Connie

AttorneyForum Discussions Started

-

All Discussions

-

If I were to surrender my mortgage brokerage and put it in hibernation and do a lateral transfer to a national mortgage brokerage company that is licensed in most of the 50 states, it there a deposit I would have to pay or empty credit card OR am I going to start off with a large negative balance on my P and L due to licensing transferring for my licensed loan officers, and myself. How about my hourly and salaried employee? Let’s take a hypothetical case scenario where I start with a national mortgage brokerage company ABC Mortgage Broker. I am on a P and L. Things go by smoothly where we are lucky to not run in the red and are able to pay our bills. What happens if all of a sudden a lot of loan fall through and we are having a slow month and are running short to make good on all of our bills. I will assume the basics such as electricity and other utilities will get paid or I can use my business credit card but how about the big ticket expenses like payroll for salaried and hourly employees. Will the parent company, ABC Mortgage Broker suspend payroll or will they need to wait until my P and L goes in the positive. The employees I am talking about are two mortgage processors and three loan officer assistants and are paid hourly and salary via W2. Their paychecks are issued on the first and fifteenth of the month with taxes being taken out. I know the mortgage industry has been rough the past two years and many mom and pop mortgage broker owners are struggling with not meeting expenses with incoming revenues. I am in Lake County, Illinois and I know both the Federal and State Department of Labor have strict laws, rules, and guidelines concerning making timely payroll payments. Can anyone advise? Thank you in adviance.

-

At 61, Melinda Gates Finally Confesses The ACTUAL Reason Behind The Divorce

She had everything. A 130 billion dollar fortune. A mansion with 66,000 square feet. Three beautiful children. And a husband, the world called a genius. But behind closed doors, Melinda Gates was lying on the floor in tears, having panic attacks for the first time in her life, and waking up screaming from nightmares about her house collapsing around her. After 27 years of silence, she is finally telling the world what really happened inside that marriage.

-

Erika Kirk’s personal life has taken another explosive turn after her new boyfriend reportedly shocked Charlie Kirk’s parents, and insiders say things got ugly fast. What was expected to be a private introduction allegedly spiraled into confrontation, confusion, and serious concern from Charlie’s family — pushing already-strained relationships even closer to the edge.

According to sources close to the situation, the backlash wasn’t about jealousy or control — it was about timing, optics, and unanswered questions surrounding Erika’s recent scandals. Charlie’s parents were reportedly blindsided, believing the relationship moved far too quickly given the legal, family, and public chaos still unfolding. Some claim the new boyfriend’s background only deepened their alarm.

Fans following the drama say this moment confirms what many suspected — the situation is no longer repairable behind closed doors. What began as tension has now turned into outright hostility, with trust completely broken and sides being chosen. Social media users are questioning whether Erika is doubling down or trying to distract from mounting pressure.

Charlie is said to be caught in the middle once again, facing a growing divide between loyalty and family — a position supporters fear could cost him everything if the conflict continues.

Stay locked to HotTeaDaily for updates as this situation escalates, reactions pour in, and the fallout turns even messier. Don’t forget to subscribe so you never miss what happens nexlt!!!

-

On Tuesday, January 6, 2026, U.S. financial markets will remain open, though with some unease. Silver is seeing a sharp correction after surpassing $76 per ounce. Mortgage and auto loans are still costly, and political risks are rising both domestically and internationally. Events like the Maduro case, Minnesota’s welfare-fraud scandal, and judicial issues in Wisconsin and sanctuary areas are fueling concerns about a major shift in policy and markets. While housing has not collapsed as in 2008, affordability is stretched, rates are high but starting to ease, and rising inventory is making for a challenging adjustment for the industry instead of a gentle transition.

Stocks, Bonds, and Interest Rates

U.S. stocks are moving within a tight and unpredictable range as investors weigh slower but still high inflation, possible further Fed rate cuts, and political uncertainty from President Trump’s pressure on the central bank and criticism of Fed Chair Jerome Powell. Treasury markets remain the main influence on mortgage and corporate loan costs. Ten-year yields are still high compared to post-2020 levels, and mortgage rates are tracking those yields rather than the Fed funds rate.

- Currently, the national average rates for a 30-year fixed-rate mortgage and a 15-year fixed-rate mortgage are 6.25% and 5.52%, respectively.

- These rates are an improvement over the rates above 7% seen in early 2025.

- Forecasters, including Redfin and Fannie Mae, agree that the 30-year mortgage rate will remain near 6.0% throughout 2026.

- This means rates should ease somewhat, but not as much as they did early in the pandemic.

- Bankrate reports that auto loan rates remain high but are starting to come down from their peaks.

- They expect average rates of 6.7% for new 60-month car loans and 7.1% for 48-month used car loans.

- These are only slight improvements over rates expected at the end of 2025.

Wider spreads on mortgage-backed securities and lender risk have also kept retail mortgage rates high. This reflects lender risk, credit concerns, and the cost of capital.

Silver: Crash, Correction, And Big‑Bank Shorts

In this cycle, silver has been the most volatile major asset. Its price surged 160% in 2025, reaching about $83 to $84 per ounce before a sharp correction into early 2026.

- Recently, silver traded above $76 per ounce, sometimes overshooting, but then dropped to the low $70s due to margin calls, profit-taking, and low liquidity.

- Analysts point to tight mine supply, record industrial demand from solar, EVs, electronics, and data centers, and silver’s addition to the U.S. critical-minerals list as reasons for a generally bullish long-term outlook, even with short-term volatility.

- Analysts also note that changes in mine ownership of critical minerals support a bullish trend, despite ongoing volatility.

Technical Analysts Now Openly Describe Three Stages For Silver’s Price Movement:

- Near-term: High volatility as speculators adjust and leverage unwinds in the $65 to $80 range.

- Mid-term: If the Fed adopts a more supportive policy and industrial demand stays strong, silver could retest and possibly break above $80.

- Long-term: More analysts now see $100 per ounce by 2026 as a realistic target if the supply-demand imbalance continues.

There is growing attention on the idea that big banks are shorting silver. Regulators’ data does not show exact dealer positions, but some trends are clear. A report in late 2025 – early 2026 states that JPMorgan has reduced/adjusted some legacy short holdings, while paradoxically increasing its shorts, giving a competitive advantage over Bank of America and HSBC on the short side.

- Industry reports suggest JPMorgan is hesitant to release physical silver to the COMEX.

- As a result, some banks and funds with short positions must settle in cash or pay high premiums for deliverable bars.

- This behavior is widening the gap between ‘paper silver’—such as unallocated accounts, ETFs, and cash-settled futures—and physical silver.

- Physical supply is tight, and premiums, especially in China, are high.

For Investors, This Has Several Implications:

- When there are delivery squeezes, paper products—especially those with unallocated accounts and futures—may trade at prices that do not reflect the true scarcity of the metal.

- In extreme cases, physical bars and coins in popular retail forms can become completely disconnected from futures prices and may sell at ongoing premiums above the spot price.

The Housing And Mortgage Markets: Not A Crash, Just A Reset

- The shock from rising mortgage rates is likely over, but the U.S. housing market is still adjusting.

- Analysts call this period the Great Housing Reset.

- Affordability remains a challenge, especially in high-priced, low-inventory areas.

- Mortgage professionals face a split market: high-inventory, low-price areas see slower sales, while listings are rising in low-inventory markets.

- Redfin predicts the average 30-year mortgage rate will be about 6.3% in 2026.

- This is down from roughly 6.6% in 2025, but still significantly higher than rates prior to 2020.

- According to an analysis from Realtor.com, the 2020 national level of affordability can only be restored if mortgage rates return to the 2% range, incomes increase by 50% or more, or home prices decrease.

- None of these events is likely to occur based on the current situation.

- As more new homes are completed, buyers and sellers are accepting that 3% mortgage rates are gone, which has increased inventory in several markets.

- Still, except for a few Sunbelt areas and markets with heavy investor activity, there is no major oversupply.

Are We Facing Another Housing Crisis, Similar To The One In 2008?

Most analysts do not expect another housing crisis on the scale of 2008, although there are still significant risks.

- Key differences now include a higher proportion of fixed-rate mortgages, stricter lending standards, and stronger household finances.

Potential Problems:

- If we experience a major recession accompanied by significant job losses, we could see a substantial increase in foreclosures.

- Aggressive Federal Reserve policies could lead to a loss of confidence in government securities, driving up long-term interest rates and therefore mortgage rates.

- The most likely outcome is a long period of reduced affordability, some regional price declines, and a slow, multi-year return to normal instead of a sudden nationwide adjustment.

In This Situation, Lenders And Brokers Are Positioned To Succeed With:

A successful business model now focuses on purchases, strong partnerships with realtors and builders, and educating clients about buydown options, adjustable-rate mortgages, and solutions to help buyers manage a 6% interest rate and scale remain important, as the volume of loan officers per mortgage is significantly lower than during the 2020-2021 refinancing boom.

Mortgage industry & Consolidation: Where Does NEXA Lending Fit In?

The mortgage industry is still adjusting to the shift from the high refinancing volumes of 2020-2021 to today’s rate-driven slowdown. Trade publications from 2024 to 2025 report that large companies like Rocket are still reducing staff after acquisitions, and similar cost-cutting measures are happening across the industry.

- Many independent shops and small brokers are closing, merging, or shifting focus to niche areas such as non-QM, DSCR, and investor loans to cope with low volumes and high costs per loan.

- Large firms with servicing income, access to capital markets, scale, or strong recruiting capabilities are acquiring producers who have been laid off elsewhere.

NEXA Mortgage-NEXA Lending

NEXA Mortgage, now rebranding as NEXA Lending, continues to operate as the largest broker‑based mortgage platform in the country by loan officer headcount, with more LOs than any other broker shop and a national rather than regional footprint. The firm has deliberately pursued a coast‑to‑coast broker model and is using the NEXA Lending name to signal an evolution toward broader lending capability, not just a traditional broker Network. In terms of scale,

NEXA Lending sponsors more than 2,400 loan officers and has been originating roughly 666 billion dollars in annual volume in the 2023–2024 period, placing it far above the typical mid‑sized broker or retail lender that might produce only hundreds of millions to low single‑digit billions per year.

While an average mid‑sized broker tends to operate in a limited local or regional market and is heavily dependent on refinance cycles, NEXA Lending’s strategy has been to remain in growth mode even through the rate shock, continuing to add LOs and expand market share nationalmortgageprofessional.

NEXA is doing this under ongoing legal and governance challenges, including leadership disputes and lawsuits that have generated reputational questions and trade‑press scrutiny. Instead of retrenching, the company has kept recruiting and investing in its platform, which suggests management is intentionally doubling down on scale at a time when many competitors are cutting staff, exiting channels, or selling their books of business just to survive the high‑rate, low‑volume environment.

- https://www.nationalmortgagenews.com/list/nexa-mortgage-ceo-talks-breakup-with-co-owner

- https://nationalmortgageprofessional.com/news/nexa-lending-signals-end-brokers-are-better

- https://housesmarketplace.com/rocket-trims-workforce-after-completing-mr-cooper-acquisition/

For Gustan Cho Associates and its subsidiaries, this environment favors well-managed correspondent and broker platforms that can:

- Offer extensive product menus (FHA/VA/USDA, non-QM, investor cash-flow, bank-statement loans) at times of thin agency refi volume.

- Attract highly qualified, information-seeking borrowers using strong SEO, content, and educational resources.

- These borrowers have been underserved as large brands have withdrawn, and GCA FORUMS digital strategy is designed to address this need.

Auto Industry And Financing

The auto sector started 2026 with sales below their 2025 peak and a more stable supply chain, but still faces challenges, especially with affordability.

- Cox Automotive projects U.S. new vehicle sales at about 15.8 million in 2026, down 2-3% from 2025, as higher rates and price fatigue limit demand.

- Edmunds and Bankrate report that new car APRs are averaging in the mid-6% range, which is an improvement.

- However, high prices and strict credit standards keep monthly payments high.

- Rising inventory and discounts in some auto loan segments, along with lower rates, may help meet pent-up demand.

- Still, these changes do not solve the problem of high prices.

- For auto finance professionals, the approach is similar to mortgages: focus on optimizing loan terms, offering targeted incentives, and educating customers about FICO tiers, instead of waiting for rates to drop.

Inflation, Fed Policy, And Powell’s Position

Rates have been cut several times in 2022 and 2023, and headline inflation in the U.S. has come down from earlier highs. Still, price growth is above pre-pandemic averages and the 2% target for core inflation.

- Mortgage and auto rates have not fallen as much as policy rates.

- Bankrate’s auto loan forecast, along Bankrate’s auto loan forecast and Redfin’s mortgage predictions expect a slowdown in near-term rate drops and a move to declining policy rates, assuming the Fed adds gradual, modest cuts in 2026.

- President Trump has called Fed chair Jerome Powell “terrible,” and there is speculation that Trump would replace Powell with a more dovish chair.

- These factors complicate the president’s relationship with the Fed. push mortgage rates higher, even if inflation is improving, because it affects the Fed’s independence and increases the term premium on Treasuries.

Politics, Law Enforcement, And Trump’s Standing

In his second term, Trump is working to shape federal law enforcement to his preferences. Appointing close associates like Pam Bondi as Attorney General and Kash Patel as FBI director has increased concerns about a more politically driven Justice Department and FBI. Patel is seen as the most politicized member of Trump’s law enforcement team, and some career officials say this is the most politicized team Trump has assembled to date.

Trump often uses aggressive language when interacting with others. He openly says he will attack Powell and foreign leaders, and threaten domestic critics and undocumented immigrants.

Some support these actions for the deregulation and tax cuts they bring. However, this approach has cost him support from many independents, civil libertarians, and global investors who worry about the rule of law. Trump’s actions are also dividing U.S. business leaders. Some support lower taxes and tariffs, while others oppose increased trade, more immigration, and a weaker central bank.

Tensions Between United States and Venezuela

As tensions rise between the U.S. and Venezuela, former Venezuelan President Nicolás Maduro and his wife have been charged with drug trafficking and are now in U.S. custody.

A new indictment has been filed with the US Attorney for the Southern District of New York. Maduro is charged, along with his wife and son, along with other members of the clan, with conspiring with drug cartel members and other “narco-terrorists” to smuggle large quantities of cocaine into the United States.

Maduro and his wife have been transferred under close watch from a Brooklyn detention center to an international court in Manhattan, where they will face trial in the U.S. This case is expected to have significant implications for sanctions, regional politics, and the Trump administration’s use of military and legal tools abroad. It marks a new stage of legal and geopolitical activity in 2026.

Scandal of Welfare Fraud in Minnesota and Its Impact on the Political Future

Minnesota is once again at the center of a welfare fraud scandal, this time involving the governor’s office. The state is embroiled in the Feeding Our Future case, in which federal prosecutors allege that 70 individuals conspired to steal over $250 million from federal nutrition programs during the pandemic.

- Most of the accused are Somali Americans, which has heightened tensions around immigration and community relations in the area. State officials, including Governor Tim Walz, have publicly condemned blaming the entire Somali community.

- Walz decided not to run for a third term to focus on fighting fraud and protecting the state’s integrity.

- He is facing new allegations, including those related to child care and welfare, as well as increasing political threats against him.

- Currently, there is no evidence that Walz is the target of a federal indictment.

- The investigation is focused on nonprofit operators and the systems that may have been abused.

- Other politicians are still questioning what the governor’s office knew and when.

Wisconsin: Judge Hannah Dugan Resigns

In Wisconsin, issues of obstruction of justice and judicial independence came together when Judge Hannah Dugan of the Milwaukee County Circuit Court was convicted of helping an immigrant avoid detection by federal authorities.

- After her December conviction and facing Republican threats of impeachment, Dugan resigned, ending her ten years on the bench resignation letter,

- Judge Dugan defended her record of fairness but acknowledged that the controversy had made it impossible for her to continue serving as she had intended.

- This situation is expected to spark more partisan fights over ICE cooperation, sanctuary policies, and state limits on local judges whom federal immigration authorities believe are not enforcing immigration laws.

Sanctuary Cities, Chicago, And State Pressure

Chicago, as a sanctuary city, is under close watch, especially by the Trump administration, which supports mass deportation and threatens local officials who do not enforce federal law.

- Because of the Trump administration’s mass deportation policies, Chicago’s budget is stretched to support thousands of migrants bused from Texas.

- This has led city officials to consider limiting the Welcoming City Ordinance.

- Trump’s new Border Czar, Tom Homan, has called Chicago ‘ground zero’ for deportations and is planning large-scale ICE operations there.

- Local officials and immigrant communities are preparing for raids at workplaces, transit stops, and even places usually considered safe.

National Update On Sanctuary Areas

- Sanctuary areas from New York to the West Coast are watching as federal officials threaten to sanction those who resist deportations.

- These threats are raising new constitutional questions.

The Mortgage Industry Is Adapting

With high home prices, mortgage rates, and slowly rising inventory, mortgage companies must adapt or leave the market. Trade coverage from 2024 to 2025 has detailed layoffs and restructuring at major firms like Rocket, Mr. Cooper, and Redfin, and this trend is expected to continue in 2026.

Survivors Typically Exhibit Several Characteristics:

- Strong purchase focus, little dependence on refinancing.

- Multi-channel structures (retail, broker, correspondent) and breadth of offerings, including non-QM, investor, and renovation loans.

- Companies are investing in content and technology to lower costs per loan and boost organic leads, especially through forums and SEO, as seen with Gustan Cho Associates.

In this environment, larger, well-funded brokerages like NEXA Mortgage and NEXA Lending, along with established content platforms like GCA Forums, are well-positioned to acquire displaced loan originators and borrowers as weaker companies close or merge. If you wish, the next step is to turn this into a GCA Forums ‘live ticker’ format, with time-stamped updates on silver, interest rates, housing, and key political or legal news, ready for posting.

-

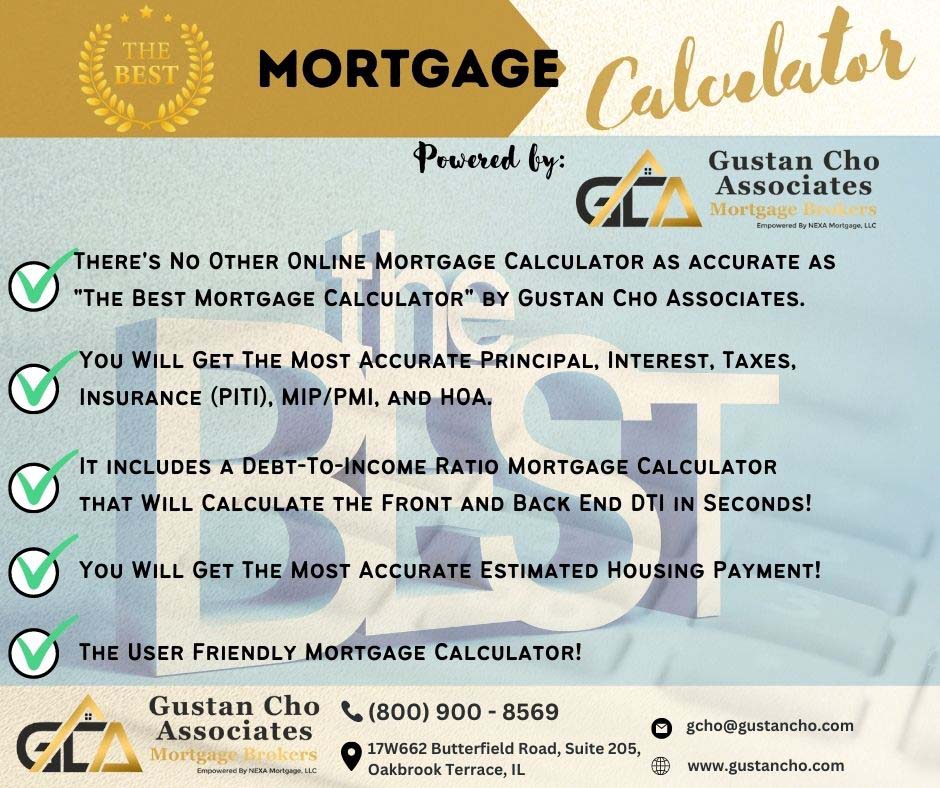

South Dakota is one of the most beautiful places to live with breathtaking mountains, open land, reasonable housing prices, great place to raise a family, great economy, low local, state, and federal taxes, and affordable place to live. The best part of South Dakota is the people are great. They are friendly, believe in the right thing to do, and go out of their way to help their neighbors and tourists. We will cover more on housing in South Dakota. Attached is the best mortgage calculator for South Dakota. Try out the South Dakota mortgage calculator and you will never want to use any other online calculator again.

-

GCA Forums News for Monday November3 2025: In today’s episode of GCA Forums News for Monday, November 3, 2025 national breaking news the following LIVE Topics and LIVE sections will be covered. The LIVE NEWS TEAM will cover the latest LIVE housing and mortgage news: What are the LIVE mortgage rates today? What is the live interest rates and what are the economists and monetary experts forecasting on the state of our economy including LIVE real estate news, LIVE mortgage news, LIVE Stock Market NEWS, LIVE Gold and Silver prices per ounce and other precious metals, LIVE national and local economic data and numbers, UPDATE on LIVE NEWS on the government shutdown and how the government shutdown is affecting government workers, HUD, VA, USDA, FANNIE MAE, and FREDDIE MAC, who is responsible for the government shutdown, the negative effect of the government shutdown has on government workers and the economy, and the overall impact city employees, elected officials such as local and county commissioners, Mayors, and Governors of towns, villages, cities, counties, townships, and states of the so called and self declared Sanctuary Cities and States. Will the federal government go after these politicians and seek criminal charges by pursuing obstructing and impeding federal law enforcement officers by ordering city, county, and state police agencies of their state with declaring their municipalities a ICE FREE ZONE AND EXECUTIVE ORDERS OF DO NOT COOPERATE WITH FEDERAL LAW ENFORECEMNT AND NATIONAL GUARD SOLDIERS FROM COOPERING WITH THE TRUMP ADMINSITRATION. STAY TUNED!!! WE HAVE A BUSY BREAKING NEWS REPORT READY TO GET RELEASED SHORTLY.

-

Breaking: Trump to Fire Fed Chair Jerome Powell as Mortgage Rates Expected to Fall by 3% Due to Renovation Controversy

For Trump, Chair Powell has crossed a line that has consequences not only for the growth rate but also for monetary policy. Trump has set his sights on replacing Powell and letting go of the five to whom his council has whittled the list. He is conducting interviews, as pried from his close advisers. There has been buzz that the new Fed Chair aims to cut the rate on 30-year loans by approximately 3%. If that is the case, the mortgage interest rate on the 30-year fixed loans will fall, which has already excited numerous people in the real estate market. Homebuyers will be very active if the mortgage interest rate is set under the 6% mark. The ongoing renovation on the Marriner S. Eccles Building and the adjoining FRB-East structure on the right are now over $2.5 billion. And the initial budget was around 1.9 billion. President Trump once claimed that the price could reach 3.1 billion. Fed officials state that the overspend is due to the one-of-a-kind asbestos and lead contamination, demanding materials, tariffs, inflation, and the inadequate state of the workforce. However, the Trump administration criticized mismanagement and fraud on the part of Powell’s team. All of that is Powell’s problem now. He expects the project to be finished by the fall of 2027, but in addition to that, he is shifting 3,000 other workers. Powell is the target of Trump’s attacks on the central bank.

The market expectations ahead of the next FOMC on 2023-10-15 are that there is little to no possibility the Fed will cut rates. However, Fed Governor Michelle Bowman predicts there will be two cuts before the end of the year, which would bracket the rates below 4. Investors expect a 25 basis point cut on October 29 at the meeting, due to the weak jobs report and sluggish economic growth. Powell has been listening to the rising issue of slow growth paired with inflation that seems to have no end. Powell, akin to the rest, has been more vocal than ever on the necessary data-driven approach.

Live U.S. Economic Indicators: Stock Markets Discordant, Gold and Silver Prices Spike Amid International Differences

The afternoon session on U.S. stock exchanges on October 14, 2025, by 3 PM ET, revealed mixed performance results amid ongoing U.S.-China trade tensions. The Dow Jones Industrial Average rose 428 points-or almost 1 percent- to 46,067.58, gaining back almost the 615-point intraday low it reached. At the same time, the S&P 500, on the other hand, crawled up 0.3 percent to 6,654.72. The fifth index, the tech-rich Nasdaq Composite index, was down 0.8 percent to 22,694.61 because of the 1.4 percent loss. The CBOE Volatility Index (VIX) was 19.03 points, indicating market nervousness.

Government bond yields slipped down 0.02 percent as the decrease was counterweighted by the interest observed in the session earlier. The price of gold went sky high, reaching 4,171.88 dollars an ounce, and the value of silver also reached an incredible 52.47 and 0.38 percent increase. In contrast, in the collapsed sky exchange, silver attained the incredible value of 53.52 dollars an ounce, its record high value. Bonds dropped as worries about the economy rose. The yield on the 10-year U.S. Treasury was down two basis points to settle at 4.03 percent.

Mortgage rates lowered again, with the average 30-year fixed rate falling four basis points to 6.24%, according to Zillow data. This brings some relief to prospective homebuyers. The latest Consumer Price Index (CPI) for August also showed a 2.9% year-over-year rise for the all-items index, up from 2.7% in July. However, the September data release has been pushed to October 24 due to the government shutdown. Regarding growth, the real GDP in Q2 2025 was growing at an annualized rate of 3.8% and has been predicted to continue at that rate with the Atlanta Fed’s GDPNow model for Q3 as of October 7.

Shocking Chicago: The ICE Agents Were Surrounded – Then The Obstruction And Imprisonment Of Johnson And Pritzker.

On the Chicago north side, there was daily calm, obliterating tension, and the federal ICE agent; however, the agent claimed they were undercover, so they witnessed the event and wanted the police for help. Movement, and the People Movement police, amid this chaos, go Pohl and Pepper Sting the ICE, take some of the citizens, and best of luck to Pep and Pohl.

The CPS police chief: Yo, bastard Palick, we sent many troublesome people to the south side on this day. All units ck, count to 100, do not trot, do not roller skate, and do not weep. There will be no backup.

This is what the federal government doesn’t want. He, Donald, the ICE agent, met Gon and wanted Il. The D did—the Mayor Bran. So do P, the governor, I think. Slap them for not saving the police!

Legal professionals caution that Pritzker and Johnson may face up to 20 years in federal incarceration for obstruction of justice and for endangering federal officers. Johnson’s latest executive order reducing federal agents’ accessibility to the federal resources of the city, and Pritzker’s public smear campaign against “Operation Midway Blitz,” have intensified the sanctuary city accusation overreach. The appeals court has sustained a block on the National Guard’s deployment to Illinois, which has deepened the deadlock. Trump supporters, including Kristi Noem, the Secretary of the DHS, have promised quick retaliation. Pritzker, labeled by some as “the fattest governor in the country,” weighing over 500 pounds and towering 5’5″, has distanced himself, calling the claims against him “harmful lies” during a CNN interview. On the ground, there are active protests, and ICE has continued with extreme enforcement actions, which have drawn more risk because of active ICE enforcement actions.

Military and ICE Pay Questions And Trump’s Firing At Will Of Over 4,200 Federal Workers

Day 13 of the government’s tirade continued as President Trump engaged in federal hiring at will, almost the same as laying off over 4,200 federal workers, despite the 150,000 being advertised being the real number. These numbers being let go still suggest some form of difficulty in controlling the expenditures, as the spending on these workers and their so-called services has become burdensome. The remaining accusations and the motives of letting these people off are still being settled in the courtroom, as no real conclusion has been made. The unions of these spineless workers, like AFSCME and AFGE, are also being suspended in time, as their accusations of the unpaid people being back-furlough law mistreated aren’t being legislated as well. As 40% of the workforce, these people are also resting, are unpaid, and frozen in time.

Lurking ever so closely are some deeper and dark notions regarding the payment of wherein lie the ICE workers, the people under the active service of the National Guard, and several other branches of the military. These people are not allowed to rest and will operate continuously. However, the fee payment they are to receive for their service remains, at least for the time being, stuck in some legal mire. The opposers of these rest and payment plans suggest the counter for payment’s backward prospect of rational sentiment; administrators with a logical bend will note it’s outlandish to suggest the funds will be on hand for spending at the future time they are needed. Trump’s aide on the budget, Russ Vought, is the one with the hardest of shelf proposals, lending a thumbs up to these policies and suggesting we abuse these people some more to solidify our free spending.

Explosive Corruption Probes: Comey Indicted while Clinton and Schiff Targeted – Renewed Scrutinies for Pelosi and McCabe

Former FBI Director James Comey argued and came out ‘Not Guilty’ for Federal charges of lying and obstruction. He is the first to be indicted within the FBI. Trump appointed U.S. Attorney Terence Halligan, who is focusing on Comey’s alleged remarks during the Russia investigation. This has also been called a “political purge” by the democrat party. Everyone calling him the “head of the FBI” is corrupt and has to be held accountable. If found guilty, Comey could serve a maximum of 30 years. Comey’s legal counsel believes the claims are nothing more than a publicity stunt due to Comey’s lack of defense for Trump.

Clinton is now under more allegations due to the ‘Russia Hoax,’ while Rep. Adam Schiff is now under investigation by the DOJ for mortgage fraud due to the 3% homes that he owns. He has been accused of mortgage fraud due to 3 houses when he served in Congress, and the rate is said to be ‘very low’ for a primary residence. The infamous Pelosi is also accused of associating with Clinton and McCabe of abuse of Intelligence and has been accused of “Insider trading”. Schiff has been saying and denying the claims. U.S. Attorney General Pamela Bondi has been calling him for not holding Trump accountable due to the 3 days of Impeachment. Trump was criticized for bringing Bondi to the stage.

Kamala Harris’ Book Tour 107 Days Faces Protest, Harris Viewed Publicly As a Foolish Relic

The former Vice President, Kamala Harris, went to carry out a promotional tour for the book *107 Days*, where Harris mopes about the former Vice President’s life and also steps into a violent altercation with the fans who, for some reason, are not very fond of Harris’s promotional tour. After releasing the book, which is supposed to contain “Surprising Insights” about Harris and Biden’s fallout and the subsequent divorce, many people have concluded that it gears more toward the party rift rather than providing closure. Harris firmly states, “Most people have the wrong impression about my campaign. It was the most qualified campaign ever run in the history of the United States.” Undoubtedly, it’s extremely alarming that more than 40% of Americans view her simply as a “fool”.

Democrats have also publicly voiced their dissatisfaction with how she has perpetually been heckled regarding uncompleted promises. Lines for former Vice President Kamala Harris’ latest event in New York were covered live. To many, it was also alarming to see how many people remained unbothered and how few people decided to show up to the event. It resembles the vacant side shows of her 107-day run with the book tour.

Gavin Newsom Fraud Bombshell: How Does California’s Governor Afford $12.8M Mansions on $200K Salary?

Gavin Newsom, the governor of California, is facing serious accusations of fraud for having two homes worth millions, including one mansion in Sacramento rented for $12.8 million, while having a current annual salary of $234,000. Therefore, Newsom has been a target of online criticism. Social media sleuths and conservative watchdogs focus on hidden donor connections and on $24 billion “missing” from homelessness programs as proof of kickbacks. Newsom, Jennifer Siebel Newsom’s wife, is said to have a nonprofit that diverted funds to insiders linked to fire victims, and there are state fraud investigations against contractors from Project Homekey.

In a Fox News defamation lawsuit that he filed for $787 million, he claims to have been a target of slander and says he has been and is a victim of fake news. He has to provide evidence for the claims, argue with the advocacy group, and say they demand that all civilians have clear finances. He has much work ahead of him, Trump tweeted, to which hundreds weighed in, giving their two cents, which he says ties to “Californian scams” in which Trump argues ditched billions on housing programs.

DNI Tulsi Gabbard Releases Obama, Hillary, Brennan, and Clapper Treason Charge Files

Today, Director of National Intelligence Tulsi Gabbard revealed documents that prove an “Obama-directed conspiracy to create the Russia collusion lie to undermine Trump’s victory” and the archives show how Obama, Hillary Clinton, former CIA John Brennan, DNI James Clapper, and especially, Andrew Weissmann, along with all others, masterminded the January 20117 Intelligence Community Assessment post-election. Gabbard calls it a “treasonous coup.” The whistleblower threats show how bad the cover-up is.

Trump backs the call and demanded that Obama, the Clintons, Brennan, Clapper, Schiff, Bolton, and a “dozen Democrats” should be prosecuted for treason and interfering with the election. “History is being rewritten” with these disclosures, Gabbard said, adding that she will continue to release documents, ignoring the howls of misinformation from the Democrats.

Ghislaine Maxwell Breaks Silence: Willing to Testify on Epstein’s Elite Pedophile Network

In her denial, Ghislaine Maxwell, who is currently in jail, talked to the DOJ and, in a released transcript, claimed she was ready to testify about Epstein’s client list. She didn’t say she had the list, but named many powerful people. She told Deputy AG Todd Blanche she didn’t see any wrongdoing by Bill Clinton or Donald Trump. However, the House Oversight Committee has obtained Epstein’s files and has subpoenaed her. They set her deposition for a Supreme Court denial.

Maxwell still fights to release her records to the grand jury, but her reasons are for the sake of the victims. She may be the assistance required to untangle the complex network of powerful people on which Rep. James Comer plans to concentrate. They are ready to testify against the Clintons.

Mortgage Fraud Reckoning: Indicting Letitia James While Adam Schiff’s Probe Deepens

New York Attorney General Letitia James was indicted on bank fraud and making false statements charges for vowing not to “bend a knee” to her political antagonists and facing a potential sentence of more than thirty years. James’s statement concerns the alleged case of Trump’s civil fraud. Experts say to the charges “bupkis” since only 38 mortgage fraud convictions took place in 2024. Indicting James profoundly impacts Adam Schiff’s probe into alleged 3% mortgage fraud on multiple properties. Senator Adam India’s Bond responds to the indictment of Schiff with an outlandish claim: “Apologies should come for his role in the impeachment.” Democrats fear a “prosecute purge” for the “profoundly rare” Nancy’s criminal case.

-

GCA Forums News Weekend Edition Report: Key Learning for Investors and Homebuyers on October 5-12, 2025

Welcome to the October 5-12, 2025, GCA Forums News Weekend Edition Report. This is a one-stop real estate and mortgages, with trends affecting the Economy, investment opportunities, and trends within their intersections. This summary targets homebuyers, real estate investors, loan officers, and other business-minded individuals. In response to summary requests, this is written to include feedback for the most timely and audience-engaging content. From Direct Home Loan October 2025 to urgent news in politics and predictions on the real estate market, we simplify the content for the audience to optimize their operations. See the in-depth section below for this and other reports, and discover how opportunities in the real estate market in October 2025 may affect your business.

LIVE Silver and Gold Prices Per Ounce 2023: Trends and Effects on Real Estate Investments

This week in precious metals was marked by fluctuations in metal prices, which also met important parameters for real estate investment in 2025. As of October 12, 2025, 3:26 p.m. ET, the LIVE gold price per ounce was $4,031.65, higher than the midweek price of $3,984.

Gold and Silver Prices Surge to Record Highs

The spike in gold prices above $4,000 on October 9 was primarily associated with geopolitical events like President Trump’s China tariff speeches and the inflation risk, dominating the economic landscape. So far in 2025, the gold price has appreciated by 50 percent, which indicates economic uncertainty. Predictions are for the price of gold to stay above $4,000. This is anticipated to be the situation in 2026 as well. This does not rule out the possibility of a rapid drop in the coming weeks as gold prices are taken for profits.

Price of Silver Per Ounce Surges Past $50.00

As per reports, at 3 p.m. on October 12, the price of silver exceeded the 50-dollar mark for the live price per ounce. Arriving at approximately 50.19 dollars, this was purportedly the highest on record for the last four decades.

Silver Short Squeeze

Some factors that have driven silver’s price phenomenally this year, at 70% are strong industrial demand and the famous or infamous London short squeeze. Increased US silver and the record high Comex inventories for silver have also contributed to the spectacular upward surge of silver’s price.

Investing in Silver is a Screaming Buy

I also want to mention the great price coefficient of volatility between silver and gold. Silver’s price volatility compared to gold is approximately 1.7 times higher. This constitutes the high dual function of silver, being a valuable metal and having industrial utility. Real estate investors should note that such times are much more critical and pressing in 2025. Global diversification in the portfolios would also be significantly required.

Breaking Political News: Trump has ICE and the National Guard in Chicago – The Democrats are Not Happy.

In a controversial move regarding immigration, President Trump ordered the use of 500 National Guard troops, along with ICE agents, in Chicago. Democratic leaders and the border have been opposing this thoroughly. The Chicago Branch of the Texas and Illinois troops has been working to aid the mission to protect the immigration personnel in the weekday war of the federal city. The mayor of Chicago, Brandon Johnson, has described these moves as “political stunts.” Illinois Governor JB Pritzker has taken matters into his own hands, filing lawsuits to block the actions and calling them unconstitutional. The federal judge has set a restraining order for “because the troops in Illinois have been federalized.” for 14 days.

Trump responded, “The attitudes to protect the ICE officers have been made.” Their debate has caused friction in the balance of power between the Southern and Northern states. The region and the housing market have been reset. All investors and house owners in Chicago have to observe these conflicts that are changing the entire infrastructure of one of America’s central real estate areas.

LIVE Breaking News: Indictment of James Comey – What Does This Mean For Regulatory Oversight

Just last week, for the first time, former FBI director James Comey was indicted for lying to congressional investigators and obstruction of a congressional proceeding, as part of the larger ongoing FBI Comey investigations, the result of significant abuses of power, done on September 25, 2025. He appeared in a court in Alexandria, Virginia, on October 8, claiming a “not guilty plea.” His lawyer is preparing a motion to dismiss the case on the grounds of ‘vengeance’ prosecution.

More Charges For Comey

Comey is attached to the 2016 Clinton email probe and lies about the investigation in question. His trial is set for January 5, 2026.

As Trump has been saying, someone needs to be held accountable. This case raises and attempts to answer why certain investigations are performed under the current administration and who they are aimed at. Like other mortgage and real estate professionals, this indictment also taps into larger issues regarding the financial system’s legislative and regulatory supervision. It may also widen the net on regulatory oversight regarding fraud, government-sponsored and other direct loans, especially FHA and VA loan programs.

New Information from Epstein’s Documents Concerning the Virgin Islands’ Guest List.

Latest reports and revelations from Epstein’s estate documents, which première in September 2025, have once more shifted the focus to Little St. James ‘Pedo Kingdom’ Islands. Little St. James’ documents, which have 33,000 pages, have piqued the media’s attention with full travel schedules and visit schedules of the guests Epstein had invited. These documents do not provide any more proof of any alleged immoral or unethical behaviors, and they do not further any of the previous accusations, but, as always, capture the media’s focus. The documents discuss the need for watchfulness in the luxury estate dealings and the real estate market.

Epstein’s List of Pedophiles

One of the documents related to the previously mentioned date was scheduled for an island visit; supposedly, Elon Musk was supposed to visit on December 6, 2014. However, the visit was probably canceled and charged to him. The House Committee on Oversight sources have not indicted him with any offense. The more Elon Musk-related documents, which were settled on the agreements, have also been settled by Prince Andrew, which led to previous accusations. The ‘meeting’ documents, which had no other associations related to them, were owned by Steve Bannon and Peter Thiel. There have been accusations of previously proposed and settled documents that have also been related to and owned by Donald Trump and Bill Clinton. Both of them have denied the accusations. The documents, which have not yet been revealed to the public and have been considered as the rule ‘in analogy’, are owned by the Idaho Senator Mike Crapo. As a lesson on prudence, they show that the real estate investors, in relation to reputation concern, should be careful about the level of unverified or unfiltered accusations that can be considered for the value of investment property valuation in 2025.

New Information About Pam Bondi, Kash Patel, and Dan Bongino: the New Policy Makers of the Hour

This week’s news focused on the prominent appointees of Trump concerning housing issues and the enforcement of fraud. Pam Bondi, one of the candidates for the post of Attorney General of the US, was left a subject of derision during her Senate confirmation hearing for having to depend on “cheat sheets”, and, together with Kristi Noem, even became the subject of an SNL skit on October 12.

Investigation of Democrats Using Political Weaponization Against Trump

A rogue tweet by Trump, which suggested Bondi should “go after” prosecutions of people like Comey, added to perceptions of the case’s politicization.

On the other hand, Kash Patel, recently confirmed to the FBI post, while on October 8, caused a stir by firing two agents during the Smith inquiry into Trump. He also stated there were no FBI “assets” in the audience on January 6, contradicting other administration claims. He showed Epstein footage during a September hearing. Dan Bongino, in the position of Deputy Director of the FBI, has recounted to senators the suspicious Smith’s actions of spying on the Republican conversations and, while in the middle of maneuvers with the Epstein case, is said to be contemplating resignation. These developments may alter which cases are prioritized, impacting mortgage fraud enforcement and lender and realtor compliance.

LIVE Mortgage Market Updates and Interest Rates October 2025: Key Takeaways for Borrowers

In October 2025, as December rate tightening commenced, the mortgage market began to ease. Thus, rates started decreasing as the Fed began signaling rate cuts. Starting October 12, the LIVE 30-year fixed conventional mortgage rate stood at 6.34 percent, down 0.02 percent from the week prior, thus making rates favorable for buyers purchasing primary residences. FHA 30-year fixed rates remained the same at 6.38 percent and are favorable for buyers with minimal down payments and a debt-to-income ratio of 50 percent. VA 30-year fixed loans are down slightly to 5.375 percent, which comes without private mortgage insurance and carries veteran-specific advantages. DSCR loans for investors start at 6.25 percent or higher, an increase of 0.10 percent. They are qualified based on property cash flow, without personal income verification. Non-QM, as does the market, still hovers at 6.50 percent, and offers options for self-employed borrowers without the tug of rate anxiety.

News Flash: The Hint of Jerome Powell’s Replacement Changes Expectations for 3% Cuts by Trump.

There was a major shake-up when President Trump fired Federal Reserve Chair Jerome Powell. President Trump also hoped mortgage rates could drop as low as 3% to help with affordability. The markets are currently pricing in a 99% chance of a rate cut in October – potentially pushing 30-year fixed rates to the mid-6% range by the end of the year. This is a huge win for refinancers, potentially saving up to $250 a month, and an expansion in DSCR loan rental investment opportunities.

### Changes to Federal Reserve Policy, Predictions for Interest Rates, and Lenders’ Requirements.

The 25 basis point cut by the Fed in the September meeting brought the federal funds rate to 4 to 4.25%. Disclosed minutes detailed the internal deliberations on pacing, with two further reductions pegged for 2025. Predictions are that rates in the fourth quarter could reach 5.75%. This would further depress origination while increasing the approval rate and ease of qualification. On the lending side, Fannie Mae and Freddie Mac eased condo lending guidelines. At the same time, automated valuation model validations came into force, easing the process for borrowers starting October 1.

Impact of Mortgage Borrowing on Credit Scores, Overleveraging, and Debt Payments

The average debt-to-income ratio for refinances improved to 34.1 percent. Credit scores for this category also increased to 722 on average. Lenders usually set a DTI of 36 percent and a credit score limit 740, where anything above that receives low interest. These ratios and scores for credit health can be favourable during a mortgage approval process in 2025.

LIVE Housing Market Indicators 2025: Sustainable Shifts for Investors and Buyers

Having tracked the housing market for October 2025, the most significant movements regarding an increase in mortgage affordability are observed from October 12 to 18. These dates signal the beginning of the buying period, in which the competition is very low and the stock is in excess. This means that first-time buyers of homes are in a very advantageous position, despite an 11.6 percent inflation. Home buyers are also struggling with the increase in median-priced homes, which is now set to 5x the median salary per annum. This leads to a condition where only 25.1 percent can purchase homes, while 74.9 percent are under mortgage stress.

Active listings for September crossed 1.1 million, the 20th month that active listings have increased yearly, with the South and West regions nearing a recovery with pre-pandemic levels. The active listings also have a prefeasibility with the national average of 400,000 active listings for September. This relates to the 20-month active listings in the increase previously mentioned, where the national average is perpetually within a 500,000 index range. The FHFA index and Quarter 2 completed at 703.91, and the national median home price is 400,000 active listings for September. The active listings have also increased 2.3 percent year on year, while receding 0.3 percent month on month, and the index suggests a price increase for the quarter of 2.3 percent.

The Best Places To Buy or Sell A House

Metropolitan areas in Florida, along with Durham, North Carolina, and even Tampa and Indianapolis, have been identified as promising in cash-flow potential, with inventory up and prices down, during these buyer’s markets. In contrast, sellers made away with Boise, Idaho, St. Petersburg, Florida, puissant Austin, and even Phoenix, where prices soar and the demand never sustains.

Marco The Rental Market

The Sun Belt also hyper-focuses as an investor hotspot with attractive multi-family housing yields. Unlike other markets, this region shows a resilient position on market shifts due to the high demand and attractive rent prices.

Home Affordability

Metrics on the region’s inflation increased this week, and home affordability projections have also shifted. It’s expected that the Columbus road will open in October of 2025. In August, the LIVE CPI indicated it to be 2.9 % annually, up from 2.7 %. The September report is set to be released on October 24 due to the government shutdown. The LIVE core PCE index appeared to have risen in August from 2.85 % in the previous period, and the yearly ratio estimate is 2.91%, with the following update at the end of October.

The marginal cut in the Federal Funds rate in September to 4 to 4.25 percent paves the way for another 25 basis point reduction in the October 28-29 meeting. While the inflation cuts argue particularly how cuts to inflation would slowly erode purchasing power, cuts to inflation would lower mortgage rates by 0.5 percent and serve as an oxygen mask to overextended buyers and investors.

LIVE Economic Reports and Job Market Trends October 2025: Augmenting Buyer Optimism

The economic data overall was mixed but tilted positively regarding buying and investing in housing. August unemployment was still controlled at 4.3 percent. With September’s jobs data drop date for October 17, initial claims for the week of October 4 shot up to 235,000.

Wages have increased at an 8.5 percent rate since the 2000s. Despite inflation and stagnant wages, the housing market increased and was visible in the 3rd quarter of 2020, reaching a 56 percent increase. Softer job markets increase the likelihood of a Federal Reserve cut, which would lower mortgage approvals but pose a greater risk of default on the loans.

Increased market sentiment in the September quarter, with an S&P increase of 3.7% and an increased percent forecasted for the 4th quarter, 7.3%, boosted business sentiment previously tempered by tariff-driven volatility.

Changes in Government Policy and Housing Regulations 2025: A Focus on Borrowers and Real Estate Agents

The scope of lending continues to evolve with new policy changes. The 2025 conforming loan limit continues to increase, with a 5.2 percent rate jump to $806,500 at the baseline. For high-cost areas, the limit jumps to $1.2 million for the FHA, VA, USDA, and Conventional programs. The First-Time Homebuyer Act proposed a tax credit of $15,000, which is still pending.

In New York City, new Rent Control Laws for October 2025 to September 2026 pegging increases at 2 to 4.5 percent complemented new Good Cause Eviction protections easing tenant eviction laws. Enforcement of the Fair Housing Act took a beating as HUD remapped disparate impact regulation enforcement to the OMB. The Homeowner Assistance Fund has provided foreclosure prevention relief to 549,000 households. The extensions for disaster-affected areas and the Fund are available till April 2025.

These trends come as homebuyers may also dynamically benefit from evolving policies, alongside realtors who face new challenges with compliance in tenant rights and housing policy 2025.

Real Estate Investment Tips 2025: Unlocking New Horizons of Wealth

Real estate remains unrivaled in terms of wealth accumulation, and it maintains its first-class status. This week’s tips focus on high-ROI strategies. For rental property LLCs, focus on cash flow territories: cities like Detroit, which offers a whopping 21.95% yield, Cleveland, and Indianapolis. Appreciation cities are Orlando and Austin.

DSCR loans at 6.25% don’t need to be personally reserved and flexibly come in at a 1.0 DTI ratio, gaining traction through 2025, which are favorable trends. For short-term rentals, market leaders like Airbnb prevail in Geneva, New York, with an 18.9% top yield; Florida has 20 top yield spots. The trends are shifting toward experience stays with higher-tech automation.

The multi-family and commercial sectors in the Sun Belt remain resilient, with 4.9% vacancies and 2.6% rent growth. The OBBBA’s extended 100 percent bonus depreciation boosts tax planning with cost segregation strategies. Combine these with 1031 exchanges for maximum benefits, and always check with professionals on real estate tax strategies 2025.

Impact on Housing and Lending Markets from Recent Business and Financial Updates

Real estate met business headlines this week. Q3 earnings start on October 13 with JPMorgan. S&P is trading at a premium with a 7.3 percent growth projection. The SBA guaranteed $44.8 billion in FY 25 loans, and the CFPB small business rules have been pushed to 2026.

Bridging innovations included the October 15 news of Opendoor accepting Bitcoin for home purchases and Morgan Stanley launching crypto ETFs. The credit and small business loans are at 6.7 to 11.5 percent, and the SBA 7(a) fee for FY 26 is refreshed. Entrepreneurs are now empowered to fuel **housing investment opportunities 2025.

Bargain Hunting Phenomena: Distressed Housing and The American Housing Crisis

The Economy is a headwind to progress. National foreclosures filed for September reached a staggering 23,761. The third quarter of 2023 had 101,513 filings. Year over year, this is a 20% increase. REO repossessions are increasing by 11,723, which is a 33 percent increase year over year. In Auction.com, investors can bid from one dollar through October 14 for distressed sales in Texas, and with winning bids, do the necessary inspections. Texas leads troubled auctions with eager investors, while distressed homeowners are empowered with prevention resources.

Focusing on scams, viral stories, and mortgage frauds tells the unfortunate tale of the former Illustrator for Dilbert, Scott Adams, who blindsided the nation by dividing Voting. Success did not evade him. His fans put in the needed effort despite trying.

The internet was overrun with mortgage fraud, Scott-free, and the closing wire fraud that surged over the summer. Allegations of her father’s “spouse” with Trump had in 1983 solid and bizarre 2 decades linked, with a total of over $217,000. The raccoon-infested house was not the only selling oddity noticed over Zillow Gone Wild.

Highlights of GCA Forums News Activity and Expert Answers: Steps Taken to Increase Community Participation

Several insightful threads were posted on the GCA Forums this week in the “Ask the Expert: DSCR for Beginners” session. Pros mentioned that no proof of personal income was a plus. Cons mentioned that no proof of personal income was a minus, while consoling that rates were higher, the experts said to go for the 1.25 DTI for the prime terms. In the debate “Powell Ouster Impact?,” the users’ suggestions were on the 65 percent who forecast a 3 percent rate drop and refinances, and there were strategies galore.

Users suggest Tampa for the yields in the “Best Investor City?” session. This led to interesting discussions on multi-family and short-term rentals. Throughout GCA Forums, users have asked and answered real estate questions specializing in mortgages, have attended special AMAs, and membership available perks to make you a real estate expert by 2025.

Providing the Most Relevant Information on Mortgages and Housing

GCA Forums News Weekend Edition does a wonderful job integrating the new and important news that people are interested in these days such as James indictment and Comey charges with Live mortgages News and rates, updates on inventory for mortgages and real estate next week and many other important and helpful resources for users enabling them to delve and learn about the issues that will go in place Fed rate cuts 2025 the best times being Oct 12-18 for the transactions.

These insights go viral and are posted on the forum to encourage and argue with other members. The best way is to give our wealth-building strategies. GCA Forums News are trackable documents that aid homebuyers, helpers, and investors. The question for the users is this: Is GCA Forums News the best informational resource available? What is the most important lesson you have learned?

https://www.youtube.com/watch?v=vgRhJMPhHq8&list=RDNSvgRhJMPhHq8&start_radio=1

-

GCA Forums News for Wednesday, August 20, 2025, divided into sections for easy reading. This covers housing, politics, the economy, and business stories you asked for.

Wednesday, August 20, 2025 – Today’s Top Stories

Housing & Mortgage News

Trump Seeks to Oust Fed Chairman Powell

In the latest housing news, President Donald Trump said he will fire Federal Reserve Chairman Jerome Powell today. Trump plans to pick a new chair who will support his economic path. Markets are anxious for an emergency Fed meeting set for Thursday. Some experts warn of a historic 3% cut to the benchmark rate.

What to Expect for Mortgage Rates

Despite high housing demand, lenders are struggling. Supply is still low, margins are tight, and defaults are rising. If the Fed pushes rates down, monthly payments could drop. Still, lenders are hesitant to loosen credit, especially with fraud probes still moving ahead at the state and federal levels.

Fraud Investigations Heat Up

- New York Attorney General Letitia James is under fire for alleged mortgage fraud linked to campaign contributors.

- Critics allege she offered special favors to certain real estate developers.

- Investigators are now reviewing campaign records and loan files.

- California Senator Adam Schiff is now the focus of a federal examination after whistleblowers accused investment firms linked to his office of crooked lending practices and manipulating property valuations.

- Schiff and his business partner, James, insist they did nothing wrong.

- However, congressional hearings are likely to begin this fall.

Political Scandals & Investigations

Governor Gavin Newsom Under Pressure

California Governor Gavin Newsom is facing sharp questions on how he went from a public salary of $200,000 to owning and maintaining two estates worth millions. Watchdog agencies demand a detailed financial audit, suggesting hidden income or financial misdeeds may be involved.

Tulsi Gabbard Drops Bombshell on the Russia Inquiry

DNI Tulsi Gabbard asserts she has acquired internal memos proving the initial Russia probe was politically engineered. She claims a conspiracy involving Barack Obama, Hillary and Bill Clinton, James Comey, John Brennan, James Clapper, Adam Schiff, and Andrew Weissmann. She warns that conspirators could face treason charges. Former President Trump has echoed the call for military tribunals.

Epstein Scandal Heats Up Again

Ghislaine Maxwell can now name names from Jeffrey Epstein’s black book. However, U.S. Attorney General Pam Bondi, FBI Director Kash Patel, and Deputy Director Dan Bongino keep saying there’s no such book. Their dismissal has sparked a huge uproar, with many calling it a cover-up. The trio, dubbed the “three stooges” in D.C., is accused of endangering Trump’s reputation by trying to bury the inquiry too soon.

Business & Tech News

- Tesla Meltdown: Cybertruck Fires & Fed Sales Ban

- Tesla stock plummeted again as reports of Cybertrucks bursting into flames, draining power, and killer failures hit coast to coast.

- The feds responded by banning new Cybertruck sales over safety concerns.

- Families of crash victims are now gushing lawsuits over the truck’s deadly defects.

Elon Musk vs. Donald Trump

The friendship between Musk and Trump has turned rocky. Trump calls Musk a “jack of all trades, master of none,” saying he’s spreading himself too thin across space, AI, social, and political projects. Musk, in turn, announced the American Party, a new political group aimed at stealing Trump’s right-wing spotlight. Trump responded by suggesting Musk might get deported, labeling him a “dangerous distraction.”

Economy, Markets & Jobs

Market Madness

Got it—here’s a clean rewrite with no charts or graphs, just straight text in clear sections:

📢 Live Market & Mortgage Update – Wednesday, August 20, 2025Dow Jones Industrial Average

The Dow Jones closed essentially flat today at 44,923, moving just a few points higher. U.S. equities remain steady despite global market volatility as investors wait for tomorrow’s Federal Reserve meeting.

Gold and Silver Prices

- Gold is trading around $3,346.90 per ounce, gaining nearly 1% as investors turn to safe-haven assets.

- Silver is about $37.83 per ounce, up roughly 1.4% today.

Precious metals are strengthening as confidence in the stock market wavers.

Mortgage Rates (National Averages)

Mortgage rates remain elevated but relatively stable:

- The 30-year fixed purchase rate is averaging 6.62%, with an APR of about 6.68%.

- The 15-year fixed purchase rate averages 5.85%, with an APR near 5.93%.

- The 5/1 adjustable-rate mortgage (ARM) is around 5.93% for initial terms.

- The 30-year fixed rate for refinances is slightly higher at 6.78% (APR about 6.85%), while the 15-year fixed refinance rate is about 6.12% (APR 6.20%).

- Jumbo 30-year fixed mortgages are running close to 6.61%.

These figures reflect national averages. Individual borrowers may qualify for different rates depending on credit, loan size, down payment, and whether points are paid.

Key Takeaway

- The stock market is steady, with investors cautious ahead of the Fed meeting.

- Gold and silver are climbing, signaling concerns over inflation and economic uncertainty.

- Mortgage rates remain in the mid-6% range for most loan products, with refinance rates slightly higher than purchase rates.

Here are the latest available figures (quotes can be delayed up to ~15 minutes):

Dow Jones Industrial Average (DJIA)

- 44,923 (about flat on the day). Reuters’ closing recap shows the Dow +1.48 pts (+0.00%) on Wed, August 20, 2025.

Spot Gold (XAU/USD)

- ≈ $3,348/oz right now. (Live spot quote page.)

Spot Silver (XAG/USD)

- ≈ $37.9/oz right now. (Live spot quote page.)

Mortgage Rates (national averages)

(Daily survey; actual lender quotes vary by credit, LTV, points, etc.)

- 30-Year Fixed: 6.61%

- 15-Year Fixed: 5.97%

- 30-Year Jumbo: 6.68%

Please tell me the exact products (e.g., FHA, VA, jumbo, points/no-points). I’ll translate these averages into payment examples tailored to your scenario.

Dow Jones: Dropped 900 points, spooking investors about a sudden Fed change.

Tesla (TSLA): Down 22% again, with shareholders heading for the exit.

Precious Metals: Gold hit all-time highs as investors dive for safety.

Housing: Demand is crashing in heatwave markets, while foreclosures and mortgage company bankruptcies shoot up.

Job Picture

Big layoffs continue in tech and retail, and bankruptcies are rising. Mid-size firms say inflation, sky-high energy costs, and fading consumer demand are forcing them to shut down.

Final Take

Wednesday’s news screams a nation at a political and economic breaking point:

- Trump’s reportedly planning to kick Fed Chair Powell and slash rates by 3%.

- Mortgage fraud claims now target big names in New York and California.

- Tesla and Elon Musk stare down possible federal sanctions and angry investor calls.

- Tulsi Gabbard is revealing hidden-state deals, with treason charges possible.

- Ghislaine Maxwell’s upcoming testimony could rock both Washington and Hollywood.

- The once-close Trump-Musk bond is fraying, with both men in the same political fight.

https://www.youtube.com/watch?v=uxrSQLWpW0I&list=RDNS6TTbFmY7McM&index=3

-

GCA Forums News for Tuesday, August 19, 2025

Breaking Housing and Mortgage News

Today, two high-profile public figures became the focus of intensified federal reviews in the housing sector, sending tremors through Capitol Hill and state capitals. The Justice Department publicly confirmed it is investigating New York Attorney General Letitia James over possible mortgage fraud linked to a Virginia home she purchased in 2023. Prosecutors allege she understated the length of time she had lived in the state to qualify for a discounted home-loan program designed for first-time buyers. James rebuffed the charges, declaring the inquiry a transparently partisan “witch hunt” aimed at discrediting her office’s probe of Donald Trump.

Simultaneously, California Senator Adam Schiff is facing a parallel mortgage examination by the same office. Investigators are examining whether the senator inaccurately designated two residences—Champion Heights and a Maryland townhouse—as his principal home to score lower interest rates, mortgage-record exemptions, and a larger state deduction. Public records show both loans were refinanced in 2024 at rates that were, at the time, 81 basis points below the prevailing market, a gap that typically flags fraud alerts. Schiff countered that he complied with all applicable state and federal disclosure laws. However, Democratic and Republican adversaries insist the dual loans and the timing of his last-minute refinance complicate his 2024 re-election narrative.

Questions are popping up about California Gov. Gavin Newsom’s real estate portfolio. With a public salary of around $200,000, critics ask how he can own several homes worth several million dollars each. So far, there’s been no formal probe, but watchdog groups warn that his wealth appearing much higher than his paycheck is enough to stir public skepticism.

Trump vs. Federal Reserve: The Clash Over Interest Rates

President Trump has turned up the heat on Federal Reserve Chair Jerome Powell. Trump demands the Fed cut interest rates by three points, saying the economy can’t handle the current borrowing costs. The showdown heats up just days before Powell’s big talk at the Jackson Hole conference, where investors worry he might push back against the president’s wishes.

Meanwhile, the search for Powell’s replacement has already kicked off. The Treasury announced that interviews for new candidates will begin on September 1, with at least ten names already floated. Analysts say Trump’s bold attempt to steer Fed policy may spook investors, chip away at the central bank’s independence, and spark new swings in the bond and housing markets.

Critics are now zeroing in on pricey upgrades made to the Fed’s Washington office, claiming costs may have climbed into the hundreds of millions. There’s no confirmed fraud, but Trump is seizing on the budget overruns to challenge Powell’s leadership and demand the Fed be held accountable.

Tesla Free-Fall and the Cybertruck Backlash

Tesla stock kept plunging today as Wall Street lost faith in Musk’s EV empire. The Cybertruck, once pitched as the game-changer, has become Tesla’s biggest headache. Federal regulators have now ordered a near-total recall of Cybertrucks after discovering structural problems, misaligned body panels, and a serious fire risk. Safety experts warn that the Cybertruck poses a fire-related fatality risk more than nearly any other vehicle on the market.

A string of high-profile crashes is fueling the fire. After a deadly Las Vegas wreck, victim families say the Cybertruck’s reinforced doors and shatterproof windows locked them in as flames raced through the cab. Tesla says it is fast-tracking design changes. However, regulators are mulling tougher measures, including a potential nationwide halt to Cybertruck sales.

Musk is getting flak for juggling too many balls at once. Tesla, SpaceX, X (the old Twitter), Neuralink, and now whispers of a new political plan have some saying he’s turning into a “jack of all trades, master of none.” Trump noticed Tesla’s latest dip and jumped in, slamming Musk for appearing scattered and blaming him for the carmaker’s hard times.

Intelligence, Treason Claims, and Political Firestorms

Yet another political fire flared when Tulsi Gabbard, the Director of National Intelligence, made public files that she says show the Obama team twisted Russian-collusion intel to hurt Trump. Gabbard claims that top names like Comey, Brennan, and Clapper helped swing the story away from the facts during the 2016 race. She’s pushing for a new probe and whispering that some could face treason.

Still, her claims are drawing a crowd of skeptics. Multiple independent digs, most recently the Durham inquiry, found that Russia, not U.S. operatives, did the 2016 hacks. Opponents say Gabbard’s talk risks ramping up the political heat without dropping anything new and solid on the table.

Donald Trump, as always, has jumped into the fire with both feet, using Tulsi Gabbard’s claims to call for treason trials against Barack Obama, Hillary Clinton, Bill Clinton, Adam Schiff, Nancy Pelosi, and a long list of others. While the statement is bombshell enough to grab headlines, the current charges sit on a shaky foundation of speculation and don’t align with what courts or investigations have settled.

In a startling twist, Ghislaine Maxwell has offered to sit down for Congressional testimony if she gets a presidential pardon. After being found guilty of sex trafficking for her role with Jeffrey Epstein, she says she is ready to name people from Epstein’s secret circle. The House Oversight Committee has already delivered a subpoena, so her questioning could kick off in the coming weeks.

This move throws the old argument over whether the full cast of Epstein’s associates will ever see the light back into the ring. Former prosecutors Pam Bondi, Kash Patel, and Dan Bongino have publicly insisted a so-called “Epstein list“ has never existed, pushing back against Trump’s past claims that one does. The opposite statements feed the idea that Trump’s readiness to use the Epstein story for political gain also exposes him to charges of double-talk and weakens the weight of his voice when the subject comes up.

Business, Economy, and Markets Update

Outside the political arena, Wall Street is preparing for a rough ride. Inflation is not budging, job cuts keep spreading through big firms, and consumers are starting to hold back on spending. Investors move into gold and silver for protection, while mortgage and real estate firms watch sales shrink. Analysts warn that there are still too many people wanting to buy homes. Yet, the number of homes for sale is dangerously low, driving prices higher.

Mortgage rates keep bouncing up and down as chatter grows that the Fed might trim rates in the coming months. Trump’s fresh barbs aimed at Powell only add to the jitters. Lenders say loan applications are slowing, profits are squeezed, and borrowers are more on edge than ever.

Trump vs. Musk: The Bromance Is Over

What once looked like a strong friendship between Donald Trump and Elon Musk has turned into a full-blown spat. The two tycoons trade insults now, with Trump taunting the Cybertruck’s rough rollout and Musk joking about starting a new “American Party” to take on both the GOP and the Democrats.

Whether Musk is serious about creating a fresh political party is still up for debate. Still, the public crash of his bond with Trump is a loud reminder of how politics, business, and personal egos keep colliding and hogging the news.

Closing Outlook August 19, 2025

America stands at a crossroads, where collapsing housing prices, political scandals, corporate failures, and wavering markets meet. A new wave of instability has broken, from the mortgage fraud probes sweeping Cabinet officials to Tesla’s latest safety meltdown, and Trump’s escalating showdown with the Fed.

The next 24 hours may be decisive. Powell’s words at Jackson Hole, Maxwell’s stalled plea negotiations, and the flurry of fresh Tesla subpoenas will shape stock prices and the reputations of the country’s most powerful political and business leaders.

-

In today’s GCA Forums News for Friday, August 1, 2025 headline news we will cover and discuss the outcome of Fed Chair Jerome Powell Wednesday’s press conference. Powell announced rates will remain the same and that the economy is doing great. Due to inflation, housing, historic high stock markets, employment, economic growth are all doing great under his watch, Powell said the Fed is not cutting rates which many think is a huge mistake. The Fed cannot be so wrong.

The stock market is inflated and on the bubble and so is the housing market. Both the stock market and housing market is about to crash. We will cover live stock market numbers, live precious metals, live rates, the job numbers, the CPI, the housing data, and how bad the U.S. economy is and how Powell is so wrong. Most Americans, business owners, and CEO strongly believe Chair Jerome Powell is incompetent and arrogant. Great Community Authority Forums will cover if President Trump will fire Fed Chair Jerome Powell. Is Jerome Powell getting investigated for his huge cost overruns on renovation of the Federal Reserve Board Building? We all agree Jerome Powell needs to go. Powell is destroying the housing and mortgage markets as well as the overall U.S. economy and the livelihood of most Americans. Read GCA Forums News for Friday, August 1, 2025 below and tell us what you think!!!

**************************************************************************************************************************************

Welcome to GCA Forums News for Friday, August 1, 2025. Critics are increasingly alarmed by signs lurking beneath the surface. Although steady wage growth has failed to keep up with inflation for most American households, it raises questions about long-term consumer purchasing power. Additionally, businesses are trimming their inventory levels, which some economists interpret as a flag that demand growth could soften in the months ahead.

Interest Rates versus Ongoing Geopolitical Volatility

Moreover, the ongoing geopolitical volatility, especially the uncertainty in the Middle East, has made commodity markets twitchy. A marked spike in oil prices over the past month, though modest thus far, amplifies concerns about renewed inflationary pressures that could force the Fed to reconsider the long-term path for borrowing costs.

What Economists Forecast