Jeannie

Dually LicensedForum Replies Created

-

Serial police impersonator Jeremy Dewitte

https://www.facebook.com/share/v/BmxAjsAt9yoGmJB7/?mibextid=21zICX

-

Silver price remain strong at $30.00 per ounce. Will this be the week where silver breaks $33.00 per share. The haters are afraid 😨 of a silver squeeze. Silver price in 1976 was $4.00 per ounce. Silver price opened today and is at $30.56.

https://www.youtube.com/live/rLzmL-5GmfU?si=Q8OkZw4NJHn-L3sx

-

That’s a clever joke! Here’s how you could share it:

“Just saw an ad for glass coffins, do you think it will take off? Remains to be seen.”

The humor here comes from the double entendre of “remains” (as in human remains) and the uncertainty of whether a novel product will become popular. It’s a great example of wordplay and a pun that combines a morbid topic with a lighthearted twist.

-

Finding $20 in a supermarket parking lot can raise ethical considerations about what to do with the money. Considering “What would Jesus do?” can guide you towards a compassionate and morally sound decision. Here are a few steps you could take, inspired by Christian principles and teachings:

1. Seek the Owner

- Look Around: Check if anyone nearby seems to be searching for something they lost.

- Report to Store Management: Hand the money over to the supermarket’s customer service or management. They can keep it in a lost and found in case someone reports it missing.

2. Help Others

- Charity: If you cannot find the owner, consider donating the money to a charitable cause. Jesus often emphasized helping the needy and giving to those less fortunate (Matthew 25:35-40).

- Acts of Kindness: Use the money to perform a random act of kindness, such as buying a meal for someone in need or contributing to a community project.

3. Reflect on Intentions

- Prayer and Reflection: Spend some time in prayer or reflection, seeking guidance on how best to use the money in a way that aligns with Christian values and teachings.

Biblical References for Guidance

- Matthew 7:12: “So in everything, do to others what you would have them do to you, for this sums up the Law and the Prophets.”

- Luke 6:31: “Do to others as you would have them do to you.”

- Acts 20:35: “In everything I did, I showed you that by this kind of hard work we must help the weak, remembering the words the Lord Jesus himself said: ‘It is more blessed to give than to receive.’”

In summary, the decision should align with principles of kindness, honesty, and generosity. By either trying to return the money to its rightful owner or using it to help others, you can follow a path that reflects Jesus’ teachings and compassionate approach to life. Or like Peter said, turn it for a bottle of wine.

-

Wine art refers to the various forms of artistic expression inspired by wine and winemaking. This can include visual arts like paintings and sculptures, as well as other creative endeavors such as wine labels, photography, and even wine-related installations. Here’s a detailed look at the different aspects of wine art:

Visual Arts

Paintings and Prints:

- Classic and Modern Art: Many artists have been inspired by wine, creating works that depict vineyards, wine bottles, and glasses. Artists like Claude Monet, Vincent van Gogh, and more contemporary artists have all created works featuring wine.

- Wine-themed Art: Modern artists often create vibrant and abstract representations of wine, capturing the essence of wine culture.

Sculptures:

- Vineyard Sculptures: Some vineyards and wineries commission sculptures to enhance the beauty of their landscapes. These can range from traditional to avant-garde pieces.

- Bottle Art: Sculptors sometimes use wine bottles or corks to create intricate and innovative sculptures.

Wine Labels

Artistic Labels:

- Brand Identity: Wine labels are a crucial aspect of a winery’s branding and can be highly artistic. Some wineries collaborate with renowned artists to create unique labels.

- Collectors’ Items: Certain wine labels become collectors’ items due to their artistic value and limited editions.

Photography

Vineyard and Winery Photography:

- Landscape Photography: Photographers often capture the beauty of vineyards and wineries, highlighting the natural landscapes where wine is produced.

- Still Life: Photographs of wine bottles, glasses, and related accessories are popular, showcasing the elegance and aesthetic appeal of wine.

Installations and Mixed Media

Wine-related Installations:

- Public Art: Some artists create large-scale installations in public spaces or wineries, integrating wine barrels, bottles, and other elements to create immersive experiences.

- Mixed Media: Artists may use a combination of materials, including wine itself, to create unique pieces that explore the sensory and cultural aspects of wine.

Notable Examples and Sources

-

Wine Spectator: Features articles and galleries on wine art, including profiles of artists and their works.

-

Wine Art Exhibitions: Various exhibitions around the world showcase wine art, such as the annual “Art and Wine” exhibit at certain galleries and wine festivals.

-

Vineyard Installations: Many renowned wineries host art installations and sculptures on their grounds, offering a blend of natural beauty and artistic expression.

By exploring these different forms of wine art, enthusiasts can appreciate the deep connection between art and the culture of winemaking. Whether through traditional paintings, modern sculptures, or innovative installations, wine continues to inspire and be celebrated in the world of art.

winespectator.com

Learn more, drink better: 400,000+ expert wine ratings, with tasting notes, score, price and when to drink. The essentials of wine, storing and serving advice, recipes and food pairing tips, best restaurants for wine, vintage charts and news

-

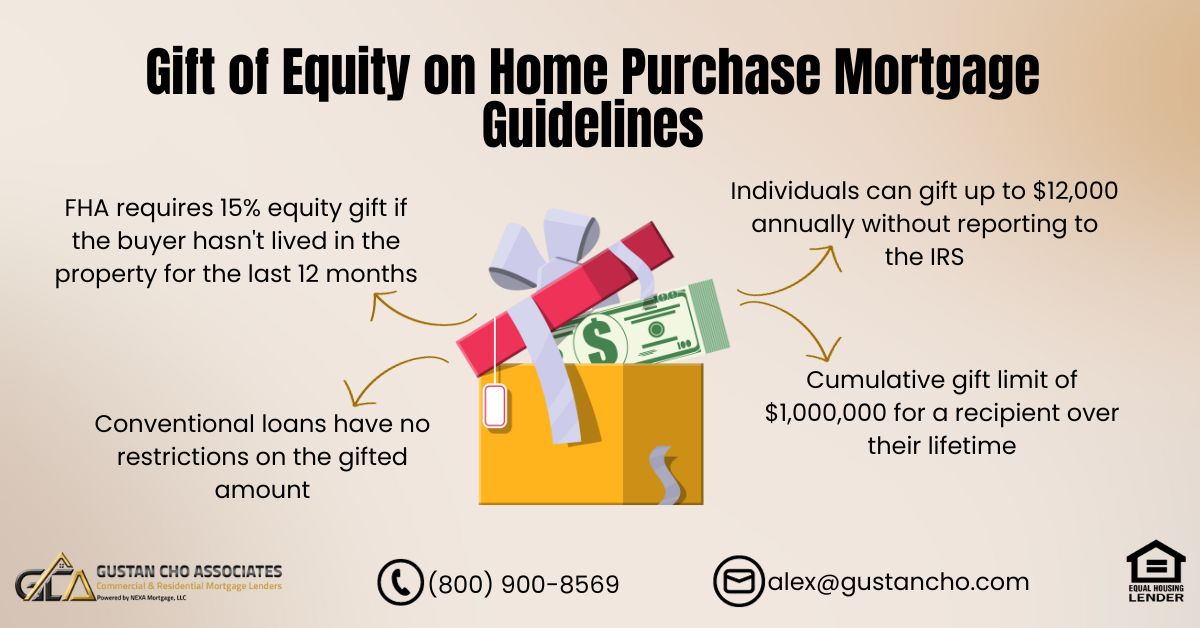

Rhonda, here is the frequently asked question on what is a gift of equity home purchase:

A gift of equity is a financial transaction in which a property is sold to a family member or close associate at a price below its market value. The difference between the market value and the selling price is considered a “gift” to the buyer. This concept is often used to help family members, particularly children, purchase a home with more favorable terms. Here’s how it works and some key points to consider:

How a Gift of Equity Works

- Property Appraisal: The property’s market value is determined through a formal appraisal.

- Sale Price: The seller agrees to sell the property to the buyer at a price lower than the appraised market value.

- Gift of Equity Amount: The difference between the appraised market value and the sale price is the gift of equity. For example, if a home is appraised at $300,000 and sold for $250,000, the gift of equity is $50,000.

- Down Payment: The gift of equity can be used by the buyer as a down payment on the property, potentially reducing or eliminating the need for additional down payment funds.

Benefits of a Gift of Equity

- Lower Down Payment: Buyers can use the gift of equity as part or all of their down payment, making it easier to afford the home purchase.

- Reduced Loan Amount: Since the sale price is lower than the market value, the buyer may need to take out a smaller loan.

- Favorable Loan Terms: The buyer may qualify for better loan terms due to the reduced loan amount and higher equity stake.

Tax Implications

- Gift Tax: The IRS treats a gift of equity as a taxable gift. However, the annual gift tax exclusion ($17,000 per recipient as of 2024) and the lifetime gift tax exemption ($12.92 million as of 2024) can apply, allowing many gifts of equity to avoid triggering gift taxes.

- Documentation: Proper documentation is essential. A gift letter from the seller to the buyer is typically required by lenders, stating that the gift is not a loan and does not need to be repaid.

Mortgage Considerations

- Lender Approval: Lenders often require specific documentation to approve a mortgage involving a gift of equity. This includes the appraisal, the sale contract, and the gift letter.

- Loan Programs: Some mortgage programs have specific guidelines for gifts of equity, so it’s important to consult with the lender to ensure compliance.

Steps to Execute a Gift of Equity Home Purchase

- Appraise the Property: Obtain a professional appraisal to determine the market value of the property.

- Agree on the Sale Price: Seller and buyer agree on a sale price that is below the market value, establishing the gift of equity amount.

- Prepare the Gift Letter: The seller provides a gift letter stating the amount of the gift of equity and confirming that it is a gift, not a loan.

- Loan Application: The buyer applies for a mortgage, using the gift of equity as part of the down payment.

- Close the Sale: Finalize the transaction with proper documentation and complete the home purchase process.

A gift of equity can be a valuable tool for facilitating the purchase of a home within a family, making homeownership more accessible. However, it’s important to understand the tax implications and mortgage requirements to ensure a smooth transaction. I do not know if the seller and buyer can qualify for a gift of equity home purchase. I suggest, you contact several wholesale rep especially @Christian Sorensen

gustancho.com

Gift Of Equity on Home Purchase Mortgage Guidelines

Gift of Equity on Home Purchase is when buying a home from a relative at below the appraised value and the seller is gifting you the equity.

-

Lender’s mortgage insurance (LMI) is a type of insurance that protects the lender (usually a bank or financial institution) in case a borrower defaults on their mortgage loan and the proceeds from the foreclosure sale are not sufficient to cover the outstanding balance of the loan. Here’s how it typically works:

-

Requirement: LMI is usually required when the borrower’s down payment on a home is less than 20% of the property’s purchase price. In other words, if the borrower provides a deposit of less than 20%, the lender will often require LMI to mitigate the increased risk associated with a higher loan-to-value ratio (LVR).

-

Premium: The borrower pays the premium for the LMI, either as a one-time upfront payment or added to the loan amount and paid as part of the monthly mortgage payments. The premium amount depends on factors such as the loan amount, loan-to-value ratio, and the insurer’s policies.

-

Protection for the Lender: LMI primarily protects the lender, not the borrower. If the borrower defaults on the mortgage and the property is foreclosed, the lender can make a claim to the insurer for the shortfall between the outstanding loan balance and the proceeds from the sale of the property.

-

Risk Management: LMI enables lenders to offer mortgages to borrowers with smaller deposits by transferring some of the risk of default to the insurance company. This can help make homeownership more accessible to borrowers who may not have saved a large down payment.

-

Cancellation: In some cases, LMI can be canceled once the borrower’s equity in the property reaches a certain threshold, typically around 20% of the property’s value. This can occur through a combination of regular mortgage repayments and appreciation in the property’s value.

It’s important to note that while LMI benefits the lender by reducing their risk exposure, it does not protect the borrower. If the borrower defaults on the mortgage, they could still face consequences such as damage to their credit score and potential legal action to recover the outstanding debt. Therefore, it’s crucial for borrowers to carefully consider their financial situation and ability to repay the mortgage before taking out a loan with LMI.

-

-

Investing in precious metals like silver and gold can be a smart move for diversifying your investment portfolio. Here’s a beginner’s guide to investing in silver or gold coins:

-

Educate Yourself: Before you start investing, take the time to learn about the precious metals market. Understand the factors that affect their prices, such as supply and demand, geopolitical events, and economic indicators.

-

Decide on Silver or Gold: Determine whether you want to invest in silver or gold coins. Silver tends to be more affordable and volatile, while gold is often seen as a store of value and tends to be more stable.

-

Research: Research different types of silver or gold coins available in the market. Some popular options include American Eagle, Canadian Maple Leaf, and South African Krugerrand coins.

-

Find a Reputable Dealer: Look for a reputable dealer to purchase your coins from. Make sure they have a good track record and are authorized by relevant authorities. You can find dealers online or visit local coin shops.

-

Understand Premiums: When buying coins, you’ll typically pay a premium above the spot price of the metal. This premium covers the cost of production, distribution, and dealer markup. Compare premiums from different dealers to get the best deal.

-

Consider Storage: Decide whether you want to store your coins yourself or use a third-party storage service. If you choose to store them yourself, make sure you have a secure place to keep them, such as a safe or a safety deposit box.

-

Start Small: As a beginner, consider starting with a small investment and gradually increasing your holdings as you become more comfortable with the market.

-

Monitor the Market: Keep an eye on the price of silver or gold regularly to stay informed about market trends. This will help you make informed decisions about buying or selling your coins.

-

Diversify: Don’t put all your investment capital into precious metals. Diversify your portfolio across different asset classes to reduce risk.

-

Be Patient: Investing in precious metals can be a long-term strategy. Prices can be volatile in the short term, so be patient and focus on the long-term potential of your investment.

Remember, investing always carries risks, so make sure to do your own research and consult with a financial advisor if needed before making any investment decisions.

-

This reply was modified 10 months, 4 weeks ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 10 months, 4 weeks ago by

Gustan Cho.

Gustan Cho.

-