-

Fannie 2-to-4 Unit Multifamily Guidelines

Posted by Lisa Jones on November 21, 2023 at 3:43 amDoes anyone know the updated Fannie Mae two-to-four ulti-family guidelines on Conventional loans for owner-occupant, second homes, and investment properties?

Angela replied 1 year, 9 months ago 2 Members · 1 Reply -

1 Reply

-

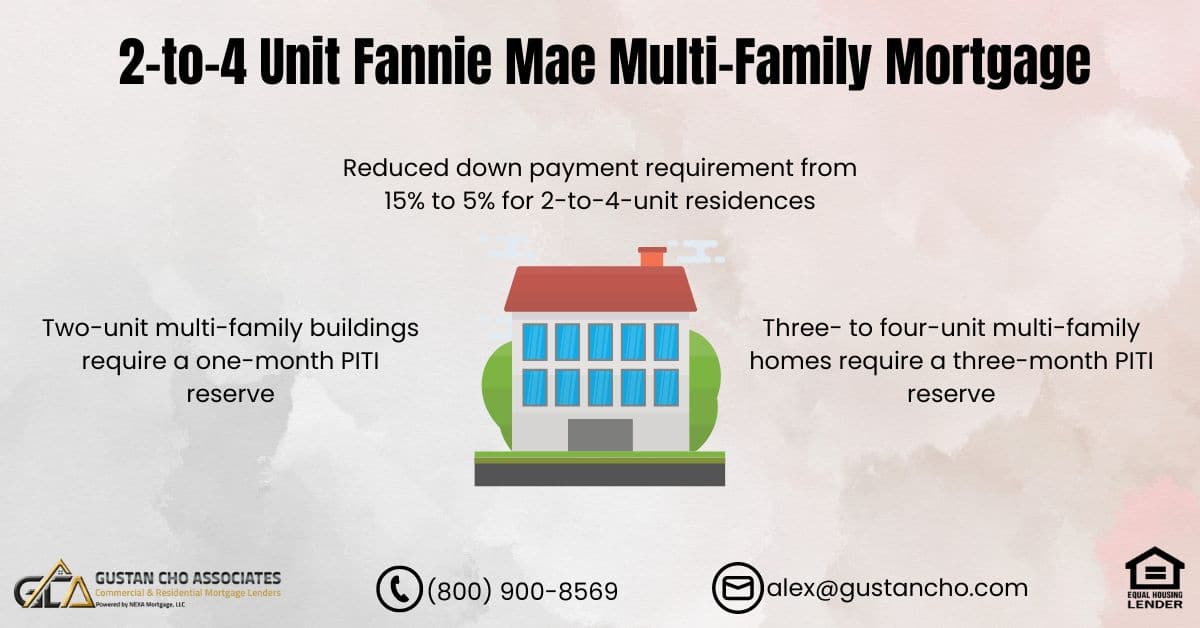

As of the last update, there was breaking news from Fannie Mae and Freddie Mac on two-to-four unit multi-family homes. In this subforum, we will cover the general guidelines provided by Fannie Mae for two-to-four-unit multi-family properties under Conventional loans. However, these guidelines can change, so it’s important to verify the latest details directly from Fannie Mae or through a reliable lender.

For Owner-Occupied Properties

- Down Payment: Typically, the minimum down payment for a multi-family property when the owner occupies one of the units can be as low as 5%, but it’s often 20-25% to avoid private mortgage insurance (PMI).

- Credit Score: Higher credit scores are generally required is 620 FICO or higher, but this can vary by lender.

- Each lender can have lender overlays which are higher lending requirements above and beyond Fannie Mae and Freddie Mac.

- Debt-to-Income Ratio (DTI): The maximum DTI is usually around 45%, but can be higher with compensating factors.

- Reserves: Borrowers might need reserves of six months’ worth of mortgage payments or more, depending on lender requirements.

For Second Homes

- Fannie Mae’s guidelines generally restrict second home designations to single-unit dwellings. Multi-unit properties typically do not qualify as second homes under Fannie Mae guidelines.

For Investment Properties

- Down Payment: The down payment requirement is usually higher for investment properties, often 25% or more for a multi-family property.

- Credit Score: Similar to owner-occupied loans, a higher credit score is beneficial, typically 680 or higher.

- DTI Ratio: More stringent DTI requirements, typically not exceeding 45%.

- Reserves: Borrowers may need significant reserves, often up to six months for each property owned, including the one being purchased.

Other Considerations

- Loan Limits: Be aware of the Fannie Mae loan limits, which vary by area and are higher for multi-unit properties.

- Mortgage Insurance: If the down payment is less than 20%, mortgage insurance will generally be required.

- Rental Income: For investment properties, rental income can be considered part of the borrower’s total income, but it often requires a history of property management experience or existing rental income streams to qualify.

These guidelines provide a framework, but Fannie Mae updates their underwriting criteria periodically to reflect changes in economic conditions and housing market dynamics. For the most accurate and current information, it’s best to consult directly with Fannie Mae’s official resources or speak to a mortgage professional who specializes in multi-family conventional loans.

https://gustancho.com/fannie-mae-multi-family-mortgage/

gustancho.com

UPDATED 2-to-4 Unit Fannie Mae Multi-Family Mortgage

Fannie Mae Multi-Family Mortgage on 2 To 4 Unit Homes: Owner occupant two to four unit homes require 15% down payment on conventional loans

Log in to reply.