GCA FORUMS and subforums were founded with one concept in mind: To serve consumers, entrepreneurs, homebuyers, home sellers, real estate investors, and the general public. When people buy or sell a certain house, they move and, therefore, have to start life in that new place. All the partnerships that they have developed with local vendors and merchants will cease to exist ………. Read More

-

All Discussions

-

Here’s an updated article on Gold investment

-

If you or someone you know is considering the purchase of a home, this is a must read article that identifies 6 key considerations.

A home purchase is likely the most significant investment you will ever make. This is not a time where you will want to act impulsively or emotionally. The development of a detailed plan will be the best protection to ensure your investment is safe and sustainable.

After reading this article if you have any questions or need assistance with developing your plan, please reach out for assistance.

Buying a home? Here are key steps to consider from top-ranked advisors

cnbc.com

Buying a home? Here are some key steps to consider from top-ranked advisors

If you plan to buy a home, you need to take proper steps to prepare for the purchase. Here's how to get there and what to consider, according to experts.

-

This thread pertains to John Parker. John, can you please explain what AXEN Mortgage is about and how AXEN MORTGAGE works. Many people are confused about AXEN Mortgage and why NEXA MORTGAGE doesn’t talk about AXEN Mortgage more often.

-

Amanda had a question on a real estate investor who has a 35 unit apartment building needing to refinance out of a bridge loan. The apartment building was purchased needing work. As a real estate investor of 7 apartment complexes consisting of 3,000 units, lenders require the following:

1. Summary sheet of the purpose of the loan and property detail. Location. What condition is building in A, B, C, D tier and what type of area is the apartment in A, B, C, D.

2. Personal financial statement

3. Three years of tax returns for conforming traditional commercial loans

4. Current P and L and rent roll which is current and proforma. Eventually need copy of leases. Need to itemized income and expenses which includes insurance, property tax, payroll, utilities, maintenance, water, and third-party vendors. Number of units, and approximate square footage. Number of rooms, bedrooms, bathrooms, and does it have dining rooms. Parking spaces or carports.

5. Type of work done and itemized cost

6. Real estate purchase contract

7. Appraisal if available and estimation of value of the property

8. How many are market rent, and section 8 housing

9. Comparable rents in the area for studio, one bedroom, two bedroom, etc.

10. What type of loan program does the borrower prefer and/or expect: Recourse, or non-recourse. How many owners to the property. Is property individually owned or in a LLC or partnership. Traditional conforming commercial loan or hard money loan, or bridge financing.

11. Any deliquent outstanding bills such as mechanics lien, tax liens, or pending lawsuit.

-

This discussion was modified 3 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 2 months, 3 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 3 months ago by

-

First time spec home. Problem- can’t seem to get a lender to give a loan. Apparently, I’ve been told I need experience with two new builds, which is rather odd in my book because for three years I was a commercial construction company’s superintendent that has overseen jobs worth 40 million+ dollars in work. Yet, due to these jobs being commercially based and not for personal use, the lender claims I do not have an ideal amount of experience. Have any suggestions?

-

Veterans and Credit Inquiries: Navigating the Double-Edged Sword

Welcome to Day 18 of our comprehensive series designed to guide our esteemed veterans through the intricacies of civilian credit. Today, we steer our ship into the waters of credit inquiries – a topic often shrouded in misconceptions but paramount in shaping your credit landscape.

Unraveling Credit Inquiries: Hard vs. Soft

Credit inquiries, at their core, are requests made by lenders to assess your credit report. They come in two flavors:

-

Hard Inquiries: These occur when a lender checks your credit for lending purposes, like a credit card application or a mortgage. These can slightly reduce your credit score for a short duration.

-

Soft Inquiries: When you check your own credit score or when companies do so for promotional purposes, it’s a soft inquiry. These don’t impact your score.

Why Veterans Should Care about Credit Inquiries

Active-duty military personnel may not encounter frequent credit inquiries, but in civilian life, these become more common. From renting an apartment to buying a car, credit checks become part and parcel of many financial decisions.

How to Tactfully Handle Credit Inquiries

-

Space Out Hard Inquiries: If you’re shopping for credit, try to do so within a short timeframe. Multiple inquiries for mortgages, auto loans, or student loans within a 45-day window are typically treated as a single inquiry.

-

Review Your Credit Report: Regularly review your report for any unauthorized inquiries. If found, you can dispute them.

-

Understand Before You Authorize: Before allowing anyone to run a credit check, understand which type of inquiry it will be.

A Veteran’s Field Guide to Inquiries

-

VA Loans and Credit Checks: Securing a VA loan will usually involve a hard inquiry, but the benefits often outweigh the temporary dip in your score.

-

Frequent Relocations: Military life might involve frequent relocations, leading to multiple rental applications. Veterans should be aware that these might involve hard inquiries.

-

SCRA and Credit Inquiries: The Servicemembers Civil Relief Act (SCRA) provides certain protections, but it doesn’t prevent or alter the effects of hard inquiries. It’s pivotal to understand this distinction.

Potential Pitfalls and Their Counterstrategies

-

Inquiry Overload: Applying for multiple credit cards or loans in rapid succession can be detrimental. Strategy: Plan major credit activities and spread them out.

-

Unfamiliar Inquiries: Finding unfamiliar hard inquiries can be alarming. Strategy: Regularly review your report and dispute any unauthorized checks.

-

Misunderstanding Inquiry Types: Many veterans, and civilians alike, may not discern between soft and hard inquiries. Strategy: Educate yourself on the differences and always inquire about the type before authorizing.

Seeing Credit Inquiries in the Grand Scheme

While inquiries are a small portion of your credit score (about 10% of your FICO score), they’re integral to understanding the bigger picture. Every ding on your report from a hard inquiry can accumulate, especially if unplanned. However, their impact diminishes over time and they fall off your report after two years.

Concluding Day 18: Charting a Course Through Inquiry Waters

Credit inquiries, much like navigating through unknown terrains in military expeditions, require knowledge, strategy, and foresight. For our veterans transitioning into civilian financial realms, understanding the terrain of credit inquiries can be the difference between smooth sailing and choppy waters.

As we wrap up today’s exploration, our compass remains set on a singular mission: equipping our nation’s heroes with the tools, knowledge, and insights necessary to command their financial destiny.

Join us for Day 19, as we continue this enlightening journey, ensuring every veteran is prepared for the challenges and opportunities in the world of credit.

-

-

It was a pleasure speaking with Kelce Rock, a residential, business, and commercial loan officer with his own team and extensive experience in commercial and business loan originator. Mr. Kelce Rock truly goes above and beyond for his clients and I have absolutely no doubt Kelce will make a phenomenal state senator and future member of U.S. Congress where he will make a difference. We need politicians who serve American Families and not dumbocrats like Imbecile Biden and Sex and Crack Addict Hunter Biden who enrich themselves and are known pedophiles. Dumbass Hunter Crackhead Biden has absolutely no morals and even goes and marries his dead brother’s wife. What a pig.

-

Is it possible to utilize a conventional loan for Airbnb properties? Any insights or experiences are appreciated. Thanks!

-

How do you go about getting a lost replacement title for an RV that is under a family members name? Can I get it from DMV or does my family member need to go in person. Trying to transfer RV from my family member to me and the lender needs the title since I am taking out on it.

-

Veterans and Credit History Length: A Journey Through Time

Welcome to Day 15 of our dedicated series, where we continue to equip our veterans with the essential tools and knowledge for navigating the civilian credit landscape. Today, our focus is on the length of credit history and its impact on credit scores, offering insights into how veterans can optimize this facet of their financial story.

Understanding Credit History Length: The Timeline Matters

The length of your credit history, or the duration over which you’ve managed credit, accounts for roughly 15% of your FICO score. This considers the age of your oldest account, the age of your newest account, and the average age of all your accounts.

The Importance of Credit History Length for Veterans

A longer credit history can provide a clearer picture of your financial habits over time. For lenders, it offers a more extended view of how you’ve managed credit. For veterans transitioning from military to civilian life, understanding this aspect is crucial, especially if there were periods of inactivity or limited credit usage during service.

Strategies to Enhance Credit History Length

-

Maintain Older Accounts: It might be tempting to close that old credit card you seldom use, but keeping it open can positively influence the length of your credit history.

-

Think Before Opening New Accounts: While new credit can be beneficial, opening numerous accounts in quick succession can reduce your average account age.

-

Check for Errors: Ensure all accounts listed on your credit report are accurate. If an old account isn’t listed, it might be worth contacting the credit bureau to rectify the error.

Veteran-Specific Insights

-

Reactivating Dormant Credit Lines: If you had credit accounts before your military service and they’ve become dormant during deployments, consider reactivating them. This can strengthen your credit history length.

-

Military Credit Protections: Some credit protections for active-duty military members can influence credit history length. Be sure to familiarize yourself with the Servicemembers Civil Relief Act (SCRA) and its implications on your credit.

-

Leverage Joint Accounts: If a spouse or family member maintained a strong credit profile while you were on active duty, consider being added as an authorized user to their account. This can potentially boost your credit history.

Challenges in Managing Credit History Length

-

The Temptation of New Offers: The allure of new credit offers with lucrative benefits can be tempting, but remember that frequently opening new accounts can impact the average age of your credit.

-

Being Unaware of Account Ages: Not knowing the age of each account might lead to inadvertently closing an older account. Periodically review your credit report to stay informed.

-

Overlooking the Comprehensive Picture: While the length of credit history is significant, it’s just one component of credit health. Maintaining a holistic view is essential.

Credit History in the Grand Tapestry of Financial Health

Your credit history length offers a glimpse into your financial journey over time. It paints a picture of consistency, reliability, and responsibility. For veterans, this timeline is uniquely intertwined with their service, sacrifices, and transitions.

Concluding Day 15: Embracing the Past to Forge a Brighter Future

The length of one’s credit history is, in many ways, a testament to their financial journey’s resilience and evolution. For our veterans, it’s a timeline punctuated with moments of valor, sacrifice, and adaptability.

As we wrap up today’s insights, our dedication remains steadfast: to illuminate the path of financial literacy for our nation’s heroes, ensuring they stride forward with confidence, armed with knowledge and foresight.

Stay with us for Day 16, as we continue to unravel the intricacies of credit, providing our veterans with the strategies and insights they deserve in their financial endeavors.

-

-

Veterans and Credit Utilization: Striking the Right Balance for Financial Health

Welcome to Day 12 of our series designed to empower our nation’s veterans with a solid grasp of credit intricacies. Today’s spotlight shines on credit utilization, a pivotal factor in determining credit scores. As veterans reintegrate into civilian life, understanding how to manage and optimize their credit utilization can be key to maintaining a healthy credit profile.

Breaking Down Credit Utilization: More than Just Spending

Credit utilization refers to the ratio of your current credit card balances to your credit card limits. It’s a measure of how much of your available credit you’re using. For example, if you have a credit card with a $5,000 limit and you’ve used $1,500, your credit utilization rate on that card is 30%.

Why Credit Utilization Matters to Veterans

Credit utilization is a significant component, contributing to 30% of your FICO score. A high utilization rate can indicate potential financial strain or over-reliance on credit, which might deter lenders. For veterans transitioning to civilian financial habits, being vigilant about their utilization ratio can help ensure their credit score remains robust.

Guidelines for Optimal Credit Utilization

-

Aim for Low Ratios: It’s generally recommended to keep your credit utilization below 30%. This shows lenders you’re not maxing out your credit cards and can manage credit responsibly.

-

Regularly Pay Balances: Even if you pay off your balance in full by the due date each month, high utilization can still impact your score if your lender reports the balance before you’ve paid it. Regular payments, possibly bi-monthly, can help maintain a lower utilization ratio.

-

Request Credit Limit Increases: Without increasing your spending, a higher credit limit can reduce your utilization ratio. However, only consider this if you trust yourself not to overspend with the added credit.

Tailored Insights for Veterans

-

Post-Deployment Debt: It’s not uncommon for veterans to accrue debt during deployments or periods of active duty. Prioritizing paying down these balances can improve both credit utilization and overall financial health.

-

Utilizing VA Benefits: Certain veteran-centric financial programs or counseling services can offer insights and strategies tailored to manage credit utilization effectively.

-

Avoid Closing Accounts Post-Service: If you’ve been using a credit card during service and are considering closing it post-deployment, think twice. Closing an account can reduce your overall credit limit, inadvertently increasing your utilization ratio.

Avoiding Credit Utilization Missteps

-

Only Paying the Minimum: While paying the minimum amount keeps your account in good standing, it doesn’t help reduce your utilization ratio significantly.

-

Accumulating Large Balances: Large purchases can spike your utilization rate. If possible, make immediate payments or spread out significant expenses.

-

Ignoring Balance Alerts: Setting up balance alerts can help you stay informed and act promptly if your utilization rate goes beyond your desired threshold.

The Broader Picture: Utilization in the Credit Ecosystem

Credit utilization, while crucial, is one of several factors determining credit scores. While it’s essential to optimize it, it’s equally important to maintain a holistic approach to credit management.

Veterans, with their disciplined and systematic approach honed during service, can incorporate these principles into their financial management strategies, ensuring not just optimal credit utilization but overall credit health.

Wrapping Up Day 12: The Art of Financial Equilibrium

The essence of credit utilization is balance – a balance between available credit and used credit, a balance between financial needs and financial capabilities. For our nation’s veterans, mastering this equilibrium can lay the foundation for a promising financial future.

As Day 12 comes to a close, our commitment remains strong: to guide, inform, and empower our heroes in every aspect of credit. Tomorrow, we continue this journey, diving deeper into the multifaceted world of credit, ensuring that every veteran is well-prepared for the financial challenges and opportunities ahead.

-

-

The government says inflation is 10%. The government are liars. Have you noticed the cost of goods at the local grocery store. A 12 pack of soda cost $3.99 just a year ago. Cost of a 12 pack of soda is now over $10.00. That’s a 300% increase in price. I remember buying a two liter plastic bottle of RC for 0.99 cents. Now any two litter soda is $3.50 to $4.00. I can go on and on. A fully decked out brand new pick up truck or SUV can cost $100,000. With skyrocketing inflation numbers, Mortgage rates surpassing 8%, wages remain the same. I remember not to long ago a $100,000 annual salary was considered high income and wealthy. $100,000 with the inflation rates today is lower middle class. If you work for the government, you will get raises because the government print dollars through their printing press. There needs to be a change and people need to wake up and stop being in a state of denial

-

Veterans and Credit Inquiries: Navigating the Landscape of Hard and Soft Pulls

Welcome to Day 10 of our series dedicated to guiding our nation’s heroes through the intricate maze of credit. Today, our focus shifts to the realm of credit inquiries. For veterans reestablishing their financial footprints in civilian life, understanding the nuances of credit checks can play a pivotal role in safeguarding their credit health.

Demystifying Credit Inquiries: Hard vs. Soft Pulls

Credit inquiries, or pulls, happen when an entity checks your credit report. There are two main types:

-

Hard Pulls (Hard Inquiries): These are initiated when you apply for a new credit line, be it a mortgage, credit card, or loan. A hard inquiry can impact your credit score for up to 12 months and remain on your report for two years.

-

Soft Pulls (Soft Inquiries): These do not affect your credit score and occur when you or a company checks your credit for non-lending purposes, like pre-approvals or background checks.

The Importance of Monitoring Inquiries for Veterans

While inquiries contribute to only about 10% of your FICO score, an excessive number of hard pulls in a short time can signal desperation or financial instability to lenders. For veterans transitioning to civilian financial norms, being aware of the inquiries made on their report is crucial.

Strategies to Manage and Monitor Inquiries

-

Space Out Applications: If you’re considering multiple credit lines, space out your applications. Lenders might view multiple hard pulls within a short span as credit-seeking behavior.

-

Inquire About Inquiry Type: Before authorizing a credit check, ask if it’s a hard or soft pull. This can prevent unwanted dents to your score.

-

Review Your Credit Report: Regularly check your report for any unauthorized or mistaken hard inquiries. If found, dispute them promptly.

Veterans and Credit Checks: Special Scenarios to Consider

-

Rate Shopping: Many veterans, when seeking loans (like auto or mortgages), might shop around for the best rates. Credit scoring models usually consider multiple inquiries for the same type of loan within a short period (14-45 days) as a single inquiry.

-

VA Loans: For veterans considering VA home loans, the lending institution will initiate a hard pull. However, the favorable terms and benefits of VA loans often outweigh the minor impact of the inquiry.

-

Security Clearances: Some veterans may need security clearances for certain jobs, which could entail a soft pull on their credit.

Staying Informed: The Power of Knowledge

-

Stay Updated: Ensure you’re aware of the latest credit scoring models and how they handle inquiries, especially if you’re rate shopping.

-

Educate Yourself: Some credit monitoring services offer insights and tips about managing inquiries, which can be particularly useful for veterans unfamiliar with civilian credit norms.

-

Seek Expert Advice: If unsure about the potential impact of an inquiry, consult with a financial advisor or credit counselor.

Avoiding Missteps in the World of Inquiries

-

Impulse Applications: Avoid applying for credit impulsively, especially for store credit cards that might seem tempting at the checkout.

-

Ignoring Your Report: Regularly check your credit report to ensure there are no unauthorized inquiries. This not only protects your score but also helps in early detection of potential identity theft.

-

Uninformed Decisions: Not all inquiries are created equal. Be clear about the type and potential impact of each credit check before giving consent.

Wrapping Up Day 10: Inquiries as Gatekeepers of Credit Health

Credit inquiries, in many ways, act as gatekeepers. They’re the checkpoints that can either pave the way for financial opportunities or serve as hurdles if not navigated wisely.

For veterans, who’ve navigated far more challenging terrains, understanding the landscape of credit inquiries becomes another mission to master. And with the right knowledge and strategies, this mission, like many before, is entirely achievable.

As we conclude our insights for the day, our promise remains: to accompany our veterans, step by step, through their financial transitions, ensuring they’re equipped with all the knowledge they need.

Join us tomorrow as we continue our journey, further illuminating the path for our nation’s heroes in the world of credit.

-

-

Modular homes look great and are better than stick built homes for a fraction of the cost and time to build. Hands down a lot of house for the money. https://youtube.com/watch?v=e3sSdeQlBSM&feature=share8

-

Inflation refers to the general increase in prices of goods and services in an economy over a period of time, leading to a decrease in the purchasing power of money. When inflation occurs, each unit of currency buys fewer goods and services than it did before. It is usually expressed as an annual percentage rate.

Inflation can be caused by various factors, but some common drivers include:

-

Demand-Pull Inflation: This occurs when the overall demand for goods and services exceeds the available supply. When demand outstrips supply, prices tend to rise.

-

Cost-Push Inflation: This type of inflation is caused by an increase in the production costs for businesses, such as rising labor costs or raw material prices. As businesses pass these increased costs onto consumers, it leads to higher prices.

-

Built-in Inflation: This is also known as wage-price inflation and occurs when businesses raise prices to compensate for increased labor costs, and workers, in turn, demand higher wages to keep up with the rising prices.

-

Monetary Factors: The money supply in an economy can also influence inflation. If the central bank prints more money without a corresponding increase in economic output, it can lead to too much money chasing too few goods, causing inflation.

Inflation is typically measured using various price indices, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI), which track changes in the prices of a representative basket of goods and services.

Some level of inflation is generally considered normal and even desirable in modern economies. A moderate and stable inflation rate can encourage spending and investment and can help avoid deflation, which is a persistent decrease in prices that can be damaging to economic growth.

Central banks and governments often aim to keep inflation at a target rate (usually around 2% in many advanced economies) through monetary and fiscal policies. However, when inflation becomes too high or too volatile, it can erode the value of savings, disrupt financial planning, and create economic instability. Conversely, low or negative inflation can also have adverse effects on the economy, such as encouraging hoarding and deferring spending. Striking the right balance is essential for maintaining a healthy and sustainable economy.

-

-

Insider tip. Buy silver bars. The dollar is going to shit, the Federal Reserve Board will be shutting down, Trump is getting reelected and will make the currency backed by Gold and Silver, Biden and Hunter will face the ⛽️ ⛽️ ⛽️ gas chamber, Obama and Michael Robinson Obama are going to come clean as a faggot and transgender, and the nation will prosper. Adam Schiff will get the electric chair for being a pedophile, Bill Gates will be sent to gas chamber for crimes against humanity, and Democrats will all vanish from coronavirus vaccine aftermath blood clots.

-

Buying a house is a significant life event and requires thorough preparation. Here’s a generalized step-by-step guide that could help you with the process of buying a house in Alabama or any other state:

1. **Determine Your Budget**: Before you start looking at homes, figure out how much you can afford to spend. A common rule of thumb is that your monthly mortgage payment should not exceed 28% of your gross monthly income. Don’t forget to factor in other costs, like homeowners insurance, property taxes, maintenance costs, and HOA fees if applicable.

2. **Check Your Credit Score**: Your credit score will significantly influence your mortgage interest rate. Ensure your credit score is in good standing; if not, you might want to improve it before applying for a mortgage.

3. **Save For a Down Payment**: It’s usually recommended to have a down payment of at least 20% of the home price to avoid paying private mortgage insurance (PMI). However, many loan programs allow for lower down payments, some as low as 3.5% or even 0% for certain types of loans.

4. **Get Pre-Approved for a Mortgage**: Before you start house hunting, get pre-approved for a mortgage. This will make your offer more attractive to sellers and give you an idea of how much house you can afford.

5. **Find a Real Estate Agent**: A good real estate agent with local knowledge can be a valuable resource. They can provide insights about the neighborhood, help negotiate the price, and guide you through the closing process.

6. **Search for Homes**: Now comes the exciting part, looking for your dream home. Remember to take notes about

-

Boats and yachts are right in line with the most Depreciation toys right behind motorhomes. Lending Network, LLC offers financing for mega boats and mega yachts up to 125% LTV in all 50 states

Check out our website about boats and mega yachts financing http://www.lendingnetwork.org/boats-and-yachts/

lendingnetwork.org

Financing boats and Yachts is offered at Lending Network, LLC. Down payment and rates depends on age of boat and borrowers credit scores

-

Financing an RV (recreational vehicle) is similar in many ways to financing a car, but it can also be akin to financing a home, particularly for larger, more expensive RVs. Here are some steps to help you secure RV financing:

1. **Check Your Credit Score**: Your credit score will impact your ability to secure financing and the interest rate you receive. The higher your credit score, the lower the interest rate you’ll typically qualify for.

2. **Determine Your Budget**: Understand how much you can afford. Use an RV loan calculator to help you determine what your monthly payments might be at different interest rates and loan terms.

3. **Save for a Down Payment**: Like with auto and home loans, having a down payment can help you secure a better rate. It also reduces the amount you need to finance.

4. **Shop Around for Lenders**: There are a number of places where you can secure financing for an RV, including:

– **Banks and Credit Unions**: Traditional financial institutions often offer RV loans. If you already have a relationship with a bank or credit union, they may be able to offer you a better rate.

– **Online Lenders**: Online financial institutions often have competitive rates and terms, and they can be a convenient option since you can apply from home.

– **RV Dealerships**: Some RV dealerships offer financing. While this can be a convenient option, keep in mind that dealership financing can sometimes be more expensive than other options.

– **RV Loan Companies**: Some lending companies specialize in RV loans, understanding the unique needs and requirements of financing an RV.

5. **Compare Loan Terms and Rates**: RV loans can have terms anywhere from 10 to 20 years, depending on the cost of the RV and your financing. Like with any loan, a longer term will usually mean lower monthly payments, but a higher total cost over the life of the loan. When you’re comparing loans, be sure to look at both the interest rate and the term to understand the total cost.

6. **Pre-Approval**: If possible, get pre-approved for your loan. A pre-approval will give you a better understanding of what you can afford and can make the purchasing process smoother.

7. **Negotiate**: Once you have your financing in place, you’re ready to negotiate the purchase of your RV. Having pre-approved financing can give you more bargaining power.

8. **Finalize Your Financing**: Once you’ve agreed on a price for the RV, you’ll need to finalize your financing. This will typically involve filling out an application with your personal information, including your income and employment information.

Remember to read all the loan terms and conditions carefully before signing the contract. Make sure you understand all the fees, the interest rate, and the terms of the loan.

Lastly, keep in mind that an RV is a big investment. Make sure you also budget for maintenance, repairs, insurance, and other ongoing costs.

-

Financing a new or used car typically involves securing a loan to cover the cost of the vehicle, which you then repay over a set period of time. Here’s a general process you can follow:

1. **Assess your budget**: The first step to financing a car is understanding what you can afford. This includes considering the monthly payments you can manage, as well as the down payment

2. Lending Network offers 125% LTV car loans and exotic car loans.

3. Ferrari, Lamborghini, and luxury six figure SUVs and pick up trucks.

-

Veterans and Credit Utilization: Mastering the Art of Balance

Welcome back to Day 8 of our in-depth series, tailor-made for our nation’s veterans, focusing on the multifaceted world of credit. Today, we plunge into a pivotal topic that resonates with many: credit utilization. For veterans aiming to optimize their financial landscape post-service, mastering the nuances of credit utilization is indispensable.

Breaking Down Credit Utilization: More Than Just a Ratio

At its essence, credit utilization is the ratio of your current credit card balances compared to your credit card limits. It’s calculated by:

Credit Utilization Ratio=(Total Credit Card BalancesTotal Credit Card Limits)×100

Credit Utilization Ratio=(

Total Credit Card Limits

Total Credit Card Balances

)×100

So, if you have a credit balance of $500 on a card with a limit of $1000, your credit utilization for that card is 50%.

Why Veterans Should Care About Credit Utilization

Credit utilization is a heavyweight when it comes to credit scoring, making up a whopping 30% of your FICO score. It serves as an indicator of your financial stability and how reliant you are on credit. Lower utilization rates are viewed favorably, signaling to lenders that you manage your credit responsibly.

For veterans, who may be adjusting to different financial dynamics post-service, understanding and managing credit utilization becomes crucial.

Golden Rules for Optimal Credit Utilization

-

Aim Low, But Not Zero: While it’s recommended to keep the ratio below 30%, having some utilization (e.g., 5-10%) shows that you actively use and manage your credit.

-

Pay Balances More Than Once a Month: To maintain a low utilization rate, consider making multiple payments throughout the month.

-

Request a Credit Limit Increase: If you’ve been a responsible cardholder, consider asking for a credit limit increase on your cards. This can instantly reduce your utilization rate, but be wary not to see it as an excuse to spend more.

Veterans and Credit Utilization: Unique Considerations

For many veterans, the financial landscape post-military service can be marked by significant changes – from purchasing homes to financing education. Some specific considerations include:

-

Transitional Expenses: Veterans might face expenses tied to relocation or adjusting to civilian life. While it’s tempting to rely heavily on credit cards, it’s crucial to monitor utilization and plan repayments.

-

Veteran Benefits: Some financial programs or credit cards cater specifically to veterans, offering lower interest rates or favorable terms. Research and leverage these to your advantage.

-

Financial Counseling: Many organizations offer financial counseling for veterans. If you’re struggling with credit utilization, don’t hesitate to seek guidance.

Avoiding the Traps: Common Missteps and How to Bypass Them

-

Maxing Out Cards: Even if you pay it off every month, maxing out cards can hurt your score if the balance is reported to credit bureaus before you make your payment.

-

Closing Old Cards: It might seem logical to close unused credit cards, but doing so can reduce your overall credit limit, spiking your utilization ratio.

-

Only Making Minimum Payments: While this might keep your account in good standing, it can slowly increase your utilization rate and accrue significant interest.

Day 8 Wrap-Up: The Delicate Dance of Credit Utilization

Credit utilization, in many ways, mirrors the delicate balance veterans master during service – the dance between discipline and flexibility, structure and adaptability.

As we wind up today’s insights into credit utilization, our commitment remains unwavering: to arm our veterans with the knowledge and tools they need to build a secure financial future in civilian life.

Join us tomorrow as we continue our odyssey into the vast realm of credit, ensuring every veteran is equipped, empowered, and enlightened.

-

-

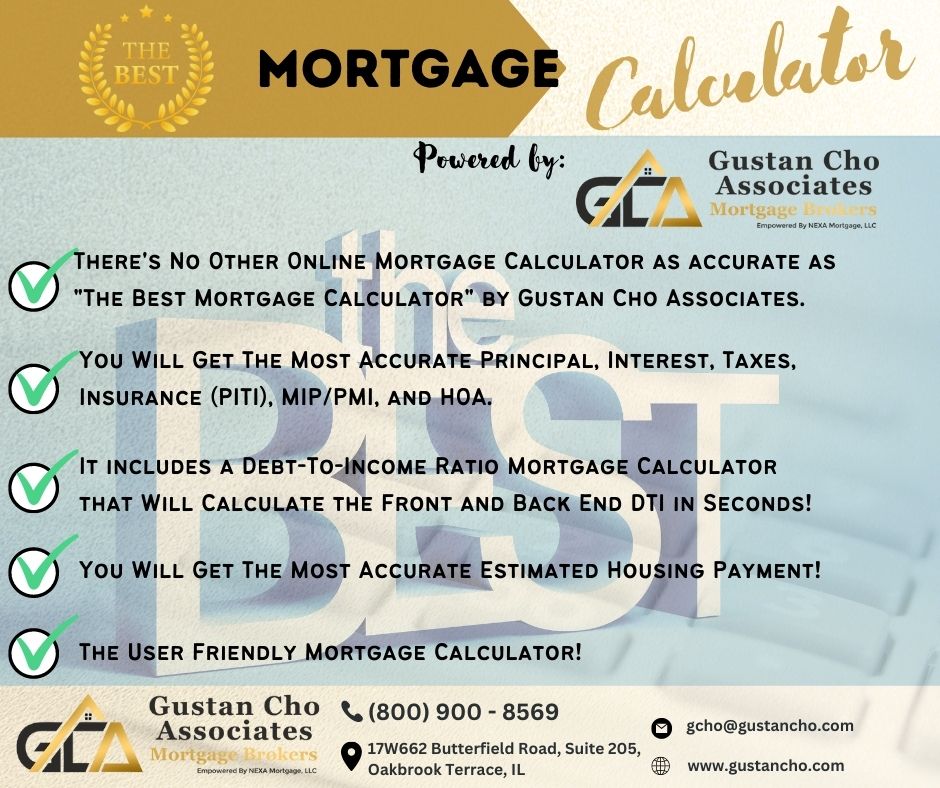

There are hundreds or thousands of Mortgage Calculators online. However. The Team at Gustan Cho Associates Alex Carlucci and Monica Cho has designed, created, tested, and launched the best mortgage calculator that is user friendly with the best accuracy than any other online mortgage calculator. The Best Mortgage Calculator is user-friendly for loan officers, processors borrowers realtors, underwriters, and the general public. Not only does it calculate PITI and Housing payments but also debt to income ratios and agency guidelines on debt to income ratios. Try out the best mortgage calculator https://gustancho.com/best-mortgage-calculator

gustancho.com

Best Mortgage Calculator | PITI, PMI, MIP, and DTI

We are at Gustan Cho Associates, You easily check your mortgage eligibility with the best mortgage calculator With PITI, PMI, MIP, HOA, and DTI.

-

Veterans and Credit Age: The Power of Long-standing Credit Relationships

Hello and welcome back on Day 7 of our veteran-centric series dedicated to unraveling the complexities of credit. As we journey further, today’s spotlight turns to a critical but often overlooked aspect of credit: credit age. For veterans finding their financial footing in civilian life, comprehending the role of credit age can be instrumental in their fiscal endeavors.

Defining Credit Age: Beyond Just Numbers

Credit age, or credit history length, refers to the duration your credit accounts have been active. This encompasses:

-

Age of Your Oldest Account: The time since your oldest credit account was opened.

-

Age of Your Newest Account: The time since your most recent credit account was opened.

-

Average Age of All Your Accounts: A mean average of the age of all your credit accounts.

Why Credit Age Matters for Veterans

Accounting for about 15% of your FICO credit score, credit age is a significant indicator for lenders. It offers insights into:

-

Reliability: A longer credit history provides lenders a more extended window to evaluate your financial behaviors.

-

Stability: It signals that you have experience managing credit over a period and are likely to continue handling it responsibly.

For veterans, especially those who might have had limited opportunities to build credit during active service, understanding the impact of credit age becomes even more pivotal.

Building and Maintaining a Healthy Credit Age: Tips for Veterans

-

Hold Onto Older Accounts: Even if you no longer use an old credit card, consider keeping it open. Closing it could reduce your credit age average.

-

Open New Credit Strategically: While diversifying credit is essential, frequently opening new accounts can lower the average age of your credit. Be intentional and strategic about when and why you open new accounts.

-

Become an Authorized User: If a trusted family member or friend has a long-standing and well-managed credit account, consider asking if you can be added as an authorized user. This can bolster your credit age, especially if you’re just starting out.

The Double-Edged Sword: Potential Pitfalls

While it’s tempting to rush to amplify your credit age, there are pitfalls veterans should be wary of:

-

Avoiding New Credit Entirely: While it’s crucial not to open too many accounts hastily, shunning new credit entirely can hinder your financial flexibility and growth. Balance is key.

-

Falling for Dormancy: Just keeping an old card won’t suffice. Occasionally use and pay off older accounts to keep them active and ensure they positively impact your credit profile.

-

Authorized User Risks: While being an authorized user can be beneficial, ensure the primary account holder manages the account responsibly. Any negative behavior will reflect on your credit report too.

Looking Beyond the Numbers: The Emotional Quotient

Credit age isn’t just about cold, hard numbers. For many veterans, these accounts can represent stages of life, milestones, or even memories. An old credit card might be reminiscent of times before deployment or significant life events. Recognizing this emotional connection can offer a more holistic approach to managing credit.

Concluding Day 7: The Legacy of Long-Standing Credit

Much like the legacy of service that veterans leave behind, a strong credit age is a testament to financial diligence and stability. It’s a reflection not just of time but of sustained responsibility and growth.

As we close today’s exploration into credit age, we reaffirm our dedication: to guide, support, and empower our nation’s veterans in their financial journeys.

Stay tuned for tomorrow’s discussion as we continue to bridge the gaps in credit knowledge, ensuring every veteran has the tools to succeed in their financial aspirations.

-

-

The decision to move and raise a family in Connecticut, or any location, will depend largely on personal preferences, as what is “good” can vary widely from person to person. That being said, as of my knowledge cutoff in September 2021, Connecticut generally had a number of attributes that many people might find attractive for family life:

1. **Education:** Connecticut is known for having a strong education system, with high test scores and graduation rates. In fact, some of its public schools are among the best in the country. Additionally, it’s home to prestigious universities like Yale.

2. **Safety:** Some towns in Connecticut boast low crime rates, which can be a draw for families seeking a safe environment for children.

3. **Quality of life:** Connecticut’s strong economy supports a high standard of living. There is access to good healthcare facilities, and residents enjoy beautiful landscapes—from the picturesque New England coastal towns to charming rural areas.

4. **Proximity to major cities:** Connecticut is located within reasonable travel distance to major cities like New York City and Boston, which is great for access to cultural events, job opportunities, and more.

5. **Outdoor recreation:** There are plenty of outdoor recreational activities available, including hiking, fishing, skiing, and boating, among others.

However, there are also some potential drawbacks:

1. **Cost of living:** Connecticut is one of the more expensive states to live in, especially when it comes to housing and taxes. This could be a factor depending on your financial situation.

2. **Economic disparities:** While Connecticut as a whole has a strong economy, there are significant disparities. Some areas, particularly larger cities like Bridgeport and New Haven, struggle with higher rates of poverty and lower-performing schools.

3. **Traffic:** Depending on where you live and work, traffic can be a significant issue in Connecticut, particularly along the I-95 corridor.

As with any major decision, it’s best to do thorough research and perhaps visit to get a feel for the areas of Connecticut you’re considering. It’s always a good idea to take into account factors like job opportunities in your field, climate, cultural fit, and specific local resources or community attributes that are important to you.

-

The decision to buy a house in Colorado, or anywhere else for that matter, depends on several factors such as your personal financial situation, the housing market in Colorado, and your long-term plans. Let’s look at some specific points:

1. **Market Conditions**: As of my knowledge cutoff in September 2021, Colorado, especially cities like Denver, Boulder, and Colorado Springs, had seen significant growth in real estate prices over the past decade. However, markets can fluctuate, so it’s essential to research the current market trends and future predictions.

2. **Location**: Different parts of Colorado offer different lifestyles. For example, Denver is a bustling city with thriving industries, while mountain towns offer outdoor recreational opportunities like skiing and hiking. The right location for you depends on your lifestyle preferences.

3. **Affordability**: Keep in mind that buying a home is a substantial financial commitment. Consider your income, savings, and other expenses to ensure you can afford the mortgage payments, taxes, insurance, and maintenance costs.

4. **Long-Term Plans**: Buying a house is typically a long-term investment. If you plan on staying in Colorado for a significant amount of time, buying could be a good decision. On the other hand, if you’re unsure about your long-term plans, renting may be a safer option.

5. **Career Opportunities**: Colorado has robust job markets in industries like technology, healthcare, and aerospace. If your career aligns with these industries, it could be a good place to invest.

6. **Quality of Life**: Colorado often ranks highly in terms of quality of life due to its outdoor recreational opportunities, access to nature, and good education and healthcare systems.

Before you decide to buy a house in Colorado, it would be a good idea to speak with a local real estate agent who can provide detailed information about the market conditions and neighborhoods. Additionally, a financial advisor can help ensure you’re financially prepared for the commitment of buying a home.

-

I need to replace a large deck with stairs, railings, and the works. Do any of you know this new decking material that is out on the market? I need to do tons of work on my home. House was built in 1998 and need everything from exterior siding, roof, gutters, sofits, fascia, downspouts, windows, driveway, you name it, I need it. This is aside from the inside remodeling project such as kitchens and bathrooms, flooring, countertops, appliances, and more. I will keep everyone posted as how things progress.

-

Food Trucks are becoming the new hot thing. However, the most important part about a food truck’s fate of success is whether the food is GREAT. You need great food. Everyone can cook hot dogs, beef, pizza, and tacos. Make a creative business plan. Something where people will wait in line for hours. Gumbo? Korean food? Noodles? Indian food? Authentic Thai food? Maybe do a different menu daily. Mondays tacos, Tuesdays Korean barbecue, Wednesdays Indian food, Thursdays Japanese food, Fridays seafood, Saturdays Ribs, Sundays Custom Noodles: All noodles day. People love noodles. I did not realize that there is over dozens of Food Truck Franchises.

-

Veterans and Credit Inquiries: Demystifying Hard and Soft Pulls

Greetings to our cherished readers on Day 6 of our veteran-focused series on credit understanding. As veterans navigate the complex transition from military service to civilian life, understanding every facet of their credit profile becomes essential. Today, we shift our focus to a topic that’s often surrounded by misconceptions: credit inquiries, specifically the difference between hard and soft pulls.

Decoding the Jargon: What are Credit Inquiries?

At its core, a credit inquiry occurs when a third party examines your credit report. Typically, this is done by lenders to determine if you’re creditworthy. However, not all credit inquiries are created equal. They are categorized into:

-

Hard Inquiries (or Hard Pulls): These occur when you actively apply for a new credit, like a mortgage, car loan, or credit card. It signals to lenders that you might be taking on more debt.

-

Soft Inquiries (or Soft Pulls): These happen without your direct action in the credit application process. Examples include when you check your own credit score or when companies do a background check for promotional offers.

The Relevance of Credit Inquiries for Veterans

For many veterans, the post-service phase involves multiple significant financial actions – buying a home, financing a car, or even starting a business. Each of these actions can trigger credit inquiries. Understanding their impact can help veterans make informed choices and minimize potential dings on their credit scores.

The Impact of Hard Inquiries

Hard inquiries might temporarily drop your credit score by a few points. While this may seem minor:

-

They Stay on the Report: Hard inquiries remain on your credit report for two years. Though their impact diminishes over time, they are visible to any future lender looking at your report.

-

Multiple Pulls Can Add Up: If you have several hard inquiries clustered together, it can be a red flag for lenders, suggesting you might be desperate for credit or taking on too much debt.

However, there’s an exception: rate shopping. For example, if you’re shopping around for the best mortgage rate and multiple lenders make inquiries in a short time frame, credit scoring models will count this as a single inquiry, recognizing that you’re rate shopping.

Soft Inquiries: The Less Intrusive Brother

Soft inquiries don’t affect your credit score. They are, in essence, harmless from a credit standpoint. This is why it’s encouraged for individuals, including veterans, to regularly check their own credit reports.

Strategies for Veterans to Manage Credit Inquiries

-

Be Selective with Credit Applications: Only apply for credit that you genuinely need. Every hard inquiry should be a calculated move.

-

Understand the Inquiry Type: Before giving anyone permission to look into your credit, clarify if it’s a hard or soft inquiry. For instance, some rental agreements might involve a credit check. Know the kind of pull they’re doing.

-

Time Your Applications: If you know you’ll be making a significant credit-based decision soon, like applying for a mortgage, try to avoid other hard inquiries until after that process.

-

Consolidate Rate Shopping: If shopping for rates, try to keep the process within a short timeframe (e.g., 14 to 45 days, depending on the credit scoring model) to ensure they’re treated as a single inquiry.

-

Regularly Review Your Credit Report: Ensure all hard inquiries on your report are genuine and dispute any that you didn’t authorize.

Credit Inquiries and the Bigger Picture

While understanding hard and soft pulls is essential, it’s crucial to see them as part of the larger credit mosaic. Payment history, credit utilization, and credit age play more substantial roles in determining your credit score. However, smart management of credit inquiries can ensure you’re not inadvertently harming your score.

Day 6 Roundup: Navigating Credit Inquiries with Confidence

Credit inquiries, though a small component of the credit universe, are an essential piece of the puzzle. For veterans, understanding this realm ensures that every step they take in their civilian financial journey is confident and informed.

As we wrap up today’s deep dive into the world of credit inquiries, we stay rooted in our commitment: providing veterans, the pillars of our nation, with knowledge and tools to navigate their financial future effectively.

Join us tomorrow for another enlightening discussion, as we continue our mission to empower, educate, and honor our veterans in the realm of credit.

-

-

As a multi-state licensed MLO, I have been pleased with what Tennessee has to offer an MLO. Home values have been climbing for several years now, and it looks like values are going to hold and increase over the next ten years. This means the availability of homeowners who have had mortgages for over 10 to 15 years have abundant equity in their most valuable asset, their home. The opportunity for large cash-out refinances, R&T refinances, and possible HELOCs is very high.

Another advantage for an MLO in Tennessee is a low inventory with an abundance of land with landowners ready to sell to the highest homebuilder bidders.

Now is a good time to begin developing relationships with local real estate agents to prepare for the future homebuilding boom in Tennessee.Let’s Make Your Mortgage Work For You!

-

Veterans and Credit Utilization: The Silent Factor Affecting Your Credit Score

Welcome to Day 4 of our series dedicated to empowering U.S. military veterans in the world of credit. As we uncover the layers of credit management, today’s spotlight is on a pivotal yet often overlooked aspect: Credit Utilization. Understanding this key component is essential for veterans aiming for financial stability post-service.

Unraveling the Mystery: What is Credit Utilization?

In the simplest terms, credit utilization is a ratio that compares your current credit card balances to your credit card limits. It gives lenders an insight into how responsibly you use your available credit. The formula for this ratio is:

Credit Utilization=(Total Credit Card BalancesTotal Credit Card Limits)×100

Credit Utilization=(

Total Credit Card Limits

Total Credit Card Balances

)×100

For instance, if you have a total credit balance of $4,000 and a credit limit of $10,000 across all your cards, your credit utilization rate is 40%.

Why Does Credit Utilization Matter for Veterans?

Credit utilization is responsible for about 30% of your FICO score calculation, making it one of the most significant factors after payment history. A high ratio might signal to lenders that you’re overly reliant on credit, possibly leading to higher interest rates or even declined applications.

For veterans transitioning to civilian life, establishing financial credibility is crucial. Whether it’s getting a mortgage for a family home, financing a car, or even supporting entrepreneurial ventures, a favorable credit score can ease the path. Keeping an optimal credit utilization ratio is an effective way to bolster that score.

The Golden Threshold: 30% and Below

While there isn’t a one-size-fits-all answer, financial experts often tout the 30% mark as the golden threshold for credit utilization. This means, to optimize credit score benefits, veterans should aim to use only 30% or less of their available credit. For example, on a credit card with a $5,000 limit, try to maintain a balance of no more than $1,500.

Strategies to Maintain an Optimal Credit Utilization Rate

-

Regularly Monitor Balances: Frequently check your credit card balances and be aware of your credit limits. This can ensure you don’t inadvertently cross the desired utilization ratio.

-

Multiple Small Payments: Instead of waiting for the due date, consider making multiple small payments throughout the month. This can help keep the balance low.

-

Request for Higher Credit Limits: Occasionally, without taking on more debt, request a credit limit increase. This can instantly lower your utilization rate.

-

Avoid Closing Old Credit Cards: Closing a credit card can decrease your available credit, potentially spiking your utilization ratio. Unless there’s a compelling reason, like a high annual fee, consider keeping your old cards open.

-

Balance Transfers: If one card is close to being maxed out while another has a zero balance, consider transferring some of the debt. This can help evenly spread out the utilization rate.

The Dual Benefit of Healthy Credit Utilization for Veterans

Maintaining a healthy credit utilization ratio offers a dual advantage for veterans:

-

Enhanced Credit Score: As mentioned, a lower utilization rate can significantly boost your credit score, making financial milestones more attainable.

-

Financial Discipline: Regularly monitoring and adjusting your credit utilization instills a habit of financial discipline, ensuring long-term well-being.

Beyond the Numbers: A Holistic Approach

While it’s essential to understand and manage credit utilization, it’s equally crucial for veterans to adopt a holistic approach to credit. Relying solely on numbers can sometimes overshadow the real goal: financial stability and prosperity.

Understanding credit utilization is a tool in the vast financial toolkit. Pair it with timely payments, a mix of credit types, and consistent monitoring of credit reports for a comprehensive credit management strategy.

In Conclusion

As we march forward in our month-long journey, Day 4’s spotlight on credit utilization underscores its silent yet profound impact on financial health. For our veterans, who’ve dedicated their lives to service, this knowledge serves as another step towards ensuring their sacrifices are met with a seamless transition to financially stable civilian life.

Stay tuned as we delve deeper into credit intricacies, always aiming to equip our veterans with the tools for a brighter financial future.

-