GCA FORUMS and subforums were founded with one concept in mind: To serve consumers, entrepreneurs, homebuyers, home sellers, real estate investors, and the general public. When people buy or sell a certain house, they move and, therefore, have to start life in that new place. All the partnerships that they have developed with local vendors and merchants will cease to exist ………. Read More

-

All Discussions

-

I have been hearing and also know a few friends and coworkers who are Jeep lovers and swear that Jeeps are great investments especially the older Jeeps where you can restore and make the jeep look like Neguyw. Many Jeeps from the 1980s especially the Jeep Wrangler Rubicon are great investments if you buy them at the right price and is mechanically sound and in excellent shape and has been well taken care of, preferably garaged. If any viewers and members of Great Content Authority Forums and Sub-Forums are Jeep experts and Jeep lovers, if you can guide us through the various types of Jeeps and suggest and recommenond what type of Jeeps to look out for and what type of Jeeps to stay away from, it would be largely appreciated. I have five large dogs and my dogs always travel together with me when running errands and when I need to go to my office. How is the space of 4 door Jeeps? From the picture, it looks cramped and not too spacious. What Jeep would you recommend for folks with multiple large dogs.

Attached is a video clip by Dennis Collins talk about 1981 to 1986 Jeep CJ. Some of these Jeeps have appreciated crazy in value.

Welcome to Coffee Walk Ep. 147!

This week we’re talking Jeep CJ’s and how to tell the difference(s) between a Base, Renegade, Laredo and a Limited Edition Model. Let me know which Jeep is your favorite in the comments section below AND let me know if this killer CJ collection that we’ve been stacking up over at our secret warehouse is something that you guys would like for us to feature on an episode here soon… although, I think I may already know the answer to Question #2!As always… GO FAST, HAVE FUN & HAVE A GREAT WEEKEND!! and thanks for watching!

-

On today’s edition of GCA Forums News for Wednesday, June 11, 2025, we will cover the following important trending topics:

1. We will update our viewers on the latest fiasco between President Donald J. Trump and Elon Musk.

2. We will cover if the relationship between Trump and Musk will ever reconcile or if this is the END of a fast-paced new friendship and alliance. Musk keeps on saying that Trump is on Epstein’s pedophile flight log which Trump vehemently denies.

3. We will cover the Los Angeles riots and the feud between Trump, Tom Homan, and California Governor Gavin Newsom and contemplate the theory that Newsom is trying to stir up political chaos, civil war, and divisions against Trump because he has an ulterior motive to gain brownie points and get ahead in the 2028 Presidential election. Kamala Harris has not announced she will run for the office of Governor of California.

4. We will cover Trump’s Big Beautiful Bill. Fellow Republican senators seem to be more opposed. Remember that the Big Beautiful Bill barely passed the House by one vote. Now, with several Republican senators against the bill, Trump has a long, dim road ahead trying to make it into law.

5. The economy and job market are awful. Many Americans either have or are expecting to lose their jobs with no promising employment in the future. The U.S. economy is on life support, and Wall Street is in denial, where the DJIA is swinging upwards by triple digits and tanking the same. The volatility in the stock market signals that the stock and bond markets are clueless..

7. We will thoroughly examine inflation, the Federal Reserve Board’s potential cuts in interest rates and mortgage rates, housing inventory, home prices, and the overall housing and mortgage markets.

8. What is going on with sanctuary cities and sanctuary states? Illinois Governor JB Pritzker is in Washington on a conference with lawmakers concerning offering a haven to illegal migrants and discussing sanctuary cities and states, as well as the federal government cutting federal funding dollars to states that are proclaimed sanctuary cities and sanctuary states.

9. What are the updates on mayors, judges, and politicians shielding illegal migrants from Federal Immigration and Customs Enforcement agents? What is the latest on Congressman Hakim Jeffreys that he will publicly name all federal ICE agents who are rounding up illegal migrants and deporting them?

10. Is Elon Musk’s Department of Government Efficiency completely dead? Is there any way to cut billions of dollars of wasteful spending? Why are U.S. Attorney General Pam Bondi and FBI Director Kash Patel dragging their feet when filing charges on the Biden Administration’s wrongdoings? Are the pardons and commutations signed with the auto pen null and void, or will nothing happen with that, too? Senator Adam Schiff, former Congresswoman Liz Cheney, Dr. Anthony Fauci, Barack Obama, Bill Gates, Hillary and Bill Clinton, Andrew Cuomo, Hunter Biden, Joe Biden, Dominion voting machines, and hundreds if not thousands of people of power who committed crimes and crimes against humanity needs to get charged, arrested, tried, and sentenced to prison for a long time. Pam Bondi and Kash Patel are either completely incompetent, lazy, or not thinking about doing anything. Why aren’t these corrupt judges getting charged, arrested, tried, and sentenced? Why are they not being put in their places? What is the latest on New York Attorney General Letitia James and Fulton County, Georgia District Attorney Fani Willis?

We will give you a comprehensive detailed report on the topics from above and more. Stay tuned.

https://www.youtube.com/watch?v=wXMEF63N3N8&list=RDNSwXMEF63N3N8&start_radio=1

-

There are now nearly 500,000 more homes for sale than buyers actively looking. See what that can mean for you.

instagram.com

3 likes, 0 comments - chadbushrealestate on June 5, 2025: "Buyer's Market: More Sellers, More Options Nearly 500,000 More Homes for Sale Than Buyers, Here’s What It Means for You Right now, there are almost half a million more sellers … Continue reading

-

Electric Vehicles or EVs were the nation’s talk, especially among Democrats. Many states, like California, have mandated that electric vehicles be the vehicle of choice by a certain year, and consumers will no longer be allowed to drive gas-powered vehicles. However, electric vehicles have been launched and are in full production. There are a lot of kinks and things wrong with electric vehicles. Tesla’s Cyber Truck was the gem of Elon Musk and considered the pinnacle of EVs. However, the Cyber Truck costs over $100,000, and values have plummeted within months of a buyer purchasing the Cyber Truck. At first, Tesla’s Cyber Truck sold for a big premium over the MSRP. For example, some consumers purchased Tesla’s electric vehicles for almost $200,000, and in less than one year, the Tesla Cyber Truck is valued at $60,000. Many people are skittish about buying a used electric vehicle because the battery panel of the EV is the heart and brain of all electric vehicles. The battery power source alone can cost over $50,000, and the battery has been proven to it can go bad in five years. With a battery needing replacing on an electric vehicle, the vehicle is worthless. Electric vehicles were expected to be a hit and very popular, exceeding gas-powered vehicles in production. Unfortunately, many EV owners threw in the towel and took the loss of selling their electric vehicle and trading it in for a gas-powered vehicle. Shaque O’Neill purchased three Tesla Cyber Trucks less than one year ago. After Elon Musk and President Trump had a big argument, Shaque O’Neill sold all three Tesla Aluminum Cyber Trucks. Plus, the infrastructure of the EV charging systems throughout the country is in its infancy, and the country is not ready to adjust and turn in its gas-powered vehicles for electric vehicles.

-

We will cover today’s comprehensive daily news in today’s GCA Forums News for Monday, June 9, 2025. We will cover the latest update between President Trump and Elon Musk. Last week, there was a major blowout between Trump and Musk. Trump and his inner circle no longer trust Musk. Musk invested millions in Trump, but what is the real story? Did Musk have an ulterior motive? Is Tesla deteriorating? Tesla’s Cyber truck is sitting dormant and not selling. The left loved Musk but no longer after he supported Trump and the Republicans. What is going on with the latest housing and mortgage news? What is happening with the Dow Jones Industrial Average, other indices, and Tesla stock? Tesla stock lost 14% last Thursday. Musk got kicked out of the White House. What is going on with Trump’s Tariffs? What is going on with precious metals? What is the latest with inflation? Did Trump use Musk and leave him after he used Musk? What is going on with the economy? What is going on with both sides of the political spectrum? What is going on with the Department of Government Efficiency? Is this the end of Elon Musk? Did the public turn its back on Musk?

GCA Forums News: Monday, June 9, 2025

Update on Trump-Musk Romance

The relationship between President Trump and Musk has degenerated into a public feud, escalating rather rapidly last week. On Trump’s part, it started on June 5, 2025, when he threatened to cut government contracts and subsidies for Musk’s companies, including Tesla and SpaceX, which he claimed could cost billions.

Accusations by Musk

- In retaliation, Musk accused Trump of running his economy into the ground, pledging a recession in the second half of 2025 at Trump’s hands.

- He even called for bursting Trump’s impeachment balloon and idly tweeted about SpaceX’s Dragon spacecraft being decommissioned—while cautioning, later, that he’d retract.

- Elon Musk intensified his social media attacks on Trump, doubled down on his reframing, and focused even more on claiming Trump’s policies had destroyed American quality of life.

- Musk claimed he should be outraged, describing this as unprecedented.

- How in a democracy someone can be de facto ruled by a person suffering from the character divide seemed immeasurable when Musk turned against Trump for his tax and spending policies, declaring them “stuffed with disgusting pork” and demanding from his followers on X that Congress kill them.

- It would be hard to forget how, together in May and March of 2025, they attended Disneyland and sipped drinks here and there while seated on couches in Trump’s cab after participating in joint dinners where they proposed spending bills.

- Musk’s critics argued that he wanted to control policy to benefit Tesla and SpaceX, which depend on federal contracts and subsidies.

- The Washington Post estimated that Musk’s companies receive approximately $38 billion of federal spending.

- Out of that, SpaceX alone constituted $22 billion. Despite this, Musk’s vocal criticisms of Trump suggest he did not expect Trump to accommodate his influence, and his attempts at accommodating Musk may have backfired.

- No concrete evidence goes beyond the stated reason for downsizing the government, for Musk’s sudden fallout with Trump, which raises questions of strategy gone wrong.

Did Trump use Musk?

- Trump’s embrace of Musk, starting with giving him the position of leading DOGE and showcasing Tesla vehicles at the White House, was a public display of approval.

- After Musk criticized Trump, the latter distanced himself, saying he was “disappointed,” which many interpreted as suggesting that Musk’s exit from DOGE was due to his inability to handle the role.

- Some House Republicans also voiced dissatisfaction with Musk’s supposed lackluster performance in the role.

- However, it seems more likely that Trump used Musk’s influence to achieve his objectives and shut him out when they no longer aligned.

Tesla’s Performance and Cybertruck Sales

- On June 5, 2025, Tesla’s stock plummeted 14.3%, erasing its value by 150 billion dollars, marking the largest single-day drop in history.

- The decline was caused by the Musk-Trump feud, specifically Trump’s threatened removal of EV tax credits, which would have netted Tesla $1.2 billion.

- Tesla’s stock price experienced a minor recovery on June 6.

- Still, it remained down 21% in 2025 and had experienced a 33% decline since Trump’s inauguration.

Sales of Cybertrucks:

- Tesla is not doing well in Cybertruck sales, as analysts point toward Musk’s prioritization of this model over more utilitarian vehicles as a bigger drag on sales.

- Total sales of Tesla vehicles have also declined partly due to Musk’s political activism, which led to protests at Tesla plants in the US and Europe.

- In the EU, sales are down because of the political backlash, while in China, Tesla faces steep competition from domestic EV manufacturers.

- These factors, along with the anticipated withdrawal of federal aid, put Tesla in a weaker position in the market.

Perception of Government and Politics

- Musk’s shift from a revered leftist tech figure to a Trump Republican has cost him a lot of goodwill.

- According to X posts, his net favorability has shifted from +24 to -19 points, with a staggering 126-point drop among Democrats.

- The backlash against Musk has also affected Tesla, with a dip of 20 in net favorability.

- Musk has recently come under fire from the left sympathizers who used to endorse him because of his green energy innovations.

- Now, he is considered disloyal for backing Trump.

- On the other hand, some Republicans question his loyalty due to his reprimands for Trump’s policies.

Is This the End of Musk?

Despite these recent conflicts, Musk remains the world’s richest man. SpaceX and Tesla play integral roles in the United States space industry and the electric vehicle market. Due to government contracts, complete dismemberment is mostly impossible. Still, his political blunders and divided focus have hurt his public image and Tesla’s market performance. Musk’s crisis management will have to focus on stabilizing Tesla alongside maintaining government partnerships for SpaceX.

Trump’s Tariffs

- Concerns about economic fallout have surged due to Trump’s aggressive policies on tariffs.

- These include a proposed 50% tariff on certain European goods and the China trade war.

- Tariffs often trigger a recession or, at the very least, stagnate growth.

- Analysts fear that these tariffs will spur inflation and disrupt international trade, a view Musk has vocally supported.

- On June 5, a phone call between Trump and Xi brought some optimism toward progress in tariff negotiations.

- However, nothing of substance has been done. The complete economic impact of these tariffs is anticipated to become much clearer in the following months.

Recent Mortgage and Housing Updates

The first dip in mortgage rates after a month, Treasury yields led to a fall. Mortgage rates are now at 6.9%. These rates continue to dampen homebuying activity, especially during the important spring period. The housing market faces wider economic uncertainty due to tariffs, federal funding cuts, and decreased government spending.

Summary of the Dow Jones Industrial Average and Other Indices

- The Dow Jones Industrial Average, on 6/6/2025, jumped over 400 points (1.1%) to 42,319.74, closing above 42K for the first time.

- This resulted in a new high for NASDAQ for the year, sitting at around 6k.

- SP500 also rose above 6000, indicating a bullish market sentiment.

- May job figures showing surprising improvement and some signs of a truce in the ongoing feud involving Trump and Musk were the reasons for this rally.

- On the other hand, markets were dipping ahead of June 5, with Tesla’s induced slump alongside uncertainty around tariffs pushing the Dow lower by 0.25%, while SP500 and NASDAQ tracked it down with declines of 0.5% and 0.8%, respectively.

Precious metals update

Concerns regarding tariffs have incentivized investors to turn to gold, silver, and platinum, which, as of June 6, have reached multi-year highs surpassing prices observed previously. While we lack specific data points, the trend indicates a growing unease about inflation and trade tensions.

Inflation Update

- Concerns related to inflation have mounted to a good extent due to the tariffs imposed by Trump.

- Based on regional inflation rates, President Jeff Schmid of the Kansas City Federal Reserve claimed on June 5 that tariffs would reignite inflation.

- He warned that their impact could be felt within months.

- China’s producer deflation contracted at the worst rate in nearly two years in May, which shows how dire the global economy is facing.

- The Federal Reserve is still cautious about slashing rates as job data remain unchanged, and the effects of tariffs are yet to be fully captured within the numbers.

Department of Government Efficiency (DOGE)

- DOGE, or Department of Government Efficiency, was created and headed by Musk as an initiative to reduce the Federal workforce and government spending and fire several contractors.

- Musk’s abrupt exit came after he classified himself as ineffective under the Trump administration.

- With no clear successor announced yet, Trump’s remarks indicate that he no longer hopes to rely on Musk’s input amid other comments criticizing Trump’s last-minute decisions.

Economic Outlook

- Reduced federal funding, imposed tariffs, and stagnant spending will heavily strain the economy.

- By laying off nearly 100,000 employees in May, U.S. employers exacerbated job cuts for 2025 to below 700,000 while increasing their rate by 47% yearly.

- This makes for a disturbing economic cocktail, especially when combined with the projected costs of increasing inflation due to tariffs.

- This prediction contrasts with Musk’s expectation of recession-inspired growth.

Meanwhile, the XX CNN and Quartz links tell of a northern trigger that surfaced across markets and did not end well. Regardless, the Tesla market value is intricately tied to Elon as both are public figures’ faces and are somewhat expected to be hurt whenever one receives subconscious criticism pointed toward the other. As pointed out, the closure of financial markets causes people to remain angry at the government and constantly bash politics publicly. With a thought, the all-terrain Lee super Oscar potential of two people at once stepping down, there would be a slight energy release from the second leading markets. Markets are less physically cap-sensitive; the evolution of the financing paradigm quite simplifies the reason behind this.

I’d like you to please follow the links to learn more about Ex AI subscription pricing for SuperGrog and X Premium. You can also view their API package directly at the GCA forums, which will post all marketed updates as soon as they become available.

https://www.youtube.com/watch?v=Q61fLCh_LZA&list=RDNSQ61fLCh_LZA&start_radio=1

-

Elon Musk and President Donald Trump had a bromance closer than any two individuals can have. However, as time passed, the relationship deteriorated until last week when Elon Musk went postal. There are very close moments in any relationship, and other times when people do not get along. This happens in personal, business, and public relationships. For example, my husband and I were together for thirty years. However, we separated half a dozen times, but eventually got back together. When we separated, it was like we would never get back together again. However, that was not the case. Employees and subcontractors are the same way. There are warm and cold moments. “Elon Musk vs President Trump Feud: Hidden Signs You Missed Body Language Analysis” Elon Musk vs President Trump Feud: Hidden Signs You Missed Body Language Analysis. Watch the video below.

https://www.youtube.com/watch?v=iWvFAKkt2pU

-

This discussion was modified 1 day, 6 hours ago by

Lisa Jones.

Lisa Jones.

-

This discussion was modified 1 day, 6 hours ago by

-

When people first saw this man walking his pack of six German shepherds without any leashes, they couldn’t believe what they were seeing. The blind obedience the dogs showed left everyone amazed. Some even thought maybe he had forced the dogs into acting this way, but when the truth finally came out, it shocked and amazed everyone even more.

-

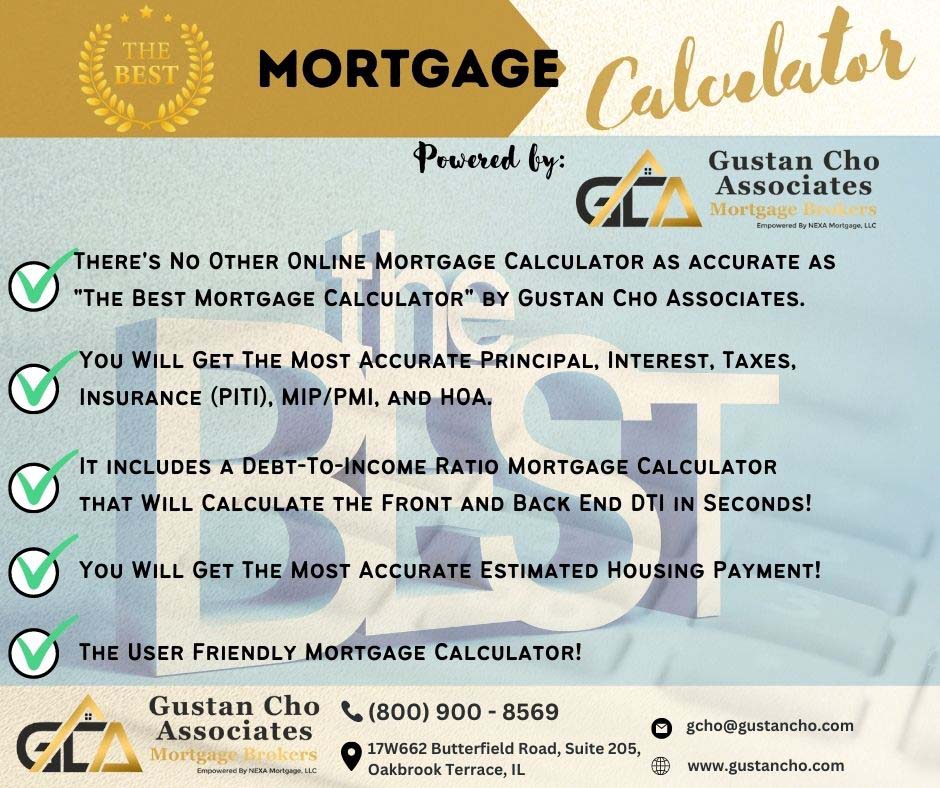

The Great Content Authority Forums, specifically known as the GCA Forums, is powered by Gustan Cho Associates. This forum serves as a platform for discussions on a wide range of topics, primarily focused on mortgage and real estate but also includes general community assistance and various other subjects like insurance, automotive, and more. Members can engage in topics ranging from FHA and conventional loan guidelines to mortgage rates, and there’s also a section for classified ads related to real estate and mortgage services.

The forum features various utilities such as mortgage calculators, FHA loan limits, and information on conventional loan limits. Members can also inquire about real estate and mortgage careers through designated sections for realtors and mortgage loan officers. Moreover, the forum provides links to subsidiary sites offering specialized services in real estate and mortgage brokering.

For those interested in diving deeper into specific topics like the differences between different mortgage companies such as AXEN and NEXA Mortgage, the forum hosts detailed discussions where experts like Michael Neill contribute insights on the intricacies of mortgage lending practices (GCA Forums) (GCA Forums) (GCA Forums).

If you’re looking to explore this forum or require more detailed information, you can access it here.

-

If a man is a permanent resident and his wife has a work permit A-10, are they eligible for an FHA loan as borrower and co-borrower? Thank you.

-

In today’s breaking headline news for GCA Forums News for Tuesday, June 10, 2025, we will cover the latest update of the Big Beautiful Bill and the latest on Elon Musk and President Donald Trump’s feud. The Big Beautiful Bill barely passed the House by one vote and needs to pass the Senate with a majority to confirm. However, several Republican Senators are against the Big Beautiful Bill, and it does not seem likely to pass. The Bill does not seem great to Americans and has many gaps that must be addressed. Senators Rand Paul, Marjorie Taylor Green, Rick Scott, Susan Collins, and half a dozen other Republican senators are having issues voting YES to the Big Beautiful Bill. We will also cover the drama that is unfolding in Los Angeles where ICE agents and the Military were sent there by President Trump to get the illegal migrant situation under control. Governor Gavin Newsom is playing thin and dared U.S. Border Czar Tom Homan to arrest him. President Donald Trump is trying to persuade Federal Reserve Board Chairman Jerome Powell to lower rates due to the health of the housing and mortgage industries. Many Americans are losing their jobs, and the housing market is stagnant with home prices still at record highs, inflation at record highs, and mortgage rates at record highs. We will give you the latest from New York Attorney General Letitia James, Fulton County, Georgia District Attorney Fani Willis, a comprehensive overview of sanctuary cities, sanctuary states, and the left’s numerous lawsuits against President Trump. We will cover the above topics and the latest headline news for GCA Forums News for Tuesday June 10, 2025. Mortgage rates are at a high of 7.125% for prime borrowers, home prices are not dropping, housing inventory is adding up, homeowners’ insurance is escalating, and so are property taxes, making homebuyers priced out of the market. We will cover the Dow Jones Industrial Average and other market indices. We will also cover the price per ounce of Gold and Silver. Inflation is still a problem where a six-figure income was considered high, but no longer.

GCA Forums News: Tuesday, June 10, 2025

Hello readers!

- We hope you are all doing well and staying safe during these uncertain times.

- Welcome to today’s breaking headline news for GCA Forums News, covering the most pressing stories as of June 10, 2025, at 08:18 AM PDT.

- Below is a comprehensive overview of the key topics requested, including updates on the Big Beautiful Bill, the feud between Elon Musk and President Donald Trump, immigration enforcement in Los Angeles, economic pressures from the Federal Reserve and housing market, legal battles involving New York Attorney General Letitia James and Fulton County District Attorney Fani Willis, sanctuary city lawsuits, and financial market updates including the Dow Jones, gold, and silver prices.

Big Beautiful Bill Updates

- According to sources within Congress, House Speaker Nancy Pelosi announced that she will remove Congressman Adam Schiff from his Intelligence Committee post on Monday night.

- This is because of his role in trying to impeach President Donald J. Trump (Note: The author provides no source link).

- One member said, “Schiff hasn’t been charged with a crime.

- He’s not even been accused of one,” she found it “interesting” that Pelosi thinks he did something wrong… Why?

- They were blackmailing each other.

- This seems like an interesting development, considering how much we’ve heard about corruption in Ukraine these past few years…

Elon Musk Vs. Donald Trump

- Did you know Elon Musk moved his company from California to Texas?

- I’ll tell you how President Donald Trump influenced this decision.

Immigration Enforcement In LA

- The Department of Homeland Security (DHS) ‘s Immigration & Customs Enforcement (ICE) says it arrested over three thousand people last week alone who had previously been released into U.S communities.

- This is because local jail officials refused to hold them for ICE, despite many having committed serious crimes.

- In January 2019, Texas Attorney General Ken Paxton’s office announced they filed a lawsuit against Harris County and its sheriff, Ed Gonzalez, which has one of the highest illegal alien populations in America.

Market Update: Dow Jones, Gold, Silver

- According to Fox Business News, the DJIA was down 116 points at closing yesterday.

- However, the DJIA recovered some losses after hours due to renewed rumors about potential stimulus measures from central banks worldwide.

- Meanwhile, spot gold prices briefly slipped below $1k per ounce before rebounding late Wednesday afternoon.

- At the same time, palladium remained under pressure following recent supply disruptions.

- This caused the metal’s accessibility gap to widen even further between its physical market price and future delivery month contracts, such as COMEX, which is why many investors are looking at purchasing this precious metal now instead of waiting until later when it could become scarce.

- Once again, it is because there may not be enough inventory left.

The Big Beautiful Bill: Struggling in the Senate

- Just a week ago, on May 22, 2025, the One Big Beautiful Bill narrowly won the House of Representatives with just one vote.

- The bill is an all-encompassing tax-and-spending legislation that extends the provisions of the Tax Cuts and Jobs Act of 2017, introduces new tax breaks such as no taxes on tips and overtime pay until 2028, strengthens border security, ends green energy subsidies, and mandates work requirements for Medicaid and SNAP benefits.

- However, it has generated controversy over its projected $2.4 trillion increase in the federal deficit over the next decade.

- According to Congress’s Budget Office (CBO) estimates, it could leave almost eleven million Americans without healthcare coverage.

Senate Challenges:

Republican Opposition:

- Several Republican Senators, including Rand Paul (R-KY), Ron Johnson (R-WI), Rick Scott (R-FL), and Susan Collins (R-ME), have committed to voting “no”.

- This is because they are worried about this bill’s $4 trillion increase in the debt limit, pushing it to $36 trillion.

- Senator Marjorie Taylor Greene (R-GA), usually allied with Trump, also has reservations about it.

- She has mentioned nothing about small business protections, but there has been a lot of talk about border security.

- The American public is divided in its opinion about the bill.

- Some feel it is a subsidy to wealthy individuals and corporations while leaving behind many middle-class Americans grappling with healthcare costs and economic hardships.

- The bill needs a simple majority approval from the Senate.

- Currently, it does not have enough support even among Republicans unless some major changes take place.

Elon Musk and President Donald Trump: A Public Feud

The relationship between President Donald Trump and billionaire Elon Musk, previously characterized as a close friendship, has become an open feud.

- Musk was instrumental in helping Trump win the 2024 election by running his “Department of Government Efficiency” (DOGE) alongside Vivek Ramaswamy.

- Still, the two men have clashed over policy priorities and political influence within government circles.

- There have been recent developments in this regard.

- Matters got worse when Musk publicly criticized Big Beautiful Bill on X, describing it as “a bloated mess” that did not address government waste.

- This was followed by an outburst by Trump during a press conference at Mar-a-Lago, during which he accused Musk of going beyond his advisory role and suggested likely regulatory actions against Tesla or SpaceX.

- Comments on X were mixed, with some supporting Musk’s demand for fiscal responsibility.

- In contrast, others viewed him as undermining Trump’s goals.

Implications

- The consequences of this feud are huge for DOGE if it hopes to streamline federal agencies as promised in its campaigns.

- If this standoff continues, analysts speculate that Musk’s influence on the administration may fade even as X continues to be a powerful tool for shaping public discourse.

Los Angeles Immigration Crackdown: Trump vs. Newsom

- Trump has sent ICE agents and military personnel to Los Angeles, where he claims illegal migration is “out of control.”

- This was followed by his appointment of Tom Homan as U.S. Border Czar, who would oversee mass deportation efforts targeting 11-20 million undocumented immigrants.

Governor Newsom’s Response

- California Governor Gavin Newsom has been defiant, challenging Homeland Security to arrest him for non-compliance with federal immigration enforcement.

- He has pledged to defend California’s sanctuary state designation based on state laws limiting cooperation with ICE.

- This prompted a stalemate with Los Angeles Mayor Karen Bass, who refused to abide by the federal orders.

Public Reaction

- Protests have erupted in Los Angeles, with clashes between pro-immigrant groups and law enforcement being reported.

- The X posts show strong division among users; while some support Trump’s crackdown, others accuse him of overreaching his mandate.

- It is still a tense situation and might get worse soon.

Economic Pressures: Federal Reserve, Housing, and Inflation

- A stagnant housing market has negatively impacted prime borrowers’ mortgage rates, reaching their highest levels at 7.125% in two decades.

- This development has increased the burden on an already troubled housing market.

Housing Market Crisis:

- Today, the prices of houses are still very high, and there is little or no affordability, as the median home price in America is $425k.

- Rising homeowners’ insurance costs, property taxes, and low housing inventory can also contribute to the lack of affordable homes.

- Additionally, job losses in tech, retail, and manufacturing sectors have worsened the situation where earning a six-figure salary is no longer enough for middle-class stability.

Inflation:

- High energy and food costs continue to fuel persistent inflation, with the Consumer Price Index (CPI) up by 4.2% YoY.

- Trump wants rate cuts to jumpstart economic growth.

- Still, Powell argues that this could destabilize monetary policy, explaining his resistance to such calls for rate cuts.

- Posts from X users vented their frustrations about not surviving due to increasing living costs and stagnant wages.

Legal Battles: Letitia James, Fani Willis, and Sanctuary Law

- In addition to a lawsuit by New York Attorney General Letitia James, Fulton County District Attorney Fani Willis is also suing President Trump.

- Some sanctuary states and cities are also filing lawsuits against the president’s immigration policies.

Letitia James:

- The New York attorney general is pursuing a $454 million civil fraud case against Donald Trump for allegedly misrepresenting his net worth to obtain favorable loans.

- Trump’s legal team has filed appeals, arguing that the charges are politically motivated.

- Judging from recent court filings, the trial may not end until 2025.

Fani Willis:

- In Georgia, Fani Willis initiated an election interference suit against Donald Trump, focusing on his actions during the most recent presidential election.

- However, there has been some conflict over whether or not Willis can remain neutral in this matter, even though she has maintained her position as the case prosecutor so far.

Sanctuary City Lawsuits:

- Sanctuary cities like Chicago, San Francisco, and New York City, as well as states such as California and New York, have sued Trump over his immigration policies, including using military personnel for deportation purposes.

- These cases claim that federal acts infringe on state sovereignty and local laws.

- Oral arguments will be heard at the Supreme Court in early 20

Financial Markets: Dow Jones, Gold, and Silver

Dow Jones Industrial Average:

- The Dow closed at 42,150 on June 9, 2025, down 2.3% from last week as investors worried about inflation and the blowback from Big Beautiful Bill’s spending spree.

- The S&P 500 and Nasdaq also saw declines, down 1.8% and 2.1%, respectively.

Gold and Silver Prices:

- Gold is trading at $2,650 per ounce year to date (YTD), up five percent due to fears of inflation, among other factors contributing to geopolitical uncertainty.

- Meanwhile, silver trades at $31.50 per ounce YTD, up three percent, as investors seek safe-haven assets.

Sanctuary Cities and States: An Overview

Trump’s immigration crackdown has brought sanctuary cities and states that limit cooperation with federal immigration enforcement into the limelight. Key sanctuary jurisdictions include:

Cities:

San Francisco, Los Angeles, Chicago, New York City, Seattle, and Washington, D.C.

States:

California, New York, Illinois, Oregon, Washington

These jurisdictions have enacted laws restricting local law enforcement agencies from cooperating with ICE, which led Trump to threaten them with funding cuts. Sanctuary states argue that this is an overreach by the federal government, which violates their rights according to the Tenth Amendment, leading to legal battles between them and departments such as the Justice Department.

Closing Notes

Today’s news highlights the deepening political and economic divides in the U.S. The uncertain fate of the Big Beautiful Bill, the Musk-Trump feud, and the Los Angeles immigration standoff all highlight the Trump administration’s challenges. Economic pressures, from high mortgage rates to continued inflation, continue to strain American families, while legal battles and sanctuary city disputes continue to add to the national tension. Keep an eye out for more updates on GCA Forums News.

https://www.youtube.com/watch?v=ZT1p4NNI6jI

-

This discussion was modified 1 day, 12 hours ago by

Gustan Cho.

Gustan Cho.

-

If I have a purebred German Shepherd female dog and want to breed her, where would I look for a male purebred German Shepherd to become her mate? How does the owner of the male German Shepherd stud get compensated? Is it a set sum paid initially, or is it one or more pups the female gives birth to? I am new to this, so can you please review the case scenarios? How many times do they have to mate? Where do they mate? At my house or the male dog’s house? How long does it take for the female dog to develop and give birth fully? How many puppies do German Shepherd dogs have? Do female German Shepherd dogs naturally know, by instinct, how to care for their pups? How long do the puppies have their eyes closed? When do the puppies open their eyes, learn about their surroundings, and play with each other? How much do German Shepherd puppies without AKC papers sell for?

-

I was heartbroken to hear that President Trump and Elon Musk had a big difference of opinion in the Big Beautiful Big. I have been following Mr. Elon Musk on his initiative, making America Great Again, way before President Trump got elected. Anyone can see that Mr. Elon Musk has been consistent, transparent, honest, and is hands down a great person with an abundance of integrity and a good heart. Mr. Musk will speak his mind, not play games, and has no ulterior motives. Mr. Elon Musk was focused on making America Great Again and fixing our country so everyone can live a fruitful, fair, honest life and have a fair chance. One thing I noticed about Mr. Musk is that he will go above and beyond to honest, hard-working folks and their families, but will put his foot down to crooks, corrupt folks, and people and companies that want to beat the system and take advantage of the honest, hard-working folks. When Elon Musk is out to set a goal and mission like fixing our corrupt form of government, nothing will stand in his way. I have a lot of respect for President Trump and have always liked his bluntness and transparency. However, out of all people, President Trump should know and realize that relationships can have a few hurdles when they grow and become stronger. President Trump should rethink this whole situation, sit down with Mr. Musk, and iron out their differences. It might just be a misunderstanding, and people learn from feuds. It makes relationships stronger. Mr. President, you can be successful and make America great. But with a power player like the one and only Elon Musk, America will be the Greatest Nation ever to exist in the history of Mankind, with not a single country coming close. Nobody can act or play someone for this long without their true colors being revealed. Mr. Elon Musk has nothing to prove. Look at his accomplishments, his day to day actions, and look at his history. I do not trust too many people and have gotten screwed more times than anyone else. However, I can honestly say that I trust Mr. Elon Musk and will stand by him. He has earned my loyalty, as well as most Americans. A Global Leader who has a lot of more to offer humankind and the world.

-

What Is Transplant Rejection?

When the immune system perceives a transplanted organ as an enemy combatant, it attempts to destroy it. Unless managed, this immune response leads to inflammation, disruption of the organ’s normal functioning, or, if severe, total organ failure.

Physicians counteract this using immunosuppressive drugs, which lower the immune system’s activity and shield the organ from rejection.

Mastering transplant rejection is pivotal for patients and caregivers because it can aid in tilting the success of the transplant and optimally enhance survival.

How The Immune System Responds To A Transplanted Organ

The immune system is chiefly the body’s defender. It has functional cells like bacteria, viruses, and pathogens designed to eliminate harmful particles. Also, it has well-specialized soldiers (T cells and antibodies) for every type of microorganism that targets the body. But when an organ is transplanted, the new organ’s antigens enable the immune system to recognize the organ as a pathogen falsely.

While an organ transplant can serve to improve the patient, a new organ does come with its complications. The following steps characterize this immune response:

T cells directly engage and destroy the organ.

Antibodies directly attack the cells forming the organs, leading to inflammation and tissue damage.

This immune assault, if not curbed, can alter the functions of the organ and increase the risk of transplant failure.

Transplant rejection types

Each rejection episode requires distinct types of treatment based on its characteristics. There are several identifiable types of transplant rejection based on their unique features and timelines:

Symptoms of febrile allograft rejection occur acutely.

Definition:

An acute transfusion reaction is a febrile hypersensitivity response to an incompatible blood Component that has been transfused. Fever, pain over the Transplant site, and organ function decrement are classic symptoms.

Management:

The immune response can be managed by administering high-booster immunosuppressive drugs (highly designated class: steroids).

Loss of organ function.

Chronic rejection occurs progressively over 4 to 14 years in Durable Interface Organ Loss, where the somatic autoimmune response leads to an organ-limited systemic autoimmune response.

Hyperacute rejection of organ transplant.

Definition:

Immediate organ rejection is a serious and rapid response that occurs between minutes and hours after transplantation. Antibodies trigger it and manifest immediately after transplantation.

Prevention:

Minimization Medics prescribed careful recipient pairs to decrease this risk.

Role of transplant rejection medications

Medically prescribed conditions that limit transfusions can be caused by the organ’s immune system. Reiss defines these conditions by a list of diseases secondary to medication. Rejected medications benefit organ transplant recipients.

How Immunosuppressants Work

Immunosuppressive medications like cyclosporine, tacrolimus, and Mycophenolate work by:

- Suppression of T-cell immunity.

- Decreased antibody production.

- Control of inflammation in the transplanted organ.

Common Side Effects

Alongside being effective, the drugs increase the chances of:

- Infection: Increased risk of bacterial, viral, or fungal infections.

- Other issues: In some cases, kidney failure, hypertension, or diabetes.

The majority of patients face a lifelong requirement for these types of medication. Dosage is tailored to the individual and the progress of the transplant.

Emerging Solutions: Immune Tolerance

These drugs, while effective, often have some unwanted effects. This has led to research into immune tolerance, a more appealing concept in which the recipient’s immune system is taught to accept a transplanted organ without requiring long-term medication.

How Immune Tolerance Works

Immune tolerance reprograms the immune system to identify the donor organ as “elf” instead of foreign. Research is focused on:

- Infusion of donor-specific cells: Infusing cells from the donor to aid in acceptance.

- Gene therapy: Changing the immune system’s response on the cellular level.

- Mixed chimerism: Development of a chimeric immune system that accepts donor and recipient cells.

Though still in the experimental phases, the potential benefit of reduced reliance on immunosuppressant drugs could greatly enhance the quality of life for transplant patients.

Guidelines for People Who Had Transplant Surgery

If you or someone you know is facing an organ transplant surgery, then here are some simple guidelines that would help mitigate rejection risk:

- Immunosuppressant medications should be taken without fail: failure to take the medications as prescribed, especially when suppressants are skipped, leads to an immunological rejection response.

- Self-monitor: Report febrile illness, swelling, or any change in organ-specific functions to your physician as soon as possible.

- Never miss a scheduled appointment.

- Chronic routine examinations and blood work can potentially identify masquerading signs of rejection that are not flexible.

- Practice the above instructions coupled with the basics of hygiene: infection prevention, adequate fluid intake, and enhancement of health status, further aiding the longevity of the transplant.

Despite the increased sophistication of transplant immunology and ever-growing knowledge of tolerance in transplant immunology, addressing the rejection issue remains a daunting challenge. With appropriate knowledge of how the bioweapon is a fortified organ, what rejection stages are needed, and what drugs are useful during what phases, minimal surgical support post-caregiving is required. During the pre-surgery and post-surgery phases, close monitoring of the healthcare setup will improve outcomes extraordinarily.

If more resources around organ transplants and rejection guidelines are required, trusted medical page sources, such as doctors and heart, kidney, or liver, are correct.

-

Welcome To The Great State of Wisconsin . In this thread and post we will cover and discuss everything Wisconsin. You can also start your own GROUP Wisconsin.

-

I have been hearing and also know a few friends and coworkers who are Jeep lovers and swear that Jeeps are great investments especially the older Jeeps where you can restore and make the jeep look like New. Many Jeeps from the 1980s especially the Jeep Wrangler Rubicon are great investments if you buy them at the right price and is mechanically sound and in excellent shape and has been well taken care of, preferably garaged. If any viewers and members of Great Content Authority Forums and Sub-Forums are Jeep experts and Jeep lovers, if you can guide us through the various types of Jeeps and suggest and recommend what type of Jeeps to look out for and what type of Jeeps to stay away from, it would be largely appreciated. I have five large dogs and my dogs always travel together with me when running errands and when I need to go to my office. How is the space of 4 door Jeeps? From the picture, it looks cramped and not too spacious. What Jeep would you recommend for folks with multiple large dogs.

-

My big guy Chase, my German Shepherd Dog, has a baby sister. SKYLAR. Skylar is an eight month old female long coat black and red German Shepherd Dog from the same breeder Chase came from. Chase is neutered and i am going to get Skylar spayed in about six months. Skylar is underweight and skinny. You can feel the ribs when you pet her on the sides of her body. Skylar was the runt of the litter and was bullied on by her furry brothers and sisters. She was bit in many places and her siblings stole her portion of Dog food so that is why she is underweight and malnourished. Had a visit to the veterinarian and got her tested for worms

and parasites. Results came back negative. Skylar is takung a 14 day antibiotics program due to her scabs, a lump on her left side rib area due to blunt trauma and urinary infection and scratches on her vulva. She got her rabbits and puppy shots and weighs 52.5 pounds. Unfortunately Skylar is not fully potty trained nor obedience trained. I will work on a training regiment after a few weeks. Extremely skittish therefore I want her to get used to her new home and her new family and environment. Here are a few photos of Skylar and Chase. One of Skylar ears is floppy. I adopted Skylar on Sunday October 6th. Dan Ivenovic dropped her off the house. Dan has two other German Shepherd pups that are nine months. Please let me know if anyone is interested . Price is discounted. 9 months old.

-

Are there many corrupt police officers where they will draft up false criminal charges against citizens? What happens if you were not speeding but get caught for speeding and you know for a fact you were not speeding. What happens if you get arrested for reckless driving for going over 30 miles over the limit and you know for a fact you were not going more than 10 miles over the speed limit. Does the police officer have to show you proof that he caught you going 30 miles over the limit? A reckless driving conviction can mean automatic cancellation of your drivers license and your insurance company can drop you. Are there many corrupt police officers? What can we do if you fall victim to a corrupt police officer? How do police departments hire honest police officers who are honest and protect and serve. I have been watching many YouTube videos about First Amendment Auditors and police corruption. Can you sue corrupt police officers? I have also seen many news reports of police officers planting evidence and lying just for the sake of arresting someone they do not like. What can we do about cleaning up society of corrupt cops?

-

Are there corrupt cops? How could that be when the recruitment and hiring process of police officers include a thorough assessment of the police applicant’s background. Background investigation includes interviews of former and current employers, co-workers, supervisors, neighbors, classmates, and teachers. Background investigators of police officer recruits will check the candidates credit and employment backgrounds, criminal arrests and convictions, public records, and medical and psychological history records. Many law enforcement agencies will conduct written psychological examinations as well as an oral interview with a board certified psychologist. Other police agencies will have polygraph examinations as part of the background investigation process. Like many other professions, there are bad apples in law enforcement. Here are some videos of corrupt police officers caught on tape.

https://www.facebook.com/share/v/8rZBrhjnZ3sU7GQR/?mibextid=D5vuiz

facebook.com

When Evil Cops Got Caught Red Handed | Mr. Nightmare #cops #police #thinblueline #lawenforcement #policeofficer #UK #usa

-

GCA Forums Headline News Weekend Edition Report: June 2–8, 2025

This report presents the week’s GCA Forums Headline News Weekend Edition Report. This report provides a trusted real estate, mortgage, and finance update. Additionally, this report aims to be valuable to home buyers, real estate investors, mortgage specialists, and business enthusiasts by offering relevant, timely, and actionable insights for your businesses. We know your time is precious, so we balanced information richness with readability. You’ll find relevant mortgage rate updates, housing market analytics, economy gauging Fed moves, market offers, and headlines capturing the world’s attention.

Mortgage Market Updates & Interest Rates

Key Highlights

Following industry sources, mortgage rates experienced minor fluctuations this week, with the 30-year fixed rate between 6.85% and 6.96%. After climbing to 6.23% on June 2, the 15-year fixed rate reflected cautious lender inflationary adjustments.

FHA and VA loans maintained favorable stances, with averages around 6.5%—6.7%, making them competitive with new homebuyers. However, non-QM and DSCR loans became harder to obtain as lenders focused on higher credit scores (680) and lower DTI ratios (43%), tightening underwriting.

Impact of the Federal Reserve:

The Federal Reserve held interest rates steady at 4.3%, with chair Jerome Powell exhibiting caution due to possible tariff inflation. Experts suggest no rate cuts will happen until at least July 2025, which would likely keep mortgage rates high.

Policy Updates:

Fannie Mae and Freddie Mac published new policies regarding DTI ratios and credit scores, improving them for refinancers and easing the debt-to-income ratio burden. However, strict appraisal standards for investment properties were incorporated, affecting DSCR loan approval.

Forecasted Rates:

Fannie Mae Analysts expect the thirty-year fixed-rate mortgage to plateau at 6.2% by the end of the year, with inflation expected to slow to 2.1%. Strong and persistent job gains will likely push declines to 6.0%, not until late 2026.

Importance

For homebuyers and refinancers, the rates are monitored closely, as a shift of 0.1% can make a substantial difference in the monthly payment. These changes provide mortgage professionals incentives for client guidance while offering investors an opportunity to track lending patterns to refine their financing techniques.

Market Indicators along with Housing News

Market Snapshot

The US housing market remains very challenging for buyers. The affordability constraint and limited housing inventory continue to stifle completion. Home sales declined slightly, while median house prices increased by 4.1% yearly.

Down Payment Assistance Programs

The severe economic climate made homeownership particularly difficult for first-time buyers. As rates and prices climbed, only 30% of households could afford a median-priced home. However, down payment assistance programs gained traction in markets like Atlanta and Phoenix.

Inventory Levels

The national housing inventory has increased slightly to 3.8 months, remaining below the balanced 5-6 month mark. Additionally, hotter markets like Austin and Miami saw inventory shrink further, favoring seller dynamics.

Regional Trends

Buyers have the most favorable opportunities in the Midwest, such as Columbus, OH, as they offer stable pricing and higher inventory. These coastal markets remain seller-friendly: San Francisco and New York.

Rental Insights

Experts predict a 4% rebound in the decline of Multifamily rentals in 2025. Secondary markets such as Raleigh and Nashville are appealing for multifamily investments due to increased demand for affordable rentals.

Market Trends

Additionally, the ETF and Tesla dispute garnered controversy. Some experts speculated it may swing to changes in policy surrounding homes and investments.

Key Takeaways

Precision in these insights increases the buyer’s and seller’s strategy for precise timing on moves. In this case, investors can base their decisions on rental trends and inventory to identify high-yield opportunities.

Inflation and Federal Reserve Reports

Summary of Trends in Inflation

Inflation is above the Fed target figure of 2%. Currently, the Consumer Price Index (CPI) stands at 2.3 percent, and the Personal Consumption Expenditure(PCE) index is at 2.5 percent. Moreover, tariff policies added to price pressures for construction materials.

Federal Reserve Position:

The main agenda item during the Fed meeting in May 2025 was the potential risks of stagflation. It was worth noting that tariffs meant to slow growth may also come with inflation, making the situation difficult. Neel Kashkari, the Minneapolis Fed president, supported keeping rates stable until the impacts of tariffs were clarified.

Impact on Real Estate:

Rising inflation reduces spending power, eroding home value. Moreover, inflation by even 1% could increase mortgage rates by 0.25%, which would mean an extra $150 for a loan of $400,000.

Speculation within the market:

With CPI and Producer Price Index (PPI) data expected to be released the following week, there is much attention surrounding it as people believe it will heighten inflation and predict Fed moves.

Why is the Data Important?

Federal actions affect inflation, which is closely related to mortgage rates and housing prices. This causes conflicts for borrowers expecting lower rates and investors waiting for inflation signals to adapt their portfolios.

Economic Reports & Job Market Trends

Economic Overview

Despite the April nonfarm payroll number being revised to 147,000, May’s number came in at 139,000. From the Fed’s G.19 report, consumer credit growth is still on track.

Job Market Strength:

The unemployment rate of 3.9%, which was capped at 3.9%, indicates a strong labor market, especially with services like healthcare and IT driving growth. This also helps in refinancing mortgages for high-income earners.

Economic Risks:

The collection of tariffs hit an all-time high of $22.3 billion in May. This is good for revenue but bad from the perspective of a consumer. Analysts warn that consumer spending declines will lead to slow growth.

Housing Implications:

While strong job creation is helpful, the demand coupled with accelerated price increases due to tariffs may make housing harder to afford for mid-tier payers.

Why It Matters

Greater economic volatility creates a healthy job market and good economic fundamentals supporting and refining strategies. This is initially crucial for entrepreneurs whose relevance is planning for active investment and homebuyers when trying to buy.

Headline News:

Latest Announcement from Elon Musk, Donald Trump, and Other Legal Matters

Further Development in Musk-Trump Rivalry

The continuing public quarrel between Elon Musk and Donald Trump captured market attention and policymaking. Musk, who recently left his post at the Department of Government Efficiency (DOGE), went further by calling Trump’s tax and spending bill a “disgusting abomination” and warning that it would inflate the deficit to $2.5 trillion. Trump fought back, saying severe consequences would come “serious consequences” if Musk decided to fund challengers to the Republicans supporting the bill.

Market Impact:

Volatility continued, with Tesla stock increasing by 8.5% after Musk refocused on it. Stocks about housing lagged, showing concern over business policy uncertainty.

Concerns Over Housing Policy:

Some analysts suggest the feud hampers DOGE’s initiatives toward housing or lending efficiency revisions.

Letitia James Prosecution

Active litigant and Attorney General Letitia James faces a federal investigation over an alleged mortgage fraud scheme connected to a property in Virginia and a loan application in Brooklyn relating to that property. A grand jury sitting in the Eastern District of Virginia issued a series of subpoenas after a referral from Federal Housing Finance Authority Director Bill Pulte. James’ counsel characterized these allegations as “threadbare” and based on “political retribution,” especially since there was no merit to Trump.

Real Estate Impact:

The inquiry might shape compliance regulations within New York’s real estate market, especially mortgage regulations that would impact lenders and borrowers.

Fani Willis’ Investigation

No major developments came to light this week regarding Willis’ investigation or prosecution. Coverage in recent weeks has highlighted precision delays and countless legal arguments Trump’s team has made, which in no way advance or delay the case. Nothing has changed for capitalism’s real estate lungs or the financial world’s arteries.

Other Notable Stories Tariff Updates:

Canada was strategically cornered by Trump’s 50% tariffs on aluminum and steel, which caused American construction developers to increase costs. A trade deal struck with the U.K. saw car tariffs drop to 10%, much to the delight of investors.

The Harvard Funding Dispute:

Trump threatened to rescind Harvard’s tax-exempt status, affecting real estate holdings tied to universities in Harvard’s portfolio.

Why It’s Relevant

Legal disputes and public skirmishes between major economic players make people pay attention to the market and what policy decisions are expected next. For real estate professionals and investors, staying alert to pivoting market chances is crucial, even during the summer lull.

Why Use GCA Forums News?

We understand that empowering our audience matters when engaging with them at GCA Forums. As much as we strive to give you reports and insights about home buying and investments, we value viewer feedback and industry polls to help build our data-derived GCA Forums News reports for mortgage professional viewers. Homebuyers or seasoned investors–regardless of your skill or experience level, trust us to keep you ahead in the industry.

Become Part of Our Community

Participate in firsthand expert webinars and become part of focus study groups to increase your market knowledge by joining GCA Forums. Get tailored real estate and finance strategies recommended for you daily. For more information, visit GCA Forums and subscribe now for exclusive daily updates and tailored strategy sessions.

Data Sources: Publicly available data from Reuters, CNN, The Economist, and posts on X, alongside industry reports and viewer polls from GCA Forums. All mortgage rates are aggregated from Freddie Mac, Fannie Mae, and Mortgage Bankers Association as of June 8, 2025.

https://www.youtube.com/watch?v=jFiN_5f_Fkg

-

In today’s GCA Forums News, we will cover up to date news for housing and mortgage lending, current mortgage rates, home prices, inflation, the stock market, Gold and Silver prices per ounce, and how our economy is heading under President Donald Trump leadership. We will also update President Donald Trump’s Big Beautiful Bill, why President Trump and Elon Musk are fighting over the Big Beautiful Bill, why Elon Musk is saying Donald Trump is ungrateful for all Elon Musk has done, and what this means for our country. What does the Big Beautiful Bill cover and why are so many in both houses are against it. Why is Trump bad mouthing Senator Rand Paul? Why are so many republican senators and members of congress turning on President Trump. Is President Donald Trump turning on his promise and cutting funding for children and the elderly? What is going on with former Joe Biden Secretary Karine Jean Pierre in turning against Joe Biden and her fellow Democrats and no longer being a Democrat and becoming an Independent? What are the latest nation’s news for Wednesday June 4 2025?

GCA Forums News: Wednesday, June 4, 2025

Housing and Mortgage Lending News

The housing market in June 2025 remains under pressure due to economic uncertainties tied to President Donald Trump’s trade policies, particularly his tariff agenda.

- Mortgage rates have seen fluctuations, with the average 30-year fixed mortgage rate climbing to around 7% in late May, up from 6.75% a month prior, according to Bankrate.

- This increase is largely driven by investor concerns over inflation and the Federal Reserve’s cautious stance on rate cuts.

- Despite a brief dip in early April following Trump’s tariff announcements, rates have stabilized in a high range.

- Experts predict they will hover above 6.5% for most of 2025 unless a significant economic downturn occurs.

Home prices continue to rise, albeit at a slower pace. The National Association of Realtors reported a median existing home sales price of $403,700 in March 2025, a 2.7% increase from the previous year. Forecasts from the Mortgage Bankers Association (MBA) and Fannie Mae suggest modest price growth of 1.3% to 4.1% by year-end. However, high borrowing costs and a persistent shortage of 2 to 4.5 million homes stifle demand. Pending home sales dropped 6.3% last month, reflecting buyer hesitation amid economic uncertainty and a “lock-in” effect, where homeowners with low mortgage rates (e.g., 3%) are reluctant to sell and face higher rates.

The termination of the VA Servicing Purchase program has raised concerns, with thousands of veterans at risk of foreclosure. Critics argue this move, supported by some Republicans, prioritizes fiscal conservatism over veteran support, exacerbating housing challenges for this group.

Current Mortgage Rates

As of June 2, 2025, average mortgage rates are:

- 30-year fixed: 7.02% (up from 6.88% in mid-May)

- 15-year fixed: 6.04%

- 5/1 ARM: 6.25%

These rates reflect market reactions to Trump’s tariffs and inflation expectations. Experts advise borrowers to shop around, as comparing lenders can save up to 1.5% on rates. The Fed’s decision to hold its benchmark rate at 4.25%–4.5% signals caution, with potential rate hikes looming if inflation accelerates.

Home Prices

Home prices remain elevated due to low inventory and high construction costs, exacerbated by tariffs that have increased material prices. The MBA projects a 1.3% rise in home prices by the end of 2025, while Fannie Mae estimates a 4.1% increase. Cash buyers, who accounted for a third of 2024 purchases, are less affected. Still, first-time buyers face affordability challenges due to high rates and prices.

Inflation

Inflation is a focal point in 2025, with the Congressional Budget Office (CBO) estimating that Trump’s tariffs will add 0.4 percentage points to inflation in 2025 and 2026, reducing household purchasing power. While inflation cooled in late 2024, prompting three Fed rate cuts, recent tariff-related price pressures have raised concerns. The ISM Services Business Survey noted the highest prices-paid reading since November 2022, when inflation hit 7.1%. Economists warn that persistent housing costs and tariff-induced supply shocks could increase inflation, potentially leading to Fed rate hikes by year-end.

Stock Market

The stock market has experienced volatility due to Trump’s trade policies and tariff uncertainties. After tariff announcements, markets slumped in early April but partially recovered following a 90-day tariff pause. Consumer and business sentiment has declined, contributing to stock market swings. The economy’s contraction in early 2025 has further dampened investor confidence, pushing buyers out of big-ticket markets like housing and equities.

Gold and Silver Prices per Ounce

As of June 4, 2025, gold and silver prices have risen amid economic uncertainty:

- Gold: ~$2,650 per ounce, driven by safe-haven demand from tariff-related market volatility.

- Silver: ~$31 per ounce, reflecting industrial demand and inflation hedging.

These prices are approximate, as real-time data varies, but the upward trend aligns with investor caution and inflation fears.

Economy Under President Donald Trump

The economy under Trump’s leadership is navigating uncharted waters. His tariff regime, including a 10% baseline tariff on most countries and steeper tariffs on the EU, UK, Canada, Mexico, and China, aims to boost American manufacturing but has sparked trade tensions. The CBO projects a $3 trillion deficit reduction from tariff revenue, offset by a $300 billion deficit increase due to economic slowdown. The economy shrank in early 2025, and consumer confidence is flagging. Federal Reserve Chair Jerome Powell has warned of rising risks to both inflation and unemployment, complicating the Fed’s dual mandate. The White House’s lack of concrete trade deals since the tariff rollout has fueled skepticism about economic stability.

Trump’s Big Beautiful Bill: Details and Controversies

The “Big, Beautiful Bill” is Trump’s signature legislative package, passed by the House on May 22, 2025, by a single-vote margin. Key components include:

- Permanent extension of the 2017 Tax Cuts and Jobs Act, preserving trillions in individual income tax breaks.

- Significant cuts to Medicaid and SNAP (food stamps) affect an estimated 8.6 million people.

- Projected $3.8–$5 trillion increase in the national debt, medians, increasing the deficit by $3.8 trillion.

The bill has drawn widespread criticism for prioritizing tax cuts for high earners while slashing safety net programs. Critics, including some Republicans, argue it exacerbates inequality and fiscal irresponsibility.

Trump and Elon Musk Conflict Over the Big Beautiful Bill

Elon Musk, initially a close Trump ally, has publicly criticized the bill, calling it a “disgusting abomination” for its “pork-filled” spending and debt increase. Musk’s frustration stems from his role as co-head of the Department of Government Efficiency (DOGE), where he pushed for $2 trillion in budget cuts but achieved only $19 billion in reductions. His public break with Trump, including calling the president “ungrateful” for dismissing his cost-cutting efforts, has strained their relationship. Musk’s exit from Washington to focus on his companies and political spending signals a shift from direct government involvement. This rift could weaken Trump’s coalition, as Musk’s influence and financial support (including $100 million pledged for 2026 midterms) are significant.

Why Are Republicans Turning on Trump?

Several Republican senators and House members, including Senator Rand Paul, oppose the Big Beautiful Bill due to its massive debt increase and insufficient spending cuts. Paul has warned that supporting the bill risks aiding Democrats and triggering a debt default. Trump’s public criticism of Paul, accusing him of disloyalty, has escalated tensions. Many Republicans fear the bill’s cuts to Medicaid and SNAP could harm vulnerable constituents, alienating voters ahead of the 2026 midterms. The narrow House passage and ongoing Senate debates reflect growing GOP divisions over fiscal priorities and Trump’s leadership style.

Is Trump Breaking Promises on Funding for Children and the Elderly?

Critics argue that the Big Beautiful Bill’s cuts to Medicaid and SNAP contradict Trump’s campaign promises to protect vulnerable populations. The Medicaid cuts could strip coverage from 8.6 million people, including children and older people. At the same time, SNAP reductions may affect 14 million individuals. Supporters claim the bill prioritizes economic growth through tax cuts. Still, opponents, including some Republicans, see it as favoring billionaires over people in need, fueling accusations of broken promises.

Karine Jean-Pierre’s Political Shift

Former Biden White House Press Secretary Karine Jean-Pierre has announced her departure from the Democratic Party to become an Independent, citing frustration with partisan gridlock and a desire to advocate for bipartisan solutions. Her move reflects broader disillusionment with political polarization but lacks specific policy implications as of June 4, 2025. This shift has sparked speculation about her future role, possibly in media or advocacy, but no concrete plans have been confirmed.

Latest National News for June 4, 2025

- Tariff Developments: The U.S. Court of International Trade temporarily blocked Trump’s tariffs, citing overreach under the International Emergency Economic Powers Act.

- The White House is appealing and exploring alternative legal avenues, like national security provisions, to reinstate tariffs.

- Federal Spending Cuts: Agencies like the Department of Education and NIH face spending reductions.

- However, congressional approval is needed to sustain these cuts, which raises concerns about their longevity.

- Harvard Contracts: The Trump administration is pushing to end $100 million in federal contracts with Harvard, citing anti-Semitism concerns, though specifics remain vague.

- Economic Outlook: The Fed’s pause on rate cuts and warnings of tariff-induced inflation signal ongoing economic uncertainty, which could impact housing and consumer spending.

June 4, 2025, highlights a nation grappling with economic and political turbulence. High mortgage rates, home prices, and tariff inflation risks are straining the housing market. The Big Beautiful Bill has deepened divisions, with Musk’s fallout with Trump and GOP infighting signaling challenges for the administration. Jean-Pierre’s shift to Independent status underscores broader political discontent. As the economy navigates tariffs, spending cuts, and policy debates, uncertainty remains the dominant theme.

https://www.youtube.com/watch?v=XwT3gHS50gU&list=RDNS5R8NbUVnOtc&index=5

-

This discussion was modified 6 days, 10 hours ago by

Gustan Cho.

Gustan Cho.

-

GCA Forums News: National Daily News – June 6, 2025

Welcome to the GCA Forums News: National Daily News dated June 6, 2025

Greetings to the National Daily News Blog for June 6 and June 6, 2025. Today’s in-depth analysis includes essential updates on the mortgage and housing industries, precious metals, corporate news, significant political controversies, recent developments in law, critical local governance issues, and other important stories shaping today.

Mortgage and Housing News: Demand Continues to Slump

As reported by Bankrate, the average for the 30-year fixed mortgage stood at 6.84%, and the 15-year fixed was 6.03%. The 5/1 ARM was 6.23%. On June 6, 2025, mortgage rates had some movement. While some rates eased, CNBC reported that mortgage demand dropped for the 3rd week. Yun, NAAR’s chief economist, remarked that “pent-up housing demand continues to grow, though not realized.” Redfin forecasts suggest that rates will remain around 6.8% for the rest of 2025. Significant declines are highly unlikely because of economic volatility and inflation concerns stemming from Trump’s tariffs.

Market Volatility

Due to market volatility and the impacts of trade policies, Fannie Mae had to revise their forecast, projecting that the 30-year mortgage rate would increase to 7% by the tail end of the year, previously believed to dip below 6%. Home values are predicted to increase by 3.5% in 2025. Still, according to a Reuters poll, Trump’s tariffs may make affordable home construction more difficult. Also, Blue Sage Solutions is partnering with Freddie Mac to promote homeownership and consider rental payment histories when underwriting mortgages, which could help long-term renters. According to ICE Mortgage Technology, US mortgage holders own a record $17.6 trillion in home equity, with $11.5 trillion deemed “tappable.”

Precious Metals Update: Gold and Silver Prices

On June 6, 2025, the prices of precious metals faced fluctuations because of economic instability and inflation worries. Gold was trading at $2650 per ounce, and silver was trading at around $31 per ounce. The slowdown in industrial activity stunted demand for silver due to the trade wars. Trump’s tariffs are expected to increase inflation in the long term while driving safe-haven demand for gold. In the meantime, markets are being shaken by surging bond yields and a stronger dollar. Changes in the coupon are expected shortly after policymakers decide on the metal, facing no alarming expectations from the market.

Business News: Company Layoffs and Trade Issues

Due to mounting global trade pressures, businesses were eager to embrace Procter & Gamble’s cost efficiencies. Procter & Gamble announced a cut of 7,000 jobs—6% of its workforce—over the next two years, citing reduced consumer demand and heightened expenses from tariffs. Despite trade challenges, a survey by the American Chamber of Commerce in China showed that many US firms in China intend to maintain or expand operations, which demonstrates resiliency in international markets. Under Trump’s leadership, US-India trade negotiations spearheaded by Modi have been aimed at doubling trade by 2030, discussing slashing tariffs on farmers and the auto industries, among other sectors. These advances demonstrate domestic policy juxtaposed with international trade.

Disagreements Trump Musk: A Public Battle Intensifies

A public rift with Elon Musk thrust Donald Trump into the headlines as the pair’s relationship soured into a full-blown feud. The disagreement strains their joint support for the “Big Beautiful Bill,” an overarching spending and tax bill passed by the House on May 22, 2025. Musk opposed the bill, citing the removal of EV tax credits as a significant blow to Tesla’s market, contributing to the estimated 2.4 trillion to 5 trillion federal deficit over 10 years. Trump responded to Musk’s comments, threatening to terminate government contracts with Musk’s companies, SpaceX, and others. Musk suggested impeachment over a furious back-and-forth on social media. Tension was noticed as mortgages and housing were expected to be influenced by the bill’s economic effects for mortgage and housing booms. As a result of the feud, these tensions could undermine policies and lower confidence from investors.

Letitia James News: Trump Administration Oversight Continues

Letitia James, New York Attorney General, was still in the news on June 6, 2025, for her attention to the Trump administration. There were no new reports of legal interventions regarding the bounds of ‘Trumpism.’ However, James was concerned about monitoring federal policies that directly affected New York’s economy and consumer protection laws. It appears that her office is considering the “Big Beautiful Bill” legislation, estimating its economic impact on legal contestation vis-a-vis New Yorkers. James’s still proactive posture ensures that she continues to be a centrally important figure in the politics of state-federal matters.

Fani Willis News: Georgia Prosecutorial Announcements

Fulton County District Attorney Fani Willis was in the news for updates on ongoing legal matters, the details of which were scant for June 6, 2025. Willis has had her work cut out with prosecuting high-profile cases, especially since the last election cycle and the aftermath of the 2024 elections. Georgia, as a state, has placed Willis under scrutiny with the media spotlight due to the complex cases her office has been tasked with. No new cases have been filed in court, nor have any new rulings been issued as of this date. Willis has become a prominent feature of the legal landscape in the US.