-

How to Improve Your Credit Scores and Rebuild Credit For Mortgage Approval

You do not need perfect credit or high credit scores to qualify for a mortgage loan. Every loan program require a minimum credit score. Besides HUD, VA, USDA, FANNIE MAE, FREDDIE MAC, or non-QM portfolio lenders requiring a minimum credit score, each lender can impose lender overlays on credit scores. Lender overlays are additional credit score requirements above and beyond the minimum agency mortgage guidelines imposed by each individual mortgage lender. Regardless of the minimum credit scores required, all lenders will normally want to see timely payment history in the past 12 months. Regardless of the prior bad credit you have, having timely payment on all of your monthly debt payments that report on the three credit reports is crucial. Do not worry about prior collections, charge-off accounts, late payments, or other derogatory credit tradelines unless you are going though a manual underwrite on FHA loans. HUD manual underwriting guidelines require timely payments in the past 24 months. VA manual underwriting guidelines require timely payments in the past 12 months. In many instances when you get an approve/eligible per automated underwriting system but late payments in the past 24 months, the lender may down grade your file to a manual underwrite. The best solution for you to increase your credit scores and strenghen your credit profile with recent late payments is adding positive credit with new credit. Please read this guide on how to boost your credit to get approved for a mortgage: Capital One Secured Credit Card will get you a $250 secured credit card with a $50 deposit. Self.Inc is a bank that has a phenomenal credit rebuilder program where you can make a monthly deposit as small as $25.00 per month. That monthly deposit goes towards a savings account but it reports as an installment loan to all three credit bureaus. Get a Discover secured card. Secured credit cards are the same as unsecured traditional credit card. The only difference is you need to put a deposit. The amount of deposit is the amount of credit you get by the credit card company. You need to make timely minimum monthly payments on your secured credit cards. Just start with these three creditors and you will see wonders in the weeks and months ahead. I will cover some quick fixes for you to increase your credit scores fast and at the end of this topic thread, I will list helpful resources on boosting your credit to qualify for a mortgage, how to reach a human at the credit bureaus, and how to rebuild your credit:

1. Capital One Secured Credit Card

2. Self.Inc

3. Discover Secured Credit Card

As time pass and you make timely payments, your secured credit card company will increase your credit limit without asking your to put additional deposit. If you can get more secured credit cards, it will expedite your credit rebuilding process. However, you should at least start with the above three creditors.

Improving your credit scores and rebuilding credit can be crucial when seeking mortgage approval. Here are some effective strategies to consider:

Review your credit reports: Obtain copies of your credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion. Identify and dispute any errors or inaccuracies that may be negatively impacting your credit scores.

Pay bills on time: Payment history is the most significant factor affecting your credit scores. Make sure to pay all your bills (credit cards, loans, utilities, etc.) on time, every time. Set up automatic payments or payment reminders if necessary.

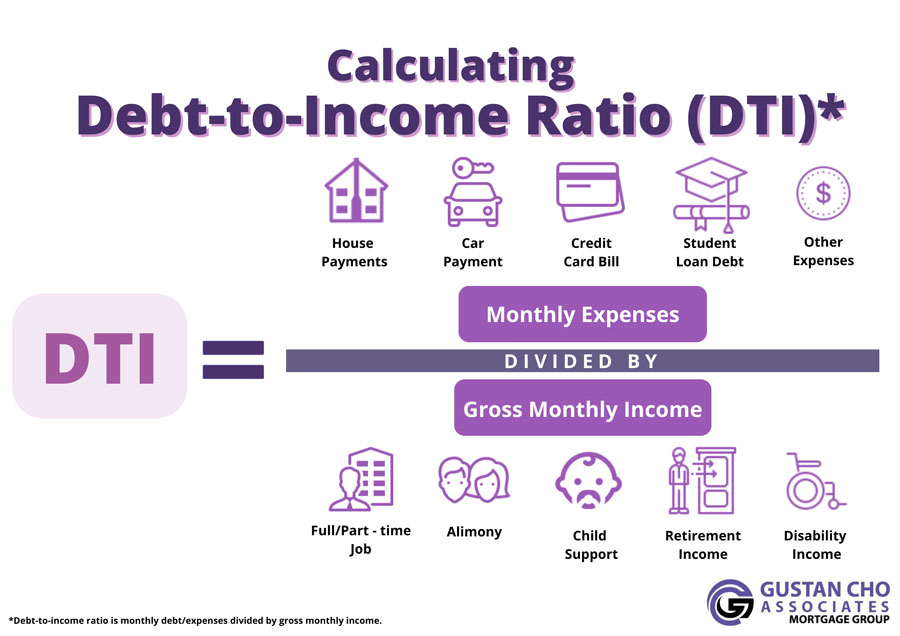

Reduce credit card balances: High credit card balances can hurt your credit utilization ratio, which accounts for a significant portion of your credit scores.

Aim to keep your credit card balances below 30% of your total available credit limit. Consider paying off credit cards with the highest balances first.

Don’t close unused credit cards: Closing credit cards can inadvertently increase your credit utilization ratio and decrease your overall available credit. Keep unused credit cards open, but avoid using them to maintain a low credit utilization ratio.

Increase credit limit: Request a credit limit increase from your credit card issuers, which can improve your credit utilization ratio. Be sure to handle the increased credit limit responsibly and avoid overspending.

Limit new credit applications: Each credit application results in a hard inquiry on your credit report, which can temporarily lower your credit scores. Limit credit applications only to when absolutely necessary.

Use different types of credit: Having a mix of different types of credit (e.g., credit cards, auto loans, personal loans) can positively impact your credit scores. Consider taking out a small loan or opening a new credit card account if you have limited credit types.

Monitor your credit regularly: Check your credit reports and scores periodically to ensure accuracy and track your progress. Consider signing up for a credit monitoring service to receive alerts for any changes to your credit profile.

Be patient and consistent: Rebuilding credit takes time and consistent effort. Stick to responsible credit habits, and your credit scores should gradually improve, increasing your chances of mortgage approval.

Remember, lenders evaluate various factors beyond just credit scores when considering mortgage applications. However, improving your credit scores and maintaining a healthy credit profile can significantly increase your chances of getting approved for a mortgage with favorable terms.

https://gustancho.com/boost-your-credit-with-new-credit/

gustancho.com

Boost Your Credit With New Credit To Qualify For A Mortgage

Boost your credit with new credit to qualify for a mortgage . New secured credit cards and credit builder loans increases credit scores for mortgage

Log in to reply.