Gustan Cho

Loan OfficerForum Discussions Started

-

All Discussions

-

Appraisal came in short at $210,000. Needed $225,000. Manufactured Home. Need 80% LTV cashout refinance to retire debts but appraisal shortage value need to explore HELOC with 90 CLTV. Any know who has the best rate and term. First mortgage is $30,000.

-

This discussion was modified 5 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 5 months ago by

-

Chicago, Illinois branded as the top three city in the .United States.

-

Chase going on a ride on my truck to get trained

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year ago by

-

Analyst’s forecast for homebuyers for 2024 is not good. Real Estate media giant ZILLOW NEWS forecasts home prices will keep increasing into 2024 despite skyrocketing Mortgage Rates. ZILLOW estimates a 4.9% increase in home prices from August 2023 to August 2024 due to short housing inventory. There’s a shortage of homes Nationally and many first time homebuyers are getting priced out of the housing market. Many homebuyers are finding it more difficult coming up with the down payment of a home purchase.

-

This discussion was modified 1 year, 6 months ago by

Sapna Sharma.

Sapna Sharma.

biggerpockets.com

Zillow Predicts a 4.9% Rise in Home Prices by Next August—Is That Possible?

Zillow is really bullish on housing, but are they right? How much are they projecting prices to grow? And who's in disagreement?

-

This discussion was modified 1 year, 6 months ago by

-

EPM EMPOWERED DPA program is the best down payment assistance mortgage grant program in the nation. You need a 620 credit score, front and back end debt to income ratios of 48.99%, rate of 7.75%, borrower paid compensation, and need an automated underwriting system findings approval. The EMPOWERED DPA PROGRAM is for first time homebuyers, first Responders, Veterans, Volunteers, teachers, medical professionals, veterans, government workers, and families who have income no greater than 140% of the areas median household income. Here is a guide on the EPM EMPOWERED DOWN PAYMENT ASSISTANCE PROGRAM. The EPM EMPOWERED DPA PROGRAM is available in all states except for Washington state. If you are interested in qualifying for EPM EMPOWERED DPA PROGRAM Contact Gustan Cho Associates dba of NEXA Mortgage LLC at gcho@gustancho.com or call 262-627-1965. Text us for a Faster Response. GCA MORTGAGE GROUP is licensed in 48 states including Washington DC, Puerto Rico, and the U.S. VIRGIN ISLANDS.

https://www.gustancho.com/down-payment-assistance

-

Inflation rates are soaring like never in history. Mortgage Rates are at 25 year highs. Mortgage rates we 2.5% 18 months ago and today is 7.625% for prime borrowers. Borrowers with sub 680 credit scores are paying 7.75% plus 3.5% in discount points. Home prices are at historic highs. Many would be homebuyers are priced out of the housing market. The mortgage industry lost 50,000 licensed mortgage loan originators from 140,000 to 90,000 and is expected to see more loan officers leave the mortgage industry. Every thing is going up. Car prices have skyrocketed and continues to go higher. Homeowners insurance premiums are increasing like never before. Joe Biden makes a speech a few days ago saying that Inflation is low under his watch. What is this guy thinking?

-

Lending Network, LLC is aggressively looking commercial loan officers as independent contractors

https://lendingnetwork.org/commercial-loan-officer-career-opportunities/

lendingnetwork.org

Commercial Loan Officer Career Opportunities

Lending Network, LLC offers commercial loan officer career opportunities with no experience to select goal oriented individuals.

-

Rent-to-own with Home Partners of America enables rents to get a home with the option to purchase at a later date. The renter would be guaranteed the home they are renting until a loan officer work on their credit so the renter qualifies for a mortgage. The rent to own homebuyer would either need to rebuild their credit or income during they are renting. Home Partners of America (HPA) coordinates the rent-to-own homes. Here is a link to Rent-To-Own Homes

https://fhabadcreditlenders.com/rent-to-own-homes

fhabadcreditlenders.com

Rent-To-Own Homes With Home Partners of America

Rent-to-own homes with Home Partners of America helps renters move into a home today while getting ready to get qualified for a mortgage loan.

-

Danny Vesokie is President of Affiliated Financial Partners Commercial Loan School, a training program for Commercial Loans. It is a three day one on one training school online with lifetime support. I have known Danny Vesokie for years and he has trained people who want to get into Commercial lending through his Affiliated Financial Partners Commercial Loan Officer School.

-

This discussion was modified 5 months, 1 week ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 5 months, 1 week ago by

-

I like to introduce my dear friend Bill Burg

Bill Burg and I go back 2017 which is six years. I hired Bill i n2017 at USA Mortgage. I was boufgr Mr. Burg was hired as a loan officer. He was offered a larger salary and position that it was better than he had at USA Mortgage at a different Mortgage Company about a year later. We kept in touch over the years until he recruited me and my team in January 2021. We grew our friendship and are still going strong with common interests we share. Bill Burger-King will be an important part and contributing partner in this section.

-

This discussion was modified 1 year, 6 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 6 months ago by

-

German Shepherds with long coats are a variety of the breed that has a longer, silkier coat compared to the standard short-haired German Shepherds. These long coats can be the result of a genetic variation in the breed, and they are not as common as the short-coated German Shepherds. The long coat variation is still recognized by kennel clubs and breed standards.

When it comes to German bloodlines, there are several well-known bloodlines and breeding programs in Germany that have produced high-quality German Shepherds. These bloodlines often prioritize specific traits, such as temperament, working ability, and conformation to the breed standard. Some of the famous German bloodlines known for producing excellent German Shepherds include:

-

West German Working Lines (WGL): These lines are known for their strong work ethic, intelligence, and versatility. They are often used in various working roles, including police work, search and rescue, and Schutzhund.

-

East German DDR Lines: Dogs from the former East Germany (DDR) were bred for their endurance and courage. They have a different appearance and temperament compared to West German Shepherds and were originally used for border patrol and military work.

-

Czech Working Lines: These German Shepherds are highly regarded for their work in protection sports like IPO (formerly known as Schutzhund). They are known for their intense drive and athleticism.

-

Show Lines: Some German Shepherds come from show lines, which prioritize conforming to the breed standard in terms of appearance. These dogs may not have the same working ability as those from working lines but are still bred for good temperament.

-

American Lines: American breeders have developed their own lines, often mixing German and American dogs. Some of these lines prioritize specific traits for different purposes, such as show, working, or family pets.

When you’re looking for a German Shepherd from specific bloodlines or with a long coat, it’s essential to do thorough research and find a reputable breeder. Reputable breeders will have a strong understanding of their dog’s lineage, health, and temperament, and they will be transparent about the bloodlines they work with.

Always prioritize the health and well-being of the dog over aesthetics or specific bloodlines, and consider adopting from a rescue organization or shelter, as there are often many wonderful German Shepherds in need of loving homes regardless of their bloodlines or coat type.

https://www.youtube.com/shorts/LGpn9HIkP0k

-

This discussion was modified 1 year, 6 months ago by

Gustan Cho. Reason: Want to get notified

Gustan Cho. Reason: Want to get notified

-

-

Loan Officers who have case scenario questions about commercial loans through Lending Network, LLC, please post them on this thread and either Gustan Cho or myself will answer them as soon as possible. Please be detailed in your questions regarding the property, such as the type of property, location, history, and other pertinent facts. Share the purpose of the loan, the current value or P and L, the repairs required, the loan amount, the scope of work, and projected P and L. Besides the purpose of the loan, explain in detail what the money will be used for, and the projected proforma P and L after the renovation or improvements. Explain the current value of the house, the renovation costs, the after improved value, and expected time to stabilize the property. The down payment the borrower has to put down, reserves, and experience of the guarantor or guarantors. If we decided this will be a loan that has merits, the next step will be to have the client complete and personal financial statement and summary sheet to us via email. If you have any questions, please post on this thread or start a new thread. We will start all inquires, case scenario, Q and As on this forum.

https://www.lendingnetwork.org

-

This discussion was modified 1 year, 9 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 5 months, 1 week ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 2 weeks, 4 days ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 2 weeks, 4 days ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 9 months ago by

-

More and more insurance companies are leaving Florida. It is becoming more difficult to insure homes in Florida due to hurricanes. Hurricanes is costing Florida homeowners insurance companies billions of dollars in losses. The latest property and casualty insurance company to exit the Florida market is Farmers Insurance.

https://gustancho.com/being-prepared-for-hurricanes/

gustancho.com

Being Prepared For Hurricanes in Florida

Being prepared for hurricanes in Florida is a matter of priority. People should prepare days or weeks ahead of the target hit date of a hurricane.

-

Here’s an updated article on Gold investment

-

This thread pertains to John Parker. John, can you please explain what AXEN Mortgage is about and how AXEN MORTGAGE works. Many people are confused about AXEN Mortgage and why NEXA MORTGAGE doesn’t talk about AXEN Mortgage more often.

-

Amanda had a question on a real estate investor who has a 35 unit apartment building needing to refinance out of a bridge loan. The apartment building was purchased needing work. As a real estate investor of 7 apartment complexes consisting of 3,000 units, lenders require the following:

1. Summary sheet of the purpose of the loan and property detail. Location. What condition is building in A, B, C, D tier and what type of area is the apartment in A, B, C, D.

2. Personal financial statement

3. Three years of tax returns for conforming traditional commercial loans

4. Current P and L and rent roll which is current and proforma. Eventually need copy of leases. Need to itemized income and expenses which includes insurance, property tax, payroll, utilities, maintenance, water, and third-party vendors. Number of units, and approximate square footage. Number of rooms, bedrooms, bathrooms, and does it have dining rooms. Parking spaces or carports.

5. Type of work done and itemized cost

6. Real estate purchase contract

7. Appraisal if available and estimation of value of the property

8. How many are market rent, and section 8 housing

9. Comparable rents in the area for studio, one bedroom, two bedroom, etc.

10. What type of loan program does the borrower prefer and/or expect: Recourse, or non-recourse. How many owners to the property. Is property individually owned or in a LLC or partnership. Traditional conforming commercial loan or hard money loan, or bridge financing.

11. Any deliquent outstanding bills such as mechanics lien, tax liens, or pending lawsuit.

-

This discussion was modified 4 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 2 weeks, 4 days ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 4 weeks ago by

-

It was a pleasure speaking with Kelce Rock, a residential, business, and commercial loan officer with his own team and extensive experience in commercial and business loan originator. Mr. Kelce Rock truly goes above and beyond for his clients and I have absolutely no doubt Kelce will make a phenomenal state senator and future member of U.S. Congress where he will make a difference. We need politicians who serve American Families and not dumbocrats like Imbecile Biden and Sex and Crack Addict Hunter Biden who enrich themselves and are known pedophiles. Dumbass Hunter Crackhead Biden has absolutely no morals and even goes and marries his dead brother’s wife. What a pig.

-

How do you go about getting a lost replacement title for an RV that is under a family members name? Can I get it from DMV or does my family member need to go in person. Trying to transfer RV from my family member to me and the lender needs the title since I am taking out on it.

-

The government says inflation is 10%. The government are liars. Have you noticed the cost of goods at the local grocery store. A 12 pack of soda cost $3.99 just a year ago. Cost of a 12 pack of soda is now over $10.00. That’s a 300% increase in price. I remember buying a two liter plastic bottle of RC for 0.99 cents. Now any two litter soda is $3.50 to $4.00. I can go on and on. A fully decked out brand new pick up truck or SUV can cost $100,000. With skyrocketing inflation numbers, Mortgage rates surpassing 8%, wages remain the same. I remember not to long ago a $100,000 annual salary was considered high income and wealthy. $100,000 with the inflation rates today is lower middle class. If you work for the government, you will get raises because the government print dollars through their printing press. There needs to be a change and people need to wake up and stop being in a state of denial

-

Modular homes look great and are better than stick built homes for a fraction of the cost and time to build. Hands down a lot of house for the money. https://youtube.com/watch?v=e3sSdeQlBSM&feature=share8

-

Inflation refers to the general increase in prices of goods and services in an economy over a period of time, leading to a decrease in the purchasing power of money. When inflation occurs, each unit of currency buys fewer goods and services than it did before. It is usually expressed as an annual percentage rate.

Inflation can be caused by various factors, but some common drivers include:

-

Demand-Pull Inflation: This occurs when the overall demand for goods and services exceeds the available supply. When demand outstrips supply, prices tend to rise.

-

Cost-Push Inflation: This type of inflation is caused by an increase in the production costs for businesses, such as rising labor costs or raw material prices. As businesses pass these increased costs onto consumers, it leads to higher prices.

-

Built-in Inflation: This is also known as wage-price inflation and occurs when businesses raise prices to compensate for increased labor costs, and workers, in turn, demand higher wages to keep up with the rising prices.

-

Monetary Factors: The money supply in an economy can also influence inflation. If the central bank prints more money without a corresponding increase in economic output, it can lead to too much money chasing too few goods, causing inflation.

Inflation is typically measured using various price indices, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI), which track changes in the prices of a representative basket of goods and services.

Some level of inflation is generally considered normal and even desirable in modern economies. A moderate and stable inflation rate can encourage spending and investment and can help avoid deflation, which is a persistent decrease in prices that can be damaging to economic growth.

Central banks and governments often aim to keep inflation at a target rate (usually around 2% in many advanced economies) through monetary and fiscal policies. However, when inflation becomes too high or too volatile, it can erode the value of savings, disrupt financial planning, and create economic instability. Conversely, low or negative inflation can also have adverse effects on the economy, such as encouraging hoarding and deferring spending. Striking the right balance is essential for maintaining a healthy and sustainable economy.

-

-

Insider tip. Buy silver bars. The dollar is going to shit, the Federal Reserve Board will be shutting down, Trump is getting reelected and will make the currency backed by Gold and Silver, Biden and Hunter will face the ⛽️ ⛽️ ⛽️ gas chamber, Obama and Michael Robinson Obama are going to come clean as a faggot and transgender, and the nation will prosper. Adam Schiff will get the electric chair for being a pedophile, Bill Gates will be sent to gas chamber for crimes against humanity, and Democrats will all vanish from coronavirus vaccine aftermath blood clots.

-

Buying a house is a significant life event and requires thorough preparation. Here’s a generalized step-by-step guide that could help you with the process of buying a house in Alabama or any other state:

1. **Determine Your Budget**: Before you start looking at homes, figure out how much you can afford to spend. A common rule of thumb is that your monthly mortgage payment should not exceed 28% of your gross monthly income. Don’t forget to factor in other costs, like homeowners insurance, property taxes, maintenance costs, and HOA fees if applicable.

2. **Check Your Credit Score**: Your credit score will significantly influence your mortgage interest rate. Ensure your credit score is in good standing; if not, you might want to improve it before applying for a mortgage.

3. **Save For a Down Payment**: It’s usually recommended to have a down payment of at least 20% of the home price to avoid paying private mortgage insurance (PMI). However, many loan programs allow for lower down payments, some as low as 3.5% or even 0% for certain types of loans.

4. **Get Pre-Approved for a Mortgage**: Before you start house hunting, get pre-approved for a mortgage. This will make your offer more attractive to sellers and give you an idea of how much house you can afford.

5. **Find a Real Estate Agent**: A good real estate agent with local knowledge can be a valuable resource. They can provide insights about the neighborhood, help negotiate the price, and guide you through the closing process.

6. **Search for Homes**: Now comes the exciting part, looking for your dream home. Remember to take notes about

-

Boats and yachts are right in line with the most Depreciation toys right behind motorhomes. Lending Network, LLC offers financing for mega boats and mega yachts up to 125% LTV in all 50 states

Check out our website about boats and mega yachts financing http://www.lendingnetwork.org/boats-and-yachts/

lendingnetwork.org

Financing boats and Yachts is offered at Lending Network, LLC. Down payment and rates depends on age of boat and borrowers credit scores

-

Financing an RV (recreational vehicle) is similar in many ways to financing a car, but it can also be akin to financing a home, particularly for larger, more expensive RVs. Here are some steps to help you secure RV financing:

1. **Check Your Credit Score**: Your credit score will impact your ability to secure financing and the interest rate you receive. The higher your credit score, the lower the interest rate you’ll typically qualify for.

2. **Determine Your Budget**: Understand how much you can afford. Use an RV loan calculator to help you determine what your monthly payments might be at different interest rates and loan terms.

3. **Save for a Down Payment**: Like with auto and home loans, having a down payment can help you secure a better rate. It also reduces the amount you need to finance.

4. **Shop Around for Lenders**: There are a number of places where you can secure financing for an RV, including:

– **Banks and Credit Unions**: Traditional financial institutions often offer RV loans. If you already have a relationship with a bank or credit union, they may be able to offer you a better rate.

– **Online Lenders**: Online financial institutions often have competitive rates and terms, and they can be a convenient option since you can apply from home.

– **RV Dealerships**: Some RV dealerships offer financing. While this can be a convenient option, keep in mind that dealership financing can sometimes be more expensive than other options.

– **RV Loan Companies**: Some lending companies specialize in RV loans, understanding the unique needs and requirements of financing an RV.

5. **Compare Loan Terms and Rates**: RV loans can have terms anywhere from 10 to 20 years, depending on the cost of the RV and your financing. Like with any loan, a longer term will usually mean lower monthly payments, but a higher total cost over the life of the loan. When you’re comparing loans, be sure to look at both the interest rate and the term to understand the total cost.

6. **Pre-Approval**: If possible, get pre-approved for your loan. A pre-approval will give you a better understanding of what you can afford and can make the purchasing process smoother.

7. **Negotiate**: Once you have your financing in place, you’re ready to negotiate the purchase of your RV. Having pre-approved financing can give you more bargaining power.

8. **Finalize Your Financing**: Once you’ve agreed on a price for the RV, you’ll need to finalize your financing. This will typically involve filling out an application with your personal information, including your income and employment information.

Remember to read all the loan terms and conditions carefully before signing the contract. Make sure you understand all the fees, the interest rate, and the terms of the loan.

Lastly, keep in mind that an RV is a big investment. Make sure you also budget for maintenance, repairs, insurance, and other ongoing costs.

-

Financing a new or used car typically involves securing a loan to cover the cost of the vehicle, which you then repay over a set period of time. Here’s a general process you can follow:

1. **Assess your budget**: The first step to financing a car is understanding what you can afford. This includes considering the monthly payments you can manage, as well as the down payment

2. Lending Network offers 125% LTV car loans and exotic car loans.

3. Ferrari, Lamborghini, and luxury six figure SUVs and pick up trucks.

-

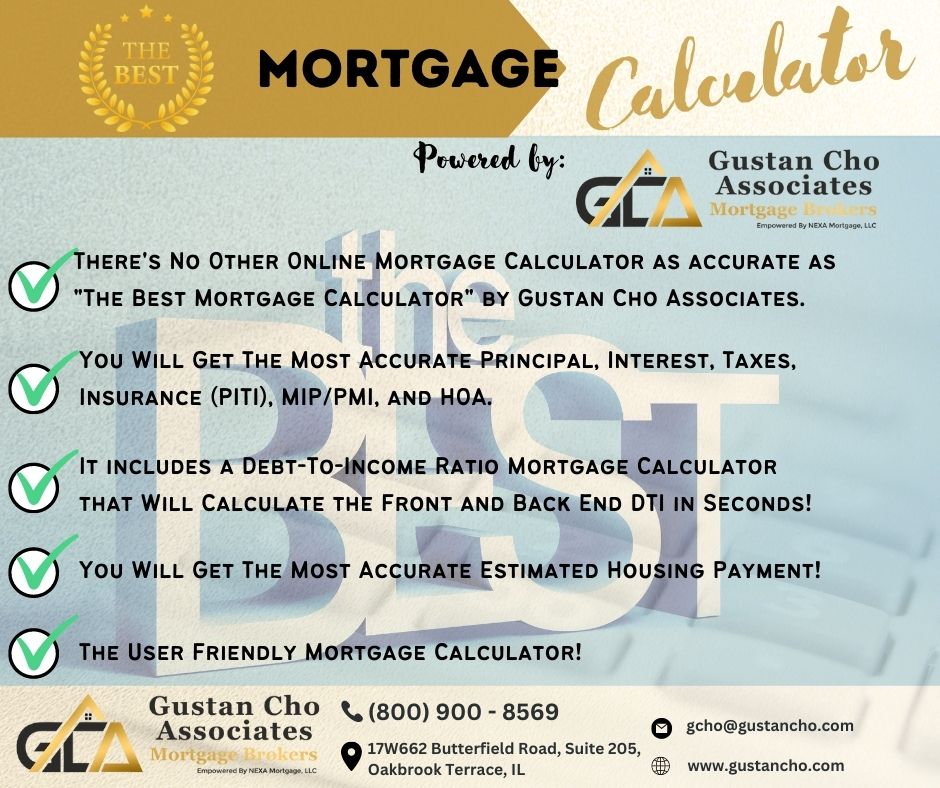

There are hundreds or thousands of Mortgage Calculators online. However. The Team at Gustan Cho Associates Alex Carlucci and Monica Cho has designed, created, tested, and launched the best mortgage calculator that is user friendly with the best accuracy than any other online mortgage calculator. The Best Mortgage Calculator is user-friendly for loan officers, processors borrowers realtors, underwriters, and the general public. Not only does it calculate PITI and Housing payments but also debt to income ratios and agency guidelines on debt to income ratios. Try out the best mortgage calculator https://gustancho.com/best-mortgage-calculator

gustancho.com

Best Mortgage Calculator | PITI, PMI, MIP, and DTI

We are at Gustan Cho Associates, You easily check your mortgage eligibility with the best mortgage calculator With PITI, PMI, MIP, HOA, and DTI.

-

The decision to move and raise a family in Connecticut, or any location, will depend largely on personal preferences, as what is “good” can vary widely from person to person. That being said, as of my knowledge cutoff in September 2021, Connecticut generally had a number of attributes that many people might find attractive for family life:

1. **Education:** Connecticut is known for having a strong education system, with high test scores and graduation rates. In fact, some of its public schools are among the best in the country. Additionally, it’s home to prestigious universities like Yale.

2. **Safety:** Some towns in Connecticut boast low crime rates, which can be a draw for families seeking a safe environment for children.

3. **Quality of life:** Connecticut’s strong economy supports a high standard of living. There is access to good healthcare facilities, and residents enjoy beautiful landscapes—from the picturesque New England coastal towns to charming rural areas.

4. **Proximity to major cities:** Connecticut is located within reasonable travel distance to major cities like New York City and Boston, which is great for access to cultural events, job opportunities, and more.

5. **Outdoor recreation:** There are plenty of outdoor recreational activities available, including hiking, fishing, skiing, and boating, among others.

However, there are also some potential drawbacks:

1. **Cost of living:** Connecticut is one of the more expensive states to live in, especially when it comes to housing and taxes. This could be a factor depending on your financial situation.

2. **Economic disparities:** While Connecticut as a whole has a strong economy, there are significant disparities. Some areas, particularly larger cities like Bridgeport and New Haven, struggle with higher rates of poverty and lower-performing schools.

3. **Traffic:** Depending on where you live and work, traffic can be a significant issue in Connecticut, particularly along the I-95 corridor.

As with any major decision, it’s best to do thorough research and perhaps visit to get a feel for the areas of Connecticut you’re considering. It’s always a good idea to take into account factors like job opportunities in your field, climate, cultural fit, and specific local resources or community attributes that are important to you.

-

The decision to buy a house in Colorado, or anywhere else for that matter, depends on several factors such as your personal financial situation, the housing market in Colorado, and your long-term plans. Let’s look at some specific points:

1. **Market Conditions**: As of my knowledge cutoff in September 2021, Colorado, especially cities like Denver, Boulder, and Colorado Springs, had seen significant growth in real estate prices over the past decade. However, markets can fluctuate, so it’s essential to research the current market trends and future predictions.

2. **Location**: Different parts of Colorado offer different lifestyles. For example, Denver is a bustling city with thriving industries, while mountain towns offer outdoor recreational opportunities like skiing and hiking. The right location for you depends on your lifestyle preferences.

3. **Affordability**: Keep in mind that buying a home is a substantial financial commitment. Consider your income, savings, and other expenses to ensure you can afford the mortgage payments, taxes, insurance, and maintenance costs.

4. **Long-Term Plans**: Buying a house is typically a long-term investment. If you plan on staying in Colorado for a significant amount of time, buying could be a good decision. On the other hand, if you’re unsure about your long-term plans, renting may be a safer option.

5. **Career Opportunities**: Colorado has robust job markets in industries like technology, healthcare, and aerospace. If your career aligns with these industries, it could be a good place to invest.

6. **Quality of Life**: Colorado often ranks highly in terms of quality of life due to its outdoor recreational opportunities, access to nature, and good education and healthcare systems.

Before you decide to buy a house in Colorado, it would be a good idea to speak with a local real estate agent who can provide detailed information about the market conditions and neighborhoods. Additionally, a financial advisor can help ensure you’re financially prepared for the commitment of buying a home.

-

I need to replace a large deck with stairs, railings, and the works. Do any of you know this new decking material that is out on the market? I need to do tons of work on my home. House was built in 1998 and need everything from exterior siding, roof, gutters, sofits, fascia, downspouts, windows, driveway, you name it, I need it. This is aside from the inside remodeling project such as kitchens and bathrooms, flooring, countertops, appliances, and more. I will keep everyone posted as how things progress.

Social Media Links