Tagged: Florida housing market

-

117000 Homes in Florida Owned by Corporations

Posted by Stanley on August 25, 2024 at 5:43 pmOne hundred seventeen thousand homes in Florida are currently for sale, and many of these properties are owned by large corporations. Some homeowner associations (HOAs) for these properties are based in Texas.https://www.tampabay.com/news/business/2024/08/22/florida-homes-owned-by-corporate-investors-117000-counting/

tampabay.com

Florida homes owned by corporate investors: 117,000 — and counting

Experts say investors capitalized on the state’s population growth and minimal renter protections.

Max replied 1 year, 6 months ago 3 Members · 2 Replies -

2 Replies

-

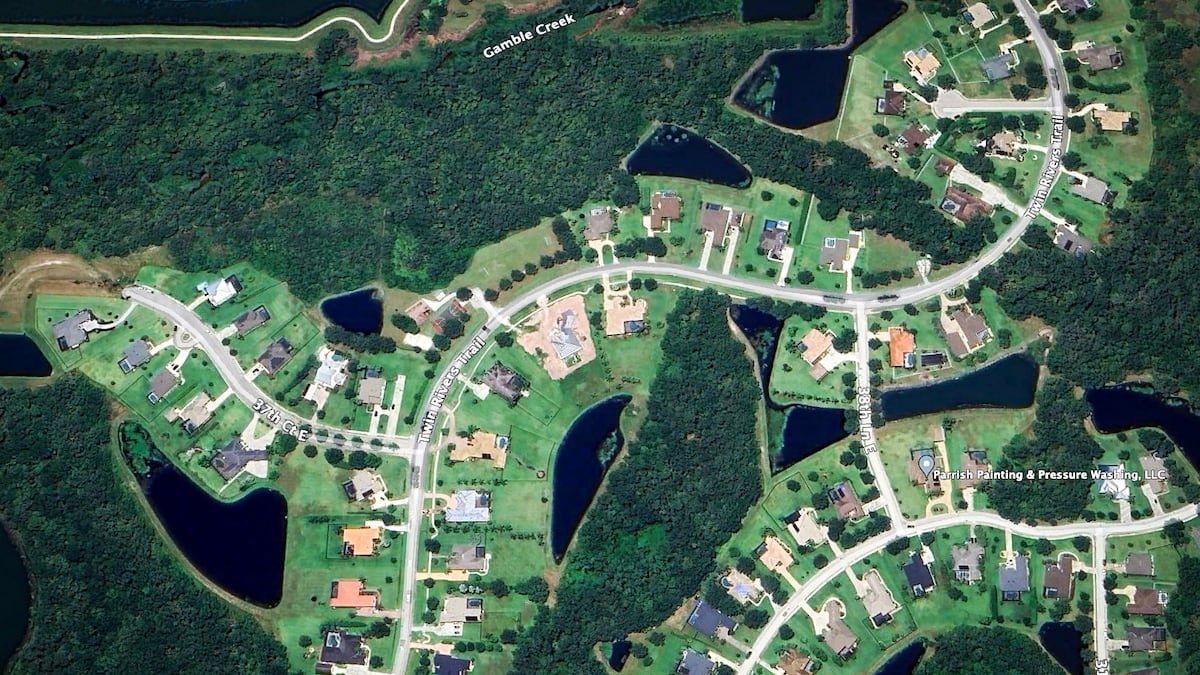

Like other states in the United States, the real estate market in the Sunshine State is undergoing several changes. Many properties are being offered. It is a reality, though, that in the estimates, 117,000 homes are bank-owned as such or left ‘as is, ‘which indicates that there is already an extremely high excess supply of these properties to all categories of buyers. The fact that most such properties are indeed piled in very few hands demonstrates institutional investors’ changing paradigm from conventional real estate investments. However, more investment opportunities for new developments are especially emerging in Florida. However, the constant and stable double-digit double-digit rise in the prices of houses in Florida ended abruptly in early 2024. Home Builders announced in early May that prices for homes will be slashed by about 25 % in 2024. Lennar Home Builders made the announcement. It is also worth noting that there is an increase in the stock of homes for sale all over Florida, leading to a fast decline in home prices.

Factors to Consider Constitutional Ownership: Corporations and other stringent institution owners usually buy houses in bulk for different reasons. Although not limited to being long-term investors partnering in the rental housing market to simply speculative purchases on the rise in the property market. There has been a steady increase in the trend in Florida. However, geographical sources such as Tampa, Orlando, and Miami have been rental markets amenable to bulk real estate purchases.

Effects on Local Markets: The further acquisition of these institutional owners improves the economy of this county. Their trickle-down demand calls for additional services. Yet, as more rental apartments are said to be needed, people want to rent more, thereby lessening their chances of owning personal homes.

Florida’s Economical Decline:

Homes inventory is experiencing exaggerated growth. New Homes are being sold off a wide range of allowances as at least one home builder, Lennar Home Builders and DR Horton, are decreasing the prices of their new homes allowance to $54,000 and over. Besides, new home builders are providing great offers on mortgage rates, as low as 5.5%. The rate of unemployment in Florida is increasing. More unemployment is occurring, and more and more people are either fired from their jobs or laid off from their workplaces due to the recession. The fees for Homeowners association and Homeowners insurance have increased again by a margin of 100% to 500%, making seniors very anxious. Although studies have revealed that businesses put more emphasis on development and expansion practices rather than putting measures in place to counter business decline or recessions, proper organization of all business operations is obligatory due to different market forces, such as government regulations or the unavailability of required factors of production.

Home Buyer’s Relations: Home buyers must consider the house’s management and the homeowner’s association types. This is very important in real estate transactions, appraisals of real estate property, and social interactions of the area in question.

Contact us right now for information on recent developments in the property bought in Florida, housing loans, or short service in providing HOAs.

-

We appreciate your following up on the current Florida real estate market. Let’s establish transformational sentences from the information you made available.

Television Home measure:

In Florida, there are now 117,000 homes offered for sale.

Even though that figure is quite impressive and can mean many things in terms of the state of the market in that there are a lot of homes available, it is a buyer’s market, or maybe the demographics or economics of the country have altered for some reason.

Corporate structure:

Most of these properties are in the hands of corporate entities. This, in fact, is why a whole new trend has emerged in the past few years: Companies venture into the residential real estate market, either purchasing houses or operating managed rentals as investments.

Non-resident management company handling the out-of-state associations:

Some of these units’ covenants homeowners associations (HOAs) are in Texas.

This is a nice point that touches on the growing phenomenon of such associations as property and community management by people who neither reside in the same community unit nor the same state.

Such factors might have several causes:

The projection of this phenomenon suggests that the corresponding real estate market in Florida may be adversely influenced by the increased stock of homes, causing home prices to depreciate.

Though these appear to be outside the factors and other controllable externalities, their significance to socioeconomic systems cannot be diluted or ignored. The impact on residents of corporations owning entire flat complexes extends well into the housing market. This impacts the individual buyers of such homes and the rental markets outside its residential pool.

With local access, out-of-state HOA management may mean that local issues will take a while to resolve or that the community will be able to address them.

This scenario can also depict wider shifts in real estate investment management, such as investment management across states.

Potential buyers or residents in Florida should consider certain measures, especially regarding property values, community management, and investment opportunities. They should seek out such informational resources about the neighborhood immediately preceding any real estate action anticipated, such as market conditions and HOA processes.

Log in to reply.