-

Discussions tagged with 'Florida housing market'

-

Florida has three different types of down payment assistance program for homebuyers including the HERO DPA home purchase program. Gustan Cho Associates dba of NEXA Mortgage is to be able to offer down payment assistance to Florida homebuyers.

-

This discussion was modified 12 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 11 months, 3 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 12 months ago by

-

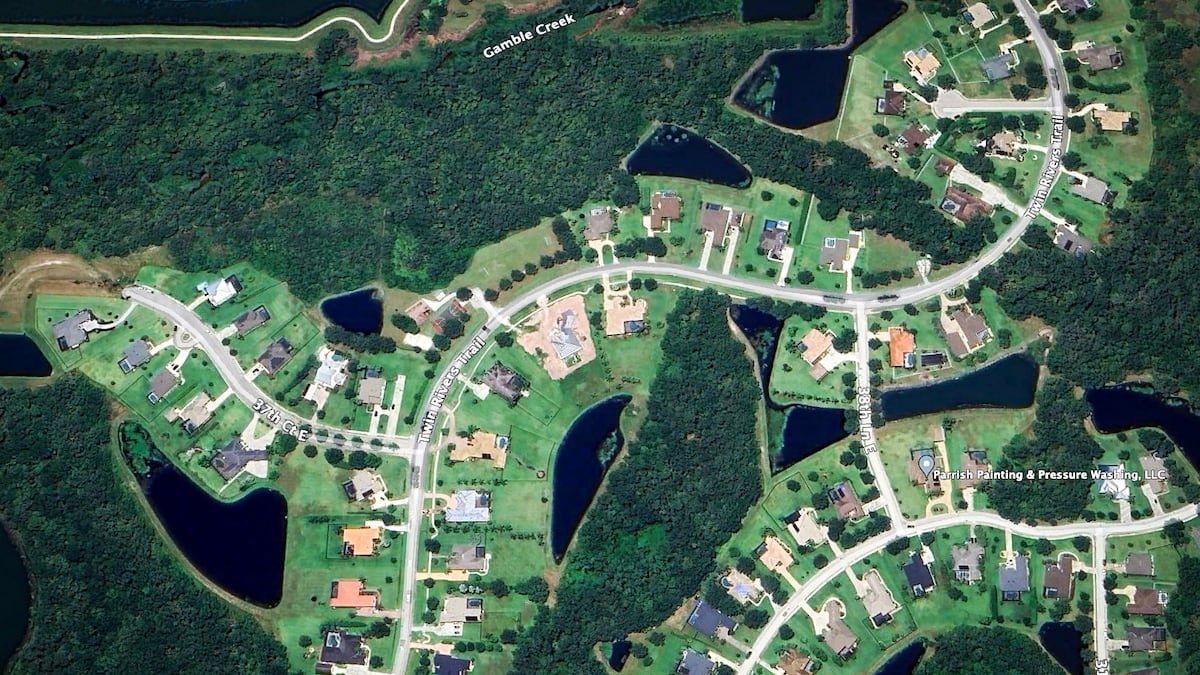

One hundred seventeen thousand homes in Florida are currently for sale, and many of these properties are owned by large corporations. Some homeowner associations (HOAs) for these properties are based in Texas.https://www.tampabay.com/news/business/2024/08/22/florida-homes-owned-by-corporate-investors-117000-counting/

tampabay.com

Florida homes owned by corporate investors: 117,000 — and counting

Experts say investors capitalized on the state’s population growth and minimal renter protections.

-

When it comes to insurance policies, insurers need to make sure they’re covering their bases. One of the ways they do this is by conducting insurance inspections and ensuring that the policyholder meets their underwriting criteria.

An insurance inspection, whether conducted by the insurance company or a trusted third-party inspector, is a comprehensive review of a property or asset. It meticulously determines its value, condition, and potential for risk. The results of this diligent inspection provide the insurer with a clear understanding of the risk associated with the property or asset, enabling them to offer the most appropriate coverage and premiums.

Meeting underwriting criteria is a crucial factor in getting approved for an insurance policy. Underwriting criteria are the set of guidelines insurers use to determine a policyholder’s eligibility. This includes factors like the individual’s credit score, age, occupation, and health status.

For example, if you’re applying for a life insurance policy, the insurer will want to know your age, whether you smoke, and whether you have any pre-existing medical conditions. Based on this information, they will determine your risk level and offer you an appropriate coverage plan.

Insurance inspections and meeting underwriting criteria go hand in hand. Insurers use the information gathered from a property inspection to determine the risk level of the asset, which in turn helps them determine the premiums they will charge. Similarly, underwriting criteria help the insurers understand the risk level of the policyholder, which plays a significant role in determining the policy’s cost.

In conclusion, insurance inspections and meeting underwriting criteria are not just processes; they are opportunities to be an active participant in your insurance coverage. They help insurers understand the risks associated with the property or asset they are insuring and the individual they are covering. As a policyholder, your transparency and provision of accurate information are key to ensuring you’re getting the coverage you need.

-

Housing inventory levels in Florida have seen a significant increase recently after years of extremely tight supply. Here are some key points about the rising inventory situation in Florida’s housing market:

- Sharp inventory rise: According to data from Florida Realtors, the inventory of active listings in Florida was up over 85% year-over-year in March 2023. This translates to around 4-5 months’ supply of homes for sale in many markets, compared to 1-2 months during the pandemic frenzy.

- Seller influx: More homeowners in Florida are listing their properties for sale, driven by factors like the desire to cash in on high home prices, concerns about missing the peak of the market, or life changes necessitating a move.

- New construction impact: An increase in new home construction over the past couple of years is also contributing to higher inventory levels across different price points.

- Investor selling: Real estate investors who bought properties during the housing boom are now offloading some of their holdings in anticipation of a market cooldown.

- Regional variations: While inventory is up statewide, the increase is more pronounced in some areas like Tampa, Orlando, and Miami, compared to others like Jacksonville.

- Price adjustments: With more choices for buyers, properties that are overpriced or less desirable are sitting longer on the market, prompting some sellers to reduce asking prices.

- Moderating sales: Higher mortgage rates and economic uncertainty have led to a moderation in home sales activity, further contributing to inventory buildup.

The surge in housing inventory in Florida provides more options for buyers who had been frustrated by the intense competition and lack of available homes during the pandemic boom years. However, it also signals a market shift that real estate investors and sellers need to navigate carefully.

Viewing 1 - 4 of 4 discussions