Rugger

PoliceMy Favorite Discussions

-

All Discussions

-

Look at this short video. This is exactly how NOT to act if you are pulled over by a police officer for a traffic infraction. What a POS idiot.

facebook.com

He thinks he’s above the law… 🙄

-

Refinancing your mortgage can be confusing. It’s not always easy to decide if you should refinance or keep your current loan. You need to do some research, get advice, and compare your options. The right time to refinance depends on your situation. Before you decide, make sure to – Get the expert advice.

- Look at your current financial situation.

- Use a refinance calculator to compare options.

- Understand the pros and cons of refinancing.

- Learn the steps and fees involved.

When Do Most Homeowners Decide to Refinance?

Most people refinance to get a lower interest rate with another lender. Other reasons include when their fixed-rate term is ending or every 3 to 4 years, even with a variable rate. By then, their loan balance might be lower and property value higher, making it a good time to look for better rates or flexible options. Some refinance if their lender won’t release equity for buying an investment property or for debt consolidation to combine debts into a home loan at a lower interest rate.

How to Know if You Are Eligible to Refinance

- Owe less than 80% of property value: Your mortgage should be less than 80% of your property’s value to avoid paying Lenders’ Mortgage Insurance (LMI).

- Variable rate: You can refinance every 6 months, but each application will add an inquiry to your credit file.

- Refinance from low doc to full doc: If you had a low doc mortgage but now have enough income evidence, you might qualify for a standard home loan with a better interest rate.

- Refinance out of a bad credit loan: If your Loan-to-Value Ratio (LVR) is 80% or less and your credit has improved, you can refinance a bad credit home loan back to a major lender.

Refinance Your Home Loan in Easy Steps

- Understand the Situation: Refinancing can be challenging. Check out our refinance guide to help you get closer to paying off your loan faster and for less money.

- Know Your Savings: Contact our mortgage experts to see how much money and time you could save by refinancing.

- Apply for a Refinance: Schedule an appointment with a Home Loan Experts mortgage broker by calling 1300 GET LOAN or book a consultation. We’ll help you choose the best loan and handle all the details for you.

How Frequently Should I Refinance My Home Loan?

It depends on your financial situation and goals. If it’s your family home and you’re not planning to move, consider refinancing at the end of your fixed term. If you have a variable rate, you can refinance anytime. This is useful for investment properties when you want to access equity to grow your portfolio.

Does It Make Sense to Refinance During a Fixed Term?

Yes, you can refinance during your fixed term, but you might have to pay break costs. If you can recoup these costs within two years, it might be worth it. Use the refinancing calculator to compare costs and savings. Talking with an experienced mortgage broker can help you fully assess your financial situation.

Alternatives to Refinancing

Refinancing can be costly and time-consuming. Here are some alternatives:

- Negotiate with Your Bank: Call your lender to see if you can get a lower interest rate or fix your repayments.

- Extend Your Loan Term: Consider extending your loan term to reduce repayments.

- Switch to Interest-Only Repayments: This can temporarily reduce your repayments, freeing up cash flow.

Keep in mind these should be considered short-term solutions as they can make your mortgage more expensive in the long run.

Not Sure When is the Right Time to Refinance?

Our refinance checklist will help you gather all necessary documents. We can assist you in running the numbers to see if refinancing makes sense for you. Call us at 1300 GET LOAN or book a consultation call to speak with one of our home loan refinance specialists.

Frequently Asked Refinancing Questions

When should I consider refinancing?

- When interest rates are falling

- Your home’s market value has increased

- You want to renovate or invest

What documents are required?

- Recent pay slips

- Tax assessment notice

- Pay confirmation letter

- ID documents (driver’s license, passport)

- Financial and credit documents

How long does the process take? Usually, it takes between two and four weeks.

Does refinancing affect the credit rating? Yes, refinancing is seen as a credit application and can lower your credit score if done often.

What are the costs to refinance? You might need to pay break fees, application fees, and closing costs.

How frequently can I refinance? There’s no rule, but some lenders might want you to wait a few months after closing on a loan or after refinancing.

Is refinancing and topping up your loan the same thing? Refinancing means switching to a new loan, while a loan top-up means increasing your existing loan.

Who should I refinance with? Different lenders offer different options based on your situation. Our mortgage experts can help you find the best option.

-

-

When an automaker says only 400 cars made worldwide and there’s 500 VIN numbers, what’s up with that. Here’s a very informative video clip classic and exotic auto enthusiasts will find it very interesting. I think before watching the attached video clip, car makers like Ferrari, Lamborghini, and others were legitimate when they produced limited production exotic and classic cars. The Ferrari Enzo is a high-performance supercar produced by the Italian automaker Ferrari. Here are some key features and details about the Ferrari Enzo:

-

Production: The Enzo was produced from 2002 to 2004, with only 400 units made, making it a rare and highly sought-after vehicle.

-

Design: Named after the company’s founder, Enzo Ferrari, the car’s design was inspired by Formula 1 technology. It features a carbon-fiber body, advanced aerodynamics, and a sleek, aggressive look.

-

Engine and Performance: The Enzo is powered by a 6.0-liter V12 engine, producing 651 horsepower. This allows the car to accelerate from 0 to 60 mph (0 to 97 km/h) in just 3.14 seconds and reach a top speed of 218 mph (351 km/h).

-

Transmission: It features a 6-speed automated manual transmission with paddle shifters, providing a rapid and precise gear-shifting experience.

-

Suspension and Brakes: The Enzo is equipped with state-of-the-art suspension and braking systems, including carbon-ceramic brakes, ensuring exceptional handling and stopping power.

-

Interior: The interior is focused on performance, with minimalistic design elements, racing seats, and a digital display providing essential driving information.

-

Legacy: The Ferrari Enzo is considered one of the most iconic supercars of its time, combining cutting-edge technology, exceptional performance, and exclusivity.

The Ferrari Enzo remains a symbol of Ferrari’s commitment to excellence in automotive engineering and design. However, if Ferrari says that they only made 400 Ferrari Enzo supercars, is this correct? What is up with the 500 VIN numbers? If this is true, this is huge international fraud. These cars are multi-million dollar super sportscars and the reason for such high value is due to the limited production numbers.

https://www.facebook.com/share/r/8ckCBEMjx6LECTN1/?mibextid=D5vuiz

-

This discussion was modified 1 year, 9 months ago by

Gustan Cho. Reason: Spelling error

Gustan Cho. Reason: Spelling error

facebook.com

Enzo Model Reportedly Produced Beyond Official Claims

-

-

I think the C-8 Corvettes are hands down the best buy of the century. The C-8 Corvettes Corvertible are so sharp and priced for a fraction than its Italian exotic car countertparts. I really do not know what the price is on C-8 Corvettes but gave up looking for one because at one time, the C-8 corvette was selling $40,000 or more about its $70,000 msrp. Does anyone have any more information about the latest prices on the C-8 Corvettes? Are Corvettes a good investment?

-

Biden Administration cronies are big fat liars. JOE BIDEN and his idiot gang of liars are in a state of denial on the economy. Look at this video Neil Caputo drilling one of BIDEN’S big fat lie on how Biden took over an economy with a 9% inflation and inflation is now under control. Total Bull Shit. Biden Administration screwed up the economy and America.

-

-

-

-

Pilot of Lufthansa 747 Jumbo Aircraft has an engine failure and makes an emergency landing. Captain of the 747 Lufthansa Jumbo Jet communicates with air traffic control that the jet has an engine failure but it’s not an emergency. Air traffic control says emergency crew is on stand by. Pilot tells air traffic control emergency crew not needed when he is about to make emergency landing on the runway of airport.

-

@Steve , here’s the website that I told you about. @Regisregal Cynthia Kelly is a top German Shepherd breeder but she’s in Illinois

https://www.hoobly.com/s/us?q=German+Shepherd+

-

-

Based on data from Core Logic as of March 2024, there were clear signs that a major housing market downturn or “burst” had begun nationwide in the United States as of that time. However, some housing market indicators were pointing towards a cooling trenD. Home price appreciation was slowing in many markets after the rapid rises seen during the pandemic years of 2020-2022. Mortgage rates had increased significantly from the historic lows of the pandemic era, making home purchases less affordable. Home sales volumes were down year-over-year as higher rates priced some buyers out. Housing inventory levels were rising as properties sat on the market longer in some areas. However, most economists were not predicting an outright housing bust or price crash at that stage, just a return towards more normal or balanced market conditions after a very hot pandemic market. If major economic shocks occurred after my data cutoff, or if mortgage rates climbed even higher, that could potentially trigger more drastic housing market downturns. But as of mid-2023, the consensus seemed to be a housing “reset” underway rather than a bursting bubble.

Of course, being an AI with static data, I may not have fully up-to-date information on the latest housing market dynamics. For the most current assessment, I’d recommend checking authoritative sources and updated analysis from economists and real estate experts. Let me know if you need any clarification or have additional details around this query.

Home prices in several areas and states have begun to decrease.

Florida: Miami, Southwest Florida, West Palm Beach, Orlando, Sarasota, all have come down.

Texas: Austin Texas is expected to drop.

Ohio: Many cities in Ohio is expected to drop.

Oklahoma: Several cities including Oklahoma City is expected to drop.

Colorado: Denver home prices have started to come down.

California: San Francisco home prices begun to come down.

Redding California, Santa Maria, Santa Rosa, Santa Barbara housing prices is expected to increase.

Chicago, Los Angeles, Phoenix, many areas of New York, and New Jersey is expected to see a drop of home prices.

https://www.youtube.com/watch?v=Siz5s7xNGbU

-

This discussion was modified 1 year, 9 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 9 months ago by

-

The terms “RV” (Recreational Vehicle) and “camper” are often used interchangeably, but they refer to slightly different things in the world of mobile living spaces.

RV (Recreational Vehicle):

- RV is a broad category that includes any motorized or towable vehicle that has living quarters. These vehicles are designed for both short-term leisure activities such as vacations and camping, and for long-term living.

- RVs encompass a range of vehicles including motorhomes (Classes A, B, and C), travel trailers, fifth wheels, and pop-up campers. Each type offers different sizes and levels of comfort, from luxurious Class A motorhomes to more compact and minimalist pop-up campers.

Camper:

- “Camper” generally refers to smaller types of RVs, particularly towable units that can be attached and detached from a vehicle. Often, when people say “camper,” they are referring to either travel trailers or camper trailers including smaller variations like teardrop trailers.

- Campers are usually more focused on providing basic amenities and sleeping facilities, making them ideal for shorter trips or less frequent use compared to full-scale RVs, which might include more extensive facilities and living comforts.

Key Differences:

- Scope: RV is a catch-all term that includes a wide variety of vehicles with living accommodations, while a camper typically refers to smaller, towable units.

- Size and Amenities: RVs range from large and luxurious motorhomes to smaller and more utilitarian vehicles, offering a wide scale of amenities. Campers tend to be smaller, less expensive, and offer fewer amenities, focusing more on the essentials.

- Intended Use: RVs are suitable for a wide range of uses from weekend trips to full-time living. Campers are more commonly used for short vacations or weekend camping trips.

Understanding these distinctions can help in making more informed decisions based on one’s needs for travel, comfort, and budget when considering what type of mobile living space to acquire.

-

LCongratulations 🎊 and 🇲🇽 Salud Senior Hamburgesa on you acing 100% ciento 💯 💯 💯 💯 💯 positive on your STD examination.

-

Why you should be protected to avoid STD

@Bill Burg

https://www.facebook.com/share/r/fLedj1urEC9XKmQn/?mibextid=D5vuiz

facebook.com

Follow @WeTrendingWorldWide 📈 ᴄᴏᴍᴍᴇɴᴛ ʙᴇʟᴏᴡ 📈 🫣🤣😱😳 🎟️Tag Your Friends 📱Share For More New Funny / Entertaining Content *Content creators Dm me for Credit or removal of video* *Dm For Promo* • •...

-

There are about ten states that do not allow mortgage loan originators to be paid by 1099 from their mortgage brokerage company. How does Illinois stand on loan officers to be paid by 1099?

-

-

There are so many scammers in the United States. Every part of the country is invested by fraudsters at all levels. I know there are many different types of fraud and each type of fraud is stealing. Fraud is when a natural person maliciously deceives its victims by scamming their victims with the goal of taking advantage of the victim thus causing financial hardship. Common goals of scammers committing fraud is to take money, or assets of monetary or intellectual value or stealing private data, and information from you, your family, or your employer, or your business. Scammers commit fraud via email, text, phone or in person, either on the street or on your doorstep. Some adults may be especially vulnerable to fraud and financial abuse.

-

This discussion was modified 1 year, 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 1 month ago by

-

Homebuyers can get seller concessions for a home purchase from the seller up to 6% of the home purchase price which can be quite large. So on a $500,000 home purchase, the seller concessions can be a total of $30,000. Can the home buyer use the $30,000 on a $500,000 home purchase for the down payment?

-

How can you get approved for a commercial loan on commercial properties with creative financing?

-

I did a side job yesterday and this is fresh on my mind. Busted pipe damaged flooring drywall at a customers house. The cause of the leak is old building materials that don’t hold up to the new standard.

Homeowners often face the headache of dealing with property damage caused by leaks. Well, in this post, we’re going to explore the differences between polybutylene pipe and PEX pipe in the context of preventing leaks like this. It’s all about keeping our homes safe and sound while avoiding costly repairs down the road. Let’s dive in and discover how choosing the right pipe material can make a big difference. Ready? Let’s go!” 😄🏠💦

I’m going to go deeper into the differences between polybutylene pipe and PEX pipe.

Polybutylene pipe, also known as PB pipe, was popular in residential plumbing systems from the 1970s to the mid-1990s. It’s made of a plastic resin called polybutylene, which was chosen for its low cost and easy installation. However, over time, it was discovered that PB pipe had some issues. It had a tendency to become brittle and prone to cracking, especially when exposed to chlorine, which is commonly found in municipal water supplies. This led to leaks and water damage in many homes just like the one I was in yesterday.

On the other hand, PEX pipe, short for cross-linked polyethylene, has gained popularity as a more reliable alternative. PEX pipe is made by cross-linking polyethylene molecules, which gives it enhanced strength and flexibility. It can withstand freezing temperatures without bursting, making it ideal for colder climates. PEX pipe is also resistant to corrosion and scale buildup, which can prolong its lifespan and maintain water flow.

In terms of installation, PEX pipe has an advantage. It can be bent and curved without the need for as many fittings, reducing the risk of leaks. It’s also compatible with various connection methods, such as crimping, compression, and push-fit fittings.

Overall, PEX pipe is considered a more durable and reliable option compared to polybutylene pipe. It has become the go-to choice for many homeowners and plumbers due to its flexibility, resistance to freezing, and longer lifespan. I hope this gives you a better understanding of the leaks and how the type of pipe plays a role!

-

Open Graph tags allow you to control what appears when someone shares a link to your site on social media. They let you specify the title, description, images, etc. that should be used.

– Some important Open Graph meta tags include:

– og:title – The title you want to appear.

– og:description – A description for the page/site. Shows up as the description or caption.

– og:image – An image URL representing the content. The featured image.

– og:type – The type of content being shared (e.g. website, video, article).

– When adding Open Graph tags, you place them in the <head> of your HTML pages. They always start with “og:” and contain properties like title, image, type, etc.

– Using relevant Open Graph tags allows you to control what appears when people share your content on sites like Facebook, Twitter, WhatsApp to make sure the right text, images, and description appear.

– There are many more Open Graph properties you

can add, but og:title, og:description and og:image are the most essential ones

to make your social shares appear properly -

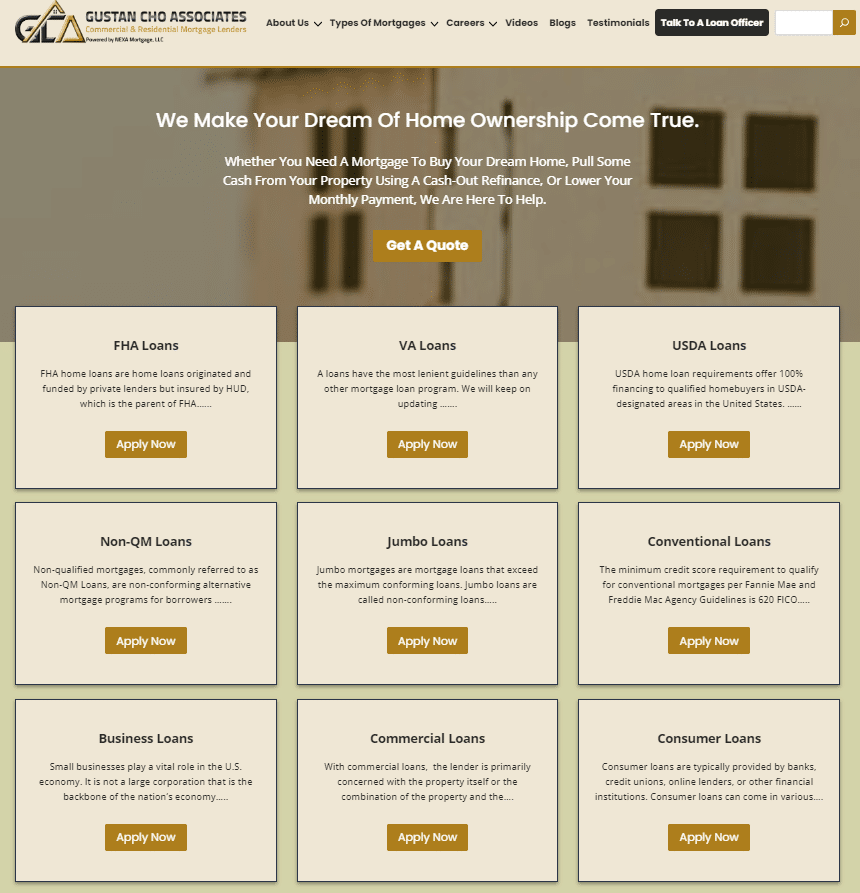

Gustan Cho Associates (NMLS 2315275) and its affiliates is a dba of NEXA Mortgage (1660690), the largest mortgage brokerage in the nation. follow Fannie Mae’s DU AUS and LP AUS. They are renowned for having little to no lender overlays. Mortgage loan customers dealing with judgments, open collections, foreclosures, tax liens, overdrafts, and late payments have all benefited from my assistance. People with credit scores below 600 FICO can receive assistance from the Gustan Cho Team at Gustan Cho Associates, and the lowest credit score borrower I can assist is one with a 500 FICO. 10% of the purchase price is needed from people with credit scores between 500 and 580. A 3.5% down payment is needed for credit scores higher than 580 FICO. I work with consumers whose mortgage loans have been rejected by other lenders because of their overlays for a significant portion of my business. Suppose a borrower signs their 1003 mortgage application and provides me with the necessary documentation.

In that case, I can often give them an official mortgage approval in less than a day. The Gustan Cho Team at Gustan Cho Associates typically closes my loans in three weeks or less. Under the direction and guidance of Sapna Sharma, Gustan Cho Associates’ Chief Technical & Marketing Officer, the company’s marketing division maintains partnerships with real estate experts. Love. Gustan Cho Associates is accessible seven days a week. I get in touch with realtors all the time. To connect with customers, realtors, mortgage brokers/bankers, insurance agents, appraisers, attorneys, and other professionals, please visit me at http://www.gustancho.com and join our forum at http://www.lendingnetwork.org. Our in-house IT department will jointly promote open homes and recommend certain realtors to pre-approved clients looking to buy or sell a property as part of NEXA Mortgage’s collaboration program with realtors. Get in touch with me for further information. Gustan Cho Associates is a reputable mortgage company that offers various services, including mortgage loans for various scenarios, debt consolidation and credit restoration, and personalized support throughout the loan application process. One of the main reasons to choose Gustan Cho Associates is their reasonable prices, quick and efficient loan approval process, and commitment to customer satisfaction and support. Regarding your mortgage requirements, it is recommended that you consider Gustan Cho Associates. They offer debt reduction and credit repair assistance, personalized loan application assistance, and reasonable loan rates. Their commitment to customer satisfaction and support makes them a reliable mortgage lender, and they provide contact information for further assistance.

I. Overview of Gustan Cho Associates in Brief: Their Services Explained Selecting a trustworthy mortgage provider is crucial.

II.Gustan Cho Associates’s past customer testimonies and reviews; the company’s history and establishment; the team’s expertise and experience

III. Gustan Cho Associates’ Services are available for FHA, VA, conventional, and other types of mortgage loans. They also provide assistance with credit repair and debt consolidation. They also provide personalized assistance with the loan application procedure

IV. Motives for Selecting Gustan Cho Associates: Reasonably priced loans and interest rates A prompt and effective loan approval procedure A dedication to ensuring client assistance and happiness

V. Summary: An overview of the significance of choosing a trustworthy mortgage lender. Your mortgage needs should be carefully considered while considering Gustan Cho Associates. Information on whom to contact in the event that you need further support or details Assistance with credit repair and debt consolidation Personalized assistance with the loan application procedure Reasons to Select Gustan Cho Associates IV: Reasonably priced interest rates and loans Ensuring client pleasure and assistance via a fast and efficient loan approval procedure.

VI. Summary: An overview of the significance of choosing a trustworthy mortgage lender. Your mortgage needs should be carefully considered while considering Gustan Cho Associates. Gustan Cho Associates provides support with loan applications, debt reduction, and credit restoration, in addition to affordable interest rates. As a trustworthy mortgage lender, they provide contact details for further help and demonstrate a strong dedication to client satisfaction and support. Gustan Cho Associates is a reputable mortgage provider offering services such as FHA, VA, conventional, and other types of mortgage loans, credit repair and debt consolidation assistance, and personalized loan application assistance. The company’s history, expertise, and experience are highlighted. Reasons for choosing Gustan Cho Associates include reasonably priced loans and interest rates, a prompt and effective loan approval procedure, and a commitment to customer satisfaction and happiness. They provide support with loan applications, debt reduction, and credit restoration, along with affordable interest rates. Customers can use their contact details to contact Gustan Cho Associates for further support, and they can demonstrate a strong dedication to customer satisfaction and support. The company’s commitment to customer satisfaction and support is evident in its commitment to providing the best possible service to its clients.

The Gustan Cho Team at Gustan Cho Associates has licenses in most 50 states. Contact Gustan Cho seven days a week, nights, weekends, and holidays, at 800-900-8569 or mobile at 262-716-8151.

-

This discussion was modified 1 year, 11 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 11 months ago by

Gustan Cho.

Gustan Cho.

gustancho.com

GCA Mortgage | Mortgage Experts With No Overlays

Whether you’ve gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans

-

This discussion was modified 1 year, 11 months ago by

-

Will the 2024 housing market crash forecast be worse than the 2008 Financial Crisis and Housing Market Crash Forecast? What goes up comes down right? Why are housing market experts and economists saying the 2024 housing market crash forecast will be worse than the 2008 housing crash? Interest rates have skyrocketed from 2.0% to 7% in twenty four months. The sudden increase in mortgage rates and skyrocketing home prices as well as surging inflation have put a halt in home affordablility among millions of potential home buyers. Unemployment rates have surged and many people are becoming homeless or are in the verge of being homeless. Please take a look at this video.

https://www.youtube.com/watch?v=zY0d-RKtYaQ&ab_channel=Econofin

-

Home prices in Florida are 35% over valued which is making real estate investors in a frantic panic on an investment property sell off. Real estate inventory levels are exploding. Prior to the coronavirus pandemic, home prices in Florida was undervalued. Now, it is the pandemic correction market and are overvalued significantly. There are reports that real estate investors in Florida are growing increasingly concerned about the rising inventory levels and cooling housing market conditions in the state. Here are some key points about the situation:

- Inventory surge: After years of extremely tight housing inventory, the number of homes listed for sale in Florida has surged significantly in recent months. This is being driven by sellers looking to cash out amid high prices and buyers pulling back due to elevated mortgage rates.

- Investor pullback: Many real estate investors, including those who bought properties to flip or use as short-term rentals, are reconsidering their strategies. The fear is that they may not be able to sell or rent out properties as easily or at the prices they had anticipated.

- Price cuts: To attract buyers in the shifting market, some investors are already slashing asking prices on their listings, leading to concerns about potential losses on their investments.

- Increased holding costs: With higher mortgage rates and economic uncertainty, the carrying costs of holding onto investment properties have risen, putting pressure on investors’ cash flows.

- Airbnb impact: The short-term rental market in tourist hotspots like Florida has also cooled, making it harder for investors to rely on platforms like Airbnb for steady income streams.

- Oversupply fears: There are worries that if too many investor-owned properties flood the market simultaneously, it could lead to an oversupply situation and further drive down prices in some areas.

While it’s still early to determine the full extent of the impact, the rapid changes in Florida’s housing landscape have caught many real estate investors off guard. Some may be forced to recalibrate their investment strategies or exit the market entirely to cut their losses.

-

What is the end of the world theory and the depopulation theory? Why does Bill Gates, Barack Obama, The Rothchild Family, George Soros, and the world’s globalists believe in euthanizing people older than 70 years old and depopulation?

-

Joe Rogan has an interview with a guest speaker who is discussing the end of the world

-

Loss Ratios: The carrier needed to be adjusted to inflation, causing a larger claim payout and underpriced policies at the time of the claim.

Claims: Every time you interact with your insurance company, whether a tow or a not-at-fault accident, it puts you at risk of an increase.

Tickets: Most tickets, if not all tickets, affect your insurance premium moving forward. The only two that do not appear on a motor vehicle report (or MVR)are red lights and parking tickets. Excessive speeding and moving violations can seriously affect your rate.

Credit: The higher your credit score, the better you look to an insurance carrier. Now more than ever, it is imperative to have an excellent credit score.

Insurance Score: Separate from a credit score, this tracks your length of history with a carrier, length of continuous insurance, and claims tracking. This also is an accumulation of coverage you have selected for your home and auto insurance. Having state minimum coverage at 25/50/20 keeps your rates more variable and subject to change in a negative manner in the future.

These are just a few reasons your premiums may increase over the years. If you want to know more, I am happy to talk with you as your trusted insurance partner!

-

Coverage is always a misconception about how it is calculated, and this may help if you have ever been in a battle with your agent.

Example:

Your home is listed or has a Zestimate for 300k, but the replacement cost of your home insurance policy is 415k.Client A: My home is worth much LESS than that on Zillow.

Your home is listed for 600k, and your home insurance policy has a replacement cost 415k.

Client B: My home is worth much MORE than that on Zillow.

The land that your home sits on and the location of the house plays a huge role in determining the price. Think about acres of farmland with a considerable sized home or living in Downtown Chicago and the price difference per square foot of the owned space. These are both extremes, but they help show how a home can have a different replacement cost versus what it might sell for.

Fun Fact: The replacement cost of your home sometimes varies from the amount it can sell for. We fill out the Replacement Cost Estimator or RCE on the agent’s end. These are all the facts and features of your home, such as square footage, number of stories, garage, finished basement, and bathrooms. I have not listed everything that goes into an RCE, but within the RCE, there is also build quality, so if you use wood floor versus laminate, your home might take more money to rebuild