Chase

Preferred Realtor PartnerForum Replies Created

-

Many donors do not want to provide their bank statements or Financials. This is a great change for the better. Thanks for sharing.

-

Chase

MemberJuly 19, 2024 at 3:03 am in reply to: Rhonda Smith: Mortgage Loan Originator at Gustan Cho AssociatesThat is amazing Rhonda. It’s the people that make a great team.

-

There’s no way the Democrats and George Clooney threw Joe Biden under the bus just because of his performance during the Presidential debate with former President Donald Trump. I knew Joe Biden was mentally ill and had dementia before the 2020 Presidential election. Something happened that triggered the Democrats to turn on Biden after the Presidential debate. George Clooney met Biden three weeks ago and he couldn’t tell that Joe Biden was not all there mentally? We will soon find out the drama among the Democrats. Out of 30 potential Democrats to run for reelection, Kamala Harris fared a 29% which is a good indication she may be the Presidential candidate for President for the Democrats.

-

Joe Biden is too old to run for reelection to be the President of the United States says a mental health expert after examining his actions during the Presidential debate with former President Donald Trump. 87% of the American people feel Joe Biden is too old and mentally not fit to run for reelection.

-

Chase

MemberJune 29, 2024 at 6:11 pm in reply to: What Type of Credit Tradelines Should I Get To Boost Credit ScoresBoosting your credit score involves: Adding positive credit tradelines to your credit report. Managing them responsibly. Maintaining a good credit history. Here are some types of credit tradelines that can help boost your credit score: Secured Credit Cards.

How It Works: Secured credit cards require a security deposit, typically your credit limit.

Benefit: These cards are easier to obtain if you have a poor or limited credit history. Responsible use (on-time payments, keeping balances low) can significantly improve your credit score.

Examples: Discover it Secured, Capital One Secured Mastercard.

Unsecured Credit Cards

How It Works: Unsecured credit cards do not require a deposit and offer a credit limit based on your creditworthiness.

Benefit: Regular, responsible use can help build credit. Cards with rewards programs can also provide additional benefits.

Examples: Chase Freedom Unlimited and Citi Double Cash Card.

Retail Store Credit Cards

How It Works: These are credit cards offered by retail stores, often with benefits like discounts or rewards for purchases at the store.

Benefit: Easier to obtain than regular unsecured credit cards and can help build credit if used responsibly.

Examples: Target REDcard, Amazon Store Card.

Credit Builder Loans

How It Works: A credit builder loan is designed to help build credit. The loan amount is held in a bank account while you make monthly payments. Once the loan is paid off, you receive the funds.

Benefit: This can help establish a positive payment history, crucial for improving credit scores.

Examples: Self Credit Builder Account, Credit Strong.

Authorized User Accounts

How It Works: Being added as an authorized user on someone else’s credit card account (typically a family member or close friend) can help boost your credit score if the primary account holder has a good credit history.

Benefit: The account’s positive payment history and low utilization rate can improve your credit score.

Examples: Any credit card where the primary account holder has a good payment history.

Personal Loans

How It Works: If managed responsibly, personal loans can help diversify your credit mix and improve your credit score.

Benefit: On-time payments contribute to a positive payment history and can improve your credit score.

Examples: Loans from banks, credit unions, or online lenders like SoFi or Marcus by Goldman Sachs.

Mortgage Loans

How It Works: A mortgage is a significant tradeline that, when paid on time, greatly improves your credit score.

Benefit: Timely mortgage payments over a long period significantly enhance your credit profile.

Examples: Home loans from banks, credit unions, or mortgage lenders.

Additional Tips for Boosting Your Credit Score

Pay Bills on Time: Your payment history is a significant factor in your credit score. Ensure all your bills, including utilities and rent, are paid on time.

Keep Balances Low: Maintain a low credit utilization ratio (ideally below 30% of your available credit).

Diversify Credit Types: A mix of credit accounts (credit cards, installment loans, mortgage) can positively impact your credit score.

Monitor Credit Reports: Regularly check your credit reports for errors and dispute any inaccuracies.

By adding and managing these tradelines responsibly, you can steadily improve your credit score, enhancing your chances of qualifying for a mortgage with favorable terms.

-

Chase

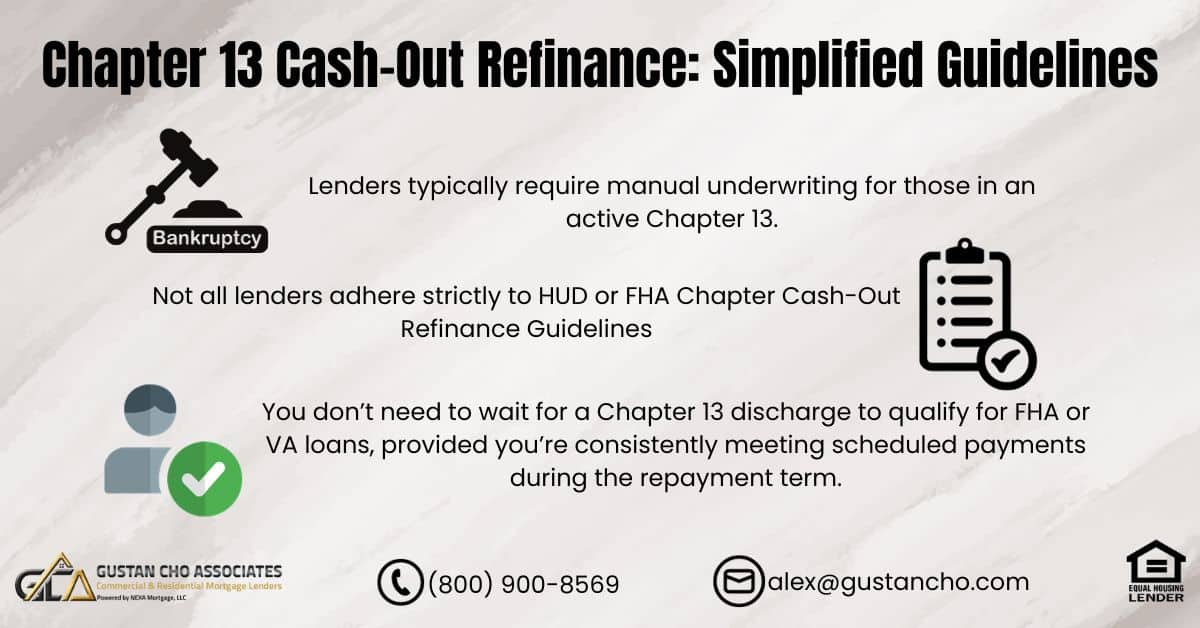

MemberJune 29, 2024 at 5:28 pm in reply to: Buy Out Chapter 13 Bankruptcy While in Repayment PlanWays of Purchasing Chapter 13 Bankruptcy with a Cash-Out Refinance

Know the prerequisites:

Home Equity: For you to be eligible for a cash-out refinance, you should have sufficient equity in your home.

Agreement on Chapter 13: Get an endorsement from your bankruptcy trustee to seek a cash-out refinance.

Credit And Income: Make sure that your credit score and income are good enough for the refinance. FHA and VA loans have more flexible requirements, sometimes allowing for lower credit scores and manual underwriting.

Talk With Your Bankruptcy Trustee:

Ask for permission: Request permission from your Chapter 13 trustee to move forward with the refinance. This is important because any changes in repayment plan must be approved by the trustee.

Plan adjustment: Explain how money generated by refinancing will be used to pay off remaining balance owed under Chapter 13 plan.

Check Loan Eligibility:

FHA Loans: These types of loans are easily accessible during chapter thirteen bankruptcies. Under FHA guidelines one can still refinance even when he/she is in active repayment plan as long as there is approval from trustee.

VA Loans: Veterans also have another option which is VA loan. It allows for refinancing during an active chapter thirteen plan provided there is consent from trustee.

Prepare Documents:

Income verification documents: Gather pay stubs, tax returns or any other necessary papers showing that indeed you earn income.

Bankruptcy papers filing evidence : Have all relevant bankruptcy forms including payment proposal together with approval from court-appointed administrator or judge presiding over such cases where applicable).

Proof Of Home Equity: Get recent valuation report done by qualified appraiser indicating current market price/value of residential property plus available equity amount if any at this time..

Find A Lender:

Specialist lenders : Look out for those who deal specifically with borrowers going through chapter thirteen bankruptcies; not every lender may know about them nor want anything to do with such cases.

Loan application: Fill in an application form for cash out refinance and indicate your bankruptcy status truthfully.Most of the information requested will be similar to that which one would provide when applying for a normal loan.

Loan Underwriting:

Manual Underwriting: If you are applying for FHA or VA loans then expect this process where they look at all details about your financial life including how well have been repaying debts so far. They usually want evidence showing regularity and consistency of such payments over time.

Appraisal: Your current home value will be assessed by an independent valuation firm working on behalf of the lender,so as to establish how much it is worth now in comparison with what was paid when you bought it initially.

Approval & Closing:

Conditional Approval: Once your application is conditionally approved, the lender will work with your trustee to ensure that part or all of the proceeds go towards settling any outstanding debts under chapter thirteen bankruptcy plan.

Closing costs: Prepare yourself financially for closing costs as they are not covered by most refinancing deals and can sometimes amount up-to few thousands dollars depending largely upon size loan being sought after plus other factors like location among others..This money may either be paid upfront during signing new mortgage loan agreement or added onto total amount borrowed thereby increasing monthly repayments slightly until fully paid off usually within first year after refinancing has taken place.

Settlement: At closure, cash received through refinancing process replaces original mortgage balance owed thus effectively buying out chapter 13 bankruptcy.Directly related expenses include trustee fees charged by court-appointed administrator who oversees debt repayment plans proposed under Chapter Thirteen rules.

https://gustancho.com/chapter-13-cash-out-refinance-guidelines/

-

This reply was modified 11 months ago by

Chase. Reason: Forgot image

Chase. Reason: Forgot image

gustancho.com

Chapter 13 Cash-Out Refinance Guidelines During Repayment

Chapter 13 Cash-Out Refinance Guidelines During Repayment Plan is allowed to pay off the Chapter 13 debt repayment plan early

-

This reply was modified 11 months ago by

-

“Under Pressure” is a rock song by Queen and David Bowie, which was released as a single in 1981. It has been considered one of their most successful hits ever since then. The two musicians joined together when they were both recording albums nearby each other during an impromptu jam session at Montreux, Switzerland.

Theme and Lyrics: This song deals with the stress that people feel under modern life’s pressures on themselves and their loved ones around them. It also talks about love for others through hard times we are all going through together as well as showing compassion towards each other during these difficult moments too. The bass line created by John Deacon remains so catchy!

Chart Performance: “Under Pressure” topped charts worldwide such UK singles charts where it stayed number one for many weeks consecutively before becoming another big hit throughout Europe; still today – even after death both Freddie Mercury’s and David Bowie’s – this tune remains among their most loved songs ever recorded anywhere at any time!

Recording and Production: The band members thought up different parts while in studio together making things up as they went along, then recorded everything right there on spot without hardly any planning or preparation before hand whatsoever! Freddy Mercury got into scat-singing during playback so David Bowie decided to try some himself while listening back which ended being left in because it sounded so good – made up on the spot!

Cultural Impact: Vanilla Ice famously sampled ‘Ice Ice Baby’ from this track but there have been other covers done over years like Annie Lennox who did her own version called ‘Little Bird’ (1992) etcetera…

Legacy of Under Pressure by David Bowie & Freddy Mercury: This is such an amazing song lyrically speaking too since it always talks about how hard life can be sometimes but no matter what happens we must keep going forward always hoping better days will come soon enough anyway; Even though he died many years ago already now but still people love to listen this one especially live with guest vocalists Qeen Brian May and Roger Taylor… These sources can provide additional insights into the creation, significance and continued popularity of “Under Pressure” by Queen & David Bowie.

-

This reply was modified 11 months ago by

Chase.

Chase.

-

This reply was modified 11 months ago by

-

If you want to take advantage of platforms such as Amazon, eBay and Shopify as well as usage of tools like PPC ads and Ecommerce software; starting an Ecommerce business will require a number of key steps. Here’s an in-depth guide to getting started:

Research and Planning

Find Your Niche and Products

Unique Products – Look for unique products that have high demand but are not easily accessible.

Market Research – Use Google Trends, Amazon Best Sellers and competitor analysis to identify trending products or niches.

Keywords – Discover relevant keywords customers may use with Google Keyword Planner, Ahrefs or SEMrush (Keyword Research Tools).

Amazon’s Keyword Tool – Use Helium 10, Jungle Scout or other third-party apps in order to find out what keywords rank high on Amazon itself.

Setting Up Your Online Store

Choose Your Platform

Amazon – Create an Amazon seller account. Decide whether you want to do FBA (Fulfillment by Amazon) or FBM (Fulfillment by Merchant).

Shopify – Sign up for Shopify which allows you to create a customised eCommerce website.

eBay – Create an eBay seller account and set up your store.

Website Integration

If you have a website already consider integrating your ecommerce store using plugins or widgets provided by these platforms.

E-Commerce Software

Viral Launch/Viral Launch Alternative Software(s)

Viral Launch: It is used for product research, keyword research & market analysis specific to Amazon only but can be helpful if needed elsewhere too…

Helium 10: Another option similar to Viral Launch however it has its own suite of tools such as product research etc. This is particularly useful for listing optimization and keyword tracking amongst other things!

Jungle Scout: Popular tool among amazon sellers which helps them locate profitable products as well as track sales etc..

Marketing & Traffic Generation

PPC Ads (Pay-per-click advertising)

Google Ads: Set up google ad campaigns targeting keywords relevant to your products.

Amazon PPC: Use amazon’s ppc platform to run sponsored product ads.

Social Media Ads: Utilise platforms like facebook, instagram or pinterest for targeted ads.

SEO (Search Engine Optimization)

Content Marketing – Create high quality content around your products & niche in order to attract organic traffic.

On-Page SEO – Optimize product listings, descriptions and meta tags with relevant keywords etc…

Logistics and Fulfillment

Amazon FBA

This involves shipping your products to Amazon’s fulfillment centers where they handle storage, packaging and shipping on your behalf. It is an efficient logistics solution that allows for scalability within the business however fees are higher as well as less control over inventory management being available among other things.

Self-Fulfillment

Shopify & eBay – Manage inventory, shipping & returns yourself through these platforms. Pros: More control over fulfilment process etc..

Cons: More time consuming + requires more resources. Financial Management

Amazon SBA

This is a lending service by Amazon which offers loans based on performance of sales made on their platform(s).

Shopify Capital

Similar concept but this time it is only applicable if you’re using Shopify as opposed to any other ecommerce provider out there. It provides funding options for merchants who want to grow their business(es) further still.

Accounting Software Use Quickbooks/Xero/Wave or something similar so as not only keep track of finances but also record sales correctly; handle tax affairs accordingly too. Customer Service

Customer Support – Be responsive when dealing with customer inquiries, returns or feedback. You can use Zendesk/Freshdesk/other software(s) to manage support tickets better than ever before!

-

Jill Biden needs to get Joe Biden some medical and pychiatric help.