Bentley

OtherForum Replies Created

-

Getting a USDA loan and an FHA loan at the same time can be complicated and is generally not allowed. Here are some things to know: USDA loans are for primary residences only. The home being financed with a USDA loan must be the borrower’s main residence. Similarly, FHA loans are also for primary residences. The borrower is required to live in the property as their primary home. Both of these loans require strict occupancy rules.

They must certify that they will occupy the house as their principal residence. There may be exceptions in rare cases; for example, if someone has a USDA loan on their primary home and wants to buy another one because they’re moving for work and need two places to live temporarily or permanently until they sell the first one (which would also have been considered their previous “primary” residence). However, getting approval for such an exception is difficult and involves providing lots of evidence plus good reasons why it should be granted along with strong justification(s) thereof.Suppose a person already has a USDA mortgage loan on their main living address but now wants to purchase another property that will serve as his/her second/vacation home; what this means is that he/she needs prove beyond reasonable doubt that the new house shall become his/her main dwelling place.If the initial dwelling place acquired through financing provided by United States Department Of Agriculture (USDA) still belongs to its buyer; then no other homes may be procured via this particular type of funding while FHA-owned houses exist.If such individual already possesses Federal Housing Administration insured mortgage credit facility which enabled him/her acquire current abode; then before applying again using similar scheme but seeking finance from US Department Of Agriculture Rural Development Program (RD); there certain requirements which have got be met so that this new structure can qualify under definition prescribed under current statute law: e.g., it has never served as his principal homestead at any time prior thereto or else had ceased functioning in that capacity before application was made.Also, it is very rare for someone to have both an FHA loan and a USDA Rural Development Program mortgage at the same time. In order for these circumstances occur, there must be extenuating factors which would require additional documentation from the borrower as well stricter guidelines set forth by each respective lending program involved with this type of transaction. The best thing you can do if you are considering getting a USDA or FHA loan (or both) is talk to lenders who work with these types of loans frequently. They will be able to give more specific information about what is possible based on your particular situation. If there are special reasons why someone might need two different types of government-backed mortgages simultaneously, such as being relocated by one’s employer across state lines; then make sure all necessary papers are filled out completely so that there no doubts whatsoever concerning applicant(s) genuine intention(s) behind such action(s) nor their ability(ies) show cause thereof convincingly to both financial institution(s). If you want to buy another house besides the first one bought through FHA financing; then don’t use USDA loan to fund second home purchase. These programs have similar requirements about primary residence ownership but they don’t always match up perfectly in practice which means that technically speaking it may still be possible under certain limited circumstances where somebody could get approved for one type while being denied other due mainly – although not exclusively -to differing interpretations given by different agencies responsible for administering them.Simultaneous receipt by any person(s) two primary residences using US Department Agriculture (USDA) Rural Development Program (RD); plus those acquired via Federal Housing Administration insured credit facility; although theoretically feasible only under very exceptional conditions usually cannot happen because rules governing eligibility into programs precludes most individuals from qualifying for either during their entire lifetime unless otherwise stated differently by law makers themselves hence should consult knowledgeable lenders in order find alternative solutions ensure compliance with all regulations applicable hereupon

-

It may be hard to qualify for USDA loans with unpaid collection accounts, charge-off accounts, and recent late payments. But USDA guidelines do allow some flexibility. Here are the main points: All accounts that went into collections don’t have to be paid off in accordance with the guidelines provided by USDA. Nonetheless, there could be overlays (additional requirements) for lenders that need collections to be paid off. Check with the specific lender you’re working with as it is important. If there are large amounts of money owed on collections; setting up a payment plan and making regular payments might help. The lender may require additional documentation or explanations if significant charge-off amounts exist although they are not repaid back based on what was stated under USDA rules . A borrower’s eligibility can be affected by having late payments within one year before applying for this loan program at any time during those 12 months all bills must have been paid on date due without exception unless good cause can shown why such action did not occur according to United States Department of Agriculture Rural Development Agency Guidelines Typically, lenders want to see at least 12 months worth of timely rental history but sometimes there’re exceptions especially when strong compensating factors (such as low debt-to-income ratio, stable employment, or significant savings) exist underwriting flexibility could look like When bad credit such as unpaid collections; charge-offs; and/or late pays are present in a file other things might be needed to make it stronger: Solid continuous employment with enough money coming in every month Lower DTI ratios will offset some credit issues Saving a lot of cash demonstrates financial stability in cases where payment plans worked out well for major collection items written explanations should State what happened and why you couldn’t pay or perform under adverse circumstances so please make sure these steps have been taken into account.

Steps For Getting Approved

Review Credit Report:

Make sure everything is accurate.

Dispute any errors.

Talk To A Lender Who Knows About USDA Loans

Go over the particulars with them.

Let them help you.

Prepare Financial Documentation That Shows Stability & Ability To Payback Loan

Consider setting up payment plans and making timely payments for significant collections

Write a clear explanation why any late payments or adverse credit events happened and how much it affected your score, especially if it was beyond anyone’s control.

Nevertheless, unpaid collections; charge-offs; and recent late payments do make qualifying for a USDA loan more complicated. However they might not necessarily be deal breakers since lenders will take into account overall credit profile including compensating factors. Therefore, ensure that you are working with an experienced loan officer who is capable of aligning their overlays to fit within USDA guidelines where applicable. In case your client can provide adequate documentation along side substantial compensating factors then they may still qualify despite having some credit challenges when applying under this program.

-

Bentley

MemberJuly 1, 2024 at 6:28 pm in reply to: Can you qualify for USDA LOANS while in Chapter 13 BankruptcyThough it is likely to be, the ability to qualify for a USDA loan while in Chapter 13 bankruptcy can be difficult. The lender must gain permission from the court so as to enter another debt obligation. This consists of taking on a different mortgage. The borrower should show the bankruptcy trustee he or she pays bills punctually every month. Normally, this means paying under their Chapter 13 plan for at least one year without being late.

The borrower needs to satisfy some credit requirements set by USDA and creditors themselves too. One of such stipulations is having at least minimal credit score which might be around six hundred and forty points depending on where you apply from; also during repayment period they must re-establish or maintain good credit history again.

USDA’s ratio between debts vs incomes (DTI) cannot exceed specific limits otherwise not granted eligibility status towards receiving any assistance whatsoever from US Department Of Agriculture housing programs such like loans unless otherwise stated herein before signed off upon these papers by both parties concerned here within.

Gross monthly income is that amount of money earned by an individual before taxes are deducted while net monthly income refers to what remains after subtracting all mandatory deductions like taxes paid directly out of wages/salary from gross pay received during a given period usually one month – often referred simply as “take-home” pay since it represents actual cash brought home each payday.

Borrower has stable employment with minimum two years work experience same employer proving stability plus reliable source funds in order meet future obligations related this mortgage agreement; otherwise no consideration will be given until further notice.

Property must fall within specific geographical boundaries recognized officially as rural areas according official maps published annually by United States Geological Survey (USGS); these may change over time due factors beyond control individuals involved herein hence always ensure checking latest updates online at http://www.usgs.gov before making final decision whether apply for loan here or not based on current location where intending purchase land/build house/both together as per your personal needs/preferences.

-

Refinancing on an FHA loan to a USDA loan normally cannot happen as USDA loans are meant for rural area home purchase that require the property to meet specific geographical and income eligibility standards not required by FHA loans. However, here is an elaborate guide on how to go about refinancing an existing USDA loan or if you want to know more about USDA refinance process. There are three main types of refinance loans provided by the USDA:

Streamlined Assist Refinance Standard Streamlined Refinance Non-Streamlined Refinance

USDA Streamlined Assist Refinance

Eligibility Requirements: The mortgage must be a current USDA loan with no late payments in the last 12 months. At least $50 monthly payment reduction should result from refinancing. No appraisal or credit review is necessary.

Steps: Contact a USDA-Approved Lender – Get in touch with any lender approved by the USDA so that they can take you through what options there are for refinancing. Submit Necessary Documents – Even though it is streamlined, some documentation may still be required like proof of income and primary residency. Loan Processing – Verify eligibility while processing your loan and ensure that it reduces monthly payment. Closing – Sign all papers needed to finalize your refinance.

Eligibility Requirements: The mortgage must be a current USDA loan with no late payments in the last 12 months. Depending on their requirements, lender may need appraisal done or review your credit history.

Contact a USDA-Approved Lender – Talk about your eligibility for refinancing with different lenders. Appraisal (if required) – Have an appraisal conducted to establish what is the current market value for your house. Submit Documentation – Submit employment evidence, show where you live most of the time among others. Loan Processing – Lenders will assess applications made including appraisals done and sometimes credits checked depending on whether needed or not. Closing – Once everything else has been done just sign those final papers so that you complete your refinance.

USDA Non-Streamlined Refinance

Eligibility Requirements: The mortgage must be a current USDA loan with no late payments in the last 12 months. An appraisal and credit review are required.

Steps: Contact a USDA-Approved Lender – Find out what lenders have to say about your refinancing possibilities and whether or not you qualify. Appraisal – Use appraisal information gathered during this process which can help determine what is currently valued at on the market today. Submit Documentation – Show proof of employment, income among other things that may be required by them. Loan Processing – Lenders will look over all relevant documents submitted along with appraisals done plus sometimes check credits if they feel like it too much but not always necessary. Closing – Sign any remaining paperwork needed for completion while undertaking such an activity as this one in particular where we are dealing with loans guaranteed by federal programs designed specifically for homeownership either through rural development or public housing initiatives otherwise referred to as FHA/VA-insured mortgages.

-

This reply was modified 10 months, 1 week ago by

Sapna Sharma.

Sapna Sharma.

-

This reply was modified 10 months, 1 week ago by

-

We are very sorry Rhonda. The very best for your friend and their family. God Bless prayers 🙏

-

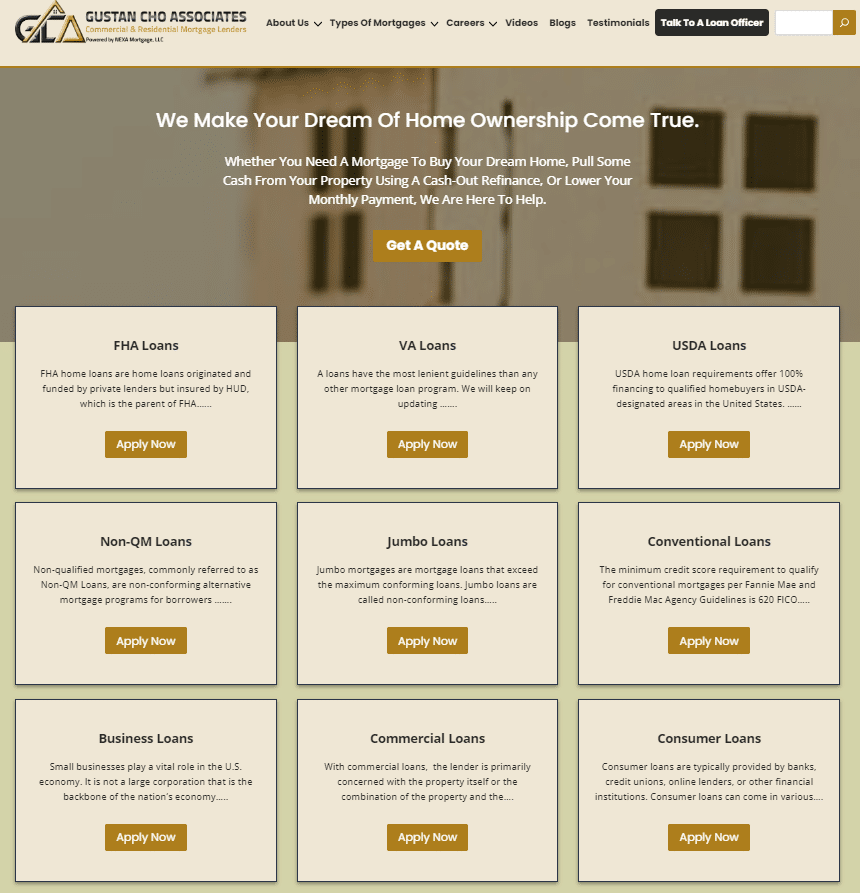

Gustan Cho Associates, a NEXA Mortgage NMLS 1660690 division, is renowned for securing mortgage loans for clients who may not qualify with other lenders. Here’s a detailed overview of how to get financing on an Airbnb property through Gustan Cho Associates, including eligibility requirements and guidelines:

Overview of Gustan Cho Associates

- Leadership: Headed by Gustan Cho, NMLS 873293, the national managing director.

- Licensing: Licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands (pending in N.Y. and M.A.).

- Reputation: Known for doing mortgage loans that other lenders cannot, with over 80% of borrowers coming from unsuccessful applications elsewhere.

- Partnerships: Collaborates with over 259 wholesale lenders for business, commercial, and residential loans.

- Rates: Offers competitive rates due to extensive partnerships.

Steps to Get Financing on an Airbnb Property

Initial Consultation:

- Contact: Schedule a consultation with Gustan Cho Associates to discuss your financing needs and property details.

- Information Sharing: Provide information about the property, financial situation, and investment goals.

Loan Application:

- Documentation: Complete a loan application with required documents such as income statements, tax returns, credit reports, and property details.

- Review: Gustan Cho Associates will review your application to determine the best loan options.

- Property Evaluation:

- Appraisal: An appraisal of the property will determine its value and potential rental income.

- Market Analysis: Assess the property’s location, condition, and demand for short-term rentals.

Underwriting:

- Assessment: The loan undergoes underwriting to assess your creditworthiness, the property’s potential, and compliance with lending guidelines.

- Documentation: Additional documentation may be requested during this phase.

Approval and Closing:

- Commitment Letter: Once approved, you will receive a loan commitment letter outlining the terms and conditions.

- Closing: Schedule a closing date to finalize the loan and receive the funds.

Eligibility Requirements and Guidelines

Credit Score:

Minimum Requirement: Generally, a minimum credit score of around 620 is required, though some loan products may accept lower scores with compensating factors.

Debt-to-Income Ratio (DTI):

- DTI Ratio: It should typically be below 50%, and your monthly debt payments should not exceed 50% of your gross monthly income.

Down Payment:

- Investment Properties: Typically require a higher down payment, often 20-25% of the property’s purchase price.

Income Verification:

- Proof of Income: Provide proof of stable income, including W-2 forms, pay stubs, tax returns, and bank statements.

- Self-Employed Borrowers: May need to provide additional documentation such as business tax returns and profit and loss statements.

Rental Income Potential:

- Consideration of Income: Potential rental income from the Airbnb property can be considered in the loan approval process.

- Analysis: Detailed analysis of expected rental income, including occupancy and nightly rates, may be required.

Property Requirements:

- Suitability for Rental: The property must meet local zoning and regulatory requirements for short-term rentals.

- Market Demand: It must be in a location with strong rental market demand to ensure consistent occupancy and income.

Loan Products:

- Types of Loans: These include conventional loans, non-QM (Non-Qualified Mortgage) loans, DSCR (Debt Service Coverage Ratio) loans, and more.

- DSCR Loans are particularly useful as they focus on the property’s income potential rather than the borrower’s.

Contact Information

For more detailed information and to start the application process, you can contact Gustan Cho Associates directly:

- Website: Gustan Cho Associates

- Phone: Contact details available on their website for scheduling consultations and obtaining more information about loan programs.

By understanding these requirements and following the outlined steps, you can successfully secure financing for your Airbnb property through Gustan Cho Associates.

gustancho.com

GCA Mortgage | Mortgage Experts With No Overlays

Whether you’ve gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans

-

Gustan Cho Associates NMLS 2315275, is headed by Gustan Cho NMLS 873293, the national managing director at Gustan Cho Associates. Gustan Cho Associates is a dba of NEXA Mortgage NMLS 1660690, the largest mortgage broker and correspondent lender in the country. Gustan Cho Associates has a national reputation for being able to do mortgage loans other lenders cannot do. Over 80% of our Borrowers at GCA Mortgage Group are folks who could not qualify at other lenders. Gustan Cho Associates has the states (licensed in 48 states including Washington, DC, Puerto Rico, and the U.S. Virgin Islands: NY and MA is pending). has the loan products (partnership with over 259 wholesale lenders of business, commercial, and residential loans), and has the lowest rates.

-

Many Americans are moving to Kansas due to a combination of factors that make it an attractive place to live. Here are some key reasons driving this trend:

Affordable Cost of Living

Lower Housing Costs: Kansas offers some of the most affordable housing in the country. The median home price in Kansas is significantly lower than the national average, making it easier for families to buy homes without overextending their budgets.

Overall Expenses: The cost of living in Kansas is generally lower across various categories, including groceries, transportation, and healthcare, contributing to a more affordable lifestyle.

Clean Environment and Quality of Life

Natural Beauty and Outdoor Activities: Kansas boasts clean air, open spaces, and a variety of outdoor activities, including hiking, fishing, and camping, which enhance the overall quality of life.

Community and Safety: Many Kansas towns and cities are known for their strong sense of community, low crime rates, and family-friendly atmosphere, making them safe and welcoming places to live.

Education in the State of Kansas

Great Schools and Universities: Kansas has numerous highly-rated public and prestigious universities, including the University of Kansas and Kansas State University, which provide excellent educational opportunities from kindergarten through higher education.

Economic Opportunities

- Job Market: Kansas has a diverse and growing economy with strong job markets in sectors like agriculture, manufacturing, healthcare, and education. The state also offers entrepreneurs various business opportunities and support.

Development Potential: With plenty of land available for development, there are significant opportunities for new businesses and residential projects, attracting investors and families looking to build their dream homes.

Tax Benefits

Low Property Taxes: Compared to many other states, Kansas has relatively low property tax rates, reducing homeownership costs.

Low Income and Sales Taxes: The state’s income and sales taxes are also relatively low, helping residents keep more of their earnings and spend less on everyday purchases. Kansas’s combination of affordable living, excellent educational institutions, strong economic opportunities, and a clean, safe environment makes it an increasingly popular choice for Americans seeking a better quality of life. Kansas offers many compelling advantages, whether you are looking to start a family, grow a business, or enjoy a more relaxed lifestyle.

Please try Gustan Cho Associates Best Kansas Mortgage Calculator:

https://gustancho.com/kansas-mortgage-calculator/

gustancho.com

Kansas Mortgage Calculator With PITI, PMI, HOA, and DTI

GCA's Kansas Mortgage Calculator with PMI, Insurance, Taxes is the most accurate calculator in the market with the debt-to-income-ratio feature

-

Why are so many people moving to Kansas? The reason why so many Americans are moving to Kansas is due to affordable cost of living. affordable homes, clean environment, great schools, great high schools and universities, low property taxes, low income and sale taxes, plenty of land and development opportunities, great economy, great job and business opportunities.Kansas is one of the most sought after states in the nation. The great state of Kansas is attracting Americans from other states as well as businesses who want to relocated to Kansas to make Kansas their lifelong home with starting a family and many business owners are excited about the idea of starting a new business and a new life. Home values in Kansas is still affordable and below the national median.

https://gustancho.com/bad-credit-mortgage-loans-kansas/

-

This reply was modified 10 months, 2 weeks ago by

Gustan Cho.

Gustan Cho.

gustancho.com

Bad Credit Mortgage Loans Kansas With Credit Scores Down To 500 FICO

Bad Credit Mortgage Loans Kansas With No Lender On FHA and VA Loans with credit scores down to 500 FICO and Non-QM mortgages

-

This reply was modified 10 months, 2 weeks ago by