Rugger

PoliceForum Discussions Started

-

All Discussions

-

Are there many corrupt police officers where they will draft up false criminal charges against citizens? What happens if you were not speeding but get caught for speeding and you know for a fact you were not speeding. What happens if you get arrested for reckless driving for going over 30 miles over the limit and you know for a fact you were not going more than 10 miles over the speed limit. Does the police officer have to show you proof that he caught you going 30 miles over the limit? A reckless driving conviction can mean automatic cancellation of your drivers license and your insurance company can drop you. Are there many corrupt police officers? What can we do if you fall victim to a corrupt police officer? How do police departments hire honest police officers who are honest and protect and serve. I have been watching many YouTube videos about First Amendment Auditors and police corruption. Can you sue corrupt police officers? I have also seen many news reports of police officers planting evidence and lying just for the sake of arresting someone they do not like. What can we do about cleaning up society of corrupt cops?

-

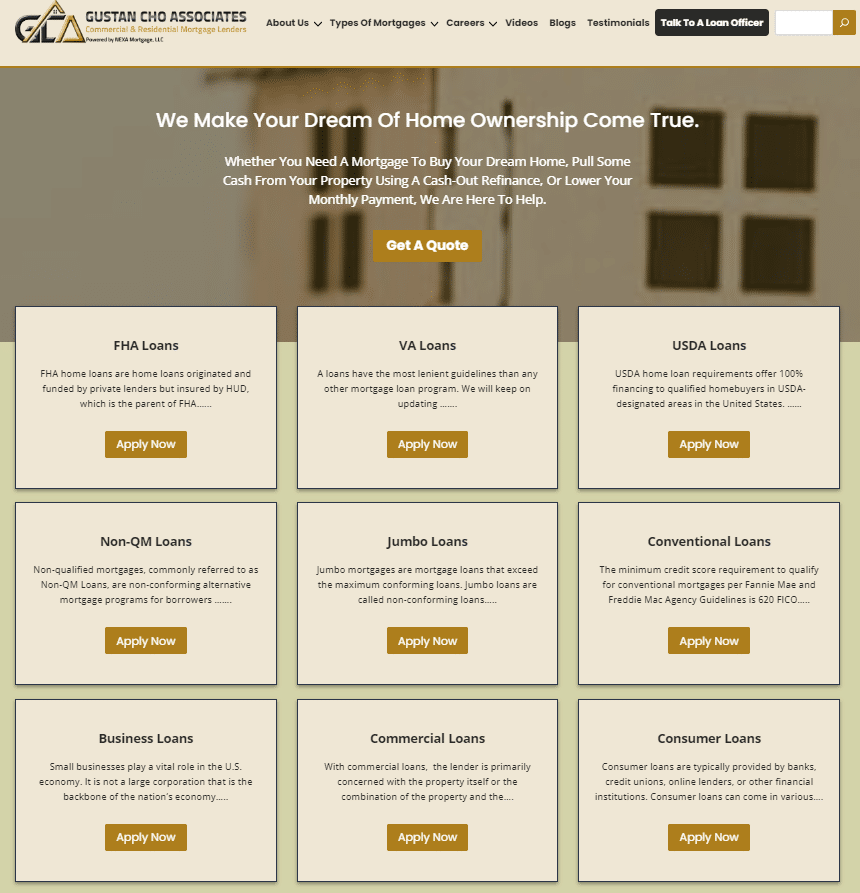

The Great Community Authority Forums, specifically known as the GCA Forums, is powered by Gustan Cho Associates. This forum serves as a platform for discussions on a wide range of topics, primarily focused on mortgage and real estate but also includes general community assistance and various other subjects like insurance, automotive, and more. Members can engage in topics ranging from FHA and conventional loan guidelines to mortgage rates, and there’s also a section for classified ads related to real estate and mortgage services.

The forum features various utilities such as mortgage calculators, FHA loan limits, and information on conventional loan limits. Members can also inquire about real estate and mortgage careers through designated sections for realtors and mortgage loan officers. Moreover, the forum provides links to subsidiary sites offering specialized services in real estate and mortgage brokering.

For those interested in diving deeper into specific topics like the differences between different mortgage companies such as AXEN and NEXA Mortgage, the forum hosts detailed discussions where experts like Michael Neill contribute insights on the intricacies of mortgage lending practices (GCA Forums) (GCA Forums) (GCA Forums).

If you’re looking to explore this forum or require more detailed information, you can access it here.

-

18 SUVs That Are IMMORTAL! (Still Perfect After 500,000 Miles)

In a world where most vehicles start showing their age around 100,000 miles, a select group of SUVs defy the laws of mechanical aging. These automotive legends don’t just survive high mileage – they improve with age, running smoother and more reliably at 300,000 miles than many vehicles do at 30,000 miles.

What makes these SUVs truly immortal isn’t just their ability to accumulate massive mileage, but how they maintain near-perfect condition throughout their extended lifespans. While other vehicles develop rattles, leaks, and performance issues as they age, these mechanical marvels continue operating with the precision and reliability of brand-new vehicles, often surprising even experienced mechanics with their pristine condition.

The secret lies in engineering philosophies that prioritize longevity over short-term profits. These SUVs were built when manufacturers competed on durability rather than just features, resulting in vehicles with robust components that seem almost over-engineered by today’s standards. Every system was designed to handle abuse beyond normal operating conditions, creating vehicles that treat 300,000 miles as merely the break-in period.

What’s particularly remarkable is how these immortal SUVs maintain value and desirability even at extreme mileage. While most vehicles become worthless after 200,000 miles, these legends often command premium prices specifically because buyers understand they’re purchasing proven reliability. A 300,000-mile example of these SUVs is often more desirable than a 50,000-mile example of lesser vehicles.

The financial implications are extraordinary. Instead of cycling through multiple vehicles over a lifetime, owners of these immortal SUVs often drive the same vehicle for decades, watching their transportation costs plummet to almost nothing while their neighbors continue making car payments on vehicles that won’t last half as long.

These aren’t just SUVs – they’re mechanical time machines that transport you back to an era when things were built to last forever.

immortal SUVs

SUVs 300000 miles

indestructible SUVs

SUVs that last forever

bulletproof SUVs

SUVs never break.

https://youtu.be/ujfCgOFnDgU?si=SQGPCSakBpb97gv1 -

This video reveals the 20 Worst Used SUVs That People Regret Buying. From reliability nightmares to expensive repairs, these SUVs have disappointed and frustrated owners. If you’re shopping for a used SUV, watch this video first to avoid making a costly mistake.

From models plagued by engine issues to those with excessive maintenance costs, we dive deep into the SUVs that don’t live up to the hype. Whether it’s based on owner reviews, repair statistics, or industry reports, these are the SUVs you might want to cross off your list.

Avoid regrets and get the facts before your next SUV purchase—hit that play button now! -

Washington State is facing a transformation few are talking about. Behind the headlines of booming tech and breathtaking landscapes lies a new reality: tax hikes, skyrocketing costs, and a quiet exodus reshaping communities. Families, entrepreneurs, and even long-time residents choose to stay and struggle or leave for more affordable states.

In this video, we’ll break down exactly what’s happening in Washington right now: erty taxes faster than incomes, new policies driving businesses away, and the unseen ripple effect on housing, jobs, and the middle class—you’ll get the full picture that mainstream media isn’t showing you.

Are these tax hikes really solving the problem, or making it worse? Why are so many people leaving, and where are they going? And most importantly—what does this mean for YOU if you live, work, or invest in Washington State?

Stay until the end, where we reveal the surprising data about migration trends and the untold story of how this “silent crisis” is reshaping the future of the Pacific Northwest. Washington’s future is changing. The question is—are you ready for it? -

There’s been a lot of talk about shutting down the Federal Reserve Board from President Donald Trump even before President Trump’s 2024 presidential election on November 4th, 2024. The potential shutdown of the Federal Reserve Board talks is not decreasing but, on the contrary. There are more and more talking points about the potential fraud and political favors the Federal Reserve Board commits as well as the trillions of dollars the Fed prints. The Federal Reserve Board is known and has a reputation decades old that it works to benefit the big banks, Democrats, Black Rock, George Soros, high-powered politicians, and the liberal radical media. The Federal Reserve Board sets the monetary policy and has tons of power they do not deserve. Federal Reserve Board Chairman Jerome Powell thinks he is untouchable and President Donald Trump cannot fire him, nor can the President influence him or threaten him on how he should lead the Federal Reserve Board. President Donald Trump did express his advice to Jerome Powell that interest rates should be cut to firestart the economy despite soaring inflation and the depressing runaway U.S. economy. Jerome Powell ignored the comments from President Donald Trump and did not change interest rates. The U.S. dollar lost value and respect from countries around the globe 🌎 due to the Federal Reserve Board printing money and giving it to their friends. Can anyone please tell us viewers of GCA FORUMS NEWS about how serious it is abolishing the Federal Reserve Board and having the United States 🇺🇸 dollar backed by gold and silver? I am getting more confidence and respect for Elon Musk and the newly created Department of Government Efficiency (DOGE) in DOGE revealing and cracking down on the out-of-control CORRUPTION and FRAUD among federal government agencies and the hundreds of billions of dollars of taxpayer money being wasted, stolen, laundered, and not accounted for until now, where it is getting discovered from President Donald Trump’s aggressive crackdown on public corruption and fraud.

https://www.youtube.com/watch?v=mUgzGTV9QVU

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year ago by

-

Most people who were renters and are becoming first time homebuyers dream of buying their very first dog. One of the questions most homebuyers have is what is the smartest dog breed. What is the smartest dog breed and dog breed that are easiest to train for first-time homebuyers.

-

Primary owner-occupant homes, also known simply as owner-occupied homes or primary residences, refer to residential properties that are primarily occupied by the owner of the property as their primary place of residence. These are homes where the owner lives and resides, as opposed to properties that are primarily used for rental or investment purposes.

Key characteristics of primary owner-occupant homes include:

-

Residence of the Owner: The owner of the property lives in the home as their primary place of residence. It’s where they reside on a day-to-day basis.

-

Personal Use: The property is used for personal and family purposes rather than being rented out to generate rental income.

-

Potential Tax Benefits: In many countries, primary owner-occupant homes may qualify for certain tax benefits or exemptions, such as property tax reductions or capital gains tax exclusions when selling the property.

-

Mortgage Considerations: When financing the purchase of a primary residence with a mortgage, there may be different lending terms, interest rates, and down payment requirements compared to investment properties.

-

Homeowner’s Insurance: Homeowner’s insurance policies are typically used to protect primary owner-occupant homes and their contents.

-

Homestead Exemption: Some jurisdictions offer homestead exemptions, which can provide property tax relief or protection from creditors for primary residences.

It’s important to distinguish primary owner-occupant homes from investment properties, vacation homes, or rental properties. These other types of properties are typically acquired with the primary goal of generating rental income or capital appreciation, whereas primary owner-occupant homes are meant for the owner’s personal use and enjoyment.

-

-

-

Nebraska is a state located in the Midwestern region of the United States. Here are some key facts and information about Nebraska:

-

Capital and Largest City: The capital of Nebraska is Lincoln, while its largest city is Omaha.

-

Geography: Nebraska is known for its flat and largely treeless landscape, particularly in the eastern part of the state, which is part of the Great Plains. The western part of Nebraska is more rugged and includes the Sandhills region, as well as the beginning of the Rocky Mountains.

-

State Motto: The state motto of Nebraska is “Equality before the law.”

-

Nickname: Nebraska is often referred to as the “Cornhusker State.” This nickname is derived from the nickname “Cornhuskers,” which was given to the University of Nebraska athletic teams.

-

History: Nebraska became the 37th state of the United States on March 1, 1867. It played a significant role in the westward expansion of the United States during the 19th century, as the Transcontinental Railroad passed through the state.

-

Economy: Agriculture has historically been a major part of Nebraska’s economy. The state is known for its production of corn, soybeans, beef, and other agricultural products. In recent years, Nebraska has also developed a growing technology sector, particularly in and around Omaha.

-

Education: Nebraska is home to several institutions of higher education, including the University of Nebraska system, Creighton University, and Nebraska Wesleyan University.

-

Natural Attractions: Nebraska has several natural attractions, including Chimney Rock, a famous landmark on the Oregon Trail, and the Sandhills, which are a unique region of sand dunes and grasslands. The state also has several state parks and recreational areas for outdoor enthusiasts.

-

Historic Sites: Nebraska has numerous historic sites and museums, including the Homestead National Monument of America, which commemorates the Homestead Act of 1862, and the Strategic Air Command & Aerospace Museum, which showcases the history of military aviation.

-

Sports: Sports are popular in Nebraska, and the state is known for its passionate fan base, especially in college football. The University of Nebraska’s football team, the Cornhuskers, has a strong following. The state also has minor league baseball teams and other sports activities.

These are just some of the key aspects of Nebraska, a state with a rich history and diverse landscapes.

-

This discussion was modified 4 weeks ago by

Sapna Sharma.

Sapna Sharma.

gcamortgage.com

Explore Nebraska mortgage loans such as FHA, VA, USDA, Conventional, Non-QM, Jumbo loans and about DPA programs at lower rates.

-

-

Second homes, often referred to as vacation homes or secondary residences, are residential properties that individuals or families own in addition to their primary residence. These homes are typically located in different geographic areas, such as vacation destinations or scenic rural areas, and they serve various purposes depending on the owner’s preferences and needs. Here are some key characteristics and reasons why people own second homes:

-

Vacation Getaways: Many people purchase second homes in attractive vacation spots or resort areas. These homes provide a convenient and comfortable place to spend holidays, weekends, or extended vacations away from their primary residence. This allows individuals and families to enjoy leisure activities, relaxation, and a change of scenery.

-

Investment Properties: Some individuals buy second homes as investment properties. They may rent out these homes when not in use to generate rental income and potentially benefit from property appreciation over time. Investment properties can be a source of passive income and a way to diversify one’s investment portfolio.

-

Retirement Planning: Some people acquire second homes with the intention of using them as retirement residences in the future. Owning a retirement home in a desirable location allows individuals to secure their ideal retirement lifestyle and potentially enjoy a lower cost of living.

-

Family and Friends: Second homes can serve as a place to accommodate family members, friends, or guests when they visit the area. This can be especially useful for those with large families or frequent visitors.

-

Lifestyle and Hobbies: People with specific interests or hobbies, such as golf, skiing, fishing, or boating, may buy second homes in areas that offer easy access to their preferred activities. These homes provide a convenient base for pursuing hobbies and recreational pursuits.

-

Tax Benefits: In some cases, owning a second home may offer tax advantages, such as deductions for mortgage interest and property taxes. However, tax benefits can vary depending on the location and usage of the second home, so it’s essential to consult with a tax professional for guidance.

Second homes can vary in size and style, ranging from small cottages to luxurious estates. The reasons for owning a second home vary from person to person, and they can provide a sense of escape, relaxation, and convenience for their owners. It’s essential to carefully consider the financial and logistical aspects of owning a second home, including maintenance costs, property management, and potential rental income, before making such an investment.

-

-

What happens if someone is advised to do a voluntary chapter 13 dismissal instead of obtaining courts approval for mortgage while in the underwriting process? Will that automatically disqualify them from getting the loan?

-

We all know that tens of thousands of people are moving out to California. What are the biggest reasons people are moving out of California?

-

Home mortgage loans for investment homes, also known as investment property loans or rental property loans, are loans specifically designed for individuals or investors looking to purchase residential properties with the intention of generating rental income or capital appreciation. These loans are different from traditional home mortgages, which are typically used to purchase a primary residence.

Here are some key points to consider when it comes to investment property loans:

-

Loan Types:

- Conventional Loans: These are traditional mortgage loans offered by banks, credit unions, and mortgage lenders. They typically require a down payment of at least 15% to 25% and have competitive interest rates.

- FHA Loans: The Federal Housing Administration (FHA) offers loans with lower down payment requirements (as low as 3.5%) but may have stricter qualification criteria.

- VA Loans: Veterans and active-duty military personnel may be eligible for VA loans, which often have favorable terms, including no down payment requirement for qualifying borrowers.

- Portfolio Loans: Some lenders offer portfolio loans that aren’t backed by government agencies. These loans may have more flexible eligibility criteria but can come with higher interest rates.

-

Down Payment:

- Investment property loans typically require a larger down payment compared to primary residence loans. The exact amount varies but is generally between 15% and 25% of the property’s purchase price.

-

Interest Rates:

- Interest rates for investment property loans may be slightly higher than those for primary residence loans. The rate you receive depends on factors such as your credit score, loan type, and lender.

-

Qualification:

- Lenders will consider your credit score, debt-to-income ratio, and the potential rental income from the property when evaluating your eligibility for an investment property loan.

-

Property Type:

- The type of property you intend to purchase can affect the loan terms. Single-family homes, multi-unit properties, and commercial properties may have different financing options and requirements.

-

Rental Income:

- Lenders often take into account the property’s potential rental income when determining loan eligibility and terms. They may require rental income documentation, such as leases and rental history.

-

Tax Implications:

- Owning an investment property may have tax implications, including deductions for mortgage interest, property taxes, and depreciation. Consult with a tax professional to understand the tax benefits and responsibilities associated with investment properties.

-

Property Management:

- Managing an investment property can be time-consuming. You may need to hire a property manager or handle property management tasks yourself.

Before pursuing an investment property loan, it’s essential to conduct thorough research, assess your financial situation, and develop a solid investment strategy. Additionally, working with a knowledgeable real estate agent and a reputable lender can help you navigate the complexities of purchasing and financing investment properties.

-

-

Investment property mortgage loans are financial products designed for individuals or entities looking to purchase real estate properties with the intention of generating rental income or capital appreciation. These loans are distinct from primary residence mortgages and come with different terms and requirements. Here are some key aspects to understand about investment property mortgage loans:

-

Types of Investment Property Loans:

- Conventional Loans: These are standard mortgage loans offered by banks and mortgage lenders. They typically require a higher down payment and have stricter qualification criteria compared to loans for primary residences.

- Government-Backed Loans: Some government programs, such as FHA (Federal Housing Administration) and VA (Department of Veterans Affairs), offer investment property loan options, but they often come with restrictions and may require the property owner to reside in one of the units.

-

Down Payment Requirements: Investment property loans typically require a larger down payment than primary residence loans. It’s common to see down payments in the range of 15% to 25% or more of the property’s purchase price. The exact requirement depends on the lender and loan program.

-

Interest Rates: Interest rates on investment property mortgage loans can be slightly higher than those for primary residences. Lenders often view investment properties as riskier, and this risk is reflected in the interest rate.

-

Loan Terms: Investment property loans typically come with fixed or adjustable interest rates and loan terms ranging from 15 to 30 years. The choice between fixed and adjustable rates depends on your risk tolerance and financial goals.

-

Rental Income Considerations: Lenders may consider the potential rental income from the property when determining your eligibility and the loan amount you qualify for. They may require rental income documentation, such as lease agreements, to verify rental income.

-

Credit and Income Requirements: Lenders will review your credit history, debt-to-income ratio, and overall financial stability when evaluating your loan application. Meeting credit and income requirements is crucial for approval.

-

Property Type: The type of investment property can affect loan eligibility and terms. Single-family homes, multi-unit properties (duplexes, triplexes, etc.), and commercial properties each have their own lending guidelines.

-

Property Location: The location of the investment property can also influence loan terms. Some lenders may have restrictions or offer different rates for properties in certain geographic areas.

-

Property Management: Lenders may inquire about your property management plans. Having a solid property management strategy in place can improve your loan application’s chances of approval.

-

Tax Implications: Investment properties may have tax benefits, such as deductions for mortgage interest, property taxes, and depreciation. It’s advisable to consult with a tax professional to understand the specific tax implications of your investment property.

Before pursuing an investment property mortgage loan, it’s essential to conduct thorough research, assess your financial readiness, and consult with mortgage professionals to determine the best financing options for your real estate investment goals. Additionally, local real estate market conditions and regulations can impact your investment decisions, so it’s advisable to seek local expertise when investing in real estate.

-

-

Becoming a Missouri State Highway Patrol (MSHP) trooper is a rigorous process that requires dedication, physical fitness, and a commitment to public service. Here are the general steps you can follow to become a Missouri Highway Patrol trooper:

-

Meet Minimum Requirements:

- Be a U.S. citizen.

- Be at least 21 years old at the time of appointment.

- Have a high school diploma or equivalent (GED).

- Have a valid driver’s license.

- Be in good physical and mental health.

-

Gain Education and Experience:

- While a college degree is not always required, having some college education or a bachelor’s degree can be an advantage.

- Gain relevant work experience, such as military service, law enforcement, or public safety, which can enhance your application.

-

Submit an Application:

- Check the Missouri State Highway Patrol’s official website for job openings and application deadlines.

- Complete the application form and submit it along with any required documents, such as transcripts, certifications, and a resume.

-

Pass the Written Exam:

- If your application is accepted, you may be invited to take a written examination, which assesses your knowledge of various subjects, including law enforcement procedures, reading comprehension, and problem-solving.

-

Physical Fitness Test:

- If you pass the written exam, you will likely undergo a physical fitness test to assess your strength and endurance. This may include activities like running, push-ups, sit-ups, and other physical tasks.

-

Background Check:

- A thorough background investigation will be conducted to ensure you have a clean criminal record and meet the department’s ethical and moral standards.

-

Interview:

- You may be invited for an interview where you’ll be assessed for your communication skills, interpersonal skills, and suitability for a law enforcement career.

-

Polygraph Examination:

- You may need to undergo a polygraph examination to verify the information you provided during the application process.

-

Psychological Evaluation:

- A psychological evaluation is conducted to assess your mental fitness for a law enforcement career.

-

Medical Examination:

- You will undergo a medical examination to ensure you meet the physical requirements for the role.

-

Academy Training:

- If you pass all the previous stages, you’ll be accepted into the MSHP’s training academy, which typically lasts for several months. You will receive comprehensive training in law enforcement procedures, firearms, defensive tactics, and more.

-

Graduation and Field Training:

- Upon successfully completing the academy, you will graduate and begin field training under the supervision of experienced troopers.

-

Probationary Period:

- After field training, you will likely have a probationary period during which your performance will be closely monitored.

-

Continuous Training:

- Law enforcement officers are expected to undergo regular training to keep their skills up to date throughout their careers.

Please note that the specific requirements and processes may vary over time, so it’s essential to check the official Missouri State Highway Patrol website or contact their recruitment division for the most up-to-date information on becoming a trooper. Additionally, meeting all the requirements and successfully completing each step of the process is competitive and challenging, so preparation and dedication are crucial.

-

-

Primary owner-occupant homes, also known simply as owner-occupied homes or primary residences, refer to residential properties that are primarily occupied by the owner of the property as their primary place of residence. These are homes where the owner lives and resides, as opposed to properties that are primarily used for rental or investment purposes.

Key characteristics of primary owner-occupant homes include:

-

Residence of the Owner: The owner of the property lives in the home as their primary place of residence. It’s where they reside on a day-to-day basis.

-

Personal Use: The property is used for personal and family purposes rather than being rented out to generate rental income.

-

Potential Tax Benefits: In many countries, primary owner-occupant homes may qualify for certain tax benefits or exemptions, such as property tax reductions or capital gains tax exclusions when selling the property.

-

Mortgage Considerations: When financing the purchase of a primary residence with a mortgage, there may be different lending terms, interest rates, and down payment requirements compared to investment properties.

-

Homeowner’s Insurance: Homeowner’s insurance policies are typically used to protect primary owner-occupant homes and their contents.

-

Homestead Exemption: Some jurisdictions offer homestead exemptions, which can provide property tax relief or protection from creditors for primary residences.

It’s important to distinguish primary owner-occupant homes from investment properties, vacation homes, or rental properties. These other types of properties are typically acquired with the primary goal of generating rental income or capital appreciation, whereas primary owner-occupant homes are meant for the owner’s personal use and enjoyment.

-

-

A VA high-balance loan, also known as a VA jumbo loan, is a mortgage program offered by the U.S. Department of Veterans Affairs (VA) that allows eligible veterans, active-duty service members, and certain members of the National Guard and Reserves to purchase or refinance homes with loan amounts that exceed the standard conforming loan limits established by the Federal Housing Finance Agency (FHFA).

Conforming loan limits are the maximum loan amounts that government-sponsored entities like Fannie Mae and Freddie Mac will purchase or guarantee. These limits vary by location and are typically adjusted annually to account for changes in the housing market. In areas with higher housing costs, such as some parts of California, New York, and Hawaii, conforming loan limits may not be sufficient to finance homes in certain neighborhoods.

A VA high-balance loan comes into play when a borrower wants to purchase a home in a high-cost area and needs a larger loan amount than the standard conforming loan limits allow. The VA guarantees a portion of the loan, which allows lenders to offer favorable terms to veterans and active-duty military personnel.

Key features of VA high-balance loans include:

-

Higher Loan Limits: VA high-balance loans have higher loan limits than standard VA loans. The specific loan limits vary by location and are based on the FHFA’s conforming loan limits for that area.

-

No Down Payment: Just like standard VA loans, high-balance VA loans typically do not require a down payment, making homeownership more accessible to eligible veterans and service members.

-

Competitive Interest Rates: VA loans often come with competitive interest rates, making them an attractive option for borrowers.

-

No Private Mortgage Insurance (PMI): VA loans do not require private mortgage insurance, even for high-balance loans. This can result in lower monthly mortgage payments compared to some conventional loans.

-

Flexible Credit Requirements: While lenders have their own credit score and underwriting requirements, VA loans tend to be more flexible than many other loan programs, making it easier for some borrowers to qualify.

It’s important to note that eligibility for VA high-balance loans is subject to specific requirements, including military service history, discharge status, and other factors. Additionally, borrowers may need to meet income and credit requirements set by the lender.

If you’re interested in a VA high-balance loan, it’s advisable to contact a mortgage lender or broker with experience in VA loans to discuss your eligibility and explore the loan options available to you. Keep in mind that loan limits and program details may change over time, so it’s essential to get the most up-to-date information when considering a VA high-balance loan.

-

-

With all the political chaos going on among the far left with transporting illegal immigrants to NYC and surrounding suburbs, increasing local, county, and state taxes, creating many rules and regulations, New York had a flood of taxpayers flee New York to other low taxed cities and states. Now with the conviction of former President Donald Trump, many economists and political science scholars are forecasting millions of taxpayers and businesses will be leaving New York to other family and friendly states. If politicians can go after a former President of the United States and his family, New York politicians can do the same to an average Joe. Tens of thousands of taxpayers and businesses have already left New York. After yesterday’s news of former President Donald Trump being found guilty of 34 felony charges, it’s going to backfire on New York.

New York can soon become a ghost 👻 town. Stay Tuned, FOLKS.

-

Biden Administration cronies are big fat liars. JOE BIDEN and his idiot gang of liars are in a state of denial on the economy. Look at this video Neil Caputo drilling one of BIDEN’S big fat lie on how Biden took over an economy with a 9% inflation and inflation is now under control. Total Bull Shit. Biden Administration screwed up the economy and America.

-

Here’s a funny clip

https://www.facebook.com/share/r/eoRe8Qxi96oS7UGf/?mibextid=D5vuiz

facebook.com

It’s just a joke! 🤣🤣🤣 #comedy #skit #justjokes #funny. Jerrold Benford · Original audio

-

-

-

LCongratulations 🎊 and 🇲🇽 Salud Senior Hamburgesa on you acing 100% ciento 💯 💯 💯 💯 💯 positive on your STD examination.

-

There are about ten states that do not allow mortgage loan originators to be paid by 1099 from their mortgage brokerage company. How does Illinois stand on loan officers to be paid by 1099?

-

How can you get approved for a commercial loan on commercial properties with creative financing?

-

Gustan Cho Associates (NMLS 2315275) and its affiliates is a dba of NEXA Mortgage (1660690), the largest mortgage brokerage in the nation. follow Fannie Mae’s DU AUS and LP AUS. They are renowned for having little to no lender overlays. Mortgage loan customers dealing with judgments, open collections, foreclosures, tax liens, overdrafts, and late payments have all benefited from my assistance. People with credit scores below 600 FICO can receive assistance from the Gustan Cho Team at Gustan Cho Associates, and the lowest credit score borrower I can assist is one with a 500 FICO. 10% of the purchase price is needed from people with credit scores between 500 and 580. A 3.5% down payment is needed for credit scores higher than 580 FICO. I work with consumers whose mortgage loans have been rejected by other lenders because of their overlays for a significant portion of my business. Suppose a borrower signs their 1003 mortgage application and provides me with the necessary documentation.

In that case, I can often give them an official mortgage approval in less than a day. The Gustan Cho Team at Gustan Cho Associates typically closes my loans in three weeks or less. Under the direction and guidance of Sapna Sharma, Gustan Cho Associates’ Chief Technical & Marketing Officer, the company’s marketing division maintains partnerships with real estate experts. Love. Gustan Cho Associates is accessible seven days a week. I get in touch with realtors all the time. To connect with customers, realtors, mortgage brokers/bankers, insurance agents, appraisers, attorneys, and other professionals, please visit me at http://www.gustancho.com and join our forum at http://www.lendingnetwork.org. Our in-house IT department will jointly promote open homes and recommend certain realtors to pre-approved clients looking to buy or sell a property as part of NEXA Mortgage’s collaboration program with realtors. Get in touch with me for further information. Gustan Cho Associates is a reputable mortgage company that offers various services, including mortgage loans for various scenarios, debt consolidation and credit restoration, and personalized support throughout the loan application process. One of the main reasons to choose Gustan Cho Associates is their reasonable prices, quick and efficient loan approval process, and commitment to customer satisfaction and support. Regarding your mortgage requirements, it is recommended that you consider Gustan Cho Associates. They offer debt reduction and credit repair assistance, personalized loan application assistance, and reasonable loan rates. Their commitment to customer satisfaction and support makes them a reliable mortgage lender, and they provide contact information for further assistance.

I. Overview of Gustan Cho Associates in Brief: Their Services Explained Selecting a trustworthy mortgage provider is crucial.

II.Gustan Cho Associates’s past customer testimonies and reviews; the company’s history and establishment; the team’s expertise and experience

III. Gustan Cho Associates’ Services are available for FHA, VA, conventional, and other types of mortgage loans. They also provide assistance with credit repair and debt consolidation. They also provide personalized assistance with the loan application procedure

IV. Motives for Selecting Gustan Cho Associates: Reasonably priced loans and interest rates A prompt and effective loan approval procedure A dedication to ensuring client assistance and happiness

V. Summary: An overview of the significance of choosing a trustworthy mortgage lender. Your mortgage needs should be carefully considered while considering Gustan Cho Associates. Information on whom to contact in the event that you need further support or details Assistance with credit repair and debt consolidation Personalized assistance with the loan application procedure Reasons to Select Gustan Cho Associates IV: Reasonably priced interest rates and loans Ensuring client pleasure and assistance via a fast and efficient loan approval procedure.

VI. Summary: An overview of the significance of choosing a trustworthy mortgage lender. Your mortgage needs should be carefully considered while considering Gustan Cho Associates. Gustan Cho Associates provides support with loan applications, debt reduction, and credit restoration, in addition to affordable interest rates. As a trustworthy mortgage lender, they provide contact details for further help and demonstrate a strong dedication to client satisfaction and support. Gustan Cho Associates is a reputable mortgage provider offering services such as FHA, VA, conventional, and other types of mortgage loans, credit repair and debt consolidation assistance, and personalized loan application assistance. The company’s history, expertise, and experience are highlighted. Reasons for choosing Gustan Cho Associates include reasonably priced loans and interest rates, a prompt and effective loan approval procedure, and a commitment to customer satisfaction and happiness. They provide support with loan applications, debt reduction, and credit restoration, along with affordable interest rates. Customers can use their contact details to contact Gustan Cho Associates for further support, and they can demonstrate a strong dedication to customer satisfaction and support. The company’s commitment to customer satisfaction and support is evident in its commitment to providing the best possible service to its clients.

The Gustan Cho Team at Gustan Cho Associates has licenses in most 50 states. Contact Gustan Cho seven days a week, nights, weekends, and holidays, at 800-900-8569 or mobile at 262-716-8151.

-

This discussion was modified 1 year, 11 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 11 months ago by

Gustan Cho.

Gustan Cho.

gustancho.com

GCA Mortgage | Mortgage Experts With No Overlays

Whether you’ve gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans

-

This discussion was modified 1 year, 11 months ago by

-

What is the end of the world theory and the depopulation theory? Why does Bill Gates, Barack Obama, The Rothchild Family, George Soros, and the world’s globalists believe in euthanizing people older than 70 years old and depopulation?

-

Every sign out there signals the housing market is in big trouble. The liberal media and the Democrats are in a state of denial and according to FED Chairman Jerome Powell, Treasury Secretary Janet Yellen, President Joe Biden, VP Kamala Harris, the liberal media from CNN, CNBC, and every major news networks are saying everything is fine and that Bidenomic is the savior of the forecasted recession and the U.S. economy had a soft landing and we are now in great shape. Who are they kidding. You do not have to be a genius to see that inflation is far worse than the numbers claim. People are not making it with what they are making. Inflation did not stabilize. That is a total crock of bullshit. Look at the prices at the grocery store. Have you seen goods and services doubling and tripling in price in such a short period of time? Most American’s wages have not gotten wage increases to match the rate of inflation. The Federal Reserve Board is headed by a total incompetent leader and the board are a mere of incompetent joke. The dollar is literally worthless and the global economic leaders have lost any and all respect for U.S. currency and I do not blame them. Anyone with a single digit IQ will tell you they will be crazy to invest in the U.S. treasuries the way they are printing the dollar like there is no tomorrow. The dollar is not backed by any hard assets such as Gold or Silver. The inflation rate is far from being stabilized. A Big Mac Value meal at McDonalds is $20.00. California, under the leadership of Gavin Newson is losing residents by the tens of thousands daily and the state is in chaos. Democrat states like California, New York, Illinois are passing laws of making illegal aliens able to own guns and become police officers. Mortgage rates, which seemed like there was a light at the end of the tunnel a few weeks ago when it dropped to the low 6.00% jumped backed up to over 7% due to FAKE economic and unemployment numbers and made up economic data which hands down is a big fat LIE. Corruption is rampant and never in history has the liberal left been as out of control as they are now. The left have no shame. They get caught cheating, lying, stealing, and can lie straight to the American people with a straight face. Home prices have doubled in the past couple of years in many areas of the country and many homeowners have done a cash-out refinance to tap into their artificial equity. The housing market crash forecast is not an IF but a DEFINITE COMING SOON to a neighborhood near you. In the past it was difficult to predict the housing market with complete certainty, as it is influenced by various economic factors that can shift over time. However, based on current data and expert analysis, the potential housing market forecast for the U.S. housing market in 2024 is definitely a given doom and gloom. Moderating home price appreciation: The deniers of the true economy seem to think that after years of rapid home price growth, housing prices will continue to increase, and most forecasts suggest a deceleration in 2024, with prices expected to rise at a more moderate pace of around 2-4% nationwide. However, the realists believe home prices will tank a solid 40% or more and the Dow Jones Industrial Average will fall below 20,000. Stabilizing mortgage rates: If inflation continues to cool, mortgage rates are projected to stabilize in the range of 6-7% by 2024, down from the peaks seen in late 2022. Improving housing inventory: As higher mortgage rates continue to cool demand, the inventory of homes for sale is expected to gradually increase, providing more options for buyers and a potential drop in home prices. More bankruptcies and foreclosures is expected as wll as divorce rates is suppose to skyrocket. Shift towards a balanced market: The deniers and globalists seem to believe the housing market is anticipated to transition from a strong seller’s market to a more balanced state, with less competition and fewer bidding wars which is a crock of shit. Realists believe the real estate market will tank worse than the 2008 financial crisis, more foreclosures, and bankruptcies than ever recorded in history. Affordability challenges: Despite moderating prices, affordability will likely remain a major concern for many buyers due to higher mortgage rates and lingering inflation and homelessness is suppose to skyrocket like never before in the history of the United States. Rental market strength: The rental market is expected to remain strong in 2024 but many rentals is forecasted to increase where many people will not be able to afford rent. Many people who could have afforded homes are not priced out of the housing market and stuck with renting because it is driven by demographic shifts and affordability constraints for homeownership. Regional variations: Housing market conditions will continue to vary across different regions and metropolitan areas, with some markets cooling faster than others. Economic factors: The overall performance of the housing market will depend on factors such as job growth, consumer confidence, and the broader economic conditions in 2024. The media is not reporting the truth about millions of people getting laid off, large number of small businesses shutting their doors, and people losing faith in the American economy. It’s important to note that these forecasts are based on current data and assumptions, and unforeseen economic or geopolitical events could alter the trajectory of the housing market. Additionally, local market conditions may differ from national trends. Wake up, America. We need a total overhaul of corrupt politicians, and a full correction of the housing market and get rid of lifelong career politicians. Fake NEWS needs to be banned and censorship needs to get outlawed. Who in the Hell is Bill Gates, Barack Obama, Anthony Fauci, Nancy Pelosi, Joe Biden, and thousands of liberals and Globalists to demand human depopulation with the coronavirus vaccine, chem trails, killing babies for adrenochrome, and human trafficking where they get to live long and euthanize Americans older than 70 years old. Americans need to voice these concerns and take our country back and eliminate the satanist, evil, mortals who do not belong in this world and need to be terminated as well as their bloodlines. Here is an informative video from Peter Schiff who called the 2008 financial crisis and was spot on.

-

What are FHA spot loans for homebuyers buying a condominium with an FHA loan? How does FHA spot loans work?