Things That Determine Mortgage Rates on Home Loans

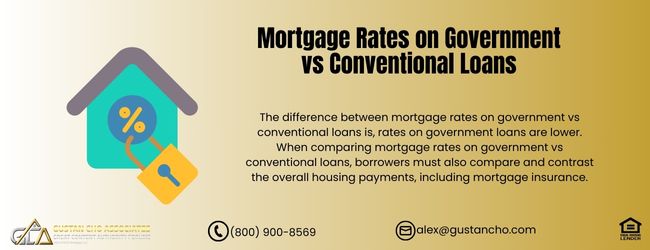

This article will discuss the factors and things that determine mortgage rates. Not every borrower gets the same pricing on mortgage rates. There are pricing adjustments that affect rates. The two main factors determining mortgage rates are credit scores and property types. However, loan-level pricing adjustments (LLPAs) are also important. With conventional loans, the loan-to-value ratio is another factor determining mortgage rates. Loan-to-value does not determine mortgage rates with FHA, VA, and USDA loans. This is mainly because these entities insure mortgage loans in the event borrowers default on them. This article will discuss mortgage rates for both government and conventional home loans.

Loan Level Pricing Adjustments on Things that Determine Mortgage Rates

Fannie Mae and Freddie Mac are the two mortgage giants in the United States that govern and regulate conventional loans. Fannie Mae or Freddie Mac does not insure conventional loans. Borrowers with a loan value greater than 80% LTV need private mortgage insurance. Borrowers who make a down payment of at least 20% do not need to get private mortgage insurance on conforming loans.

Mortgage Insurance Premium Requirements on Mortgage Loan Programs

FHA loans require a mandatory one-time upfront mortgage insurance premium and an annual premium for the life of a 30-year fixed-rate mortgage loan. VA loans do not require an annual mortgage insurance premium. However, an upfront VA funding fee is required. The funding fee can be rolled into the balance of the VA loan. USDA requires an annual mortgage insurance premium.

Ready to Buy a Home? Let’s Help You Find the Perfect Mortgage Loan!

Contact us today to explore your options and get pre-approved for a mortgage.

Things That Determine Mortgage Rates On Conventional Versus Government Loans

Conventional loans have the highest mortgage rates compared to other loan programs, regardless of their impact on credit scores. To get the lowest mortgage interest rates, borrowers must put a 25% down payment on a home purchase and have a credit score of over 740 FICO. The lower the down payment and the higher the loan-to-value, the higher the mortgage rates will be for borrowers. The lower the credit score, the higher the mortgage rates. No government entity insures conventional loans. So, private mortgage insurance is required for all conventional homebuyers who put less than 20% down as a down payment and have a loan-to-value (LTV) higher than 80% LTV.

Impact On Credit Scores And Things that Determine Mortgage Rates

Credit scores do have an impact on government loans. FHA loans, VA loans, and USDA loans are called government loans. This is because a governmental agency insures them. The Federal Housing Administration insures FHA loans. The United States Department of Veterans Affairs insures VA loans. The USDA Rural Development Guaranteed Housing Loan Program insures USDA loans. These government housing guarantee agencies will guarantee lenders if the borrower defaults on government mortgage loans. Due to this guarantee, lenders of government loan programs do not care how much down payment borrowers put as the down payment. This is because, in the event of borrower default, it gets insured.

Credit Scores and Things That Determine Mortgage Rates On Government Versus Conforming Loans

Mortgage rates impact government loans. However, credit scores and rates are not as sensitive as conventional loans. For example, borrowers will not need a 740 FICO to get the best mortgage interest rates on government loans. A 680 credit score will be sufficient for the best FHA and VA mortgage interest rate. However, borrowers with credit scores under 640 will get higher mortgage rates on FHA and VA loans, even though the federal government guarantees them. Lower credit scores mean higher-risk borrowers. Higher-risk borrowers are charged higher mortgage rates.

Things That Determine Mortgage Rates With Bad Credit, Prior Bankruptcy, And Foreclosures

Most borrowers are under the assumption that bad credit, prior bankruptcies, and foreclosures will hurt the mortgage rates they will get. This is not the case. Lenders only use the borrower’s credit scores to determine mortgage rates, except for conventional loans, where the loan-to-value does have an impact. Prior bad credit has no impact on mortgage rates.

Examples of Derogatory Credit Tradelines and Things That Determine Mortgage Rates

Examples of derogatory tradelines that have no impact on mortgage rates are the following:

- such as outstanding unpaid collection accounts

- Prior late payments

- prior judgments

- prior charge-offs

- prior tax liens

- prior bankruptcy

- prior foreclosure

- prior short sale

- prior deed instead of foreclosure

- Other prior derogatory credit issues have no impact on mortgage rates

Consumers no longer face high interest rates on home loans due to bad credit, as it is now illegal. Again, prior bad credit has no bearing on home loan rates. Credit scores determine mortgage rates and property types.

Property Types And The Type of Loan Program

The type of property you purchase, along with the type of loan program, determines the mortgage rates. Single-family homes have lower mortgage rates than condominiums or two- to four-unit properties. This is because lenders feel that a single-family home is a less risky investment than a condominium or a 2- to 4-unit property. The type of loan program is one of the things that determines mortgage rates as well. Mortgage rates on a second or investment home will be higher than those of an owner-occupant primary residence mortgage loan.

Pricing Adjustments On Things That Determine Mortgage Rates: Loan Programs

FHA 203k loans have higher mortgage rates than standard FHA loans. This is because mortgage lenders view FHA 203k rehab loans as riskier investments than standard FHA loans. Jumbo mortgages have higher mortgage rates than standard, conforming, conventional loans. Lenders view them as riskier investments than standard conventional loans.

Risk Factors and Things that Determine Mortgage Rates

If the lender forecloses on a jumbo loan, it will take much longer for lenders to sell and liquidate the higher-end property than for a standard home. The jumbo home market is a niche market with fewer buyers who can afford higher-end homes, and the lending standards for jumbo mortgages are significantly stricter than those for conventional or government loans. GCA Forums Mortgage Group has no overlays on government and conforming loans. You are welcome to call or text us at 800-900-8569 for a faster response. Or email us at gcho@gustancho.com.

A complex mix of economic, financial, and personal factors affects home mortgage rates. Here is a summary of the most essential ones:

Looking for the Best Mortgage Loan? We’ve Got You Covered!

Reach out now to learn how we can help you qualify and get the best loan for your home.

Economic Factors on Things That Determine Mortgage Rates

- Federal Reserve Policies: The Fed’s monetary policy and precise handling of the federal funds rate affect short-term rates, which in turn influence mortgage rates. The Fed’s rate-hike policy to control inflation has increased mortgage rates.

- Inflation: Worsening inflation reduces the purchasing power of money. Mortgage lenders would then have to increase mortgage rates to protect margins. The CPI and PPI are excellent indicators of this.

- Economic Conditions: Increased demand for credit and relatively high economic growth result in high GDP and low unemployment. Economic slowdowns tend to lower demand for mortgage credit and, therefore, lower rates.

- Bond Market (10-Year Treasury Note): The yield on the 10-year Treasury note often tracks mortgage rates, as it indicates market confidence and expectations of rates.

Loan Specific Factors

A complex mix of economic, financial, and personal factors affects home mortgage loan rates. Here is a summary of the most essential ones:

Economic Factors

- Federal Reserve Policies: The Fed’s monetary policy and precise handling of the federal funds rate affect short-term rates, which influence mortgage rates.

- Due to the Fed’s rate-hike policy for controlling inflation, mortgage rates have been increasing.

- Loan Type: Fixed-rate mortgages tend to be priced higher than adjustable-rate mortgages (ARMs) because the latter pass some risk onto the borrower if rates increase in the future.

- Term of Loan: Short-term loans are lower in price due to less risk from the lender than long-term loans.

- Size of Loan: Conforming loan limits impose an additional risk on lenders, making jumbo loans pricier.

- Down Payment: Larger down payments on jumbo loans reduce a lender’s risk, allowing for better rates and improved loan-to-value (LTV) ratios.

Borrower as a factor as a Person

- Creditworthiness: Higher-valued debts sharpen a borrower’s credit score, improving terms. At the same time, a lower credit score results in the loss of value of debt, bringing greater costs through fees.

- Debt-to-Income Ratio: A servicing burden lower than 36 percent is a positive sign, improving repayment potential.

- Employment and Consistency of Income: A borrower with steady employment and income is likely less risky to a lender, allowing them to have better terms.

External Environment and Lender Factors

- Competition between Lenders: Borrowers often get better terms, such as lower rates, for mortgage loans during competitive periods.

- Mortgage Backed Securities (MBS): The market price of MBS greatly influences interest rates. Demand for MBS results in lower rates.

- Points and Fees: Paying discount points upfront can lower your rate, but lender fees and closing costs will impact the total cost of the loan.

External Factors

- Global Events: Geopolitical uncertainty or global economic shifts, such as trade wars or pandemics, can drive mortgage rates down as yields on these safe assets fall.

- Housing Market Conditions: The robust demand for availability may also increase borrowing rates. In contrast, a stagnant market might lower borrowing rates to encourage economic activity.

- Recent Context: Web sources indicate that 30-year fixed rates are sitting at approximately 6.5-7% as the Fed is expected to cut rates if inflation increases. A post on X suggests borrowers may be experiencing a wide range of prices based on their credit profile and type of loan.

- To get the most precise and tailored rate, consult several lenders. Rates change daily based on the market and the borrower’s profile. You are welcome to ask if you want me to track current rate trends or evaluate specific lenders.

To get the most precise and tailored rate, consult several lenders. Rates change daily based on the market and the borrower’s profile. You are welcome to ask if you want me to track current rate trends or evaluate specific lenders.

Need a Mortgage Loan? We Make the Process Simple and Affordable!

Reach out today to see how we can help you qualify for the best loan for your needs.

Responses