-

Difference Between Mortgage Bankers, Mortgage Brokers, Retail MLO, and Wholesale

Posted by Connie on June 26, 2024 at 5:51 pmWhat is the difference between mortgag bankers, correspondent lenders, mini-correspondent lenders, mortgage brokers, retail loan officers, and wholesale mortgage lenders?

Gustan Cho replied 1 year, 8 months ago 3 Members · 3 Replies -

3 Replies

-

Wholesale Lending versus Retail Lending versus Mortgage Brokers: Understanding the differences between wholesale lending, retail lending, and mortgage brokers is important when navigating the mortgage market. Each has a different role and comes with its advantages and disadvantages.

Wholesale Lending

Definition: Wholesale lenders provide loans to borrowers through third-party entities such as mortgage brokers or correspondent lenders rather than directly to the consumer.

Key Features:

Business Model: They work with brokers who bring them clients. They do not interact directly with borrowers.

Rates and Fees: Since they have lower overhead costs than retail lenders, they often offer lower rates and fees.

Volume: Partnering with many brokers results in high volume, which can lead to competitive pricing.

Pros:

Competitive Rates: This is because wholesale lenders have lower overhead costs.

Broker Expertise: Various lenders’ offerings are understood by a borrower as better off using a mortgage broker.

Flexibility: Have a wide array of loan products specific to various borrower needs.

Cons:

No Direct Communication on Loan Issues: Sometimes, it becomes difficult for borrowers to communicate since they do not have direct contact with the lender involved in this matter.

Inconsistent Service Delivery: Much depends on how knowledgeable and helpful the broker is; hence, service delivery may vary greatly from one broker to another around the United States.

Retail Lending

Definition: Retail lenders issue loans directly to consumers. They can be banks, credit unions, or independent mortgage companies.

Key Features:

Direct Interaction: Borrowers deal directly with the lender’s loan officers throughout the process.

Loan Products: These retail lenders offer unique loan products and services.

Pros:

Direct Communication: It is much easier for a borrower seeking a loan from retail lenders because they deal directly with these financial institutions without involving other intermediaries like brokers or consultants.

Branch Access—Since many people who want mortgages prefer face-to-face interactions, this move helps them and also makes retail lenders accessible to many borrowers.

Control Over Process: Lenders exercise full authority over the loan process, resulting in a smoother transaction.

Cons:

Higher Costs—Retailers have higher rates and charges associated with their services because they have higher overhead costs compared to other institutions.

Limited Product Range: The retailer’s product offering is typically limited to its stock, i.e., its loans.

Mortgage Brokers

Definition: Mortgage brokers act as intermediaries between borrowers and lenders. They work with multiple lenders to find the best mortgage product for the borrower.

Key Features:

Variety: Brokers can access various loan products from various lenders.

Personalized Service: These people provide advice based specifically on your case, such as how much you can borrow or the number of years you should opt for.

Pros:

Wide Selection: By selecting various options at different lenders these individuals can offer borrowers low interest rates and reasonable mortgage terms.

Expert Guidance—Brokers specializing in mortgage knowledge can assist borrowers and show options that fit customers’ financial situations.

Efficiency—This step helps the customer save time since most tiresome procedures, such as searching for an appropriate loan, are carried out by financial institutions, who then forward their findings back to customers.

Cons:

Fees: Intermediaries may also charge extra fees, thus increasing the total cost of home loans purchased through them.

Variable Quality: The standard of service available via intermediaries may be inconsistent across all providers involved.

No Direct Control – With no power over approval processes, brokers end up causing delays even when everything else about an application is excellent.

Every alternative has its pros and cons, depending on a borrower’s particular requirements, preferences, and financial position. The mortgage broker is suitable for those who want personalized assistance and have choices in terms of financial products. The other option is retail lending, which may be preferable for those people who need direct contact and easy processes. On the other hand, wholesale lending appeals to individuals who desire competitive rate offerings and a wide range of products from a broker.

https://gcamortgage.com/mortgage-brokers-versus-lenders/

gcamortgage.com

Difference Between Mortgage Brokers Versus Lenders

Consumers have lower rates and mortgage loan options with mortgage brokers versus lenders due to a lower yield spread premium cap at 2.75%.

-

This is such an important topic and am very glad we are discussing the difference between mortgage bankers, brokers, retail loan officers, direct lenders, correspondent lenders, mini-correspondent lenders and other types of lenders because majority of loan officers do not know the difference. Consumers and even some loan officers think consumers get the best rates and terms if they deal with direct lenders, or correspondent lenders. This is so NOT TRUE. You get the best rates and terms if you deal with mortgage brokers.

Differentiating Between Different Types of Mortgage Professionals

Knowing what different mortgage professionals do to navigate the mortgage market is important. Some of these professionals include mortgage bankers, correspondent lenders, mini-correspondent lenders, mortgage brokers, retail loan officers, and wholesale mortgage lenders:

Mortgage Bankers

Definition: Mortgage bankers are individuals or institutions that originate, fund, and sometimes service mortgage loans. They provide their own financing for the loan and then sell it to investors or secondary market entities like Fannie Mae or Freddie Mac.

Key Characteristics:

Funding: uses its capital to fund loans.

Servicing: still servicing the loan or selling the servicing rights.

Loan Sales: selling the loans shortly after closing to free up capital more often.

Pros: Direct control over the loan process. A chance of faster loan approvals and Funding.

Cons: Their offerings are limited to products and rates

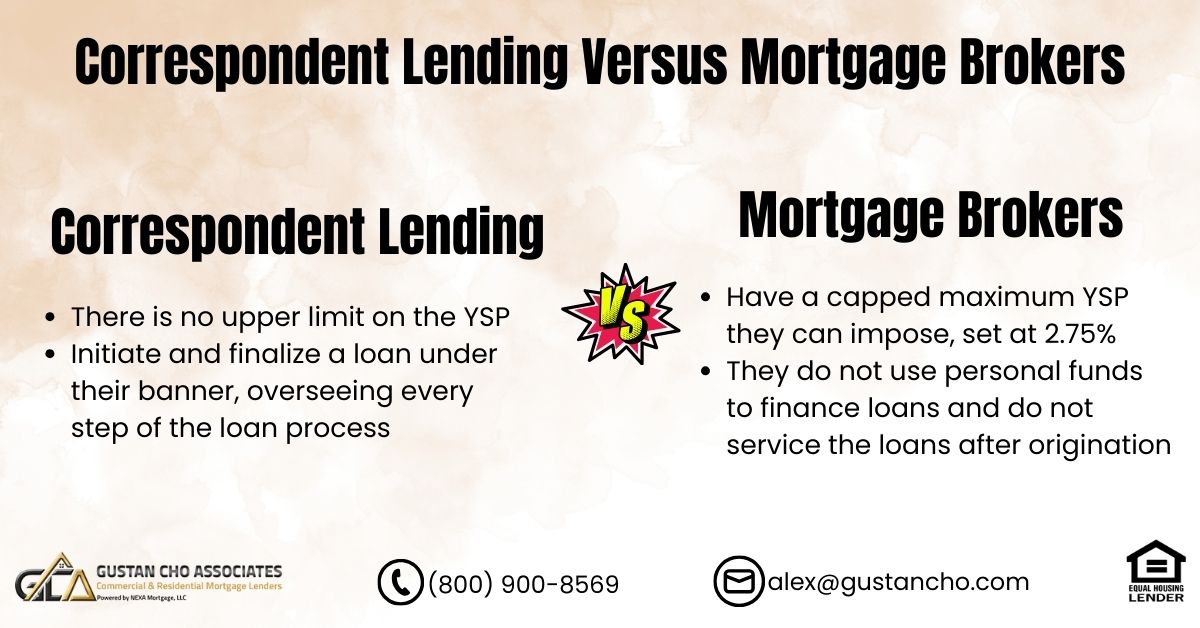

Correspondent Lenders

Definition: Correspondent Lenders are companies that originate and fund loans in their name but agree to immediately sell those loans to large mortgage lenders or investors after they close them.

Key Characteristics:

Funding and Sale: Funded with their money sales made directly after closing loans.

Product Variety: Owning relationships with larger investors allows a lender such as a correspondent lender (also called wholesale) to offer many different types of loans.

Pros:

Access to a wider range of loan products compared with some other options. Often quicker processing times and approval times.

Cons:

Limited flexibility because they must adhere to purchasing investor’s guidelines.

Mini-Correspondent Lenders

Definition: Mini-correspondent Lenders resemble Correspondents but work on a smaller scale; they may have fewer resources than full correspondents and use third-party the funding process.

Key. characteristics:

Hybrid Role: Some features are taken from both sides: Mortgage banker’s & Broker’s hybrid role.

Third-Party Funding: this is typically done through a third-party investor.

Pros:

Flexibility of a broker with some control over the funding process;

Can offer a variety of loan products from which to choose

Cons:

Limited by their smaller scale and reliance on third parties

Mortgage Brokers

Definition: Mortgage brokers are middlemen who help borrowers find the right mortgage product from among several lenders; they do not use their funds to originate loans.

Key Characteristics:

Intermediary Role: intermediaries between borrowers and lenders.

Product Access: access to numerous loan products from various lenders.

Pros:

Ability to search for the best rates and loan choices for borrowers while brokering; Personalized attention with guidance provided.

Cons:

They don’t have any power in the approval process or decisions concerning loans; Maybe additional fees charged by the broker also

Retail Loan Officers

Definition: Retail loan officers work for banks, credit unions, or mortgage companies and originate loans directly to consumers.

Key Characteristics:

Direct Sales: originates loans working directly with borrowers.

Institution-Based: representing specific lending institutions.

Pros:

Direct communication and service from the lender itself;

Access to institution-specific products and services like credit cards, checking accounts, etc.

Cons:

Only what the employer offers in terms of products and rates. Potentially higher rates than those offered by brokers.

Wholesale Mortgage Lenders

Definition: Wholesale mortgage lenders provide loans through third-party brokers and correspondents rather than directly to consumers; they are responsible for providing brokers with loan products and funding them.

Key Characteristics:

Third-Party Relationships: Make partnerships with mortgage brokers & correspondents so that they can offer them loans.

Product Variety: A full range of loan products available through a wholesale lender (sometimes called correspondent).

Pros:

Lower overhead expenses lead to more competitive costs, all things being equal; A wide array of different loan types is available via intermediaries.

Cons:

The borrower’s direct engagement is limited.

The level of quality can depend on the broker’s competence. Every kind of mortgage professional has a specific part to play in the mortgage lending process, as follows:

Mortgage Bankers: They, as lenders, use their own money.

Correspondent Lenders: Originate and sell loans to larger investors.

Mini Correspondent Lenders: Smaller correspondent lenders with some activities shared with mortgage bankers.

Mortgage Brokers: Middlemen offering multiple products from various lenders.

Retail Loan Officers: Direct representatives of lending institutions.

Wholesale Mortgage Lenders: Fund loans through brokers and correspondents. Your specific needs, preferences, and type of loan determine the ideal professional for you.

https://gustancho.com/correspondent-lending/

gustancho.com

Correspondent Lending Versus Mortgage Brokers

Correspondent Lending is when a mortgage sell the loans they fund on the secondary market to a larger wholesale mortgage banking company

-

Loan officers are licensed and mortgage underwriters are not.

Log in to reply.