Tagged: Budget for First Home, mortgage calculator

-

Budget for a Primary Home

Posted by Piper Brown on September 23, 2024 at 7:40 amHow do I determine my budget for a primary home?

Gustan Cho replied 1 year, 5 months ago 2 Members · 1 Reply -

1 Reply

-

Setting aside money to buy your first house entails deep diving into a process. A formula and several factors. In this regard, the following is an endeavor undertaken to the end:

Budget Your Revenue:

The first factor you need to look at is your monthly gross income. Just because a lender says you are qualified to get approved for a home mortgage does not mean you can afford the home. The key question is how much house you can afford, not how much you qualify for.

Estimate your DTI:

It is highly recommended borrowers go by the 28% front-end and 36% back-end debt-to-incomedebt-to-income ratio, even though lenders can get you approved with a higher debt-to-income ratio. You must understand that what you qualify for and how much house you can afford are two different things. Mortgage underwriters will not consider credit tradelines that do not report on credit bureaus, such as utilities, childcare, vacations, education, senior care, animal food and care, hobbies, car maintenance, home maintenance, and other expenses.

- The debt-to-income ratio is a key factor in how much home you can afford.

- Lenders go off gross income and not net income.

- Assess other monthly expenses like credit card payments, housing, and mortgage.

- As per the industry standards, this is achieved by stating the number of short-term and long-term loans and income per month.

The maximum debt-to-income ratio on conventional loans is 50% DTI. HUD, the parent of FHA, can go up to a 46.9% front-end and 56.9% back-end debt-to-income ratio. VA loans do not have a maximum debt-to-income ratio cap. USDA loans have a maximum of 33% front-end and 44% back-end debt-to-income ratio cap.

Borrowers should forget what lenders want for their debt-to-income ratio and be comfortable with a DTI ranging from 28% front to 43%end and 36% back-end debt-to-income ratio, which includes the anticipated mortgage payments.

The 28/36 rule:

- The amount spent on housing should be based on at least 28% of gross monthly earnings since that is not earned for free or given lightly.

- Be aware that the ratio of ongoing debt payments (which includes the mortgage) to income should not exceed 36%.

- Willing to provide its investors with down payment ranges:

Ordinarily, most conventional ranges provide 3-20% of the purchase price since that is called principal.

Most FHA loans offer an attractive deal that 3.5% is the best acceptable for borrowers as a down payment.

There are no down payment requirements on USDA and VA loans. Borrowers can ignore the down payment entirely for the VA, more so for eligible veterans who use bonds.

Account for additional housing costs:

- Property Taxes.

- Homeowners Insurance.

- If the down payment is less than 20%, PMI.

- HOA fees, if any.

- Utility bills.

- Servicing and repairs of houses also require a budget of 1-2% of home value per year.

Evaluate your savings:

- Always have a contingency plan.

- For example, save at least three or up to 6 months’ worth without allocating the money towards the down payment.

- Be aware that there are other costs with the transfer of deeds, which vary from 2-5% of the real price of the house.

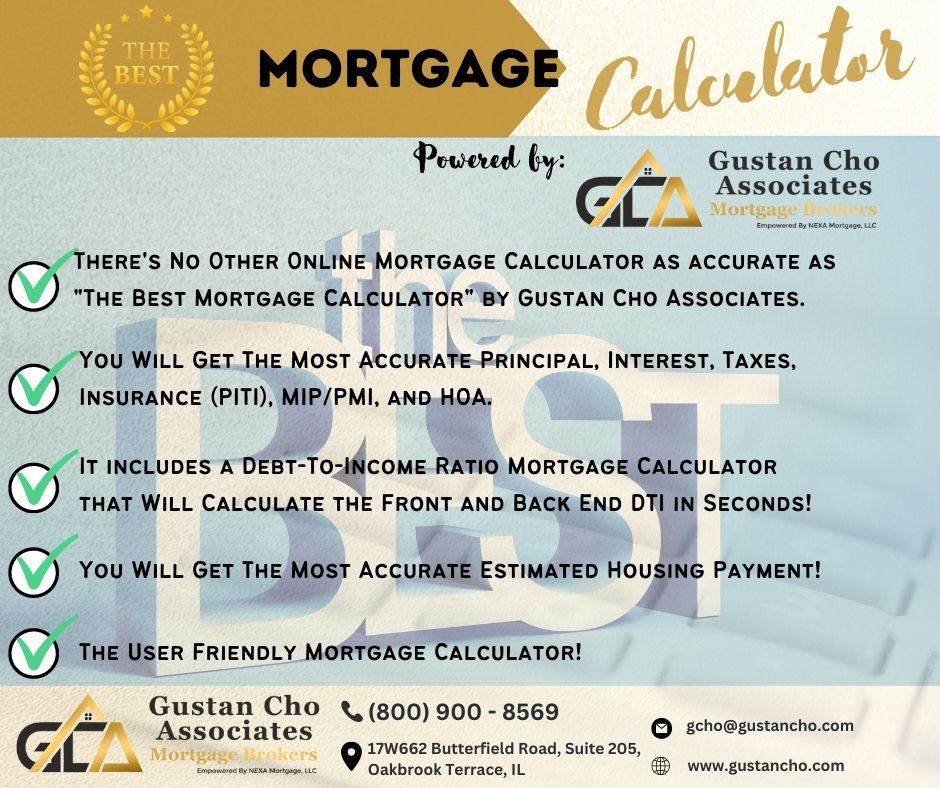

Use online calculators:

- You can use various online mortgage calculators to receive an accurate approximation of your monthly payments based on your home value, interest rates, and loan length.

Get pre-approved for a mortgage:

This will give you a clear picture of how much funding a lender can provide.

Consider future changes:

Predict any possible changes, such as a decrease or increase in your earnings, an increase in family members, or other major expenditures.

Consider your lifestyle choices:

Always factor in the amount of the house that you can afford without sacrificing your goals or even your normal way of life.

Search:

Determine the cost of properties and the cost of living in such places.

Look far:

- Assess the possibility of unplanned appreciation that you may credibly look towards, considering how long you will stay in the home.

Example calculation:

- After income taxes, the monthly income received by the household is $7,000.

Using the 28% rule for housing application of monthly income obtained: $7,000*0.28=$1,960 maximum amount to be spent on housing expenses.

- Deducting other expenses for property tax and insurance: $500.

- The available amount to make payments towards the mortgage of the property is $1,460.

Given the prevailing interest rates and some other factors, this would have translated into an unaffordable home cost of approximately $300,000 -$350,000

This is, however, a guide rather than a conclusion. Your final budget should. However, consider your circumstances, including the prevailing conditions in the property market within the locality and your objectives in the long run.

https://www.gustancho.com/best-mortgage-calculator

-

This reply was modified 1 year, 5 months ago by

Gustan Cho.

Gustan Cho.

gustancho.com

Best Mortgage Calculator | PITI, PMI, MIP, and DTI

We are at Gustan Cho Associates, You easily check your mortgage eligibility with the best mortgage calculator With PITI, PMI, MIP, HOA, and DTI.

Log in to reply.