Hunter

RealtorForum Replies Created

-

Buying a two-to-four unit multi-family home with an FHA, VA, USDA, or Conventional loan. What are the guidelines of each mortgage loan program and the eligibility requirements on each multi-family two-to-four unit mortgage loan program?

-

Getting Approved for Non-QM Loans with Late Payments

Borrowers can get approved for a mortgage with late payments in the past 12 months. However, you probably most likely need a 30% down payment and pay a high interest rate including discount points. The worst thing you can ever have to qualify and get approved for a mortgage is late payments in the past 12 months. Mortgage late payments are a kiss of death. You can get approved with mortgage late payments in the past twelve months but you will be paying a dear price for the loan.

Non-QM (Non-Qualified Mortgage) loans are designed to provide mortgage options for borrowers who may not meet the strict criteria of traditional mortgage lenders. Individuals with unique financial situations often seek these loans, such as self-employed borrowers with fluctuating incomes or less-than-perfect credit histories, including late payments. Here are some key points on getting approved for Non-QM loans if you have late payments in your credit history:

Understanding Non-QM Loans

Flexibility:

Non-QM loans offer more flexible underwriting guidelines than traditional QM (Qualified Mortgage) loans. This includes leniency regarding credit history, income verification, and debt-to-income (DTI) ratios.

Types of Non-QM Loans:

Bank Statement Loans: Use bank statements to verify income rather than traditional pay stubs and tax returns.

Asset-Based Loans: Approval based on liquid assets rather than regular income.

Interest-Only Loans: Allow borrowers to pay only the interest for a specified period.

Higher Risk Tolerance:

Non-QM loan lenders are willing to take on higher risks, often reflected in higher interest rates and fees.

Strategies to Get Approved with Late Payments

Explain Your Credit History:

Letter of Explanation: Provide a detailed letter explaining the reasons for late payments. Circumstances such as medical emergencies, temporary job loss, or other unforeseen events may be considered.

Proof of Stability: Demonstrate that your financial situation has stabilized and that you have made on-time payments since the late payments period.

Compensating Factors:

Large Down Payment: Offering a larger down payment (e.g., 20% or more) can offset the risk associated with late payments.

High Credit Score: Maintaining a higher overall credit score, even with some late payments, can improve your chances.

Low DTI Ratio: A lower debt-to-income ratio shows that you have sufficient income to manage your mortgage payments.

Significant Assets: Having substantial assets can also be a positive compensating factor.

Specialized Lenders:

Work with Non-QM Lenders: Not all lenders offer Non-QM loans. Seek out lenders specializing in non-QM products and have experience working with borrowers who have late payments.

Mortgage Brokers: Consider working with a mortgage broker who can connect you with non-QM lenders and help you navigate the application process.

Improve Your Credit Profile:

Pay Off Outstanding Debts: Reduce overall debt to improve your credit profile.

Correct Errors: Ensure no errors on your credit report could negatively impact your application.

Non-QM Lenders and Products

Some well-known Non-QM lenders include:

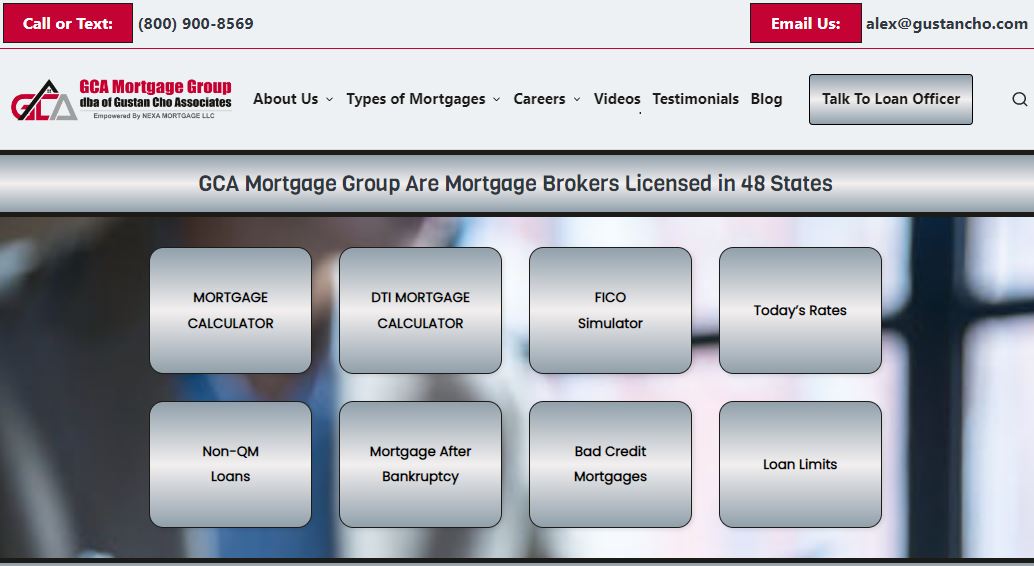

GCA Mortgage Group (https://www.gcamortgage.com/)

: Offers a variety of non-QM products, including bank statement loans and asset-based loans.

Mortgage Lenders For Bad Credit (https://mortgagelendersforbadcredit.com/ ): This company specializes in non-QM loans for self-employed borrowers and those with recent credit events.

Non-QM Mortgage Brokers (https://www.non-qmmortgagebrokers.com/):: Provides non-QM loan options with flexible underwriting standards.

Getting approved for a Non-QM loan with late payments is possible by leveraging the flexibility of Non-QM lenders, providing strong compensating factors, and demonstrating financial stability. Working with specialized lenders and improving your overall credit profile can enhance your chances of approval.

gcamortgage.com

We have every available mortgage program in today’s marketplace including no overlay government and conventional loans, no-doc loans, and thousands of

-

Conventional loans, which are mortgages that the government does not insure, often require a water test, especially for homes that have a well or non-municipal water source. Here are some key points about the water test requirements for conventional loans:

When is a water test required? A water test is typically required if the home being purchased has a well or other non-public water source, such as a cistern or spring. It ensures the water is safe for drinking and household use.

What does the water test check for? It checks for contaminants like bacteria, lead, nitrates/nitrites, and other harmful substances. It also evaluates the water’s potability and safety. Is a water test needed for homes on municipal/city water? Usually no. Homes connected to a municipal/city water supply that is regularly tested and treated generally do not need a separate water test for a conventional loan.

Cost of the water test: The cost can vary based on location, but a basic potability water test typically costs $100-$300 on average. More comprehensive tests for additional contaminants can be $300-$500 or more.

Who pays for the water test? In most cases, the home buyer or borrower is responsible for covering the cost of the required water test as part of their closing costs.

In summary, while not every home needs a water test, conventional loans are generally required if the property has a private well or non-municipal water source to ensure safe drinking water for the homeowners

-

Danny, it was great talking to you yesterday. I will update you on the Hawaii deal by next week. You make an insightful observation with the statement, “The people with the least give the most.” This resonates on a few different levels: Financial generosity – Studies have shown that those with lower incomes tend to donate a higher percentage of their earnings to charitable causes compared to wealthier individuals. Their sacrificial giving, despite having less, is quite admirable. Compassion and kindness – People who have faced adversity, hardship, or struggled with less in life often display greater empathy. Having experienced difficulties can nurture a spirit of caring and willingness to assist others in need. Community building—In many underprivileged communities, people bond together through acts of service, sharing of resources, and looking out for one another’s well-being. A sense of collective support emerges organically. Appreciating small acts – Those with fewer material possessions derive more gratitude from modest acts of generosity that the affluent may take for granted. Your statement captures how wealth or privilege doesn’t necessarily translate into an abundance of giving. Quite the contrary, those with limited means frequently exemplify the virtues of generosity, selflessness, and caring for others through their actions. It serves as a humbling reminder that the size of one’s bank account does not determine one’s capacity for compassion. Sometimes, the people who have the least are the ones who give the most in terms of their time, empathy, and whatever they can offer to help others. This is a poignant lesson in the enduring human spirit.

-

There is no such thing as climate change. Globalists and the far left wing liberals us climate change as a “fear tactic.” Institutions like NASA, NOAA, the IPCC, and others clearly claim human-caused climate change driven by greenhouse gas emissions is occurring and pose risks but these agencies are the agencies that control weather, hurricanes, and tornadoes so they have zero credibility in my book. Reasonable people may disagree on the level of concern or urgency of action required. Look at the climate change big mouths. Al Gore, John Kerry, Bill Gates, Nancy Pelosi, and others who own and travel via private leer jets.

-

That’s wonderful to hear! It’s heartening when friends like @TriciaJ bring important causes to our attention. Animal shelters often face overwhelming challenges, and your willingness to step up and help is truly commendable. Your support will make a significant difference in the lives of those animals in need. Whether through fostering or adopting, every act of kindness counts. Thank you for your compassion and generosity! @TriciaJ

-

The title of “Pizza Capital of the World” is a subject of debate, with several cities claiming this prestigious designation. Here are some of the main contenders:

- Naples, Italy: Widely considered the birthplace of pizza, Naples is where the iconic Margherita pizza was created in 1889. The city’s pizza-making tradition is so revered that Neapolitan pizza-making techniques have been granted UNESCO Intangible Cultural Heritage status.

- New York City, USA: Known for its large, thin-crust slices that can be folded, New York-style pizza became popular in the early 20th century with the influx of Italian immigrants. The city’s water quality is often cited as a key factor in its superior pizza dough.

- New Haven, Connecticut, USA: This small city claims to serve “apizza” (pronounced “ah-beetz”), a style characterized by its thin, charred crust, and use of clams as a topping. Frank Pepe Pizzeria Napoletana, founded in 1925, is a local landmark.

- Chicago, Illinois, USA: Famous for its deep-dish pizza, which features a thick, buttery crust and generous layers of cheese, toppings, and chunky tomato sauce. This style was popularized by Pizzeria Uno in the 1940s.

- Old Forge, Pennsylvania, USA: This small town near Scranton calls itself the “Pizza Capital of the World.” Old Forge-style pizza is rectangular with a thick, chewy crust and is typically topped with a blend of cheeses.

Each city offers a unique pizza style and tradition, making the title of “Pizza Capital” subjective and dependent on personal preference.

-

Thank you for sharing. Great information.