GCA FORUMS and subforums were founded with one concept in mind: To serve consumers, entrepreneurs, homebuyers, home sellers, real estate investors, and the general public. When people buy or sell a certain house, they move and, therefore, have to start life in that new place. All the partnerships that they have developed with local vendors and merchants will cease to exist ………. Read More

-

All Discussions

-

When an automaker says only 400 cars made worldwide and there’s 500 VIN numbers, what’s up with that. Here’s a very informative video clip classic and exotic auto enthusiasts will find it very interesting. I think before watching the attached video clip, car makers like Ferrari, Lamborghini, and others were legitimate when they produced limited production exotic and classic cars. The Ferrari Enzo is a high-performance supercar produced by the Italian automaker Ferrari. Here are some key features and details about the Ferrari Enzo:

-

Production: The Enzo was produced from 2002 to 2004, with only 400 units made, making it a rare and highly sought-after vehicle.

-

Design: Named after the company’s founder, Enzo Ferrari, the car’s design was inspired by Formula 1 technology. It features a carbon-fiber body, advanced aerodynamics, and a sleek, aggressive look.

-

Engine and Performance: The Enzo is powered by a 6.0-liter V12 engine, producing 651 horsepower. This allows the car to accelerate from 0 to 60 mph (0 to 97 km/h) in just 3.14 seconds and reach a top speed of 218 mph (351 km/h).

-

Transmission: It features a 6-speed automated manual transmission with paddle shifters, providing a rapid and precise gear-shifting experience.

-

Suspension and Brakes: The Enzo is equipped with state-of-the-art suspension and braking systems, including carbon-ceramic brakes, ensuring exceptional handling and stopping power.

-

Interior: The interior is focused on performance, with minimalistic design elements, racing seats, and a digital display providing essential driving information.

-

Legacy: The Ferrari Enzo is considered one of the most iconic supercars of its time, combining cutting-edge technology, exceptional performance, and exclusivity.

The Ferrari Enzo remains a symbol of Ferrari’s commitment to excellence in automotive engineering and design. However, if Ferrari says that they only made 400 Ferrari Enzo supercars, is this correct? What is up with the 500 VIN numbers? If this is true, this is huge international fraud. These cars are multi-million dollar super sportscars and the reason for such high value is due to the limited production numbers.

https://www.facebook.com/share/r/8ckCBEMjx6LECTN1/?mibextid=D5vuiz

-

This discussion was modified 1 year ago by

Gustan Cho. Reason: Spelling error

Gustan Cho. Reason: Spelling error

facebook.com

Enzo Model Reportedly Produced Beyond Official Claims

-

-

Only 20 Lamborghini Reventon Ever Made. The Lamborghini Reventón is an iconic and extremely limited-edition supercar produced by the Italian manufacturer Lamborghini. Here are some key details and features about the Lamborghini Reventón:

Production: The Lamborghini Reventón was produced between 2007 and 2009. Only 20 units were made for customers, with an additional car (numbered 0/20) produced for the Lamborghini museum, making it one of the rarest Lamborghini models ever made.

Design: The design of the Reventón was heavily inspired by modern fighter jets, with sharp, angular lines and an aggressive, aerodynamic profile. The car features a carbon-fiber exterior, with a matte finish giving it a distinctive, stealthy appearance.

Engine and Performance: The Reventón is powered by a 6.5-liter V12 engine, producing 650 horsepower. This allows the car to accelerate from 0 to 60 mph (0 to 97 km/h) in just 3.4 seconds and reach a top speed of 211 mph (340 km/h).

Interior: The interior of the Reventón is a blend of luxury and high-tech features, with carbon fiber, leather, and Alcantara materials used throughout. The instrument panel is entirely digital, with two LCD screens displaying vital information in a format reminiscent of a jet cockpit.

Price: When it was released, the Lamborghini Reventón had a price tag of around $1.5 million, making it one of the most expensive cars at the time.

Legacy: The Reventón is often regarded as a precursor to the Lamborghini Aventador, with many design and technological elements influencing the latter model. Its rarity, performance, and design have made it a highly sought-after collector’s item.

The Lamborghini Reventón remains a symbol of Lamborghini’s commitment to pushing the boundaries of automotive design and performance, embodying the brand’s tradition of creating bold, head-turning supercars.

Here’s a video clip of the Lamborghini Reventon Lamborghini enthusiasts may find interesting.

https://www.facebook.com/share/v/qSgCMtdX1T1mHnEc/?mibextid=D5vuiz

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

facebook.com

Too Good To Be True: Could This Reventón Be Real?!

-

This discussion was modified 1 year ago by

-

Are Ferrari GTB great investments for the future. I remember Gustan Cho telling me about the two classic Ferrari to invest in. The Ferrari Testarossa and the Ferrari 599 GTB.

-

Chase helped himself to ice cream 🍦 while I was mowing. He knows how to open the refrigerator door. He better not have the shits.

-

Mowing everyday. Keeps raining here and grass won’t stop growing. Landscapers on furlough until I get caught up on mortgage and thanks to Biden’s Bidenomics, Inflation, and high labor costs. I am ruining my John Deere tractor. Using up tons of Diesel ⛽️. May need to get some goats 🐐 😬 🤔 or some potheads to smoke 🚬 up my grass. Hate mowing. I will probably be mowing all summer ☀️

Budget cuts.

-

I am a pizza! Caio! I came to this country from humble beginnings, not sure exactly where or when. But, I know I am Italian by birth, somewhere in the south, maybe Naples or Rome. I’m a simple dish made from flour, tomatoes, and cheese; yes, I have evolved and morphed into something entirely different.

Many other countries claim I am theirs; that’s because they all have flatbread with some cheese and tomatoes. I’ll tell you what I wasn’t born with: pepperoni, pineapple, and other toppings. No pepperoni in Italy; it’s soppressata, an Italian sausage.

Gennaro Lombardi was the first Italian to introduce me to America. I grew up on the Lower East Side of Manhattan, 23 1/2 Spring Street in Little Italy, a block away from Mulberry Street. I’m still here after 120 years. He took his recipe from Naples, Italy. Although pizza varies from Italian province to Italian province, I’m still basically the same.

Roman makes oval pizza, Naples’s pizza is round, and Sicilian pizza is square. Now we have thin-crust and deep-dish pizza. New York pizza is different from Italy; in New York, you walk down the street with the pizza folded and olive oil dripping down your arm. The only toppings I’m okay with are anchovies, olives, oregano, and red pepper. I don’t need much; fresh basil is nice to make a Margarita pizza. This pizza displays the color of the Italian flag, red, green, and white.

I really think I am the most popular food in the United States. Lots of countries take credit for me. I was called focaccia, just a flatbread, 2000 years ago. I have seen many things in my life. Did I ever tell you the time I first witnessed wine being discovered? I mean, what goes better with pizza than red wine.

So, I’m lying around just cooling off after just coming out of the oven, waiting to be devoured. All of a sudden, these Romans start throwing all these discarded pieces of fruit, mostly grapes, into a huge terra cotta vat in the corner. After a few days, it began to stink! It smelled like rotten eggs, which I learned was H2S, Hydrogen Sulfide. Whatever gave the Roman Centurian the idea to drink it? I thought for sure he would get sick and vomit. Instead, he suddenly turns to address the Roman Senate and says, “It needs more time.” Two weeks later, the rotting fruit turned into my favorite beverage – wine.

The same was true for cheese years ago; you encourage this mold to grow. The mold is yeast and is cultured into cheese. Many kinds of cheese really stink, so my question always was, “How do you know when cheese is bad?” You can just cut the mold off and eat the rest. I prefer “muzzarella,” aka mozzarella, made from Italian buffalo. The fresher, the better. Yes, I know “muzz” is hard to melt; that’s why the oven is over 1000 degrees.

I love when olive oil is drizzled over me; it tickles! The olive oil simmers, the cheese melts, and the tomatoes are cooked. Boy, do I smell good! I don’t even feel the pizza cutter slice through me. I am a pizza! I am round, square, and oval. Any way they make me; I am a pizza! Bon Appetite!

-

James Strebel is the President and CEO of REO Foreclosure Services. REO Foreclosure Services is a preferred referral partner of Gustan Cho Associates and its subsidiaries. The business model of “REO Foreclosure Services” typically refer to the suite of services provided by banks or financial institutions for managing properties that have been acquired through foreclosure. These services may include:

Property Management: Banks often need to manage the properties they acquire through foreclosure. This can involve tasks such as property maintenance, repairs, and ensuring that the property is secure.

Marketing and Sales: REO properties need to be marketed to potential buyers in order to sell them. This may involve advertising the properties through various channels, coordinating showings, and negotiating offers.

Title Services: Clearing title issues is an important aspect of selling REO properties. Banks may provide title services to ensure that the title is clear and marketable.

Closing Services: Once a buyer has been found for an REO property, closing services are needed to finalize the sale. This may involve coordinating with the buyer, their lender, and other parties involved in the transaction.

Asset Valuation: Banks need to accurately value their REO properties in order to determine listing prices and make informed decisions about their disposition.

Loss Mitigation: Some banks offer loss mitigation services to help distressed homeowners avoid foreclosure. This may include options such as loan modifications, short sales, or deed in lieu of foreclosure.

Overall, REO foreclosure services are designed to help banks efficiently manage and sell properties acquired through foreclosure while minimizing losses. @Lilboss

-

-

My dog is thirsty; he has been thirsty for the last three hours. His bowl is empty, and I don’t really care. My son took him on a long walk, and my dog returned very thirsty. His bowl can’t be more than three feet from me, yet I am unable to get up off my couch and replenish his water. Why? I have PTSD.

This is a crippling disorder that is not only mental and physical; it is a biological disorder. I never thought I would encounter something so physically and mentally disabling.

In brief, I was the first responder at a fatal, freaky accident that took the life of an innocent young girl younger than my daughters. An errant double axle tire came loose from a semi-truck and traveled 400 yards before crushing a girl to death, then bounced back at my wife and I. The tire destroyed our car and came within feet of killing us. I couldn’t save the girl. I carry that guilt.

I wrote a book about my experience some years ago, “Espiritus,” which helped set me on a new writing path to help me cope. Writing is my therapy. I always thought PTSD couldn’t affect me because I wasn’t a soldier who witnessed unspeakable things. PTSD is fairly new; in WW1, it was considered shell-shocked; in WW2, it was called battle fatigue. Vietnam introduced PTSD. Apparently, first responders, police, and firefighters can suffer as well. Anyone can suffer from this disorder. There is no cure, just ways of curbing the edge of this depression.

You go about your daily business, and suddenly you are derailed. There are many triggers.

The more you deny you suffer from PTSD, the worse it gets. Learning self-control of situations that suddenly hit you out of nowhere is something else that happens, and you need to find your “safe place” in your mind when this happens. I have a daily box of tools to delve into. My dog is one of my tools; he is extremely helpful. His unconditional love helps. My daily song for my bride releases my heart; planning and cooking dinner is great therapy, as well as long walks to sync my mind and body.

Finally, the most important part of my daily therapy is pausing several times each day to thank God for my wonderful life, followed by prayers for the young girl who died.

I support Wounded Warriors, and the proceeds from my book are donated to this worthy cause.

Thank you for reading my stories.

Peter Arcuri

-

Business credit cards are specialized credit cards designed for business-related expenses. They are offered by various financial institutions and are intended for use by businesses, regardless of their size – from small startups to large corporations. These cards provide a convenient way for businesses to separate their personal and business expenses, track their spending, and manage their cash flow. Here are some key features of business credit cards:

Separation of Business and Personal Expenses: Business credit cards help maintain a clear distinction between personal and business finances. This is essential for financial reporting, tax purposes, and overall financial management.

Expense Tracking: Many business credit cards offer detailed expense reporting tools. This can simplify accounting processes by providing categorized statements that make it easier to track and analyze business spending.

Rewards and Perks: Similar to personal credit cards, business credit cards often come with rewards programs, cashback incentives, and other perks. These rewards may be tailored to business-related expenses such as travel, office supplies, or telecommunications.

Employee Cards: Business credit cards often allow business owners to issue supplementary cards to employees. This can be helpful in managing employee spending, setting individual spending limits, and tracking expenses by employee.

Credit Building: Responsible use of a business credit card can contribute to building a positive credit history for the business. This can be valuable when the business needs to apply for loans or other forms of financing.

Higher Credit Limits: Business credit cards typically come with higher credit limits compared to personal credit cards. This can be advantageous for businesses that have significant operational expenses.

Access to Business Tools: Some business credit cards provide additional tools and resources, such as expense management software or travel benefits, to help businesses streamline their operations.

Interest Rates and Fees: Business credit cards may have varying interest rates and fees, so it’s important for business owners to carefully review the terms and conditions. Some cards may offer an introductory 0% APR period or other promotions.

It’s crucial for business owners to use business credit cards responsibly and pay attention to their terms and conditions. Keeping personal and business finances separate, monitoring expenses, and paying bills on time are key practices to make the most of these financial tools.

-

This discussion was modified 1 year, 5 months ago by

Chase.

Chase.

-

This discussion was modified 5 months, 1 week ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 5 months ago by

-

I think the C-8 Corvettes are hands down the best buy of the century. The C-8 Corvettes Corvertible are so sharp and priced for a fraction than its Italian exotic car countertparts. I really do not know what the price is on C-8 Corvettes but gave up looking for one because at one time, the C-8 corvette was selling $40,000 or more about its $70,000 msrp. Does anyone have any more information about the latest prices on the C-8 Corvettes? Are Corvettes a good investment?

-

I recently posted about the high prices for houses in Florida, especially Tampa. With the diligent help of Gustan Cho, Angie Torres and Donna Davidson, bless her Irish heart, they have come through! There is a place in Florida where the prices are reasonable. A brand new house on a quarter acre. Three bedrooms, two baths for under $270,000 list. Its a bit rural but beautiful. If you are curious about the area contact: Donna Davidson, she ultimately made our dream come true!

-

In our Forums, users or visitors can search or find member according to their profession which they used at time of registration.

For this search: – got o member page https://gcaforums.com/members/ and you can see All Type dropdown list, choose the profile type there like if you choose Doctors, the page show all members which select Doctor as their profession or profile type

See attachment for more clearance

-

Peter Arcuri is a professional writer and author of four books. Peter Arcuri and his wife Doreen live in Florida. Born and raised in New York, Peter Arcuri is a man of many talents and is a consultant to many entrepreneurs and businesses including GCA Group and its subsidiary partners. Peter Arcuri is also a member of GCA FORUMS and a contributer to the news division of Gustan Cho Associates and third party editor for all GCA Group websites and social media platforms. Here’s a Video by Peter Arcuri tge singing Wine Guy

-

Senator John Kennedy slams Joe Biden for ruining the United States economy. Joe Biden keeps on repeating he drove inflation down from. 9% to 3% and created jobs, infrastructure, and stability for Americans which are blatant lies..

-

Here’s a short prank racist joke

-

20 Million people are forecasted to lose their homes all at the same time. Many baby boomers took early retirement and now they cannot afford their homes. More on this topic coming.

-

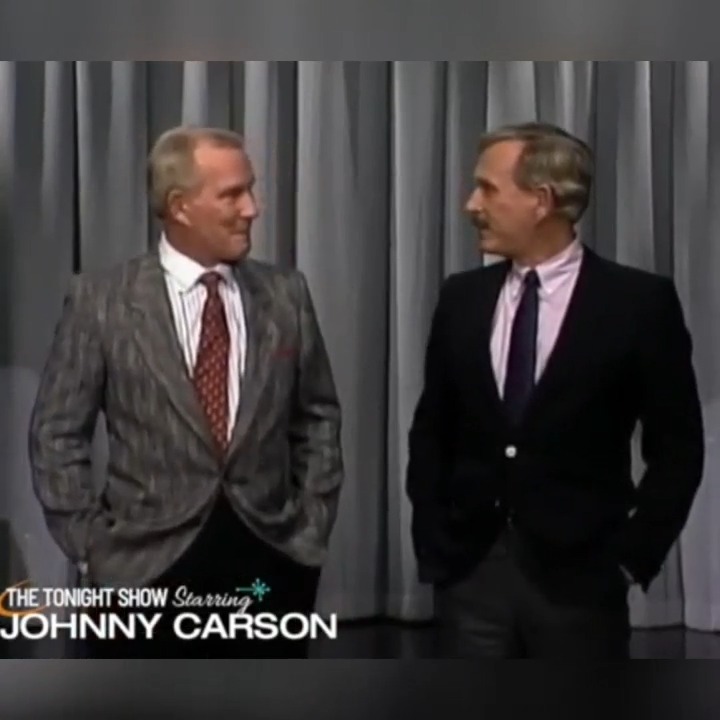

Here’s a funny comedy short from the Johnny Carson show

https://www.facebook.com/share/r/xCqEdP6dVFda6MzV/?mibextid=D5vuiz

facebook.com

Part 2 - Tommy Smothers Walks Out As Johnny | Carson Tonight Show

-

Who Pays for Lenders’ Mortgage Insurance?

In Australia, if you’re buying a house with a small deposit (less than 20% of the home’s price), you might need Lenders Mortgage Insurance (LMI). This insurance protects the lender if you can’t make your mortgage payments and they have to sell the house for less than what you owe. Usually, it’s the homebuyer who pays for it, not the bank. Think of it as an extra cost to help the lender feel secure about giving you the loan also feel free to reach out.

How is LMI Calculated?

LMI is primarily calculated based on the loan-to-value ratio (LVR), which is how much of the house’s value you’re borrowing. The higher the LVR, the more expensive the insurance. Other factors, like the size of your loan, also play a role. Typically, you can pay LMI as a one-time fee upfront or include it in your loan repayments. Different lenders have their own methods for calculating it, but they all consider similar factors like the amount you’re borrowing and the property’s value.

Can LMI Be Avoided?

Yes, you can avoid paying LMI by saving up a deposit of 20% or more of the home’s price. This makes you less risky to lenders. If saving that much isn’t possible, you might still avoid or reduce LMI by:

- Saving more to borrow less.

- Getting a guarantor, like a family member, to back your loan.

- Finding lenders offering no LMI deals for certain professions or conditions.

- Negotiating with your lender if you have strong finances.

Is LMI Transferable Between Loans or Properties?

No, LMI isn’t transferable. If you switch loans or buy a new property, you’ll likely have to pay LMI again if your deposit is less than 20% of the new property’s price. Each new loan application requires an evaluation of your borrowing amount and property value to determine if LMI is necessary.

What Happens to LMI If I Refinance?

When you refinance your mortgage in Australia, the LMI you paid on your original loan usually doesn’t carry over. If your new loan is more than 80% of your property’s value, you might need to pay LMI again. Each new loan application involves a fresh assessment of your borrowing needs and property value.

Does LMI Protect Me If I Can’t Make My Loan Payments?

No, LMI does not protect you if you can’t make your loan payments. It protects the lender. If you default on your mortgage and the lender sells your property for less than what you owe, LMI covers their losses. It doesn’t provide any financial help to you if you’re struggling with payments.

How Can I Reduce the Cost of LMI?

You can reduce the cost of LMI by:

- Saving more upfront to borrow less and lower the LMI cost.

- Shopping around for lenders with cheaper LMI rates.

- Getting a guarantor to avoid LMI altogether.

- Negotiating with your lender if you have a strong financial profile.

- Looking for special deals or discounts for certain professions or areas.

Are There Any Tax Implications with LMI?

For most people, there aren’t any direct tax implications with LMI. You usually can’t claim it on your taxes like mortgage interest. However, if LMI helps you get a bigger loan, you might pay more mortgage interest, which is tax-deductible for investment properties. If the property is used to earn income, the LMI cost might be deductible. It’s best to consult a tax professional for personalized advice.

How Do I Know If I’m Getting a Fair LMI Rate?

To ensure you’re getting a fair LMI rate:

- Shop around and compare rates from different lenders.

- Understand how your loan amount, deposit, and property value affect the rate.

- Compare multiple quotes to find the best deal.

- Consider the overall mortgage package, including interest rates and fees.

- Seek advice from a mortgage broker or financial advisor.

Can I Pay LMI Upfront or Does It Have to Be Capitalized on the Loan?

You have two options:

- Pay the full LMI cost upfront to reduce overall interest.

- Include the LMI cost in your loan amount and pay it off over time with your regular repayments.

What Factors Affect the Cost of LMI Apart from the Loan-to-Value Ratio (LVR)?

Other factors that affect LMI cost include:

- The loan amount: higher loan amounts usually mean higher LMI premiums.

- Property type: certain property types may be considered riskier.

- Your credit history: a good credit history might result in lower LMI rates.

- Loan term: longer loan terms can increase LMI costs.

- The lender’s LMI provider: different providers have varying rates.

Is There a Difference in LMI Rates Between Owner-Occupied Homes and Investment Properties?

Yes, LMI rates for investment properties are generally higher than for owner-occupied homes. Investment properties are seen as riskier because of potential rental income fluctuations and the borrower’s financial stability. This difference in rates should be considered when calculating the overall cost of purchasing an investment property.

Can LMI Be Refunded If I Pay Off My Mortgage Early?

No, in Australia, LMI is typically non-refundable. Once you’ve paid it, you can’t get a refund, even if you pay off your mortgage early.

What Are the Alternatives to Paying LMI for Low-Deposit Borrowers?

Instead of paying LMI, consider:

- A family guarantee, where a family member uses their home’s equity to secure your loan.

- Government schemes like the First Home Loan Deposit Scheme (FHLDS) for first-time buyers.

- Special offers from lenders that waive LMI if you meet certain conditions.

In a Nutshell

Understanding Lenders Mortgage Insurance (LMI) in Australia is essential for homebuyers. Knowing who pays for it, how it’s calculated, and ways to reduce costs can help you make smarter choices when getting a mortgage. By exploring these FAQs, you’ll feel more confident managing LMI and finding the best deal for your situation.

-

This is a frequently asked question from many real estate agents on behalf of their homebuyers. There are more and more homebuyers with bad credit than ever before. Many homebuyers with bad credit think they are the worst of the food chain and should not shop for the best mortgage rates. However, mortgage lenders today are starving for business and will work with bad credit borrowers in getting them the best rates. I just saw this guide on can you shop for the best mortgage rates with bad credit and I wanted to share this with everyone. It does make sense. By shopping for a mortgage with the best rates means getting a mortgage with bad credit with low credit scores with no discount points. Discount points are a total waste of money and you will never recoup discount points even on a refinance later when mortgage rates drop.

-

Biden Administration cronies are big fat liars. JOE BIDEN and his idiot gang of liars are in a state of denial on the economy. Look at this video Neil Caputo drilling one of BIDEN’S big fat lie on how Biden took over an economy with a 9% inflation and inflation is now under control. Total Bull Shit. Biden Administration screwed up the economy and America.