Tagged: VA Guidelines on Student Loans

-

How Are Student Loans Calculated On VA Loans

Posted by Julio Munoz on August 24, 2024 at 12:56 pmHow Are Student Loans Calculated On VA Loans?

Max replied 1 year, 6 months ago 2 Members · 1 Reply -

1 Reply

-

Student loan payments affect borrowers’ debt-to-income ratio during VA loan application processes. Student loans can impact a borrower’s ability to qualify for a mortgage loan. Every mortgage loan program has its student loan guidelines on deferred student loans, income-based repayment, or hypothetical amortized student loan plans. Generally, this is how student loans are dealt with in a VA loan application process:

Current Payment Status:

The Veterans Administration considers the debt-to-income ratio threshold based on what students owe on their loans, either ‘in repayment,’ ‘in deferment,’ or ‘in forbearance. ‘

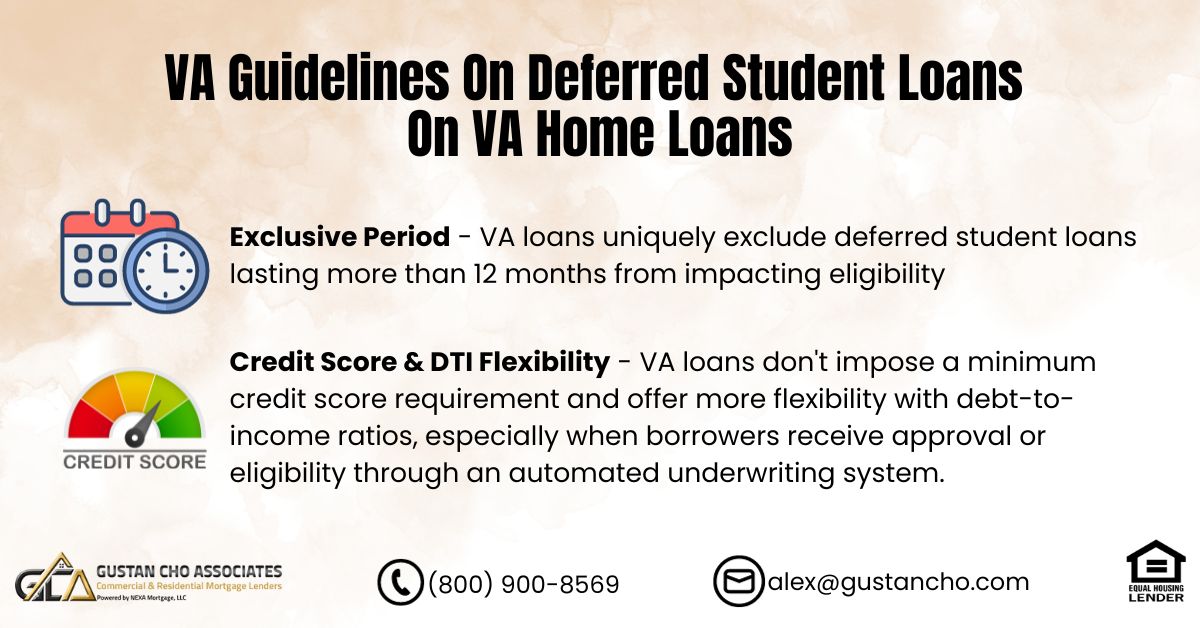

VA Guidelines on Deferred Student Loans

Deferred student loans for over 12 months are exempt from debt-to-income ratio calculations.

Loans in Repayment:

Fixed Payment Amount: For student loans that have gone into repayment and have a fixed repayment amount, lenders will use the fixed-monthly payment amount for DTI purposes in cases where an applicant avails of such loans. The payment must fully amortize the student loan, which will be repaid over time.

Income-Driven Repayment (IDR) Plans: If you are on the Income-Driven Repayment plan and the payment amount is a non-zero dollar amount, then the lender will need to account for that payment towards the DTI procedure as long as that payment is displayed on the credit report website of the lender.

Deferment or Forbearance Loans:

In cases where the VA grants deferment or forbearance on student loans, the guidelines require lenders to consider a formula graded against the balance of the outstanding loans. In this case, the lender will divide 5% of the money owed by 12 to get a monthly payment figure. This payment is typically the one used to compute the DTI.

Example Calculation:

Regarding repaying the student loan balance of $30,000:

5% of $30,000 = $1,500

$1,500 divided by 12 months = 125, i.e., in monthly payment towards DTI.

Sometimes, extra documentation is required to record the balance and the status of the student loan. All these are necessary documents; we look for the borrower’s cun and the loan statements. We can call the servicer for this information.

The extra student loan payment so worked out becomes part of the monthly obligations for computing the DTI. The VA does not stipulate a maximum DTI. Most lenders prefer a DTI of less than 41%. Higher DTI ratios can be approved if they are accompanied by sufficient compensating factors such as residual income or net worth.

Requirement for Residual Income:

Besides DTI, the VA considers residual income to be another funding phenomenon. Residual income is the net income after deducting all basic expenditures, such as estimated student loans. This helps ensure you have enough household maintenance funds after servicing your loans.

Regarding VA loans, your educational debt is considered to be current. In instances where loans are being serviced, the actual payment made is considered as opposed to cases where the loans are postponed or forbearance, performing 5% of the balances owed divided by 12 in the scenario. The nature of your student loans and their impact on DTI and residual income must be considered, especially in preparation for acquiring the VA loan, thus enabling the likelihood of approval.

https://gustancho.com/va-guidelines-on-deferred-to-student-loans/

gustancho.com

VA Guidelines On Deferred Student Loans On VA Mortgages

VA Guidelines On Deferred Student Loans And Debt To Income Ratio: VA is the only loan program that exempts deferred student loans

Log in to reply.