Tagged: HELOC, second mortgage

-

90 PERCENT CLTV SECOND MORTGAGE OR HELOC

Posted by Ollie on August 24, 2024 at 3:02 amDo you know any banks that offer 10% down on second mortgages or 90% CLTV or HELOC with a 700 credit score or better with income of over 70,000 yearly?

George replied 1 year, 6 months ago 2 Members · 1 Reply -

1 Reply

-

Indeed, several banks and other lenders may also grant second mortgages, Home equity Line of Credit (HELOC), or any other type of loan for a combined loan-to-value (CLTV) ratio of 90 percent for borrowers earning more than $70,000 yearly and having a credit score above 700. Here are some of the alternatives worth your attention:

Loyalty Programs:

Lenders in the Conventional category:

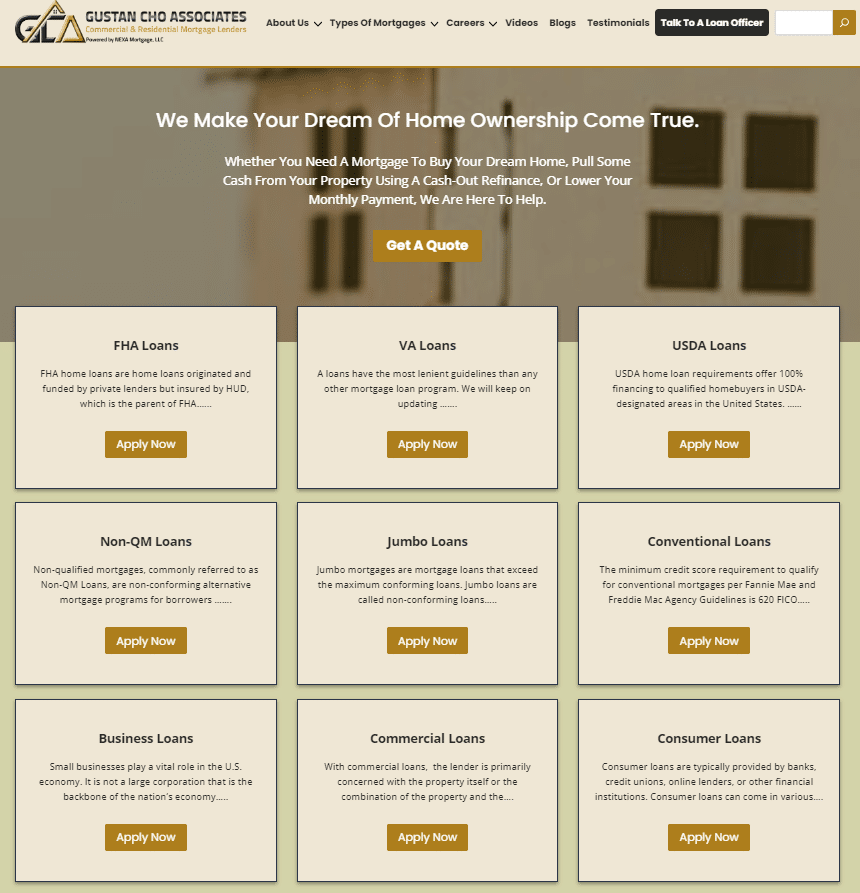

Gustan Cho Associates:

HELOC Options: At Gustan Cho Associates, a dba of AXEN Mortgage, the maximum CLTV for HELOCs can be as high as 85-90%. AXEN Mortgage HELOC program is subject to a review of the borrower’s credit risk and the home’s appraisal.

Second Mortgages: Gustan Cho Associates (https://www.gustancho.com/) also undertakes second mortgages through AXEN Mortgage. The terms may vary, and it’s better to check with the loan officer about what’s offered.

GCA Mortgage Group:

HELOC Options: GCA Mortgage Group’s home equity lines of credit feature relatively flexible CLTV averages. Obtaining a claim to equity of up to 90% is also possible. GCA Mortgage Group (https://gcamortgage.com/), powered by Gustan Cho Associates, has a network of 250 wholesale investors and financial institutions where loan officers can shop for the best rates and terms on first mortgages, second mortgages, and HELOCs.

Cash-Out Refinances: They do not provide second mortgages, but cash-out refinances that could serve as second mortgage alternatives.

National Mortgage Brokers and Lenders:

Preferred Mortgage Rates (PMR):

Second Mortgages and HELOCs: Known for their very low or competitive rates, Preferred Mortgage Rates https://www.preferredmortgagerates.com, PMR, offer surprisingly high CLTV ratios, often as high as 90%. Membership is a condition generally limited to military service members and their families.

Non-QM Mortgage Lenders:

HELOC Options: Non-QM Mortgage Lenders (https://www.non-qmmortgagelenders.com) home equity lines of credit are comparable to those that allow equity loans up to ninety percent CLTV to applicable borrowers. They also offer industrial rates and flexible built-up terms.

Online Lenders and Mortgage Companies:

Lenders For Best Rates:

Second Mortgage/HELOC Options: At Lenders For Best Rates, second mortgage and HELOC options are available, with the limit ratio of cltv varying by ninety percent and the best ratio of income to cltv.

Mortgage Lenders For Bad Credit:

HELOCs and Second Mortgages: There are second mortgages and HELOCs written in the mortgage products of Mortgage Lenders For Bad Credit (https://www.mortgagelendersforbadcredit.com/), which are up to 90% CTL, based on solid income and credit.

Regional Mortgage Lenders:

FHA BAD CREDIT LENDERS:

HELOC Options: FHA Bad Credit Lenders (https://www.fhabadcreditlenders.com/) is a regional lender that has emerged in the South. It also offers home equity lines of credit by allowing 90% CLTV to people with strong credit profiles.

Great Community Authority (GCA) FORUMS:

HELOC and Second Mortgage Options: For Great Community Authority or GCA FORUMS (https://www.gcaforums.com/), clients qualified for the program will offer a database of the best mortgage brokers and lenders of first and second mortgages with CLTV up to 90%, subject to credit risk and other financial circumstances.

Tips for Securing a Second Mortgage or HELOC:

Shop Around: Determine Loss Prevention and quote the potential lenders with an option that meets your specifications and is well under your expectations.

Prepare Documentation: Talk to the lender and inform them of the secured documents you will present and the terms for income verification and credit history.

Clutch the Prada: Negotiate the terms with any reservations, especially regarding credit capability and gross pay.

Numerous financial institutions, including banks, credit scoring agencies, and online lenders, allow for 10% down payments in case of second mortgages or 90% CLTV HELOCs if a loan applicant has a credit score of 700 and above and is earning enough income. It is important to note the importance of hunting for the best deal on the market.

For more specific suggestions or help, please do not hesitate to ask!

gustancho.com

GCA Mortgage | Mortgage Experts With No Overlays

Whether you’ve gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans

Log in to reply.