-

All Discussions

-

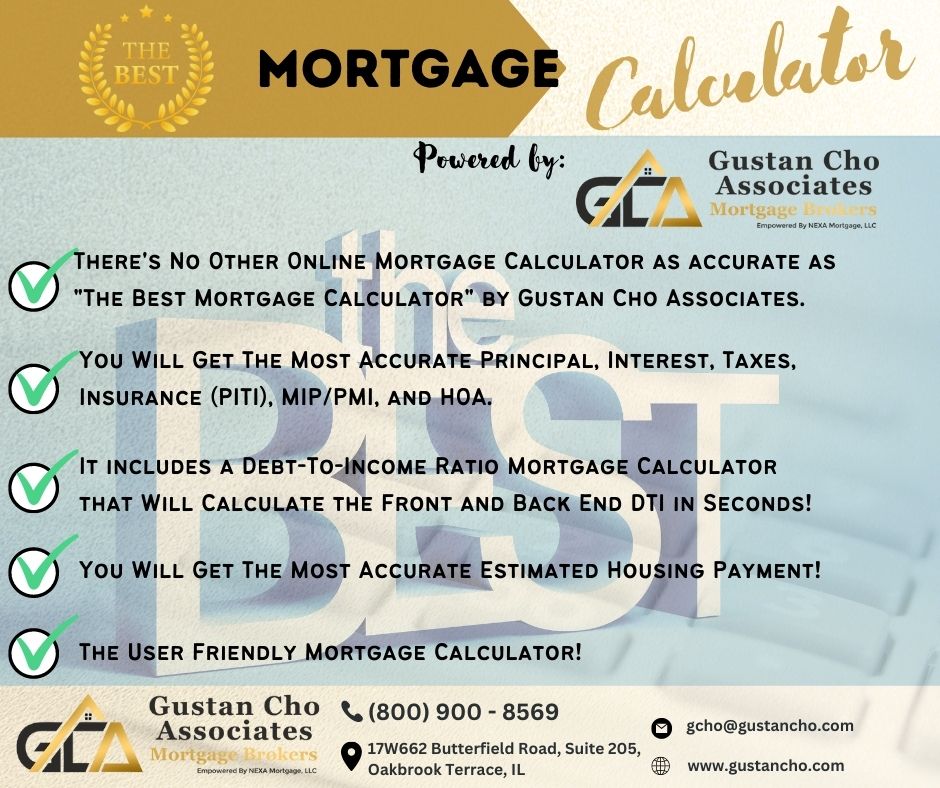

There are hundreds or thousands of Mortgage Calculators online. However. The Team at Gustan Cho Associates Alex Carlucci and Monica Cho has designed, created, tested, and launched the best mortgage calculator that is user friendly with the best accuracy than any other online mortgage calculator. The Best Mortgage Calculator is user-friendly for loan officers, processors borrowers realtors, underwriters, and the general public. Not only does it calculate PITI and Housing payments but also debt to income ratios and agency guidelines on debt to income ratios. Try out the best mortgage calculator https://gustancho.com/best-mortgage-calculator

gustancho.com

Best Mortgage Calculator | PITI, PMI, MIP, and DTI

We are at Gustan Cho Associates, You easily check your mortgage eligibility with the best mortgage calculator With PITI, PMI, MIP, HOA, and DTI.

-

Never used a contract mortgage processor and I normally process my own loans or my LOA will assist. Can ypu please advise me on how contract mortgage processors work? I know you pay the contract preocessing company on a case by case basis once the loan closes. How much do contract processors charge per file? I am also considering hiring an inhouse mortgage processor and comparing what type of processor is better for my small mom and pop mortgage broker. What is the going rate on a full time mortgage processor? Can I hire a contract processor where the contract processor works with the mortgage processing company and myself, an independent mortgage broker at the same time? I would be hiring the contract mortgage processor for my files and pay her a base plus commission and the contract processor will also work for her contract processing company in dependent and separate from me. Thank you in advance.

-

As a mom and pop mortgage broker owner with a small operation of three licensed loan officers, one full-time processor, and one full-time loan officer assistant and licensed in three states, the cost of a tri-merger credit report is becoming more and more unaffordable. I remember when a tri-merger credit report from Credit-PLUS cost $28.00 and a soft pull from one credit bureau cost $2.00. I have not been doing a lot of production but am starting to. Let me get this straight. A tri-merger hard pull costs $127.00 dollars per borrower? How about if you add a co-borrower or co-borrowers? What if you have one main borrower and two non-occupant co-borrowers? Would that cost $127.00 times three people so $381.00? How much are soft pulls? I heard many companies are sending out payment links for the mortgage applicants to pull their own hard pull tri-merger credit report where the borrower pays and get a copy of the tri-merger credit report and the loan officer gets sent a copy of the tri-merger credit report. By having the borrower pay the tri-merger credit report, the borrower does not get charged credit report fees at closing, correct? Normally, if the loan officer pulls credit and the mortgage broker company pays for it, does the lender charge a premium for credit reporting fees or the $381.00 just gets charged? How would you present to the borrower on directing them to go to the payment link and pay for the tri-merger credit report? Thank you in advance.

-

If I were to surrender my mortgage brokerage and put it in hibernation and do a lateral transfer to a national mortgage brokerage company that is licensed in most of the 50 states, it there a deposit I would have to pay or empty credit card OR am I going to start off with a large negative balance on my P and L due to licensing transferring for my licensed loan officers, and myself. How about my hourly and salaried employee? Let’s take a hypothetical case scenario where I start with a national mortgage brokerage company ABC Mortgage Broker. I am on a P and L. Things go by smoothly where we are lucky to not run in the red and are able to pay our bills. What happens if all of a sudden a lot of loan fall through and we are having a slow month and are running short to make good on all of our bills. I will assume the basics such as electricity and other utilities will get paid or I can use my business credit card but how about the big ticket expenses like payroll for salaried and hourly employees. Will the parent company, ABC Mortgage Broker suspend payroll or will they need to wait until my P and L goes in the positive. The employees I am talking about are two mortgage processors and three loan officer assistants and are paid hourly and salary via W2. Their paychecks are issued on the first and fifteenth of the month with taxes being taken out. I know the mortgage industry has been rough the past two years and many mom and pop mortgage broker owners are struggling with not meeting expenses with incoming revenues. I am in Lake County, Illinois and I know both the Federal and State Department of Labor have strict laws, rules, and guidelines concerning making timely payroll payments. Can anyone advise? Thank you in adviance.

-

Have a case scenario for a client of a loan officer. Borrower inherited a $3 million dollar home in Fort Lauderdale. Waterfront property. The land is worth $2 million. Free and clear. Wants to borrower $300,000 via private or hard money but does not want to get homeowners insurance because the insurance carrier will want the house fixed before insuring it. Even if the house got destroyed, the lien holder/lender will not get hurt because the land itself is $2 million. The house was built in 1950 and could be a tear down. Advise would be appreciated.

-

Hello,

I have a question I was hoping you can answer.

If I have a home currently under a natural disaster forbearance that I end with a disaster loan modification will there be a waiting period to qualify for a new mortgage ?

I’m looking to rent this one out and buy a home somewhere else.Thank you,

-

I need to buy a house and I got denied with a lender who was extremely incompetent where I got pre-approved and at the last minute I got denied due to my debt to income ratio. I am trying to buy a house for $200,000. My situation is I have full time employment. However, in 2024, I worked 40 hours consistently and made 80,000. However, in 2025, I only made 50,000 because my hours was reduced to a minimum of 32 hours due to going to a certificate training program for work. I am still classified full time since I work between 32 and 36 hours. I will be done with the certified training program in June 2026. I also have two newer vehicles under my name which is 780 per month for mine and 600 per month for my fiancee. This pushes my debt to income ratio to 70% back end with my father included as non-occupant co-signer. What solution do you have on me qualifying and getting approved for an FHA loan? Any ideas would be greatly appreciated. Is there any way my fiancee can take the hit on the vehicle he is driving and paying for even though it is under my name? He cannot refinance under his name because he went through a divorce and has tons of recent derogatory tradelines.

-

-

IS 12 MONTHS CANCELED CHECKS REQUIRED TO QUALIFY FOR A MORTGAGE? Is there a faster way of getting rid of the record of debt settlement on your credit report? Is achieving a 700 PLUS FICO credit score possible one year after a bankruptcy discharge?

-

Are you in a spot where you have to make some important financial decisions concerning your home? Is it better to do a big remodeling of your home before you put it on the market and increase the asking price or just leave it as is and ask for a lower price?

-

Could I finance land only? A site-built home or mobile home would come later after I’ve paid off the land. Are down payments on land higher? Are credit restrictions tougher?

-

FICO 5, 4, 2 is 610, 569, and 599. We have 4-year-old unpaid COs (job loss, very sick child). Pre-approved with different lenders from $173k (low end) to $225k (high end). the single borrower makes $45k, has a car payment of $370, and has low credit card limits with under 5% util. Excellent VOR and flawless payment history from the past 24 months and on. I made an offer on a house and was accepted for $190k, but I am now curious about other lenders. We’ll need manual underwriting, won’t we? Can GCA FORUMS Mortgage Group do manual underwriting? Are they a direct lender? Can they help us make this dream a reality?

-

In California, to refinance a property I owned before marriage does my spouse need to sign?

Underwriting wants me to write a letter on my late payments and charge the account off. What should I write?

-

In California, to refinance a property I owned before marriage, does my spouse need to sign?

-

Va loan with a 500 credit score, any way that has ever been done. Lady was married spouse passed and then she got cancer. Which she is cancer free now. So they have foreclosed on the home she is living in that was her husbands. She was not on loan. She is an RN, I know VA is not so much credit score. This below picture of info came from a Realtor friend. We would love to be able to help get some way, if possible purchase the home that foreclosed. She is still living in it still. She is an heir to property, so I was unsure how it would affect. As her name is on deed but not mortgage.

-

-

I was on a call, not sure which one about assignments. Commented, stating some lenders allow assignments, and buyers can close a loan with assignments. Did I hear it right? Like years ago, before Obama, my husband was flipping.

He helped a friend out, and we did some work. The buyer did a conventional loan. I did not do the loan. We did back-to-back closings,

Assignments have really gone crazy here. So, the state made some new rules because of it.

I personally think one was getting taken advantage of.

So I am asking that the form you provided us from Utah is awesome.

Can one do an assignment on a standard conventional loan? If so, I figured it would be just a few investors. How do I find them?

I am seeing opportunities with our new products. Where I may get a chance to get a foot in the door. My old-school investors, are now running investment groups and doing classes and things with them. A few of them are on a national level.

I will talk to you later about that and a few other things.

I am terrible at email.

-

This discussion was modified 12 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 11 months, 3 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 12 months ago by

-

One thing about mortgage lending is every case can have its own separate case scenario. There is always a unique case scenario for each individual borrower. We will go over the hundreds of case scenarios we encounter as loan officers.

-

How do 401k Loans Effect a Mortgage Application? Can someone get a mortgage if they have a 401k loan and does it count against them?

-

-

What happens if you are in the VA loan process and the property has issues and you can’t close? Can you just find another with the same price or less? Or does that mean you would have to file for court approval again?

-

Is it possible to alleviate your monthly debts without having to sell your home or refinance with another 30 year mortgage even if you have significant mortgage balance and credit card debt?

-

Scenario: Borrower wants to do a Cash-out refinance. Property worth is $350K and she owes $157K.

Rocket Said that they can do a Refi Debt Consolidation in August.

Issue: Mortgage late: 08/2022

Recent Lates: 06/23 (2 tradelines)

Open Tradelines: 3 (car, and 2 CC)

FICO: 459

Thank you

-

I have a client with multiple 60 day lates on a mortgage in last 24 months prior to filing a chapter 13 bankruptcy..

If the mortgage is in the chapter 13 are those 60 day lates excluded from the manual underwriting guideline rule of no more than 2X 30 day lates on an installment loan last 24 months?

-

This discussion was modified 1 year, 2 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 2 months ago by

-

Adding someone to mortgage. Can you add someone to a mortgage afterward? Will a lender add someone to the mortgage later if asked? -

My application is currently in underwriting. I am concerned that because my student loans are so high that my DTI may not pass. I have found a home that is scheduled to close on 12/2. Honestly I did not see you site until after applying thru my current lender. Would you be able to take over the case and will I still be able to close on 12/2 or earlier? I am in Illinois and also seeking downpayment assistance from IDHA. The Home Inspection and Appraisal have all been completed. My student loans total 186k and I am currently in deferment, but the lender is saying that the payments are coming up to 1300 per month…but I am paying $0.00. My credit score middle is 643. Also I am currently employed but will start a new job in a week making more money. Can you help? What steps will I need to take.

-

MY husband Hector has an old judgement from 2009 before we were married. it has not been revived. Will this prohibit a home purchase? I have a second loan mortgage would I be able to refinance only that part of the loan?

-

I recently got denied by an incompetent lender because I was not properly qualified. Can you please help?

-

I want to close business for 4-6 months due to covid. Would i get a mortgage loan. I’m self-employed wanting to qualify for a mortgage loan using 1 year of tax returns

-

I live in Texas and would like to know how much of a loan you can get approved for with a 590 score?

You must be logged in to create new discussions.