-

Commission-Income Guidelines

Posted by Gustan Cho on July 22, 2023 at 5:37 pmCommission-income borrowers can qualify for a mortgage loan. John Parker NMLS 124935 authored this blog on commission-income mortgage guidelines:

https://gustancho.com/commission-income-mortgage-guidelines/

gustancho.com

Commission-Income Mortgage Guidelines

Commission-Income Mortgage Guidelines require all self-employed and 1099 income earners 2 years of self-employment income to qualify

Danny Vesokie | Affiliated Financial Partners replied 11 months, 1 week ago 3 Members · 2 Replies -

2 Replies

-

Thank you for bringing up the commission-income borrowers qualifying for mortgage loans. Based on the information provided, here’s a general overview of commission-income mortgage guidelines:

Income Calculation: It is typically based on a 2-year average of commission income. Some lenders may consider a 1-year history if the borrower has been in the same line of work.

Documentation Required:

- Last two years’ tax returns

- W-2 forms for the last two years

- Recent pay stubs

- Year-to-date profit and loss statement (if self-employed)

Stability of Income:

- Lenders look for consistent or increasing income

- Decreases in income may require an explanation

Length of Employment:

- Generally, a minimum of two years in the same field is preferred

- Less than two years may be considered with strong compensating factors

Debt-to-Income Ratio:

- Commission income is factored into the debt-to-income ratio calculation

- Lenders typically prefer a DTI of 43% or lower, though some programs allow higher

Down Payment:

- Commission-based borrowers may need to show larger cash reserves

Loan Programs:

- Conventional, FHA, VA, and USDA loans may all be options, depending on the borrower’s situation

- Unreimbursed Business Expenses:

- These are typically subtracted from gross commission income

Future Income:

- Projections of future commissions are generally not considered

Seasonal or Cyclical Income:

- It may require additional documentation or averaging over a longer period

It’s important to note that lender and loan program guidelines can vary. Borrowers should work closely with their loan officer to understand specific requirements and present their income in the most favorable light.

For the most up-to-date and detailed information, refer to John Parker’s full blog post or consult directly with a mortgage professional. Would you like me to elaborate on any specific aspect of commission-income mortgage guidelines?

-

Commission-Income Mortgage Guidelines

Commission-income borrowers face unique challenges when qualifying for a mortgage loan due to the variability and unpredictability of their earnings. However, they can secure mortgage financing with the right documentation and a clear understanding of the guidelines. Gustan Cho Associates are experts on commission-income mortgage guidelines, and here are the key considerations for such borrowers:

Income Calculation

Two-Year Average: To account for fluctuations, lenders typically average commission income over the past two years.

One-Year History: Some lenders may consider a one-year history if the borrower has been in the same line of work and can demonstrate consistent or increasing income.

Documentation Required

Tax Returns: Borrowers must provide the last two years of tax returns, including all schedules.

W-2 Forms: W-2 forms for the last two years are required to verify income.

Pay Stubs: Recent pay stubs to show current earnings.

Profit and Loss Statement: A year-to-date profit and loss statement may be required if self-employed.

Stability of Income

Consistency: Lenders look for consistent or increasing income over the two years.

Decreases in Income: Any decreases in income may require a detailed explanation.

Length of Employment

Minimum Employment: Generally, a minimum of two years in the same field is preferred.

Less Than Two Years: Borrowers with less than two years of commission income may be considered if there are strong compensating factors, such as excellent credit or substantial savings.

Debt-to-Income Ratio (DTI)

Calculation: Commission income is factored into the DTI ratio, which lenders typically prefer to be 43% or lower, although some programs allow higher ratios.

Down Payment and Reserves

Cash Reserves: Commission-based borrowers may need to show larger cash reserves to compensate for the variability in income.

Loan Programs

Available Options: Commission-income borrowers can explore conventional, FHA, VA, and USDA loans, depending on their circumstances.

Unreimbursed Business Expenses

Deductions: These expenses are typically subtracted from gross commission income, affecting the income calculation.

Seasonal or Cyclical Income

Additional Documentation: Lenders may require additional documentation or average the income over a longer period to account for seasonality. While commission-income borrowers face additional scrutiny when qualifying for a mortgage, understanding the specific guidelines and providing thorough documentation can significantly improve their chances. Working with experienced mortgage professionals, like those at Gustan Cho Associates, can provide valuable guidance and support throughout the process.

For more detailed information, consider consulting these resources:

gustancho.com

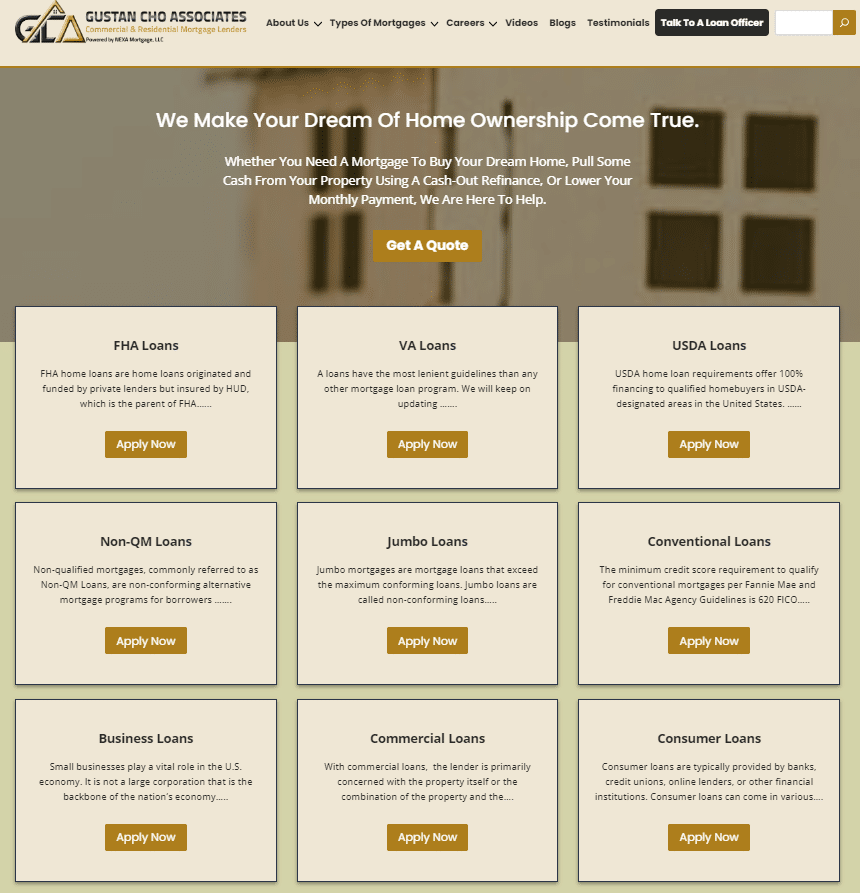

GCA Mortgage | Mortgage Experts With No Overlays

Whether you’ve gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans