-

Discussions tagged with 'Hard Money Loans'

-

NEXA Mortgage LLC now offers 100% acquisition and renovation investment property loans. Needs to have a after improved value of 65% LTV.

-

This discussion was modified 2 years, 4 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 2 years, 4 months ago by

-

Gustan Cho Associates and Lending Network LLC are Mortgage Lenders licensed in Alaska and can help borrowers who need residential, business, and commercial loans.

-

Cameron LeClair just told me about their great rental financing program for first-time real estate investors and Donal Trump wannabees. Cameron is a wholesale account rep at The LENDER. The Lender has creative financing programs on non-QM loans. This month’s special at The Lender is Their No-Doc 25% down payment rental property financing program with no DSCR, no income verification, and no doc. It is like a hard money loan but non-hard money fees and LTV. First-time investors are allowed from $150,000 to $2 million. This month’s special is no points on rate, and only the borrower paid compensation at 1.5%. Contact Cameron LeClair at The LENDER. Here is a blog written by Dale Elenteny on investor cash-flow financing on rental properties:

https://gustancho.com/investor-cash-flow-financing-for-rental-properties/

gustancho.com

Investor Cash-Flow Financing For Rental Properties

Gustan Cho Associates offers the no-doc Investor Cash-Flow Financing For Investment Properties where we just underwrite the rental property

-

If you are a builder of one to four unit homes, we can get you a 25% down payment on the land and up to 100% on the construction costs at competitive rates and fast closing. No credit score required, no maximum debt to income ratio, and no income verification. Please inquire if you are interested in getting new construction financing on spec homes

-

Builder and Developers can get hard money loans. Land acquisition and construction loan. 25% down payment and up to 100% construction. No credit scores, no debt to income ratio, no income. No DSCR, NO RED TAPE. FAST CLOSINGS. For one to four units residential non-occupant projects.

-

Commercial lending is such a broad field. Most commercial lenders are specialists on certain types of commercial loans. For example, some loan officers only specialize in SBA loans. Other commercial loan officers only do hard money loans. Yet, other commercial loan officers only limit to factoring or accounts receivables. One of the main benefit http://www.lendingnetwork.org differs from the competition is that lending network is a one-stop-commercial lending shop.

-

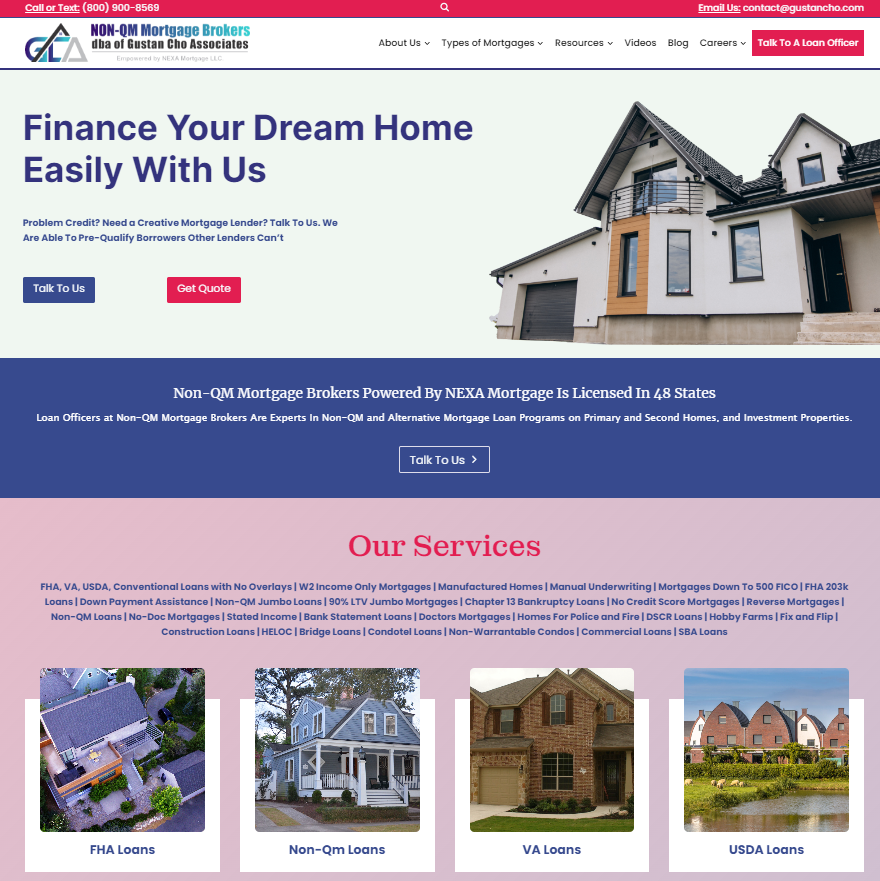

Non-QM Mortgage Brokers is a national mortgage broker and correspondent lender licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. Non-QM Mortgage Brokers is a wholly-owned subsidiary of Gustan Cho Associates, Inc. Gustan Cho Associates, also referred to as GCA Mortgage Group NMLS 2315275 is a dba of NEXA Mortgage, LLC NMLS 1660690, the nation’s largest mortgage broker and correspondent lender with nearly 3,000 licensed mortgage loan originators and equally number of support, operations, and third-party independent contractor service providers. Non-QM Mortgage Brokers specialize in providing mortgage options for individuals who may need to meet the standard lending criteria set by the Consumer Financial Protection Bureau (CFPB). Licensed mortgage loan originators at Non-QM Mortgage Brokers offer more flexible mortgage loans regarding income and credit requirements, which can benefit borrowers such as business owners, self-employed individuals, and gig workers.

Here are some key features of non-QM loans:

Flexible Income Documentation: Borrowers may use alternative methods, such as tax returns, bank statements, or 1099s, to demonstrate their ability to repay the loan.

Higher Debt Limits: Some non-QM loans allow for debt-to-income ratios over 50%, compared to the standard 43%.

No Waiting Period After Bankruptcy: Certain non-QM loans do not require a waiting period after bankruptcy or foreclosure, enabling quicker access to a mortgage.

Higher Down Payment Requirements: Non-QM loans often require a larger down payment, typically between 15% to 20%.

Higher Interest Rates: Due to the increased risk associated with these loans, non-QM mortgages usually come with higher interest rates.

If you’re considering a non-QM loan, it’s important to shop around and compare offers from different lenders to find the best terms for your situation. Remember that while non-QM loans can provide a path to homeownership for those who don’t qualify for traditional mortgages, they also come with higher costs and risks. It’s advisable to consult with a financial advisor or mortgage broker to understand all the implications before proceeding. Non-QM Mortgage Brokers is the nation’s largest mortgage broker of non-qualified mortgages. For more information, visit us at Non-QM Mortgage Brokers, Inc. at

https://www.non-qmmortgagebrokers.com/

non-qmmortgagebrokers.com

Home - Non-QM Mortgage Brokers

Finance Your Dream Home Easily With Us Problem Credit? Need a Creative Mortgage Lender? Talk To Us. We Are Able To finding The Perfect Mortgage For Your Dream Home Find A Lender With Us Fill out the form by click … Continue reading

-

Buying rental properties with hard money loans is a great idea if you need to renovate the property. Hard money loans are easy and fast to get approved and closed. Most hard money lenders like to extend a one-year term on hard money loans. Here is a blog on buying rental properties with money loans on Gustan Cho Associates. It is a comprehensive blog on buying rental properties with hard money loans. https://gustancho.com/buying-rental-properties-with-hard-money-loans/

-

This discussion was modified 1 year, 8 months ago by

Gustan Cho.

Gustan Cho.

gustancho.com

Real Estate Investing Mortgage Loan Programs For Investors

Real estate investing comes with risk. Rewards can outweigh the risks. The acquisition price is the key most important factor for property investors.

-

This discussion was modified 1 year, 8 months ago by

-

Small Business Administration (SBA) loans are a type of financing that the U.S. government provides to small businesses and entrepreneurs to encourage economic growth. The SBA doesn’t lend money directly to small business owners. Instead, it sets guidelines for loans made by its partnering lenders, community development organizations, and micro-lending institutions.

Here’s how the process generally works:

1. **Choose the Right Loan:** The SBA offers several different types of loans, so you’ll need to determine which one is the best fit for your business. Some of the most common ones include the 7(a) Loan Program for general small business loans, the Microloan Program for smaller loans, the 504 Loan Program for commercial real estate and equipment purchases, and the Disaster Loan Program for businesses affected by disasters.

2. **Find a Lender:** Not all banks and lenders offer SBA loans, so you’ll need to find one that does. The SBA provides a Lender Match tool on its website to help connect you with suitable lenders.

3. **Prepare Your Application:** Each SBA loan program has its own eligibility requirements, but generally, you’ll need to provide information about your business, a detailed business plan, financial statements, information on any existing debt, and personal financial information.

4. **Apply for the Loan:** Submit your loan application to your chosen lender, who will review your application and make a decision about whether or not to offer you a loan. If they approve your application, they’ll submit it to the SBA.

5. **SBA Review:** The SBA will then review your application. If it approves the loan, it will provide a guarantee to the lender, which essentially insures a portion of the loan against default. This guarantee can cover up to 85% of the loan amount, depending on the loan program.

6. **Receive Your Funds:** If your loan is approved by both the lender and the SBA, you’ll receive your funds and can begin using them for your intended business purposes.

Keep in mind that while SBA loans can provide much-needed capital for small businesses, they also come with certain costs, such as interest and fees, and require repayment over a set period of time. It’s important to understand the terms of your loan before accepting it.

-

Lending Network LLC has Hard Money Loans available to qualified borrowers at 75% LTV on commercial loans and investment properties. Case by case scenario for higher loan to value commercial loans

-

Hard Money Loans at 70% LTV on investment properties non DODD FRANK. No residential property only investment properties and commercial properties. 75% LTV in Utah and Nevada

Check out our Commercial Loans threads -

Hello Team!

Anthony Fiero is one of our top niche wholesale investors for non-QM primary home, second home, and investment home mortgage loans. However, Anthony Fiero hands down the only wholesale lender we have for hard money loans on primary homes but is limited to California. You can get hard money loans on primary homes in California and Callifornia ONLY. Closing in a matter of days after all paperwork is in. Interest only hard money loans with a five year balloon. Anthony Fiero is an active member of GCA FORUMS and will be the moderator for Non-QM and alternative mortgage loan programs. @AnthonyFierroLendingAnswer

-

Viewing 1 - 13 of 13 discussions