Michelle

Dually LicensedForum Replies Created

-

The Commercial Loan Officer Training at Affiliated Financial Partners, led by Danny Vesokie, is a highly rated program designed to prepare individuals for careers in commercial lending. The initial training lasts three days, but participants receive lifetime support and access to private forums at Great Content Authority FORUMS. The program covers crucial topics such as credit analysis, loan structuring, risk assessment, regulatory compliance, financial statement analysis, industry-specific lending practices, relationship management, and loan documentation. For more details, contact Affiliated Financial Partners or visit their official website.

Affiliated Financial Partners, Inc. Address: 50 Fullerton Ct Unit 102, Sacramento, CA 95825 Phone: (916) 235-8324

-

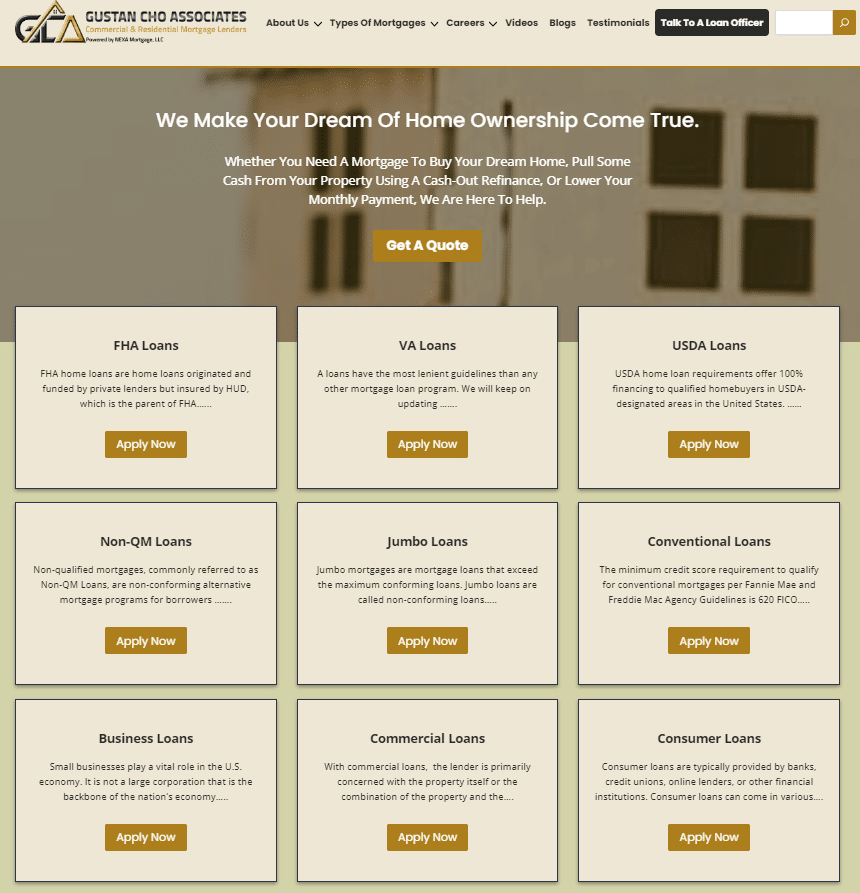

Thank you for providing this information about Gustan Cho Associates’ non-QM loan offerings. Let’s break down each of these programs:

Bank Statement Loans:

- Ideal for self-employed borrowers or those with irregular income

- Uses bank statements instead of traditional tax returns for income verification

- Typically looks at 12-24 months of statements

- Beneficial for business owners, freelancers, and gig economy workers

Asset-Based Loans:

- Designed for high-net-worth individuals

- Qualifies borrowers based on their liquid assets rather than income

- It can be useful for retirees or those with significant assets but lower regular income

- Often involves calculating a theoretical income from the assets

Investor Cash Flow Loans:

- Tailored for real estate investors

- Uses the potential rental income of the property for qualification

- Also known as DSCR (Debt Service Coverage Ratio) loans

- Focuses on the property’s ability to generate income rather than the borrower’s income

Interest-Only Loans:

- Offers lower initial payments by allowing borrowers to pay only interest for a set period

- After the interest-only period, payments increase to include principal

- It can be beneficial for borrowers expecting increased future income or for investment properties

Recent Credit Event Loans:

- Provides options for borrowers with recent negative credit events like bankruptcies or foreclosures

- Often has shorter waiting periods than conventional loans

- It may require larger down payments or higher interest rates to offset the increased risk

These Non-QM options from Gustan Cho Associates offer flexibility for borrowers who don’t fit conventional loan criteria. However, it’s important to note that non-QM loans typically come with higher interest rates and fees than traditional mortgages, reflecting the increased risk for lenders.

Potential borrowers should carefully consider their financial situation and long-term goals before choosing a non-QM product. It is advisable to discuss these options in detail with a mortgage professional who can provide guidance based on individual circumstances.

For the most up-to-date and detailed information about these programs, including specific terms, requirements, and current availability, interested parties should contact Gustan Cho Associates directly or visit a website that is a wholly-owned subsidiary of GCA Mortgage GROUP.

https://www.mortgagelendersforbadcredit.com/non-qm-loans/

-

This reply was modified 10 months, 3 weeks ago by

Michelle.

Michelle.

mortgagelendersforbadcredit.com

NON-QM Loans - mortgage Lenders For Bad Credit

This Article Is About Everything You Need To Know About Non-QM Mortgages

-

Gustan Cho Associates offers a variety of Non-QM (Non-Qualified Mortgage) loan programs designed to meet the needs of borrowers who do not fit traditional lending criteria. These include:

Bank Statement Loans: Using bank statements to verify income for self-employed borrowers.

Asset-Based Loans: For high net worth individuals qualifying based on assets.

Investor Cash Flow Loans: These are for real estate investors using rental income to qualify.

Interest-Only Loans: Featuring initial interest-only payments.

Recent Credit Event Loans: For borrowers with recent bankruptcies or foreclosures.

Gustan Cho Associates can approve and close mortgage loans that other lenders cannot due to their no-overlay policy on government and conventional loans. This means they adhere strictly to agency guidelines without adding additional requirements, making them more flexible. They also offer a wide range of Non-QM (Non-Qualified Mortgage) loan programs, catering to borrowers with unique financial situations, such as self-employed individuals, real estate investors, and recent credit events like bankruptcies or foreclosures. For more detailed information, you can visit Gustan Cho Associates.

gustancho.com

GCA Mortgage | Mortgage Experts With No Overlays

Whether you’ve gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans

-

Moving to Washington, D.C.: A Comprehensive Guide

Moving to Washington, D.C., offers a unique experience filled with historical significance, vibrant culture, and diverse neighborhoods. Here’s a detailed guide to help you navigate your move to the U.S. capital:

Why Move to Washington, D.C.?

Historical Significance:

- It is home to numerous historical landmarks, monuments, and museums, such as the Lincoln Memorial, the Washington Monument, and the Smithsonian Institution.

Cultural Diversity:

- It is a melting pot of cultures with a rich blend of international communities, cuisines, and cultural events.

Career Opportunities:

- A hub for government, politics, international relations, and various other industries, offering numerous job opportunities.

Education:

- Excellent educational institutions, including Georgetown University, George Washington University, and American University.

Public Transportation:

- An extensive public transportation system (Metro) that makes commuting convenient.

Steps to Moving to Washington, D.C.:

Research and Plan: Understand the cost of living, which can be high compared to other cities—factor in housing, utilities, transportation, and other living expenses.

Choose a Neighborhood:

Capitol Hill: This historic area has charming row houses close to the U.S. Capitol.

Georgetown: Upscale neighborhood with historic homes, shopping, and dining.

Dupont Circle: Vibrant area with a mix of residents, nightlife, and cultural institutions.

Adams Morgan: Known for its nightlife, eclectic dining, and diverse community.

Navy Yard: Modern, up-and-coming area with new developments and waterfront views.

Secure Housing: Decide whether to rent or buy a home. Explore listings on online real estate platforms and consider working with a local real estate agent for guidance.

Renting: Look for apartments, condos, or row houses that fit your budget and needs.

Buying: If you want to buy, get pre-approved for a mortgage and work with a real estate agent to find the right property.

Employment:

- If you’re moving for work, ensure your job is secured.

- If you’re job hunting, research companies and organizations in your field.

- Networking is crucial in D.C., so consider joining professional groups or attending industry events.

Utilities and Services:

- Set up utilities such as electricity, water, gas, and internet before you move in.

- Companies like Pepco provide electricity, and Washington Gas provides natural gas services.

- Update your address with the post office and notify banks, insurance providers, and other essential services.

Education and Schools:

- If you have children, research the local school districts and register them for school. D.C. has a mix of public, private, and charter schools.

- Explore higher education options if you or your family are pursuing further education.

Healthcare:

- Find local healthcare providers and register with a primary care physician.

- D.C. has top-notch healthcare facilities and hospitals, such as MedStar Washington Hospital Center and Georgetown University Hospital.

- Ensure you have health insurance coverage accepted by local providers.

Transportation:

Public Transportation: Utilize the Metro system for commuting. Check routes and schedules to plan your daily travel.

Driving: If you plan to drive, ensure your vehicle is registered and you have a valid D.C. driver’s license.

Bike-Friendly: D.C. is bike-friendly, with numerous bike lanes and Capital Bikeshare programs available.

Community Engagement:

- Join local clubs and organizations or volunteer in your new community.

- This is a great way to meet people and integrate into the community.

- Attend local events and festivals to experience the culture and spirit of Washington, D.C.

Tips for a Smooth Transition:

Visit Before Moving: Visit D.C. before your move to get a feel for the area and explore different neighborhoods.

Budget for Moving Costs: Moving can be expensive, so budget for hiring movers, transportation, and initial setup expenses.

Stay Organized:

- Keep a checklist of tasks to ensure everything is noticed during the moving process.

- Staying organized can reduce stress and help everything go smoothly.

Connect with Locals in Washington, DC:

- Use social media and online forums to connect with locals who can offer advice and insights about living in Washington, D.C.

Moving to Washington, D.C., offers a rich blend of history, culture, and professional opportunities. By planning carefully and considering all aspects of the move, you can make a smooth transition to your new home. Whether you’re drawn by career opportunities, educational institutions, or the vibrant community, Washington, D.C., has something to offer everyone.

-

Top 12 Places to Visit in Oregon

Oregon is a state known for its diverse landscapes, vibrant cities, and outdoor adventures. Here are the top 12 places to visit in Oregon:

Crater Lake National Park:

- Description: Home to the deepest lake in the United States, Crater Lake is known for its stunning blue water and surrounding cliffs.

- Activities: Hiking, boat tours, scenic drives, and snowshoeing in winter.

Columbia River Gorge:

- Description: A spectacular canyon along the Columbia River offers breathtaking views and numerous waterfalls.

- Activities: Hiking, windsurfing, scenic drives, and visiting waterfalls like Multnomah Falls.

Portland:

- Description: Oregon’s largest city is known for its vibrant arts scene, food culture, and beautiful parks.

- Activities: Exploring the Pearl District, visiting Powell’s City of Books, strolling through Washington Park, and enjoying local breweries.

Cannon Beach:

- Description: A picturesque coastal town famous for its iconic Haystack Rock and expansive sandy beaches.

- Activities: Beachcombing, tide pooling, shopping, dining, and exploring nearby Ecola State Park.

Mount Hood:

- Description: Oregon’s highest peak and a popular destination for outdoor recreation.

- Activities: Skiing, snowboarding, hiking, camping, and visiting Timberline Lodge.

Bend:

- Description: A city in Central Oregon known for its outdoor activities and craft beer scene.

- Activities: Hiking, mountain biking, skiing at Mount Bachelor, floating the Deschutes River, and brewery tours.

Oregon Coast:

- Description: A scenic stretch of coastline with charming towns, rugged cliffs, and sandy beaches.

- Activities: Exploring tide pools, whale watching, visiting lighthouses, and enjoying coastal drives.

Willamette Valley:

- Description: Oregon’s wine country is renowned for its Pinot Noir and picturesque vineyards.

- Activities: Wine tasting, touring vineyards, and enjoying farm-to-table dining experiences.

Smith Rock State Park:

- Description: A rock climber’s paradise with dramatic cliffs and spires.

- Activities: Rock climbing, hiking, bird watching, and photography.

Astoria:

- Description: A historic town at the mouth of the Columbia River with a rich maritime history.

- Activities: Visiting the Astoria Column, exploring the Maritime Museum, and walking along the Riverwalk.

Newport:

- Description: A coastal city known for its fishing industry, historic bayfront, and Oregon Coast Aquarium.

- Activities: Visit the aquarium, explore Yaquina Head Lighthouse, and enjoy fresh seafood.

Silver Falls State Park:

- Description: Known as the “crown jewel” of the Oregon State Parks system, it is famous for its ten waterfalls.

- Activities: Hiking the Trail of Ten Falls, camping, and picnicking.

Oregon offers a wealth of natural beauty and cultural experiences, making it a top destination for travelers. From the stunning Crater Lake National Park to the vibrant city of Portland, there is something for everyone to enjoy. Oregon has it all, whether you’re into outdoor adventures, wine tasting, or exploring charming towns.

-

In Tennessee, like in other states, compensation for mortgage brokers and lenders can be complex, and there are regulations governing both borrower-paid and lender-paid compensation. Here’s a breakdown of how these compensations typically work and any specific rules that may apply in Tennessee:

Borrower-Paid Compensation

Borrower-Paid Compensation (BPC): This is the fee paid directly by the borrower to the mortgage broker. It is often a fixed percentage of the loan amount and must be disclosed upfront.

Federal Regulations: According to the Dodd-Frank Act, mortgage broker compensation cannot vary based on loan terms other than the principal loan amount. This means the compensation must be based on a set percentage, not the interest rate or other loan features.

Tennessee-Specific Rules:

Cap on BPC: No explicit state law in Tennessee caps borrower-paid compensation at 2%. However, broker compensation is subject to federal regulations, which generally enforce a cap to ensure compensation structures do not create incentives for steering borrowers into less favorable loan terms.

Lender-Paid Compensation

Lender-Paid Compensation (LPC): This is paid by the lender to the broker and is included in the interest rate or fees charged to the borrower.

Common Practice: It is common for LPC to be capped at around 2.75% of the loan amount, but this can vary based on lender policies and market conditions.

Comparing BPC and LPC

Lender-Paid Compensation: Typically, lender-paid compensation can be higher (up to around 2.75%) because it is built into the interest rate, and the borrower indirectly pays for it over the life of the loan.

Borrower-Paid Compensation: This is often lower because it is a direct fee paid at closing, making it more transparent and immediate for the borrower.

Industry Practices

Common Percentages: In practice, many lenders and brokers may have a typical range for BPC and LPC. The exact percentages can depend on various factors, including market conditions, lender policies, and the specifics of the loan transaction.

Legal and Compliance Considerations

Truth in Lending Act (TILA): Under TILA and its implementing regulations (Regulation Z), both borrower-paid and lender-paid compensation must be disclosed to the borrower.

Anti-Steering Provisions: These provisions ensure that brokers cannot receive higher compensation for steering borrowers into higher-cost loans, thus protecting consumer interests. While Tennessee does not specifically cap borrower-paid compensation at 2%, federal regulations and market practices typically govern these compensations. Mortgage brokers and borrowers must understand these rules to ensure compliance and transparency. For the most accurate and detailed information, it is recommended that they consult with a mortgage compliance expert or legal advisor. You can check resources from the Consumer Financial Protection Bureau (CFPB) or the Tennessee Department of Financial Institutions for further reading and verification.

-

Another prankster joke.

https://www.facebook.com/share/r/m9t2gQJJonN2kTYy/?mibextid=D5vuiz

facebook.com

This man harvey🤦♂️ YT damii #damii #publicprank #public #fyp #viral | By Zippity ZapFacebook

This man harvey🤦♂️ YT damii #damii #publicprank #public #fyp #viral

-

Hate to say this about Kamala Harris but I think the country is better off with Joe Biden versus this dingbat Kamala Harris. Is she acting this dumb or is she brains 🧠 dead?

https://www.facebook.com/share/v/eKWg6sUD9LVqAB3P/?mibextid=21zICX

facebook.com

Kamala Harris has been branded "dangerously dumb" online after the US Vice President announced a national strategy to combat "Islamophobia".