Angela

Dually LicensedForum Replies Created

-

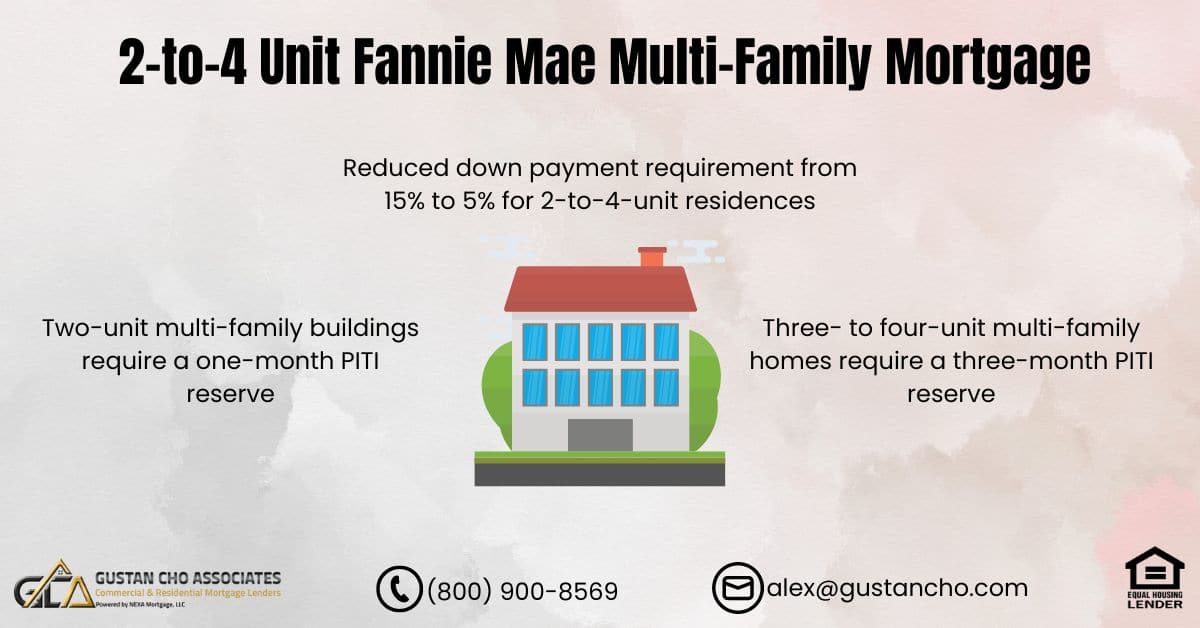

As of the last update, there was breaking news from Fannie Mae and Freddie Mac on two-to-four unit multi-family homes. In this subforum, we will cover the general guidelines provided by Fannie Mae for two-to-four-unit multi-family properties under Conventional loans. However, these guidelines can change, so it’s important to verify the latest details directly from Fannie Mae or through a reliable lender.

For Owner-Occupied Properties

- Down Payment: Typically, the minimum down payment for a multi-family property when the owner occupies one of the units can be as low as 5%, but it’s often 20-25% to avoid private mortgage insurance (PMI).

- Credit Score: Higher credit scores are generally required is 620 FICO or higher, but this can vary by lender.

- Each lender can have lender overlays which are higher lending requirements above and beyond Fannie Mae and Freddie Mac.

- Debt-to-Income Ratio (DTI): The maximum DTI is usually around 45%, but can be higher with compensating factors.

- Reserves: Borrowers might need reserves of six months’ worth of mortgage payments or more, depending on lender requirements.

For Second Homes

- Fannie Mae’s guidelines generally restrict second home designations to single-unit dwellings. Multi-unit properties typically do not qualify as second homes under Fannie Mae guidelines.

For Investment Properties

- Down Payment: The down payment requirement is usually higher for investment properties, often 25% or more for a multi-family property.

- Credit Score: Similar to owner-occupied loans, a higher credit score is beneficial, typically 680 or higher.

- DTI Ratio: More stringent DTI requirements, typically not exceeding 45%.

- Reserves: Borrowers may need significant reserves, often up to six months for each property owned, including the one being purchased.

Other Considerations

- Loan Limits: Be aware of the Fannie Mae loan limits, which vary by area and are higher for multi-unit properties.

- Mortgage Insurance: If the down payment is less than 20%, mortgage insurance will generally be required.

- Rental Income: For investment properties, rental income can be considered part of the borrower’s total income, but it often requires a history of property management experience or existing rental income streams to qualify.

These guidelines provide a framework, but Fannie Mae updates their underwriting criteria periodically to reflect changes in economic conditions and housing market dynamics. For the most accurate and current information, it’s best to consult directly with Fannie Mae’s official resources or speak to a mortgage professional who specializes in multi-family conventional loans.

https://gustancho.com/fannie-mae-multi-family-mortgage/

gustancho.com

UPDATED 2-to-4 Unit Fannie Mae Multi-Family Mortgage

Fannie Mae Multi-Family Mortgage on 2 To 4 Unit Homes: Owner occupant two to four unit homes require 15% down payment on conventional loans

-

Here is a video clip on how great Bidenomics is;

https://www.youtube.com/watch?v=vmnAYoXhc2c&t=167s&ab_channel=MSNBC

-

The Joe Biden Admistration and main stream media supporting the Joe Biden Adminstration are panicking and lying about economic numbers. What Inflation, they claim. Anyone supporting the far left liberals are trying to mask our state of economy and soaring inflation numbers. Fake news and misinformation about economic numbers and inflation can have significant consequences on public perception and policy decisions. It’s important to rely on credible sources and understand how to identify and debunk fake news. Here’s a guide on recognizing fake news about economic numbers and inflation, supported by multiple sources.

Identifying Fake News on Economic Numbers and Inflation

-

Check the Source:

- Credible Sources: Always verify information with credible and established sources such as government websites, respected financial news outlets, and reputable research institutions.

- Fact-Checking Websites: Use fact-checking websites like Snopes, FactCheck.org, and PolitiFact to verify claims.

-

Common Red Flags:

- Sensational Headlines: Be wary of sensational or alarmist headlines designed to provoke an emotional response rather than inform.

- Lack of Data: Reliable reports on economic numbers and inflation should include data and references to official statistics from sources like the Bureau of Labor Statistics (BLS), Federal Reserve, and other recognized entities.

-

Compare Multiple Sources:

- Cross-Verification: Check multiple news sources to see if the information is consistent. Discrepancies between credible sources and an outlier can indicate misinformation.

-

Understand the Basics:

- Economic Indicators: Familiarize yourself with basic economic indicators and their sources. For example, the Consumer Price Index (CPI) is a primary measure of inflation and is published by the BLS.

Examples of Misinformation

Case Study: Misleading Claims About Inflation Rates:

- Fake Claim: Some sources might claim inflation is skyrocketing based on selective data points or without considering seasonal adjustments.

- Debunking: Cross-checking with BLS reports and Federal Reserve analyses can provide context and accurate trends.

Resources for Accurate Information

-

Bureau of Labor Statistics (BLS):

- Official Data: The BLS provides accurate and up-to-date data on employment, inflation, and other economic indicators.

- Website: BLS.gov

-

Federal Reserve:

- Economic Research: The Federal Reserve offers comprehensive reports and analyses on economic conditions.

- Website: FederalReserve.gov

-

Fact-Checking Websites:

- PolitiFact: Evaluates the truthfulness of statements made by public figures and organizations.

- Website: PolitiFact.com

- FactCheck.org: A project of the Annenberg Public Policy Center, it checks the factual accuracy of claims.

- Website: FactCheck.org

Conclusion

To combat fake news on economic numbers and inflation, rely on credible sources, verify information through multiple channels, and understand the basics of economic indicators. By doing so, you can discern accurate information from misinformation and make informed decisions based on reliable

bls.gov

U.S. Bureau of Labor Statistics

The Bureau of Labor Statistics is the principal fact-finding agency for the Federal Government in the broad field of labor economics and statistics.

-

-

Angela

MemberMay 15, 2024 at 2:33 am in reply to: 10% Down Payment 2-to-4 unit Multifamily Non-qm LoansHere are some key points about multi-family homes: A multi-family home refers to a residential property that contains more than one housing unit. This includes duplexes, triplexes, fourplexes, and apartment buildings. The main advantage is that they produce rental income from the additional units beyond the one the owner occupies. This can help pay the mortgage and provide cash flow.

Multi-family properties are typically classified as residential real estate if they have four or fewer individual units. Properties with five or more units are considered commercial real estate. Financing for multi-family homes often requires a higher down payment compared to single-family residences, usually at least 20-25% down.

Lenders look at the potential rental income from vacant units when qualifying borrowers for multi-family loans.

Landlords of multi-family properties must comply with landlord-tenant laws and fair housing regulations.

Managing tenant turnover, maintenance, and repairs across multiple units is more involvement than a single-family rental.

So in summary, multi-family homes allow investors to live in one unit while generating rental income from the others, but also require more capital upfront and active landlording.

https://gustancho.com/2-to-4-unit-mortgage-loans/

-

This reply was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 1 year ago by

Sapna Sharma.

Sapna Sharma.

gustancho.com

2 To 4 Unit Mortgage Loans Mortgage Guidelines And Requirements

Gustan Cho of Gustan Cho Associates Mortgage Group now offers 3.5% down payment 2 to 4 unit mortgage loans in the United States with no lender overlays.

-

This reply was modified 1 year ago by

-

Bitcoin is not a buy according to Peter Schiff. Peter Schiff makes all the sense in the world.

-

Average to lower price homes in Sarasota Florida are still selling over list price. It is higher priced homes that are having a difficult time getting under contract. Many homeowners who purchased homes at its peak during 2021 and 2022 throughout the state of Florida are expected to take a major hit between $25% to 45% which diminishes their appreciation. Many homeowners who purchased homes before the peak will most likely not lose money but the probability they will wipe out all their capital gains is extremely likely most experts predict.

-

There’s difference between mobile homes and modular or manufactured homes. You normally cannot finance mobile homes because mobile homes are not considered real estate. Mobile homes have wheels and can be transported elsewhere. Manufactured homes are home sections manufactured elsewhere and have wheels to be trailered to there final destination. Once delivered the wheels come off and fixed to a slab where it can be tied down or fixed to a permanent foundation. Modular homes are manufactured elsewhere in sections or panels. The panels and parts are transported to the final destination where it is assembled there. Manufactured and mobile homes are considered riskier investments for lenders and investors, therefore loan-level pricing adjustment applies. Homeowner insurance is higher and so are the rates. Many lenders have overlays on manufactured and modular homes such as higher rates, higher credit scores, verification of rent, reserves, lower debt-to-income ratios, and may not finance single wide mobile version and only double wide with at least 1,000 square feet. Ask our preferred insurance agent @Brent about homeowners insurance premiums of manufactured and modular homes versus stick built homes. The last manufactured home I financed for a homebuyer had the lowest homeowners insurance premium of $2,500 on a manufactured home but has gotten quotes as high as $4,700 per year versus a stick built homeowner insurance premiums of $800 per year.

-

-

Angela

MemberApril 25, 2024 at 6:41 pm in reply to: Stress Management: How to Relieve and Reduce StressPleasure to meet you, Tatiana. How do you manage anxiety and stress? How do I manage my mind from stress?