Tagged: No-Doc Loans

-

NO-DOC Loans

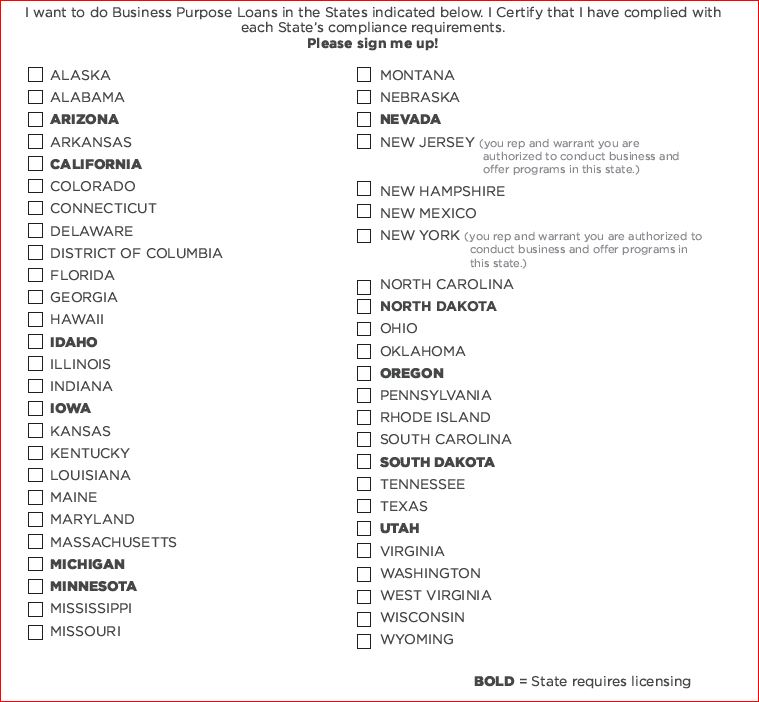

Posted by Gustan Cho on July 11, 2023 at 7:12 pmThere are certain states that you cannot do NO-DOC Loans. Anyone know what states you cannot do no-doc loans.

Marilyn replied 1 year, 4 months ago 3 Members · 2 Replies -

2 Replies

-

Hey Gus,

If you are inquiring about rental properties, We can do NO DOC DSCR in ALL 50 States.

-

States Where No-Doc Loans Are Generally Banned

You wouldn’t expect any documentation or no-doc loans to be easily available, especially with the regulations imposed after the last financial crisis, and you would be right. Some rules differ from lender to lender and product to product, but no-doc loans are offered or practiced in these states.

- California

- New York

- Texas

- Florida

- Nevada

- Ohio

- New Jersey

Critical Factors to Consider

Regulatory Environment—The fear of losing finances has led states to tighten laws around education specifications. For instance, in the USA, states have prohibited no-doc loans for years to avoid risky lending.

Lender Practices—In no-document loan states, if they are not outright banned, such as in the USA, some lenders may not completely offer them as a risk management strategy.

Other Ways: If chances are available, it is recommended that borrowers find other openings, such as alternate stated income loans. These require some kind of income verification, although the documentation provided is less than in the case of a fully documented loan.

Summation

In cases where a no-document loan is desired, it is wise to check some of the provisions provided as lenders’ requirements because things change from time to time, especially regarding the law and state affairs. The safest and wisest measure is always to seek the assistance of a mortgage expert.

Log in to reply.