Tagged: gift of equity, no down payment, rental home

-

Gift of Equity, 0 down

Posted by Rhonda on May 25, 2024 at 2:50 pmTrying to see if buyer that has been renting home for 14 years , with option to purchase. How can he get in home with no down payment. Home is worth 245,000 selling 180,000 seller paying closing cost and prepaids . They are not related but have been good friends like his grandfather prior to renting. I assumed it was no way suggested 3.5 down make 12 payments. And refi as he has an irs lien he wants to pay off. So he can have the money he pays them stop coming out of his check.

Rhonda replied 1 year, 8 months ago 4 Members · 8 Replies -

8 Replies

-

Great question, Rhonda. If the buyer and seller have written rent with an option to buy agreements, the agreement needs to state that a portion of the rental agreement goes towards the down payment of the home purchase. Or if the renter given a substantial deposit, the memo on the check needs to state that it goes towards the down payment. They may want to make a lease with the option to buy now so in six months, they are ready to purchase with no money down. We also have EPM EMPOWERED DOWN PAYMENT ASSISTANT PROGRAM which is a forgiveable DPA program. Closing costs can be covered with a 6% seller concession. This seems like it is definitely doable deal. @Rhonda

https://gcaforums.com/topic/how-does-epm-empowered-dpa-program-work/

-

If I can get a year worth of canceled checks. And they say rent on it . As he has been living there for 14 years. I was just thinking it would be more cost effective to purchase at agreed amount. whichis 160,000 Not wanting to pull out equity. Wants note cheap as he has been paying 875. Note will be 1400. But wants to get in with 3.50 or less. I have application 700+ SCORE BUT WIFE is 0. score

-

-

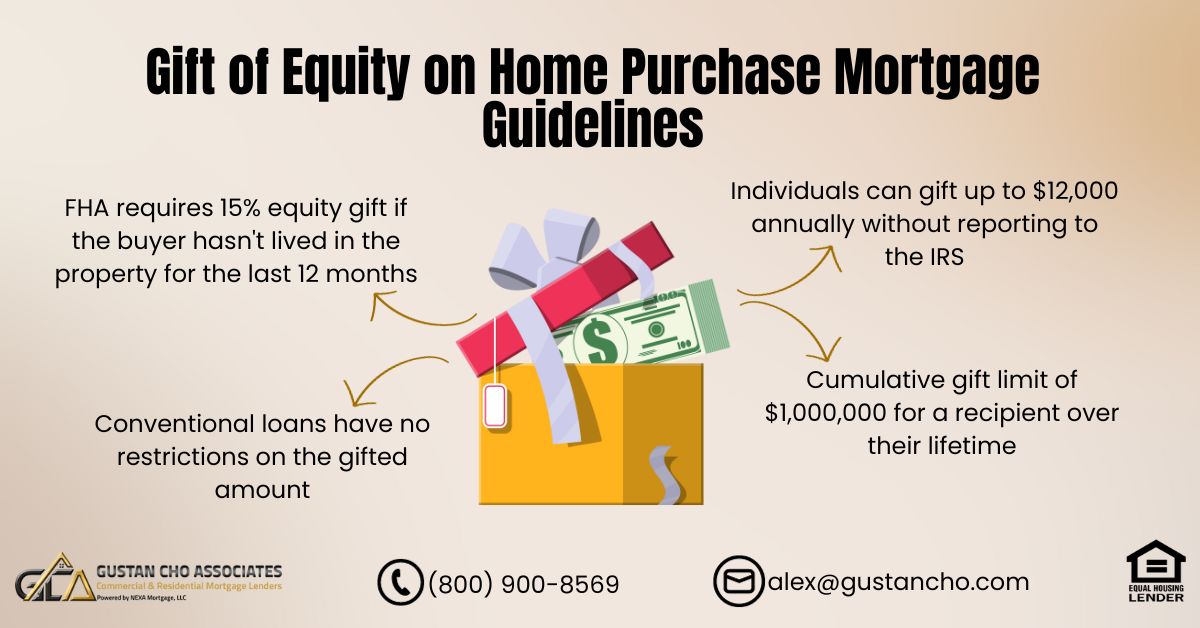

Rhonda, here is the frequently asked question on what is a gift of equity home purchase:

A gift of equity is a financial transaction in which a property is sold to a family member or close associate at a price below its market value. The difference between the market value and the selling price is considered a “gift” to the buyer. This concept is often used to help family members, particularly children, purchase a home with more favorable terms. Here’s how it works and some key points to consider:

How a Gift of Equity Works

- Property Appraisal: The property’s market value is determined through a formal appraisal.

- Sale Price: The seller agrees to sell the property to the buyer at a price lower than the appraised market value.

- Gift of Equity Amount: The difference between the appraised market value and the sale price is the gift of equity. For example, if a home is appraised at $300,000 and sold for $250,000, the gift of equity is $50,000.

- Down Payment: The gift of equity can be used by the buyer as a down payment on the property, potentially reducing or eliminating the need for additional down payment funds.

Benefits of a Gift of Equity

- Lower Down Payment: Buyers can use the gift of equity as part or all of their down payment, making it easier to afford the home purchase.

- Reduced Loan Amount: Since the sale price is lower than the market value, the buyer may need to take out a smaller loan.

- Favorable Loan Terms: The buyer may qualify for better loan terms due to the reduced loan amount and higher equity stake.

Tax Implications

- Gift Tax: The IRS treats a gift of equity as a taxable gift. However, the annual gift tax exclusion ($17,000 per recipient as of 2024) and the lifetime gift tax exemption ($12.92 million as of 2024) can apply, allowing many gifts of equity to avoid triggering gift taxes.

- Documentation: Proper documentation is essential. A gift letter from the seller to the buyer is typically required by lenders, stating that the gift is not a loan and does not need to be repaid.

Mortgage Considerations

- Lender Approval: Lenders often require specific documentation to approve a mortgage involving a gift of equity. This includes the appraisal, the sale contract, and the gift letter.

- Loan Programs: Some mortgage programs have specific guidelines for gifts of equity, so it’s important to consult with the lender to ensure compliance.

Steps to Execute a Gift of Equity Home Purchase

- Appraise the Property: Obtain a professional appraisal to determine the market value of the property.

- Agree on the Sale Price: Seller and buyer agree on a sale price that is below the market value, establishing the gift of equity amount.

- Prepare the Gift Letter: The seller provides a gift letter stating the amount of the gift of equity and confirming that it is a gift, not a loan.

- Loan Application: The buyer applies for a mortgage, using the gift of equity as part of the down payment.

- Close the Sale: Finalize the transaction with proper documentation and complete the home purchase process.

A gift of equity can be a valuable tool for facilitating the purchase of a home within a family, making homeownership more accessible. However, it’s important to understand the tax implications and mortgage requirements to ensure a smooth transaction. I do not know if the seller and buyer can qualify for a gift of equity home purchase. I suggest, you contact several wholesale rep especially @Christian Sorensen

gustancho.com

Gift Of Equity on Home Purchase Mortgage Guidelines

Gift of Equity on Home Purchase is when buying a home from a relative at below the appraised value and the seller is gifting you the equity.

-

@Rhonda Please find out the type of relationship the seller and buyer have and let’s contact @Christian Sorensen on Monday. Maybe gift of equity will fly. Here’s a blog about buying a home with a gift of equity that you may find helpful:

https://gustancho.com/buying-home-from-family-members/

gustancho.com

Buying Home From Family Members With Gift of Equity

Buying home from family members with no down payment and no closing costs with a gift of equity from the home seller if the seller is a relative.

-

They can qualify for EPM EMPOWERED DPA PROGRAM. It is a forgivable down payment program for first-time homebuyers. A first-time homebuyer is a buyer who had no ownership on a homeownership in the past three years. There are other down payment assistance programs as well. You can streamline the EPM DPA PROGRAM after six months and do not have to pay the down payment assistance.

https://gcaforums.com/topic/how-does-epm-empowered-dpa-program-work/

gcaforums.com

HOW DOES EPM EMPOWERED DPA PROGRAM WORK? - Great Content Authority Forum

How does EPM EMPOWERED DPA and GRANT PROGRAM work? How do I qualify for the EMPOWERED DPA PROGRAM for first time homebuyers?

-

Thank you , I need to set up account. So I can go in and print marketing flyers

-

Will do , I have been emailing back and forth with her today. Trying to get my domain linked to arrive. Plus I sat up business account tictoc, instagram and Facebook. So I need to get all the Gustan Viedos linked on my accounts.

Still trying to figure out my Google page , It still not showing up where I changed it from previous company. I think they are not using the business accounts from the gmail. I am not a tech person but know what I want . lol

Log in to reply.