-

Discussions tagged with 'Gustan Cho Associates'

-

The Great Community Authority Forums, specifically known as the GCA Forums, is powered by Gustan Cho Associates. This forum serves as a platform for discussions on a wide range of topics, primarily focused on mortgage and real estate but also includes general community assistance and various other subjects like insurance, automotive, and more. Members can engage in topics ranging from FHA and conventional loan guidelines to mortgage rates, and there’s also a section for classified ads related to real estate and mortgage services.

The forum features various utilities such as mortgage calculators, FHA loan limits, and information on conventional loan limits. Members can also inquire about real estate and mortgage careers through designated sections for realtors and mortgage loan officers. Moreover, the forum provides links to subsidiary sites offering specialized services in real estate and mortgage brokering.

For those interested in diving deeper into specific topics like the differences between different mortgage companies such as AXEN and NEXA Mortgage, the forum hosts detailed discussions where experts like Michael Neill contribute insights on the intricacies of mortgage lending practices (GCA Forums) (GCA Forums) (GCA Forums).

If you’re looking to explore this forum or require more detailed information, you can access it here.

-

Gustan Cho Associates and Subsidiary Sites:

Gustan Cho Associates Mortgage Group (NMLS 2315275) is a dba of NEXA Mortgage (NMLS 1660690). Licensed in 48 states (MA & NY pending), including Washington, DC, Puerto Rico, The U.S. Virgin Islands, and Guam, NEXA Mortgage ranks as one of the largest, if not the largest, in terms of licensed loan officers and volume, mortgage broker, and correspondent lenders in the Nation.

Scope of Work and Mission

Gustan Cho Associates assists borrowers with business, commercial, and residential loans. Not only does Gustan Cho Associates offer competitive rates, but over 80% of our borrowers are folks who could not qualify at other mortgage companies due to overlay or the lenders not offering the mortgage loan program for the borrower. This fact-checked statement confirms that the competition has nothing to say. With a lending network of 280 wholesale lenders (not including commercial lending programs) licensed in 48 plus states, with very competitive rates, it will be difficult, if not impossible, for the competition to come close.

A One-Stop, All-in-One Mortgage Superstore

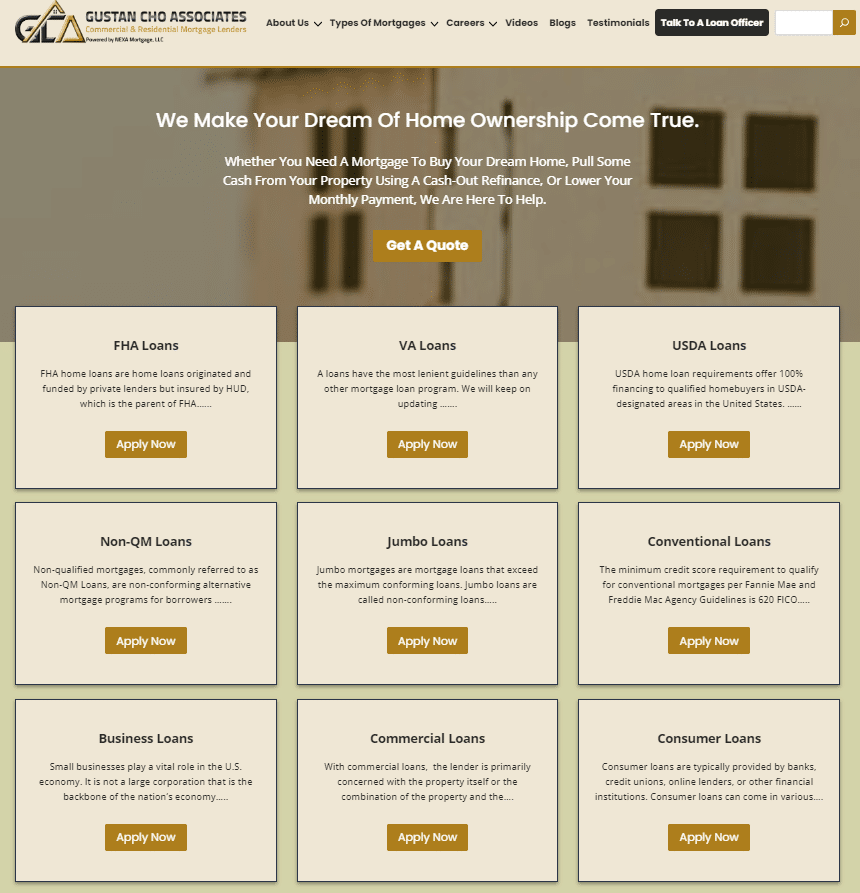

Consumers often ask mortgage companies what they specialize in. This is a great question. The valid answer differs for each mortgage lender. There are mortgage lenders that specialize only in non-QM loans. Other lenders do not touch government and conventional loans. Credit unions often only offer conventional loans and not government-backed loans. Most mortgage companies do not offer any business or commercial loans. Gustan Cho Associates has a national reputation for being an all-in-one, one-stop national mortgage superstore.

Below is a comprehensive description of the company:

Core Services and Loan Products Traditional Mortgage Products

Conventional Loans:

- Conventional loans are offered to people with good credit ratings as they fall under prime loans.

- Fannie Mae and Freddie Mac are included in this class.

FHA Loans

- FHA Loans help mitigate poor credit scores, such as those of self-employed clients with a high debt-to-income ratio.

VA Loans:

- These home buyers are veterans or current service members and don’t have to make a down payment.

USDA Loans:

- The requirements for these loans are comparable to those for VA and FHA loans, except no down payment is required to qualify.

- However, they are restricted from purchasing a designated home in rural land.

Non-QM Loans

Bank Statement Loans:

- Bank statement loans are for self-employed individuals with sufficient cash flow to maintain normal income verification requirements but who do not reach them.

DSCR (Debt-Service Coverage Ratio) Loans:

- DSCR loans are aimed at real estate investors who want to include rental income in the qualification requirements.

No-Doc Loans:

- This type of loan is granted without requiring borrowers to provide proof of income, so the income level does not matter.

- It was created for those with high liquidity or who are self-employed.

ITIN Loans

- ITIN loans allow people to purchase a house without legal permission from U.S. residents. This class includes illegal immigrants.

Specialty Loan Products

Fix-and-Flip Loans

- Short-term loans are used by those who purchase property that must be renovated and sold.

Construction Loan

A construction loan seeks to finance the sequential construction of a building for builders and homeowners.

- The same doing on its level may again be within a construction context, taking a scope and developing a new building.

Construction to Commercial Loans

- Among more common, CCC or construction to-commercial is its divergence from the more common form of building construction on which many construction firms focus heavily in today’s market.

- Lenders design a construction loan for homeowners wishing to build a home on a piece of land, directing funds exclusively to finance construction projects.

Commercial Loan

- With a commercial loan, the financing covers the purchases or refinancing of multifamily units, mixed commercial, real estate development, and a few other commercial projects.

Hard Money Loans:

- For this profile of borrowers desperate for capital recall, these loans make the transition between lenders despairing and lenders friendly owing to extreme urgency.

Key Features and Differentiators:

From the credit history aftermath of banks shunning these borrowers with low scores, GCA Mortgage Group differentiates itself with various features. It has gone as far as having borrowers with surrounding credit scores of less than five hundred or those wishing to graduate from their debts that were toilets and earlier bankrupt, and lenders aid them in earning months ago.

Private lenders commonly impose and/or usually expect their borrowers to have as overlays any restrictions they wish to impose on them. However, they do not infringe on the agency rules, which Fannie Mae, Freddie Mac, FHA, VA, and USDA tend to comply with.

Gustan Cho Associates is a prominent national mortgage company with a team of government experts, conforming, nonqualified, and nonqualified mortgages. It currently ranks best in the industry due to its extensive range of self-employed businesses and mortgage solutions for investors and borrowers.

GCA Mortgage Group is in various parts of the country, with licenses in multiple states.

Ortal only provides unparalleled service to its customers. At the same time, GCA has gained recognition in the market for its fast and clear solutions.

Social Media

Website:

- Gustan Cho Associate claims it is the best platform for applying for a loan.

- It is important for borrowers because it has many informative resources, such as qualification requirements, loan plans, and blogging content about mortgages.

GCA Forums:

- A GCA Forum aims to bring customers and professionals together to discuss their mortgage needs and other experiences in the sector.

Educational Content:

- Blogs, videos, and guides on fixing credit, declaring bankruptcy, non-QM loans, and purchasing a home enhance search optimization.

Leadership

- The firm is operated by professionals who possess relevant industry expertise and many years of practice:

Gustan Cho:

- Gustan, a veteran mortgage expert, is the founder and chief motivator of the company.

- He has a vast wealth of experience and particularly aims to assist unbanked borrowers, which, in combination with GCA Mortgage Group’s reputation, has been the primary driver of innovation.

Target Audience

Low Down Payment First-Time Homebuyers:

In addition to providing almost no down payments, we guide first-time homebuyers through the entire home-buying process in depth.

Credit-Challenged Borrowers

People who already owe loans but have experienced some bad credit history or faced some bad financial events are the kind of audience GCA targets.

Self-Employed Applicants

Programs that don’t require extensive documents and use a few techniques like self-reporting are acceptable.

Property Investors: Targeting the investment market with various products, including DSCR and fix-and-flip loans.Investors in Commercial Real Estate: Multifamily, mixed-use, and commercial properties are collateral-based loans.

Customer Testimonials

The borrowers of GCA Mortgage Group gave the following compliments:

- Responsiveness. The pre-approval process takes less time, and consultations can be conducted on the same day.

- Expertise. I have good knowledge of niche lending programs and other related underwriting programs.

- Advocacy. Effects of Trying to Get More Approvals in Difficult Circumstances.

Vision and Mission

The company’s vision is to increase the volume of the target market for home ownership. Its purpose is to facilitate the broad spectrum of potential borrowers by providing various inventive, flexible, and simple mortgage products while enhancing its citizens’ economic literacy and quality of life.

You can contact them through their team or websites to browse through different loan options and get more personalized assistance.

-

When you see market with such high rates – your reaction be like ! yet we can work together and get to finish line !!

0:07

-

Look at this video clip of an Angel

-

Gustan Cho Associates has a national reputation for being able to do mortgage loans other lenders cannot do. What makes Gustan Cho Associates different than the competition? Over 80% of the borrowers of Gustan Cho Associates are folks who could not qualify at other mortgage companies. How can I find out more about Gustan Cho Associates and get introduced to a mortgage loan officer. Gustan Cho Associates is a one-stop lending shop. They are experts in business funding, commercial loans, and traditional and alternative residential mortgage loans.

-

Stayed tuned, people. We create, design, and develop a one-stop lending shop mortgage loan officer website. This one-in-all marketing-support-operations-business-development mega website is for select loan officers who want to be in the top 20% of the nation and belong to a team of winners. Many talented goal-oriented folks want to become top-producing loan officers but do not have the guidance, training, tools, and direction to lead them there. After a decade of research and development, making thousands of fixes, and making thousands of hours of mistakes, my team and I have mastered a mega one-stop lending shop. Training a loan officer is one of the most difficult tasks there is. There is no sure proof training program in the market place. The best way to learn to become a successful loan officer is by getting trained by a mentor. Training a loan officer is like training an attorney. Say a young lawyer graduates from an IVY LEAGUE LAW SCHOOL like Harvard, Yale, Princeton, or Stanford Law School. The young, newly law school graduate masters the Bar Exam and is now licensed to practice. What NOW? How is he or she going to represent clients in court, let along simple parking tickets or simply real estate closings? Same with loan officers. You will be clueless and lost. So the best way to train a young recruit loan officer is to take a few steps backward to go forwards. A newly licensed loan officer should not even do a single loan until they have processed three to six loans themselves under the supervision of a loan processor. The loan officer will never become a master mortgage processor and I do not recommend they be one if they want to originate loans, but loan officers will be working very closely with mortgage processors on every single loan. To this day, most loan officers are clueless on how mortgage processing works and often bitch and degrade mortgage processors if shit does not go your way. Master processing, at least how it work, before you proceed to originating. In the system we will have on http://www.viralwebsitedevelopers.com, we will have a detailed training section on processing and how mortgage processing works. Once you have the basics on how mortgage processing works, the next step is to learn origination. So one of the frequently asked questions is do I need to memorize all the mortgage guidelines before proceeding. The answer is NO. There is no way you will learn and know all of the FHA, VA, USDA, FANNIE, FREDDIE, and NON-QM mortgage guidelines. Learning the guidelines is not enough. Every lender has their own lender overlays. Lender overlays are additional mortgage guidelines above and beyond the minimum guidelines of HUD, VA, USDA, FANNIE MAE, and FREDDIE MAC. However, every loan officer should know the basic agency guidelines on government and conventional loans. Everything you need to know, you can find it on http://www.gustancho.com. AGAIN, loan officers should get familiar with the basic guideline but no need to memorize it. You will go back to it often. Again, all the guidelines will be on the master website from Viral Website Developers. Remember, our mission at Viral Website Developers is to create a one-stop mortgage lending online shop with your very one virtual digital media website. So, the next step for brand new loan officers are loan officers transferring to Gustan Cho Associates on a branch level or an independent loan officer sponsored by a member of the Gustan Cho Associates family is getting leads. Again, your newly assigned one-stop shop lending virtual mega loan origination website will have an organic lead generation system which will grow and add more value as it seasons with age and content. I will continue this part at the next time I am able to continue.

-

This discussion was modified 2 years, 8 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 2 years, 8 months ago by

Gustan Cho. Reason: Updates

Gustan Cho. Reason: Updates

-

This discussion was modified 2 years, 8 months ago by

-

“Best Rate: Call Now” “No Hidden Fees” “4% Interest With Our Lender.”

We have all seen the ads for mortgages. How do you know who to choose? Quicken Loans made everything sound so easy and appealing when refinancing, until you got the final documents and they overcharged you on closing costs. My wife and I had been shopping for a new home since last June. We found a great realtor who was honest and had our best interests in mind. Next was to find a lender; we did, but something came back negative on our credit report that couldn’t be disclosed. We were denied a mortgage, and this baffled us. We sent for credit reports over the next few months, but nothing was resolved. We applied again and had the same initial results at first. This time, we applied through Gustan Cho Associates. He noticed right away what the problem was. Instead of turning us away, he and his team worked diligently to get a resolution. It was a nightmare; we had a time share at one time and sold it back. The deed in lieu of foreclosure was documented. Somewhere, somehow, the time share listed us as a foreclosure. Gus sorted through everything and signed us with his company, and that was not an easy task.

Since Gus and I have become good friends, our love of dogs and fellow men has forged a friendship. Knowing I was a writer and knew a lot about food and wine, he asked me to help with his forum. I accepted since he had been so instrumental in our mortgage. Over time and in conversations, he explained his philosophy of business. I listened at first the best I could to all the topics about finance and loans, which were all Greek to me. He explained every step, and soon I began to learn.

His foundation is solid. After losing a fortune, gaining a fortune, and losing again, he learned the very first lesson. Try again! Einstein said, “The sign of a true idiot is someone who does the same thing over and over again with the same results.” Gustan had to reinvent himself. Gustan’s mantra is “failure is the best teacher.” When Gustan reestablished his mortgage business, he did what no other lender would do: he gambled on people with low credit ratings and gave them a mortgage and a chance at life. He cared about each person.

This was the start of building a new foundation. The first building block was trust. Although Gustan had trusted in the past and had been wrong, he continued to follow his heart through humanity. His philosophy was to believe in the people, not the process. The second building block was transparency. No confusion in contracts; everything is out in the open.

When my wife and I were looking at new homes, I called Gus and told him a builder was offering 4.5% on a mortgage, and he responded, “Be careful, Peter, there are a lot of hidden costs, and if they can offer you a better deal, take it.” Of course he was right; there were many hidden costs. Gus was looking out for me, the person.

Family values were the third building block. Belief in family and God may be the foundation for all of us. Honesty is another building block. Do not lie; it will only catch up with you later. Integrity is always important, as is doing the right thing. And I think the most important building block was having his workers, whom he calls his team, take ownership of the business. He has the respect of his team. Work smart and streamline; make everything clear and transparent.

Enjoy what you do, or don’t do it.

Make Cho your choice for a mortgage, Choose Cho!

-

Next week, Gustan Cho, President of Lending Network, Inc. is going to announce the roll out of the commercial lending programs Lending Network LLC. Gustan Cho will be launching and finalize our commercial lending platform with NEXA Mortgage and AXEN Mortgage. The merger with NEXA/AXEN and Lending Network LLC will be a game changer for NEXA Mortgage loan officers and for recruiting nee loan officers. Stay tuned. For more information please click Lending Network, https://www.lendingnetwork.org/

-

This discussion was modified 1 year, 8 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 11 months, 3 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 8 months ago by

-

What is Gustan Cho Associates? Gustan Cho Associates is the parent company of GCA stand for Great Community Authority (GCA) FORUMS and dozens of subsidiaries and affiliate partners. We are a not-for-profit information and resource center of mortgage and real estate content. We do not sell viewer information nor sell leads. Our support, operations, and licensed staff originate, process, and close all inquiry leads in house or refer them to reputable member partners. Our moderators and advisors have a track record of being able to qualify, approve, and close mortgage loans other lenders cannot do. Gustan Cho Associates power GCA stand for Great Community Authority (GCA) FORUMS and its sub-forums.

-

This discussion was modified 3 years ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 3 years ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 3 years ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 2 years ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 11 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 6 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 5 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 3 years ago by

-

NEXA Mortgage has revenue share which is residual income for loan officers and employees for NEXA Mortgage. Residual income is an override of every loan officer they recruit who does production. The residual income is through revenue share of loan officers monthly revenue and it goes down three levels. CEO Mike Kortas does a Zoom webinar live every Thursdays at 11 am Arizona time. It is a live Q and A for all loan officers who are interested in joining NEXA Mortgage. I have been with NEXA Mortgage going on two years come February 24th, 2024 and I can attest that CEO Mike Kortas is the real deal. We have a rock solid Chief Executive Officer and with that, we have a rock solid foundation. It is hands down better to take a few steps backwards to go forwards and make sure whatever you do, make sure you have a solid foundation. Anything with a weak foundation will not last. You can build a multi-million dollar home in a cracked foundation and it is not if it will crack but when it will collapse. I have been in the mortgage industry since 2012 and was a real estate investor and developer since 1998 and I have never met so many scumbags in any industry like the mortgage industry. Most CEOs of mortgage companies will tell you one thing and not honor their word in a matter of months. CEO Kortas has honored every single word he has said or promised. Never in my career have I ever met such a man of integrity, honor, and fairness like CEO Michael Kortas. With a strong foundation, you can rest assured you have the keys to your destiny in the mortgage industry.

https://gustancho.com/mlo-revenue-share-residual-income/

gustancho.com

MLO Revenue Share Residual Income For Loan Officers

Loan officers at Gustan Cho Associates will have the opportunity to participate in the MLO Revenue Share Residual Income, up to $3 million down.

-

Many mortgage companies do not allow real estate agents to become loan officers at their mortgage company. Licensed realtors need to surrender their real estate license and put the real estate license in hibernation if the mortgage lender is going to sponsor them. This is not the case at NEXA Mortgage. Realtors can become loan officers at the same time and can represent their homebuyers as their loan officers on the same transaction. Here is the blog that was posted on this matter:

https://gustancho.com/can-realtors-be-loan-officers/

-

This discussion was modified 1 year, 10 months ago by

Gustan Cho.

Gustan Cho.

gustancho.com

Can Realtors Be Loan Officers at the Same Time?

Can Realtors Be Loan Officers and make money on the same transaction? The dual realtor/MLO gets compensation as the realtor and loan officer.

-

This discussion was modified 1 year, 10 months ago by

-

Gustan Cho Associates (NMLS 2315275) and its affiliates is a dba of NEXA Mortgage (1660690), the largest mortgage brokerage in the nation. follow Fannie Mae’s DU AUS and LP AUS. They are renowned for having little to no lender overlays. Mortgage loan customers dealing with judgments, open collections, foreclosures, tax liens, overdrafts, and late payments have all benefited from my assistance. People with credit scores below 600 FICO can receive assistance from the Gustan Cho Team at Gustan Cho Associates, and the lowest credit score borrower I can assist is one with a 500 FICO. 10% of the purchase price is needed from people with credit scores between 500 and 580. A 3.5% down payment is needed for credit scores higher than 580 FICO. I work with consumers whose mortgage loans have been rejected by other lenders because of their overlays for a significant portion of my business. Suppose a borrower signs their 1003 mortgage application and provides me with the necessary documentation.

In that case, I can often give them an official mortgage approval in less than a day. The Gustan Cho Team at Gustan Cho Associates typically closes my loans in three weeks or less. Under the direction and guidance of Sapna Sharma, Gustan Cho Associates’ Chief Technical & Marketing Officer, the company’s marketing division maintains partnerships with real estate experts. Love. Gustan Cho Associates is accessible seven days a week. I get in touch with realtors all the time. To connect with customers, realtors, mortgage brokers/bankers, insurance agents, appraisers, attorneys, and other professionals, please visit me at http://www.gustancho.com and join our forum at http://www.lendingnetwork.org. Our in-house IT department will jointly promote open homes and recommend certain realtors to pre-approved clients looking to buy or sell a property as part of NEXA Mortgage’s collaboration program with realtors. Get in touch with me for further information. Gustan Cho Associates is a reputable mortgage company that offers various services, including mortgage loans for various scenarios, debt consolidation and credit restoration, and personalized support throughout the loan application process. One of the main reasons to choose Gustan Cho Associates is their reasonable prices, quick and efficient loan approval process, and commitment to customer satisfaction and support. Regarding your mortgage requirements, it is recommended that you consider Gustan Cho Associates. They offer debt reduction and credit repair assistance, personalized loan application assistance, and reasonable loan rates. Their commitment to customer satisfaction and support makes them a reliable mortgage lender, and they provide contact information for further assistance.

I. Overview of Gustan Cho Associates in Brief: Their Services Explained Selecting a trustworthy mortgage provider is crucial.

II.Gustan Cho Associates’s past customer testimonies and reviews; the company’s history and establishment; the team’s expertise and experience

III. Gustan Cho Associates’ Services are available for FHA, VA, conventional, and other types of mortgage loans. They also provide assistance with credit repair and debt consolidation. They also provide personalized assistance with the loan application procedure

IV. Motives for Selecting Gustan Cho Associates: Reasonably priced loans and interest rates A prompt and effective loan approval procedure A dedication to ensuring client assistance and happiness

V. Summary: An overview of the significance of choosing a trustworthy mortgage lender. Your mortgage needs should be carefully considered while considering Gustan Cho Associates. Information on whom to contact in the event that you need further support or details Assistance with credit repair and debt consolidation Personalized assistance with the loan application procedure Reasons to Select Gustan Cho Associates IV: Reasonably priced interest rates and loans Ensuring client pleasure and assistance via a fast and efficient loan approval procedure.

VI. Summary: An overview of the significance of choosing a trustworthy mortgage lender. Your mortgage needs should be carefully considered while considering Gustan Cho Associates. Gustan Cho Associates provides support with loan applications, debt reduction, and credit restoration, in addition to affordable interest rates. As a trustworthy mortgage lender, they provide contact details for further help and demonstrate a strong dedication to client satisfaction and support. Gustan Cho Associates is a reputable mortgage provider offering services such as FHA, VA, conventional, and other types of mortgage loans, credit repair and debt consolidation assistance, and personalized loan application assistance. The company’s history, expertise, and experience are highlighted. Reasons for choosing Gustan Cho Associates include reasonably priced loans and interest rates, a prompt and effective loan approval procedure, and a commitment to customer satisfaction and happiness. They provide support with loan applications, debt reduction, and credit restoration, along with affordable interest rates. Customers can use their contact details to contact Gustan Cho Associates for further support, and they can demonstrate a strong dedication to customer satisfaction and support. The company’s commitment to customer satisfaction and support is evident in its commitment to providing the best possible service to its clients.

The Gustan Cho Team at Gustan Cho Associates has licenses in most 50 states. Contact Gustan Cho seven days a week, nights, weekends, and holidays, at 800-900-8569 or mobile at 262-716-8151.

-

This discussion was modified 1 year, 11 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 11 months ago by

Gustan Cho.

Gustan Cho.

gustancho.com

GCA Mortgage | Mortgage Experts With No Overlays

Whether you’ve gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans

-

This discussion was modified 1 year, 11 months ago by

Viewing 1 - 13 of 13 discussions