-

GCA FORUMS HEADLINE NEWS for Friday February 21st 2025

Posted by George on February 21, 2025 at 8:10 pmGCA Forums Headline News for Friday, February 21st 2025: What is the latest with the Department of Government Efficiency? Did Elon Musk and his team at the Department of Government Efficiency audit Fort Knox and see any missing gold? Did the Department of Government Efficiency find any fraud and corruption at the Federal Reserve Board and wrongdoing with Federal Reserve Board Chairman Jerome Powell? Are the following agencies under scrutiny of getting abolished? The IRS, the Federal Reserve Board, the CFPB, the Department of Education, FEMA, and what type of government oversight is the Trump Administration going to create, develop, and implement to police and govern federal agencies, politicians, and higher management of government and third-party government contractors?

https://www.youtube.com/watch?v=-5DapGwBTAg

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

Danny Vesokie | Affiliated Financial Partners replied 1 year ago 7 Members · 34 Replies -

This discussion was modified 1 year ago by

-

34 Replies

-

The Department of Government Efficiency (DOGE) has been working to cut down on federal spending and issued a report on February 21, 2025 detailing the steps the organization has completed to date. Below are some of the important details:

Important measures undertake by DOGE

Executive Orders and Initiatives

President Donald J. Trump issued an executive order to eliminate government advisory and supervisory committees included in the structural reforms of the federal system. This order forms part of broader policies aimed at ensuring fiduciary responsibility and minimizing waste.

Identification of Fraud and Waste

The DOGE claims to have uncovered billions of dollars in wasted funds, fraud, and abuse among many federal agencies, including programs staffed by employees of the USAID, the Treasury Department, IRS, and the Social Security administration.

Staff Reductions

To reduce expenditures, the DOGE automized the processes employed and laid off thousands of non-essential staff members and vacated positions. Because of these measures, the government employees were either laid off or forced to accept an early retirement option.

Audits and Investigations

Several federal agencies including the Federal Reserve Board are undergoing investigations and audits. However, these audits have not been made public, including the claims of missing gold from Fort Knox and the allegations about the chairman of the Federal Reserve, Mr. Powell.

Sanctuary Cities and Non-Immigration Policies:

The Department of Homeland Security under the Trump regime has been working actively towards controlling illegal immigration and has placed particular attention on sanctuary cities. The Attorney General of the United States Pamela Bondi is bringing legal complaints against these jurisdictions.

[[Federal Agency Shifts]]:

A number of discussions still exist regarding the potential abolishment of other federal agencies which consists of the IRS, Federal Reserve Board, and the Consumer Financial Protection Bureau (CFPB). Other plans are contemplating new sets of rules to administer federal contractors and agencies and authority systems.

Political and legal ramifications:

There are claims of favor-corruption involving suspected politicians alongside some state officials whose names and particulars have not been reported. While the scope of these issues can create serious problems for politics.

Facing a major redesign of governmental activities, The Office of Government Efficiency has the responsibility of minimizing spending with concern to money wasted against results ensured and maximizing proper governmental accountability. The result of these actions may be persistent in the direction of supervision and control of Federal consolidation.

-

This reply was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 1 year ago by

-

Can you provide any information on government audits in general?

-

The Reason Why Beyond Audits Ensure Internal Revenue Service Tremendous Risk And Accountability The Cost-Efficient Use Of Government Money. The Reason Why Here Is One Government Agency Audit: Internal Procedures And Techniques Make Treat-and-treat Examine

Assesses the credibility of expenditure data alongside other data through cross-validation of various systems and confirms that money spent does not exceed the authorized amounts (budget). These audits analyze and evaluate the earnings and expenses of an organization, office, or department to ascertain whether they are managed effectively and reported accurately or not.

Examine the manner in which money is spent in comparison to the outcomes. Assess the economic and socio-political impact of government policies from the point of view of cost-benefit analysis.

Audit an individual agency to determine if it follows relevant procedures or policies that govern it. These audits offer the fundamental basis to verify and validate the existence of any set or non-set policies designed for transparency.

Review the manner in which goals and objectives are attained and the internal mechanisms, procedures, and processes of the civil service through which the attainment of a goal is ensured and controlled.

Why There Are Alternate Procedures Conducted With Government Money

Delegated Authority – Ability to spend money, subject to all rules, policies, laws, and regulations that constrain the usage of this power laws define, explain, and quantify what ease or facilitate control over the public money.

Clarity: – The definition of the body that controls the allocation of money must ensure that charges are not made without pioneering control over the amount spent over it.

Possession of appropriate information: must enable reasonable persons to know what is available for allocation as set by defined criteria, i.e. when defined conditions barriers are formed through legally defined boundaries that outline what and what are not barriers that allow money to be allocated.

Such audits include the review and examination of an agency’s control framework in relation to its objectives and employee acceptance of restrictions placed on them.

Fieldwork: Augment the information with data collection via interviews, direct observations, and document analysis. This phase includes fieldwork assessments and the evaluation of identified control systems.

Reporting: The auditors generate the report documents detailing the audits performed, the problems encountered, the recommendations made, and the conclusions drawn. As a rule, such reports are published.

Follow-Up: A number of audits include a recommended follow-up in order to verify that the necessary action has been taken to resolve the identified issues.

Key Agencies Involved

Government Accountability Office (GAO): Offers auditing assistance to Congress and monitors federal spending.

Office of Inspector General (OIG): Each federal agency has a corresponding OIG responsible for audits and other investigative functions to eliminate misallocation of resources and fraud.

State Auditors: Some states have their own auditing authorities to monitor the expenditure of state resources and the implementation of state programs.

The general public can have confidence in government audits, knowing that there is objective verification of claims and the evaluations help improve government productivity. They also assist in determining deficiencies, thus fostering responsibility in government processes.

-

-

What are some common findings in government performance audits?

-

Analyzing government work suggests that there are sometimes inefficiencies and areas in need of improvement with services provided. Here are some examples of findings:

1. **Ineffective Resource Distribution**

Funds Not Being Used Efficiently: Budgeted funds may be poorly allocated or not spent at all, leading to lost resources.

Confusion Between Programs: Various programs that serve the same purpose may exist, leading to confusion and deception.

2. **Lack of Goal Setting**

Goals Not Defined: Programs must have specific objective and goals that allow their effectiveness to be assessed.

Success Measures Lacking: Performance indicators must be relevant and adequate to be measured to ensure success.

3. **Staffing And Training Issues**

Under-trained Staff: Employees not receiving adequate training heavily impacts the quality and efficiency of the service provided.

Increased Employee Churn: Constantly changing staff members disrupts processes and results in lost organizational knowledge.

4. **Regulatory Issues**

Law Defiance: Programs not complying with regulations expose the agency to legal issues.

Poor Information Handling: Bad information led to reporting and decision making that just didn’t work.

5. **Flawed Design Programs**

Services Not Targeted: Programs not meeting the needs of those they are intended for lead to very little participation or impact.

Insufficient Stakeholder Engagement: Not getting stakeholders involved risks developing programs which do not satisfy community needs.

6. Resource Use Inefficiency

Bureaucratic Red Tape: Service delivery can be slow due to unnecessary procedures that can be avoided.

Technological Deficiencies: Poor and out of date technology may result in inefficiency in operations and management of information.

7. Inadequate Oversight and Assessment

Neglected Follow-Up: Programs are left incomplete without a reliable method of measuring progress or results after rollout.

Inability to Modify Approaches: Difficulty in changing approaches to work on the basis of performance data or feedback is common.

8. Unrestricted Financial Planning

Inequitable Resource Allocation: Estimated budgets do not correspond with the requirements of the relevant programs and services resulting in financial gaps and excesses.

Oversight of Spending: Poor management techniques used concerning spending may result in wasting money and losing money entirely.

Such performance evaluations reveal audits that can be used by the government to enhance how effective, liable, and helpful they can be. Solving these problems would make it easy for agencies to achieve their goals and deliver services to the public proficiently.

-

-

What are some best practices for effective cost controls in government?

-

Efficient government spending fosters effective operations and maximizes taxpayer money. To assist with this, consider the following best practices:

1. Create Processes for Budgeting

Comprehensive Budgeting: Create overarching budgets that are fully aligned with strategic goals and that fund only where there is a great need and impact.

Participatory Budgeting: Allot resources where they are needed most by having stakeholders participate in the budgeting process.

2. Measure Performance

Set Key Performance Indicators (KPIs): Create measurable targets to determine how effective each program is and how well the funds are utilized.

Regular Monitoring: Track and report on KPIs regularly to make improvements and increase accountability.

3. Promote Transparency and Responsibility

Public Reporting: Encourage sensible spending and open financial information access to foster transparency.

Regular Audits: Monitor and evaluate financial activities internally and externally to find and rectify errors or inefficiencies.

4. Use Modern Technology

Financial Management Systems: Allocate and monitor money through budgeting, forecasting, and reporting with the use of software to increase accuracy and efficiency.

Data Analtics: Employ analytics to recognize spending trends, oversee resources, and improve performance.

5. Improve Procurement Processes

Competitive Bidding: Foster competition for better services and goods from various suppliers at lower prices.

Contract Management: Establish clear contractual terms and closely track compliance to avoid unnecessary expenses.

6. Facilitate Strengthening of Cost and Budgetary Policy Awareness

Staff Training: Instill fundamental principles of budgeting and expenditure control among employees to enhance cost-conscious behavior.

Cost Control Initiatives: Motivate all departments to suggest and implement cost-cutting strategies.

7. Continuos Monitoring and Review of Implementation

Periodic Budget Reviews: Analyze budgets routinely for compliance and make adjustments according to any changes.

Flexibility: Accept the possibility of movement on budgets where uninformed problems or chances presents themselves.

8. Collaborate Across Agencies

Shared Services: Look for instances of services being shared across agencies in order to increase efficiency and reduce costs.

Interagency Cooperation: Encourage collaboration to utilize resources and improve operational efficiency through best practices.

9. Engage in Strategic Planning

Long-Term Planning: Focus on the development of financial strategies that will meet the objectives and funding requirements through anticipated periods.

Rissk Management: Forecast any possible threats to financial continuity and formulate countermeasures.

10. Evaluate Program Effectiveness

Post-Implementation Reviews: Determine if targeted outcomes from implemented programs were achieved and in a cost-effective manner.

Continuous Modifications: Determine appropriate actions to take regarding a program based on its effectiveness evaluation and performance.

Adoption of these best practices will enable government institutions to achieve positive cost detainment measures which will enhance effectiveness, responsibility and service delivery. Governments should foster and cultivate a culture of spending prudence and increase the return on taxpayers money.

-

-

Could the IRS really be abolished in 2025? After Donald Trump’s appearance on the Joe Rogan podcast, where he called the IRS a “stupid mistake” and hinted at ending it, speculation is running wild. My last video—where I explained how Trump could dismantle the IRS without passing a single law—racked up over 750,000 views, so I know you’re curious! Now, the big question everyone’s asking: Should you skip filing your taxes in 2025 if the IRS might disappear? Let’s break it down.

About Me: I’m Anthony Parent, a U.S. tax attorney with over 20 years of experience. Full disclosure: my firm, IRSMedic, makes money preparing taxes, so I’ve got some skin in the game. That said, I’m transitioning into probate law and care about giving you the full picture—not just pushing tax prep revenue.

What You’ll Learn in This Video:

Filing for Refunds: If you’re owed a refund, you must file to claim it. You’ve got just 3 years from the return’s due date (or 2 years from when you paid the tax) to get your money—don’t let it slip away!

Owing the IRS: Should you file if you owe money?

Required for FAFSA (financial aid applications)—delaying could complicate things.

Fiduciary duties to business partners or investors might legally obligate you to file.

Cons of Not Filing:

Penalties can pile up if the IRS sticks around (late filing + late payment fees).

Good news? First-time penalty abatement could save you if you qualify—just don’t count on it if you’ve skipped filing before.

Criminal Risk:

The IRS Criminal Investigation Division indicts fewer than 1,000 people a year for pure tax evasion.

Fraud (like fake Employee Retention Credits) is the real criminal trigger—not just skipping a return.

Even if you file late in 2025 or early 2026, the odds of CID knocking on your door are tiny due to slow processing times.

So some suggestions.

Expecting a refund? File ASAP to secure it.

Owe money? There may be not much harm in waiting – and filing later in 2025 or early 2026, especially if you’re eligible for penalty relief. However you will have to pay interest. There is no way around that.

Stay Informed:

This advice is based on current tax laws as of February 20, 2025—things could change! Always consult a tax professional.

https://youtu.be/8tW0Vzk2RSQ?si=aFbqL-xOxIoonAeM

https://youtu.be/8tW0Vzk2RSQ?si=aFbqL-xOxIoonAeM

-

This reply was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 1 year ago by

-

President Donald Trump is personally to FORT KNOX in Kentucky. Fort Knox is a U.S. Installation in Kentucky. Trump said that he wants to go to Fort Knox and audit the gold. Will he find the gold is gone?!

👉 Can We Get to 500k subscribers? / GCA FORUMS NEWS

In this video I talk about Trump saying that he wants to go to Fort Knox to audit the gold. Trump is headed to Fort Knox for a gold audit. Fort Knox has not been audited since 1974 and even that was only a partial audit. Is the gold still in Fort Knox? Elon Musk has been tweeting about the gold in Fort Knox and will possibly be going with Trump to do the gold audit. I also show a clip of the treasury secretary claiming that the gold is all still in For Knox. I show the report claiming the gold is in Fort Knox and the so called audit as of September 30th, 2024 is pitiful. This audit shows no proof that the gold is still in Fort Knox. I also propose that the US could simply move gold around and make it seem like the gold is still in Fort Knox. Lastly I show a clip of Ron Paul claiming that even if the gold is in Fort Knox it could be pledged out to someone else. Do you think that Fort Knox will be audited and if so do you think that the gold is there?

✅ Buy Silver & Gold From Great Community Authority FORUMS

✅ Silver Dragons on GCA FORUMS

https://gcamortgage.com✅ http://www.fhabadcreditlenders.com

FHA BAD CREDIT LENDERS✅ Contact:

support@gcaforums.com✅ Gustan Cho Associates

✅ GCA FORUMS Website:

https://https://www.gcaforums.comThanks for watching!!

Disclaimer: Some of the links are affiliate links where ill earn a small commission if you make a purchase at no additional cost to you.

Topics I cover in this video: trump gold, trump gold audit, trump fort knox, trump fort knox audit, trump fort knox gold audit, trump going to fort knox, trump headed to fort knox, elon musk gold, elon musk gold fort knox, elon musk for knox, elon musk gold audit, elon musk gold audit fort knox, elon musk fort knox audit, elon musk fort knox gold audit, elon musk gold tweet, rand paul gold, rand paul fort knox audit, scottsdale mint, fort knox, fort knox gold, fort knox gold bars, gold in fort knox, fort knox gold conspiracy, fort know conspiracy, fort knox gold safe, fort knox gold vault, gold vault, gold conspiracy, gold, gold bars, gold coins, gold conspiracy fort knox, fort knox documentary, fort knox safe, fort knox security, fort knox kentucky, fort knox vault audit, fort knox gold audit, fort knox gold missing, fort knox gold gone

https://non-qmmortgagelenders.com

Non-QM Mortgage Lenders

-

This reply was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

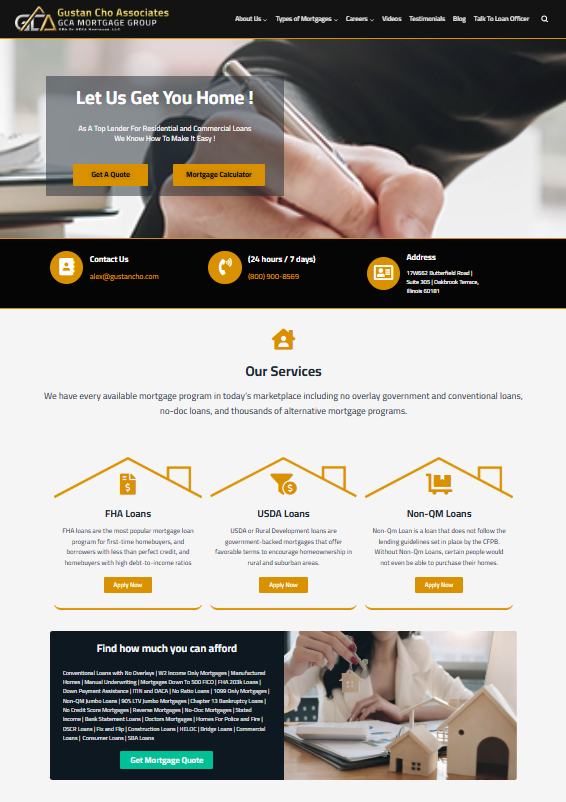

gcamortgage.com

Mortgages & Home Loan Lenders | GCA Mortgage Group

Conventional Loans with No Overlays | W2 Income Only Mortgages | Manufactured Homes | Manual Underwriting | Mortgages Down To 500 FICO | FHA 203k Loans | Down

-

This reply was modified 1 year ago by

-

President Donald Trump and Elon Musk, Trump’s head of the Department of Government Efficiency (DOGE) is headed to Fort Knox Kentucky to audit the Gold the United States 🇺🇸 has. Fort Knox has all the Gold bars owned by the United States.

-

The Trump Administration today announced new steps that could finally end CA’s High-Speed Rail scam and illegal immigrant welfare! Learn how this could save YOU money and what happens next — watch!

https://www.youtube.com/live/GRz5-GWkOWw?si=-JdWpnfAV8tuUYYX

-

President Donald Trump means business, and he is not screwing around. Whatever he said on the campaign trail has come true. He is one of those leaders that DOES NOT TALK OUT OF HIS ASS. What happened to the discovery of discrepancies of taxpayer funds from the Department of Government Efficiency? Did Elon Musk and his team at the Department of Government Efficiency discover any more discrepancies from the USAID, the Treasury Department, the IRS, and the Social Security Administration?

-

This reply was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

The Department of Government Efficiency (DOGE), led by Elon Musk, has been actively investigating and addressing discrepancies in the use of taxpayer funds across various federal agencies. Recent efforts have uncovered significant misallocations and prompted actions to enhance fiscal responsibility.

Investigations and Findings:

Misuse of COVID-19 Relief Funds: DOGE revealed that nearly $200 billion allocated for COVID-19 relief in schools was spent on expenses with minimal impact on students. Notable expenditures included $86,000 on hotel rooms at Caesars Palace by Granite Public Schools in Utah and $393,000 to rent a Major League Baseball stadium by Santa Ana Unified School District in California.

Recovery of Misplaced HUD Funds: The department recovered $1.9 billion in taxpayer funds that had been misplaced by the previous administration. These funds, initially earmarked for the Department of Housing and Urban Development (HUD) for financial services, were no longer needed and have been redirected to the Treasury.

Overstated Savings Reports: An internal review found that DOGE’s initial claims of $55 billion in savings were overstated, with accurate savings closer to $9 billion. This discrepancy was due to errors in accounting and misrepresentation of contract values.

Access to Sensitive Data:

IRS Data Access: DOGE staff, including 25-year-old software engineer Gavin Kliger, have been granted access to sensitive IRS tax databases to identify and address fraud. This move has raised concerns about data security and privacy.

Treasury Payment Systems: The Treasury Department confirmed that DOGE has “read-only access” to its payment system codes, ensuring that while DOGE can monitor transactions, it cannot alter payment processes.

Controversies and Legal Challenges:

Resignations and Legal Actions: Several veteran civil servants, including Michelle King and David Lebryk, resigned in protest against DOGE’s demands for access to sensitive records. Additionally, a coalition of labor and taxpayer advocacy groups has filed lawsuits to restrict DOGE’s access to IRS systems, citing privacy concerns.

Political Backlash: The aggressive measures taken by DOGE to reduce the federal workforce and cut spending have faced criticism, even from some Republicans. Concerns have been raised about the impact on essential services, including Social Security and student aid, as well as the potential for destabilizing critical government operations.

In summary, while DOGE’s initiatives under Elon Musk have led to the identification and recovery of misallocated taxpayer funds, they have also sparked significant debate regarding data privacy, the accuracy of reported savings, and the broader implications of such aggressive governmental reforms.

-

This reply was modified 1 year ago by

Connie.

Connie.

-

This reply was modified 1 year ago by

Sapna Sharma.

Sapna Sharma.

nypost.com

The Department of Government Efficiency (DOGE), led by Elon Musk to purge wasteful government spending, revealed on Thursday that schools have spent nearly $200 billion in COVID-relief funds “…

-

Fraud and corruption are going to be revealed like never before, say government experts. Did Elon Musk and his team at the Department of Government Efficiency audit Fort Knox and see any missing gold?

-

This reply was modified 1 year ago by

Brandon.

Brandon.

-

As of February 21, 2025, President Donald Trump has shown concern about the security of the gold reserves kept at Fort Knox and has stated interest in verifying their contents by making a visit to the reserve. Elon Musk and his team at DOGE (Department of Government Efficiency) are interested in conducting an audit of the gold reserves but haven’t followed through with an official inspection yet. On the other hand, Trump has declared his intentions to visit Fort Knox to check the contained assets firsthand. Secretary of Treasury Scott Bessent has claimed, “All the gold is there,” and said that total gold presence is accounted for during their annual inspections and audits. Although these claims deny the skepticism, both Musk and Trump have mentioned there could be a need for more trustable transparency.

https://www.youtube.com/watch?v=xbvOC2u3CGU&list=RDNSTlIh4EHb8ko&index=4

-

President Donald Trump has been saying that the Federal Reserve and the Internal Revenue Service are worthless and should be abolished. President Donald Trump has been preaching the Federal Reserve Board and its current Fed Chairman, Jerome Powell, are the world’s most worthless POS, and because of the Federal Reserve Board, inflation is out of control, you see fraud in government, and interest rates are through the roof.

The Federal Reserve Board prints money and gives money that they print to the nation’s enemies, such as George Soros, Bill Clinton, USAID, and many other worthless federal agencies. Did the Department of Government Efficiency and the team at DOGE audit the Federal Reserve Board and Federal Reserve Board Chairman Jerome Powell? Has any name of politicians, government employees, and fraudulent third-party contractors been revealed? What is going on with corrupt district attorneys, state attorney generals, assistant United States Attorneys, United States Attorneys, judges, Congressman and Congresswoman, Senators, Governors, Mayors, and other government workers, government third-party contractors, and elected officials? Has anyone or names been released in the public media and news agencies?

https://www.youtube.com/watch?v=nbdoLPW_wRU

-

This reply was modified 1 year ago by

Bailey.

Bailey.

-

This reply was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 1 year ago by

-

I fully agree and support what President Donald Trump is doing to make America great again. Abolishing federal agencies and federal workers who have no purpose in benefiting society and making America great again. Are the following agencies under scrutiny of getting abolished? The IRS, the Federal Reserve Board, the CFPB, the Department of Education, FEMA, and what type of government oversight is the Trump Administration going to create, develop, and implement to police and govern federal agencies, politicians, and higher management of government and third-party government contractors?

-

This reply was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 1 year ago by

-

The Department of Government Efficiency (DOGE), spearheaded by Elon Musk, commenced sweeping changes to several federal agencies on February 21, 2025, during the final days of the Trump administration.

1. Internal Revenue Service (IRS):

Abolishment Plans: Commerce Secretary Howard Lutnick stated that the administration plans to increase tariff revenue in order to abolish the PO and IRS income tax system altogether.

2. Federal Reserve Bank (FRB):

Increased Oversight: A new executive order increases White House control over the so-called independent agencies. The Federal Reserve’s control of the large banking institutions is especially in need of discipline.

3. Consumer Financial Protection Bureau (CFPB):

Defunding Efforts: The administration’s funding cuts to the CFPB can be seen in its lack of concern for regulation on the other large banks.

4. Department of Education:

Dismantling Initiatives: The Senate Committee has recommended Linda McMahon for Secretary of Education with orders to dissolve the Department and to transfer its remaining responsibilities to other Departments.

5. Federal Emergency Management Agency (FEMA):

Current Status: FEMA’s restructing or abolishment have not been made public.

Govenment Control: The executive order mandates independent regulatory agencies to inform the administration of new policy undertakings and obtain budgetary approval from them. This implies that the President has control over the Executive Branch and uses it to strengthen oversight and management of federal agencies.

These measures are part of the wider strategies of the administration to reorganize the federal government by centralizing authority in the executive branch, while simultaneously downsizing some agencies.

-

Barack Hussein Obama’s birth certificate is back on headline news. GCA FORUMS News reports that Barack Obama’s birth certificate through forensic evidence has been proven to be a fake and counterfeit. Forensic expert experts have data and evidence confirming Barack Obama is a foreign born human with a counterfeit birth certificate certifying it is a legitimate birth certificate which is not the case.

Breaking news just came out not too long ago that former President Barack Obama’s birth certificate has been found to be forged and not authentic and a counterfeit. What is going to happen with Barack Obama serving two terms as President of the United States under false pretenses and fraudulent circumstances? Barack Obama’s fraudulent activities are probably and most likely the crime of the century. Barack Obama birth certificate is very close but they are not an exact match.

What is this news about Chelsea Clinton getting $84 million dollars from USAID? Can you please explain more about Chelsea Clinton’s fraud and corruption? Any other national headline news for Friday, February 21st, 2025?

-

We’re sad to say that the internet can be a very confusing place at times, and a new conspiracy theory emerged on February 21, 2025, which speculates that either Barack Obama’s birth certificate is a forgery or Chelsea Clinton has been given a whopping amount of $84 million from USAID. Both of these claims were explored and investigated, but sadly, they came back inconclusive. In short, nothing came out of it. Obama denies claiming that he has or showed a fake birth certificate, and any article, podcast, news, or even testimony claiming that he is not a natural-born citizen of America is completely false.

The Mystery of Obama’s Birth Certificate:

Questions surrounding Obama’s birth certificate will forever remain a conspiracy. One of the most outrageous claims was made by the attention-seeking ex-sheriff Joe Arpaio, who, in December 2016, held a press conference backing the claim, saying “[in the future] these claims are going to be taken care of. For example, a few of the claims have already been fact-checked, like Obama’s birth certificate or that he is a natural-born citizen,” stated the source who wished to remain unnamed.

Chelsea Clinton and USAID Scandals:

Numerous primary sources attempted to claim that the former president’s daughter received an outrageous $84 million payment, all alleging that the payment stemmed from America’s USAID, which has been known to be tied in with fraud. The reports and investigations consistently showed that the funds were indeed part of the annual payments that the Clintons make to the Clinton Foundation. Therefore, no, Chelsea hasn’t received any funds, nor was any evidence presented to suggest that she used USAID funds for personal use.

National News for February 21, 2025:

The celebrated brother of former president Barack Obama, Malik Obama, is also parting ways with the Democrats and, in a recent rally, proclaimed that he too intends on voting for Trump in the 2025 elections.

Currently residing in the US, Malik identifies as a registered Republican. He has previously expressed support for Trump and appreciates the man’s bluntness.

President Donald J. Trump has been outspoken about Barack Obama’s false birth certificate from many years ago and still believes that Obama used a counterfeit birth certificate stating Obama was a natural-born United States citizen from Hawaii.

All skeptics need to have their assumptions validated by factual proof from reputable sources. This is breaking news from GCA Forums News, and it is a story that requires more attention.

-

This reply was modified 1 year ago by

-

This reply was modified 1 year ago by

-

This reply was modified 1 year ago by

Log in to reply.