Cameron

Virtual AssistantForum Replies Created

-

Viral Website Developers are the best Digital Marketing Website Builders and Developers and can help you. Please email me at support@gustancho.com.

Creating and launching an online general information forum is a multi-step process. Here’s how to do it, along with realistic expectations about going viral and generating organic leads:

- Choose a Niche:

- Despite being “general information,” focus on a broad theme (e.g., lifestyle, technology, current events).

- Too broad, and you’ll struggle to build a community.

- Select Platform:

- Self-hosted: phpBB, MyBB (more control, more work)

- Cloud-based: ProBoards, Vanilla Forums (easier setup)

- Build on existing sites: Reddit, Quora (instant audience, less control)

- Design & Setup (1-2 weeks):

- Install software or set up account

- Customize design to match your brand

- Create main categories and subcategories

- Content Seeding (2-3 weeks):

- Start 20-30 engaging threads yourself

- Cover a wide range of topics in your niche

- Ask open-ended questions to encourage debate

- User Management:

- Set clear rules and guidelines

- Recruit moderators (offer incentives)

- Plan for spam control

- Promotion (Ongoing):

- Share on social media (Twitter, Facebook groups)

- Guest post on blogs with forum links

- Engage in other forums, add signature links

- Consider paid ads for a boost

- Engagement (Critical):

- Respond to every post initially

- Host weekly discussions or AMAs

- Offer rewards for top contributors

- SEO (3-6 months for results):

- Use keywords in thread titles and first posts

- Encourage long-form discussions

- Build backlinks from reputable sites

- Email Marketing:

- Offer digest subscriptions

- Send trending thread notifications

Going Viral:

- Definition: Rapid, exponential growth in visitors.

- Timeframe: Unpredictable. Could be days, months, or never.

- Catalysts:

- Hot topic threads (e.g., breaking news, controversies)

- Celebrity or influencer participation

- Feature on a major site like Reddit’s front page

- Reality: Viral spikes are rare and often short-lived.

Organic Leads:

- Definition: Non-paid traffic that converts.

- Timeline:

- 3-6 months: Start seeing consistent traffic

- 6-12 months: Noticeable organic leads if content is strong

- 12-24 months: Substantial, reliable lead flow

- Factors:

- Content quality

- User engagement

- Domain authority

- Niche competitiveness

Monetization:

Ads: Enable once you hit 1000+ daily pageviews

- Sponsorships: Approach brands after 6-12 months

- Premium Memberships: Launch when community is tight-knit

Case Study: TripAdvisor’s forums took about 2 years to become a significant lead generator for their hotel bookings.

Remember:

- Patience is key. Forums are slow-burn projects.

- Community > Numbers. Engaged users bring more value.

- Be prepared for a 12-18 month commitment before seeing substantial returns.

- “Going viral” shouldn’t be the goal; steady growth is more sustainable.

Building a successful forum is a long-term endeavor. Focus on quality, engagement, and consistent growth rather than viral hits.

https://www.youtube.com/watch?v=1OJFmDHS4qQ

-

This reply was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 1 year ago by

Sapna Sharma.

Sapna Sharma.

youtube.com

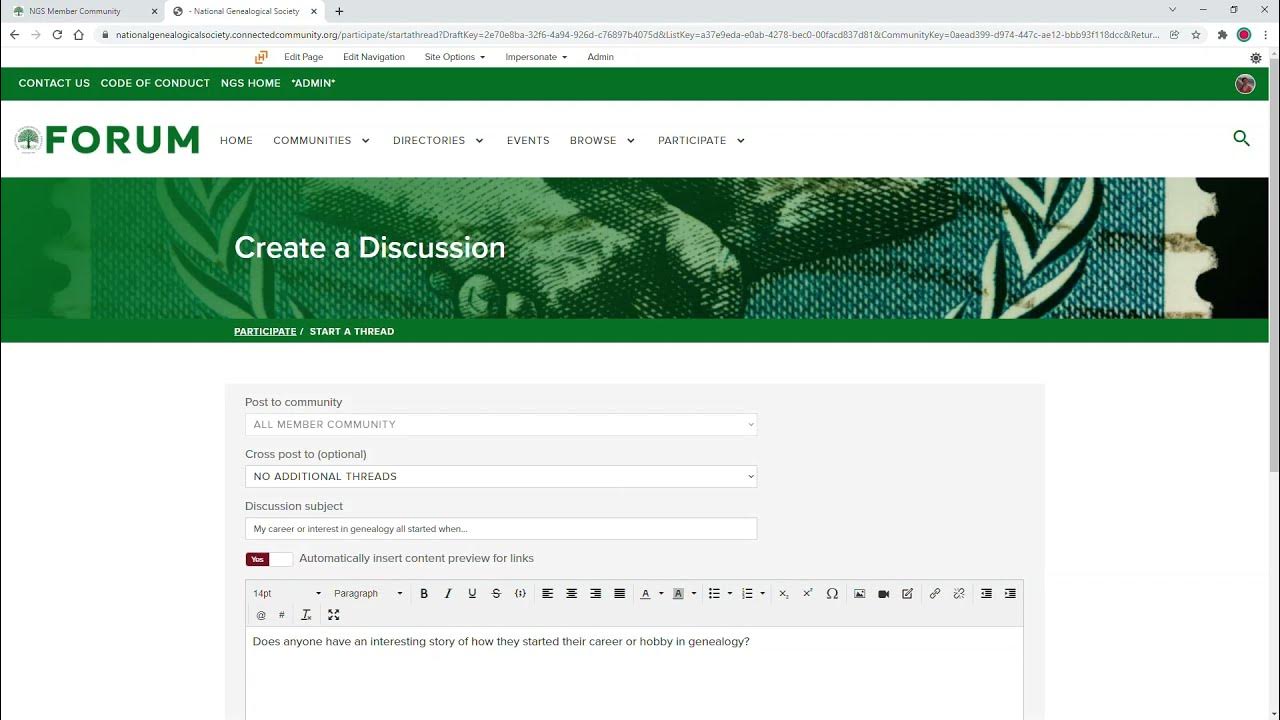

Participate on Forum: Starting a Thread, Replying to Posts, and Adding Tags

Watch this Forum tutorial video to learn about how to start a discussion thread, reply to posts, and add keyword tags to posts. Forum is the online home for ...

-

Cameron

MemberMay 31, 2024 at 5:07 pm in reply to: How is President Donald Trump Gulty Verdict Affect NEW YORKThe potential convictions of former President Donald Trump in the state of New York could have various impacts on the state, both directly and indirectly. Here are some key areas of impact:

Legal and Judicial System

- Reputation and Credibility: Successfully prosecuting a high-profile figure like Trump could enhance the reputation of New York’s judicial system, showcasing its commitment to the rule of law and the principle that no one is above the law.

- Precedent: Convictions could set legal precedents for handling similar cases in the future, particularly involving high-profile individuals and complex financial crimes.

Political Climate

- Polarization: The case is likely to deepen political polarization within New York and across the country. Supporters of Trump may view the convictions as politically motivated, while his critics may see them as a victory for justice.

- Political Mobilization: Both sides of the political spectrum may become more energized. Trump’s supporters might rally in his defense, potentially increasing political activity and voter turnout in future elections.

Economic Impact

- Legal Costs: The state may incur significant legal costs associated with prolonged investigations and trials, though these are typically part of the state’s budget for judicial processes.

- Business Environment: Trump has various business interests in New York. Convictions could lead to financial penalties or restrictions on his business operations, potentially affecting local economies tied to his ventures.

Social and Public Opinion

- Public Trust: The outcome of the trials could influence public trust in the legal and political institutions. Successful convictions might reinforce confidence in the legal system, while acquittals or perceived unfairness could undermine it.

- Community Reactions: Depending on the verdicts, there could be demonstrations or public protests, which might affect local communities and require increased law enforcement presence.

Media and Attention

- National Spotlight: The trials will likely attract extensive media coverage, keeping New York in the national and international spotlight. This attention could have various repercussions, including tourism and public perception.

Future Legal and Political Landscape

- Legal Reforms: The high-profile nature of these cases might prompt discussions about legal reforms or adjustments in how similar cases are handled in the future.

- Political Careers: The handling of these cases could influence the careers of key figures involved, such as prosecutors, judges, and political leaders, potentially shaping their future roles and reputations.

Overall, the convictions of Donald Trump in New York could have wide-ranging implications, affecting the state’s legal, political, economic, and social landscapes.

-

Cameron

MemberMay 31, 2024 at 4:58 pm in reply to: Former President Donald Trump Guilty on All CountsCrooked Joe Biden is so happy former Donald Trump got convicted on 34 counts. Joe Biden could not help but say that “Nobody’s Above The Law.” WOW. How can he say that with a straight face. Former President Donald Trump faces 187 years in prison on the 34 felony convictions. The indictment of former President Donald Trump involves a complex interplay of legal, political, and procedural factors. Here are key points to understand:

Role of the Biden Administration and Democrats

- Independence of the Judiciary: In the United States, the judiciary operates independently from the executive branch. Indictments and prosecutions are carried out by the judicial system, not directly by the President or Congress.

- Federal and State Cases: Trump’s legal challenges involve both federal and state cases. State cases, such as the one in New York led by District Attorney Alvin Bragg, are initiated at the state level and are not directly influenced by the federal government.

- Department of Justice (DOJ): Federal cases, such as those involving alleged mishandling of classified documents or election interference, fall under the purview of the Department of Justice. While the DOJ is part of the executive branch, it is expected to operate independently from political influence. Special Counsel Jack Smith, appointed by Attorney General Merrick Garland, is overseeing these federal investigations to ensure impartiality.

- Political Context: While some Republicans and Trump supporters may view the indictments as politically motivated, arguing that Democrats are using the legal system to target Trump, others emphasize the importance of accountability and the rule of law. Democrats and other critics of Trump argue that legal proceedings are based on credible allegations and evidence of wrongdoing.

Public Perception

- Polarization: The indictments have further polarized public opinion. Trump’s supporters often see these actions as a continuation of what they perceive as unfair treatment and political persecution, while his critics believe that no one is above the law and that Trump should be held accountable for any alleged crimes.

- Impact on Elections: The legal challenges could have significant implications for Trump’s political future and the broader political landscape, including potential impacts on upcoming elections.

While the Biden administration and Democrats are not directly responsible for the indictments, the political context and public perceptions are heavily influenced by the ongoing partisan divide. The legal processes are conducted by independent judicial and prosecutorial bodies, both at the state and federal levels, with the goal of upholding the law.

-

Great topic. Great article. These days there is no such thing as good food you can buy unless you set up reservations weeks or months in advance, and costs you thousands of dollars for you, family, relatives, friends, and co-workers. Everything is so shitty. Franchise food, food from delis, frozen prepared food, and frozen pizza. All local Chinese foods tastes the same. I miss the good ole days of mom’s and grandma’s home cooked meals. The real food era need to return and food should be an art. That special time of the day where the family gathers together for a special weekly dinner. Miss that and hope Peter Arcuri can make this happen for us members of Great Content Authority Forums.

Cooking food in a smoker can add a deep, rich, and smoky flavor that is hard to achieve with other cooking methods. Here are some tips and steps to get you started with smoking food:

Types of Smokers

- Charcoal Smokers: Use charcoal as the primary heat source and wood chunks or chips for smoke.

- Electric Smokers: Use electricity to heat a rod that ignites wood chips, making them easy to control.

- Gas Smokers: Use propane or natural gas with wood chips for smoking.

- Pellet Smokers: Use compressed wood pellets as both fuel and smoke source, offering precise temperature control.

Basic Steps for Smoking Food

- Choose the Right Wood: Different woods impart different flavors. Some popular choices include:

- Hickory: Strong, smoky flavor, great for pork and ribs.

- Mesquite: Intense flavor, best for beef and stronger meats.

- Apple: Mild and fruity, good for poultry and pork.

- Cherry: Sweet and mild, suitable for most meats.

- Oak: Versatile and strong, works well with almost anything.

- Prepare the Smoker:

- Clean the smoker grates and ensure all components are in good working order.

- Preheat the smoker to the desired temperature, typically between 225°F and 250°F (107°C and 121°C).

- Prepare the Meat:

- Seasoning: Apply a dry rub or marinade to the meat. Common rub ingredients include salt, pepper, paprika, garlic powder, and brown sugar.

- Rest: Let the seasoned meat rest at room temperature while the smoker preheats.

- Smoking Process:

- Add Wood Chips or Chunks: If using wood chips, soak them in water for about 30 minutes before adding them to the smoker. This helps them smolder and produce smoke rather than burning quickly.

- Place the Meat in the Smoker: Position the meat on the smoker grates, ensuring it is not touching other pieces to allow for even smoke circulation.

- Maintain Temperature: Keep a close eye on the smoker’s temperature, adjusting vents or adding fuel as needed to maintain a consistent temperature.

- Monitor Smoke: Ensure a steady stream of thin, blue smoke. Thick, white smoke can impart a bitter flavor to the meat.

- Cooking Time:

- Smoking is a low and slow process. Cooking times vary depending on the type and size of the meat. For example:

- Ribs: 5-6 hours

- Brisket: 10-14 hours

- Pork Shoulder: 8-10 hours

- Whole Chicken: 4-5 hours

- Smoking is a low and slow process. Cooking times vary depending on the type and size of the meat. For example:

- Check for Doneness:

- Use a meat thermometer to check the internal temperature of the meat. Some target temperatures include:

- Ribs: 190°F – 205°F (88°C – 96°C)

- Brisket: 195°F – 205°F (90°C – 96°C)

- Pork Shoulder: 195°F – 205°F (90°C – 96°C)

- Chicken: 165°F (74°C)

- Use a meat thermometer to check the internal temperature of the meat. Some target temperatures include:

- Rest the Meat:

- Once the meat reaches the desired internal temperature, remove it from the smoker and let it rest for at least 15-30 minutes. This allows the juices to redistribute and enhances the flavor and tenderness.

Tips for Success

- Keep the Lid Closed: Avoid opening the smoker frequently, as this can cause temperature fluctuations and extend cooking time.

- Use a Water Pan: Placing a pan of water in the smoker can help maintain moisture and stabilize the temperature.

- Experiment with Flavors: Try different wood types, rubs, and marinades to find your favorite flavor combinations.

Smoking food can be a rewarding culinary adventure, resulting in delicious, flavorful meals with a unique smoky taste.

-

“The Sopranos” is widely regarded as one of the greatest television series of all time. It has left a lasting impact on popular culture and television storytelling. Here are some of the best aspects of “The Sopranos,” including memorable episodes, characters, and moments:

Memorable Episodes

- “Pilot” (Season 1, Episode 1): The episode that started it all, introducing Tony Soprano and his complicated life.

- “College” (Season 1, Episode 5): Tony takes his daughter Meadow on a college tour while also tracking down a former mobster turned informant.

- “Pine Barrens” (Season 3, Episode 11): Christopher and Paulie get lost in the woods after a hit goes wrong, leading to one of the most iconic and darkly comedic episodes.

- “Whitecaps” (Season 4, Episode 13): Tony and Carmela’s marriage reaches a breaking point in this intense and emotional season finale.

- “Long Term Parking” (Season 5, Episode 12): Adriana’s fate is sealed in one of the most heartbreaking and shocking episodes.

- “Made in America” (Season 6, Episode 21): The series finale, known for its ambiguous and controversial ending.

Iconic Characters

- Tony Soprano (James Gandolfini): The complex mob boss struggling with mental health issues and family dynamics.

- Carmela Soprano (Edie Falco): Tony’s loyal yet conflicted wife, who grapples with the moral implications of her husband’s life.

- Dr. Jennifer Melfi (Lorraine Bracco): Tony’s psychiatrist, who provides insight into his psyche and personal struggles.

- Christopher Moltisanti (Michael Imperioli): Tony’s protégé and nephew, whose ambition and addiction create ongoing turmoil.

- Paulie Walnuts (Tony Sirico): A loyal but unpredictable soldier in Tony’s crew, known for his eccentric personality and humor.

- Silvio Dante (Steven Van Zandt): Tony’s consigliere, known for his level-headedness and loyalty.

- Meadow and AJ Soprano (Jamie-Lynn Sigler and Robert Iler): Tony and Carmela’s children, who each deal with their father’s criminal life in different ways.

Key Themes and Moments

- Mental Health: Tony’s therapy sessions with Dr. Melfi explore themes of mental health, depression, and the impact of trauma.

- Family Dynamics: The show delves into the complexities of the Soprano family, balancing traditional family values with the violence and criminal activities of Tony’s mob life.

- Power and Loyalty: The series examines the power dynamics within the mob and the importance of loyalty and betrayal.

- Morality and Consequences: Characters often face moral dilemmas and the consequences of their actions, adding depth to the narrative.

- Cultural Impact: “The Sopranos” influenced subsequent television dramas with its character-driven storytelling, anti-hero protagonist, and blending of dark humor with serious themes.

Legacy

“The Sopranos” set a new standard for television storytelling, with its complex characters, intricate plots, and willingness to tackle difficult subjects. It remains a touchstone in the evolution of modern television dramas, influencing countless shows that followed.

Rewatching “The Sopranos” reveals new layers and nuances, making it a show that continues to resonate with audiences years after its original airing.

-

Cameron

MemberMay 31, 2024 at 5:07 pm in reply to: How is President Donald Trump Gulty Verdict Affect NEW YORKIt is not about former President Donald Trump. I would not see any former president arrested, tried, and convicted for some BS that is alledged happened over a decade ago. Stormy Daniels? Michael Cohen? No president should get accruciated like this ever. We are a world laughing stock and the political hacks of New York really ruined it for Americans this time. No bueno, my fellow Americans. Not good and whatever these far left liberal politicians did will back fire on them big time.

-

Silver price broke $32.00 per ounce today. This is a key factor for silver breaking out after a huge correction one week ago last Friday. Many people don’t realize how important silver making this comeback after last week’s correction. Silver is expected outpace in return in ROI.