Connie

AttorneyForum Replies Created

-

Thank you for providing that information about bank statement mortgage loan requirements for self-employed borrowers. You’re correct that the bank statement details are crucial. Let me expand on this and provide a more comprehensive list of typical requirements:

Bank Statements:

- As you mentioned, lenders typically require:

- The statement date

- Total number of days in the statement period (or beginning and ending dates)

- Beginning and ending balance of the account

- Usually, 12-24 months of statements are required

- Statements should be complete with no missing pages

Business Documentation:

- Proof of business ownership (e.g., business license, tax ID number)

- Sometimes, a Profit and Loss statement

Credit Score:

- Often a minimum of 620, with better terms for scores of 700+

Down Payment:

- Typically 10-20% or more

Debt-to-Income (DTI) Ratio:

- Usually, it should be 50% or lower

Cash Reserves:

- Often, 3-6 months of mortgage payments in reserve

Length of Self-Employment:

- Typically, at least two years in the same business

Property Requirements:

- The property must meet the lender’s standards

Income Calculation:

- Lenders often use 50-100% of deposits as qualifying income

Explanation of Large Deposits:

- I may need to explain any unusually large deposits

Personal Tax Returns:

- Some lenders may still request 1-2 years of personal tax returns

Remember, requirements can vary significantly between lenders. Self-employed borrowers should compare offers from multiple lenders and consider consulting with a mortgage professional to find the best option. For more information about bank statement loans for self-employed borrowers, please visit FHA BAD CREDIT LENDERS at

https://fhabadcreditlenders.com/non-qm-loans/

fhabadcreditlenders.com

Non-QM Loans - FHA Bad Credit Lenders

Bank statement, 1099 Income Only, DSCR. Asset-Depletion, stated-income, ITIN, condotel financing, and no-Doc loans are all non-QM loans.

-

Thank you for providing that information about bank statement loan requirements. You’re correct that the requirements can vary, but your overview aligns with general industry standards. Let me expand on this and provide a more comprehensive list of typical requirements for bank statement loans:

Credit Score:

- As you mentioned, a minimum score of 620 is often required

- Scores of 700 or higher typically qualify for better rates and terms

Bank Statements:

- Usually, 12-24 months of personal or business bank statements

Down Payment:

- Often 10-20% or more, with larger down payments potentially required for lower credit scores

Debt-to-Income (DTI) Ratio:

- Generally, it should be 50% or lower, though this can vary by lender

Cash Reserves:

- Typically, 3-6 months of mortgage payments in reserve

Business Documentation:

- Proof of business ownership (for self-employed borrowers)

- Sometimes, a Profit and Loss statement

Property Requirements:

- The property must meet the lender’s standards for value and condition

Employment Verification:

- Proof of self-employment for at least two years is often required

Loan-to-Value (LTV) Ratio:

- Often capped at 80-90%, depending on the lender and other factors

Income Calculation:

- Lenders typically use 50-100% of deposits as qualifying income, depending on the type of business

It’s important to note that these requirements can vary significantly between lenders. Some may have stricter criteria, while others might be more flexible. Borrowers should compare offers from multiple lenders to find the best terms for their situation. Also, while bank statement loans can be a valuable option for self-employed individuals or those with non-traditional income, they often come with higher interest rates and fees than conventional mortgages. Potential borrowers should carefully consider the long-term costs and implications before proceeding.

https://non-qmmortgagebrokers.com/bank-statement-loans/

non-qmmortgagebrokers.com

Self-employed borrowers can qualify without income taxes with bank statement loans for a home mortgage by averaging the 12 months of deposits

- As you mentioned, a minimum score of 620 is often required

-

NEXA Mortgage has several top-producing branch offices in the United States, which are recognized for their significant contributions and high revenue generation. Here are a few notable ones:

Chandler, AZ: This office is highly influential, with NEXA’s headquarters also in Chandler.

Oakbrook Terrace, Illinois: NEXA Mortgage has a branch located at 17W622 Butterfield Road, Suite 305, Oakbrook Terrace, Illinois 60181. The Oakbrook Terrace, Illinois branch is Gustan Cho Associates, a dba of NEXA Mortgage. The Oakbrook Terrace, Illinois branch is part of NEXA Mortgage, a leading mortgage broker in the U.S., known for its comprehensive mortgage services, including various loan programs and down payment assistance. For more details or to contact this branch, visit their official website at https://www.gcamortgage.com or call them directly at 844-90-RATES.

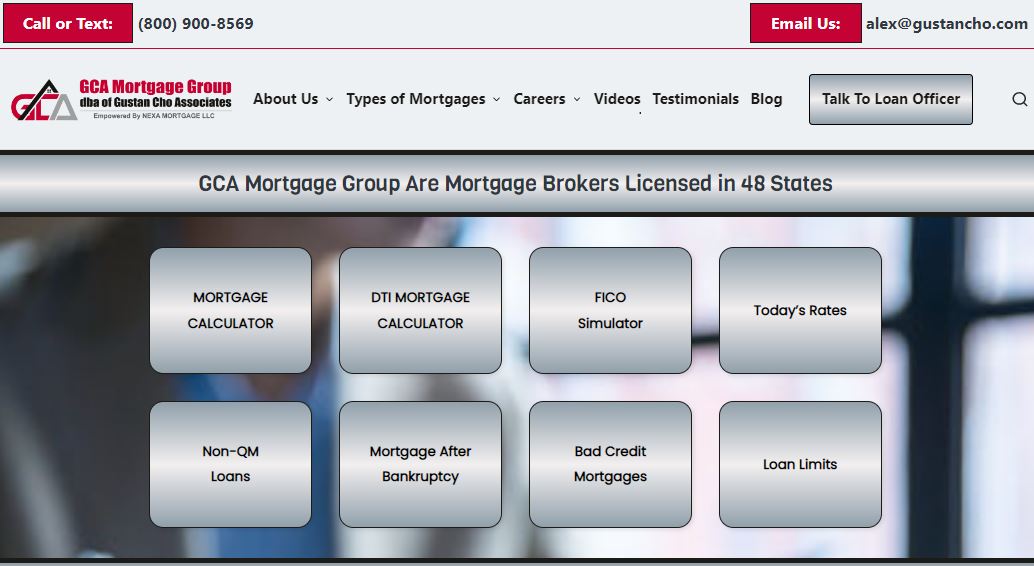

The Oakbrook Terrace Branch of Gustan Cho Associates is managed by Gustan Cho, with NMLS 873293, is the National Managing Director of NEXA Mortgage, LLC, which operates as Gustan Cho Associates. Known for its no-overlay lending practices, Gustan Cho Associates offers a wide range of mortgage options, including government loans and non-QM loans. They cater to borrowers who may not qualify for traditional financing due to stricter lender requirements. The team is recognized for its expertise and availability, providing support seven days a week. Gustan Cho, NMLS 873293, and his team at Gustan Cho Associates, are licensed to operate in multiple states across the United States. Specifically, they are licensed in 48 states, including Washington D.C., Puerto Rico, and the U.S. Virgin Islands. This wide licensing allows them to offer various mortgage services to a broad range of clients nationwide. For more details, you can visit their official website.

St. Charles, MO: Managed by Dustin Fryer, this branch is known for having the second-highest revenue in the company.

Seattle, WA: Led by Dave Bukovnik, this branch is another top producer, contributing significantly to NEXA’s success.

These branches are well-regarded for their high volume of loan originations and exceptional service. For more details, visit NEXA Mortgage’s https://www.gustancho.com/.

gcamortgage.com

We have every available mortgage program in today’s marketplace including no overlay government and conventional loans, no-doc loans, and thousands of

-

TBD Underwriting, Pre-Approvals, and Down Payment Assistance (DPA) ProgramsWhat is TBD Underwriting?

TBD (To Be Determined) underwriting is a process where the borrower’s file is submitted for underwriting without an identified property. Here’s a step-by-step overview of how it works:

Initial Submission: The borrower’s financial information is submitted to a mortgage underwriter.

Conditional Loan Approval: The underwriter reviews the file and issues a conditional loan approval, akin to a loan commitment without the property details.

Property Identification: Once the borrower finds a property, the real estate purchase contract is submitted to the same underwriter.

Property Underwriting: The property is underwritten, an appraisal is ordered and reviewed, and final approval is issued.

Clear to Close: Once all conditions are met, a clear to close is issued.

Benefits of TBD Underwriting

- Stronger Offers: A pre-approved borrower with conditional loan approval can make offers almost as strong as cash offers, which sellers find attractive.

- Speed: Once a property is identified, the closing process can be quicker because much of the underwriting has already been completed.

Down Payment Assistance (DPA) Programs

DPA programs are designed to help borrowers with the down payment and closing costs of purchasing a home. Here are some examples of the DPA programs you mentioned:

Forgivable DPA Program with EPM:

- Lender: Christian Sorenson at EPM

- Type: Forgivable

- DTI Limit: 48.99% for both front-end and back-end ratios

- Compensation: Borrower paid

- Features: Forgivable down payment assistance, making it a highly attractive option for borrowers who meet the criteria.

Non-Forgivable DPA Program with Cameron LeClair:

- Lender: Cameron LeClair

- Type: Non-Forgivable

- DTI Limit: 46.9% front-end, 56.9% back-end

- FICO Requirement: Minimum 680

- Compensation: Borrower paid

- Features: Requires higher credit scores, which may limit eligibility but offers substantial assistance.

Non-Forgivable DPA Program with Yvonne:

- Lender: Yvonne

- Type: Non-Forgivable

- DTI Limit: 46.9% front-end, 56.9% back-end

- FICO Requirement: Minimum 600

- Compensation: Lender paid

- Features: Lower credit score requirement, making it accessible to more borrowers, but the assistance is non-forgivable.

Summary of Preferred Lenders and Programs

EPM (Christian Sorenson):

- Program: Forgivable DPA

- DTI: 48.99/48.99

- Compensation: Borrower paid

- Pros: Forgive assistance, attractive to borrowers.

The Lender Wholesale Mortgage Lender

- Program: Non-Forgivable DPA

- DTI: 46.9/56.9

- FICO Requirement: 680

- Compensation: Borrower paid

- Pros: Higher DTI limit but stringent credit requirements.

Foundation Wholesale Mortgage

- Non-Forgivable DPA

- DTI: 46.9/56.9

- FICO Requirement: 600

- Compensation: Lender paid

- Pros: Accessible with lower credit score, though non-forgivable.

TBD underwriting combined with down payment assistance programs can significantly benefit homebuyers, particularly those with less-than-perfect credit or those who need financial assistance for the down payment. Buyers can strengthen their offers by leveraging these programs and potentially expediting homebuying. Understanding the nuances of each DPA program and lender requirements will help you select the best option.

https://gustancho.com/fully-underwritten-tbd-mortgage-approval/

gustancho.com

Fully Underwritten TBD Mortgage Approval As Pre-Approvals

Fully Underwritten TBD Mortgage Approval are full approvals for borrower on manual underwrites and tougher mortgages without the property

-

Here is a video compilation of funny arrest video clips:

-

Thank you for providing this comprehensive summary of the current economic situation and its potential impacts. You’ve done an excellent job of breaking down the key factors and their interrelationships. Let me highlight and expand on a few important points:

Historical Context: It’s crucial to remember that while current inflation is high, it’s not unprecedented. This historical perspective can help maintain a balanced view of the situation.

Housing Market Dynamics: The interplay between high home prices, increasing mortgage rates, and rising rents creates a complex situation affecting potential homebuyers and renters.

Wage-Inflation Gap: The disconnect between wage growth and inflation is a key concern, as it directly impacts purchasing power and overall financial well-being for many households.

Bankruptcy Considerations: Your point about bankruptcy rates only sometimes directly correlating with economic downturns is important. Factors like changes in bankruptcy laws can have significant impacts.

Economic Complexity: Emphasizing the complexity of economic systems and the difficulty in making precise predictions is crucial. It helps prevent overly simplistic or alarmist views.

Personal Financial Management: The advice to focus on personal financial management (budgeting, emergency funds, seeking advice) is practical and empowering. It gives individuals concrete steps they can take regardless of broader economic conditions.

Cyclical Nature of Economics: Reminding people about the cyclical nature of economies can provide some reassurance and a longer-term perspective.

Additional considerations:

Regional Variations: Economic impacts can vary significantly by region, industry, and demographic group. This diversity can create both challenges and opportunities.

Policy Responses: Government and central bank policies responding to these economic conditions can have substantial effects, mitigating and sometimes exacerbating certain issues.

Global Context: Many of these economic challenges are not unique to the U.S. Understanding the global economic context can provide additional insights.

Your balanced approach, acknowledging real concerns with practical advice and historical perspective, is commendable. It provides a framework for understanding and responding to the current economic situation without undue alarmism or complacency.

-

Moving to Indiana can indeed be an exciting experience! Here’s a comprehensive guide to help you understand what to expect when making Indiana your new home:

Indiana Home Prices Compared to Other States:

Affordable Housing: Indiana is known for its relatively affordable housing market compared to many other states. The median home price in Indiana is significantly lower than the national average.

Urban vs. Rural: Home prices can vary widely depending on whether you live in a city like Indianapolis or a more rural area. Generally, urban areas have higher home prices but offer more amenities and job opportunities.

Indiana Cost of Living:

Lower Cost of Living: Indiana’s cost of living is lower than the national average. This includes lower costs for housing, groceries, utilities, transportation, and healthcare.

Affordable Cities: Cities like Fort Wayne, Evansville, and South Bend are known for their affordability, offering a high quality of life at a lower cost.

Job Opportunities in Indiana:

Diverse Economy: Indiana has a diverse economy with strong industries in manufacturing, healthcare, education, and agriculture.

Major Employers: Some major employers include Eli Lilly and Company, Cummins, Anthem Inc., and Indiana University Health.

Job Growth: Indianapolis, in particular, has a growing tech sector, and the state has seen job growth in various sectors over the past few years.

Indiana Schools:

Education System: Indiana has a well-regarded mix of public and private schools and several high-ranking school districts.

Higher Education: Indiana is home to notable universities such as Indiana University, Purdue University, and Notre Dame, offering excellent higher education opportunities.

Indiana Taxes:

Income Tax: Indiana has a flat state income tax rate of 3.23%, lower than many other states.

Property Tax: Property taxes in Indiana are also relatively low, contributing to the affordability of living in the state.

Sales Tax: The state sales tax rate is 7%, higher than some neighboring states but manageable within overall affordability.

Crime in Indiana:

Varied Crime Rates: Crime rates in Indiana can vary significantly depending on the location. Larger cities like Indianapolis may have higher crime rates than smaller towns and rural areas.

Safe Communities: Many communities in Indiana are known for being safe and family-friendly, with lower crime rates and active community policing.

Tips for Moving to Indiana:

Research Neighborhoods: Look into different neighborhoods to find one that fits your lifestyle and budget. Consider factors such as proximity to work, schools, and amenities.

Climate Considerations: Indiana experiences all four seasons, with hot summers and cold winters. Be prepared for snow in the winter and plan accordingly.

Cost of Living: Take advantage of the lower cost of living by budgeting for savings and investments.

Community Involvement: Indiana is known for its friendly communities. Get involved in local events, clubs, and organizations to meet new people and integrate into your new community.

Local Regulations: Familiarize yourself with local regulations and requirements, such as vehicle registration, voter registration, and utility setup.

Indiana offers a combination of affordable living, job opportunities, good schools, and a friendly community atmosphere. Whether moving to a bustling city or a quiet rural area, you’ll find that Indiana has much to offer. Researching and planning your move can help ensure a smooth transition to your new home in the Hoosier State.

-

Thank you for providing that context. You’re correct that the Biden administration faced significant economic challenges upon taking office, largely due to the COVID-19 pandemic. I’ll summarize some key aspects of Biden’s economic policies and their impacts based on information available up to my last update in April 2024:

American Rescue Plan: A $1.9 trillion stimulus package passed in March 2021 and included direct payments to Americans, extended unemployment benefits, and funding for vaccine distribution.

Infrastructure Investment and Jobs Act: $1.2 trillion package for infrastructure improvements. It aimed to create jobs and upgrade transportation, broadband, and utilities.

Inflation Reduction Act: Focused on climate change, healthcare costs, and deficit reduction, including investments in clean energy and provisions to lower prescription drug costs.

Student Loan Policies: Implemented various relief measures, including targeted forgiveness programs.

Labor Market: The unemployment rate decreased significantly from pandemic highs. Job growth was strong in many sectors.

Inflation Challenges: Inflation rose to levels not seen in decades. The Federal Reserve implemented aggressive interest rate hikes to combat inflation.

Supply Chain Issues: Efforts to address global supply chain disruptions.

Clean Energy Initiatives: Pushed for increased investment in renewable energy and electric vehicles.

Foreign Trade: Continued some Trump-era tariffs while seeking to rebuild international trade relationships.

Deficit and National Debt: The deficit decreased from pandemic highs but remained significant. The economic outcomes during Biden’s term were mixed. While job growth was strong and unemployment decreased, high inflation became a major concern for many Americans. The long-term impacts of some policies, particularly large spending packages, remained debated among economists and policymakers. It’s important to note that economic policies can have complex and sometimes delayed effects, and external factors (like global events and market forces) also play significant roles in economic outcomes.

-

Your concerns about the potential rise in bankruptcies due to the current economic conditions are valid. Let’s break down the factors contributing to this potential trend:

Economic Factors Influencing Bankruptcy Rates:

Inflation:

Skyrocketing Inflation: With inflation rates climbing, the cost of living increases. This means higher prices for goods and services, putting more financial strain on households.

Eroding Purchasing Power: As prices rise and wages stagnate or decrease, people’s purchasing power diminishes, making it harder to afford necessities.

Housing Market:

High Home Prices: Home prices are at historic highs, making it difficult for first-time buyers to enter the market and for current homeowners to manage increased mortgage payments.

Rising Mortgage Rates: With mortgage rates approaching 8%, monthly mortgage payments are becoming unaffordable for many, especially those with variable-rate mortgages or those looking to refinance.

Rental Market:

Increasing Rents: As homeownership becomes less attainable, more people turn to renting, which drives up demand and, consequently, rental prices.

Wage Stagnation: Despite rising costs, wages have not kept pace, leading to more income being spent on housing.

Wages and Employment:

Stagnant or Decreasing Wages: In many sectors, wages are not increasing at the same rate as inflation, effectively decreasing real income.

Job Insecurity: Economic uncertainty can lead to job cuts or reduced hours, further decreasing household income.

Potential Outcomes:

Increased Financial Stress: As more people struggle to make ends meet, financial stress can lead to increased reliance on credit cards and loans, accumulating debt that becomes unmanageable.

Rising Bankruptcy Rates: Given the financial pressures from high living costs, unaffordable housing, and stagnant wages, more individuals and businesses may turn to bankruptcy as a last resort to manage insurmountable debt.

Policy Responses: Governments may need to intervene with policies to stabilize the economy, such as rent controls, wage increases, or direct financial aid to struggling households. Monetary policies to control inflation and stabilize mortgage rates might also be necessary to prevent further economic hardship.

Historical Context:

Economic downturns, high unemployment rates, and financial crises have historically increased bankruptcy filings. The combination of high inflation, stagnant wages, and high housing costs presents a similar scenario that could significantly raise bankruptcy rates.

Given the current economic indicators—high inflation, soaring home prices, increasing mortgage rates, and stagnant wages—it is reasonable to anticipate a rise in bankruptcy rates. Individuals and policymakers must know these trends and prepare for potential economic interventions to mitigate the impact on households and the broader economy.