Cameron

Virtual AssistantForum Replies Created

-

I love the newly designed C8 Corvettes.

-

In this section, we will guide you how to learn basic computer skills through eLearning. Many older folks are afraid of learning new basic computer skills and often rely on someone else to help them. Without feeling confident that you can learn, it will be difficult to tackle basic computer skills. Learning basic computer skills online is accessible and can be tailored to fit your schedule and learning pace. Here’s a guide to help you get started:

Step-by-Step Guide to Learning Basic Computer Skills Online 1. Identify What You Need to Learn

Basic computer skills can include a variety of topics, such as:

- Operating Systems: Understanding Windows, macOS, or Linux.

- Software Applications: Using Microsoft Office (Word, Excel, PowerPoint), Google Suite (Docs, Sheets, Slides), etc.

- Internet Skills: Browsing the web, using search engines, email, and social media.

- Basic Troubleshooting: Learning how to solve common computer problems.

- File Management: Organizing, saving, and retrieving files and folders.

- Online Safety: Understanding cybersecurity basics to protect your data.

2. Choose the Right Learning Platform

Many platforms offer free and paid courses to help you learn basic computer skills. Here are some popular ones:

- Coursera:

- Offers courses from universities and colleges.

- Courses often come with certificates upon completion.

- Example Course: “Computer Basics for Absolute Beginners.”

- edX:

- Similar to Coursera, offers a range of courses from institutions.

- Example Course: “Introduction to Computer Science.”

- Khan Academy:

- Free educational resources on a variety of topics.

- Has a section for computer science and basic computer skills.

- LinkedIn Learning (formerly Lynda.com):

- Offers a vast library of video tutorials on many subjects, including basic computer skills.

- Example Course: “Learning Computer Literacy.”

- Google Digital Garage:

- Free courses on digital skills, including basic computer use and online safety.

- Example Course: “Introduction to Computers and Office Productivity Software.”

- YouTube:

- Numerous free video tutorials on basic computer skills.

- Channels like “GCFLearnFree” and “TechBoomers” offer structured lessons.

3. Follow a Structured Learning Path

To ensure comprehensive learning, follow a structured path. Here’s a suggested sequence:

- Basic Concepts:

- Learn about computer hardware and software.

- Understand the operating system you are using.

- Software Applications:

- Start with word processing (Microsoft Word, Google Docs).

- Move to spreadsheets (Microsoft Excel, Google Sheets).

- Learn presentation software (Microsoft PowerPoint, Google Slides).

- Internet Skills:

- Learn how to use web browsers (Chrome, Firefox, Safari).

- Understand email basics (Gmail, Outlook).

- Explore search engines and research techniques.

- Get introduced to social media platforms.

- File Management:

- Learn how to create, save, and organize files and folders.

- Understand cloud storage options (Google Drive, Dropbox).

- Online Safety:

- Understand the basics of cybersecurity.

- Learn about safe browsing habits and protecting personal information.

- Basic Troubleshooting:

- Learn common troubleshooting steps for both hardware and software issues.

4. Practice Regularly

Practice is key to mastering computer skills. Try to:

- Perform daily tasks using the skills you’ve learned.

- Take on small projects, like creating a document, spreadsheet, or presentation.

- Explore new software and tools to expand your skill set.

5. Join Online Communities

Joining forums and communities can provide support and additional resources:

- Reddit: Subreddits like r/learnprogramming or r/technology.

- Stack Exchange: Various forums for asking and answering technical questions.

- Online Study Groups: Websites like Meetup or Facebook groups for learners.

6. Get Certified

If you want formal recognition for your skills, consider certification:

- Microsoft Office Specialist (MOS): Certification in Microsoft Office applications.

- Google IT Support Professional Certificate: Basic IT skills, including computer fundamentals.

- CompTIA IT Fundamentals (ITF+): A broad certification covering basic IT skills.

Learning basic computer skills online is convenient and flexible. By identifying what you need to learn, choosing the right platform, following a structured learning path, practicing regularly, joining online communities, and considering certification, you can effectively gain and enhance your computer literacy. In this thread, we will continue to update basic computer skills for beginners and older generation computer users on basic computer eLearning tutorials with videos.

https://www.youtube.com/watch?v=y2kg3MOk1sY

-

This reply was modified 8 months, 3 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

This reply was modified 5 months ago by

Sapna Sharma.

Sapna Sharma.

-

The Business Directory Listing on GCA FORUMS has been structured to be SEO Driven. Be detailed and utilize all fields with rich local keywords for maximum Search Engine Optimization.

Creating an SEO-driven business directory listing involves optimizing the directory itself as well as individual business profiles to ensure high visibility in search engine results. Here’s a detailed guide to help you build an effective SEO-driven business directory listing:

Steps to Create an SEO-Driven Business Directory Listing1. Directory Structure and Design

- User-Friendly Design:

- Ensure the directory is easy to navigate with a clean, intuitive layout.

- Use clear categories and subcategories to help users find businesses easily.

- Responsive Design:

- Make sure the directory is mobile-friendly. A significant amount of local searches are performed on mobile devices.

- Fast Loading Speed:

- Optimize images, use caching, and minimize code to improve page load times. Search engines favor fast-loading sites.

2. Keyword Research

- Identify Target Keywords:

- Conduct keyword research to identify what potential users are searching for. Tools like Google Keyword Planner, SEMrush, or Ahrefs can be useful.

- Focus on local keywords (e.g., “best restaurants in [city]”, “plumbers near me”).

- Incorporate Keywords:

- Use these keywords strategically in directory titles, meta descriptions, headings, and content.

3. On-Page SEO

- Title Tags and Meta Descriptions:

- Craft compelling and keyword-rich title tags and meta descriptions for each directory page and listing.

- Headings:

- Use proper heading tags (H1, H2, H3) to structure content. The primary keyword should be in the H1 tag.

- Content Optimization:

- Write unique, informative descriptions for each category and business listing. Avoid duplicate content.

- Include relevant keywords naturally within the content.

- Internal Linking:

- Create internal links between related categories and listings to improve navigation and SEO.

4. Business Listings Optimization

- Accurate Business Information:

- Ensure all business details (name, address, phone number, website) are accurate and consistent across the directory.

- Use structured data (schema markup) to help search engines understand the information.

- Detailed Descriptions:

- Write detailed and engaging business descriptions. Highlight unique selling points and services offered.

- Customer Reviews:

- Encourage businesses to gather customer reviews. Positive reviews can improve local SEO and attract more customers.

- Implement a system for collecting and displaying reviews on each business profile.

- High-Quality Images:

- Use high-quality images for each business listing. Optimize images by compressing them and using descriptive file names and alt text.

- Local SEO:

- Optimize listings for local search by including local keywords, using Google My Business, and ensuring NAP (Name, Address, Phone) consistency.

5. Off-Page SEO

- Backlinks:

- Build backlinks to the directory and individual listings from reputable websites. This can improve domain authority and search rankings.

- Use outreach strategies to get local blogs, news sites, and relevant industry sites to link to your directory.

- Social Media:

- Promote the directory and individual listings on social media platforms.

- Encourage businesses to share their listings on their own social media accounts.

- Local Citations:

- Ensure the directory is listed in other local business directories and citation sites to boost local SEO.

6. Monitoring and Analysis

- Analytics:

- Use tools like Google Analytics and Google Search Console to monitor traffic, user behavior, and search performance.

- Analyze data to understand which listings and categories perform well and identify areas for improvement.

- Regular Updates:

- Regularly update the directory with new businesses, reviews, and content.

- Keep an eye on SEO trends and algorithm changes to adjust your strategy accordingly.

Conclusion

Creating an SEO-driven business directory listing involves a combination of strategic keyword use, high-quality content, local SEO practices, and continuous monitoring and improvement. By following these steps, you can ensure that your directory and its listings are easily discoverable by search engines and users alike, ultimately driving more traffic and business engagement.

Additional Resources

- Moz Local Learning Center: Offers comprehensive guides on local SEO.

- Google My Business Help: Provides detailed instructions on optimizing business profiles for local search.

- Ahrefs Blog: Regularly publishes articles on advanced SEO strategies and techniques.

The more content you post, the higher your SEO will be driven for maximum exposure.

- User-Friendly Design:

-

Cameron

MemberMay 6, 2024 at 11:51 pm in reply to: Is It Better To Renovate My Current RV or Buy New?Deciding whether to renovate your current RV or buy a new one depends on several factors including your budget, the condition of your existing RV, and your specific needs for upgrades or changes. Here are some considerations to help you make an informed decision:

Renovating Your Current RV

Pros:

- Cost-Effective: Renovations can often be more budget-friendly than purchasing a new RV, especially if the changes needed are cosmetic or minor.

- Customization: Renovating allows you to customize your RV to your exact preferences and needs, which might not be possible with a new model.

- Familiarity: Keeping your current RV means maintaining familiarity with its handling, quirks, and maintenance needs.

Cons:

- Potential Hidden Costs: Renovation projects can uncover additional repairs that need to be addressed, potentially leading to unexpected expenses.

- Time-Consuming: Renovations can be time-consuming, and depending on the extent of the work needed, it might take longer to complete than purchasing a new RV.

- Limited Improvements: Some structural or technological improvements might not be feasible through renovation alone.

Buying a New RV

Pros:

- Latest Features and Technology: New RVs come with the latest features, technology, and design innovations that older models can’t match.

- Warranty and Reliability: New vehicles come with warranties and are less likely to require immediate repairs, offering peace of mind during travels.

- Energy Efficiency: Newer models are often more energy-efficient and may have better fuel economy and modern amenities that improve the overall travel experience.

Cons:

- Higher Cost: New RVs are significantly more expensive upfront than renovating an existing one.

- Depreciation: New RVs depreciate quickly, losing value as soon as they are driven off the lot.

- Adaptation Time: Getting accustomed to a new RV’s systems and handling can take time.

Making the Decision

- Assess the Current Condition: Evaluate the current state of your RV. If the foundation and mechanical systems are in good shape, renovation might be a viable option.

- Consider Your RV Usage: Think about how you use your RV. If you spend a lot of time in it or live in it full time, comfort and functionality become priorities, which might be better addressed by a new purchase.

- Budget: Determine your budget. If you can handle a new RV’s cost without financial strain, it might be worth the investment for the long-term benefits.

- Future Needs: Consider whether your current RV can be effectively updated to meet your future needs or if a new model would be a better fit.

Ultimately, the decision to renovate or buy new involves weighing the cost against the benefits of each option. It might be helpful to consult with RV professionals or renovation experts to get a detailed assessment and quote before making your decision.

-

Cameron

MemberMay 4, 2024 at 1:11 pm in reply to: Can Mortgage Loan Originators Be Paid By 1099 and W2Can Mortgage Loan Originators Be Paid By 1099 and W2 depending on the state?

Mortgage Loan Originators (MLOs) or loan officers are generally classified as W-2 employees across the United States, largely due to federal guidelines and the nature of their job duties. The classification as W-2 employees rather than 1099 independent contractors is primarily influenced by federal regulations, specifically the Fair Labor Standards Act (FLSA) and the rules outlined by the Internal Revenue Service (IRS).

Federal Regulations and Guidelines:

-

FLSA and IRS Guidelines: The classification of workers under these guidelines is based on factors that consider the degree of control the employer has over the worker and the independence of the worker. Given that employers usually set MLOs’ hours, provide tools, and control how and when their work is done, MLOs are typically classified as employees rather than independent contractors.

-

Consumer Financial Protection Bureau (CFPB) and Dodd-Frank Act: Regulations under the Dodd-Frank Act, enforced by the CFPB, provide specific rules about how MLOs can be compensated. These rules are designed to prevent conflicts of interest and biased financial advice based on the way loan officers are paid (e.g., they cannot be paid more for steering clients into higher-interest loans). These regulations support the employee model over the independent contractor model because they require detailed oversight and control of compensation methods.

State Specifics: While states do enforce these federal guidelines, there is no state where the law explicitly allows or disallows MLOs to be paid as 1099 independent contractors based solely on state law. However, some MLOs who own their brokerage might be classified differently if they truly operate their business independently from a larger lending institution.

Considerations for MLOs as Independent Contractors: It’s rare for an MLO to be properly classified as a 1099 contractor due to the nature of the work and regulatory environment. If an MLO were working as a 1099 independent contractor, it would require a high degree of independence that is uncommon in the mortgage industry, where compliance with strict lending regulations and oversight is required.

Advice for Employers and MLOs: For any lending institution or individual unsure about the appropriate classification, it’s advisable to consult with a labor attorney or a specialist in employment law to ensure compliance with all applicable laws and regulations. Misclassification can lead to significant penalties, including back taxes, fines, and damages for improperly classified workers.

In summary, while theoretically, it might be possible under very specific and controlled circumstances for an MLO to be classified as a 1099 independent contractor, practically and legally, they are almost always W-2 employees to comply with federal and state employment laws.

-

-

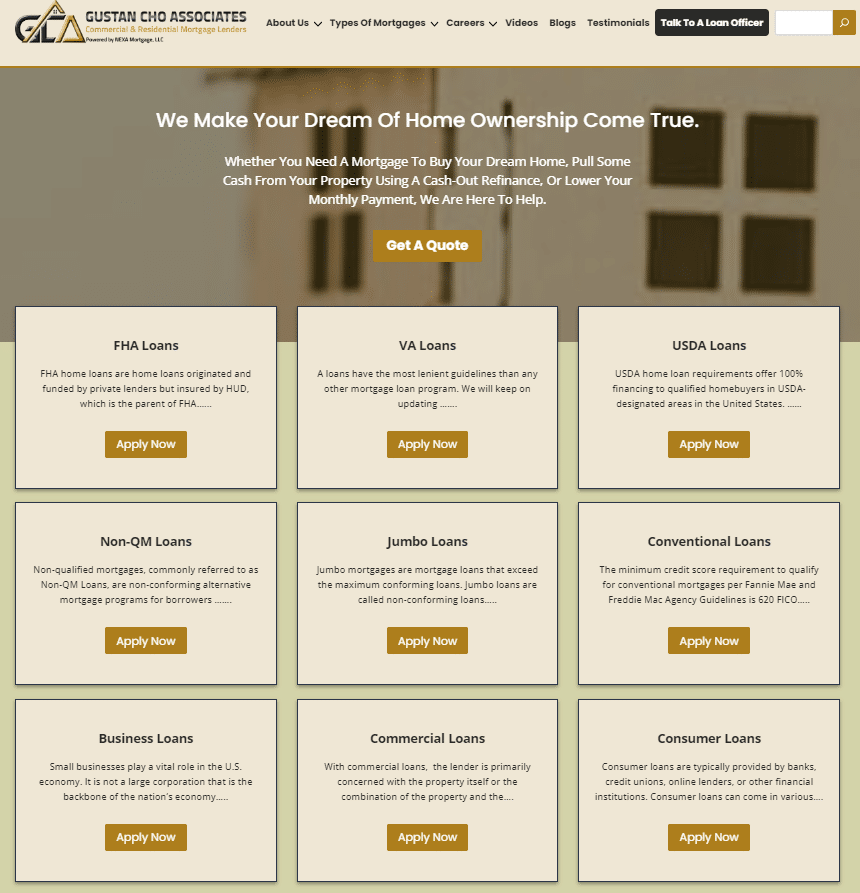

Gustan Cho Associates, operating under NEXA Mortgage, LLC, has established itself as a significant player in the mortgage industry, particularly for those who may have difficulties securing loans from other lenders. They specialize in a variety of loan types without lender overlays, which means they do not add additional requirements to the basic qualifications set by major lending agencies. This approach allows them to serve borrowers with lower credit scores or those who have unique financial situations.

The company offers an extensive range of mortgage products including traditional loans like FHA, VA, and USDA loans, as well as non-QM loans, which are not typical qualifying mortgages and include options like bank statement loans, asset depletion loans, and loans for those just a day out of bankruptcy or foreclosure. Their ability to provide such a diverse array of financial products stems from their vast network of over 210 wholesale lending relationships, allowing them to accommodate nearly any borrower’s needs.

Gustan Cho Associates is known for its commitment to making the mortgage process accessible and manageable for its clients, offering support seven days a week and tailoring services to accommodate even the most complex financial situations (Gustan Cho Associates Mortgage Brokers) (Gustan Cho Associates Mortgage Brokers) (GCA Mortgage) (GCA Mortgage) (Gustan Cho Associates Mortgage Brokers).

For more detailed information, you can visit their official site through this link.

gustancho.com

GCA Mortgage | Mortgage Experts With No Overlays

Whether you’ve gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans

-

Cameron

MemberApril 30, 2024 at 11:07 pm in reply to: What is Homes For Heroes Mortgage Loan Program?Homes for Heroes is a private nationwide program that provides mortgage loan discounts and other benefits to certain groups of homebuyers, including:

- Military members and veterans: Active duty military (including National Guard and Reserves). Retired or disabled military. Unmarried surviving spouses of those who died in service

- First responders: Law enforcement officers (police, sheriff, highway patrol). Firefighters (municipal, wildland, etc.). Emergency medical technicians (EMTs) and paramedics

- Healthcare professionals: Doctors, nurses, and other medical professionals. Healthcare support staff (orderlies, lab techs, etc.)

- Teachers: Pre-K through 12th grade teachers. School support staff. To qualify for the Homes for Heroes mortgage loan discounts, you must be employed in one of those eligible professions and provide proper credentials/documentation. The specific benefits can vary but may include: Mortgage rate discounts (typically 0.125% – 0.5% off the rate)

Discounts on lender fees

Discounts/credits from affiliated real estate agents

Discounts on home inspection, title services, moving help

The program is affiliated with certain mortgage lenders, real estate companies, and service providers that offer these discounts to Homes for Heroes participants when they use their approved partners.

It’s a nationwide private program, so the exact requirements, discounts, and partners can vary by location. You’d need to go through the Homes for Heroes qualification process in your area.

-

This reply was modified 1 year, 1 month ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 1 year, 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

A credit inquiry, also known as a credit check, occurs when a lender, credit card issuer, or another financial institution checks your credit report as part of a decision-making process. These inquiries are recorded on your credit report and can be categorized into two types:

-

Hard Inquiries: These occur when you apply for a loan, credit card, or mortgage, and you have authorized the lender to check your credit report. Hard inquiries can slightly lower your credit score for a short period and can stay on your credit report for up to two years. They are visible to anyone who views your credit report.

-

Soft Inquiries: These occur when you check your own credit score or when a lender checks your credit for pre-approval offers, without you initiating an application. Soft inquiries do not affect your credit score and are not visible to lenders, only to you.

Understanding the impact of these inquiries can help you manage your credit more effectively, especially if you are considering applying for new credit.

-

-

Removing a credit inquiry from your credit report can be a nuanced process, depending on whether the inquiry was authorized or not. Here are the general steps and considerations:

-

Identify if the Inquiry is Hard or Soft:

- Soft inquiries are not visible to creditors and do not affect your credit score (e.g., checking your own credit).

- Hard inquiries occur when a lender checks your credit for a lending decision, and these can affect your score if there are too many at once.

-

Dispute Unauthorized Inquiries:

- If you did not authorize an inquiry, you can dispute it with the credit bureau (Equifax, Experian, or TransUnion). You will need to provide documentation that you did not authorize the credit check.

- You can file a dispute online, via mail, or over the phone. The bureau typically has 30 days to investigate the dispute.

-

Wait for Inquiries to Fall Off:

- Hard inquiries will naturally fall off your credit report after two years, which is the simplest way to remove them if they were authorized.

-

Good Practices Moving Forward:

- Limit the number of credit applications you submit.

- Regularly monitor your credit report to catch and address issues early.

It’s important to note that successfully removing a hard inquiry usually involves proving it was unauthorized. If the inquiry was legitimate, it cannot be removed and will remain on your report for up to two years. Regular review of your credit report can help you identify any discrepancies or unauthorized activities early on.

-