Tagged: gift of equity

-

Gift of Equity FHA LOANS

Posted by Tom Miller on March 30, 2024 at 2:13 pmHere’s a blog about HUD Guidelines on gift of Equity.

Russell replied 1 year, 10 months ago 7 Members · 6 Replies -

6 Replies

-

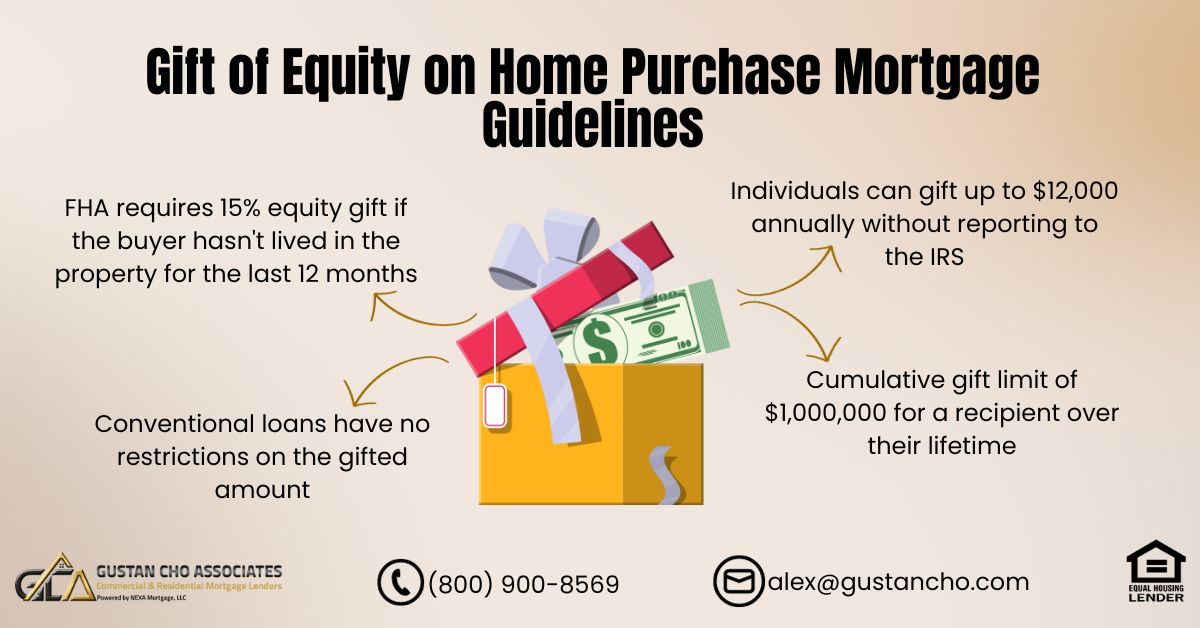

Gift of Equity is when a seller sells a home at a discount to family member at a discounted price such as 15% discount of market value.

https://gustancho.com/gift-of-equity-on-home-purchase/

gustancho.com

Gift Of Equity on Home Purchase Mortgage Guidelines

Gift of Equity on Home Purchase is when buying a home from a relative at below the appraised value and the seller is gifting you the equity.

-

Here is Anthony Fiero @AnthonyFierroLendingAnswer

Wholesale mortgage products

Quick summary of my products

** OO and NOO Hard Money – 1st/2nd Lien Available | No Income/Assets/Appraisal Required in Most Cases. For 1st Lien, I can doc 24-48 hours after receiving a full package **CA ONLY**

** No Income Jumbo | No Income HELOCs

** DSCR in 36 States – Including Foreign National, FICOs Down to 575, and DSCR Service Ratios to 0.0

-

This reply was modified 1 year, 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

Thank you Team!

I know we’re at month end – everyone is focused on closing what you’ve got in the pipeline.

Let’s connect first part of May on our

** OO and NOO Hard Money – 1st/2nd Lien Available | No Income/Assets/Appraisal Required in Most Cases. For 1st Lien, I can doc 24-48 hours after receiving a full package **CA ONLY**

** No Income Jumbo | No Income HELOCs

** DSCR in 36 States – Including Foreign National, FICOs Down to 575, and DSCR Service Ratios to 0.0

-

This reply was modified 1 year, 1 month ago by

-

Buying a house with a gift of equity from a family member is a practical way to purchase a home, especially for first-time buyers who might struggle with coming up with a down payment. Here’s how you can proceed with this type of transaction:

1. Understand What a Gift of Equity Is

- A gift of equity involves a family member selling you their property for less than its market value. The difference between the selling price and the market value is considered the gift of equity. For example, if a home is worth $300,000 and it is sold to you for $250,000, there is a $50,000 gift of equity.

2. Agree on the Home’s Value

- Have the home appraised to determine its fair market value. This will be important for both setting the sale price and for financing purposes.

3. Draft a Gift of Equity Letter

- The family member who is selling the home must write a gift of equity letter that declares the amount of equity being gifted. This letter should include the estimated value of the home, the sale price, and the amount of equity being gifted. It should also state that the gift is being given freely and that repayment is not expected.

4. Secure Financing

- Apply for a mortgage. You will need to inform the lender about the gift of equity, as it can often count as part of your down payment. The lender will consider the gift of equity in the same way as a traditional down payment, which can help in qualifying for a loan, especially if you otherwise would not have enough funds for a down payment.

- Provide the gift of equity letter to your lender during the loan application process.

5. Consider Tax Implications

- Consult with a tax advisor. There can be tax implications for both the giver and the receiver of a gift of equity. The person giving the gift may need to file a gift tax return if the amount of equity exceeds the annual gift tax exclusion limit ($16,000 per person in 2023).

6. Close the Sale

- Proceed with the usual home buying steps, including inspections and finalizing the mortgage. The closing process will involve transferring the title from your family member to you and handling any necessary legal and financial paperwork.

7. Record the Transaction

- Ensure that the transaction is properly recorded in local real estate records, including the adjusted sale price and the gift of equity.

Using a gift of equity can make home ownership more accessible and financially feasible, especially for young buyers or those without substantial savings. However, it’s crucial to handle all aspects of the transaction legally and transparently, especially with regard to financing and taxes, to ensure everything is conducted smoothly.

https://www.youtube.com/watch?v=1vrQvQ8Myeg&t=48s&ab_channel=GustanChoAssociates

Log in to reply.