Tina

Dually LicensedMy Favorite Discussions

-

All Discussions

-

Property Tax Assessment Fraud Nationwide. Did the Jackson County Property Tax Assessor commit Property Assessment Fraud? Missouri orders Jackson County property tax rollback, sparking fears of budget shortfalls. What parcels are in Jackson County, Missouri? What role does a tax assessor play in determining property taxes? How do I get the extra money I paid in property taxes due to property tax assessment fraud?

https://youtu.be/sVGD2ccUiq0?si=hiyhLJZa3U-o5eyN

-

This discussion was modified 9 months, 1 week ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 9 months, 1 week ago by

-

Value of Silver will outpace Value of Gold as precious metals skyrocket. Silver trade in a thin market. Plus Silver has investment Value as well as practical industrial Value. In 2011 Value of Silver doubled to $45 per ounce. Trading of Silver opened higher today. Start stacking Silver today.

-

GCA Forums News National Headline Reports—April 29, 2025 Domestic Policies and Government Issues Updates

Approval Rating Nosedive During the First Trump Term

United Parcel Service (UPS) announced 20,000 job cuts for 2025, which surged its stock price

It’s because of Amazon’s volume loss. Twenty thousand jobs are 4.0% of its workforce.

Polls reveal that the self-identified Republicans’ count reached a historical low of 35% at the beginning of Trump’s second term, with only a 34% optimistic view of America’s economy. How does the economy even function when 37% of people are frightened about the condition of the country? An ABC News Washington Instagram poll cites Trump as the lowest historically rated president out of eighty years. Project 2025’s policies, especially Trump’s immigration plans alongside his economic tariffs, are set to face mounting opposition. For some reason, sections of voters still back his deportation plans, so the mandate is kept for lower-vote immigration.

Federal Layoff Policy Dispute

An alliance of trade unions, NGOs, and regional governments took Trump, Musk, and almost two dozen heads from federal branches of the Trump administration to court to disrupt massive layoffs proposed for the federal government. Resounding concerns that cuts to government employees will shatter the fabric of the nation’s governance drove this legal response.

Header One

White House border czar Tom Homan goes as far as suggesting that undocumented immigrants self-deport. He follows this up by threatening prosecution for those undocumented immigrants who stay behind. This follows reports of deportations, some even including children who were legal guardians in the custody of the US, which sparked some controversy. The National Immigration Project condemned it, saying, “these families have been given insufficient options to remedy this situation,” which many claim to be true. On top of this, over one hundred immigrants were detained in a raid at an Underground nightclub in Colorado Springs, where it was alleged that active-duty Military personnel had taken part.

Vancouver Festival Attack Incident

Elsewhere in the world, the Vancouver car-ramming attack permeated a Filipino heritage festival, claimed 11 victims, and injured dozens more, including a 5-year-old girl and both her parents, which puts the total injuries close to 4 dozen and continues to claim headlines. Kai Ji Adam Lo, age 30, remains the main suspect, charged with no less than eight counts of second-degree murder. Oftentimes, Vancouver is referred to as having its “darkest day,” which has a range of vigils and mourning from the traumatizing pieces in the fallout that were spurred by this incident.

Illinois After-School Camp Crash

A crash in Chatham, Illinois, took the lives of four people aged 4 to 18 after a car drove through an after-school camp. Others were injured, but the footage shows chaos. Saucers are looking into what may have led to the incident.

This work serves two masters: the justice we achieve and the places we are dealt with while reporting crime.

Florida Turnpike Van Crash

An incident in Osceola County where a van overturned on Florida’s Turnpike resulted in five deaths and seven injuries. The event continues to deepen existing worries regarding the safety and quality of the roads in heavily used regions.

Social and Cultural News

Betsy Arakawa Death Public Information

The death of Betsy Arakawa, the spouse of actor Gene Hackman, was confirmed as a result of contracting Hantavirus pulmonary syndrome. An autopsy later cleared Hackman of the disease, putting an end to public speculation. Due to Hackman’s prominence, this news has garnered widespread attention.

Universal Orlando Epic Universe Park

Universal Orlando Resort has made tickets for the new Epic Universe theme park available to the public from April 29 to May 19, 2025, about a month before its opening on May 22. The park is expected to include attractions such as SUPER NINTENDO WORLD and The Wizarding World of Harry Potter. So far, its announcement has sparked great interest, prompting rapid sales for some tickets.

Legal and Judicial Updates

US 2nd Circuit Court of Appeals Judgment

The US 2nd Circuit Court of Appeals scheduled arguments for May 6 in Rumeysa Ozturk’s case. However, the details are quite sparse in public versions. This suggests that some action is taking place that may be of considerable importance.

Florida School District Joins Social Media Lawsuit

The Indian River County School District in Florida voted to join a nationwide lawsuit aimed at popular social media platforms because of their negative impacts on mental health and educational development. This comes after a canceled attempt to create state parks, with the put-on-hold plan illustrating a change in local focus.

A National Issue with a Global Angle

Power Outage in Spain and Portugal

Soaring crime rates do not have the desired effect on travel. April 28, for instance, witnessed Spain and Portugal being interconnected with a single power grid. The resulting paralysis of transport routes and medical servicing meant that a global emergency infrastructure undertook many tasks that the US might need to think rationally about. After part 29, a lack of imagination also caused people further problems.

Canada’s Election Influenced by US Politics

Trump might not be in attendance. Premier Trump irrationally fueled the hubris in 2021. It is yet a ridiculous excerpt, porous-wise. The dynamic will probably impact the relationship between the two countries, the US and Canada, for some time.

Economic and Public Sentiment

Public sentiment is divided over Trump’s policies of tariffs and immigration crackdowns. According to polls, 29% of Americans registered economic pessimism. And Trump’s handling of immigration is losing voters’ support. Nonetheless, his administration continues to push through with high-profile appointments, such as adding a council with Defense Secretary Pete Hegseth and Texas Governor Greg Abbott, seeking to set heads of appointments on system issues.

As of April 29, 2025, the perplexing nature of politics and the culmination of tragic events and cultural happenings can be distilled into a single trending headline, “The Popularity of Trump – Coverage Was Imminent.” The president’s fiercely low approval ratings and controversial policies overshadow the discourse. Society grieves over the harm caused by the Vancouver attack; Illinois causes the public to focus on the wish to turn up the heat.

Epic Universe’s preview is progressively getting released. Social media is basing being legally allowed to be suspended for public layoffs on keeping watch, in turn shaping the policies of Meta beyond consideration surrounding diverse public focus, which is where GCA Forums News urges their readers to wish not to remain asleep as stories unfold about anything touching on policies, security, and betterment of life.

https://youtu.be/N2sV7mh2JaM?si=s0Jn6Bcg5kmcrTZM

-

This discussion was modified 3 weeks, 2 days ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 3 weeks, 2 days ago by

-

The United States Congress releases bombshell news on Former Congressman Matt Gaetz. Various allegations and investigations have been centered on former Congressman Matt Gaetz. Here’s a summary of the key points related to these allegations.

Sexual AllegationsInappropriate Conduct with Minors:

Gaetz has been accused of building sexually related connections with young girls below the legal age of consent. One of these claims includes paying for sex, something that he has heavily denied. It all started as a part of the investigation surrounding his conduct and relationships.

Other Investigations

Legal Investigations:

As per reports, the Department of Justice has charged Matt Gaetz with potential cases related to sex trafficking, among other series of allegations under investigation. The bias of this entire procedure was to determine if he had participated in breaching federal laws for sex trafficking minors.

Testimonial Misreports

The allegations against Gaetz were further complicated when witnesses were called to testify against him.

Personal Misconducts

Partying:

In several instances, Matt Gaetz has been observed drinking excessive amounts of alcohol and acting inappropriately with partygoers who witnessed the misconduct.

Drugs:

Drugs, including crack, have been smoked by Gaetz and made part of his use history, although facts and sources around these remain vague.

Political Impact

Party Response:

As a result of the allegations, considerable scrutiny has emerged within the Republican Party—some of its members have repudiated Gaetz. In contrast, others have stated that there is no reason to feel guilt as no formal charges have been made against him.

Media Coverage

The matter has undoubtedly attracted much media attention and added to the controversies surrounding Gaetz’s political endeavors.

Gaetz’s Denials

He stood resolute that all the accusations against him were politically touched, unqualified, and wrongly founded by denying their authenticity. He has contended that the allegations are made against him as a tactic to vilify him because he is assertive about different issues and cracks down on various people in the political arena.

The allegations against Gaetz have these proof, which are very serious, which include the alleged inappropriate behavior of having sex with multiple underage teenage girls, drug abuse, and much more. While investigations have been conducted, Gaetz denied the allegations and labeled them politically motivated. It’s a combination of legal and political issues that add to the matter and constantly change.

https://youtu.be/mQrcJltHCn4?si=_006moZmvv2Ib3Un

-

This discussion was modified 5 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 5 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 5 months ago by

-

Jeremy Dewitte is a cop wannabe police impersonator

Jeremy Dewitte has gotten arrested for impersonating police officers since he was 17 years old. Since Jeremy Dewitte is not hireable as a POST certified law enforcement officer in any state of the nation, Jeremy Dewitte opened a funeral escort service company in the state of Florida. In his fleet of vehicles for funeral escort services, Jeremy Dewitte has vehicles that resemble law enforcement vehicles such as dressing up Ford Crown Vics, Ford Explorer SUVs and motorcycle with police look alike stripes,badges, and emergency flashing lights and sirens. Check out this video

https://www.facebook.com/share/v/PVYpy8obKqn6cb19/?mibextid=21zICX

-

This discussion was modified 1 year, 1 month ago by

Gustan Cho. Reason: Spelling error

Gustan Cho. Reason: Spelling error

-

This discussion was modified 11 months, 3 weeks ago by

Sapna Sharma.

Sapna Sharma.

facebook.com

Serial Police Impersonator Arrested by Real Police (Part One) #criminals #cops #police #chasing

-

This discussion was modified 1 year, 1 month ago by

-

Are there many corrupt police officers where they will draft up false criminal charges against citizens? What happens if you were not speeding but get caught for speeding and you know for a fact you were not speeding. What happens if you get arrested for reckless driving for going over 30 miles over the limit and you know for a fact you were not going more than 10 miles over the speed limit. Does the police officer have to show you proof that he caught you going 30 miles over the limit? A reckless driving conviction can mean automatic cancellation of your drivers license and your insurance company can drop you. Are there many corrupt police officers? What can we do if you fall victim to a corrupt police officer? How do police departments hire honest police officers who are honest and protect and serve. I have been watching many YouTube videos about First Amendment Auditors and police corruption. Can you sue corrupt police officers? I have also seen many news reports of police officers planting evidence and lying just for the sake of arresting someone they do not like. What can we do about cleaning up society of corrupt cops?

-

There’s a video series about several pet monkeys. Little pet monkeys are extremely intelligent and cute.

Considering A Pet Macaque Monkey

Insights, Availability, Costs, and Wisconsin Regulations.

You might think owning a monkey is an interesting idea, especially bear macaw mandrills for pets. These monkeys are known for their extreme intelligence and very sophisticated social customs. Their faces are expressive with distinctive features and immensely playful. Therefore, some people consider them exotic pets. But there is a need to ponder a bit deeper before adopting a pet monkey, particularly a baby macaque monkey. This requires consideration of various important factors, including cost, availability, and legal issues, especially in Wisconsin.

Understanding Macaque Monkeys as Pets

Having a pet monkey is like having a small, adorable friend in your home. These pets are also considered very intelligent. They have sophisticated family structures. Macques live in social groups and engage in various physical and mental activities. Suppose they are kept in a domesticated setting like a house or an apartment. In that case, it’s very difficult to replicate this, which can cause severe behavioral problems. An owner must accommodate a multi-dimensional approach to meeting a Macaque’s needs. People wanting these pets should also be ready for the commitment because pet monkeys, particularly macaques, can live for decades.

Availability and Cost of Baby Macaque Monkeys

Contact trusted breeders or exotic pet shops to buy a pet monkey or baby macaque.

Here are several websites that are useful guides in your search.

Supreme Exotic Animals for Sale:

- This website offers several varieties of baby macaques for sale.

- One of the babies, Lily, is listed for roughly $750.

- supremeexoticanimalsforsale.com

General Monkeys for Adoption:

- Another website offers black long-tail macaques for about $1,200 and pigtail macaques for around $900 to $1,000.

- generalmonkeysforadoption.com

Exotic Animals for Sale:

- Features listings like baby marmosets (pocket monkeys) and squirrel monkeys.

- Prices vary.

- Potential buyers must fill out a request form for specific pricing.

Exotic Animals for Sale:

- Features listings like baby marmosets (pocket monkeys) and squirrel monkeys.

- Prices vary.

- Potential buyers must fill out a request form for specific pricing.

- exoticpetsforsale.com.

It’s crucial to note that prices can fluctuate based on factors such as age, health, and monkey rarity. The initial purchase price is just the beginning. Ongoing costs include specialized diets, veterinary care, and suitable housing to ensure the monkey’s well-being.

Legal Considerations in Wisconsin

- Before acquiring a macaque monkey, it’s imperative to understand the legal landscape in your state.

- Wisconsin’s regulations regarding exotic pets are nuanced:

Exotic Animals for Sale

- Features listings like baby marmosets (pocket monkeys) and squirrel monkeys.

- Prices vary.

- Potential buyers must fill out a request form for specific pricing.

- dinocalifornia.com

Wisconsin Is Watching

General Regulations:

- Wisconsin is among the states with relatively lenient laws concerning the ownership of non-native species.

- Owning a monkey, or almost any other non-native animal species, is currently legal in Wisconsin.

It is among five states:

- Alabama

- Nevada

- North Carolina and South Carolina

The above states are the other states with no bans on owning ‘dangerous’ exotic animals.

Check out the link for further information.

- Blackfeminity.com

- Dinocalifornia.com

Wisconsin Watch: Animal Law

Importation Requirements:

- A General Import Permit application is necessary if the animals are privately owned and relocated to Wisconsin.

- Different permit applications exist for some animals, such as those in a rodeo, circus, or menagerie visiting Wisconsin briefly.

Restrictions on Local Ordinances:

- While state laws may allow certain exotic animal ownership, local city or county laws might be more restrictive.

- You should check with local authorities to ensure you abide by all relevant laws.

Perspectives From Current Monkey Owners

The following information may be helpful for current pet owners of monkeys:

Social Media Groups:

- Facebook has groups that serve as communities where enthusiasts and owners can share experiences.

- For instance, one user posted about some ‘adorable’ capuchin monkeys for sale, and comments highlighted how sweet and playful they are.

Educational Videos:

Some mini-documentaries feature “pet monkeys,” showing how smart and charismatic they can be. One video of a pet monkey named “Lilly,” who lives in Vietnam, shows how much love this monkey has for her owner. It is as if she is a mother to a young child.

Ultimately

As tempting as it may be to own a baby macaque monkey, proper research and preparation is advised:

Ongoing Responsibility:

- Macaques regularly need your attention, time, and resources.

- Their care is complex, and their lifespan can reach several decades.

Moral and Legal Duty:

- Ensure that, at the first stage, owning a macaque will adhere to all legal terms.

- Remember the moral issues for keeping a wild animal as a pet.

World Population Review

Other types of engagement:

- If ownership appears difficult, consider donations to primate rescue facilities or volunteer activities that allow hands-on involvement without requiring permanent placement.

To sum up, some pet owners may find it rewarding on some level to have pet macaque monkeys, but they need to be mindful of the obligations and difficulties that come with it. Those willing to leap should know and be ready to tackle these issues for harmonious coexistence with their primate pet.

They are no different than having a little kid that normally behaves. Each pet monkey has its own personality. Anyone raise a pet monkey? Watch this short video. The owner of Lilly lives in Vietnam. This video will make your day. 😍

https://youtu.be/HhVmi-if1yU?si=RY380dlthSfvqHsY

-

This discussion was modified 2 months, 3 weeks ago by

Gustan Cho.

Gustan Cho.

-

Should I get section 8 or market rent tenants for my investment properties? What are the pros and cons having tenants with section 8 vouchers or market rent tenants?

-

Factoring and Merchant Cash Advance (MCA) are two different financial arrangements that businesses use to access funds based on their accounts receivable, but they work in distinct ways:

- Factoring:

Factoring is a financial transaction where a business sells its accounts receivable (unpaid invoices) to a third-party financial company known as a “factor” at a discounted rate. In exchange, the business receives immediate cash, typically a percentage (e.g., 80–90%) of the total invoice value upfront. The factor assumes the responsibility of collecting payments from the customers on those invoices.

Here’s how factoring typically works:

- A business provides goods or services to its customers and generates invoices with payment terms (e.g., net-30, net-60).

- Instead of waiting for these invoices to be paid, the business sells them to a factoring company.

- The factoring company pays the business a portion of the invoice amount upfront, usually within 24-48 hours.

- The factoring company then takes over the responsibility of collecting payments from the customers.

- Once the customers pay the invoices, the factoring company remits the remaining amount to the business, minus their fees and charges.

Factoring is often used by businesses that need immediate cash flow to cover operating expenses or fund growth. The factor’s fee is typically determined by factors such as the creditworthiness of the business’s customers, the size of the invoices, and the industry in which the business operates.

- Merchant Cash Advance (MCA):

A Merchant Cash Advance (MCA) is a form of financing where a business receives a lump sum of cash in exchange for a percentage of its daily credit card sales or future receivables. Unlike factoring, which is based on accounts receivable invoices, MCA is primarily tied to a business’s daily credit card transactions or other incoming revenue streams.

Here’s how MCA typically works:

- A business applies for an MCA from a financing company.

- The MCA provider assesses the business’s daily credit card sales or future receivables.

- Based on this assessment, the MCA provider offers the business a lump sum of cash.

- Instead of fixed monthly payments, the MCA provider collects a percentage of the business’s daily credit card sales or receivables, often referred to as the “daily holdback.”

- The MCA provider continues to collect the agreed-upon percentage until the advance, along with fees and charges, is paid off.

MCAs are known for their convenience and quick access to cash but can be expensive due to the high fees and the daily repayment structure. Businesses that have inconsistent cash flow or a significant portion of their revenue coming from credit card sales may consider MCAs when they need short-term financing.

It’s important for businesses to carefully assess the terms, costs, and implications of both factoring and MCA before deciding which financing option is most suitable for their needs, as they can be expensive forms of financing compared to traditional loans.

-

This discussion was modified 1 year, 6 months ago by

Gustan Cho. Reason: Wrong url

Gustan Cho. Reason: Wrong url

-

Former President Barack Obama used to be a rising star. However, Barack Obama is pretty much a nobody. Obama has a huge ego and thinks his endorsement of Kamala Harris would guarantee Kamala Harris a victorious landslide 2024 Presidential win. Unfortunately, Obama made his endorsement and presence worse than better. Obama had the nerve to say that black brothers needs to vote for Kamala Harris or they ain’t black. The arrogance of Barack Obama backfired on him

Barack Obama thinks he is more important than he is and many Americans have zero respect for this arrogant incompetent former President. Here’s a video about Barack Obama.

-

I spoke with James Abrams, who normally goes by JD. JD is a BDM at NEXA Mortgage, and I have known him for several years. I have heard different, if not shocking, news from JD. JD adopted a German Shepherd dog over a year ago. The dog’s name is Chloe. The German Shepherd dog Chloe is two years old. I asked JD how his German shepherd dog was doing. JD went on to tell me that his dog is doing great and how much he loves Chloe. Then he went on to tell me about an incident he had with Chloe a few months back. James said his German shepherd dog, Chloe, had ten puppies. The father of the ten puppies is not known since Chloe got out of her territory and wandered the neighborhood. The weirdest part of the story was that every time James went to check on the puppies, the number of pups was getting reduced. For example, the ten puppies he witnessed and counted, it went down to eight pups. Then seven puppies. Then five. So JD said something was up. Long story short, Chloe, the German shepherd dog that gave birth to ten puppies, was eating her own puppies with two puppies left over. Besides the ten puppies, the German shepherd Chloe at two birds, Cockatiels, that James kept as pets. I will ask James if he can share the entire story on this forum. Anyone hear of such a bizarre incident where a dog who gave birth to a large litter of puppies at the entire litter? I heard of animals eating the placentas of their newborns but not devouring the entire pup. Something is wrong with her. Any response to this thread will be greatly appreciated.

JD, I appreciate you sharing your story. I am sure you going through this bizarre incident with Chloe is not the first case among those dog lovers and owners who are either intentionally or unintentionally breeding their dogs.

-

Mortgage-Housing and Real Estate News for Thursday January 23rd 2025: Mortgage-Housing and Real Estate News for Thursday January 23rd 2025: Mortgage-Housing and Real Estate News for Thursday January 23rd, 2025:

How Trump’s Policies Immediately Affected Real Estate & Mortgages

GCA FORUMS NEWS UPDATE for Thursday January 23rd 2025 on the Daily Mortgage, Housing, and Real Estate News for our viewers and members of our online community: Great Content Authority Forums Mortgage and Housing News: Daily National Comprehensive Overview of Mortgage and Real Estate News with special emphasis on business news, interest rates, forecast of mortgage rates, housing forecasts, new construction data, how builders forecast housing market, states with mass exodus of residents and businesses, consumer confidence, auto market and auto financing, auto repossession rates, consumer price index, employment numbers and job forecast, national economy, bankruptcy, foreclosure, and investment news. Seems Donald Trump is acting fast with pardons, executive orders, turning Tik-Tok back on, and suspending top secret clearances for those who betrayed the U.S. Constitution. What benefit has President Trump done to the Real Estate and Mortgage sector? Will Trump do something with promoting housing market and lowering mortgage rates? Viewers and members of GCA FORUMS NEWS are welcomed to view and participate on GCA FORUMS NEWS National Daily News Summary and participate asking questions and volunteer news information that may interest viewers for Thursday January 23rd, 2025.

Mortgage, Housing, and Real Estate News for Thursday, January 23, 2025

With the recent actions taken by President Donald Trump, executive orders are bound to affect the mortgage, housing, and real estate industries. Here’s a glimpse of what is happening at the moment:

Effects of the Executive Order on DEI Programs on Housing and Mortgages

DEI Programs Dissolution:

- President Trump has ordered the end of federal diversity, equity, and inclusion programs.

- This is a huge move in the housing sector, as there is equity of access to getting a house or a mortgage.

- All DEI-funded related staff have also been placed on immediate leave.

Suspending Clean Energy Loan Initiatives:

- The government has shut off $300 billion in clean energy loans that will halt many renewable energy projects.

- This could further affect decades economically on real estate spending that uses easy renewable energy sustenance.

Mortgage Rates and Housing Market Trends

Mortgage Rates:

- In 2025, Donald Trump’s campaign forecast of mortgage rates dropping to 3% will be extremely inaccurate as they haven’t shown any signs of changing.

- Policies like tariffs and tax cuts tend to increase rates and lower the value of infrastructure.

Housing Starts:

- There was a rise in US single-family mortgages during December, marking a decade-high.

- Unfortunately, this shows a rise in the housing window, but the dipping rates of mortgages combined with the oversupply of homes tend to stifle that growth.

- Videos claiming that Fannie Mae and Freddie Mac will be privatized have resurfaced, with investors buying into the claim.

- As a result, it is possible that mortgage rates will rise, affecting homebuyers’ affordability.

Industrial Related Changes

Changes in the Barron:

- The government has appointed a few trusted people in the real estate industry.

- This move suggests a strong policy change in housing and development will follow.

- As I previously mentioned, Barron Trump, President Trump’s youngest son, plans to start his own real estate company in the luxury sector, which will continue to bring in the family.

Expect Trump’s tariffs and trade policies to impact the mortgage, housing, and real estate markets highly. The initiatives can stimulate some sectors, but challenges will arise in other aspects, like setting mortgage rates and housing prices. It is advisable for everyone on the field to keep a close eye on and be vigilant about the changes.

GCA Forums News Update: Mortgage, Housing, and Real Estate News

-

Comprehensive National Daily Headline News for Tuesday, January 21st 2025, with a special detailed update of President-Elect Donald Trump Inauguration, Corruption, Inflation, Interest Rates, Business News, Banking News, California Pacific Palisades Fire, Unemployment, Economy, Bankruptcy, and Politics. Life is celebrated when folks get a fresh start. National Headline News: For Tuesday, January 21st, 2025, we will focus on national news, such as the Palisades Fire in California and companies going bankrupt. GCA Forums National Headline News needs to update our viewers about National Headline News on the economy and business news. CPI report, unemployed, job numbers, inflation, interest rate forecast, corruption, the mainstream media, bankruptcies, and cabinet confirmations in politics. Also, Trump is inaugurated, and I heard he is taking action, signing executive orders, pardoning January 6th insurrection protesters, and border czar Tom Homan is taking action, sending ICE agents to crack down on illegal migrants. border agent shot by an illegal migrant.

National Daily Headline News for Tuesday, January 21, 2025

President Trump Takes Office And Immediately Makes Policy Changes

What Trump Did at His Inauguration and Trump’s First Actions After Becoming The President

On January 20, 2025, Donald Trump was sworn in as the 47th President of the United States, thus completing his second term. Because of unusually cold temperatures, the swearing-in ceremony was held indoors at the U.S. Capitol Rotunda. Elon Musk, Jeff Bezos, and Mark Zuckerberg were some of the attendees from the technology sector.

After taking the oath of office, Trump set a new agenda, which included executive orders that reversed the previous administration’s policies. Some key actions taken on the first day include the following:

Pardoning Individuals Convicted of the January 6 Capitol Riots

Across the board, President Trump Pardoned the vast majority of individuals who were convicted for the riots that occurred during the Capitol Riot on January 6, 2021.

Declaring An Emergency for Immigration and National Security

At the southern border, migrants were questioned by armed force troops too elite to cross the border. The new chief of the border, Tom Homan, proposed a shock and awe technique for deporting illegal immigrants with qualifications.

Energy Policy

The filling low within the Paris Climate Accord.

Vital Constructed Aid Programs and Business Updates.

Rate of Inflation and Interest

- The Consumer Price Index report for December 2024 indicated a rise of 0.3%, signaling a rise in the rate of inflation.

- In particular, the Federal Reserve will likely keep interest rates on hold, although it will monitor the economy’s performance for any possible rate changes.

Unemployment And Job Figures

- The latest employment report shows that the unemployment rate remains unchanged at 4.2%, and new jobs for December came in at 150,000.

- Some growth is occurring in specific sectors, such as technology and healthcare, which were growing, and manufacturing, which was declining to some extent.

Corporate Insolvencies

- The retail company ShopMart has filed for Chapter 11 protection due to the sell-off of company stores.

- Unlike other companies impacted by e-commerce inflation, this company will restructure and close certain stores that are underperforming in sales relative to others.

Now, here’s the fire news from California.

- Over the weekend, a wildfire broke out in the Pacific Palisades region of California, engulfing numerous houses and forcing residents to evacuate.

- Firefighters have put out 60% of the fire and expect to contain it completely by Wednesday.

- So far, no deaths have occurred, and the fire is still under investigation.

Political and Legal Developments

Cabinet Nominations:

- This week, the Senate will hold confirmation hearings for President Trump’s cabinet appointments.

- In addition to the Secretary of State and Attorney General, other nominees are also expected to be scrutinized by both political extremes.

Policy Initiatives:

- During his inaugural address, the President boasted about improving immigration policy, increasing energy production within the country, and overhauling trade deals.

- Therefore, he revealed plans to substitute some civil employees with loyalists and annihilate federal agencies’ diversity, equity, and inclusion programs.

Corruption and Legal Proceedings

- Throughout the country, numerous state officials have been accused of corrupt practices in relation to infrastructure projects and other legal dealings.

- The Department of Justice has promised to prosecute them to command public confidence in governmental activities.

The effects of President Trump’s inauguration are tremendous. His first steps include legal matters concerning immigration, energy, and global relations. Policy changes will include active measures against the country’s modern economic, environmental, and political challenges. With the change in leadership, an entire country expects to be willing to tackle these challenges from government officials toward citizens.

-

-

Homes prices in Sarasota Florida is expected to tank in 2024. This year is an election year and many homebuyers are jittery during a turbulent election year. Lower interest rate is forecasted in the later half of the year. Home prices are forecasted to plummet 40% or more in Sarasota County Florida. Average price of homes in Sarasota Florida is $535,000 for single family homes. Condos are priced in the low $500,000 median price range.

-

NEXA Mortgage has independent loan officer branch manager opportunities and loan officer opportunities under a producing branch. You now have the opportunity to run your own P and L business in the mortgage industry. You are your own boss and run your own mortgage company the way you seem fit. CEO Michael Kortas gives the entreprenuer loan officer their own keys to take it where they want to. The sky is the limit. CEO Mike has a hands off policy and never tells you what to do. CEO Kortas is there to help you and will never say NO if you have great ideas in expanding your own business. You can run your mortgage broker business as a dba of NEXA Mortgage. Becoming a NEXA mortgage branch is better than owning your own mortgage company. Contact me at 262-627-1965 or email me directly at gcho@gustancho.com. Please post any questions on this forum or private message me.

https://gustancho.com/career-opportunities/

gustancho.com

NEXA Career Opportunities » Mortgages » Realtor - MLO

Career Opportunities as mortgage loan originators, mortgage processors, account managers, loan processors, mortgage underwriters now available

-

It is human nature to easily be tempted into corruption due to greed. There is overwhelming evidence Joe Biden is an obvious corrupt politician. How can a politician without ever having a job and a family of no wealth can become a multi millionaire as a career politician. Here is a clip about the Joe Biden Crime Family

-

The U.S. mortgage and real estate market is shifting significantly as of December 18, 2024, which affects sellers, buyers, and investors alike. Here’s a comprehensive overview:

Mortgage Rates and Predictions

Let’s look at the current averages step by step. These include the 30-year fixed mortgage, which sits at around 6.78%; the 15-year fixed rate, which sits at 5.94%; and the 5/6 adjustable-rate mortgages (ARMs), which average 7.35%. While all this was happening, the Federal Reserve steadily implemented cuts by scaling the benchmark rate to around 4.3%. However, because of the economic woes and low inflation, mortgage rates remained high, above 6%, as many analysts calculated.

Housing Market Activity

7.35% fixed mortgage rates, along with inflation and remodeling costs, severely restricted builders and home buyers alike from pursuing new projects. Most builders’ optimistic stance, hoping for a turn in market conditions, along with the continued price rise even as remodeling costs rose from $350,000 to $370,000 between 2020 and 2021, further restricted activity in the industry.

NewHome Construction

As housing construction felt the initial effects of the CR2 storm in 2021, the sudden rise in temperatures in the fall of 2022, coupled with the lack of consistent supply, felt like a final unlocking of the keyhole to this issue, with building starts in November having risen by 6.4% to an annual rate of an estimated 1 million units.

Although prices have risen, the rate of increase has been moderated compared to previous years.

Home Price Forecast for 2024-2029

Due to increased listings enabling a relatively higher home sales rate, home prices are predicted to remain flat. However, home prices will gradually rise between 2025 and 2029, with an estimated 1% increase yearly.

Housing Market Forecast for 2024

Substantial growth is anticipated in metropolitan housing markets, such as Oxnard, CA, Rochester, NY, and San Diego, CA. Prices and sales will ideally grow due to good economic conditions and stable prices.

Consumer Insights and Issues in the MarketMillennials as Homebuyers

One of the biggest blocks preventing millennials from fully engaging in the market is high home prices and higher mortgage rates. Based on current trends, 30-year-olds have a 43% homeownership rate, compared to 52% for baby boomers of the same age. Perceptions of homeownership or wealth due to economic imbalance within the generation heavily impact the decision-making process.

Concerns About Affordability: Today, as before, affordability continues to be an issue due to increased home prices and high mortgage interest rates. This led to elevated monthly repayments on existing mortgages. The increasing inventory levels would assist many prospective buyers, but the financial problem would remain.

Investment Opportunities

Real Estate Investment Trusts (REIT): Analysts say total returns on U.S. REITs should fall between 5 and 15 percent in 2025.

American Healthcare REIT, Extra Space Storage, and Cousins Properties are the best choices. These have made sensible investments and displayed steady occupancy rates. Still, their performance could be influenced by high valuations and anticipated changes in tax policies.

The American mortgage and real markets are adjusting to a trying period defined by high rates, low appreciation of home prices, and shifting consumer habits and behaviors. Operators must keep abreast of economic indicators to operate effectively in this economy, including the Federal Reserve’s decisions, policies, and market trends.

-

This message is more towards John Strange, the FHA and VA STREAMLINE REFINANCE expert. Can you please explain how FHA and STREAMLINE REFINANCE loans work

-

-

-

-

Many people are getting diabetes. Diabetes is also known as a silent killer. Anyone explain the dangers of diabetes?

-

Will a personal loan (unsecured loan) used to payoff cc’s improve my score?

I discovered a website today http://www.prosper.com that offers personal loans for all sorts of reasons. It looks like the real deal. Somehow tied in such that it reports to your credit report though. So my question would be: If I have a personal loan for ~$14k on my report-pay back over 3 yrs., is that better for my score than the 7 different credit cards that total the same? I am just looking for chances to consolidate and strengthen my score.

-

Thousands of Loan Officers and Real Estate agents are leaving the Mortgage and housing industries. Every professional in the housing industry is going through a hard time including Loan Officers, Realtors, Auto Salesman, Attorneys, Appraisers, Home Inspectors, and third party professionals. Banks, credit unions, and other creditors are not extending credit to commissioned mortgage and real estate professionals due to volatile mortgage markets. The 10 year treasuries keep on skyrocketing without any signs of correction. Mortgage Rates on government loans are 7.5% for 730 credit score borrowers and conventional loans have Rates over 8% for 700 plus credit score borrowers. With surging inflation and out of control mortgage rates many homebuyers are priced out of the housing market. Thousands of Loan Officers and Realtors including owners of mortgage companies and real estate brokers are leaving the business or closing their doors. What business is the best business to get into if you were to leave the mortgage industry or real estate industry for those who have been in the industry for years or decades?

-

What do you guys think about opening a bride broker business where I can broker women from the Philippines to successful American men looking for a loyal woman for marriage. I was thinking about being a Bride Broker for American men broker Filipinas? My friend Alex Carlucci and I were thinking about the idea. I can name is Alex Carlucci’s Bride Broker-Phillipines: Love Guaranteed or Your Money Back.

-

Financing a new or used car typically involves securing a loan to cover the cost of the vehicle, which you then repay over a set period of time. Here’s a general process you can follow:

1. **Assess your budget**: The first step to financing a car is understanding what you can afford. This includes considering the monthly payments you can manage, as well as the down payment

2. Lending Network offers 125% LTV car loans and exotic car loans.

3. Ferrari, Lamborghini, and luxury six figure SUVs and pick up trucks.

-

Veterans and Credit Utilization: Mastering the Art of Balance

Welcome back to Day 8 of our in-depth series, tailor-made for our nation’s veterans, focusing on the multifaceted world of credit. Today, we plunge into a pivotal topic that resonates with many: credit utilization. For veterans aiming to optimize their financial landscape post-service, mastering the nuances of credit utilization is indispensable.

Breaking Down Credit Utilization: More Than Just a Ratio

At its essence, credit utilization is the ratio of your current credit card balances compared to your credit card limits. It’s calculated by:

Credit Utilization Ratio=(Total Credit Card BalancesTotal Credit Card Limits)×100

Credit Utilization Ratio=(

Total Credit Card Limits

Total Credit Card Balances

)×100

So, if you have a credit balance of $500 on a card with a limit of $1000, your credit utilization for that card is 50%.

Why Veterans Should Care About Credit Utilization

Credit utilization is a heavyweight when it comes to credit scoring, making up a whopping 30% of your FICO score. It serves as an indicator of your financial stability and how reliant you are on credit. Lower utilization rates are viewed favorably, signaling to lenders that you manage your credit responsibly.

For veterans, who may be adjusting to different financial dynamics post-service, understanding and managing credit utilization becomes crucial.

Golden Rules for Optimal Credit Utilization

-

Aim Low, But Not Zero: While it’s recommended to keep the ratio below 30%, having some utilization (e.g., 5-10%) shows that you actively use and manage your credit.

-

Pay Balances More Than Once a Month: To maintain a low utilization rate, consider making multiple payments throughout the month.

-

Request a Credit Limit Increase: If you’ve been a responsible cardholder, consider asking for a credit limit increase on your cards. This can instantly reduce your utilization rate, but be wary not to see it as an excuse to spend more.

Veterans and Credit Utilization: Unique Considerations

For many veterans, the financial landscape post-military service can be marked by significant changes – from purchasing homes to financing education. Some specific considerations include:

-

Transitional Expenses: Veterans might face expenses tied to relocation or adjusting to civilian life. While it’s tempting to rely heavily on credit cards, it’s crucial to monitor utilization and plan repayments.

-

Veteran Benefits: Some financial programs or credit cards cater specifically to veterans, offering lower interest rates or favorable terms. Research and leverage these to your advantage.

-

Financial Counseling: Many organizations offer financial counseling for veterans. If you’re struggling with credit utilization, don’t hesitate to seek guidance.

Avoiding the Traps: Common Missteps and How to Bypass Them

-

Maxing Out Cards: Even if you pay it off every month, maxing out cards can hurt your score if the balance is reported to credit bureaus before you make your payment.

-

Closing Old Cards: It might seem logical to close unused credit cards, but doing so can reduce your overall credit limit, spiking your utilization ratio.

-

Only Making Minimum Payments: While this might keep your account in good standing, it can slowly increase your utilization rate and accrue significant interest.

Day 8 Wrap-Up: The Delicate Dance of Credit Utilization

Credit utilization, in many ways, mirrors the delicate balance veterans master during service – the dance between discipline and flexibility, structure and adaptability.

As we wind up today’s insights into credit utilization, our commitment remains unwavering: to arm our veterans with the knowledge and tools they need to build a secure financial future in civilian life.

Join us tomorrow as we continue our odyssey into the vast realm of credit, ensuring every veteran is equipped, empowered, and enlightened.

-

-

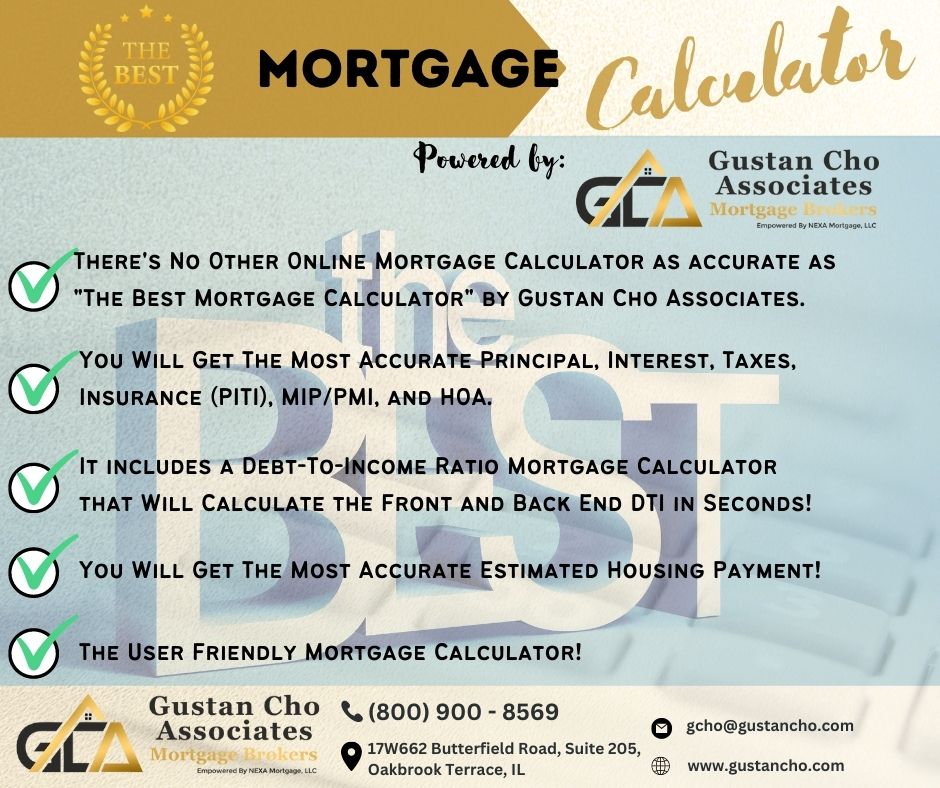

There are hundreds or thousands of Mortgage Calculators online. However. The Team at Gustan Cho Associates Alex Carlucci and Monica Cho has designed, created, tested, and launched the best mortgage calculator that is user friendly with the best accuracy than any other online mortgage calculator. The Best Mortgage Calculator is user-friendly for loan officers, processors borrowers realtors, underwriters, and the general public. Not only does it calculate PITI and Housing payments but also debt to income ratios and agency guidelines on debt to income ratios. Try out the best mortgage calculator https://gustancho.com/best-mortgage-calculator

gustancho.com

Best Mortgage Calculator | PITI, PMI, MIP, and DTI

We are at Gustan Cho Associates, You easily check your mortgage eligibility with the best mortgage calculator With PITI, PMI, MIP, HOA, and DTI.

-

The decision to buy a house in Colorado, or anywhere else for that matter, depends on several factors such as your personal financial situation, the housing market in Colorado, and your long-term plans. Let’s look at some specific points:

1. **Market Conditions**: As of my knowledge cutoff in September 2021, Colorado, especially cities like Denver, Boulder, and Colorado Springs, had seen significant growth in real estate prices over the past decade. However, markets can fluctuate, so it’s essential to research the current market trends and future predictions.

2. **Location**: Different parts of Colorado offer different lifestyles. For example, Denver is a bustling city with thriving industries, while mountain towns offer outdoor recreational opportunities like skiing and hiking. The right location for you depends on your lifestyle preferences.

3. **Affordability**: Keep in mind that buying a home is a substantial financial commitment. Consider your income, savings, and other expenses to ensure you can afford the mortgage payments, taxes, insurance, and maintenance costs.

4. **Long-Term Plans**: Buying a house is typically a long-term investment. If you plan on staying in Colorado for a significant amount of time, buying could be a good decision. On the other hand, if you’re unsure about your long-term plans, renting may be a safer option.

5. **Career Opportunities**: Colorado has robust job markets in industries like technology, healthcare, and aerospace. If your career aligns with these industries, it could be a good place to invest.

6. **Quality of Life**: Colorado often ranks highly in terms of quality of life due to its outdoor recreational opportunities, access to nature, and good education and healthcare systems.

Before you decide to buy a house in Colorado, it would be a good idea to speak with a local real estate agent who can provide detailed information about the market conditions and neighborhoods. Additionally, a financial advisor can help ensure you’re financially prepared for the commitment of buying a home.