Bailey

Commercial Mortgage LenderForum Replies Created

-

Lady Gaga – Always Remember Us This WayThat Arizona sky burning in your eyes

You look at me and, babe, I wanna catch on fire

It’s buried in my soul like California gold

You found the light in me that I couldn’t find

So when I’m all choked up

But I can’t find the words

Every time we say goodbye

Baby, it hurts

When the sun goes down

And the band won’t play

I’ll always remember us this way

Lovers in the night

Poets trying to write

We don’t know how to rhyme

But, damn, we try

But all I really know

You’re where I wanna

The part of me that’s you will never die.

So when I’m all choked up

But I can’t find the words

Every time we say goodbye

Baby, it hurts

When the sun goes down

And the band won’t play

I’ll always remember us this way

Oh, yeah

I don’t wanna be just a memory, baby, yeah

When I’m all choked up

But I can’t find the words

Every time we say goodbye

Baby, it hurts

When the sun goes down

And the band won’t play

I’ll always remember us this way, oh, yeah

When you look at me

And the whole world fades

I’ll always remember us this way

https://youtu.be/Cjpf1Q9njGw?si=SrjIt_GFOxzO-TRW-

This reply was modified 8 months, 3 weeks ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 8 months, 3 weeks ago by

-

Housing and Mortgage Market Summary: May 12, 2025 Key Trends

Mortgage Rates:

Compared to 8% in 2023, the current rate of 30-year fixed mortgages, sitting at 6.5–7%, is an improvement, although still high compared to the pre-2022 era. Remaining volatile, the rate will decrease to roughly 6% by late 2025.

Housing Supply:

There continues to be a 3.7 million-unit shortage as new construction cannot keep up with household creation despite a 2024 6.5% increase. Existing home inventory lags due to the lock-in effect.

Home Prices:

Moderately increasing, the median price is expected to reach $420,000 by Q3 2024. Growth is forecasted at around 1-2% above inflation through 2029. The bolstering of homeowner wealth increases for equity-rich homes to 47%.

Mortgage Performance:

Expect a modest rise in 2025 origination volumes of $429 billion during Q2 2024, accompanied by a delinquency rate of 3.92% alongside serious delinquencies at 1.55%.

Policy Impacts:

Trump’s proposed tariffs and the federal land outline raise the supply side of construction costs, increasing housing affordability.

Market Outlook

Opportunities:

Declining rates and increased equity may boost demand and inventory, particularly for first-time buyers.

Challenges:

Without major policy changes or rate shifts, the description of a “tremendous explosion” seems a bit too far off the mark, given the high tariff-driven costs, low supply, and rampant inflation.

Risks:

Tariff retaliation and the possibility of China selling MBS could raise inflation rates while delaying cuts from the Fed.

Recommendations

Buyers:

Prioritize monthly payment affordability over market timing. Consider incentives from builders and assistance with down payments.

Homeowners:

Utilize equity for renovations or selling if relocating, but consider the increased rates on new mortgages.

Investors:

Track Federal Reserve policies and their impact on tariffs, yields, and construction costs for a housing-related investment.

-

Bailey

MemberMay 11, 2025 at 8:30 pm in reply to: GCA Forums News Weekend Edition from May 5-11 2025The constant stream of voices on podcasts and social media can make navigating the housing and mortgage industry overwhelmingly flooded with opinions, especially when sensationalized claims dominate the conversation. Let’s sift through the chaos and concentrate on what matters most: applying the latest trustworthy updates from analysts and industry professionals. Many of you are frustrated with self-styled commentators and doom-and-gloom narratives that dominate the discourse. To address some of those concerns, I would like to provide factual information, but I am not, in any capacity, associated with Great Community Authority Forums (GCA Forums) or their news outlet. Regardless, I will follow the preference for professional-grade and reliable information.

Countering the Gloom-and-Doom Narrative

On platforms like Facebook or YouTube, “gloomers and doomers” content creators seem to be fixated on the worst-case scenarios. They often talk about how the housing market is ready to implode or mortgage rates are hitting unmanageable levels. This becomes even more dangerous when you hear of a podcaster with no verifiable expertise in housing or the mortgage markets. While admitting a few challenges, today’s market is not near the state it was in the Great Depression. To put it bluntly, most of the alarmist claims being made are filled with contextless contradictions.

For the sake of first-time homebuyers, I would like to provide a reasoned narrative by outlining my take on the current state of the housing and mortgage market, using recent data and trends.

Current News on Housing and Mortgages (Updated May 11, 2025)

Informative news about the housing market and mortgages has been collected from various sources. Here is a brief overview of what I found:

Current Mortgage Rate and Loan Changes in the Market

Current Rates:

- In May 2025, the mortgage rates for a 30-year fixed mortgage were 6.78%, a 15-year fixed was 5.95%, and a five-over-one ARM was 6.20%.

- Moreover, Bankrates.com reports a 30-year record at 6.82, an increase from what they saw in the early bird season.

Trends:

- Even though the rates are the same in September 2023, there is a sign of an increase.

- Earnings calls from Republic Airways and Schlumberger suggest that the woes of these mysterious forces could be decreasing, equalizing demand.

- Examining this moving goalpost is complicated when looking towards the future and considering the changes made to the Overseas Young Men’s Club Tariff.

- Changing locks on slowly resetting factors like tariffs and inflation would spell disaster.

Circumstances:

- Surging inflation has hit normal users particularly hard in the last decade.

- Home prices hit 403,700 dollars in March 2025, up from 2,000 to their current 2,870, making the ambitions’ monthly payments tough.

- But the good side is no different from the upper limit of 50 averaged.

Real Estate Activity: Sluggish but Showing Signs of Life

Demand Spike:

- New American Funding noted an increase in buyer interest, with mortgage applications reaching a peak on May 7, 2025.

- This is attributed to increasing buyer confidence, possibly from stabilizing rates or pent-up demand.

Sales, Listings, and Market Trends:

- As of March 2025, existing home sales were down 5.9% month-over-month, and pending sales were down 2.8% year-over-year, indicating a downturn in the market.

- However, new listings have risen 6.1% year-over-year, indicating increased inventory.

- Additionally, the median days on the home market have increased, demonstrating a slower sales pace.

Pricing Problems:

- First-time buyers are facing new challenges when it comes to affordability as prices continue to remain high.

- The median family income of $97,800 in 2024 and rising home values and student debt create additional strain.

- On the other hand, some buyers are taking advantage of FHA and 203(k) loans, which allow for lower barriers to entry, such as a 580 credit score and only 3.5% down payment requirements.

Refinancing Opportunities:

- Increased credit card debt draws more buyers towards refinancing options.

- Industry leaders, like Patty Arvielo from New American Funding, expect a booming refinance market.

Buydown Options:

- Rate reduction strategies like temporary buydowns (for instance, the 2-1 buydown, where rates are decreased by 2% in year one and 1% in the second year) are gaining traction.

- They provide temporary relief.

Regulatory and Fraud Developments

Mortgage Fraud Investigation:

- The DOJ is investigating New York AG Letitia James for alleged mortgage fraud involving lying about a home’s primary residence to obtain more favorable loan terms.

- This demonstrates some of the scrutiny within the industry.

UK Changes:

- The Financial Conduct Authority is lifting some restrictions on mortgage lending in the UK by streamlining affordability evaluations, which may ignite similar debates in the US.

Economic and Policy Influences

Concerns about a Global Trade Policy:

- President Trump’s new tariffs may impede international commerce, jeopardize supply chains, and raise inflation, increasing mortgage rates.

Federal Reserve Approach:

- The pause in rate cuts suggests mortgage rates won’t fall quickly, as the Fed remains cautious due to unpredictable economic conditions.

Consumer spending:

- Subdued consumer confidence and the current economic landscape have delayed high-value purchases.

- Still, a rebound remains possible if economic conditions improve.

Doomsayers and Their Myths:

A Perspective Shift

- The podcasters asserting that the mortgage rate is “sky-high” or that the housing market is “at its worst ever since the Great Depression” are using hyperbole to grab attention.

Here is the analysis:

Not the Great Depression:

- During the Great Depression, unemployment was above 20%, and home prices fell by 25-50%.

- Now, unemployment is roughly 4%, and, in many regions, home prices are stable or rising.

- The 2008 financial crisis was more severe than today due to rampant foreclosures and a freeze in the credit market.

Rates in Context:

- Mortgage rates of 6.78-6.82% are high compared to 2020-2021.

- However, they are lower than the 18% peak in the 1980s and the 7.5-8% average during the 1990s.

- Statements claiming rates are “going through the roof” completely ignore historical benchmarks.

First-Time Buyers Not Fully Priced Out:

- Even though the market has become more difficult with players such as first-time buyers, there are still FHA loans, VA loans, and down payment assistance programs, making it easier for first-time buyers to purchase homes.

- On top of that, 56% of borrowers only get preapproval from one lender, improving their chances.

Unqualified Voices:

- Numerous podcasters do not possess an NMLS license and do not have experience as mortgage loan originators, realtors, or economists.

- Unlike HousingWire, Bankrate, and Mortgage News Daily, whose forecasts are made by licensed professionals or vetted industry experts, podcasters base their forecasts solely on fear.

Advice for First-Time Homebuyers

While the market does not seem apocalyptic, it is surely tough. Here’s how to tackle it:

Don’t Settle for the First Offer:

- Getting preapproved by one lender does not mean you have to stop there.

- Always check multiple lenders to achieve the lowest rate available.

Check for Other Loan Types:

- There are loans like FHA (3.5% down, 580+ credit score), VA loans for veteran members, and 203(k) loans for those looking to buy and repair homes that ease access.

Buydown Considerations:

- Temporary buydowns that reduce payments in the short term can make the first few years affordable.

Hire Experts:

- Always hire professionals such as NMLS-licensed mortgage loan originators or certified financial advisors.

- Don’t rely on social media personalities without verification.

Market Timing:

- Risking a “crash” in rates overlooks the unpredictability of forecasts.

- If you find a favorable home within your budget, buying now is better, as rates could be locked and refinanced later if rates drop.

Stay Informed:

- Follow credible and professional sources for data-driven updates, such as HousingWire, Bankrate, or Mortgage News Daily.

- For GCA Forums, trustworthy content can be directly trusted by licensed professionals if it can be trusted.

Why Trust This Analysis?

This is unlike podcasters, who chase views and do not prioritize the truth. This has been analyzed against data from reputable sources such as HousingWire, Bankrate, and Mortgage News Daily, which hire or cite professionals bound by ethics and licensed and editorial standards. X posts are added carefully to capture sentiment but are ignored as truth without verification. My approach scrutinizes panic narratives, adding historical counterclaims, turning your trusted facts credible, and balancing harsh exaggerations you expect alongside professional analysis and verification.

High interest rates, economic uncertainty, and affordability issues are all hurdles homeowners face in today’s market. This doesn’t spell apocalypse, though – far from it. The market offers considerable help for first-time buyers through government-backed loans or strategic rate shopping. Overlook the noise made by amateur podcasters without formal credentials and instead make choices based on cold, hard facts. If you are interested, I can develop deeper analyses of loan options, local market trends, or GCA Forums content if you share a link or details. Please tell me how else I can help.

-

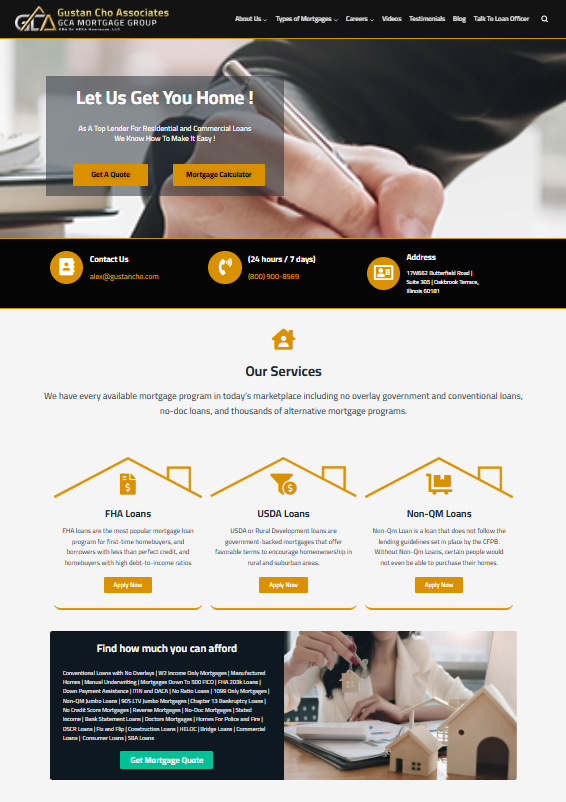

About Gustan Cho Associates

As Your Trusted Partner in Alternative Mortgage Solutions, Gustan Cho Associates believes every person has a right to call a house a home, no matter their credit score or money story. Traditional banks won’t always say yes, so we stepped in and built a name for ourselves by saying yes far more often than no. We focus on finding workable paths to a mortgage, not listing reasons a borrower won’t fit the usual mold.

Our Goals and Mission

- Eighty percent of the folks who walk through our virtual door were turned away by a bank down the street.

- That record proves we’ve become a lighthouse for buyers who thought the loan sea was too rough.

- We keep the mission simple: personal touch, wide-ranging options, and real invitations to homeownership.

What Sets Us Apart

Your One-Stop Mortgage Shop:

- Try to list what’s missing from our menu, and you won’t be writing for long.

- Business cash, commercial deals, hard money-whatever those buckets hold-were not dipping into them.

- We shine in everyday sticks-and-bricks loans that bend instead of break for the borrower.

No Lender Overlays:

Ask for FHA, VA, USDA, or conventional backing, and you’ll hit the same sweet spot with us- no extra hoops patched on by a nervous lender. Strip away the usual overlays, and the mortgage door swings wider.

Flexible Credit Standards

Sometimes, life throws curveballs, and a 500 FICO score can feel like a brick wall. We lower that wall so homeownership remains within reach, even when past credit dramas linger.

Vast Lending Network

- Because we are both mortgage brokers and correspondent lenders, we don’t have just one playbook:

- We have over 280 options on the shelf.

- Each wholesaler and investor in our Rolodex fills a different borrower gap.

Coast-to-Coast Footprint

- Licensed in 48 states (MA and NY pending) plus D.C., Puerto Rico, the Virgin Islands, and Guam, we can help a client in Portland or Ponce with the same level of care. No corner of the map has to miss out on thoughtful mortgage advice.

The Family Brand

- Gustan Cho Associates doesn’t just sit behind a single sign.

- We split the workload across several in-house shops, each built for a specific type of lending story.

- Expect different windows to serve different financial chapters.

GCA Mortgage Group

GCA Mortgage Group is the workhorse division, where underwriters get eyes on quirky income docs and crazy self-employment tax returns. Personal touches still matter when a numbers-heavy world feels cold.

Website: https://www.gcamortgage.com

Great Community Authority Forums

- Great Community Authority Forums exist to decode the jargon.

- Daily Breaking News through GCA Forums News, webinars, blogs, business directories, classified ads, and a lively comments section gives borrowers the low-down without hiring a lawyer or lender first.

- We also have a widely used Resource Center to help you with your homebuying or refinancing needs.

Website: https://gcaforums.com

Mortgage Lenders for Bad Credit

- Mortgage Lenders for Bad Credit run a tighter lane, digging into credit scars to find livable financing.

- This team follows every score drop and late payment with lenders who don’t shade an entire application when one blemish appears.

Website: https;//mortgagelendersforbadcredit.com

Non-QM Mortgage Lenders

Our non-QM team has your back if traditional paperwork gives you a headache. We specialize in self-employed borrowers and real estate pros who can pay their bills but don’t fit the usual mortgage mold. Instead of W-2s, we look at bank statements, 1099s, or whatever shows your cash flow, so you can keep moving toward that next property.

Website: https://non-qmmortgagelenders.com

Market-Leading Rates

Finding great rates can feel like hunting for a needle in a haystack, especially when the economy shifts. Luckily, our rate team is dialed in with lenders willing to bend a little, even when times are tough. We focus on locking in terms that let you save more without extra hoops.

FHA Options for Credit Challengers

Bad credit isn’t a deal-breaker in our book, and it is not with FHA backing the loan. Our niche FHA group works hand-in-hand with folks who are rebuilding their scores or buying a first home on a limited budget. Streamlined processing and government-guaranteed rules mean you spend less time guessing and more time packing boxes.

Why We Do This

We function as both hands-on mortgage brokers and behind-the-scenes correspondent lenders. That dual role gives you the warmth of a small team plus the muscle of 280 wholesale lenders. By shopping your application across that wide network, we chase the loan program that fits you best- no one-size-fits-all nonsense.

Scope of Work and Mission of Gustan Cho Associates

- Gustan Cho Associates is more than a lender.

- We see ourselves as your co-pilot in the mortgage sky.

- That means we sit down, listen, and figure out your money story.

- After sorting through your details, we scan our huge network of lenders and pull together options that make sense for you, not for some one-size-fits-all brochure.

- Decades of hands-on work with alternative lending sit behind every bit of advice you’ll get, so the guidance feels practical, not textbook.

Website: https://gustancho.com

A big part of that know-how comes from steady ties to specialty lenders who aren’t shy about backing tricky borrower profiles.

Why Choose Gustan Cho Associates? Proven Record:

Roughly 80 out of every 100 clients we serve once heard the polite no from another shop, so tough cases are routine for us.

Deep Network:

Partnering with 280 wholesalers and investors means we can hunt down the right loan no matter how unique your profile might be.

Dual Role:

Acting as both mortgage broker and correspondent lender lets us show you brokered rates one minute and direct terms the next. That flexibility can save both cash and closing time.

No Extra Hurdles:

Many lenders apply secret rules, lender overlays that knock good borrowers off the list. We skip that nonsense and stick to the core FHA, VA, USDA, and conventional guidelines.

Nationwide Reach:

We can close your loan if you’re in a bustling city or a tiny territory. Gustan Cho Associates is active in 48 states, plus D.C., Puerto Rico, the Virgin Islands, and Guam.

Life-Changing Service:

- At Gustan Cho Associates, pushing papers is secondary: changing lives is the goal.

- We’d love to turn your homeownership wish into a signature on a closing document, no matter how bumpy your credit path has been.

Curious about what a mortgage could look like for you? Give us a shout at 800-900-8569, and you’ll see why so many people lean on Gustan Cho Associates for flexible loan options. You may text or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, including late evenings, weekends, and holidays.

https://www.youtube.com/watch?v=E_NkdW0Kwm8

-

This reply was modified 9 months ago by

Sapna Sharma.

Sapna Sharma.

-

This reply was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

gcamortgage.com

Mortgages & Home Loan Lenders | GCA Mortgage Group

Conventional Loans with No Overlays | W2 Income Only Mortgages | Manufactured Homes | Manual Underwriting | Mortgages Down To 500 FICO | FHA 203k Loans | Down

-

Tax talk can feel dense, but the real-world math almost always revolves around how much cash folks keep in their wallets. Let’s run through several typical taxpayers who are in your neighborhood.

Married W-2 Couple, $170K

- With the One Big Beautiful Bill, the couple stays in the same bracket, the $32,000 standard deduction remains, and the $30,000-$40,000 SALT cap remains, edging them toward the ceiling.

- A new paycheck, overtime tip, and a break land on top, giving them a small bonus no one asked for.

- In short, they pad their return by a few hundred bucks or hold even instead of falling behind.

- There is no OBA, no cushion.

- When 2025 rolls in, brackets climb, the deduction shrinks, and the SALT limit flips back to $10,000.

- The CBO folks and, frankly, the economists at the Action Forum figure their bill jumps by 5% to 10%, not the headline 67% that keeps zooming around the talk shows.

Single W-2 Earner, $100K

- It’s the same story at a different income level.

- This one-worker household lands a lower marginal rate, pockets the same big standard, and then benefits from that tip-and-overtime goodie.

- Tax software will flag the number as modest savings, which feels accurate enough for a paycheck-by-paycheck life.

- Flip the equation, and the OBA disappears, the bracket creeps up, and the same deductions drop, leaving the Earner looking at an effective increase in the ballpark of 5% to 8% based on distribution studies.

Mom-and-Pop Construction Crew (Pass-Through)

- Small construction outfits filing as pass-throughs see a sharper change.

- The new package raises the existing 20% pass-through break to 23%, tacking on immediate hundred-dollar relief for everyone from drywallers to roofers.

- They expense gear in one year instead of spreading it.

- If the bill doesn’t clear the finish line, that deduction slides back, and expensing limits snap on again.

- The crew’s tax hit creeps up by 5% to 15%, depending on how fat the payroll checks look.

Mom-and-Pop Used Car Lot

- A local dealer that qualifies for the OBA can write off big repair bills in the same year they spend the cash.

- That modest tax break often means they pay less to the IRS.

- If you skip the new rules, some shops will lose those write-offs.

- Taxes will climb, but most experts peg that jump at only 5 to 10 percent.

The 67% Tax Hike Myth

- Supporters of the fail-safe budget fix claim the average American will see a 67 percent bump.

- A quick look at CBO math shows no such avalanche.

- According to AmericanActionForum, Households that miss the bill face roughly 5 to 15 percent higher taxes.

- It stings, but nobody is being crushed overnight.

Clean Energy and Job Risks

- OBA strips or slowly ends the credits that a solar firm counts on.

- Data from Time says that the move could wipe out more than 830,000 jobs in panels and windmills.

- Economists at Scientific American warn that if the fix clears Congress, annual new installations of renewable gear could drop about 20 percent by 2040.

- Families pay hundreds more for electricity annually because clean projects cost more without the credits.

- That is a 7 or 8 percent jump in most electric bills.

Key Takeaway List

- Tax clauses buried in OBBBA tilt heavily toward wealthy filers.

- Ordinary W-2 workers see almost nothing, even though the headline number sounds shocking.

- Small firms save a little on payrolls, yet the relief is far from dramatic.

- Low-income voters who lean on Medicaid or SNAP feel the pinch hard because spending caps will squeeze those programs.

- Clean-energy factories, scientists, and environmental advocates agree that passing OBA could stifle America’s green investment boom.

- Are you curious where all this budget talk ends in your kitchen drawer?

- I can lay out the CB sports household-level curves so you can eyeball the spread yourself.

Want a front-row seat to how clean-energy jobs will bounce around state lines once OBA shakes out? A side-by-side set of case studies is ready and waiting.

Tariff factories, green tech start-ups, coal country electricians, and everyone else ask the same question: Which play slides faster under OBA, and how does that stack up against the Inflation Reduction Act? The quick comparative chart tells the story.

-

Yes, can you please explore the Big Beautiful Bill among the various income brackets?

-

Bailey

MemberMarch 19, 2025 at 4:47 pm in reply to: GCA Forums Headline News for Wednesday March 19 2025Indeed, there were discussions and attempts to modify the U.S. Constitution with respect to the power of presidential pardon, albeit none have gone through the required legislative procedures.

Following are some attempts and discussions of these:

Historical Proposals:

- Over the years, a number of American lawmakers and legal scholars have come up with suggestions proposing a limitation or at least some form of clarification to the presidential pardoning powers.

- These suggestions came as a direct response to controversial and highly publicized pardons that sparked a nationwide wave of public anger.

Post-Watergate Reforms:

- There were debates to limit the pardon powers after President Ford pardoned former President Nixon due to fears of future misuse.

- There were suggestions that stated pardons should be accompanied with congressional approval, or at the very least, be suffocated for serious crimes.

1980s and 1990s Discussions:

- During the Reagan and Clinton’s presidential terms, there was a notable rise in the discussion concerning reforms to the process of pardoning.

- Almost all stakeholders advocated for more control and visibility over the issuance of controversial pardons.

Recent Proposals:

- More recently, there have been legislative considerations to amend the constitution, especially following high-profile pardons by Presidents Trump and Biden.

- Such proposals tend to center around issues of political corruption, granting an increased focus on accountability by enforcing a review process prior to the grant of pardon.

Regardless of the conversations held, no constitutional amendments concerning presidential pardons have garnered enough attention to progress through Congress. It is purposefully made hard to change or amend the Constitution in the USA – it requires a two-thirds majority in both the House and Senate, or two-thirds of state legislatures call a convention. After that, three-fourths of the states have to approve it. Therefore, suggestions to amend the pardon power exist as mere speculation and have not resulted in formal legislative proposals.

-

Bailey

MemberMarch 19, 2025 at 4:42 pm in reply to: GCA Forums Headline News for Wednesday March 19 2025Once granted, no presidential pardons have been legally contested as being irrevocably bound to the U.S Constitution’s executive powers, and would be considered nullified. Despite public scrunity, several pardons have been literally challenged within a legal framework but not fundamentally revoked. A few descriptions are provided below:

Gerald Ford and Richard Nixon

Despite ire and political unpopularity, Nixon’s pardon was never revoked and resisted out of court. The legal battles were more around the broader context and implications of the pardon instead of a claim for action that would seek to lift the legal order.

Jimmy Carter and Vietnam War Draft Evaders

Carter’s pardon was subject to criticism, but there was never a legal tussle where they sought to issue a challenge for revocation. The political cost was enormous but they politically processed these documents.

Bill Clinton and Marc Rich

Rich’s pardon did incur some backlash including calls for legal challenge but to no avail. Political arguments surrounding it were centered on the existence of a court without defenses based on political motivations.

George W. Bush and I. Lewis “Scooter” Libby

There were scrutizny and demands for his conviction after Liber’s sentence was commuted but the pardon received no legal litigation, nor was there debate to sue over it.

Donald Trump and His Widley Disregarded Pardons

Pardons problematic in their public reception, such as those given to Michael Flynn and Roger Stone, had no legal challenges that could rescind them. The legal difficulties concerning the questions for the underlying convictions remained estranged from the legal issues relevant to the pardons.

In general, the controversies surrounding granting pardons are numerous and heavily fraught with partisanship and agitated allegations. However, the legal structure dealing with the power to issue a presidential pardon creates obstacles to rescinding it after it has already been exercised.

-

Bailey

MemberMarch 19, 2025 at 4:36 pm in reply to: GCA Forums Headline News for Wednesday March 19 2025Ford and Nixon (1974)

Notable Pardon:

- President Ford decided to grant Nixon a pardon for any deeds he did during his presidency, including the Watergate scandal.

Challenges:

- This pardon faced legal hurdles and public backlash.

- Many critics also claimed it set a dangerous precedent for the American democracy.

Jimmy Carter and Vietnam War Draft Evaders (1977):

Notable Pardon:

- Ignoring the draft during the Vietnam War is considered a crime.

- However, President Carter decided to pardon those who did so.

Challenges:

- There were sustained protests from veterans and active personnel.

- Fulfilling the social contract and escaping were starkly divided, leading to intense public discussion.

Marc Rich and Bill Clinton (2001)

Notable Pardon:

- Financial fugitive Marc Rich was controversially pardoned by Clinton.

- He faced multiple charges for tax evasion and other financial crimes.

Challenges:

- People widely disapproved Clinton’s decision due to the political donations which came from Rich.

- It raised concerns regarding the money inteferance in the pardon and political inquiry became very common.

George W. Bush granted clemency to I. Lewis “Scooter” Libby in 2007 on the following grounds:

Pardon:

- President Bush commuted the sentence of I. Lewis Libby, who was convicted of perjury and obstruction of justice in the CIA leak case.

Challenges:

- The decision faced criticism for seeming to protect a political ally from facing consequences, igniting discussions regarding the legitimacy of presidential pardons in cases that are politically volatile.

Donald Trump’s term in office from 2017 to 2021 came with several controversial pardons.

Pardon:

- President Trump issued several controversial pardons, including those for individuals involved in high-profile criminal cases, such as Michael Flynn and Roger Stone.

Challenges:

- The pardons drew fierce criticism and scrutiny, especially from people who believed there was no substantial justification for the pardons other than the recipients’ association with Trump.

The examples highlight how the use of presidential pardons, this time in the hands of Presidents Trump and Bush, can result in multifaceted legal complications that provoke critical thought about the state of democracy in the country.