-

Discussions tagged with 'No-Ratio Loans'

-

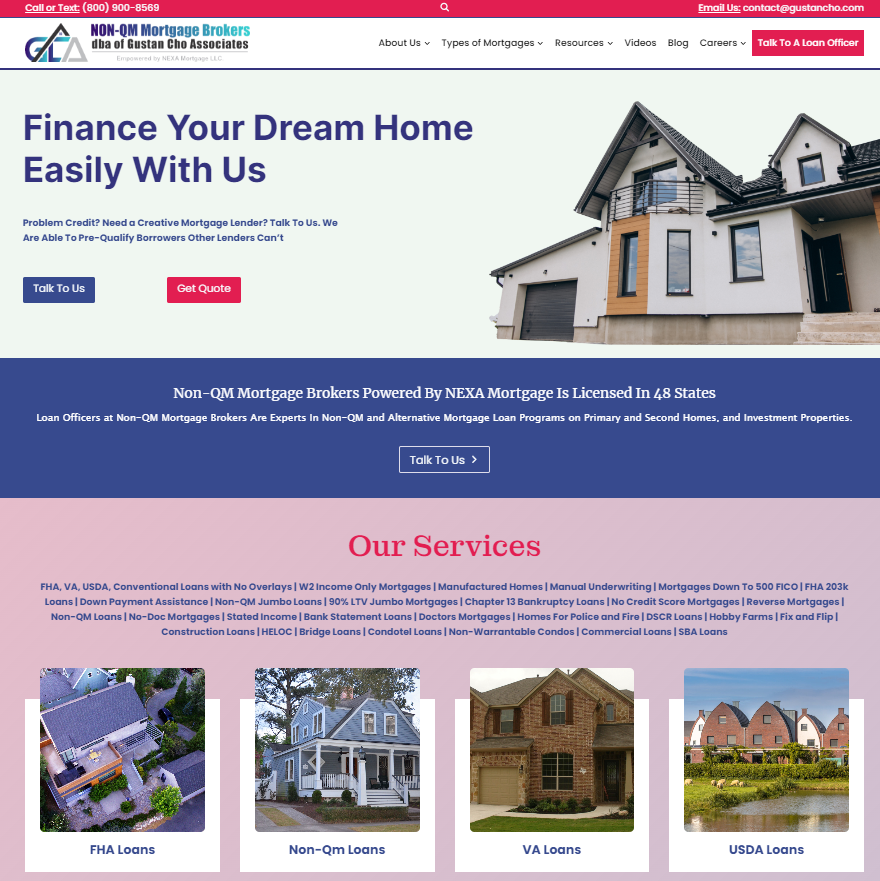

Non-QM Mortgage Brokers is a national mortgage broker and correspondent lender licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. Non-QM Mortgage Brokers is a wholly-owned subsidiary of Gustan Cho Associates, Inc. Gustan Cho Associates, also referred to as GCA Mortgage Group NMLS 2315275 is a dba of NEXA Mortgage, LLC NMLS 1660690, the nation’s largest mortgage broker and correspondent lender with nearly 3,000 licensed mortgage loan originators and equally number of support, operations, and third-party independent contractor service providers. Non-QM Mortgage Brokers specialize in providing mortgage options for individuals who may need to meet the standard lending criteria set by the Consumer Financial Protection Bureau (CFPB). Licensed mortgage loan originators at Non-QM Mortgage Brokers offer more flexible mortgage loans regarding income and credit requirements, which can benefit borrowers such as business owners, self-employed individuals, and gig workers.

Here are some key features of non-QM loans:

Flexible Income Documentation: Borrowers may use alternative methods, such as tax returns, bank statements, or 1099s, to demonstrate their ability to repay the loan.

Higher Debt Limits: Some non-QM loans allow for debt-to-income ratios over 50%, compared to the standard 43%.

No Waiting Period After Bankruptcy: Certain non-QM loans do not require a waiting period after bankruptcy or foreclosure, enabling quicker access to a mortgage.

Higher Down Payment Requirements: Non-QM loans often require a larger down payment, typically between 15% to 20%.

Higher Interest Rates: Due to the increased risk associated with these loans, non-QM mortgages usually come with higher interest rates.

If you’re considering a non-QM loan, it’s important to shop around and compare offers from different lenders to find the best terms for your situation. Remember that while non-QM loans can provide a path to homeownership for those who don’t qualify for traditional mortgages, they also come with higher costs and risks. It’s advisable to consult with a financial advisor or mortgage broker to understand all the implications before proceeding. Non-QM Mortgage Brokers is the nation’s largest mortgage broker of non-qualified mortgages. For more information, visit us at Non-QM Mortgage Brokers, Inc. at

https://www.non-qmmortgagebrokers.com/

non-qmmortgagebrokers.com

Home - Non-QM Mortgage Brokers

Finance Your Dream Home Easily With Us Problem Credit? Need a Creative Mortgage Lender? Talk To Us. We Are Able To finding The Perfect Mortgage For Your Dream Home Find A Lender With Us Fill out the form by click … Continue reading

Viewing 1 of 1 discussions