Tina

Dually LicensedForum Replies Created

-

Tina

MemberOctober 29, 2024 at 8:31 pm in reply to: Day 8 Veterans and Credit Utilization: Mastering the Art of BalanceVeterans and Credit Utilization: Learning to Balance

Understanding Credit Utilization

Credit utilization is the ratio of credit card convenience used concerning credit card limits allocated. Its weight is so significant that it can be said to account for 30 percent of credit scores. For veterans, keeping track of the credit utilization ratio can prove beneficial in establishing a good credit profile, which will secure better credit terms, especially for VA loans.

Why Credit Utilization is a Notice

Impact on the Credit Score: Ideally, goals with a credit utilization ratio remaining less than 30% would increase the likelihood of higher credit scores. This can help veterans who wish to get mortgage re-finance rates, auto loan rates, or other personal loans.

Credit Provider’s Views: Various lenders view the use of high credit cards as a reason to deem you a risk factor. On the contrary, maintaining a good utilization ratio is proof of controlling one’s credit accounts.

Use of the Credit Mix Effectively: Maintaining a low credit score utilization means having the ability to deal with any major expenditure expected without affecting one’s credit rating.

How to Optimize Credit Utilization

Check Up on Your Current Balances: It is prudent to check the amount spent on credit card utilization as they accumulate quite physically and shift them towards reasonable amounts relative to their limits.

Payments on Balances Owed: Where the retention of the average balances on owed credit card amounts is unreasonable, aim to clear the amounts owed to the balance facilities every month in those scenarios where you still have a few months timelines to accomplish.

Request Higher Limits: Try requesting an extension of your credit limit if you’ve been good with making payments previously. If so, this changes your utilization ratio, provided your balances do not rise either.

Push Spending On Everything: Instead of spending on one card, use all your cards to maintain decreased ratios on almost every card.

Use Your Got Tools And Alerts: If you are nearing your limit, use tools or software to monitor your credit, which can help keep your utilization ratio down.

What Are The Special Considerations For VA Loan Benefits For Veterans:

VA Loan Benefits: Veterans are qualified to get VA loans, which come with better terms. Other advantages can come from having a good credit score.

Financial Advisory: Several companies offer specialized counseling for veterans. They can give specialized advice on credit management and better financial management.

Ending Statement

To maintain a strong profile across the credit databases, veterans have to find a way to master the utilization of credit. Managing the use of your credit, along with how much you spend, will help you enhance your credit score. That way, you’ll also be able to get cheaper loans. The main aim is for credit usage to be as low as possible while benefiting from it.

-

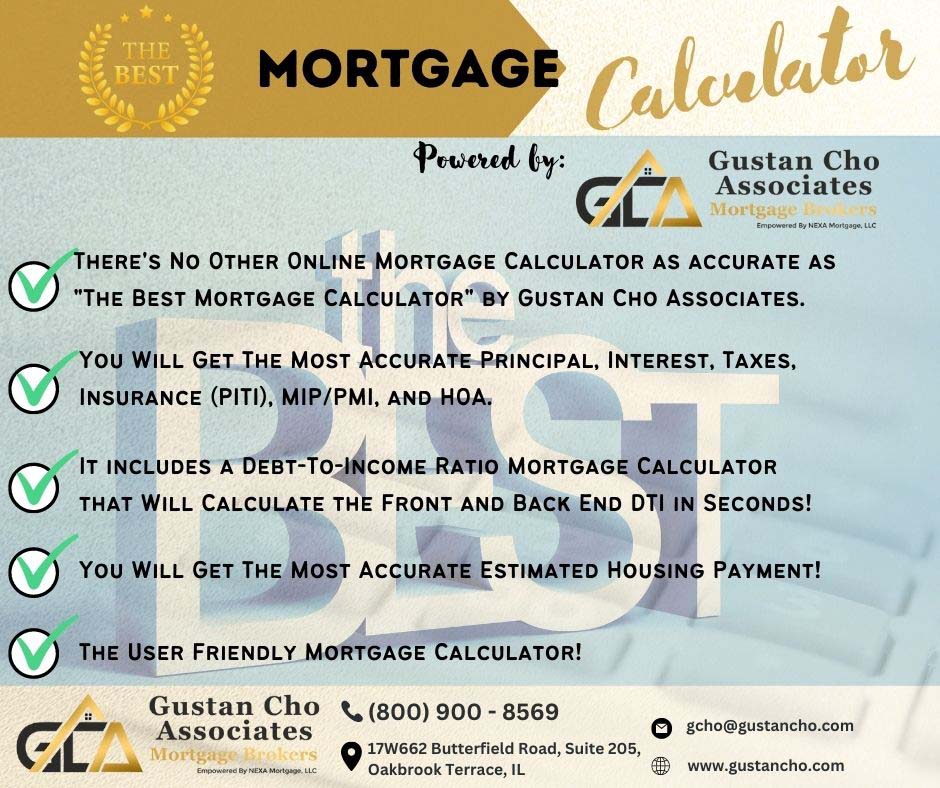

The best online mortgage calculator, which has come out as number one, was designed by Gustan Cho Associates, along with Alex Carlucci and Monica Cho. This calculator is awesome and uniquely designed, but that’s not the only reason it is the best.

Easy to use: It has been designed for all users, whether loan processors, borrowers, realtors, underwriters, or the public.

Wide range of calculations: Most clients who have used mortgage calculators are usually able to compute only the average numbers, but with the following machine, it’s quite different, as it can compute:

PITI, which stands for principal, interest, taxes, and insurance

Payments for housing

Debt-to-Income Ratio Guideline: calculates the low ratio of borrowers to comply with the agency’s guidelines:

Accuracy—This has required rigorous testing, and the result has been the decision that they will enjoy accurate estimates. The home increases reliability and becomes a tool for buyers.

If you want to know how this can help you and how it can assist you, feel free to use the calculator at https://www.gustancho.com/best-mortgage-calculator.

gustancho.com

Best Mortgage Calculator | PITI, PMI, MIP, and DTI

We are at Gustan Cho Associates, You easily check your mortgage eligibility with the best mortgage calculator With PITI, PMI, MIP, HOA, and DTI.

-

It appears you have a lot of work to do since you are about to embark on a major home renovation journey. Well, so below, one can discover several elements of modern decking materials and some aspects that should be considered for your constructive plans for your home as well:

A Brief Description of Decking Materials:

Composite Decking:

Description: Composite decking is made of bonded wood fibers bonded together. It is highly durable and requires little maintenance.

Benefits: It will not fade, stain, or be affected by mold. It also does not need to be cleaned or sealed annually, as normal wooden decking does. Some popular brands are Trexx, Timber Tech, and Fiberon.

PVC Decking:

Description: PVC decking is entirely plastic, making it lightweight and moisture-resistant.

Benefits: It is resistant to many things and has options to dry quickly. It is low maintenance and comes in different designs. Azek has some great-quality ones.

Aluminum Decking:

Description: Aluminum decking is lightweight, resistant to rust, and can withstand extreme weather.

Benefits: Aluminum decking is very durable, resistant to fire, and requires little care. It is ideal for places that see a lot of rain or heavy snow.

Wood Decking:

Description: Cedar, redwood, and pressure-treated lumber are always available.

Benefits: Natural wood may be more appealing, but it is also more work since it needs regular staining and sealing to maintain its longevity.

Other Considerations in the Project

Exterior Work:

Siding: Materials considered for durability and beauty are vinyl, fiber cement boards, or wood.

Roofing: Should you prefer asphalt shingles, metal roofing, or tiles, ensure they are within your budget and style goals.

Windows: Consider investing in energy-efficient windows, as they have the potential to save energy expenditures and improve insulation. The double—or triple-pane types would be better.

Gutters and Downspouts:

Use seamless gutters and maybe consider installing gutter guards, as this would aid in proper drainage and lessen maintenance.

Interior Remodeling:

Kitchens and bathrooms: Consider details like efficient layouts, the workability of good-quality cabinets, and hardwearing countertops. Popular countertop choices are quartz or granite.

Flooring: For best results, consider using laminate, hardwood, and luxury vinyl plank when flooring.

Appliances: Another factor to consider when saving on utility bills is energy-efficient appliances, which help improve kitchen functionality.

Project Management Tips

Budgeting: Cost control can be achieved by making thorough cost estimates for each project in advance.

Prioritization: Based on the urgency of a project, classify it into tenable projects.

Hiring Professionals: For bigger renovation projects, hire an architect or other registered contractors specializing in roofing, plumbing, and electrical work.

Permits: Your region’s building codes should provide answers about permits necessary for bigger works.

It looks like your restoration journey is long but fulfilling! Selecting modern materials and careful planning can improve the utility and appearance of your dwelling. Please follow along with your progress or request tips on any project stage!

-

Tina

MemberOctober 29, 2024 at 3:22 pm in reply to: Commerical, Business And Residential Loans In AlsakaThe licensing of Gustan Cho Associates and Lending Network LLC as mortgage lenders in Alaska has significantly enabled the company to cater to a large pool of borrowers. Here is an outline of the types of loans that they can assist with, as well as the benefits for the consumers when working with them:

Range of services Residential Loans First Mortgage: A conventional loan that is sensitive to the borrower’s credit score and is often in more than one percent down payment.

FHA Loans: Insurance the Federal Housing Administration provides on loans. First-time buyers or those with poor credit may apply.

Veterans Affairs Loans: These loans are available to current and former military members. No down payment is required, and the terms are ideal.

USDA Loans: Loans available to purchase a home in select eligible regions targeting rural homebuyers by providing full finance.

Commercial Business Loans SBA Loans: These are usually offered to business owners, and the Small Business Administration has guaranteed them. They normally have lower down payments, better interest rates, and other terms.

Commercial Real Estate Loans: This type of loan offers options for acquiring or refinancing commercial property. Commercial Loans: These loans are specifically for purchasing commercial real estate, such as office buildings, retail properties, multifamily, etc.

The pros of Gustan Cho Associates and Lending Network LLC: As an Alaskan-based company, they know how the market works in the state and the laws relevant to borrowers looking to operate.

Many Products In A Single Place: Their loan category description translates to granting loans for residential and commercial purposes irrespective of financial condition. They offer a variety of loan products to suit different financial situations and goals.

Quick turnaround time: Due to their customer-oriented approach and experience, the entire loan application procedure might be sped up, thereby making it easier for the loan taker to obtain the desired financing.

Flexible as per your need: In certain instances, they can offer tailored financing, which is important for the borrower’s unique needs or circumstances.

They have already described the services they would provide if a borrower who resides within the state of Alaska seeks to obtain a residential, business, or commercial loan. Do not hesitate to reach out if you have more concrete questions about the loans or their application procedures!

-

The current mortgage business scene is complex, with several factors affecting lenders and their clientele. Below are some insights and considerations regarding this situation.

Current Challenges in the Mortgage Market: A Synopsis

High Mortgage Rates:

There has been a surge in mortgage rates, which have reached a 26-year high, which makes buying convincing for some home buyers to evade the market. More elevated rates increase the monthly payments needed, making purchasing homes impossible.

Federal Reserve Actions Faces Action:

The Federal Reserve has been increasing interest rates over time to combat increasing inflation, thereby raising the cost of borrowing. Such measures, coupled with the high rate of borrowing, will tend to dampen the activity in the housing markets, as most consumers will shy away from purchasing due to the difficulty of getting finances.

Inflation:

Inflation has indeed been one of the greatest influencers of loss in purchasing power, thereby ensuring that required expenses on upkeep or servicing the home can cost much more on the ladder. This economic strain makes it difficult for buyers to plan for new exogenous expenditures.

Rising Home Prices:

There has been a continuous rise in home prices even amidst incremental mortgage rates. This can largely be attributed to the tight level of supply exacerbated by great demand in some regions. Such a scenario can make it rough, especially for first-time home purchasers or those wishing to shift to a bigger house.

It is about Exit Strategy: Loan Originators

Some licensed loan originators may decide not to pursue a career in the current market. The expected drop-off in NMLS license renewal applications epitomizes the predicaments and difficulties anticipated by professionals in this market.

Market Context

Transformation in Buyer Dynamics:

A few potential home buyers will refrain from making purchases and wait days until the rates settle or reduce, which will mean fewer buyers for homes for sale.

Ongoing Wars Among Lenders:

In the event of a market shrinking, lenders must manage by quoting lower rates, making lending feasible, varying the terms, or introducing newer products.

Increased Focus on Refinance Options

Many believe that other homeowners in the future will also consider refinancing if the rate goes down, but presently, most people would still foreclose due to the rate lock from the previous years.

Offering more Adaptation and Innovation:

Mortgage companies would have no choice but to pivot and find alternative ways of doing business, such as targeting niche markets and enhancing customer service, to maintain business.

The Way Forward:

Watch Economic Indicators: To anticipate market changes, it will be important to observe certain inflation indicators, such as the inflation rate, Fed actions, and housing market trends.

Potential Buyers should be enlightened. To make informed decisions, potential buyers should be educated on the present market conditions, the variety of financing options available, and the benefits of one chance at owning a home.

Networking and Collaboration: Loan originators and mortgage professionals should share experiences in these turbulent times.

The mortgage sector has many challenges, but by being resourceful and creative, firms always have something to offer, even in tough markets. Although some of these developments are self-evident, industry professionals and consumers must continue to observe and discuss them. If you have specific questions or topics you are interested in, do ask!

-

Tina

MemberSeptember 14, 2024 at 3:40 am in reply to: How Does Kamala Harris $25,000 Homebuyer Grant WorkThis initiative has no down payment opportunity of Kamala Harris’s $25,000 housing grants for individuals circulates to increase the number of people purchasing homes for the first time. The activity is shown below: Eligibility Criteria:

The considering program is intended for people who have never owned a house before. The target group is low—and moderate-income homebuyers. Upper-income limits and other eligibility criteria may be appropriate for the relevant area council median income.

Assistance Structure:

$25,000 would be provided as a grant or forgivable loan to help meet the down payment and additional costs incurred during the house’s acquisition. This type of assistance can hasten the buying process for many buyers. This is because it reduces the total amount mobilized for borrowers to secure the necessary mortgages.

Local Partnerships:

The program may use local authorities and housing bodies to facilitate the provision of finance to benefit the intended beneficiaries.

Homebuyer Education:

The program might require the participants to undergo some form of home-buying education to help inform them about the responsibilities associated with the home and the mortgage.

Funding Sources:

The program would primarily rely on federal programs because it is directed at providing reasonable housing costs. It would involve budgets or collaboration with private investors.

Impact Goals:

The aim is to increase the ratio of home ownership in general and the mainly ignored groups in particular and deal with the homeownership gap brought about by the hitherto discriminatory injustices.

You should follow the official websites and state news oriented toward this campaign to learn about new campaigns and particular goals related to these issues.

-

Tina

MemberSeptember 14, 2024 at 2:10 am in reply to: What values do you think makes for a healthy relationship?There are some principal values and principles upon which many healthy relationships are based.

Trust is the most important skill to develop in any relationship. It involves being dependable, truthful, and trusting the other person.

Respect:

Recognition of opinions, boundaries of persons, and their version of individuality.

Communication:

- One of the important characteristics of people is how they communicate.

- Clear and reasonable communication is necessary for the parties to understand each other.

- Settle any disagreements.

Empathy:

- Sharing your partner’s feelings and understanding their emotions.

Support:

- Providing support to one another both in normal situations and difficult times.

Compromise:

- The act of actively seeking a middle ground and making joint decisions.

Independence:

- The ability of individuals to remain who they are.

- Develop themselves in the course of the marital relationship.

Forgiveness.

- People make mistakes.

- But there is always a point of contention on whether parties should give room for that and even hurt.

Loyalty:

- Standing up to the parties of the relationship and to the relationship itself.

Honesty:

- There is open communication within people.

- People do not beat about the bush with facts and details.

Equality:

- Laying unfair expectations on one another.

- Ensures fair play with responsibilities.

Kindness:

- Consideration and compassion towards the others’ psycho-emotional state.

Patience:

- Acceptance of the fact that forming a relationship between two parties is often a gradual process.

- People have a tendency to transform.

Intimacy:

- Cuddling, physical involvement.

- Emotional closeness.

Common values and aspirations:

- The possibility of working together.

- There is a consensus about the way life should be lived.

The shared values in a relationship form a firm, safe, nurturing foundation. It must be understood that every couple’s relationship is different, and what values each partner considers the most important individually and when partnered should be voiced.

Do any of these values need to be explained further, or do you want to know how they are implemented?

-

Tina

MemberSeptember 14, 2024 at 1:59 am in reply to: What Credit Scoring Model Do Mortgage Lenders UseThis is an interesting and revealing set of questions about credit reports and the role credit scores play in mortgage finance. Now, let’s analyze this in several ways:-

Credit Scoring Models Used by Mortgage Lenders

The majority of mortgage lenders utilize FICO scores instead of VantageScores.

Narrowing the strategies employed, they tend to employ earlier generations of Vantage score:

- FICO 2 (Experian).

- FICO 4 (TransUnion).

- FICO 5 (Equifax)

FICO and VantageScore

- VantageScore is rarely used to make mortgage lending decisions.

- FICO scores are usually lower than Vantage Scores, but this is sometimes true.

- This range of divergence is further extended when VantageScore is compared with FICO score across different credit profiles.

FICO Versions

However, while FICO 8 is the most common version for cards and other types of cards, as mentioned, I find mortgage lenders reverting to the older versions.

Particular Loan Programs and Score Models

- FHA, VA, USDA: Most government-assisted loans apply to the old FICO models.

- Fannie Mae and Freddie Mac: Again, use the old FICO models.

- Non-QM loans: This will depend upon the lender.

- However, many still utilize FICO scores, such as Fair Isaac Corporation.

What Is A Good FICO Score For Mortgages?

- A good standard to follow in assessing one’s eligibility for creditworthiness for mortgage loans is to consider a score of 620 or more as adequate for all conventional mortgages.

- 580 is usually the minimum credit score for FHA insurance loans with a 3.5 percent down payment percentage.

- More often than not, scores above 700 would be associated with more favorable interest rates.

- On average, most borrowers with scores of 740 and above will be offered the best rate.

FICO Scoring History:

- In this context, conforming loans must stick to these old versions for the mortgage market.

- This standardization assists in underwriting and secondary mortgage markets.

- While credit scores sit on top of a mountain of considerations, they are not the only thing that will get you a mortgage.

- Calculations such as the debt-to-income ratio, employment history, available assets, and many others come into play.

The appropriate department for obtaining a specific mortgage trust score with maximum commercial utility includes bankers and providers of targeted acumen ratings denoting accurate subtype. Most credit monitoring services cover VantageScores and more updated FICO scores because these are not the usual things mortgage lenders look at.

-

Tina

MemberSeptember 14, 2024 at 3:49 am in reply to: How Does Kamala Harris $25,000 Homebuyer Grant WorkKamala Harris’s down payment assistance program is income-based. It uses several factors to determine their whittling income ceilings. They consider, for example, the median income of a particular geographical area and family size. Most of these programs target below 80% of the area’s median income. Nevertheless, the policies on the cutoffs tend to differ.

Income limits obtained by collateralized assets qualification must be justified. Thus, the following should be considered the most resourceful in this regard:

Local Housing Authorities: They handle your area, and as evident, your locality will most likely have some programs with different eligibility criteria.

Federal Housing Programs: The federal Programs have some independent arms organizing them, one of them being HUD, which has details on income caps of some of the programs.

These could be useful if interested in a certain area or program.