Danny Vesokie | Affiliated Financial Partners

EducationMy Favorite Discussions

-

All Discussions

-

Kamala Harris spent $1 Billion Dollars on her campaign in just 100 days. Not only did Kamala Harris spend one billion in just two months, but she is 20 million dollars in the hole. It turns out that Kamala Harris paid many celebrities for their endorsement: Beyonce was paid $10 milliion. Where is My Daddy Podcast was paid $100,000. Al Sharpton was paid $500,000, the list goes on. How can someone spend over one billion dollars and not win? How can Kamala Harris spend a billion dollars in two months and be negative 20 billion and consider herself fit to become President of the United States? Can Kamala Harris get in trouble for this? You can help out so many poor families with a billion dollars. Is this campaign fraud?

https://www.youtube.com/watch?v=4NRiRPe7mfw&ab_channel=KREM2News

-

Congratulations to former President Donald Trump. On November 5th, 2024, Former President Donald J. Trump and Senator JD Vance won the Republican ticket to the White House. Kamala Harris and her running mate Tim Waltz lost the Democrat ticket to the Presidency after Kamala Harris spent $1 billion dollars and is $20 million in debt. There are still staff members who are due their paychecks and are waiting.

Here are a few relevant points to consider:

Political Implications of Election Results

Impact on the Republican Party: Trump’s nomination could unify different factions within the GOP or exacerbate divisions, depending on how his campaign is received by various voter demographics.

Democratic Strategy Moving Forward: The outcome of Kamala Harris and Tim Walz may prompt the Democratic Party to reassess its strategies, messaging, and candidate selection for future elections.

Campaign Financing: The mention of significant campaign spending and debt raises questions about campaign finance regulations and money’s political influence.

Staff and Campaign Management: The situation with unpaid staff can affect morale and the overall effectiveness of a campaign. It highlights the importance of financial management in political campaigns.

Voter Sentiment: Understanding voter sentiments and the issues that matter most to them will be crucial for both parties’ preparations for the general election.

-

I’ve come to the conclusion that marriage or the Covenant of marriage is under attack. It seems that more than ever before husbands and or wives are giving up instead of fighting for the marriage. This is a serious issue in our current culture.

Why is it that people are giving up in this modern day culture? Why are people failing to see the value of fighting for marriage?

Deception! We are fighting a fight with God’s enemy. Satan is hell bent on destroying the Covenant relationship. The Covenant of marriage is a beautiful thing and in its proper place and order in proper alignment with the Covenant we have with God the Father through Jesus Christ’s incredible gift on calvary, we can find the beauty of what God intended for us.

Love is being willing to lay down one’s life for someone else. In a marriage we are going to find that our mate isn’t always doing things we like and certainly aren’t always easy to love. It’s not the actions we need to love. If we base our decisions to love based on what they do instead of loving them because we decide it’s the right thing to do we will always be on a roller coaster ride that feels like it will never end.

The apostle Paul tells us in the first letter the the church of Corinth in chapter 13 verses 4 to 8 love is patient and kind; love does not envy or boast; its not arrogant or rude. It does not insist on its own way; it’s not irritable or resentful; it does not rejoice at wrongdoing., but it rejoices with the truth. Love bears all things; believes all things hopes all things; endures all things. Love never ends.

Imagine this being you he’s describing. Speak this with your name in each line. Now do the same for your spouse. Do you see how powerful this is? This is what we are called to do. We are called to do this for our spouse and others.

If you find yourself contemplating your future with your spouse, stop and consider what did Jesus do for you and me? He gave everything on the cross on Golgotha. He said in his dying breath Father forgive them for they know not what they do. We are called to lay down our rock like he convinced the men looking to stone the woman found in sexual sin. He wants us to lay down our Grievances toward one another and leave our incredible baggage at the cross for him to carry. Then pickup our cross realizing that it’s gonna hurt and follow him.

Oh, that’s not a popular statement is it? Everyone wants to believe when you come to Jesus it’s going to be rainbows and unicorns, but that’s never promised to us. We are promised that we will see trouble and we will have sorrow but that joy comes in the morning. We are promised that if we follow him we can have peace that passes all understanding.

So what are you waiting for? Focus on staying healthy in your relationship but if you’ve messed up and everyone does. Forgive and help your spouse find their way back to repentance and restoration with Christ Jesus. This is the message of the Gospel. I’m so glad to know and be able to walk in this and I hope this helps someone stay and stand for their marriage just like me. It’s worth it to fight. God’s already won. I know…

I read the end of the story. You can too.

-

About time

Home prices in Chicago South Loop are plummeting. Sellers are lowering prices and offering incentives. This correction is continuing throughout the city and Suburbs. Expect the downturn to continue in Chicago and other cities. Stay tuned

-

-

It’s over folks. Comcast, the parent of MSNBC is up for sale. Viewership at MSNBC dropped 51% due to anti-Trump and anti-Republican stance. Major layoffs is also expected. On another note, CNN lost 21% of its Viewership

The mainstream media is on life support.

It is reported that Oprah Wilfrey was paid one million dollars by the Kamala Harris campaign. The Democrat Party is deteriorating and deteriorating fast

Many Democrat states are losing citizens changing parties to the Trump Team.

https://www.youtube.com/live/rdyMVnYBw1w?si=ZIiFLCLNsh7HI4DB

-

I have been in the same line of work for 25 years but went from W2 to 1099 in August of last year, and my husband is always W2 as he has been a teacher for 20 years. Can we use our combined income? We will have 3.5-5% down and are currently working to pay our credit card debt to below 30%.

-

CNBC Jim Cramer and Crooked Media announced the economy is going strong and job opportunities are strong and little unemployment therefore interest rates should go higher. What are they thinking?

-

This discussion was modified 1 year, 8 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 8 months ago by

-

What is affiliate marketing and how do you get started? Can you make good money with affiliate marketing? What are the step by step process in getting started and becoming successful with affiliate marketing?

-

Is Kamala Harris the best candidate The Democrats have to face former President Donald Trump for 2024 Presidential Election? Are the Democrats that desperate of having a semi-descent candidate for President? Do Democrats think the American people are that stupid? Do Democrats need to name Kamala Harris, the person who slept her way up the political latter? Kamala Harris slept with former San Francisco Mayor Willie Brown to kick off her political career. Kamala Harris is not too smart. Many people cannot believe how she even became a lawyer let alone District Attorney of San Francisco, Attorney General of California, United States Senator, and Vice President of the United States. Now she is running for President? OMG. What has Kamala Harris ever achieved in her political career. Watch this video clip about Kamala Harris.

https://www.youtube.com/live/RcsRfo16ZC8?si=gFA0rsAlw8iu0KLU

-

Breaking: The World’s 🌎 🗺 🌏 🌐 🌍 MOST UNLIKED & THE WORLD’S BIGGEST LYING HUMAN BEING, KAMALA HARRIS has gone postal folks. The fact-checked incompetent Kamala Harris has exploded 🤯 💥 😳 😂 and 🇺🇸 had her Howard Dean moment and it has been recorded on video. This is breaking NEWS and the American people can now see that it is NOT just President Joe Biden has mental illness and mental stability issue. Please click 🙏 the video link below:

https://rumble.com/v5j7joc-kamala-harris-just-had-her-howard-dean-moment…-shes-done.html

rumble.com

Kamala Harris just had her "Howard Dean" moment... she's done

This was Kamala Harris' "Howard Dean" moment.

-

“Usually the disinformation we saw was pro-Trump… We’ll investigate, and then it goes just up to another team to take it [the post] down,” admits Matthew Fowler, a Software Engineering Manager at Meta, during an undercover date with an O’Keefe Media Group journalist. Fowler emphasized that Meta’s investigations often rely on mainstream media for verification, stating, “The news is going to do their job, and then based on what the outlets say… you have to trust that.”

Plamen Dzhelepov, a Machine Learning Engineer at Meta, agreed, “Meta has the right to suppress anything,” acknowledging the company’s political bias by noting, “they’re biased if they do that against the Republicans.” Dzhelepov detailed Meta’s censorship capabilities, confirming they target “crazy conspiracy right-wing people,” actively demoting their opinions.

Michael Zoorob, a Data Scientist at Meta, described the fact-checking process, stating, “the fundamental problem is that… the vast majority of what fact-checkers label as false is shared by conservatives,” admitting that any policy demoting content labeled false by fact-checkers disproportionately affects conservatives.

When addressing misinformation, Dzhelepov explained Meta’s approach: “it’s either censored or it says a [community note] thing, where it says, ‘this is disinformation, it’s probably fake’ under the post,” adding that Meta “actually suppresses certain voices.” Zoorob also recalled how Meta had downranked the Hunter Biden laptop story upon the FBI’s warning, stating, “We just downranked it,” making the post less visible in users’ feeds.”

-

Here is my story about my experience with Discover and the disputes I have been going through. Advise our viewers on this type of case situation if any of you run into it. Very time-consuming, stressful, and a total waste of time for me and my staff. I will start with the scenario of what has transpired from day one:

I am Gustan Cho Associates’s branch manager, a dba of NEXA Mortgage, LLC. We are a national mortgage lender licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. I am the manager of operations, support staff, and loan origination for the Oakbrook Terrace, Illinois, Branch NMLS 2315275 located at 17W662 Butterfield Road, Suite 305, Oakbrook Terrace, Illinois. The Oakbrook Terrace, Illinois, Branch is licensed in 48 states, including DC, Puerto Rico, and the Virgin Islands. We are the largest producing branch at NEXA Mortgage in production and have a lot of monthly expenses. I have two different types of credit cards to pay my monthly debts. Under no circumstances do I ever use my personal credit card for business related expenses. I mainly use my Discover credit card for my personal expenses. My personal expenses include anything that is not business related that cannot be written off from my income taxes. If you can review my Discover card statements for the past three years, you can see that only personal expenses such as fuel, groceries, shopping dog food and other merchandise for personal use from AMAZON, personal homeowners insurance. Now Discover is saying that I am responsible for payment even though it was not authorized for concurring charges on my Discover. Anyone had things like this happen? I will update you on the progress.

NEXA Mortgage issues us a corporate credit card from US Bank to pay all our branch expenses about the business. We are only allowed to charge business expenses. Any business expenses is charged to US Bank corporate business credit card. Business expenses includes rent, advertising expenses such as (YLOPO, RAVEN, ZILLOW, GOOGLE LEADS) expenses for leads, marketing, printing, co-marketing expenses with realtor partners, business lunches, travel, licensing, training and education, and any other direct and/or third-party business-related expenses. I have always use any business-related expenses on my corporate US Bank Visa card for business expenses and never my personal credit cards.

-

Most Americans are aware that many people from different walks of life hate former President Donald Trump. I have never witnessed the hatred people can have against one person. I will try to keep the tone of this post as objective and neutral as possible and base the content on FACTS. I want to compare which candidate is the best leader as President to be the Commander in Chief of the United States. Suppose you can focus on facts and comment on which candidate will be the best President in the best interest of America and the people of the United States so we remain the leader of the free world 🌎. In that case, we can Unite our country and get back to being Americans with one goal in mind: What’s best for our livelihood, the livelihood of our children, the livelihood of our grandchildren, and the livelihood of our future generations? The way our country is divided and the hatred that exists is not healthy. It’s more of a crisis and equivalent of stage 4 cancer. More and more Americans are beginning to speak out and not remain silent. Nobody is above the law. Not Trump, Not Biden, Not Kamala Harris. We don’t have to like or love Trump. However, take a step back and compare Joe Biden, Kamala Harris, and Donald Trump. Who is the best man for the job? Who’s the man who can get us out of the rathole we are in? Who is the man who can get rid of the lying, corrupt, and politically infested system that is destroying America 🇺🇸? Let’s get a thread on your thoughts and opinions on making America a country that the entire World would envy. Let’s brainstorm and become a country of the people. A country of honesty, integrity, pride, honor, and the country helping and caring for people. Let’s decimate corruption, fraud, Treason, and criminals who commit crimes against humanity.

-

What credit score model do mortgage lenders use? Is VantageScore so much higher than FICO? Do Mortgage Lenders Check FICO or Vantage? For the majority of lending decisions do most lenders use your FICO score? And which type of FICO score? FICO 2, 4, 8?

How far off is VantageScore from FICO? What FICO or Vantage Score Model does FHA, VA, USDA, FANNIE MAE, FREDDIE MAC, and Non-QM mortgage loans use? What is a good FICO score to get a mortgage?

-

This discussion was modified 8 months, 3 weeks ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 8 months, 3 weeks ago by

-

Good morning, folks. Does anyone know about HUD, FANNIE MAE, and Freddie Mac suspending income-based repayment on FHA and Conventional loans? I heard you can no longer use IBR payments because IBR is getting sued. From my understanding, our borrowers can only use 0.50% of the outstanding student loan payment for debt-to-income ratio calculations. Appreciate any feedback. Seems most wholesale account executives and underwriters do not know about this either. Thank you in advance.

-

-

A wildfire recently broke out near me in Orange County, and I could see the giant smoke plume from my place in Irvine for several days. It reminded me just how real the threat of wildfires can be here in California. If you’re not from the area, you’ve probably at least seen all the news about wildfires across the state.

While wildfires are something to be mindful of, there are plenty of ways to lower the risks—especially for homes in fire hazard zones. If you’re looking to buy a home, it’s good to understand where these zones are and what steps you can take to keep your property safer. Not all homes are at the same level of risk, but knowing about these zones can help you make more informed decisions.

What Is a Wildfire Zone?

Certain areas in California are marked as “Fire Hazard Severity Zones.” This means the area has a higher chance of wildfires because of things like weather, dry vegetation, and terrain. You might expect these zones to be mostly in rural places, but even some urban neighborhoods are at risk. Knowing if a house is in one of these zones is key.

Important Things to Know as a Homebuyer:

- Check the Fire Risk: Before you get too excited about a house, find out if it’s in a high-risk wildfire zone. You can check using CAL FIRE’s map or ask your realtor for more information. This will help you understand what extra steps, like special insurance, might be needed.

- Get the Right Insurance: Not all homeowner’s insurance covers wildfire damage, especially in high-risk areas. You might need to add more coverage to fully protect your home. Also, homes in wildfire zones usually come with higher insurance premiums, so keep that in mind when budgeting.

- Look for Fire-Resistant Features: Some homes are built using materials that can resist fire, like concrete or metal roofs. When viewing homes in wildfire zones, ask about the building materials and whether the owner has made any upgrades to improve fire safety.

- Defensible Space Around the Home: One way to help keep a home safe from wildfires is to have “defensible space.” This means keeping the area around the house clear of things like dry brush, dead leaves, or other stuff that can easily catch fire. When you’re checking out homes, see if the current owner has kept up with this—and be ready to do the same if you move in.

- Community Efforts Matter: Some neighborhoods have strong community efforts to reduce wildfire risks. They might have a fire-safe council, evacuation plans, or firebreaks in place. Living in a community that takes fire prevention seriously can make a big difference in reducing your overall risk.

- Be Ready for Evacuations: If you buy a home in a wildfire zone, there may be times when you have to evacuate, especially during fire season. It’s a good idea to learn the local evacuation routes and be prepared in case you need to leave quickly. This is especially important if you have pets or kids.

The Bottom Line

Buying a home in a wildfire zone doesn’t have to be a dealbreaker—but you do need to make sure you’re fully informed. Things like having the right insurance, keeping defensible space, and being ready for emergencies can make a big difference in staying safe and protecting your home. Staying aware of the risks and taking precautions can help you feel confident in your home-buying decision.

Have more questions about buying in these areas? Feel free to reach out—I’d be happy to help guide you through the process!

chadbushre.com

Chad Bush - Southern California Realtor

Your resource to southern California real estate. Stay informed on the latest housing market trends and available homes throughout the area.

-

-

-

There’s a whistleblower who came up that ABC NEWS and Kamala Harris cheated on Tuesday’s Presidential debate.

https://www.youtube.com/live/DqVrnTP7vSM?si=vj-wcq6-NIN6x6ef

-

Here’s a few pics and videos of Chase.

The Tale of Chase and His Half-a-Ball: A Long-Haired German Shepherd Love Story

There are dog lovers, and then there are staunch “my-dogs-are-my-co-pilots, my-shadow, my-ride-or-dies” type of dog lovers. My wife and I? Definitely the latter. And it all began with Chase, our Long-Haired German Shepherd born on 25th January 2023; a majestic and fluffy, fiercely loyal, and ridiculously stubborn dog with one very peculiar obsession: his prized possession, half-a-ball.

The Ball that Never Dies

Chase adored a particular toy above all others: a red ball. But let’s make no mistake—this is not a ball, and once it even ceased to exist. A long time ago, it did, and in fact Chase loved to fetch it—round, smooth and completely undamaged. However, now? Well, now it resembles an object of interest that has been subjected to a brutal archaeological dig. It overflows with bite marks, is disfigured beyond recognition, is in need of surgery, and quite frankly, had physics not intervened, would have ceased to exist by now.

As dutiful dog guardians, we engaged in speculative thinking. Why do we not attempt to acquire a new ball for him? Or, alternatively, how about two dozen brand new red balls that are identical to the first one? Since it was clear to us that the only issue was his lack of options. Makes sense, right?

No, not at all.

When Chase came out to play, he was greeted by several pristine new balls. Instead of running towards them like a sane dog, he sniffed them thoroughly and walked away as if he had just seen the antichrist. He didn’t even bother touching the fresh balls because at the end of the day, all he wanted was his half-ball. His one true love, the ball most people would disassociate with, is a half-chewed, nearly unrecognizable, blended piece of rubber that is coated with slobber. No other ball comes close to it.

Meet Skylar and Floppy: The Sister Duo

At this point, I am sure you have also deduced that Chase is our favorite dog in the family. For reasons that I am sure will be explained later, we can’t be normal people and leave him all by himself, hence, we got him two sisters. Now Chase was born on January 25, 2023, and so were his new sisters, making him a year older than the two. We surely love a good symmetric story.

Floppy most accurately describes the look of confusion, her ears thrown in different directions, give her a quirky, cartonish look style that can be also described as outright unique. Together with Skyler, who serves as the more excitement-driven dog, they have singlehandedly changed Chase’s life for the better, but the worst for Chase’s owners. The sweetest part? The lovely, heart-melting chaos they create while together.

The Three Musketeers (And Their Chauffeur—Me)

These three are a tight-knit group, and it is amusing to note that they would take my job if given the chance. They sit in the front row of the car when we go for rides together, which is a must. It gets pretty crowded because Chase assumes the shotgun role, while Skylar and Floppy scrunch up at the back like two misbehaved toddlers on a family trip.

As I am idling at stoplights, Chase scans the pedestrians and judges every single person’s life decisions while Sklyar and Floppy use the chance to bark at random objects. It is hard to get any gas without an event happening either. Whenever I leave the car unattended, all three dogs treat me like I am abandoning them and press their noses on the window as I step away until I come back.

The Ball Conspiracy Continues

With the arrival of two new sisters, one would assume that Chase would loosen up over the ball. Chase doesn’t share, nor does he seem inclined to. Everyone is baffled along with Skylar and Floppy because they are unaware of his bizarre dedication to the mangled ball. Those two other dogs would much rather chase the new red balls, which frustrates Chase to no end as he sits and perpetually observes the younger dogs, shaking his head in disbelief.

Now and then, Floppy makes an attempt to capture Chase’s half-ball to try understanding the excitement surrounding it, which is always an awful decision. Chase always gets it back with all the fervor of a person who is safeguarding the final piece of pizza at a party.

Life with The Trio

Our lives now center around three enormous, cute, spoiled, and incredibly funny dogs. Some bone of contention includes but is not limited to:

✅ Chase still not accepting the fact that his ball is not a ball anymore.

✅ Skylar being the main culprit of mischief.

✅ Floppy attempting to act like a baffled potato.

✅ All of them fighting for a ride in the car as if the car belongs to them.

We would not want it any other way.

So, if you ever spot a car zooming past with three extravagant Long Haired German Shepherds- one inconspicuously gripping a half-ball in his mouth while the other two stare in perplexment- you now have an idea as to who we are.

And if by chance you have a chewed up, barely recognizable red ball that is too damaged for any normal person to use, then to you Chase may just consider you his best pal.

P.S. Your guess is as good as mine on how we can convince Chase to replace the beloved trinket he keeps with a brand new, whole red ball. It’s safe to assume that whatever he has will remain. 🐾

https://www.facebook.com/reel/1128964241712575?mibextid=9drbnH

-

This discussion was modified 3 months, 1 week ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 3 months, 1 week ago by

-

wanted to inquire about an issue I’m experiencing with my DU approval. Guy changed jobs after 4 plus years. In May and July changed again. Back at original job. had initially received DU approval, but after adding a modular home to the equation, there seems to be a problem. He does not have a lot of credit, so I assume needed to add tradelines.

The DU findings state:

- “This case is ineligible because the loan amount of $168,875 exceeds the FHA maximum loan calculation of $160,190.” *

Could you please clarify what steps I can take to address this issue or how we can adjust the loan amount or any other factors that may be affecting my eligibility? I appreciate your assistance in resolving this matter.

Thank you for your time and help.

-

It’s a real shame how people and corporations treat the elderly in 2024. These people have worked their entire lives and supported and raised families. If it weren’t for them, we would have nothing. Yet they are being discarded once they have been sucked dry of all their money, even when having a lifetime contract to live in a senior living facility.

-

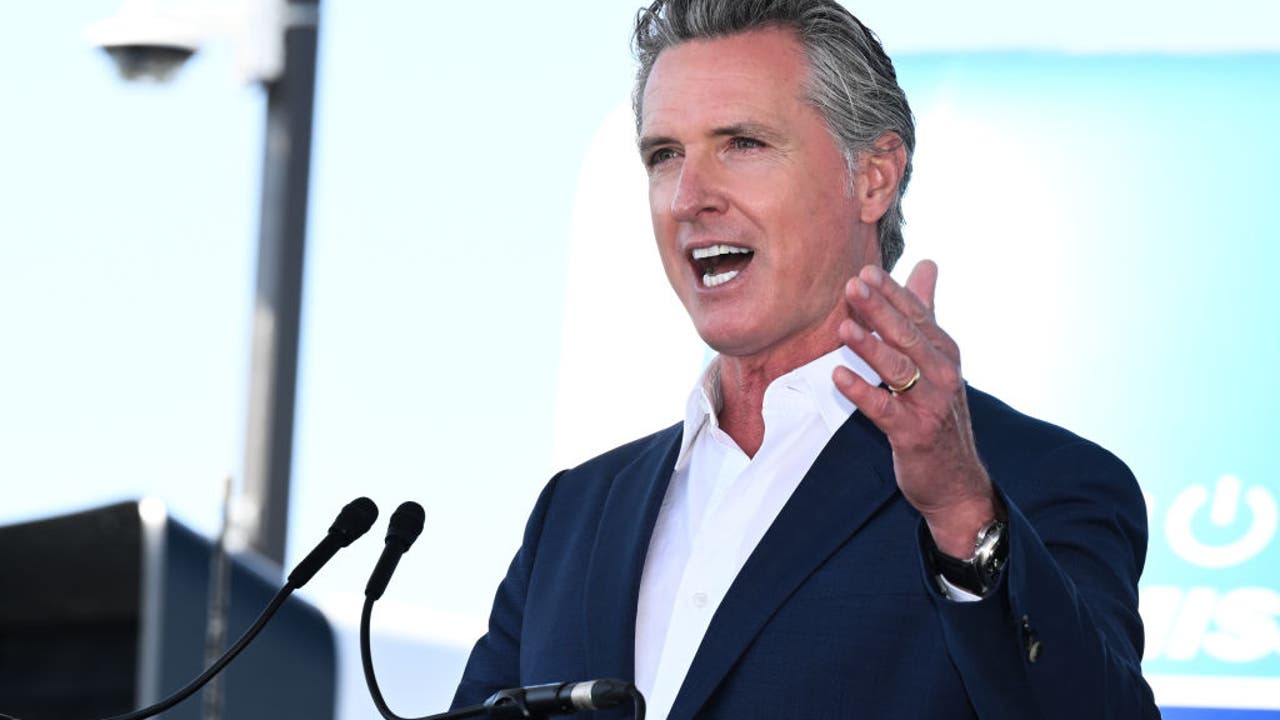

California Governor Gavin Newsom vetoes bill that would have given undocumented immigrants access to home loans. Can you please explain the $150,000 Housing Grant Bill to undocumented immigrants in California?

https://www.foxla.com/news/newsom-vetoes-bill-housing-loans-illegal-immigrants

-

This discussion was modified 8 months, 3 weeks ago by

Gustan Cho.

Gustan Cho.

foxla.com

Newsom vetoes controversial bill that would have given housing loans to illegal immigrants

California Gov. Gavin Newsom vetoed a controversial bill that would have given hundreds of thousands of dollars in housing loans to illegal immigrants.

-

This discussion was modified 8 months, 3 weeks ago by

-

Kamala Harris is the nation’s biggest laughing stock. Kamala Harris is hands down the biggest jackass. Her accent imitation makes her become the dumbest Global idiot, including for the DEMOCRATS. Kamala Harris is such a FAKE. It is also alleged Kamala Harris is a severe alcoholic—more on this rambling idiot Kamala Harris. The incompetent Kamala Harris is a major embarrassment and disgrace. She’s one disgusting, unlikeable, lying, uncreditable, flip-flopping, mentally deranged subhuman blizzard piece of shit.

-

What is the current state of our economy? Has Bidenomics helped our economy like Kamala Harris keeps on saying? Did the United States have a soft landing like Janet Yellen and Jerome Powell said? Democrats are saying we dodged a bullet because of the Biden Administration. The unemployment numbers came in at 4.2%. Are the unemployment numbers real or not accurate? Inflation numbers are at 3% but that number is not correct if you shop for goods and services. Mortgage rates went from 2.5% in 2019 to 7.5%. How did the sudden 400% jump in rates affect the economy? How is the 100% plus increase in home values affecting our economy? How is unemployment numbers at 4.2% is not reflective to actual Americans out of work?

-

Where is the housing market headed? What are your thoughts? I want to hear everyone’s thoughts about the housing market forecast. Are we headed towards a housing crisis worse than the 2008 financial crisis? Take the following into consideration:

1. Rates went from 2.5% in 2019 to today’s 7.5%.

2. Inflation at historic rates.

3. Housing prices up 50% or more since 2018.

4. Economic numbers are lies. The Biden Administration have lied about economy and economic growth. Joe Biden said our economy is doing great and Inflation is only a 4% and unemployment rate is only 3.2%. BIG FAT LIES AFTER LIES.

5. Kamala Harris, the first woman who slept her way to the White House touts Bidenomics is GREAT 👍 and that it WORKS: BULLSHIT 🐎 🐴 🎠 🏇 HORSESHIT 🫏 🐴 🫏 🐴

-

How much does your lender make on your loan?

-

I am an Experienced Mortgage Loan Originator. How Can You Approach a Home Builder and Become The Builder’s Preferred Lender. Why do home builders want to use you as their preferred lender? How do you become a Preferred Lender of a Home Builder? What do home builders want of a preferred lender. The bottom line is How Do You Become a Preferred Lender For a Home Builder? What can I do to get an opportunity to become a preferred lender for a regional or national home builder?