Tagged: Mortgage Late Payments, Non-QM Loans

-

Non-QM Loans With Late Payments

Posted by Gustan Cho on February 13, 2023 at 11:58 pm

Non-QM late payment guidelines are set by individual wholesale lenders. Non-QM loans are portfolio loans and do not have uniform standardized agency mortgage guidelines like qualified mortgages. One non-QM lender can have a certain guidelines while a different lender will not. Only a few wholesale lenders will do non-qm loans for late mortgage payments in the past 12 months. In this FORUM, we will cover non-QM late payment guidelines by non-QM portfolio wholesale lenders.

Hunter replied 1 year, 8 months ago 2 Members · 1 Reply -

1 Reply

-

Getting Approved for Non-QM Loans with Late Payments

Borrowers can get approved for a mortgage with late payments in the past 12 months. However, you probably most likely need a 30% down payment and pay a high interest rate including discount points. The worst thing you can ever have to qualify and get approved for a mortgage is late payments in the past 12 months. Mortgage late payments are a kiss of death. You can get approved with mortgage late payments in the past twelve months but you will be paying a dear price for the loan.

Non-QM (Non-Qualified Mortgage) loans are designed to provide mortgage options for borrowers who may not meet the strict criteria of traditional mortgage lenders. Individuals with unique financial situations often seek these loans, such as self-employed borrowers with fluctuating incomes or less-than-perfect credit histories, including late payments. Here are some key points on getting approved for Non-QM loans if you have late payments in your credit history:

Understanding Non-QM Loans

Flexibility:

Non-QM loans offer more flexible underwriting guidelines than traditional QM (Qualified Mortgage) loans. This includes leniency regarding credit history, income verification, and debt-to-income (DTI) ratios.

Types of Non-QM Loans:

Bank Statement Loans: Use bank statements to verify income rather than traditional pay stubs and tax returns.

Asset-Based Loans: Approval based on liquid assets rather than regular income.

Interest-Only Loans: Allow borrowers to pay only the interest for a specified period.

Higher Risk Tolerance:

Non-QM loan lenders are willing to take on higher risks, often reflected in higher interest rates and fees.

Strategies to Get Approved with Late Payments

Explain Your Credit History:

Letter of Explanation: Provide a detailed letter explaining the reasons for late payments. Circumstances such as medical emergencies, temporary job loss, or other unforeseen events may be considered.

Proof of Stability: Demonstrate that your financial situation has stabilized and that you have made on-time payments since the late payments period.

Compensating Factors:

Large Down Payment: Offering a larger down payment (e.g., 20% or more) can offset the risk associated with late payments.

High Credit Score: Maintaining a higher overall credit score, even with some late payments, can improve your chances.

Low DTI Ratio: A lower debt-to-income ratio shows that you have sufficient income to manage your mortgage payments.

Significant Assets: Having substantial assets can also be a positive compensating factor.

Specialized Lenders:

Work with Non-QM Lenders: Not all lenders offer Non-QM loans. Seek out lenders specializing in non-QM products and have experience working with borrowers who have late payments.

Mortgage Brokers: Consider working with a mortgage broker who can connect you with non-QM lenders and help you navigate the application process.

Improve Your Credit Profile:

Pay Off Outstanding Debts: Reduce overall debt to improve your credit profile.

Correct Errors: Ensure no errors on your credit report could negatively impact your application.

Non-QM Lenders and Products

Some well-known Non-QM lenders include:

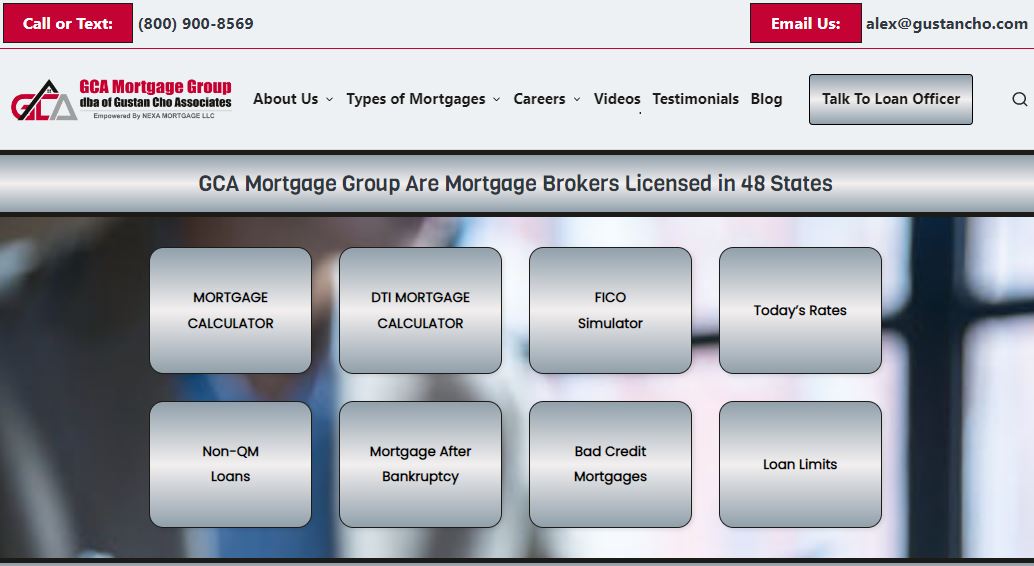

GCA Mortgage Group (https://www.gcamortgage.com/)

: Offers a variety of non-QM products, including bank statement loans and asset-based loans.

Mortgage Lenders For Bad Credit (https://mortgagelendersforbadcredit.com/ ): This company specializes in non-QM loans for self-employed borrowers and those with recent credit events.

Non-QM Mortgage Brokers (https://www.non-qmmortgagebrokers.com/):: Provides non-QM loan options with flexible underwriting standards.

Getting approved for a Non-QM loan with late payments is possible by leveraging the flexibility of Non-QM lenders, providing strong compensating factors, and demonstrating financial stability. Working with specialized lenders and improving your overall credit profile can enhance your chances of approval.

gcamortgage.com

We have every available mortgage program in today’s marketplace including no overlay government and conventional loans, no-doc loans, and thousands of

Log in to reply.