Bill

Loan OfficerForum Replies Created

-

Hello, we’re happy to help. Answer the question and figure out the best solution for your brother. Can you hold at home after divorce? Most definitely the answer is yes as far as his personal circumstances it’s going to be based on his personal credit and income how much he has in the way of assets to help him buy.

-

Bill

MemberFebruary 10, 2024 at 6:54 am in reply to: Ever wanted to own you own mortgage brokerage??Thanks Gus.

Motto Mortgage is a franchise model that is actually Owen by the Remax company. It’s setup much the same way as Remax in that it’s geographically locked to a territory.

A question you need to ask yourself is does it make since for your mortgage business to be locked to a signal location when all banks and and loan officers can do business nationwide as long as they’re licensed or the institution is licensed depending on their model?

Franchising makes since if it gives you an edge or a benefit that you do not receive anywhere else. unfortunately motto Mortgage is not McDonald’s. It doesn’t give the kind of recognition to the public that draws the public to them over anyone else. In addition to that they charge a franchise fee that is quite significant. And a monthly fee for a locked in term of I want to say seven years grand total it’s usually around $350,000 to own Motto mortgage franchise.

There are better options available just about any option in my personal humble opinion is better than diving headlong into such an expensive adventure that locks you and geographically and doesn’t give you the freedom to be able to work loans across the United States or another geographic areas. A better model that I have found is that of NEXA Mortgage, they allow you to recruit and retain and do loans anywhere in the United States. You can build teams across the country you can do loans with realtors across the country you can pick up business and all four and 48 of the 50 states and Washington DC Puerto Rico, and the Virgin Islands right now as we speak it’s such an incredible flexible model that allows you to have significant freedom without the overhead and headache that you would have and running a franchise. if you’re interested in finding out what it might look like for you, feel free to head us up would be glad to help you out give you some advice. Give you some education on what that this actually could look like for you. It’s important to break the right decisions when you’re starting a business and starting to do business and one big benefit that NEXA Mortgage has is the amount of lenders that they have available. They right now 239 lenders available and over 5000 products available and niches and opportunities that are just numerous too many to count. The amount of money you can make per transaction , the caps at a higher level than anyone else I see in the industry and the list just goes on and on the benefits and support structure that’s available to you to help you and support you with little to no money coming out of your pocket you will very much appreciate what you have available to you in a model such as Nexa. So feel free to ask us will share with you what it looks like and what can you.

-

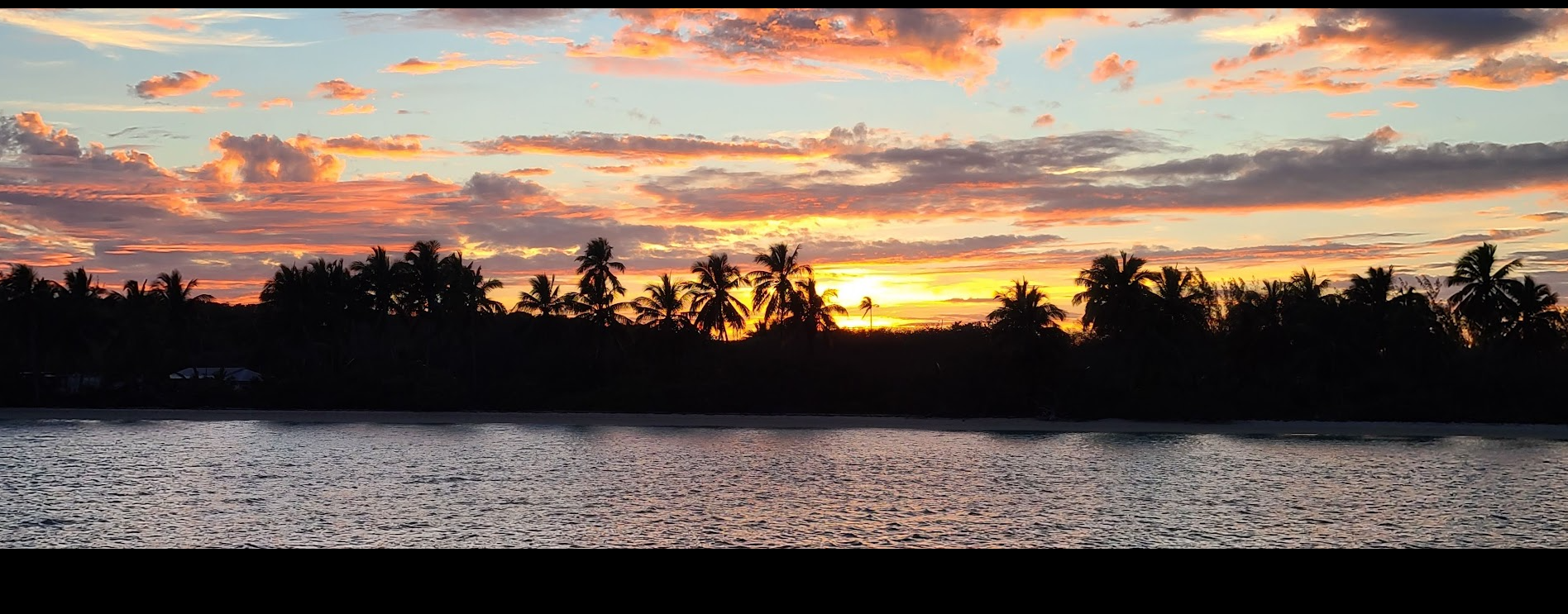

I’ve just returned home from visiting one of my friends in Puerto Rico. They invested a few extra dollars to set there beautiful home up with solar and a battery backup system as well as Starlink. So while many or most were without power in the last hurricane they were able to stay completely operational in paradise.

As for the catamaran life it’s happening. I’m able to setup a home base on a dock for $400 to $600 a month and then travel to amazing islands that many only dream of seeing. Living life as full as possible is what I intend to do. I will keep sharing my experiences. It’s fun to be able to live life and not be controlled by the struggles of life.

If anyone in the mortgage space wants to understand how I’ve done this I’m happy to share.

-

This is a tough industry right now. I agree. I know I’m seeing a shift but I just received 5 new aplicents wanting to buy in the last 2 days. I’m going to be able to help all of them because of the company I work for. It seems to matter much more today than ever before. It helps when you have 219 mortgage companies to choose from and over 5000 products. The lowest rates for the clients while at the same time paying the highest compensation for the loan officer to take care of them and their families. This is why I love working for my company they built the company for times like this.

-

Bill

MemberSeptember 30, 2023 at 5:19 am in reply to: Can I become a commercial loan officer at Lending Network LLCHey Gunner. You sure can. All the available products. The problem is that some really great products are only available through NEXA when it comes to commercial mortgages. Let me know if you what to know more. I’m happy to help.

-

Stick to what you know…

What that would be, I’m not sure. It can’t be much.

I take that back. I’m sorry.

You know a lot about dogs. you own like 17 yourself.

-

This reply was modified 1 year, 7 months ago by

Bill.

Bill.

-

This reply was modified 1 year, 7 months ago by

-

Wow… Nice share. The Philipines have something going right if they keep finding a way to show respect and keep the family together. I pray we all find a better balance in our lives. Life is too short for the stress and frustration to continue destroying us.

-

Thanks Max. This is some of the best advice I found for myself early on. It’s crushal to finding truth and healing.

-

Rhonda’s the best. She’s also licensed to help with mobile home financing.