Missy

DoctorMy Favorite Discussions

-

All Discussions

-

Jeremy Dewitte is a cop wannabe police impersonator

Jeremy Dewitte has gotten arrested for impersonating police officers since he was 17 years old. Since Jeremy Dewitte is not hireable as a POST certified law enforcement officer in any state of the nation, Jeremy Dewitte opened a funeral escort service company in the state of Florida. In his fleet of vehicles for funeral escort services, Jeremy Dewitte has vehicles that resemble law enforcement vehicles such as dressing up Ford Crown Vics, Ford Explorer SUVs and motorcycle with police look alike stripes,badges, and emergency flashing lights and sirens. Check out this video

https://www.facebook.com/share/v/PVYpy8obKqn6cb19/?mibextid=21zICX

-

This discussion was modified 1 year ago by

Gustan Cho. Reason: Spelling error

Gustan Cho. Reason: Spelling error

-

This discussion was modified 11 months, 3 weeks ago by

Sapna Sharma.

Sapna Sharma.

facebook.com

Serial Police Impersonator Arrested by Real Police (Part One) #criminals #cops #police #chasing

-

This discussion was modified 1 year ago by

-

Here is a link about an economist aggressively forecasting mortgage rates will drop under 4% in 2024. Could 2024 be a bull market for loan officers? Out of 150,000 loan officers, close to 100,000 either left the mortgage industry completely, retired early, or let their NMLS licenses expire and are in a different industry or thinking about going into a different industry. Hundreds if not thousands of mortgage companies, whether they are mortgage bankers, correspondent lenders, or mortgage brokers went out of business in 2023

-

Primary owner-occupant homes, also known simply as owner-occupied homes or primary residences, refer to residential properties that are primarily occupied by the owner of the property as their primary place of residence. These are homes where the owner lives and resides, as opposed to properties that are primarily used for rental or investment purposes.

Key characteristics of primary owner-occupant homes include:

-

Residence of the Owner: The owner of the property lives in the home as their primary place of residence. It’s where they reside on a day-to-day basis.

-

Personal Use: The property is used for personal and family purposes rather than being rented out to generate rental income.

-

Potential Tax Benefits: In many countries, primary owner-occupant homes may qualify for certain tax benefits or exemptions, such as property tax reductions or capital gains tax exclusions when selling the property.

-

Mortgage Considerations: When financing the purchase of a primary residence with a mortgage, there may be different lending terms, interest rates, and down payment requirements compared to investment properties.

-

Homeowner’s Insurance: Homeowner’s insurance policies are typically used to protect primary owner-occupant homes and their contents.

-

Homestead Exemption: Some jurisdictions offer homestead exemptions, which can provide property tax relief or protection from creditors for primary residences.

It’s important to distinguish primary owner-occupant homes from investment properties, vacation homes, or rental properties. These other types of properties are typically acquired with the primary goal of generating rental income or capital appreciation, whereas primary owner-occupant homes are meant for the owner’s personal use and enjoyment.

-

-

A vivid overview of the country, its businesses, and its economy, as a whole, over the period from December 23 to 28 has been presented below:

American News

Government Shutdown Avert:

- The risk of the US government shutting down was averted on the 21st day of the 12th month of the year 2024.

- This was possible because the representatives had signed a spending amendment bill that Biden later enacted.

- As I have stated above, the US was on the brink of a government shutdown as there was a lot of discord over the signing of the bipartisan bill and the subsequent amendments.

- The bill was not signed, while the spending amendment was enacted to prevent the US from shutting down.

Biden’s Death Sentence Commutes

On December 23, 2024, President Joe Biden commuted the death sentences of 37 federal inmates. The main goal behind this act was to reflect the current president’s stance on capital punishment in the US and widen the scope of justice in the legal system.

American Airlines Flight Delays

On September 24, 2024, Amer American faced a technical issue that delayed over 900 flights. The issues were resolved later that day, but the travel season was massively disrupted due to the holiday season, as flights were grounded nationwide.

Business News

Retail Store Closures:

- 2024 proved to be the year when America officially disintegrated into a retail apocalypse, as it saw the closure of hundreds, if not thousands, of retail stores and chains.

- Estimates suggest that in November, about 7,100 stores in the US closed, a considerable 69% jump from the previous year.

- Some notable closed stores included Family Dollar, CVS Health, Big Lots, and Walgreens, which closed 677, 586, 580, and 259 stores, respectively.

- Big Lots closed all 963 remaining stores because the deal between them and Nexus Capital Management LP did not go through.

- Furthermore, CVS and Walgreens have also shut down multiple stores and are planning to expand the closures.

- The stock market’s performance was unsatisfactory for the S&P 500, which lost 1.1% on Friday, resulting in a loss of yet another 1% for the month.

- The index rose 25% throughout the year, with a 5.7% increase in November.

- The tech sector performed extremely well, especially the Magnificent Seven, which includes Apple, Tesla, Alphabet, Amazon, and Nvidia.

- Apple’s valuation reached close to $4 trillion.

- Strong software and AI performers, including Palantir Technologies and AppLovin, brought growth stocks to the forefront of 2024.

- Sezzle topped the performer’s list after its stocks rose beyond 1000% because of its rising revenue.

Broader stock market leadership, compared to 2023, was observed, with several industry groups performing well.

Economic News

Consumer Confidence Data:

- Compared to November, the American consumer confidence level has decreased with a ratio of 81.1, where 80 would be recession indicative.

- This depicts a recessionary trend due to the steep decline in short-term expectations of over a dozen points in income, business, and the upcoming job market.

- The Conference Board’s consumer confidence index dropped to 104.7 from 112.8 beating analysts expectations for 113.8.

- However, despite consumer confidence declining over the three months, retail store sales increased by 0.7%, indicating that consumers could still be positive for the economy.

US Productivity Improvement

The United States seemsseemsis following on the edge of potential productivity improvement, similar to the internet boom in the mid-1990s. Worker productivity lately has started showing positive growth trends and has recorded over 2% growth. Further, investments in labor-saving technologies and post-COVID better job-role matches also contribute to the growth. Economists have predicted further advances in these developments, especially in AI, improving productivity growth in the 1990s era from 2.5% to 3%. This increase in productivity is essential for the country in managing its debt and economic well-being.

US Economic Policy Forecast

If the US Republican party wins the 2024 elections, as they appear to do, the economic outlook will change noticeably.

Donald Trump, the president-elect, has plans to grow the American economy through policies such as lowering taxes, tightening immigration laws, raising tariffs, and loosening regulations. Thanks to the Republican majority in Congress and in the Senate, there will be very few problems implementing these policies. It is a crucial juncture to predict since the facets of the policies after the election can vary. However, the economy will be impacted greatly by the elections.

-

Lennar Homes are slashing their new home prices by 25% in 2024. CEO of Lennar admits their mortgage division is experiencing delinquencies and a higher number of debt to income ratio from consumers. Lennar Homes is America’s second largest New Home Builder.

-

What are the latest Google algorithm changes and how will it affect website organic traffic?

-

To clarify our previous discussion. Late PAYMENTS within the last 6 or 12 months isn’t a blanket guide in which we grant without valid reasoning behind the lates. In addition to other things that may paint a proper picture away from financial management, usually via the credit report.

example.

If the applicant clearly has been making effort to keep a clean nose for the prior year(s) leading up to the lates. But fell off the wagon in recent times with one or two lates (simultaneous or sequential). A proper LOX or even owning the mistake as they do happen, has a good chance of being sympathetic to this situation due to historical evidence that’s contrary to financial mismanagement.

If said applicant has a history of multiple lates leading up to recent lates that just so happen to lapse into 12-month guidelines. Highly likely, 12 months of clean credit history is going to be required. Financial mismanagement is established with past history which connects dots far too easily.

At any rate, we will certainly do all that’s possible and within reason to have a deal succeed. Otherwise, we have no business doing 500 fico manuals

@Gustan Cho NMLS 873293

-

Look at this video clip of an Angel

-

Veterans and Credit Inquiries: Navigating the Double-Edged Sword

Welcome to Day 18 of our comprehensive series designed to guide our esteemed veterans through the intricacies of civilian credit. Today, we steer our ship into the waters of credit inquiries – a topic often shrouded in misconceptions but paramount in shaping your credit landscape.

Unraveling Credit Inquiries: Hard vs. Soft

Credit inquiries, at their core, are requests made by lenders to assess your credit report. They come in two flavors:

-

Hard Inquiries: These occur when a lender checks your credit for lending purposes, like a credit card application or a mortgage. These can slightly reduce your credit score for a short duration.

-

Soft Inquiries: When you check your own credit score or when companies do so for promotional purposes, it’s a soft inquiry. These don’t impact your score.

Why Veterans Should Care about Credit Inquiries

Active-duty military personnel may not encounter frequent credit inquiries, but in civilian life, these become more common. From renting an apartment to buying a car, credit checks become part and parcel of many financial decisions.

How to Tactfully Handle Credit Inquiries

-

Space Out Hard Inquiries: If you’re shopping for credit, try to do so within a short timeframe. Multiple inquiries for mortgages, auto loans, or student loans within a 45-day window are typically treated as a single inquiry.

-

Review Your Credit Report: Regularly review your report for any unauthorized inquiries. If found, you can dispute them.

-

Understand Before You Authorize: Before allowing anyone to run a credit check, understand which type of inquiry it will be.

A Veteran’s Field Guide to Inquiries

-

VA Loans and Credit Checks: Securing a VA loan will usually involve a hard inquiry, but the benefits often outweigh the temporary dip in your score.

-

Frequent Relocations: Military life might involve frequent relocations, leading to multiple rental applications. Veterans should be aware that these might involve hard inquiries.

-

SCRA and Credit Inquiries: The Servicemembers Civil Relief Act (SCRA) provides certain protections, but it doesn’t prevent or alter the effects of hard inquiries. It’s pivotal to understand this distinction.

Potential Pitfalls and Their Counterstrategies

-

Inquiry Overload: Applying for multiple credit cards or loans in rapid succession can be detrimental. Strategy: Plan major credit activities and spread them out.

-

Unfamiliar Inquiries: Finding unfamiliar hard inquiries can be alarming. Strategy: Regularly review your report and dispute any unauthorized checks.

-

Misunderstanding Inquiry Types: Many veterans, and civilians alike, may not discern between soft and hard inquiries. Strategy: Educate yourself on the differences and always inquire about the type before authorizing.

Seeing Credit Inquiries in the Grand Scheme

While inquiries are a small portion of your credit score (about 10% of your FICO score), they’re integral to understanding the bigger picture. Every ding on your report from a hard inquiry can accumulate, especially if unplanned. However, their impact diminishes over time and they fall off your report after two years.

Concluding Day 18: Charting a Course Through Inquiry Waters

Credit inquiries, much like navigating through unknown terrains in military expeditions, require knowledge, strategy, and foresight. For our veterans transitioning into civilian financial realms, understanding the terrain of credit inquiries can be the difference between smooth sailing and choppy waters.

As we wrap up today’s exploration, our compass remains set on a singular mission: equipping our nation’s heroes with the tools, knowledge, and insights necessary to command their financial destiny.

Join us for Day 19, as we continue this enlightening journey, ensuring every veteran is prepared for the challenges and opportunities in the world of credit.

-

-

It was a pleasure speaking with Kelce Rock, a residential, business, and commercial loan officer with his own team and extensive experience in commercial and business loan originator. Mr. Kelce Rock truly goes above and beyond for his clients and I have absolutely no doubt Kelce will make a phenomenal state senator and future member of U.S. Congress where he will make a difference. We need politicians who serve American Families and not dumbocrats like Imbecile Biden and Sex and Crack Addict Hunter Biden who enrich themselves and are known pedophiles. Dumbass Hunter Crackhead Biden has absolutely no morals and even goes and marries his dead brother’s wife. What a pig.

-

Is it possible to utilize a conventional loan for Airbnb properties? Any insights or experiences are appreciated. Thanks!

-

How do you go about getting a lost replacement title for an RV that is under a family members name? Can I get it from DMV or does my family member need to go in person. Trying to transfer RV from my family member to me and the lender needs the title since I am taking out on it.

-

How is the National Realtor Association ruling affect real estate agents making money especially buying agents. Thank you in advance.

-

-

What is the reason Great Content Authority (GCA) FORUMS is experiencing explosive growth is blowing away all other online message boards including Quora and Reddit. What makes everyone on the internet want to go visit and become a member of GCA FORUMS. I HAVE fact-checked verified information about Great Content Authority (GCA) FORUMS experiencing explosive growth or outperforming other online platforms like Quora and Reddit. However, I don’t have access to real-time data or insider information about emerging platforms. With concrete data and reliable sources, I can confirm and explain the growth describing Great Content Authority FORUMS and SUBFORUMS. Online platform success of Great Content Authority FORUMS (GCA FORUMS) can be due to many factors, including:

- Unique features or user experience

- Effective marketing strategies

- Timing and market conditions

- High-quality content or discussions

- Strong community engagement

- Niche focus or specialized content

- Viral growth through word-of-mouth

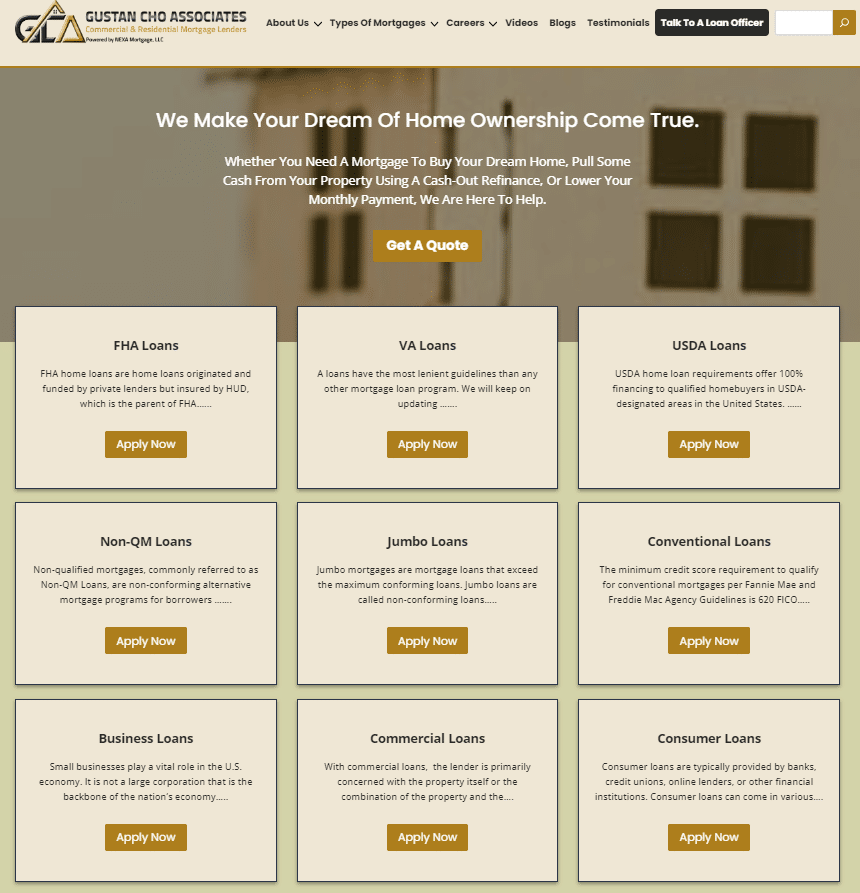

However, these are general factors and may not apply specifically to GCA FORUMS. There is solid reasons why GCA FORUMS is indeed experiencing rapid growth. That is because GCA FORUMS is powered by Gustan Cho Associates, a dba of NEXA Mortgage and the largest mortgage company in the United States. We have facted-checked and verified official statements from the platform, industry reports, or reliable tech news sources for accurate information about their performance and reasons for success. The key is GCA FORUMS, Great Content Authority FORUMS powered by Gustan Cho Associates, it gives GCA FORUMS creditbility and authority because Gustan Cho Associates is a licensed mortgage company with a national operations and is licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands (MA and NY is pending). Gustan Cho Associates has other national online mortgage and real estate platforms and portals that are wholly owned subsidiaries of Gustan Cho Associates. We have more specific information about GCA FORUMS’ growth or comparative performance. If you have access to specific data or sources about their growth, I’d be happy to discuss those details. Please visit https://www.gustancho.com/

gustancho.com

GCA Mortgage | Mortgage Experts With No Overlays

Whether you’ve gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans

-

There are instances when mortgage underwriters will require reserves from borrowers. What does reserves mean? Can equity in the home or 401k be used for reserves? How about if you have a paid off vehicle or precious metals? Or what if you have hard core cash. Can those be used for reserves?

-

If you ever question Nancy Pelosi or the Democrat Elites, you get automatically blacklisted. Democrat politicians cannot think on their own and need party approval. Otherwise you get blacklisted from the Democrat party. This is what happened to Hawaii Democrat Congresswoman Tulsi Gabbard. Democrat party is evil 😈 and demons. Here is proof Democrat party is evil. Tulsi Gabbard and many good Democrats are leaving the Democrat party in droves.

-

What is the party of Democrat Socialist. What do Democrat Socialist stand for and believe in?

-

Dementia Joe Biden doesn’t need Cognitive Test. Joe Biden’s voters do.

-

What is our current state of our economy. Here’s what the two sides of our state of economy:

Democrats:

What inflation? What unemployment? What do you mean recession? Economy is great. Look at the Dow Jones Industrial Average which is at all time high. Rates are great. Home prices are up and that’s a good sign.

Republicans: Skyrocketing inflation, surging home prices, all time high rates, economy is bad and getting worse. FEDS are printing money and our economy is going down the shitter

-

When Cops crossed the line and violate a citizens civil and constructional rights, they will lose their jobs and get arrested, charged and sued. They are not above the law.

-

-

It’s bad enough getting pulled over for a traffic infraction by a police officer but how would you feel getting pulled over by police impersonators. What luck huh!!!

https://www.facebook.com/share/v/JG76Nt5SHkcU4Wxj/?mibextid=21zICX&startTimeMs=39951

facebook.com

If you're ever pulled over by this man, drive off... 😨

-

Arrogant incompetent Pennsylvania Congressman should be disbarred and tried for Treason, Obstruction of Justice, and just being Butterfield ass ugly.

-

Home prices in Florida are 35% over valued which is making real estate investors in a frantic panic on an investment property sell off. Real estate inventory levels are exploding. Prior to the coronavirus pandemic, home prices in Florida was undervalued. Now, it is the pandemic correction market and are overvalued significantly. There are reports that real estate investors in Florida are growing increasingly concerned about the rising inventory levels and cooling housing market conditions in the state. Here are some key points about the situation:

- Inventory surge: After years of extremely tight housing inventory, the number of homes listed for sale in Florida has surged significantly in recent months. This is being driven by sellers looking to cash out amid high prices and buyers pulling back due to elevated mortgage rates.

- Investor pullback: Many real estate investors, including those who bought properties to flip or use as short-term rentals, are reconsidering their strategies. The fear is that they may not be able to sell or rent out properties as easily or at the prices they had anticipated.

- Price cuts: To attract buyers in the shifting market, some investors are already slashing asking prices on their listings, leading to concerns about potential losses on their investments.

- Increased holding costs: With higher mortgage rates and economic uncertainty, the carrying costs of holding onto investment properties have risen, putting pressure on investors’ cash flows.

- Airbnb impact: The short-term rental market in tourist hotspots like Florida has also cooled, making it harder for investors to rely on platforms like Airbnb for steady income streams.

- Oversupply fears: There are worries that if too many investor-owned properties flood the market simultaneously, it could lead to an oversupply situation and further drive down prices in some areas.

While it’s still early to determine the full extent of the impact, the rapid changes in Florida’s housing landscape have caught many real estate investors off guard. Some may be forced to recalibrate their investment strategies or exit the market entirely to cut their losses.

-

Bidenomics is destroying our economy and inflation is going through the roof, prices at the grocery store is becoming unaffordable, interest rates are soaring with no signs of green light at the end of the tunnel. What is a family with children and pets supposed to do. Many people are putting their beloved dogs and cats up for adoption because they can no longer afford food and veterinary care for them. The only solution that may help but not solve the economic problems we are facing is planting your own garden. $100,000 salary is no longer high income. You cannot survive with $100,000 salary if you have a family. Most people no longer can afford a house due to home prices soaring out of control and mortgage rates in the 7 percent range with the Democrats and Globalists saying we had a soft landing and Joe Biden Bidenomics was the magic pill that stopped a recession and economic nightmare. Bidenomics is a crock of shit and enough is enough with false economic fake news and propaganda the liberal lunatics are trying to brainwash the American people. Many people are hesitant to plan a Garden because of the Chem trails. Biden, Pelosi, Obama, Clinton, Bill Gates, The Rothschild Family, George Soros, Chuck Schumer, and countess Democrats and Globalists are trying to destroy America, depopulate the world, and restrict the food and Housing Supply. Look at the false manipulated stock market. Look at how they are printing money that is not backed by any source of assets. Anyways, here is an informative guide on starting your own garden Bed.

https://suite101.com/raised-garden-bed-plans/

suite101.com

30 Free DIY Raised Garden Bed Plans (PDF Instructions)

Find 30 free diy raised garden bed plans (pdf instructions) that contain step-by-step instructions on how to build a raised garden bed.

-

Many heard about the Rothschild Family how they control the World 🌎 and the controversial things they do from financing wars to cannibalism to pedophilia, to the imnense power they have. The Rothschild Family is the World’s most powerful Family and many people heard stories about how they finance wars and with finance both parties to the war, as well as many other controversial things about them. Here is a link to a short informative video about the world’s best most powerful Family.

-

We are going to launch John Parker’s websites and show the progress in this section. John, think about the layout, template, functionality of the following websites: