison has been involved in several fraud cases, but details about his most recent cases are limited due to ongoing investigations.

Caution: While investigations continue, avoid making generalizations about any community or group. Fraud is committed by a small minority. Most public assistance recipients are honest people facing difficult circumstances. jections

The Federal Reserve is trying to balance competing priorities.

- The Federal Reserve is working to balance different goals.

- The main interest rate is expected to be between 4.00% and 4.25% at some point in 2026.

- Current Rate of Inflation: 2.8%, above the Fed target of 2%

- Current Unemployment Rate: Increasing, but still near record lows

Current Unemployment Rate: Rising, But Still Near Record Lows.

- Price Moderation Continues: Home prices are expected to remain steady in most areas, though some places may see prices fall by 2-5%.

- Inventory Normalization: More people are expected to list their homes for sale, showing they are adjusting to the new prices.

- Volatility in Mortgage Rates: Rates will likely continue to fluctuate, ending up around 6-7%.

- Geographic Differences: Markets in Texas and the Southeast are expected to keep rising, while overvalued markets in the Pacific Northwest and California may decline.

Important Economic Indicators

- PCE Inflation Data: Fed’s target measure of inflation

- Employment Reports: Evidence of a weak labor market may lead to Fed rate cuts

- GDP Growth: Healthy at 2.1% but vulnerable to shocks

- Moderating Consumer Spending: People are showing signs of financial stress when making large purchases.

Trouble in Commercial Real Estate:What to Invest in for 2026Conservative Approach Suggested

Given current economic conditions, financial advisors recommend the following:

For Home Buyers:

- Only buy a home if you plan on living there for 5 or more years.

- Get the lowest possible inGet the lowest interest rate you can, and plan to refinance if better rates become available. ur budget (housing costs should not exceed 28% of your gross income).

- Save 6-12 months of your expenses for your emergency fund.

For Real Estate Investors:

- Focus on generating a steady income from your properties rather than hoping they will appreciate in value.

- Don’t over-leverage your investment.

- Invest in areas with more jobs and growing populations.

- Review each investment carefully before making a decision.

For General Investors:

- Keep your investments spread across different asset classes, such as stocks, bonds, and real estate.

- Maintain sufficient emergency savings in a high-yield account, where rates of 4-5% are available.

- Avoid risky investments such as cryptocurrency and trendy internet stocks.

- For personalized financial advice, consider working with a fee-only financial advisor.

Gustan Cho Associates: Your Mortgage Solutions Partner

In response to today’s challenging mortgage market, Gustan Cho Associates offers the following specialties:

- FHA Loans – First-time buyers with low down payment options.

- VA Loans – No down payment financing for qualifying veterans.

- USDA Loans – Financing for rural properties with no money down.

- Non-QM Loans – Options for self-employed persons and other specialty cases.

- Bank Statement Loans – Qualify using your bank statements instead of tax returns.

- Jumbo Loans – Financing for expensive real estate

- Credit Repair Guidance – Strategies to improve your credit.

- Fast Closings – For contracts requiring expedited closing.

What Sets Gustan Cho Associates Apart?

- Nationally licensed with a footprint that covers 48 states

- No extra rules; we follow the official agency guidelines exactly.

- Expert, professional assistance for complex loan challenges

- Our reliable technology helps us process loans quickly.

- You get direct access to your loan officer, personalized service, competitive pricing, and a wide range of lender options.

Get in Touch With Us:

📞 Phone: 800-900-8569

📧 Email: alex@gustancho.com

Website: https:gustancho.com

Market Summary for January 17, 2026

- The Fed Under Pressure: DOJ’s investigation into Powell raises new concerns about the central bank’s independence.

- Although the Fed is slowly lowering rates, mortgage rates remain high at 6-7%.

- Rability: High prices and interest rates are keeping many potential buyers out of the market.

- Auto Market Stress: Record-high car payments and rising loan delinquencies show that people are under more financial pressure.

- Despite these issues, the U.S. economy is still growing at a steady 2.1% rate.

Market Stability:

- Equity markets remain strong despite political and economic uncertainties.

- Silver and gold are drawing attention, but be cautious of extreme price predictions.

- Strategic Consolidation: The mortgage and auto finance sectors are seeing significant company failures and mergers.

- Regional Variations: State and local rules are creating big differences in business conditions and migration patterns.

- Opportunity in Adversity: Savvy buyers and investors can still find good opportunities, even in today’s challenging market.

Disclaimer

This report is provided for informational purposes only and does not constitute financial, legal, or investment advice. Market conditions change rapidly, and all data is subject to revision. Interest rates, home prices, and economic forecasts are estimates based on available information as of January 17, 2026. Individual circumstances vary, and readers should consult with qualified professionals before making financial decisions.

Gustan Cho Associates NMLS 2315275 is a licensed mortgage broker and does not provide investment advisory services. All loan programs are subject to borrower and property eligibility. Rates and programs are subject to change without notice.

justice.gov

Department of Justice | Homepage | United States Department of Justice

Official website of the U.S. Department of Justice (DOJ). DOJ’s mission is to enforce the law and defend the interests of the United States according to the law; to ensure public safety against threats foreign and domestic; to provide federal … Continue reading

-

Comprehensive Guide to Mortgage Loans, Programs, and Home Buying Tips in Arizona for 2026

Arizona attracts homebuyers from across the country with its sunny weather, strong economy, and lively cities such as Phoenix, Tucson, Mesa, and Chandler. From the Grand Canyon to its diverse landscapes, Arizona’s natural beauty attracts tourists and inspires people to buy homes. Whether you are buying your first home or have done it before, be ready: Arizona’s mortgage options are as unique and complex as its scenery.

The Arizona Home Market

Arizona’s home prices have gone up a lot over the past ten years, especially in busy cities like Phoenix. More people moving in and lots of jobs keep demand high. At the same time, cities like Flagstaff, Prescott, and Sierra Vista are becoming more popular with buyers looking for something new.

When looking at Arizona’s housing market, pay attention to water supplies, the increase in winter visitors, and how remote work and retirement are changing where people want to live.

Arizona’s property taxes are usually moderate and often beat the national average. However, don’t forget to budget for those higher summer cooling bills when weighing your options.

Types of Arizona Mortgage Loans

Arizona *https://gustancho.com/best-arizona-mortgage-lenders-for-bad-credit/) offers many mortgage programs for different budgets and buyers. Choosing the right loan can save you a lot of money over time.

Conventional Loans

Conventional loans are not backed by the government and usually need credit scores of 620 or higher and bigger down payments. You can get them with fixed or adjustable interest rates, and they usually last 15 or 30 years.

If you have good credit and a steady income, conventional loans often have the best interest rates. Many Arizona lenders even have programs with down payments as low as 3% for first-time buyers.

FHA loans are popular with first-time Arizona homebuyers, especially those with lower credit scores. These government-backed loans need a 3.5% down payment if your credit score is above 580, and you pay an upfront insurance fee of 1.75% of the loan amount, plus monthly insurance payments. These features help buyers with lower credit scores or incomes. Outside Phoenix, FHA loans work well for people shopping in Arizona’s more affordable areas that meet FHA limits.

VA Loans (Veterans Affairs)

Arizona has a big military community, with bases like Luke Air Force Base and Davis-Monthan Air Force Base (https://www.dm.af.mil/), so VA loans are very important here. These loans let eligible veterans, active-duty service members, and military spouses buy a home with no down payment.

VA loans ( https://gustancho.com/va-loan-with-500-credit-scores/) usually have lower interest rates, do not require monthly mortgage insurance, and have more lenient credit requirements. The VA funding fee, which is 2.3% for first-time users with no down payment, can be added to the loan, so you pay less upfront.

Arizona is a great place for veterans because of its friendly communities, tax breaks for military retirees, and easy access to VA loans. Many lenders focus on helping military buyers and know the VA loan rules well. Development loans offer zero-down-payment opportunities for buyers eyeing rural or select suburban homes. Plenty of communities just beyond Arizona’s big cities, even near Phoenix and Tucson, are eligible for this financing.r USDA loans ( https://gcamortgage.com/?s=usda+loans) are designed for buyers with moderate incomes, up to 115% of the area median. They come with a guarantee fee and annual mortgage insurance, but for those in places like Apache Junction, Casa Grande, or parts of Yavapai and Coconino counties, these loans can be a real advantage. Coconino County, Jumbo loans are the ticket to Arizona’s luxury markets, including Paradise Valley, Scottsdale, and Sedona. These loans go beyond conventional limits and require higher credit scores, larger down payments, and a healthy cash reserve. While jumbo loans can carry higher interest rates than standard mortgages, well-qualified buyers can still find competitive deals. Be ready to provide detailed proof of your income and assets.

Arizona-Specific Mortgage Programs and AssistanceThe Arizona Department of Housing offers several state programs to help new residents settle in and buy a home.

Home Plus Program: Offers up to 5% down payment assistance to first-time buyers and those who have not owned a home in the past 36 months. The assistance is a second lien with no monthly payments and is forgiven if the buyer stays in the home for a set period.

Pathway to Purchase: Combines favorable interest rates with down payment assistance to help Arizona families with low to moderate incomes achieve homeownership.

MCC (Mortgage Credit Certificate): Eligible buyers can get a federal tax credit for 20% of the mortgage interest they pay, which can save a lot of money and help them afford more.

Whether you can get help from the county depends on your income and the home’s price. Check if you qualify before you apply, and remember that many Arizona lenders can help you with the process.

Many Arizona cities also have their own programs to help homebuyers, giving you even more ways to buy your dream home.

- Phoenix IDA (Individual Development Account): Provides matched savings on down payments to assist buyers.

- Tucson Metropolitan Homeownership Center: Provides counseling and educational services.

- Pima County Housing Programs: Offer various types of assistance to first-time buyers.

How to Buy a Home in Arizona

Buying a home in Arizona follows a familiar path, but there are a few unique twists to keep in mind:

1. Financial Preparation: Before you start looking for a home, get pre-approved for a mortgage from a licensed Arizona lender. Pre-approval shows how much you can afford and tells sellers you are a serious buyer, which matters in busy markets.

2. Work with Real Estate Pros: Arizona agents are licensed and know the ins and outs of local rules. Pick someone who knows your target neighborhoods, whether that’s Phoenix, Tucson, or a hidden gem nearby.

3. Search for Homes and Make an Offer: Arizona’s MLS has lots of choices. If you end up in a bidding war, consider adding a clause to raise your offer if needed and ask the seller to help with closing costs.