Russell

PoliceMy Favorite Discussions

-

All Discussions

-

Police corruption is out of control. There are more arrests and convictions based on percentage versus the entire civilian population. The hiring process needs to get more strict recruiting police officer recruitment. Anyone with a high school diploma, GED, or two year junior college degree in law enforcement or 60 college semester hours can become a police officer. Here’s a video of Oklahoma police chief Carl Stout, the most Corrupt Police DEPARTMENT under the leadership of Chief Carl Stout.

-

Davey Jones was one of the most talented people and founder of The Monkeys 🐒. One of the classic songs he wrote was Day Dream Believer

-

Buying a home is one of the biggest financial decisions you’ll make, and it’s important to stay informed about recent changes in the real estate process that could impact your experience. Recently, the National Association of REALTORS® (NAR) reached a settlement introducing new guidelines to increase transparency for homebuyers. Here’s a breakdown of what you need to know and how it might affect you.

What’s Changed?

One of the key changes is that homebuyers will now be required to sign a written Buyer Representation Agreement before touring homes with an agent. This agreement outlines the services your agent will provide, how they’ll be compensated, and the duration of the representation. The idea behind this change is to ensure that you and your agent clearly understand your working relationship from the outset.

Understanding the Buyer Representation Agreement

The Buyer Representation Agreement is essentially a contract between you and your agent. It specifies the terms of your partnership, including:

- Agent Responsibilities: Clearly defines what your agent will do for you during the representation period.

- Transparency of Services: Ensures you understand your agent’s role and the services they’ll provide.

- Compensation Details: Specifies how and what your agent will be paid.

- Expert Guidance: This guarantees that you have a professional on your side to help you navigate the complex homebuying process.

These changes are designed to protect you by ensuring that everything is clearly laid out before you start the homebuying process.

What About Seller-Paid Fees?

One important point to note is that while the ruling restricts the advertisement of the buyer’s agent fee on the MLS, it doesn’t prevent the seller from covering your agent’s fee. In many cases, your REALTOR® can still negotiate with the seller to have them pay your agent’s fee as part of the transaction. This can be a significant financial benefit, as it could reduce the amount you need to bring to closing. Your agent will advocate on your behalf to ensure you’re getting the best possible deal, which might include negotiating for the seller to cover some or all of your agent’s fee.

Why Work with a REALTOR®? Even with these new requirements, working with a REALTOR® can provide significant benefits during your homebuying journey:

-

Expertise: REALTORS® are trained professionals who understand the complexities of the real estate market. They can help you navigate contracts, negotiations, and other important aspects of buying a home.

-

Local Knowledge: A REALTOR® with experience in your area can provide valuable insights into neighborhoods, property values, and market trends that might not be obvious at first glance.

-

Support and Guidance: The homebuying process can be overwhelming, especially for first-time buyers. A REALTOR® can guide you through each step, helping you make informed decisions along the way.

These recent changes are about ensuring you’re fully informed and protected throughout the homebuying process. The Buyer Representation Agreement is a tool to ensure transparency and clear communication between you and your agent, ultimately leading to a smoother and more confident homebuying experience.

If you have any questions about how these changes might impact you or if you want to discuss what to expect, feel free to reach out (949-414-9433) or visit my website (chadbushre.com/).

-

This discussion was modified 9 months, 3 weeks ago by

Chad Bush.

Chad Bush.

chadbushre.com

Chad Bush - Southern California Realtor

Your resource to southern California real estate. Stay informed on the latest housing market trends and available homes throughout the area.

-

-

Anyone know about French Bulldogs and their traits? Are French Bulldog puppies expensive? I see them advertised for $2,500 and higher? Why are French Bulldogs so expensive? Any health issues? What is the lifespan of French Bulldogs. Do French Bulldogs get along with small children and other dogs? How about cats? Are French Bulldogs good with cats? French Bulldog puppies are extremely cute 😍 💖 💕 💓 ❤️. Look at the attached video clip about a talking French Bulldog.

https://www.facebook.com/share/r/jJRSvKteVoWhg7PQ/?mibextid=NqTh7c

facebook.com

This dog loves to talk 🥹❤️ #shorts #cutedogs #virals #dog

-

How does disability affect relationships? Can disabled and unattractive men have a romatic relationship with beautiful gorgeous women? Do beautiful women find disabled and handicapped men attractive? How do you deal with a disabled partner? Can you still have a romantic and lifelong relationship if your spouse becomes disabled? Would you marry a disabled man and not laugh at his handicap? What do others think about a disabled man married to an attractive woman? Women who have been marrying unattractive high status men since forever. Here is a video about six disabled people who married beautiful women.

https://www.facebook.com/share/r/x3fcJ6Sk9ekrme1J/?mibextid=NqTh7c

-

This discussion was modified 10 months ago by

Gustan Cho.

Gustan Cho.

facebook.com

6 Disabled People Who Married Beautiful Women

-

This discussion was modified 10 months ago by

-

Inspirational story on how dreams can come true 👍 How dreams comes true. Immigrant family moves to the United States and parents hold menial jobs with a son making ends meet. Son is talented in basketball and makes it to the the NBA and buys parents a new house. Son had a friend who believed in him and gave him rides to basketball practices throughout his friendship and son buys friend a brand new car. Inspiring story.

https://www.facebook.com/share/v/YwdBc8PhjeirkcKg/?mibextid=NqTh7c

-

This discussion was modified 10 months ago by

Gustan Cho.

Gustan Cho.

facebook.com

Rich Kid Makes Fun Of A Poor Immigrant Boy | By Dhar MannFacebook

Rich Kid Makes Fun Of A Poor Immigrant Boy | By Dhar MannFacebook

-

This discussion was modified 10 months ago by

-

-

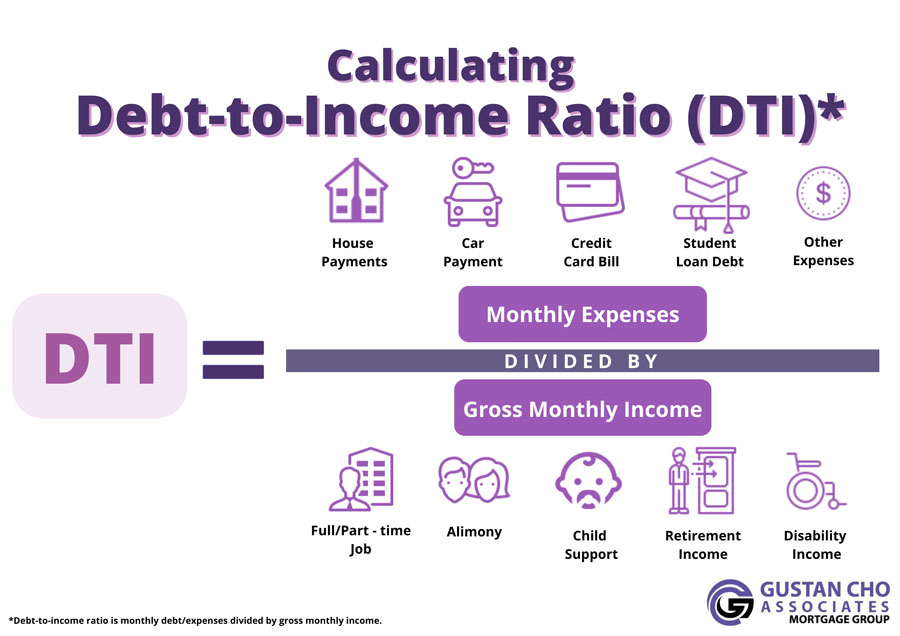

I have a question I asked multiple people who are called expert loan officers and credit repair geniuses but I am getting conflicting answers. I want to know if a consumer needs to get his credit scores up for a mortgage to a 640 FICO. He has never missed a monthly payment and has perfect payment history the past five years. He has 10 credit card accounts with all of them maxed to the credit limit. Here are the credit card balances and credit card limit. His middlw credit score is currently 525. Question is what credit card should he pay down the balance to lower his credit utilization ratio. Should he start paying down the lower limit credit first or should he pay down the higher credit limit credit card first. Here is his credit cards, the balances, and the credit limit.

CREDIT CARD. BALANCE LIMIT

1. DISCOVER $498. $500

2. CAPITAL ONE. $470. $500

3. CREDIT ONE. $490. $500

4. SELF VISA. $1,500. $1,490

5. TRUMP CARD $4,000. $4000.

6. JOURNEY CARD $2,130 $$2,200

7. CREDIT PLUS $3,490. ,$3,500

8. BUDDY VISA $1,500. $1,600

10. MISSION LANE $1498 $1,500

-

I have been a customer of Marine Credit Union since 2020. The reason I am a loyal customer of Marine Credit Union is because of personal banker Troy Fredrick. Troy is one of the most hard working banking professionals I have met and will not tell you what you want to hear but the facts. The answer you will get from Mr. Troy Fredrick is never a NO. It’s not if you will get a loan but WHEN. He will recommend a game plan for you to either enhance your credit profile or if it is something Marine Credit Union cannot do, Mr. Fredrick will open up potential avenues for his borrowers may explore. Troy always acts for the benefit of his clients and never steers his clients in a direction where he sees any potential harm. Troy Fredrick always goes above and beyond and I have witnessed him work diligently on a $1,000 Credit Rebuilder loan the Same diligent way he does a $20,000 loan. As a national manager of a national mortgage company licensed in 48 states including Washington DC, Puerto Rico and the U.S Virgin Islands, I use Troy Fredrick as a inspiration and role model to all my support and licensed personnel. I am a firm believer that it’s the people that make a great company and institution. There is a reason why Marine Credit Union is a leader in its field with a reputation for being the best of the best financial institution. Answer is a no Brainer. Troy Fredrick. Thank you Troy Fredrick for being you. You are not taken for granted and appreciated for everything you do for me and my family. Professionals like Troy Fredrick are the true silent heroes in life. Humble, honest, and transparent. Five plus stars. Like to thank upper management of Marine Credit Union for having platinum professionals like Troy Fredrick representing your awesome financial institution. God Bless. Marine Credit Union offers auto loans, RV loans, second mortgages, lines of credit, and most importantly, a great credit rebuilder program for people who need to rebuild and establish their credit. Contact Troy Frederick if you need the services of a great credit union at troy.frederick@marinecu.com

Here is the link for Marine Credit Union

marinecu.com

At Marine Credit Union, we believe every member of the community can achieve the goal of financial ownership and giving back.

-

The verdict is in on former President Donald Trump’s trial in New York. Former President Donald Trump has been found guilty on all 34 charges in his hush money case. Never before in history has a former president of the United States been tried after they left office of the Presidency. This trial of former President Donald Trump was politically motivated with many things wrong with even going to trial. No doubt the trial was politically motivated due to the fear and panic of former President Donald Trump running for office of the Presidency of the United States in November 2024. The charges against President Donald Trump are related to falsifying business records to conceal a $130,000 payment made to adult film star Stormy Daniels. This payment was part of an effort to prevent Daniels from going public with her claims about a 2006 encounter with Trump. This historic conviction marks Trump as the first former U.S. president to be convicted of felony crimes. The jury deliberated for 9.5 hours before reaching their verdict, which involved examining numerous invoices, vouchers, and checks connected to the reimbursement payments made to Trump’s former lawyer, Michael Cohen, who initially covered the payment to Daniels. The sentencing for Trump is scheduled for July 11, just before the Republican National Convention where he is expected to be nominated as the 2024 presidential candidate.

https://www.youtube.com/watch?v=NM1v-Tyvvso&list=RDNSNM1v-Tyvvso&start_radio=1

-

Breaking NEWS from CEO MIKE KORTAS over the announcement of NEXA MORTGAGE 100. Effective immediately, all NEXA Mortgage loan originators who recruit one full time independent Mortgage Loan Originator and that loan officer does one loan a month in one or all three wholesale lending mini-correspondent investors (EPM, MLB, and UWM) the loan officer will make 100% of the revenues. Let’s dive into the details of NEXA Mortgage’s commission structure. If you’re a self-producing Mortgage Loan Originator (MLO) looking for a change in brokerages, NEXA has some exciting possibilities for you:

-

Base Commission:

- The first layer of NEXA Mortgage’s compensation plan is the Base Commission. You start by selecting a margin applied to your lender-paid compensation deals.

- While you have the flexibility to choose different margins, it’s recommended to opt for 275 basis points, which grants you 220 basis points.

- With this competitive rate, your commissions can significantly increase, especially when closing larger loan amounts.

-

Bonus Commission:

- NEXA rewards hard work and dedication with the Bonus Commission.

- Once you hit $3 million in funded volume per month, you’ll receive a 100% commission on everything beyond that threshold.

- This bonus structure motivates MLOs to exceed their targets, and the potential for increased earnings is substantial. So, the sky’s the limit when it comes to achieving higher commissions!

-

Partnership Compensation Plan:

- Taking their commitment to growth and recognition a step further, NEXA introduces the Partnership Compensation Plan.

- When you’ve introduced 10 Originators producing at NEXA, you become eligible for this plan.

- Instead of waiting to hit $3 million, you get a 100% commission starting at $2 million in production.

- This incentive encourages MLOs to contribute to the company’s success by bringing in top-performing Originators.

-

Revenue Share Program:

- Interested in building a business within a business? NEXA Mortgage offers an enticing Revenue Share Program.

- By introducing other Originators to NEXA, you can earn a portion of their commissions, creating a powerful source of passive income.

- As you develop your downline and help others succeed, your Revenue Share can grow significantly.

-

Daily Payouts:

- Gone are the days of waiting for weeks to receive your commissions.

- NEXA Mortgage pays you daily, treating you like a realtor and ensuring you get your hard-earned money promptly1.

Remember, always do thorough research and consider all aspects before making any decisions. If you’re interested in joining NEXA, reach out to them directly to explore the opportunities further!

https://gustancho.com/career-opportunities/

-

This discussion was modified 1 year, 1 month ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 1 month ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 1 month ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 1 month ago by

Gustan Cho.

Gustan Cho.

-

-

What are HUD Chapter 13 Bankruptcy dismissal guidelines to qualify for an FHA LOAN. Is there any waiting period requirements.

-

James O’Keefe an undercover journalist and former President of Project Veritas went on a date with a gay senior White House Cyber Security Executive Advisor confirming Dementia Joe Biden does have Dementia and is Senile. Also mentioned is Kamala Harris is not liked and not respected by staff members and senior White House advisors

-

If this doesn’t imply my landscaper has ADHD, I don’t know what does. I had to hire a temporarily landscaper from a Craigslist ad to help me with mowing the lawn for $25 dollars for the job and this is what I get.

-

Is there such a thing as an odometer stopper? Does an odometer stopper roll back the odometer of your car? Is an odometer stopper illegal? How does an odometer stopper work? Is it a crime to install an odometer stopper on your vehicle?

https://www.facebook.com/share/v/j8fy76kcKupqZad5/?mibextid=D5vuiz

facebook.com

Lamborghini Huracan With A Mileage BLOCKER 🤦♂️

-

American consumers are getting squeezed economically. Interest rates on cars are between 11% to 19%. Average amount of monthly car payment is $700.00. Many consumers have car payments higher than $1,000 per month. Ford Motors announced great earnings. Now how can that be. Well, Ford CREDIT was offering zero percent on special FORD vehicles.

-

Remember when Elon Mosk declared war against California Governor Gavin Newsom and said he was going to move Tesla to Austin Texas. Well, Tesla moved to Texas and thousands of Tesla workers packed up their belongings and families and moved to Austin Texas. Austin Texas housing market has been on fire and appreciated like never before. Now with electric car market in the dumps and Tesla Motors in financial crisis and laying off thousands of workers, the Austin Texas housing market is in trouble. There are thousands of Taxpayers fleeing Austin Texas like never before. Texas home prices are tanking. Just in the past few months, homes in AUSTIN plummeted by 20%. Rents on studio apartments plummeted 17% last months. Many Tesla laid off workers can’t afford their homes in Texas. This is a developing story folks. More to come.

-

Ed Why is the U.S. Currency becoming worthless? Why is the world no longer considering the U.S. Dollar the premium Currency of the free World? Why is the United States 🇺🇸 losing respect from the free world? Why is Joe Biden no respect and thought of as an idiot. Why is Kamala Harris not respected as the Vice president of the United States of America 🇺🇸. Why is Kamala Harris referred to as an idiot. What did Kamala Harris do that people around the world refer her as a slut and whore. Who is Big Mike? Why is Barack Obama referred to as gay? Is Barack Obama gay? Is Michelle Obama a man?

-

It is ridiculously crazy at some classic car values and how much they are fetching in today’s automotive markets. Who ever thought 🤔 a $3,000 1970 – 1971 Dodge Cuda Big Block can be worth several hundred thousand dollars. Who ever thought a $3,000 1950 Mercedes Benz 300 SL Gullwing would be worth over a million dollars today. There are Classic Cars like the old Ferrari 250, Ferrari Boxers, Ferrari Dino, Ferrari F40, FERRARI F50, Lamborghini Countach, Lamborghini Miura, 2005-2006 FORD GT, 2004-2005 Porsche Carrera GT, and many more cars that is worth six to seven figures. Look at the attached video.

https://www.facebook.com/share/r/qTiAt9pBkeZSiXUo/?mibextid=D5vuiz

facebook.com

This Addition Would Make a Car Worth $1.8 More 💰 🚗

-

Getting Old

I know we all heard the stories about aging, aging gracefully. Fifties the new forties, sixties the new fifties and seventies the new sixties. I’m here to tell you its all bullshit! I just turned seventy, my mind thinks I’m fifty, until I get down on the ground with out having a plan on how to get up.

Things happen gradually, when someone asks you if you can remember your childhood phone number, you proudly recite it with that smug look. However, you can’t remember the password you created yesterday. Another sign of getting old is when you think you lost your glasses, and their on top of your head. Can’t find your phone, you borrow some else’s to call your number and soon realize you can’t remember your cell number, but you remember you childhood phone number which isn’t doing you much good right now. You hope someone calls your cell. Then you remember its on mute because of too many telemarketers.

Walking into a room and forgetting why you walked into the room in the first place.

Its not all dismal, you try to save money and clip coupons, which you never use. You buy BOGOs and forget you have enough paper towels in the garage to clean up an oil spill in the ocean.

My all time favorite is watching a movie I have already seen. Half way through the movie it hits me, I’ve seen this movie before, but can’t remember the ending. So, I get to watch it all over again, just like a new movie. You walk past a bathroom and figure, what the hell, I might as well go while I’m here.

My tip on investing when you get old, don’t buy green bananas.

-

Only 20 Lamborghini Reventon Ever Made. The Lamborghini Reventón is an iconic and extremely limited-edition supercar produced by the Italian manufacturer Lamborghini. Here are some key details and features about the Lamborghini Reventón:

Production: The Lamborghini Reventón was produced between 2007 and 2009. Only 20 units were made for customers, with an additional car (numbered 0/20) produced for the Lamborghini museum, making it one of the rarest Lamborghini models ever made.

Design: The design of the Reventón was heavily inspired by modern fighter jets, with sharp, angular lines and an aggressive, aerodynamic profile. The car features a carbon-fiber exterior, with a matte finish giving it a distinctive, stealthy appearance.

Engine and Performance: The Reventón is powered by a 6.5-liter V12 engine, producing 650 horsepower. This allows the car to accelerate from 0 to 60 mph (0 to 97 km/h) in just 3.4 seconds and reach a top speed of 211 mph (340 km/h).

Interior: The interior of the Reventón is a blend of luxury and high-tech features, with carbon fiber, leather, and Alcantara materials used throughout. The instrument panel is entirely digital, with two LCD screens displaying vital information in a format reminiscent of a jet cockpit.

Price: When it was released, the Lamborghini Reventón had a price tag of around $1.5 million, making it one of the most expensive cars at the time.

Legacy: The Reventón is often regarded as a precursor to the Lamborghini Aventador, with many design and technological elements influencing the latter model. Its rarity, performance, and design have made it a highly sought-after collector’s item.

The Lamborghini Reventón remains a symbol of Lamborghini’s commitment to pushing the boundaries of automotive design and performance, embodying the brand’s tradition of creating bold, head-turning supercars.

Here’s a video clip of the Lamborghini Reventon Lamborghini enthusiasts may find interesting.

https://www.facebook.com/share/v/qSgCMtdX1T1mHnEc/?mibextid=D5vuiz

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

facebook.com

Too Good To Be True: Could This Reventón Be Real?!

-

This discussion was modified 1 year ago by

-

This is a frequently asked question from many real estate agents on behalf of their homebuyers. There are more and more homebuyers with bad credit than ever before. Many homebuyers with bad credit think they are the worst of the food chain and should not shop for the best mortgage rates. However, mortgage lenders today are starving for business and will work with bad credit borrowers in getting them the best rates. I just saw this guide on can you shop for the best mortgage rates with bad credit and I wanted to share this with everyone. It does make sense. By shopping for a mortgage with the best rates means getting a mortgage with bad credit with low credit scores with no discount points. Discount points are a total waste of money and you will never recoup discount points even on a refinance later when mortgage rates drop.

-

You do not need perfect credit or high credit scores to qualify for a mortgage loan. Every loan program require a minimum credit score. Besides HUD, VA, USDA, FANNIE MAE, FREDDIE MAC, or non-QM portfolio lenders requiring a minimum credit score, each lender can impose lender overlays on credit scores. Lender overlays are additional credit score requirements above and beyond the minimum agency mortgage guidelines imposed by each individual mortgage lender. Regardless of the minimum credit scores required, all lenders will normally want to see timely payment history in the past 12 months. Regardless of the prior bad credit you have, having timely payment on all of your monthly debt payments that report on the three credit reports is crucial. Do not worry about prior collections, charge-off accounts, late payments, or other derogatory credit tradelines unless you are going though a manual underwrite on FHA loans. HUD manual underwriting guidelines require timely payments in the past 24 months. VA manual underwriting guidelines require timely payments in the past 12 months. In many instances when you get an approve/eligible per automated underwriting system but late payments in the past 24 months, the lender may down grade your file to a manual underwrite. The best solution for you to increase your credit scores and strenghen your credit profile with recent late payments is adding positive credit with new credit. Please read this guide on how to boost your credit to get approved for a mortgage: Capital One Secured Credit Card will get you a $250 secured credit card with a $50 deposit. Self.Inc is a bank that has a phenomenal credit rebuilder program where you can make a monthly deposit as small as $25.00 per month. That monthly deposit goes towards a savings account but it reports as an installment loan to all three credit bureaus. Get a Discover secured card. Secured credit cards are the same as unsecured traditional credit card. The only difference is you need to put a deposit. The amount of deposit is the amount of credit you get by the credit card company. You need to make timely minimum monthly payments on your secured credit cards. Just start with these three creditors and you will see wonders in the weeks and months ahead. I will cover some quick fixes for you to increase your credit scores fast and at the end of this topic thread, I will list helpful resources on boosting your credit to qualify for a mortgage, how to reach a human at the credit bureaus, and how to rebuild your credit:

1. Capital One Secured Credit Card

2. Self.Inc

3. Discover Secured Credit Card

As time pass and you make timely payments, your secured credit card company will increase your credit limit without asking your to put additional deposit. If you can get more secured credit cards, it will expedite your credit rebuilding process. However, you should at least start with the above three creditors.

Improving your credit scores and rebuilding credit can be crucial when seeking mortgage approval. Here are some effective strategies to consider:

Review your credit reports: Obtain copies of your credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion. Identify and dispute any errors or inaccuracies that may be negatively impacting your credit scores.

Pay bills on time: Payment history is the most significant factor affecting your credit scores. Make sure to pay all your bills (credit cards, loans, utilities, etc.) on time, every time. Set up automatic payments or payment reminders if necessary.

Reduce credit card balances: High credit card balances can hurt your credit utilization ratio, which accounts for a significant portion of your credit scores.

Aim to keep your credit card balances below 30% of your total available credit limit. Consider paying off credit cards with the highest balances first.

Don’t close unused credit cards: Closing credit cards can inadvertently increase your credit utilization ratio and decrease your overall available credit. Keep unused credit cards open, but avoid using them to maintain a low credit utilization ratio.

Increase credit limit: Request a credit limit increase from your credit card issuers, which can improve your credit utilization ratio. Be sure to handle the increased credit limit responsibly and avoid overspending.

Limit new credit applications: Each credit application results in a hard inquiry on your credit report, which can temporarily lower your credit scores. Limit credit applications only to when absolutely necessary.

Use different types of credit: Having a mix of different types of credit (e.g., credit cards, auto loans, personal loans) can positively impact your credit scores. Consider taking out a small loan or opening a new credit card account if you have limited credit types.

Monitor your credit regularly: Check your credit reports and scores periodically to ensure accuracy and track your progress. Consider signing up for a credit monitoring service to receive alerts for any changes to your credit profile.

Be patient and consistent: Rebuilding credit takes time and consistent effort. Stick to responsible credit habits, and your credit scores should gradually improve, increasing your chances of mortgage approval.

Remember, lenders evaluate various factors beyond just credit scores when considering mortgage applications. However, improving your credit scores and maintaining a healthy credit profile can significantly increase your chances of getting approved for a mortgage with favorable terms.

https://gustancho.com/boost-your-credit-with-new-credit/

gustancho.com

Boost Your Credit With New Credit To Qualify For A Mortgage

Boost your credit with new credit to qualify for a mortgage . New secured credit cards and credit builder loans increases credit scores for mortgage

-

Home staging is the process of preparing a home for sale by making it look as attractive and appealing as possible to potential buyers. The goal of home staging is to help buyers envision themselves living in the space and to highlight the home’s best features. Here are some key aspects of home staging:

- Decluttering and depersonalizing: Removing excess furniture, personal items like family photos, and clutter to create a sense of openness and allow buyers to imagine their own belongings in the space.

- Furniture arrangement: Rearranging and sometimes renting furniture to showcase the flow and function of each room optimally.

- Deep cleaning: Ensuring the entire home is thoroughly cleaned, from windows to carpets, to create a fresh, move-in ready feeling.

- Curb appeal: Enhancing the home’s exterior by power washing, landscaping, and making the entrance inviting.

- Repairing and updating: Attending to minor repairs like patching holes and updating elements like light fixtures to give the home a well-maintained look.

- Style and accents: Using stylish yet neutral decor pieces, fresh linens, pillows, and accents to give rooms an updated, model home appearance.

- Staging vacant homes: For empty properties, staging companies bring in rental furniture and decor to make the space feel warm and livable.

Home staging aims to appeal to the highest number of potential buyers by making the home look its absolute best while remaining neutral enough for buyers to envision their own style. Studies show well-staged homes tend to sell faster and for higher prices.

Chic interiors and home staging are key elements in creating a stylish, inviting, and market-ready home. Whether you’re decorating for personal enjoyment or preparing to sell, understanding these concepts can make a significant difference.

Chic Interiors

Chic interiors are defined by their elegant, fashionable, and timeless qualities. Key elements include:

- Neutral Color Palette: Soft tones like white, beige, gray, and black provide a sophisticated base. Accents in metallics, pastels, or bold colors can add personality.

- Quality Over Quantity: Invest in high-quality furniture and decor pieces. Fewer, well-chosen items can make a bigger impact than cluttering the space with too many things.

- Mix of Textures: Combine different materials like velvet, leather, wood, and metal to create depth and interest.

- Minimalist Aesthetic: Keep spaces uncluttered and streamlined. Use sleek, modern furniture with clean lines.

- Statement Pieces: Incorporate standout items like a designer chair, a piece of art, or a unique lighting fixture to add a focal point to the room.

- Functional Design: Ensure that the design is not only beautiful but also practical. Furniture should be comfortable and arranged for ease of movement and conversation.

Home Staging

Home staging involves preparing a property for sale by making it appealing to the highest number of potential buyers. Key aspects include:

- Decluttering and Depersonalizing: Remove personal items and excess furniture to make the space look larger and allow buyers to envision themselves living there.

- Neutral Decor: Use neutral colors to appeal to a broad audience. This helps buyers focus on the home itself rather than the decor.

- Furniture Arrangement: Arrange furniture to highlight the flow and function of each room. Create cozy conversation areas and ensure there’s enough space to move around.

- Lighting: Use a mix of ambient, task, and accent lighting to create a warm and inviting atmosphere. Ensure all lights are functioning and rooms are well-lit.

- Curb Appeal: Enhance the exterior of the home with fresh landscaping, clean walkways, and a welcoming front entrance.

- Clean and Fresh: A clean home is more appealing. Pay attention to details like fresh paint, clean windows, and pleasant scents.

Tips for Combining Chic Interiors and Home Staging:

- Focus on Key Rooms: Prioritize staging the living room, kitchen, master bedroom, and bathrooms. These are the areas buyers focus on the most.

- Highlight Features: Use decor to draw attention to the home’s best features, like a fireplace, large windows, or architectural details.

- Use Chic Decor: Incorporate chic elements like stylish throw pillows, modern artwork, and elegant lighting fixtures to elevate the overall look.

- Update Strategically: Small updates like new cabinet hardware, fresh paint, and updated light fixtures can make a big impact without a significant investment.

Resources and Inspiration:

- Interior Design Magazines and Websites: Publications like Architectural Digest, Elle Decor, and Houzz offer inspiration and tips.

- Professional Stagers: Consider hiring a professional home stager for expert advice and hands-on help.

- DIY Resources: Books, online courses, and DIY blogs can provide step-by-step guides to achieving chic interiors and effective staging.

By combining the principles of chic interior design with strategic home staging, you can create a beautiful, inviting space that appeals to both you and potential buyers.

-

Is the FED printing money? If so, what is the negative outcome of printing money in our economy.

-

-

This subforum will feature Tatiana Bougdaeva, a mortgage loan originator licensed in multiple states and banking professional with over thirty years of experience. Besides being an expert in the lending and real estate profession.

Tatiana Bougdaeva @Tatiana My good friend and business associate Tatiana Bougdaeva is a the owner, founder of Kalm Strategy. Tatiana Bougdaeva is a life coach and will explain what she does helping fight the aging process, and bringing yourself to peaceful and healthy life style.

Organic Anti-Aging Coaching Program

Check out her website at http://www.kalmstrategy.com

-

This discussion was modified 1 year, 1 month ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 1 month ago by

Gustan Cho.

Gustan Cho.

kalmstrategy.com

Kalm Strategy | Stress management, bring peace, health and wellness, Yoga, Reiki and Shamanic healing

-

This discussion was modified 1 year, 1 month ago by