This FORUM will cover foreclosure, deed-in-lieu of foreclosure, and short sales and how homeowners go through the foreclosure and short sale process. We will also discuss how you can qualify for a mortgage after foreclosure, deed...

View more

-

All Discussions

-

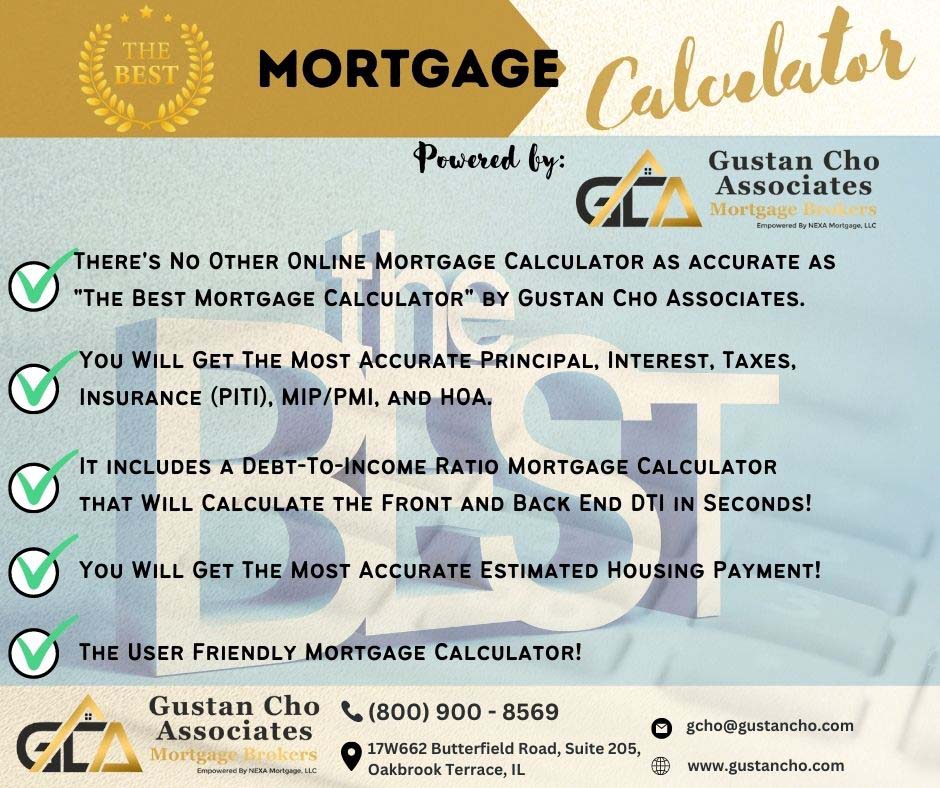

I like to go over a case scenario on a house that has been or is in the final stages of getting foreclosed in Sacramento, California. The homeowner has not made a mortgage loan payment in quite some time. Therefore, the house is under the receivership-temporary ownership of the lender, which is often referred to as REO. It is a bank owned property and the bank is responsible to get the most and highest priced offer for the property. The home is located in 2663 LA VIA WAY, Sacramento, CA 95825. The bank has hired a real estate broker and/or California DRE expert to prepare a comprehensive report of the subject property. The Repart was prepare on May 26, 2025. The house needs to be sold to the highest bidder. The exterior and interior condition of the subject property is not fully known nor can it be warranteed by the seller, or in this particular case, the note holder which is the bank. The current homeowner who defaulted on the mortgage is currently living on the subject property and the potential buyer of the property should not expect cooperation as of the condition and answers to questions they may have. I have attached GCA Forums Best Mortgage Calculator to figure and calculate the monthly housing payment versus the rental income and what the minimum monthly lease needs to be charged with a potential tenant in order to be profitable as a real estate investor unless the homebuyer is planning on living on the house as a primary owner-occupant home. Any feedback from real estate experts in the Sacramento, California area who are members of Great Community Authority Forums would be greatly appreciated. Here is the link to Gustan Cho Associates Best Mortgage Calculator:

https://gustancho.com/best-mortgage-calculator/

gustancho.com

Best Mortgage Calculator | PITI, PMI, MIP, and DTI

The best mortgage calculator powered by GCA Mortgage Group is different than the competition due to PITI, PMI, MIP, HOA, and DTI features.

-

My home had a mortgage against me (wife). The house deed had both of our names on it. The house has since foreclosed. Is my husband liable for the mortgage or taxes. He is applying for a new mortgage, they brought up the foreclosure. Will he be approved?

-

-

Here is a blog written by Mehgan Bahm about buying a foreclosed home.

-

This topic on non-QM loans after bankruptcy with no waiting period requirements is mainly addressed to Michelle McCue. Michelle, it has been a while since I kept up to date on non-QM guidelines on mortgages after bankruptcy and foreclosure. Do you know the credit score, down payment, credit requirements, and waiting period on non-QM loans after bankruptcy or bankruptcy?

-

This discussion was modified 3 years ago by

Gustan Cho. Reason: Forgot to check NOTIFY ME BOX

Gustan Cho. Reason: Forgot to check NOTIFY ME BOX

-

This discussion was modified 3 years ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 3 years ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 3 years ago by

-

What is the purpose of a short sale of a home? What does it mean by a short-sale in real estate? Can you give a case scenario of a short-sale in real estate? Do real estate agents get paid on a short-sale? Can you go over several case scenarios of the short-sale real estate process? Can a person qualify for a new mortgage after they had a short-sale on a home? What do homebuyers need to know about short-sales? Risks and rewards of buying a short-sale home. Is short-sale bad for the homebuyer? Is it a good idea to buy a short sale house? What is the difference between a short-sale versus a foreclosure? What are the eligibility requirements on getting for a mortgage loan after a short-sale and foreclosure? What are the different loan programs I can qualify for and get pre-approved after a short-sale and foreclosure?

-

Veteran Class A Actor Kevin Spacey loses his house due to non-payment and got his Baltimore Maryland home foreclosed on. Kevin Spacey avoided bankruptcy up to today but may need to file in the coming weeks or months. Asked how much money he has, he replied NOTHING. There is a lot of talk, rumors, accusations, and news reports alleging Kevin Spacey being one of the most notorious child molesters and pedophiles in the world. Here’s a copy of a recent interview of Kevin Spacey and a reporter.

https://www.facebook.com/share/r/7TPvuyVjNncq12he/?mibextid=D5vuiz

facebook.com

#KevinSpacey breaks down telling #PiersMorgan he’s losing his home and is millions in debt. #trending #fyp #interviews #spacey #houseofcards #moviemagicwithbrian #foryou #foryourpage #foryoupage...

-

The difference between a deed-in-lieu of foreclosure and a foreclosure centers on the process and implications for the homeowner and the lender:

Foreclosure:

- Process: Foreclosure is a legal process initiated by the lender when the homeowner fails to make mortgage payments. The lender takes legal action to seize the home to recover the money owed.

- Impact on Credit: Foreclosure has a significant negative impact on the homeowner’s credit score and can remain on the credit report for up to seven years.

- Public Auction: Typically, the foreclosed property is sold at a public auction, and the lender may still pursue a deficiency judgment if the sale price does not cover the mortgage balance owed.

- Legal Proceedings: Involves court intervention, especially in judicial foreclosure states, where the process can be lengthy and costly.

Deed-in-Lieu of Foreclosure:

- Process: A deed-in-lieu of foreclosure is a voluntary process initiated by the homeowner who cannot make mortgage payments. The homeowner hands over the deed to the property to the lender to satisfy the loan, thereby avoiding foreclosure.

- Impact on Credit: While it still negatively affects credit scores, a deed-in-lieu may be slightly less damaging than a foreclosure. It also shows on a credit report for up to seven years but is often viewed slightly more favorably since it demonstrates proactive management of the default.

- Resolution: This process is generally quicker and less costly than foreclosure. It also avoids the public auction aspect of foreclosures.

- Deficiency Judgment: Typically, a deed-in-lieu agreement includes a provision that forgives any deficiency between the home’s value and the amount owed, though this needs to be negotiated with the lender.

Choosing Between Them:

- Homeowner’s Situation: The choice between pursuing a deed-in-lieu of foreclosure versus undergoing a foreclosure often depends on the homeowner’s specific circumstances, including their ability to negotiate with the lender and the lender’s willingness to accept the deed-in-lieu.

- Lender’s Discretion: Not all lenders will accept a deed-in-lieu of foreclosure, especially if there are other liens against the property, as these complicate the transfer of a clear title.

Both options are ways for borrowers to address financial hardship and impending foreclosure, but they carry different implications for the time required, impact on credit health, and potential financial obligations following the event. Homeowners facing such decisions may benefit from consulting with a financial advisor or a legal professional to explore the best course of action based on their personal situation and the specific terms of their mortgage agreement.

-

James Strebel is the President and CEO of REO Foreclosure Services. REO Foreclosure Services is a preferred referral partner of Gustan Cho Associates and its subsidiaries. The business model of “REO Foreclosure Services” typically refer to the suite of services provided by banks or financial institutions for managing properties that have been acquired through foreclosure. These services may include:

Property Management: Banks often need to manage the properties they acquire through foreclosure. This can involve tasks such as property maintenance, repairs, and ensuring that the property is secure.

Marketing and Sales: REO properties need to be marketed to potential buyers in order to sell them. This may involve advertising the properties through various channels, coordinating showings, and negotiating offers.

Title Services: Clearing title issues is an important aspect of selling REO properties. Banks may provide title services to ensure that the title is clear and marketable.

Closing Services: Once a buyer has been found for an REO property, closing services are needed to finalize the sale. This may involve coordinating with the buyer, their lender, and other parties involved in the transaction.

Asset Valuation: Banks need to accurately value their REO properties in order to determine listing prices and make informed decisions about their disposition.

Loss Mitigation: Some banks offer loss mitigation services to help distressed homeowners avoid foreclosure. This may include options such as loan modifications, short sales, or deed in lieu of foreclosure.

Overall, REO foreclosure services are designed to help banks efficiently manage and sell properties acquired through foreclosure while minimizing losses. @Lilboss

-

20 Million people are forecasted to lose their homes all at the same time. Many baby boomers took early retirement and now they cannot afford their homes. More on this topic coming.

-

I being 120 days on a mortgage loan the same as a foreclosure. I have someone who was late 150 days on a mortgage and cannot get a mortgage loan approved because lenders are saying a 120 mortgage late is no different than a foreclosure.

-

Can I get approved for a mortgage loan after a timeshare foreclosure with no waiting period? Many lenders say I cannot qualify and get approved for a mortgage after a timeshare foreclosure and need to wait three years for FHA loans and seven years for conventional loans.

-

James Strebel of REO Foreclosure Services is nationally known for his cleanup and renovation after the home forecloses. James Strebel’s clients are banks and financial institutions that take over the property due to breach of the terms of the mortgage loan agreement. This includes residential and commercial properties. @James

You must be logged in to create new discussions.