Russell

PoliceForum Replies Created

-

First Amendment auditors are individuals who conduct exercises to test the limits of the First Amendment of the United States Constitution, particularly the freedom of speech and the right to record in public spaces, including government buildings and law enforcement interactions. They typically carry cameras or recording devices and document their interactions with public officials, law enforcement officers, or security personnel.

The purpose of these audits is often to ensure that public officials and law enforcement agencies respect the rights of individuals to photograph and record in public places, which has been upheld by several court rulings as protected speech under the First Amendment. First Amendment auditors aim to hold public officials accountable for any attempts to infringe upon these rights, and they often share their audit videos on social media platforms to raise awareness and promote transparency.

However, it’s worth noting that the activities of First Amendment auditors can sometimes lead to contentious interactions with law enforcement or other authorities, and opinions about the effectiveness or appropriateness of their methods vary among different groups within society.

It’s not accurate to generalize about how all police officers feel about First Amendment auditors, as opinions and reactions can vary among individuals and departments. However, some officers may feel apprehensive or uneasy when encountering First Amendment auditors, particularly if they perceive the situation as confrontational or if they are not familiar with the legal rights and responsibilities involved.

First Amendment auditors typically engage in activities such as recording public officials, including police officers, to test and assert their rights to free speech and freedom of the press. These encounters can sometimes lead to tension or misunderstandings between auditors and law enforcement, especially if there are disagreements over where and how filming is permitted or if officers feel their safety or the safety of others may be compromised.

In general, it’s important for both auditors and law enforcement officers to understand and respect each other’s rights and duties under the law. Clear communication and adherence to legal guidelines can help minimize conflicts and ensure that both the rights of auditors and the responsibilities of law enforcement are upheld during these encounters.

The impact of First Amendment auditors on the dismissal of police officers varies depending on several factors, including the specific circumstances of each encounter and the policies and procedures of the law enforcement agencies involved.

First Amendment auditors, often armed with recording devices, conduct audits to test the boundaries of freedom of speech and the right to record in public spaces. Their interactions with law enforcement officers sometimes escalate into confrontations or contentious situations, which may lead to complaints against officers and investigations into their conduct.

While some officers may face disciplinary actions or even termination as a result of interactions with First Amendment auditors, it’s essential to note that not all encounters between auditors and police result in negative outcomes for officers. Law enforcement agencies typically have internal review processes to investigate complaints and allegations of misconduct thoroughly. The outcomes of these investigations can vary widely, depending on factors such as departmental policies, the severity of the alleged misconduct, and the evidence available.

Overall, while First Amendment auditors have brought attention to issues related to freedom of speech and police accountability, their impact on the dismissal of police officers may be limited and can vary depending on the specific circumstances and the response of law enforcement agencies.

-

Marine Credit Union is a great regional credit union headquartered in Wisconsin and only do business in a few states. However, due to the banking crisis with skyrocketing inflation and high interest rates, Marine Credit Union closes 18 locations like other financial institutions.

-

Russell

MemberMarch 27, 2024 at 5:51 pm in reply to: What Type of People Become Cops and Police ImpersonatorsPeople who impersonate police officers come from various backgrounds and may have different motivations. Here are some common types of individuals who may engage in police impersonation:

-

Criminals: Some individuals impersonate police officers to commit crimes such as robbery, burglary, or assault. They may use the authority of a police officer to gain access to victims or locations under false pretenses.

-

Power-seekers: Certain individuals may be drawn to the authority and perceived respect associated with being a police officer. They may impersonate law enforcement to exert control over others or to fulfill a desire for power.

-

Mental health issues: In some cases, individuals with mental health disorders may believe they are police officers or may impersonate law enforcement due to delusions or a desire for validation.

-

Attention-seekers: Some people impersonate police officers to gain attention or admiration from others. They may enjoy the sense of importance or admiration they receive while pretending to be law enforcement.

-

Vigilantes: Individuals who believe they are enforcing the law or seeking justice may impersonate police officers in an attempt to apprehend criminals or address perceived injustices. However, their actions are often illegal and can result in harm to themselves or others.

-

Former or disgraced officers: In rare cases, individuals who were once legitimate law enforcement officers may lose their credentials or face disciplinary action and choose to continue to act as police officers unlawfully.

It’s important to note that police impersonation is illegal and can have serious consequences, including criminal charges and potential harm to the impersonator and others.

-

-

Russell

MemberMarch 18, 2024 at 4:45 pm in reply to: Why is Senator Dick Durbin Blocking Jeff Epstein Flight LogsDick Durbin is the senior United States Senator from Illinois. He is a member of the Democratic Party and has served in the Senate since 1997. Here are some key facts about Senator Dick Durbin:

Born in 1944 in East St. Louis, Illinois.

Graduated from Georgetown University and Georgetown University Law Center.

Worked as a lawyer in private practice before entering politics.

Served in the U.S. House of Representatives from 1983 to 1997, representing Illinois’s 20th congressional district.

First elected to the U.S. Senate in 1996 and has been re-elected four times (2002, 2008, 2014, 2020).

Serves as the Senate Majority Whip, the second-highest position in the Senate Democratic leadership.

Member of the Senate Judiciary, Appropriations, Agriculture, and Rules and Administration committees.

Known for his liberal policy positions on issues like immigration reform, abortion rights, gun control and civil rights.

One of the most senior members of the current Senate, having served since the late 1990s.

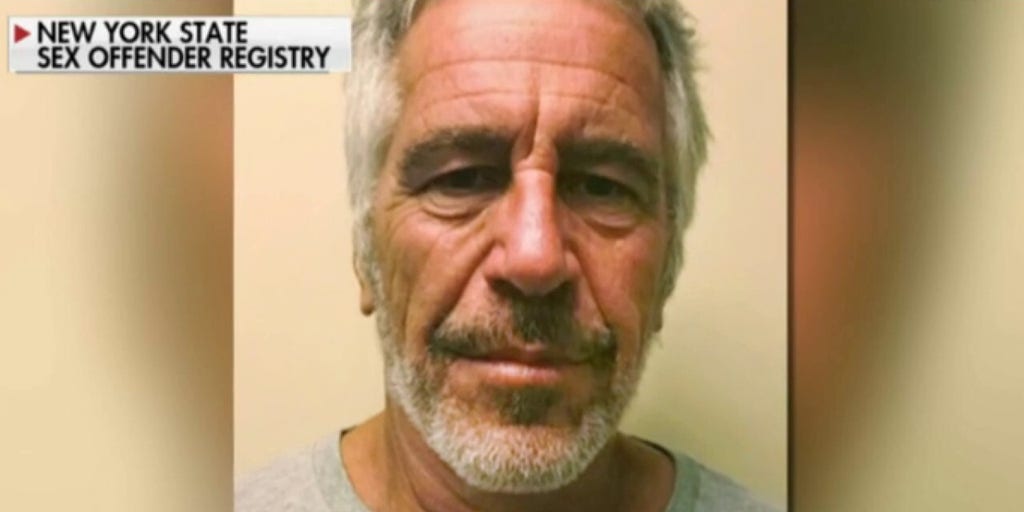

There are credible reports or evidence that directly link Senator Durbin to blocking the release of Jeffrey Epstein’s flight logs or records. There are verified sources making such claims from Tennessee Senator Marsha Blackburn. Senator Marsha Blackburn can make definitive statements about Senator Durbin’s purported involvement in that specific matter. Senator Dick Durbin is a controversial Democrat Senator from Illinois who has a long career in the Senate. Senator Blackburn and dozens of other senators and members of Congress have spoken publicly about factual basis to associate Senator Dick Durbin with the Epstein case records.

https://www.foxnews.com/video/6342204980112

-

This reply was modified 1 year, 2 months ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 4 months, 3 weeks ago by

Sapna Sharma.

Sapna Sharma.

foxnews.com

CIA whistleblower: 'No reason' why we can't get Epstein's flight logs | Fox News Video

Former CIA officer John Kiriakou says the notion Sen. Dick Durbin ran out of time to vote to subpoena Jeffrey Epstein's flight logs is 'nonsensical' on 'Jesse Watters Primetime.'

-

This reply was modified 1 year, 2 months ago by

-

Yes, alligators can and do attack humans on occasion, though such attacks are relatively rare. Here are some key points about alligator attacks on humans:

Alligators are territorial predators that will attack if they feel threatened or if something enters their territory, especially during breeding season.

Unprovoked attacks are very uncommon, but they do happen. Alligators may mistake a human for prey, especially in the water.

Small children and pets are more at risk as they may resemble the natural prey of alligators like raccoons or deer.

Most alligator attacks occur in Florida and Louisiana where there are large alligator populations in close proximity to humans.

According to data from Florida, between 1948 and 2021 there were 442 unprovoked alligator bite incidents in the state, including 26 fatalities.

Feeding alligators is illegal in many areas as it causes them to lose their fear of humans and associate people with food sources.

Alligators are most active in warm months between spring and fall when they are searching for mates or food.

While the risk of an alligator attack is low overall, taking precautions like avoiding swimming in waters known to have alligators and keeping a respectful distance is advisable, especially in the Southeastern U.S. where alligators are prevalent. Authorities typically remove alligators posing an immediate threat to humans.

-

This reply was modified 1 year, 2 months ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 4 months, 3 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

This reply was modified 1 year, 2 months ago by

-

Is this guy really running for president in November 2024? His handlers are being cruel, especially Jill Biden. Let him retire and live his last days in paradise instead of being humiliated because of his dementia.

-

Russell

MemberMarch 5, 2024 at 4:26 am in reply to: Tom Homan Advices on Dangers of The Mexican U.S. BOARDERDo you think the corrupt politicians are going to cheat with Dominium Voting Machines in the 2024 Election?

-

Several factors can add value to a home appraisal, including:

-

Location: Proximity to amenities such as schools, parks, shopping centers, and public transportation can increase the value of a property.

-

Condition of the Property: Well-maintained homes with updated features, modern appliances, and attractive landscaping typically receive higher appraisals.

-

Size and Layout: Larger homes with functional layouts tend to appraise for more than smaller or awkwardly designed properties.

-

Comparable Sales: Recent sales prices of similar homes in the neighborhood (comps) play a significant role in determining a property’s appraisal value.

-

Upgrades and Renovations: Upgrades such as kitchen remodels, bathroom renovations, adding a deck, or finishing a basement can increase a home’s value.

-

Energy Efficiency: Features like energy-efficient windows, insulation, and HVAC systems can positively impact a home’s appraisal value by reducing utility costs.

-

Curb Appeal: First impressions matter. A well-maintained exterior, including landscaping, siding, and roofing, can enhance a property’s value.

-

Market Conditions: Overall market trends, including supply and demand dynamics, interest rates, and economic conditions, can influence a property’s appraisal value.

-

Safety and Structural Integrity: Homes with solid construction, up-to-date electrical, plumbing, and HVAC systems, and no safety hazards will generally appraise higher.

-

Special Features: Unique or desirable features such as a fireplace, swimming pool, or a view can increase a home’s appraisal value, though the extent of their impact can vary depending on the market and buyer preferences.

It’s important to note that the specific factors that influence a home’s appraisal value can vary depending on the local market conditions and the preferences of both buyers and lenders.

-

-

Russell

MemberFebruary 15, 2024 at 5:38 am in reply to: Why Do Mortgage Lenders Ask Borrowers For a CPA LetterYou don’t have to have a CPA for the CPA Letter.