Juan

ContractorMy Favorite Discussions

-

All Discussions

-

I have a question I asked multiple people who are called expert loan officers and credit repair geniuses but I am getting conflicting answers. I want to know if a consumer needs to get his credit scores up for a mortgage to a 640 FICO. He has never missed a monthly payment and has perfect payment history the past five years. He has 10 credit card accounts with all of them maxed to the credit limit. Here are the credit card balances and credit card limit. His middlw credit score is currently 525. Question is what credit card should he pay down the balance to lower his credit utilization ratio. Should he start paying down the lower limit credit first or should he pay down the higher credit limit credit card first. Here is his credit cards, the balances, and the credit limit.

CREDIT CARD. BALANCE LIMIT

1. DISCOVER $498. $500

2. CAPITAL ONE. $470. $500

3. CREDIT ONE. $490. $500

4. SELF VISA. $1,500. $1,490

5. TRUMP CARD $4,000. $4000.

6. JOURNEY CARD $2,130 $$2,200

7. CREDIT PLUS $3,490. ,$3,500

8. BUDDY VISA $1,500. $1,600

10. MISSION LANE $1498 $1,500

-

We all know that tens of thousands of people are moving out to California. What are the biggest reasons people are moving out of California?

-

There are thousands of reports that Joe Biden is dead. There are reports of witnesses seen Joe Biden wear a lifelike mask. There are reports the current Joe Biden is a body double. So what is it. Is Joe Biden dead? Did Joe Biden get executed due to crime against humanity and TREASON in Guantemo Bay through Military Tribunal?

https://www.youtube.com/live/r6oAH36Y-rk?si=FRUWJbYBJdkhdpB0

-

This discussion was modified 8 months, 3 weeks ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 8 months, 3 weeks ago by

-

What are the requirements for a small home builder to get qualified for ground up one-to-four unit new construction homes. How do you qualify, how do you get pre-approved, what are the guidelines, and what is the mortgage process on ground up one-to-four unit new construction homes?

-

Lending Network, Inc. is the commercial lending division of Gustan Cho Associates headed by Gustan Cho. Gustan Cho is the President and Managing Partner of Operations of Lending Network, powered by NEXA Mortgage.

Lending Network, Inc., dually powered by Gustan Cho Associates and Mortgage Sensei, is a commercial financial services company that deals with various business, investment, and commercial mortgage loan products and lending solutions not offered by traditional banks and commercial financial institutions.

What Types of Commercial Loan Programs Does Lending Network Offer

Lending Network has a national reputation for being able to offer business and commercial loans that other financial institutions of business and commercial financial products cannot do. With the backing of the largest residential mortgage broker in the nation, NEXA Mortgage, it is easier to ask us what commercial loan program Lending Network does NOT do. We strive to live by our national reputation as a one-stop lending shop. Lending Network aims to give individualized monetary answers that cater to the distinct requirements of borrowers of business and commercial lending options, even if they do not fit into standard traditional commercial loan qualifications. For more information, please refer to their official website – http://www.lendingnetwork.org

-

This discussion was modified 9 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 month, 1 week ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 month, 1 week ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 4 weeks, 1 day ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 9 months ago by

-

There are many conflicting questions and theories about who is Michelle Obama and what relationship is Michelle Obama to Michael Robinson? Is Michelle Obama Michael Robinson Obama? What does this mean for Barack Hussain Obama? Does this mean that Barack Hussain Obama is the first U.S. President married to a man? Or transgender? We need to have some transgender answers.

https://www.tiktok.com/t/ZT8x5ryLU/

-

The verdict is in on former President Donald Trump’s trial in New York. Former President Donald Trump has been found guilty on all 34 charges in his hush money case. Never before in history has a former president of the United States been tried after they left office of the Presidency. This trial of former President Donald Trump was politically motivated with many things wrong with even going to trial. No doubt the trial was politically motivated due to the fear and panic of former President Donald Trump running for office of the Presidency of the United States in November 2024. The charges against President Donald Trump are related to falsifying business records to conceal a $130,000 payment made to adult film star Stormy Daniels. This payment was part of an effort to prevent Daniels from going public with her claims about a 2006 encounter with Trump. This historic conviction marks Trump as the first former U.S. president to be convicted of felony crimes. The jury deliberated for 9.5 hours before reaching their verdict, which involved examining numerous invoices, vouchers, and checks connected to the reimbursement payments made to Trump’s former lawyer, Michael Cohen, who initially covered the payment to Daniels. The sentencing for Trump is scheduled for July 11, just before the Republican National Convention where he is expected to be nominated as the 2024 presidential candidate.

https://www.youtube.com/watch?v=NM1v-Tyvvso&list=RDNSNM1v-Tyvvso&start_radio=1

-

Is investing in copper a good investment? Whether investing in copper is a good investment or not depends on several factors, including the investor’s goals, risk tolerance, and investment horizon. Here are some key points to consider regarding investing in copper:

- Copper is a cyclical commodity: The demand for copper is closely tied to the overall health of the economy, particularly in sectors like construction, manufacturing, and infrastructure. When the economy is growing, demand for copper typically increases, driving up prices. However, during economic downturns, copper prices tend to decline.

- Supply and demand dynamics: Copper is a finite resource, and its price is influenced by the balance between supply and demand. If new copper mines are brought online or existing mines increase production, it could lead to an oversupply and lower prices. Conversely, supply disruptions or increasing demand from emerging economies like China and India can drive prices higher.

- Industrial usage: Copper is an essential material in many industries due to its excellent electrical and thermal conductivity, as well as its resistance to corrosion. It is widely used in electrical wiring, plumbing, and various industrial applications. The growth or decline of these industries can impact copper demand and prices.

- Investing options: Investors can gain exposure to copper through various instruments, including copper futures contracts, copper mining stocks, exchange-traded funds (ETFs) that track copper prices, or physical copper (e.g., copper bars or coins).

- Volatility and risk: Like many commodities, copper prices can be volatile and subject to significant fluctuations due to various factors, including global economic conditions, geopolitical events, and supply disruptions. Investing in copper carries risks, and investors should be prepared for potential price swings.

Ultimately, the decision to invest in copper should be based on thorough research, an understanding of the copper market dynamics, and an assessment of one’s investment objectives and risk tolerance. It may be advisable to consult with a financial advisor or conduct further research to determine if copper suits your investment portfolio.

-

You do not need perfect credit or high credit scores to qualify for a mortgage loan. Every loan program require a minimum credit score. Besides HUD, VA, USDA, FANNIE MAE, FREDDIE MAC, or non-QM portfolio lenders requiring a minimum credit score, each lender can impose lender overlays on credit scores. Lender overlays are additional credit score requirements above and beyond the minimum agency mortgage guidelines imposed by each individual mortgage lender. Regardless of the minimum credit scores required, all lenders will normally want to see timely payment history in the past 12 months. Regardless of the prior bad credit you have, having timely payment on all of your monthly debt payments that report on the three credit reports is crucial. Do not worry about prior collections, charge-off accounts, late payments, or other derogatory credit tradelines unless you are going though a manual underwrite on FHA loans. HUD manual underwriting guidelines require timely payments in the past 24 months. VA manual underwriting guidelines require timely payments in the past 12 months. In many instances when you get an approve/eligible per automated underwriting system but late payments in the past 24 months, the lender may down grade your file to a manual underwrite. The best solution for you to increase your credit scores and strenghen your credit profile with recent late payments is adding positive credit with new credit. Please read this guide on how to boost your credit to get approved for a mortgage: Capital One Secured Credit Card will get you a $250 secured credit card with a $50 deposit. Self.Inc is a bank that has a phenomenal credit rebuilder program where you can make a monthly deposit as small as $25.00 per month. That monthly deposit goes towards a savings account but it reports as an installment loan to all three credit bureaus. Get a Discover secured card. Secured credit cards are the same as unsecured traditional credit card. The only difference is you need to put a deposit. The amount of deposit is the amount of credit you get by the credit card company. You need to make timely minimum monthly payments on your secured credit cards. Just start with these three creditors and you will see wonders in the weeks and months ahead. I will cover some quick fixes for you to increase your credit scores fast and at the end of this topic thread, I will list helpful resources on boosting your credit to qualify for a mortgage, how to reach a human at the credit bureaus, and how to rebuild your credit:

1. Capital One Secured Credit Card

2. Self.Inc

3. Discover Secured Credit Card

As time pass and you make timely payments, your secured credit card company will increase your credit limit without asking your to put additional deposit. If you can get more secured credit cards, it will expedite your credit rebuilding process. However, you should at least start with the above three creditors.

Improving your credit scores and rebuilding credit can be crucial when seeking mortgage approval. Here are some effective strategies to consider:

Review your credit reports: Obtain copies of your credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion. Identify and dispute any errors or inaccuracies that may be negatively impacting your credit scores.

Pay bills on time: Payment history is the most significant factor affecting your credit scores. Make sure to pay all your bills (credit cards, loans, utilities, etc.) on time, every time. Set up automatic payments or payment reminders if necessary.

Reduce credit card balances: High credit card balances can hurt your credit utilization ratio, which accounts for a significant portion of your credit scores.

Aim to keep your credit card balances below 30% of your total available credit limit. Consider paying off credit cards with the highest balances first.

Don’t close unused credit cards: Closing credit cards can inadvertently increase your credit utilization ratio and decrease your overall available credit. Keep unused credit cards open, but avoid using them to maintain a low credit utilization ratio.

Increase credit limit: Request a credit limit increase from your credit card issuers, which can improve your credit utilization ratio. Be sure to handle the increased credit limit responsibly and avoid overspending.

Limit new credit applications: Each credit application results in a hard inquiry on your credit report, which can temporarily lower your credit scores. Limit credit applications only to when absolutely necessary.

Use different types of credit: Having a mix of different types of credit (e.g., credit cards, auto loans, personal loans) can positively impact your credit scores. Consider taking out a small loan or opening a new credit card account if you have limited credit types.

Monitor your credit regularly: Check your credit reports and scores periodically to ensure accuracy and track your progress. Consider signing up for a credit monitoring service to receive alerts for any changes to your credit profile.

Be patient and consistent: Rebuilding credit takes time and consistent effort. Stick to responsible credit habits, and your credit scores should gradually improve, increasing your chances of mortgage approval.

Remember, lenders evaluate various factors beyond just credit scores when considering mortgage applications. However, improving your credit scores and maintaining a healthy credit profile can significantly increase your chances of getting approved for a mortgage with favorable terms.

https://gustancho.com/boost-your-credit-with-new-credit/

gustancho.com

Boost Your Credit With New Credit To Qualify For A Mortgage

Boost your credit with new credit to qualify for a mortgage . New secured credit cards and credit builder loans increases credit scores for mortgage

-

-

Climate change refers to significant changes in global temperatures and weather patterns over time. While climate variability is natural, much of the recent observed changes are due to human activities, particularly the emission of greenhouse gases (GHGs) like carbon dioxide and methane. This phenomenon is also commonly referred to as global warming or anthropogenic (human-caused) climate change. Here’s a broad overview of its causes, impacts, and the response strategies:

Causes of Climate Change

- Greenhouse Gas Emissions: The burning of fossil fuels (coal, oil, and natural gas) for energy, deforestation for agriculture, and industrial processes contribute to increased concentrations of greenhouse gases in the Earth’s atmosphere.

- Land Use Changes: Deforestation not only releases the carbon stored in trees but also reduces the planet’s capacity to absorb CO2 from the atmosphere.

- Agriculture: This sector contributes significantly through methane emissions from livestock and rice fields, and nitrous oxide from over-fertilized fields.

Impacts of Climate Change

- Temperature Increases: The most direct effect is the rise in global temperatures, leading to heatwaves and disrupted weather patterns.

- Ice Melt and Sea Level Rise: The increase in global temperatures has led to the melting of ice caps and glaciers, contributing to rising sea levels, which can cause coastal erosion, increased flooding, and threaten coastal communities.

- Ocean Acidification: CO2 absorption is making the oceans more acidic, affecting marine life and ecosystems, particularly coral reefs and shellfish populations.

- Extreme Weather Events: There is an increase in the frequency and intensity of extreme weather events like hurricanes, droughts, and heavy rainfall.

- Impact on Biodiversity: Climate change is altering habitats and threatening species with extinction, disrupting natural ecosystems.

- Socioeconomic Effects: Impacts include threats to food security from decreasing crop yields and the loss of livable land, which could lead to displacement and climate refugees.

Responses to Climate Change

- Mitigation: This involves reducing the flow of heat-trapping greenhouse gases into the atmosphere, either by reducing sources of these gases (e.g., the burning of fossil fuels for electricity, heat, or transport) or enhancing the sinks that accumulate and store these gases (such as the oceans, forests, and soil). Renewable energy sources like wind, solar, and hydroelectric systems generate electricity with little or no pollution and GHG emissions.

- Adaptation: Involves making adjustments in ecological, social, or economic systems in response to actual or expected climatic stimuli and their effects or impacts. It aims to reduce vulnerability to climate change impacts, allowing societies to manage risks and damage while taking advantage of potential opportunities.

- International Agreements: The Paris Agreement under the United Nations Framework Convention on Climate Change (UNFCCC), signed in 2015, is one of the global efforts where countries committed to limiting global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels through nationally determined contributions.

Personal and Community Actions

- Reduce, Reuse, Recycle: Adopting more sustainable practices in daily life can significantly reduce one’s carbon footprint.

- Energy Efficiency: Using more energy-efficient appliances and vehicles, upgrading insulation in homes, and using public transport can reduce individual GHG emissions.

- Support/Advocate: Supporting policies and leaders who prioritize climate actions and sustainable practices is crucial. Community-level actions can amplify individual efforts.

Addressing climate change requires coordinated global actions but also hinges on national, local, and individual efforts. The collective engagement in mitigation and adaptation measures is essential to effectively manage and hopefully overcome this global challenge.

Joe Biden and his administration are planning a climate emergency in the coming days or weeks. The Democrats are panicking because of the low approval rating and are cornered on what they can do to cheat their way to get reelected. Americans should expect more crisis, climate emergency Lock downs, wars, riots, pandemics, or natural disasters

.https://youtu.be/yogGHWVZlYE?si=PhvAZVL8NaOCP8Hp

-

This discussion was modified 11 months, 3 weeks ago by

Gustan Cho.

Gustan Cho.

-

Gustan told me last night that wholesale mortgage lenders like The Lender offers free trimerger hard credit pulls which costs $77.00 either to the borrower or the Loan Officer. Where can I get more detail on this on how it works.

-

The apartment building values started to plummet as much as 40%. Apartment and multifamily properties peaked in May 2022 and started falling since then. Besides plummeting apartment building values, foreclosure of apartment building properties are skyrocketing to 2007 levels. The numbers of apartment building values plummeting and soaring foreclosure rates vary from city and state. We will cover more in this breaking news as more develop in the coming days and weeks. Besides apartment building properties, values of commercial properties in general have and are plummeting at record levels.

https://youtu.be/QuDEubYPMoM?si=sYcSVFDyYmK1MeBC

-

This discussion was modified 11 months, 4 weeks ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 11 months, 4 weeks ago by

-

Ponds and waterfalls can add a serene and natural aesthetic to any garden or outdoor space. They not only enhance the beauty of the environment but also provide a habitat for various forms of wildlife. Here’s an overview of what they involve:

Ponds

Ponds are water bodies that can be either natural or man-made and are usually smaller than lakes. They can be a central feature in gardens, providing a peaceful spot for relaxation. Homeowners can stock their ponds with fish like koi or goldfish and plant aquatic vegetation to promote a balanced ecosystem.

Waterfalls

Waterfalls in a garden setting are typically constructed as part of a pond system. They add visual interest and the soothing sound of flowing water, which can enhance the tranquility of the space. Waterfalls are also beneficial for circulating and aerating the water in ponds, which helps maintain water clarity and supports the health of fish and plants.

Installation and Maintenance

Installing a pond or waterfall requires planning the right location, size, and filtration system to ensure sustainability and ease of maintenance. It’s crucial to consider factors such as sunlight exposure, proximity to trees (to avoid leaf debris), and accessibility for cleaning.

Maintenance involves regular cleaning of the water, checking and managing the water pH and other quality parameters, and maintaining the pumps and filters that keep the water circulating and clean.

Benefits

Beyond aesthetics, ponds and waterfalls offer environmental benefits such as supporting local biodiversity and providing a micro-habitat for birds, insects, and amphibians. The sound of water from waterfalls can also mask background noise, creating a quieter and more serene atmosphere.

Incorporating ponds and waterfalls into landscaping not only boosts the visual appeal of the property but also increases its value. They are a long-term investment in the beauty and ecological health of your outdoor living space.

-

Our dear friend and colleague at Gustan Cho Associates decided to make her new home in the mortgage industry at Loan Factory, a mortgage brokerage licensed in multiple states. Besides Loan Factory, Wendy Lahn also joined a second mortgage brokerage firm Loanworks. I did not realize that it was allowed to be licensed with more than one mortgage company but I guess I was wrong. Wendy is an attorney by education, a loan officer, and a real estate broker so I can have her explain the compliance end of being licensed with more than one mortgage broker.

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year ago by

-

-

The German Shepherd Dog, often referred to simply as the German Shepherd or GSD, is a popular and versatile breed known for its intelligence, loyalty, and versatility. Here’s some information about the German Shepherd:

Origin of the German Shepherd: The breed originated in Germany in the late 19th century, developed primarily by Max von Stephanitz, who aimed to create the ideal working dog.

Appearance: German Shepherds are medium to large-sized dogs with a strong, muscular build. They have a distinctive double coat, which is usually tan and black, or red and black, although other color variations exist.

Temperament: They are known for their intelligence, loyalty, and courage. They are often used as working dogs in roles such as police, military, search and rescue, and as service dogs for people with disabilities.

Training: German Shepherds are highly trainable and eager to please, which makes them excellent candidates for obedience training and various dog sports. They thrive on mental and physical stimulation.

Health: Like all breeds, German Shepherds are prone to certain health issues, including hip dysplasia, elbow dysplasia, and degenerative myelopathy. Responsible breeding and regular veterinary care can help mitigate these risks.

Exercise: They are an active breed and require regular exercise to stay mentally and physically healthy. Long walks, hikes, and play sessions are important for their well-being.

Socialization: Proper socialization from a young age is crucial for German Shepherds to ensure they grow up to be well-adjusted and confident around people and other animals.

Popularity: German Shepherds are consistently ranked among the most popular dog breeds worldwide due to their versatility, intelligence, and loyalty.

Overall, German Shepherds make excellent companions for active individuals and families who can provide them with the mental and physical stimulation they need. However, potential owners should be prepared for the commitment of time, training, and exercise required to raise a happy and healthy German Shepherd.

https://www.youtube.com/watch?v=2MqvumRb0nc

-

This discussion was modified 1 year, 1 month ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 1 month ago by

-

Many people wonder what are the benefits and negatives between a car purchase and car lease? Which benefits a automobile consumer?

-

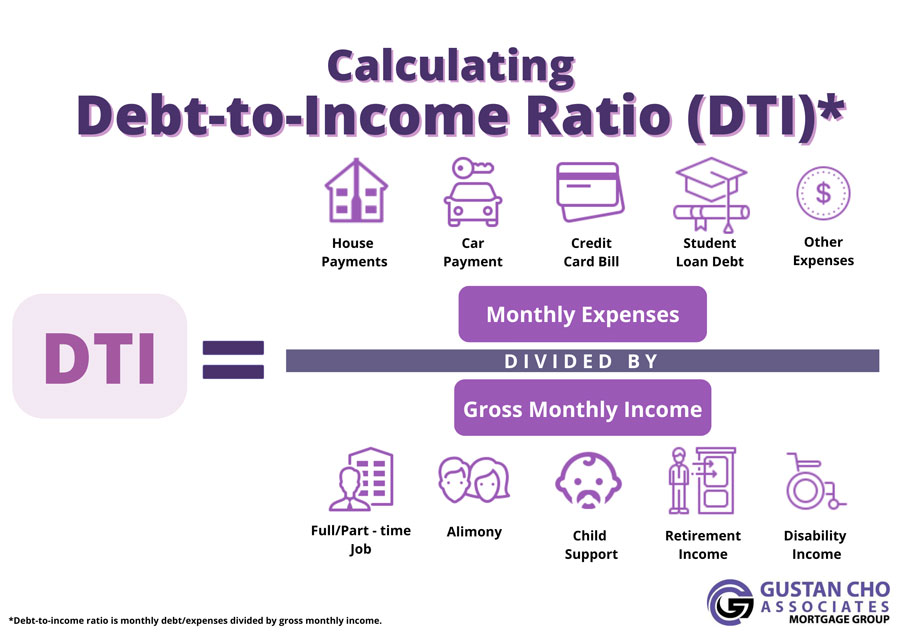

How will having a car lease affect my debt-to-income ratio when getting approved for a mortgage loan?