George

LawyerMy Favorite Discussions

-

All Discussions

-

Went to the grocery store and my change contained a 1963 Silver Dime, Gus advises investing in silver. I guess I just started, I think its worth $25. Any opinions?

-

Qualifying for a land loan can vary depending on the lender and your financial situation. Land loans are typically riskier for lenders than loans for homes with structures, so the requirements can be stricter. Here are some general steps and factors to consider when trying to qualify for a land loan:

-

Check your credit score: A good credit score is crucial when applying for any type of loan. Lenders often require a higher credit score for land loans compared to other types of loans. Aim for a credit score of at least 700 to increase your chances of approval.

-

Save for a down payment: Lenders usually require a larger down payment for land loans compared to home loans. Expect to put down 20% to 50% of the land’s purchase price. A larger down payment can improve your loan terms and make you a more attractive borrower.

-

Research lenders: Different lenders may have different requirements and terms for land loans. It’s essential to shop around and compare offers from various lenders, including banks, credit unions, and online lenders. Look for one that specializes in land loans or has experience in this area.

-

Demonstrate your ability to repay: Lenders will assess your income, employment stability, and debt-to-income ratio (DTI). They want to ensure you have the financial means to make loan payments on top of your existing financial commitments.

-

Prepare a detailed land plan: Having a well-thought-out plan for the land you want to purchase can be beneficial. Include information about the land’s intended use, any improvements you plan to make, and any potential income the land may generate (e.g., farming, leasing). A solid plan can demonstrate your commitment to the investment.

-

Gather documentation: Be prepared to provide documentation such as tax returns, bank statements, pay stubs, and financial statements. Lenders may request this information to assess your financial stability and ability to repay the loan.

-

Show your land’s viability: Lenders may want to ensure that the land you’re buying is suitable for its intended use and that it has adequate access to utilities and services. Providing information about the land’s condition and potential value can help your case.

-

Be prepared for higher interest rates: Land loans typically come with higher interest rates compared to traditional home mortgages. Make sure you can afford the interest payments along with the principal.

-

Consider a co-signer: If you have difficulty meeting the lender’s requirements on your own, you might consider having a co-signer with a strong credit history and financial stability. A co-signer can help you qualify for a loan or secure better terms.

-

Be patient and persistent: Obtaining a land loan can be more challenging than other types of loans, so be prepared for a potentially lengthy process. Be persistent and work with your lender to address any issues or concerns that may arise during the application process.

Remember that each lender has its own criteria, so it’s essential to discuss your specific situation with potential lenders to understand their requirements and expectations. Consulting with a financial advisor or mortgage broker can also be helpful in finding the right lender and navigating the land loan application process.

-

-

No-doc real estate loans, short for “no documentation” or “no document” loans, were a type of mortgage loan that gained popularity in the early 2000s during the housing boom in the United States. These loans were designed to make it easier for borrowers to obtain mortgages without having to provide extensive documentation of their income, employment, or financial assets. The key characteristic of no-doc loans was that they required minimal or no documentation from the borrower to verify their financial status.

Here are some key features of no-doc real estate loans:

-

Limited Documentation: Borrowers typically did not need to provide traditional income verification documents, such as pay stubs, tax returns, or W-2 forms. Instead, they might state their income on the loan application without providing any supporting evidence.

-

Higher Interest Rates: Due to the increased risk associated with lending without thorough income verification, no-doc loans often came with higher interest rates compared to traditional mortgage loans.

-

Lower Down Payments: Lenders might accept smaller down payments, allowing borrowers to purchase homes with less money upfront.

-

Risky Borrowers: No-doc loans were often marketed to self-employed individuals or those with irregular income streams who had difficulty qualifying for conventional mortgages.

-

Adjustable-Rate Mortgages (ARMs): Many no-doc loans were structured as adjustable-rate mortgages, which meant that the interest rate could change over time, potentially leading to higher monthly payments.

-

Declining Values: The popularity of no-doc loans contributed to the housing bubble and subsequent financial crisis in the late 2000s, as many borrowers who couldn’t afford the loans defaulted when interest rates adjusted or home values declined.

As a result of the housing market collapse and the financial crisis, regulations surrounding mortgage lending were tightened, and risky loan products like no-doc loans largely disappeared from the market. Today, lenders typically require borrowers to provide comprehensive documentation to verify their income and financial stability when applying for a mortgage, with the aim of ensuring that borrowers can afford the loans they are seeking.

-

-

I am a new loan officer and I want to know what states are the states that property taxes are paid in arrears and there is property tax prorations. Can you use property tax prorations for the down payment since the sellers owe you the property taxes that were not paid with property tax prorations?

-

Another message from the one and only, Kevin DeLory. Thank you Kevin, for sharing

-

My friend Greg Stadlin of Collier RV in Northern Illinois referred me to one of his clients, David. David did a complete renovation of his 37 feet RV which included two new slide outs. I spoke with David today and he said he spent $150,000 to renovate his RV with two new slide outs, interior and exterior. He will send me pictures of before and after of his RV. I can stop by the storage at Collier RV and take a look. I have a 2001 Tiffin Zephyr 42 ft. coach with only 52,000 miles I was thinking of trading in for a newer one but am afraid of losing value. RVs depreciate more than any other property or vehicles.

-

What are HUD Chapter 13 Bankruptcy dismissal guidelines to qualify for an FHA LOAN. Is there any waiting period requirements.

-

Primary owner-occupant homes, also known simply as owner-occupied homes or primary residences, refer to residential properties that are primarily occupied by the owner of the property as their primary place of residence. These are homes where the owner lives and resides, as opposed to properties that are primarily used for rental or investment purposes.

Key characteristics of primary owner-occupant homes include:

-

Residence of the Owner: The owner of the property lives in the home as their primary place of residence. It’s where they reside on a day-to-day basis.

-

Personal Use: The property is used for personal and family purposes rather than being rented out to generate rental income.

-

Potential Tax Benefits: In many countries, primary owner-occupant homes may qualify for certain tax benefits or exemptions, such as property tax reductions or capital gains tax exclusions when selling the property.

-

Mortgage Considerations: When financing the purchase of a primary residence with a mortgage, there may be different lending terms, interest rates, and down payment requirements compared to investment properties.

-

Homeowner’s Insurance: Homeowner’s insurance policies are typically used to protect primary owner-occupant homes and their contents.

-

Homestead Exemption: Some jurisdictions offer homestead exemptions, which can provide property tax relief or protection from creditors for primary residences.

It’s important to distinguish primary owner-occupant homes from investment properties, vacation homes, or rental properties. These other types of properties are typically acquired with the primary goal of generating rental income or capital appreciation, whereas primary owner-occupant homes are meant for the owner’s personal use and enjoyment.

-

-

A VA high-balance loan, also known as a VA jumbo loan, is a mortgage program offered by the U.S. Department of Veterans Affairs (VA) that allows eligible veterans, active-duty service members, and certain members of the National Guard and Reserves to purchase or refinance homes with loan amounts that exceed the standard conforming loan limits established by the Federal Housing Finance Agency (FHFA).

Conforming loan limits are the maximum loan amounts that government-sponsored entities like Fannie Mae and Freddie Mac will purchase or guarantee. These limits vary by location and are typically adjusted annually to account for changes in the housing market. In areas with higher housing costs, such as some parts of California, New York, and Hawaii, conforming loan limits may not be sufficient to finance homes in certain neighborhoods.

A VA high-balance loan comes into play when a borrower wants to purchase a home in a high-cost area and needs a larger loan amount than the standard conforming loan limits allow. The VA guarantees a portion of the loan, which allows lenders to offer favorable terms to veterans and active-duty military personnel.

Key features of VA high-balance loans include:

-

Higher Loan Limits: VA high-balance loans have higher loan limits than standard VA loans. The specific loan limits vary by location and are based on the FHFA’s conforming loan limits for that area.

-

No Down Payment: Just like standard VA loans, high-balance VA loans typically do not require a down payment, making homeownership more accessible to eligible veterans and service members.

-

Competitive Interest Rates: VA loans often come with competitive interest rates, making them an attractive option for borrowers.

-

No Private Mortgage Insurance (PMI): VA loans do not require private mortgage insurance, even for high-balance loans. This can result in lower monthly mortgage payments compared to some conventional loans.

-

Flexible Credit Requirements: While lenders have their own credit score and underwriting requirements, VA loans tend to be more flexible than many other loan programs, making it easier for some borrowers to qualify.

It’s important to note that eligibility for VA high-balance loans is subject to specific requirements, including military service history, discharge status, and other factors. Additionally, borrowers may need to meet income and credit requirements set by the lender.

If you’re interested in a VA high-balance loan, it’s advisable to contact a mortgage lender or broker with experience in VA loans to discuss your eligibility and explore the loan options available to you. Keep in mind that loan limits and program details may change over time, so it’s essential to get the most up-to-date information when considering a VA high-balance loan.

-

-

Have you seen the commercials for HIMs and HERS? I must be missing something; I thought we were sensitive to the non-binary society? When pronouns are used like XIR or MX, I’m in a fog. Is it a certain code that only non-binary people get? Everyone wants to be identified as something. We wear T-shirts that have a message: we want to be labeled as someone unique. Why? Aren’t we happy being what God intended? How is it that today, when a child is born, the parents can name them non-brinary? Is this predestined?

I know I can rant and rave about genders; my question would be, “What does the non-binary person, {I can use person, right, I’m not offending anyone, am I?}

What happens if a HIMS takes a HERS? Or a HERS takes a HIMS? Hair growth, stronger sexual desire?

Will there be a THEMS or an ITS? Please help!

-

I know the difference between mortgage broker and mortgage banker. However, I do not fully understand what a mini-correspondent mortgage lender is. I know NEXA Mortgage is a mortgage broker but the sister company of NEXA which is AXEN Mortgage is a mini-correspondent mortgage lender. From my understanding, if you are part of NEXA Mortgage, you can do both mortgage broker and mortgage banker through its correspondent mortgage division AXEN Mortgage. Thank you in advance.

-

Please make sure all LO’s have this

How to find active builders and spec builders.

one way is to go to realtor.com, choose a large city go to filters, click home, age no min, and less than 1 year. this should list the new construction homes. get the addresses. The agent usually doesn’t want you speaking with their client, however, call the agent anyway and let them know that you can help theri builder to build more homes, and sometimes they will introduce you. if not, then do a google search for parcel search using the city, or county, and state. Usually, they have a gis map, and you can use this to locate the owner and the owner’s address, where you can further search and get a cell phone. realtor.com is a great source to see who is building where and at what price.

-

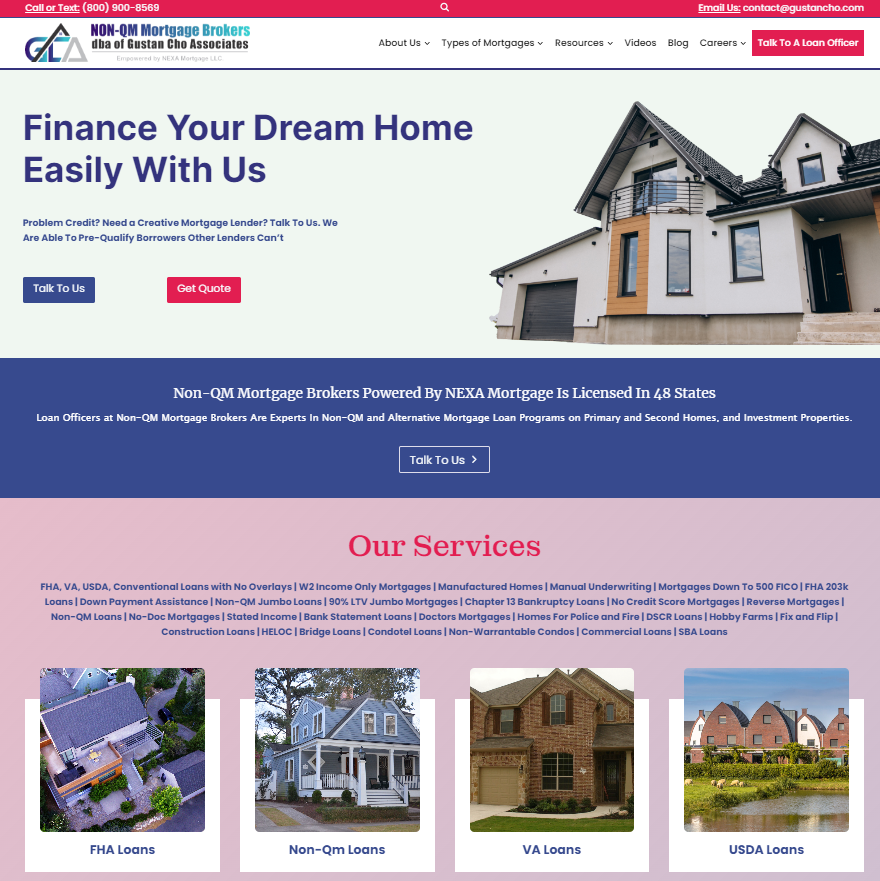

Non-QM Mortgage Brokers is a national mortgage broker and correspondent lender licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. Non-QM Mortgage Brokers is a wholly-owned subsidiary of Gustan Cho Associates, Inc. Gustan Cho Associates, also referred to as GCA Mortgage Group NMLS 2315275 is a dba of NEXA Mortgage, LLC NMLS 1660690, the nation’s largest mortgage broker and correspondent lender with nearly 3,000 licensed mortgage loan originators and equally number of support, operations, and third-party independent contractor service providers. Non-QM Mortgage Brokers specialize in providing mortgage options for individuals who may need to meet the standard lending criteria set by the Consumer Financial Protection Bureau (CFPB). Licensed mortgage loan originators at Non-QM Mortgage Brokers offer more flexible mortgage loans regarding income and credit requirements, which can benefit borrowers such as business owners, self-employed individuals, and gig workers.

Here are some key features of non-QM loans:

Flexible Income Documentation: Borrowers may use alternative methods, such as tax returns, bank statements, or 1099s, to demonstrate their ability to repay the loan.

Higher Debt Limits: Some non-QM loans allow for debt-to-income ratios over 50%, compared to the standard 43%.

No Waiting Period After Bankruptcy: Certain non-QM loans do not require a waiting period after bankruptcy or foreclosure, enabling quicker access to a mortgage.

Higher Down Payment Requirements: Non-QM loans often require a larger down payment, typically between 15% to 20%.

Higher Interest Rates: Due to the increased risk associated with these loans, non-QM mortgages usually come with higher interest rates.

If you’re considering a non-QM loan, it’s important to shop around and compare offers from different lenders to find the best terms for your situation. Remember that while non-QM loans can provide a path to homeownership for those who don’t qualify for traditional mortgages, they also come with higher costs and risks. It’s advisable to consult with a financial advisor or mortgage broker to understand all the implications before proceeding. Non-QM Mortgage Brokers is the nation’s largest mortgage broker of non-qualified mortgages. For more information, visit us at Non-QM Mortgage Brokers, Inc. at

https://www.non-qmmortgagebrokers.com/

non-qmmortgagebrokers.com

Home - Non-QM Mortgage Brokers

Finance Your Dream Home Easily With Us Problem Credit? Need a Creative Mortgage Lender? Talk To Us. We Are Able To finding The Perfect Mortgage For Your Dream Home Find A Lender With Us Fill out the form by click … Continue reading

-

Dan Bongino livid at Bill O’Reilly because Bill O’Reilly called Dan Bongino a fanatic because Dan Bongino said even Democrats don’t want illegal immigrants to vote. Look at Dan Bongino podcast. A lot of F# and MF BOMBS.

https://rumble.com/v52t19p-dan-bongino-destroyed-bill-o-riley-wow-.html

rumble.com

Dan Bongino Destroyed Bill O Riley wow 🤯

Tip/Donating (everything I do is free, so any tips are appreciated) https://www.givesendgo.com/theunshakeablepundit Truth Seeker in my Spare Time You Can Follow Me at: Telegram is my home base of Oper

-

There is many conflicting answers as to when you can apply for a mortgage after Chapter 11 Bankruptcy mortgage. Per HUD guidelines, there is a two year waiting period after a Chapter 11 Bankruptcy discharge date to be eligible for an FHA loan.. Chapter 11 Bankruptcy repayment plan should be the same type of guidelines per HUD as Chapter 13 Bankruptcy. More on this in the coming days. Will be contacting HUD to get confirmation.

-

Every state has a state housing authority where homebuyers can get down payment assistance for their down payment and closing costs. The lending requirements for each state, county and city is different. We will be covering every state’s down payment assistance program available through their down payment assistance program for first time homebuyers on the individual state thread of this forum.

-

Great NEWS. Like to thank our National Operations Director at Gustan Cho Associates Angelica Torres for coordinating the team at Gustan Cho Associates | NEXA Mortgage to officially be an approved lender for Utah Down Payment Assistance homebuyers program. More details on the two down payment assistance homebuyer’s program coming soon.

-

This discussion was modified 11 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 11 months ago by

-

Southern Living just voted Athens Georgia the South’s best college town. Home to the University of Georgia, and their beloved mascot UGA the bulldog, Athens has it all. Night life, restaurants, a healthy economy and beautiful homes. If Athens is your home, what do you love about it? I would love some feedback from local realtors as well as residents.

-

Does Tennessee cap borrower paid compensation at 2%? Never heard of a state allowing 2.75% Lender Paid comp at 2.75% but lower on borrower Paid yield spread premium.

-

I am calling the next Supercar to skyrocket in value to be the 599 GTB Ferrari V12 supercar. The Ferrari 599 GTB Fiorano is a high-performance sports car produced by the Italian automaker Ferrari. It was manufactured from 2006 to 2012. The “599” in its name refers to the engine displacement, with a 6.0-liter V12 engine under the hood. The “GTB” stands for “Gran Turismo Berlinetta,” which is a term often used by Ferrari to denote their two-seater, front-engine, and rear-wheel-drive sports cars.

Key specifications of the Ferrari 599 GTB Fiorano include:

-

Engine: The car is powered by a naturally aspirated 6.0-liter V12 engine, which produces a substantial amount of horsepower and torque. The engine is known for its fantastic sound and delivers exhilarating performance.

-

Performance: The 599 GTB can accelerate from 0 to 60 mph (0 to 100 km/h) in around 3.7 seconds and has a top speed of approximately 205 mph (330 km/h).

-

Transmission: It typically comes with a 6-speed manual gearbox, although an F1 automated manual transmission is also available, providing paddle-shift capability.

-

Handling: The car features advanced suspension technology and active aerodynamics to enhance its handling and stability at high speeds. It has been praised for its balance and precision in corners.

-

Design: The 599 GTB Fiorano features a sleek and aerodynamic design, with distinctive Ferrari styling cues. Its front-engine layout gives it a long hood and a classic GT profile.

-

Interior: Inside, it offers a luxurious and driver-focused cabin with high-quality materials and various customization options.

-

Technology: The 599 GTB includes various technological features, including a modern infotainment system and driver aids to enhance the driving experience.

Please note that my knowledge is based on information available up to January 2022, and there may have been updates or newer models released since then. Ferrari often produces limited-edition and special variants of their vehicles, so it’s a good idea to check the latest information directly from Ferrari or a reliable automotive source for the most current details on their models.

-

-

-

Joe Biden is expected not to run for 2024 Presidential election. So who will face Donald Trump for President in 2024? Kamala Harris? Gavin Newsome? Michelle Obama? Who can destroy the United States.

-

When an automaker says only 400 cars made worldwide and there’s 500 VIN numbers, what’s up with that. Here’s a very informative video clip classic and exotic auto enthusiasts will find it very interesting. I think before watching the attached video clip, car makers like Ferrari, Lamborghini, and others were legitimate when they produced limited production exotic and classic cars. The Ferrari Enzo is a high-performance supercar produced by the Italian automaker Ferrari. Here are some key features and details about the Ferrari Enzo:

-

Production: The Enzo was produced from 2002 to 2004, with only 400 units made, making it a rare and highly sought-after vehicle.

-

Design: Named after the company’s founder, Enzo Ferrari, the car’s design was inspired by Formula 1 technology. It features a carbon-fiber body, advanced aerodynamics, and a sleek, aggressive look.

-

Engine and Performance: The Enzo is powered by a 6.0-liter V12 engine, producing 651 horsepower. This allows the car to accelerate from 0 to 60 mph (0 to 97 km/h) in just 3.14 seconds and reach a top speed of 218 mph (351 km/h).

-

Transmission: It features a 6-speed automated manual transmission with paddle shifters, providing a rapid and precise gear-shifting experience.

-

Suspension and Brakes: The Enzo is equipped with state-of-the-art suspension and braking systems, including carbon-ceramic brakes, ensuring exceptional handling and stopping power.

-

Interior: The interior is focused on performance, with minimalistic design elements, racing seats, and a digital display providing essential driving information.

-

Legacy: The Ferrari Enzo is considered one of the most iconic supercars of its time, combining cutting-edge technology, exceptional performance, and exclusivity.

The Ferrari Enzo remains a symbol of Ferrari’s commitment to excellence in automotive engineering and design. However, if Ferrari says that they only made 400 Ferrari Enzo supercars, is this correct? What is up with the 500 VIN numbers? If this is true, this is huge international fraud. These cars are multi-million dollar super sportscars and the reason for such high value is due to the limited production numbers.

https://www.facebook.com/share/r/8ckCBEMjx6LECTN1/?mibextid=D5vuiz

-

This discussion was modified 11 months, 3 weeks ago by

Gustan Cho. Reason: Spelling error

Gustan Cho. Reason: Spelling error

facebook.com

Enzo Model Reportedly Produced Beyond Official Claims

-

-

Mowing everyday. Keeps raining here and grass won’t stop growing. Landscapers on furlough until I get caught up on mortgage and thanks to Biden’s Bidenomics, Inflation, and high labor costs. I am ruining my John Deere tractor. Using up tons of Diesel ⛽️. May need to get some goats 🐐 😬 🤔 or some potheads to smoke 🚬 up my grass. Hate mowing. I will probably be mowing all summer ☀️

Budget cuts.

-

I am a first-time precious metal investor. How do you go about investing in Gold and Silver? Do I need to watch out for scammers? Where do I buy gold or silver? What is the minimum I can invest in Gold and Silver?

-

-

CEO Mike Kortas terminates co-founder Mat Grella of NEXA Mortgage. More to come.

https://nationalmortgageprofessional.com/news/co-founder-mat-grella-terminated-nexa

-

FHA loans are the most popular mortgage loan program for homebuyers and homeowners with bad credit. Homebuyers with less the perfect credit and low credit scores can qualify and get approved for FHA loans with bad credit with a 3.5% down payment. FHA loans with bad credit allows borrowers to qualify for an FHA loan with bad credit with credit scores down to 500 FICO. To qualify for a 3.5% down payment home purchase FHA loan, you need at least a 580 credit score. Borrowers with under a 580 credit score and down to 500 FICO can qualify for an FHA loan with bad credit with a 10% down payment.

-

Can I get approved for a mortgage loan after a timeshare foreclosure with no waiting period? Many lenders say I cannot qualify and get approved for a mortgage after a timeshare foreclosure and need to wait three years for FHA loans and seven years for conventional loans.

-