Welcome to the Non-QM loans Sub-FORUM of Gustan Cho Associates. Non-QM loans are back. No-doc mortgages are back. Stated-income loans have reincarnated my friends. Never in many’s wildest dreams did they ever think...

View more

Sub Forums

-

Welcome to the DSCR Sub-Forums of GCA FORUMS, powered by Gustan Cho Associates. In the DSCR Sub-Forums, we…

-

All Discussions

-

What is the minimum loan amount i can get approved for on non-QM loans? What is the minimum loan amount on bank statement mortgage loans? What is the minimum loan amount on DSCR LOANS?

-

Are non-QM loans hard money loans? What is the difference between NON-QM Loans vs Hard Money Loans?

-

What rates should I expect and how long will it take to close and what do I need to show for getting approved for Non-QM loan for a house (Sale Price $680 K)

* My Mortgage Scores are 720+

* Last year gross business income $853K

* Business Checking has over $150K

* Self Employed since 2007 running the same company.

-

Need To Qualify For No Wait Period Mortgage With 10% Down Payment Need Of Refinance To Lower My Monthly Mortgage Before Mortgage Rates Go Higher Fannie Mae and multiple parcels – if contiguous does it matter if they are buildable?

-

Non-QM lenders are portfolio mortgage lenders, which means they fund their mortgage loans and either keep them in their portfolio or sell it on a private secondary market to institutional investors, insurance companies, money managers, or hedge funds.

-

This discussion was modified 3 years ago by

Eric Jeanette.

Eric Jeanette.

-

This discussion was modified 3 years ago by

-

Non-QM loans or Non-Qualified Mortgages are portfolio loans that do not conform to Fannie Mae or Freddie Mac agency mortgage guidelines. Here are examples of non-QM mortgage loans:

- Bank StatementMortgage Loans for self-employed borrowers

- There is no income tax or income documentation required on bank statement mortgages.

- The average of 12 months of bank statement deposits is required to calculate income on bank statement loans.

- Non-QM Jumbo Loans with bad credit

- No Income Documentation Mortgage Loans

- No-Doc mortgage loans

- Asset-Based Loans

- Foreign National Loans (ITIN) mortgage loans

- Recent Credit Event Loans. …

- Commercial loans

- 1099 income-only mortgages

- Stated-income mortgage loans

-

What type of mortgage options do I have to finance an condotel unit? What type of non-QM loans are available for condo hotel financing. Can I do a bank statement loan on a condotel in the Florida Keys?

-

-

-

What rates should I expect and how long will it take to close and what do I need to show for getting approved for Non-QM loan for a house (Sale Price $680 K)

-

-

-

-

How do non-QM mortgage lenders calculate debt-to-income ratio requirements on non-QM loans.

-

-

-

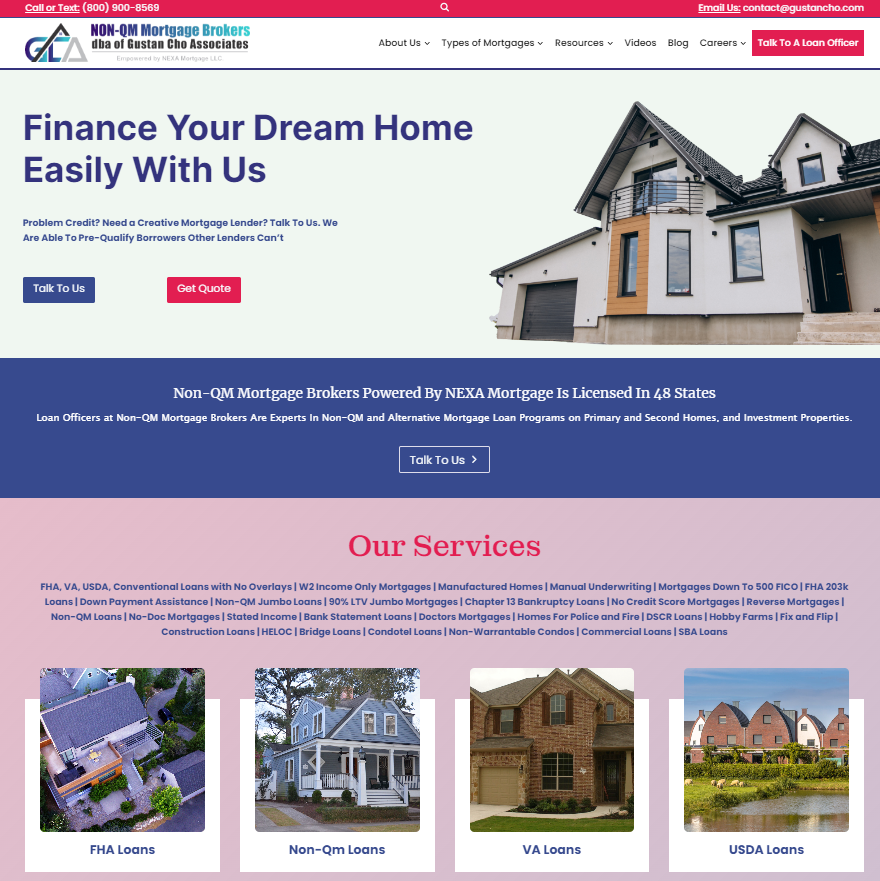

Non-QM Mortgage Brokers is a national mortgage broker and correspondent lender licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. Non-QM Mortgage Brokers is a wholly-owned subsidiary of Gustan Cho Associates, Inc. Gustan Cho Associates, also referred to as GCA Mortgage Group NMLS 2315275 is a dba of NEXA Mortgage, LLC NMLS 1660690, the nation’s largest mortgage broker and correspondent lender with nearly 3,000 licensed mortgage loan originators and equally number of support, operations, and third-party independent contractor service providers. Non-QM Mortgage Brokers specialize in providing mortgage options for individuals who may need to meet the standard lending criteria set by the Consumer Financial Protection Bureau (CFPB). Licensed mortgage loan originators at Non-QM Mortgage Brokers offer more flexible mortgage loans regarding income and credit requirements, which can benefit borrowers such as business owners, self-employed individuals, and gig workers.

Here are some key features of non-QM loans:

Flexible Income Documentation: Borrowers may use alternative methods, such as tax returns, bank statements, or 1099s, to demonstrate their ability to repay the loan.

Higher Debt Limits: Some non-QM loans allow for debt-to-income ratios over 50%, compared to the standard 43%.

No Waiting Period After Bankruptcy: Certain non-QM loans do not require a waiting period after bankruptcy or foreclosure, enabling quicker access to a mortgage.

Higher Down Payment Requirements: Non-QM loans often require a larger down payment, typically between 15% to 20%.

Higher Interest Rates: Due to the increased risk associated with these loans, non-QM mortgages usually come with higher interest rates.

If you’re considering a non-QM loan, it’s important to shop around and compare offers from different lenders to find the best terms for your situation. Remember that while non-QM loans can provide a path to homeownership for those who don’t qualify for traditional mortgages, they also come with higher costs and risks. It’s advisable to consult with a financial advisor or mortgage broker to understand all the implications before proceeding. Non-QM Mortgage Brokers is the nation’s largest mortgage broker of non-qualified mortgages. For more information, visit us at Non-QM Mortgage Brokers, Inc. at

https://www.non-qmmortgagebrokers.com/

non-qmmortgagebrokers.com

Home - Non-QM Mortgage Brokers

Finance Your Dream Home Easily With Us Problem Credit? Need a Creative Mortgage Lender? Talk To Us. We Are Able To finding The Perfect Mortgage For Your Dream Home Find A Lender With Us Fill out the form by click … Continue reading

-

Non-QM late payment guidelines are set by individual wholesale lenders. Non-QM loans are portfolio loans and do not have uniform standardized agency mortgage guidelines like qualified mortgages. One non-QM lender can have a certain guidelines while a different lender will not. Only a few wholesale lenders will do non-qm loans for late mortgage payments in the past 12 months. In this FORUM, we will cover non-QM late payment guidelines by non-QM portfolio wholesale lenders.

-

Did you know you can purchase an owner-occupied property without income, employment or debt to income restrictions? Well, you can!

There are restrictions based on state law of course, but you can purchase or refinance a home without income or employment. Admittedly, that feels odd. How can that be?

The lenders that provide no-ratio loan qualify the borrower based on credit and assets.

- Credit scores must be over 660

- 12-18 months of reserve mortgage payments must be documented.

- Maximum Loan to value 70% on a cash out refinance, the cash out can be used for reserves

- Rate and term refinance maximum Loan To Value of 80%

- Purchase Loan To Value 65-80%.

- The lender will verify funds electronically with a VOD (verification of deposit)

- Gift funds are allowed to 95% – 5% of funds and reserves must belong to the borrower.

- Ability to repay is satisfied through taking the Framework home buyer’s class.

-

Real estate investors benefit from using fix and flip loans by getting a mortgage for the cost of the acquisition of the property and the cost of construction all in one loan closing. Once the property has been renovated, the investor will sell it for a profit. Many investors, including novices, can get fix and flip loans and start investing in distressed properties.

-

DSCR mortgage loans require a 20% to 30% down payment. The down payment depends on the borrower’s credit score. The lower the credit scores the higher the down payment requirement on DSCR loans. There is no income tax returns required on DSCR loans.

-

This discussion was modified 3 years ago by

Eric Jeanette.

Eric Jeanette.

-

This discussion was modified 3 years ago by

-

I was told that non-qm lenders require a certain number of credit tradelines that has been seasoned for 12 to 24 months. Can someone tell me the number of seasoned credit tradelines required on non-QM loans. Does authorized user credit cards count? Does non-traditional credit count as a credit tradeline?

-

Hello Everybody on GCA!

I wanted to create a discussion regarding all Questions & Concerns regarding all NON-QM products.

I am Sales Account Executive & I will be going through Generics & specifics on guidelines & also details to pay attention to with your loan process as Broker, Client, AE & Agent.

Will be also posting FAQ’s as well.

Please feel free to reply with any comments 🙂

I look Forward to hearing all your thoughts!

Thank you!

Cameron Leclair

You must be logged in to create new discussions.